Beruflich Dokumente

Kultur Dokumente

Treasury Management

Hochgeladen von

rakeshrakesh1Originalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Treasury Management

Hochgeladen von

rakeshrakesh1Copyright:

Verfügbare Formate

Treasury Management Q.1.

what are the diverse functions of an integrated

treasury as compared to a conventional treasury?

Ans:

Functions of Integrated Treasury of a Bank

The banks have the compulsions of operating in almost all the organized markets. Apart from this, they also have to manage the risks arising from liquidity, interest rates, foreign exchanged. Therefore, the functions of an Integrated Treasury of a bank cover most of the functions of a modern Treasurys) Statutory Investment Management: Every bank has to maintain a Cash Reserve Ratio (CRR) and statutory liquidity ratio (SLR). The law requires every bank to maintain the investment and its form in order to ensure the liquidity of the banks. Treasury has the b a s i c duty of statutory compliance by making suitable investment and m a i n t a i n i n g sufficient cash reserves in the manner prescribed. b) Funds Management: It is also necessary to determine the suitable mix of deposits and other borrowings. This will determine the cost of funds and the liquidity position of the banks. It is also necessary to design the assets mix, which will include the investment and loans mix, designing the investment portfolio, and designing the loan portfolio in line w i t h t h e s o c i a l b a n k i n g p o l i c i e s of t h e g o v e r n m e n t . S u c h a p l a n n i n g o f a s s e t s w i l l determine the liquidity of the bank and its profitability) Asset- Liability Management (ALM): The ALM has the objectives of achieving all theor g a n i s a t i o n a l o b j e c t i v e s of t h e b a n k . T h e o r g a n i z a t i o n a l o b j e c t i v e s of t h e b a n k ar e solvency (survival in the long-term), profitability and sufficient liquidity. In performing the

necessary functions to achieve the objectives, the Treasury decides on important aspects like designing deposit products, loan products etc.

Risk Management: As the bank is operating in all the organized markets, it is subject to every type of risk like currency risk, interest rate risk, market risk etc. Ever since the RBIliberalized interest rates and the banks started offering floating rate loans, the banks are subject to the risk arising from the changes in the interest rates. It becomes necessary for t h e b a n k s t o u s e e v er y t y p e of d e r i v a t i v e t o m a n a g e t h e r i s k l i k e i n t e r e s t r a t e s w a p , arbitrage and hedging) Capital Adequacy: The Treasury must ensure that the bank has sufficient TIER I capitalize. Equity share capital and reserves & surplus. This is to ensure long-term solvency of t h e b a n k , a s o n l y t h e e q u i t y s h a r e c a p i t a l w i l l b e a r t h e l o s s of b a d l o a n s u l t i m a t e l y . Reserve Bank of India has also prescribed the deadline of March 31, 2009 to comply with capital adequacy norms. In the light of this, Treasury has the responsibility to raise the necessary equity capital through the issue of equity shares. We have already noted that Treasury, instead of being a conventional cost center has become a profit centre. The main source of profit for the Treasury arises from the following dealings. Foreign Exchange Dealing: By using the export income judiciously, a corporate can make a huge profit. Movements in foreign exchange market reflect the developments from countries all over the world. Thus, the fluctuations under the free float or managed free float are very high. A brilliant Treasury makes profit that is directly proportional to the fluctuations in the market.

Money Market Dealings: T r e a s u r y c a n i n v e s t i n m o n e y m ar k e t i n s t r u m e n t s l i k e Treasury Bills, Commercial Paper, and Certificate of Deposit. In addition, they can also operate in the CBLO (Collateralized Borrowing and Lending Obligations discussed in subsequent modules) with huge funds flowing into the market. Corporate can make a hefty profit with the fluctuations in the interest rates.3. Securities & Commodities Markets : Either directly or through Investment Trusts, corporates invests in equities, bonds, or debentures. These are held either for long term or churned often to maximize the returns. In addition, organizations like banks sell gold by importing them directly leading to the profit on sale. Investment in equities offers twin benefits to the corporate. It contributes to the profits on frequent purchase and sale. Equities accumulated in large quantities can help in taking over the concerned Joint Stock Company at a later date. In this manner, Treasury operations add to the strategic plans of the organisation.In short, Treasury has come to occupy a significant position in a modern organization. This is due to the maturing of financial markets with complex instruments like derivatives for risk management. This importance will continue to grow with more financial sector reforms and a more intense level of globalization

Q.2 Explain the features of book-building and different

stages involved in book building.

Ans: Features of Book-building: 1. Quantity Assessment: The number of shares to be issued so that company can get the maximum price is assessed and determined. Larger quantity of shares may reduce the s h a r e pr e m i u m . T o a v o i d t h i s , t h e q u a n t i t y i s a s s e s s e d b y c o l l e c t i n g t h e o p i n i o n s of institutional investors.

2. Price Discovery: The investors are given a choice to bid different quantities at different prices. As happens in a public auction, the investors bid at different prices. Before public does this, the price preference of institutional investors is collected to determine the price band. 3. Documents: Instead of relying on a single document called prospectus as in the fixed price public offer, different documents can be used like notice, circular, Information Memorandum or a Red-Herring Prospectus (A prospectus that is incomplete regarding the price). The final prospectus is prepared after the allotment by including the issue price (cut-off price). 4.Category: The issue can be divided into two categories a)Private Placement Portion: It is the portion that is offered to the syndicate members and to the institutional investors. Institutional Investors are called "Qualified Institutional Buyers (QIB)". They comprise mutual funds, financial institutions, foreign institutional investors etc. b)Public Issue: It is that portion which is offered to the public for bidding. It is known, as "net offer to the public" Originally 25% of the issue size was to be reserved for net offer to the public. From 2005, this portion is increased to a minimum of 35%.5. Lead Book Running Manager the main Merchant Banker is appointed as Lead Book Running Manager (LBRM). Other merchant bankers are called CoBook Runners. For c o l l e c t i n g t h e b i d s o n b e h a l f o f t h e i r c u s t o m e r s , s y n d i c a t e m e m b e r s a r e a p p o i n t e d . Syndicate Members are those financial intermediaries who are eligible to be appointed asunderwriters.Different stages involved in book building Financial Intermediaries involved The number of financial intermediaries involved in book-building is less in comparison with f i x e d p r i c e p u b l i c i s s u e o f s h a r e s . T h e a c t i v i t y i s m or e f o c u s e d w i t h a l e s s e r n u m b e r of i n t e r m e d i a r i e s o p e r a t i n g u n d e r a s o p h i s t i c a t e d s y s t e m o f of f i c e m a n a g e m e n t . A s t i m e o f c o m p l e t i o n i s v e r y c r u c i a l , a l l t h e i n t e r m e d i a r i e s o p e r a t e u n d e r a s y s t e m o f a h i g hl e v e l Information Technology absorption. Total net worked system is essential for the successful operation of the system. Important financial intermediaries and their functions are presented briefly.

A. Merchant Banker as a Book Runner A Merchant Banker is appointed as the Lead Book Runner. Other Merchant Banker may be appointed as Co-Book Runners. The Lead Book Runner has the following responsibilities: .Advising the company in the appointment of other Book Runners Enabling the appointment of Syndicate Members Preparation and circulation of Information Memorandum among Syndicate Members. Through the Syndicate Members, collecting information about the quantity and the price at which the institutions are willing to buy. P r e p a r a t i o n o f a R e d H e r r i n g P r o s p e c t u s a n d F i l i n g i t w i t h S E B I a l o n g w i t h t h e Information Memorandum. Enabling the Companies to appoint other financial intermediaries like Registrar to the Issue, Bankers to the Issue etc., Filing Due Diligence Certificate with SEBI declaring the satisfaction of all the regulation. Determining the Price Band. Announcing the opening of the subscription and arranging the graphic presentation of bids received. Closure of Bid Collection. Allotment of shares through Registrar after deciding the cut-off price. Getting the shares listed on the stock exchange. Preparing the Final Prospectus and filing it with SEBI and Registrar of Companies. Syndicate Members: The issuing company, on the advice of the Merchant Bankers, appoints the Syndicate Members. O n l y t h o s e f i n a n c i a l i n t er m e d i a r i e s w h o ar e r e g i s t e r e d w i t h S E B I a s u n d e r w r i t er s c a n b e appointed as the Syndicate Members. The Syndicate Members perform the following basic functions. 1. Facilitating Quantity Assessment: From various institutions (QIB), Syndicate Members collect the various prices and the respective quantities the institutions are willing to buy. They pass on this

information to the Merchant Banker to assess the total demand for the shares and the price- band at which the shares are to be offered. 2.Underwriting: They underwrite that portion of the shares which will be offered to the public for subscription. The net offer to the public should be compulsorily underwritten, which is done by the syndicate members. 3.Collection of Bid-Cum-Application Forms: Once the public issue is open, the syndicate members ensure the availability application forms to the public. They do this through their branch offices or through franchisees. In turn, the Application Forms are collected from the public and uploaded in to the IT o n l i n e s y s t e m of a s t o c k e x c h a n g e . This will help the Lead Book Runner to make available a graphic p r e s e n t a t i o n of t h e d e t a i l s of b i d s r e c e i v e d f or t h e b e n e f i t o f t h e public. 4.Registrar to the Issue: T h e L e a d B o o k R u n n e r h e l p s t h e c o m p a n y i n a p p o i n t i n g a Registrar who generally discharges the following functions. a)Appointment of Bankers : The Registrar helps the company in appointing bankers and opening Escrow A/Cs for accepting the Application money. b) Printing & Supply of Forms: He arranges to print the Application cum Bid Forms, Red Herring Prospectus. The same is supplied to various Syndicate members and their branch offices. c) Allotment: The net-public offer portion of public issue is allotted by the Registrar to the retail investors in consultation with the Lead Book Runner, the Company and the Stock Exchange officials. d) Other Procedure: T h e R e g i s t r a r a l s o a r r a n g e s t o c r e d i t t h e D e m a t a c c o u n t s of t h e allottees and dispatch allotment letters or refund orders.

Explain the concept of float. How float can be managed effectively?

Q.3

Ans: The float can be positive or negative. If the firm has deposited the cheques for collection and delay is caused for crediting the effects, we call it a negative float. On the other hand, the firm has issued cheques to its suppliers or others and delay is caused in debiting the firms bank a c c o u n t , it is called a positive float. The firm can do its best to see that the p o s i t i v e f l o a t increases and the negative float decreases. The float can be managed effectively by way of: A. Accelerating Cash Inflows B.Decelerating Cash Outflows A) Accelerating Cash Inflows: Organizing an Effective Cash Department: The function of Cash Department should be organized well. Arrangements should be made to bring in the mail early in the morning b y o p e n i n g a s e p a r a t e m a i l b o x . I n s t e a d o f r el y i n g u p o n t h e e m p l o y e e of t h e p o s t a l department, an employee of the firm should collect it early in the morning. It must be made clear that the cheques received should be recorded in the books and sent to the bank w e l l b e f or e t h e t i m e t h e b a n k s c a r r y t h e c h e q u e s f or t h e c l e a r i n g . S c a n n e r s c a n b e installed to catch the digital image of cheques from which entries can be made in the books after sending the cheques to the bank. Electronic Clearance of Cheques: Arrangements must be made with the banks to get thec h e q u e s c l e a r e d t hr o u g h N a t i o n a l E l e c t r o n i c F u n d s T r a n s f e r o r R e a l T i m e G r o s s settlement of the RBI. Making use of foreign banks or new generation private sector banks for clearing the cheques will reduce the time involved in collection of the cheques.

Quick Credit of Cheques: Wherever allowed, arrangements must be made with the banks t o cr e d i t t h e p r o c e e d s e v e n b e f o r e c o l l e c t i o n or b y w a y of g e t t i n g t h e i n s t r u m e n t discounted with the banker. Instruments Payable at Par: A r r a n g e m e n t s c a n a l s o b e m a d e w i t h t h e c u s t o m e r s t o receive the payments by way of Demand Drafts drawn on the bank branch with which the firm has an account. Alternatively, after the adoption of core banking by the Indian banks whereby all the branches are networked, they have started issuing multi-city cheques or A t P a r C h e q u e s . T h e s e c h e q u e s a r e p a y a b l e a t p a r a t a n y branch of the bank Immediately. More and more banks are issuing such cheques. Therefore, the delay in c o l l e c t i o n c a n b e a v o i d e d . O n e m o r e a n d t h e m o s t ef f e c t i v e w a y i s t o e n c o u r a g e t h e customers to make payments online using a credit card or debit card. This will ensure the removal of all the delays and transfer the funds from the bank account of the customer to the bank account of the firm immediately. Cheque Truncation: A c c o u n t s c a n b e o p e n e d w i t h b a n k s , w h i c h ar e u s i n g c h e q u e truncation for collecting the cheques. Truncation is a process whereby the collecting banker sends only the digital image of the cheque to the paying banker. Cheques are not sent physically for collection. ATMS are also being developed so that cheques deposited into the ATMS for collection are accepted and the digital image is sent via the network to the paying banker immediately. The credit is given instantly as soon as the cheque is cleared by the paying banker. Using Lock Box System: Arrangements are also made with the post office to open a lock box system from where the bank collects the cheques directly. This arrangement reduces the procedure of cheques received by the firm and sent to the bank for collection. Though conventional practice regards this system to be very effective one, the banks will charge heavily for this service. In addition, the firm may have to depend upon the efficiency of the bank staff in prompt receipt of cheques from the lock box every day. Added to that, t h e f i r m h a s t o d e p e n d u p o n t h e b a n k s p e r i o d i c a l s t a t e m e n t s i n t h e m a n a g e m e n t o f accounts receivable

that will create a delay in the monitoring of accounts receivable. Differences may also arise in accounting for the cheques. Disputes m a y a r i s e a n d rectification has to be done periodically. Concentration Banking : A corporate having branches spread throughout the country d e s i g n a t e s c e r t a i n s t r a t e g i c a l l y l o c a t e d br a n c h e s t o c o l l e c t t h e c h e q u e s o n b e h a l f o f branches in different regions. The branches inform the customers to make payment d i r e c t l y t o t h e d e s i g n a t e d br a n c h ; a n e f f e c t i v e s y s t e m c a n b e i n s t a l l e d f or q u i c k a n d speedy collection of cheques. This system removes the disadvantage of mailing delay involved in sending the customers cheques of all the branches to the head office. The designated branches are nearer to customers than the head office. At the same time, it a v o i d s t h e i n e f f i c i e n c y of e a c h br a n c h r e c e i v i n g t h e c h e q u e s a n d s e n d i n g t h e m f or collection. B) Decelerating Cash Outflows: The payments made are delayed as much as possible without attracting any extra cost or penalty. Payment on the Last Date : Payments are not made early. They are delayed as much as possible. For purchases, the payment is made on the last date allowed. If highest cash discount is available for payment within 15 days, payment is made only on the 14th day or 15th day. For power bill, payment is made on the last day without attracting penalty. Even for payment of taxes, they are paid only on the last permitted date. Payment by Head Office: Payments on behalf of all the branches should be made by the Head office. The Branch Heads are not given the powers to make payments. They have to deposit all the receipts into the accounts of the Head Office opened with a bank in the locality of the branch. For all payments, the Branch Manager must write to the Head Office. The Head Office in turn will draw cheques on the banks in the locality of the branch, and send them to the Branch Manager even for the payment of salary; the same system should be followed. Naturally, it will entail delays resulting in conservation of cash.

Cheque Kiting : Cheques can be sent to the supplier even if there is no balance in the bank. As it involves a float on the part of the payee, it will take anything between 7 daysto 10 days for the cheque to be presented by the bank. By that time, either there will be some receipts to take care of it or we can make arrangement to deposit the amount. There are many firms, which come to an understanding with the banker. On receipt of cheques by way of presentation, the bank informs the firm. After that, the firm deposits the necessary amount into the bank account or uses the overdraft facility to make payment. Using Credit Cards for Payment: Credit cards generally give a months time for making the payment to the bank. If payment is made within the date specified, the bank levies no interest. Payments need not be made in the month of purchase. In the second month, the bank sends the demand statement. By the end of second month, if the payment is made, interest is saved for almost two months.

Selection of Banks: The bank may be selected in such a way that we get the maximum positive float. There are banks known for very inefficient system of collection. Every c o l l e c t i o n o f o u t s t a t i o n c h e q u e t a k e s m or e t h a n 1 5 d a y s . Cheques can be drawn on accounts maintained with such banks. A g a i n , a b a n k m a y b e s e l e c t e d s p e c i f i c a l l y because it has only a small network of branches. This will make the cheque to come t hr o u g h m o r e than one bank for collection. Naturally, delay is caused and cash is conserved

Das könnte Ihnen auch gefallen

- Treasury Operations In Turkey and Contemporary Sovereign Treasury ManagementVon EverandTreasury Operations In Turkey and Contemporary Sovereign Treasury ManagementNoch keine Bewertungen

- External Commercial BorrowingDokument14 SeitenExternal Commercial BorrowingKK SinghNoch keine Bewertungen

- SecuritizationDokument39 SeitenSecuritizationSakshi GuravNoch keine Bewertungen

- Asset Allocation 5E (PB): Balancing Financial Risk, Fifth EditionVon EverandAsset Allocation 5E (PB): Balancing Financial Risk, Fifth EditionBewertung: 4 von 5 Sternen4/5 (13)

- Asset Backed SecuritiesDokument179 SeitenAsset Backed SecuritiesShivani NidhiNoch keine Bewertungen

- Implementation of the ASEAN+3 Multi-Currency Bond Issuance Framework: ASEAN+3 Bond Market Forum Sub-Forum 1 Phase 3 ReportVon EverandImplementation of the ASEAN+3 Multi-Currency Bond Issuance Framework: ASEAN+3 Bond Market Forum Sub-Forum 1 Phase 3 ReportNoch keine Bewertungen

- Types of CDOsDokument9 SeitenTypes of CDOsKeval ShahNoch keine Bewertungen

- Presentation On Financial InstrumentsDokument20 SeitenPresentation On Financial InstrumentsMehak BhallaNoch keine Bewertungen

- Evolution and Function of MoneyDokument14 SeitenEvolution and Function of MoneyGhulam HasnainNoch keine Bewertungen

- Treasury ManagementDokument47 SeitenTreasury Managementsinghsudhir261Noch keine Bewertungen

- Banker and CustomerDokument23 SeitenBanker and CustomerAnkan Pattanayak100% (1)

- Fema 2000Dokument31 SeitenFema 2000Manpreet Kaur SekhonNoch keine Bewertungen

- Loan SyndicationDokument4 SeitenLoan SyndicationRalsha DinoopNoch keine Bewertungen

- CH 1 - Scope of International FinanceDokument7 SeitenCH 1 - Scope of International Financepritesh_baidya269100% (3)

- Core Risks in BankingDokument9 SeitenCore Risks in BankingVenkatsubramanian R IyerNoch keine Bewertungen

- Credit and Collection For The Small Entrepreneur: By: John Xavier S. Chavez, MFMDokument46 SeitenCredit and Collection For The Small Entrepreneur: By: John Xavier S. Chavez, MFMRheneir MoraNoch keine Bewertungen

- Chapter 6 - Portfolio Evaluation and Revision - KeyDokument26 SeitenChapter 6 - Portfolio Evaluation and Revision - KeyShahrukh ShahjahanNoch keine Bewertungen

- Different Contracts in Legal Aspect of BankingDokument7 SeitenDifferent Contracts in Legal Aspect of Bankingdrishya3Noch keine Bewertungen

- Bank of Uganda Releases Agent Banking RegulationsDokument2 SeitenBank of Uganda Releases Agent Banking RegulationspokechoNoch keine Bewertungen

- Assignment Retail BankingDokument3 SeitenAssignment Retail BankingSNEHA MARIYAM VARGHESE SIM 16-18Noch keine Bewertungen

- Secondary MarketDokument27 SeitenSecondary MarketAmit BharwadNoch keine Bewertungen

- Characteristics of The Money MarketDokument8 SeitenCharacteristics of The Money Marketshubhmeshram2100Noch keine Bewertungen

- Asset - Liability Management System in Banks - Guidelines: 4. ALM Information SystemsDokument12 SeitenAsset - Liability Management System in Banks - Guidelines: 4. ALM Information SystemsKevin VazNoch keine Bewertungen

- What Is A "Derivative" ?Dokument4 SeitenWhat Is A "Derivative" ?RAHULNoch keine Bewertungen

- Ch21 (Term Loan & Lease)Dokument37 SeitenCh21 (Term Loan & Lease)মেহেদি তসলিমNoch keine Bewertungen

- Financial Services.Dokument127 SeitenFinancial Services.srn@1234Noch keine Bewertungen

- Non Convertible DebenturesDokument3 SeitenNon Convertible DebenturesAbhinav AroraNoch keine Bewertungen

- Bond ValuationDokument50 SeitenBond Valuationrenu3rdjanNoch keine Bewertungen

- Currency ConvertibilityDokument37 SeitenCurrency Convertibilitylavkush_khannaNoch keine Bewertungen

- Banking Operations (MAIN TOPICS)Dokument32 SeitenBanking Operations (MAIN TOPICS)Saqib ShahzadNoch keine Bewertungen

- Problem Loan ManagementDokument13 SeitenProblem Loan ManagementAsadul HoqueNoch keine Bewertungen

- Banking Products and ServicesDokument13 SeitenBanking Products and ServicesDharmeshParikhNoch keine Bewertungen

- Loan RestructuringDokument22 SeitenLoan RestructuringNazmul H. PalashNoch keine Bewertungen

- Principles of Sound LendingDokument2 SeitenPrinciples of Sound LendingRajat Das100% (1)

- Fixed Income Securities: IntroductionDokument33 SeitenFixed Income Securities: IntroductionYogaPratamaDosen100% (1)

- On Depository SysDokument12 SeitenOn Depository SysShelly GuptaNoch keine Bewertungen

- Foreign Exchange Risk ManagementDokument12 SeitenForeign Exchange Risk ManagementDinesh KumarNoch keine Bewertungen

- Memo Model Netting ActDokument12 SeitenMemo Model Netting ActChristine LiuNoch keine Bewertungen

- Project On Commercial PaperDokument23 SeitenProject On Commercial PaperSuryaNoch keine Bewertungen

- Indian Debt MarketDokument32 SeitenIndian Debt MarketProfessorAsim Kumar Mishra0% (1)

- Maricris G. Alagar BA-101 Finance IIDokument5 SeitenMaricris G. Alagar BA-101 Finance IIMharykhriz AlagarNoch keine Bewertungen

- Depository SystemDokument38 SeitenDepository SystemTarun SehgalNoch keine Bewertungen

- Origin of BankingDokument6 SeitenOrigin of BankingamaznsNoch keine Bewertungen

- Credit Markets1Dokument45 SeitenCredit Markets1David Raju GollapudiNoch keine Bewertungen

- International Financial MarketsDokument13 SeitenInternational Financial Marketsmanojpatel5150% (4)

- Investment PolicyDokument23 SeitenInvestment Policyrj5307Noch keine Bewertungen

- WCM - Unit 2 Cash ManagementDokument51 SeitenWCM - Unit 2 Cash ManagementkartikNoch keine Bewertungen

- 15 International Working Capital Management: Chapter ObjectivesDokument16 Seiten15 International Working Capital Management: Chapter ObjectivesNancy DsouzaNoch keine Bewertungen

- A Study On IDLC Finance LimitedDokument33 SeitenA Study On IDLC Finance LimitedKelly McmillanNoch keine Bewertungen

- Guide To Par Syndicated LoansDokument10 SeitenGuide To Par Syndicated LoansBagus Deddy AndriNoch keine Bewertungen

- Islamic Commercial BankingDokument26 SeitenIslamic Commercial BankingjmfaleelNoch keine Bewertungen

- Techniques For Managing ExposureDokument26 SeitenTechniques For Managing Exposureprasanthgeni22100% (1)

- Private Sector BanksDokument3 SeitenPrivate Sector BanksBalaji GajendranNoch keine Bewertungen

- Organisational StructureDokument30 SeitenOrganisational StructureUsama ShahNoch keine Bewertungen

- Prudent Private Wealth Company ProfileDokument5 SeitenPrudent Private Wealth Company ProfilepratikNoch keine Bewertungen

- Merchant BankDokument13 SeitenMerchant Bankmdeepak1989Noch keine Bewertungen

- Classification of CreditDokument25 SeitenClassification of CreditJohn Nikko LlaneraNoch keine Bewertungen

- International BankingDokument8 SeitenInternational BankingpalaksinghalNoch keine Bewertungen

- Insurance Act, 1938Dokument101 SeitenInsurance Act, 1938dodoNoch keine Bewertungen

- Performance AppraDokument51 SeitenPerformance Apprarakeshrakesh1Noch keine Bewertungen

- Table of ContentsDokument1 SeiteTable of Contentsrakeshrakesh1Noch keine Bewertungen

- Centre For Child Rights: Hildren'SDokument4 SeitenCentre For Child Rights: Hildren'Srakeshrakesh1Noch keine Bewertungen

- Zeme Church Delhi: Certificate of Child DedicationDokument1 SeiteZeme Church Delhi: Certificate of Child Dedicationrakeshrakesh1Noch keine Bewertungen

- Ma HS Iii SemDokument23 SeitenMa HS Iii Semrakeshrakesh1Noch keine Bewertungen

- January: Monday Tuesday Thursday Friday Saturday SundayDokument13 SeitenJanuary: Monday Tuesday Thursday Friday Saturday Sundayrakeshrakesh1Noch keine Bewertungen

- Analysis of Working Capital Management in Parle Biscuits Pvt. LTDDokument1 SeiteAnalysis of Working Capital Management in Parle Biscuits Pvt. LTDrakeshrakesh1Noch keine Bewertungen

- Export Procedure IN CM Logistics India Pvt. LTDDokument1 SeiteExport Procedure IN CM Logistics India Pvt. LTDrakeshrakesh1Noch keine Bewertungen

- Holiday Homework OF: EnglishDokument4 SeitenHoliday Homework OF: Englishrakeshrakesh1Noch keine Bewertungen

- Er-Diagram: User Id Password DOBDokument1 SeiteEr-Diagram: User Id Password DOBrakeshrakesh1Noch keine Bewertungen

- 2.2 Data Flow Diagram (DFD) : Agent Reservati Cancella Customer Records Change PasswordDokument2 Seiten2.2 Data Flow Diagram (DFD) : Agent Reservati Cancella Customer Records Change Passwordrakeshrakesh1Noch keine Bewertungen

- View DetailsDokument2 SeitenView Detailsrakeshrakesh1Noch keine Bewertungen

- "A Comparative Study of Two Wheeler Industry in India" With Special Reference To Hero MotocorpDokument1 Seite"A Comparative Study of Two Wheeler Industry in India" With Special Reference To Hero Motocorprakeshrakesh1Noch keine Bewertungen

- Smu Neev EducationDokument1 SeiteSmu Neev Educationrakeshrakesh1Noch keine Bewertungen

- Financial Analysis of L & T: Neev Education Pvt. LTDDokument3 SeitenFinancial Analysis of L & T: Neev Education Pvt. LTDrakeshrakesh1Noch keine Bewertungen

- Source File of Showroom: Project OnDokument1 SeiteSource File of Showroom: Project Onrakeshrakesh1Noch keine Bewertungen

- Document 12Dokument1 SeiteDocument 12rakeshrakesh1Noch keine Bewertungen

- EflDokument14 SeitenEflrakeshrakesh1Noch keine Bewertungen

- Growth of Retail Marketing in India: Project Guide Submitted byDokument5 SeitenGrowth of Retail Marketing in India: Project Guide Submitted byrakeshrakesh1Noch keine Bewertungen

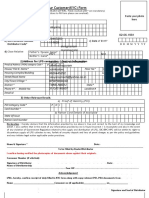

- Part - A: Fresh Application FormDokument3 SeitenPart - A: Fresh Application Formrakeshrakesh1Noch keine Bewertungen

- Chapter 6 - Adobe Photoshop: Image ResolutionDokument2 SeitenChapter 6 - Adobe Photoshop: Image Resolutionrakeshrakesh1Noch keine Bewertungen

- Bhabendra Nath SaikiaDokument1 SeiteBhabendra Nath Saikiarakeshrakesh1Noch keine Bewertungen

- Concurrent Course For Hon. Prog.: (Language Credit Course) English LanguageDokument3 SeitenConcurrent Course For Hon. Prog.: (Language Credit Course) English Languagerakeshrakesh1Noch keine Bewertungen

- A Synopsis ON "A Study On Measuring Customer Satisfaction On Honda City"Dokument8 SeitenA Synopsis ON "A Study On Measuring Customer Satisfaction On Honda City"rakeshrakesh1Noch keine Bewertungen

- 6 D 95 CBB 6 BC 3Dokument7 Seiten6 D 95 CBB 6 BC 3Héctor DíazNoch keine Bewertungen

- Unicorn Report 2023 - v7Dokument175 SeitenUnicorn Report 2023 - v7EmmyNoch keine Bewertungen

- 5-SETTLEMENT-Outward Clearing 1Dokument21 Seiten5-SETTLEMENT-Outward Clearing 1ola.cloudsNoch keine Bewertungen

- ONT LM241UW5 Datasheet - V1.2Dokument6 SeitenONT LM241UW5 Datasheet - V1.2mnowarulalam2085Noch keine Bewertungen

- Syllabus D.com 1 WWW - Tauqeerhillsjab.blogspotDokument57 SeitenSyllabus D.com 1 WWW - Tauqeerhillsjab.blogspotHills JabNoch keine Bewertungen

- Naan MudhalvanDokument4 SeitenNaan Mudhalvanharishguhan92Noch keine Bewertungen

- For Which Item Does A Bank Not Issue A Debit Memorandum?: E. To Notify A Depositor of A Deposit To Their AccountDokument33 SeitenFor Which Item Does A Bank Not Issue A Debit Memorandum?: E. To Notify A Depositor of A Deposit To Their AccountUyenNoch keine Bewertungen

- Facebook Moves Into E-CommerceDokument4 SeitenFacebook Moves Into E-CommerceNanda RezkyNoch keine Bewertungen

- MASDokument9 SeitenMASJulius Lester AbieraNoch keine Bewertungen

- Fertilizer CalculatorDokument5 SeitenFertilizer CalculatorsameershukNoch keine Bewertungen

- National Health Insurance Scheme: Career Opportunities For Health WorkersDokument3 SeitenNational Health Insurance Scheme: Career Opportunities For Health Workersyusuf hamidNoch keine Bewertungen

- Hospital Organizational StructuresDokument25 SeitenHospital Organizational StructuresSparsh SharmaNoch keine Bewertungen

- BBA Major ProjectDokument40 SeitenBBA Major ProjectDeepak Bhatia100% (5)

- Handout Errors LessonDokument14 SeitenHandout Errors LessonKiri chrisNoch keine Bewertungen

- Contoh Soal AKMDokument3 SeitenContoh Soal AKMNada AlfiyahNoch keine Bewertungen

- Fitbase Cancellation FormDokument1 SeiteFitbase Cancellation FormMarley HarrisNoch keine Bewertungen

- Transport Ludeña, Mere, Rivera, FloresDokument11 SeitenTransport Ludeña, Mere, Rivera, FloresBrenda Valeria rivera fernandezNoch keine Bewertungen

- Thank You For Choosing Our Top-Rated Cover: Your DetailsDokument13 SeitenThank You For Choosing Our Top-Rated Cover: Your DetailsChuck K SydneyNoch keine Bewertungen

- Summer Training Project On HDC Bank Varanasi SHISH MBA SAMS IBM VaranasiDokument85 SeitenSummer Training Project On HDC Bank Varanasi SHISH MBA SAMS IBM VaranasiShish ChoudharyNoch keine Bewertungen

- Full Download Ebook PDF A Practical Guide To Advanced Networking 3rd Edition PDFDokument41 SeitenFull Download Ebook PDF A Practical Guide To Advanced Networking 3rd Edition PDFlydia.hawkins293100% (28)

- Employees OrientationDokument26 SeitenEmployees OrientationRojila luitelNoch keine Bewertungen

- M-Pesa Public CaseDokument23 SeitenM-Pesa Public CaseRinaldo DikaputraNoch keine Bewertungen

- e-StatementBRImo 716901009766537 Oct2023 20231019 110239Dokument1 Seitee-StatementBRImo 716901009766537 Oct2023 20231019 110239yenimaisya9Noch keine Bewertungen

- WORKDokument7 SeitenWORKzekariasNoch keine Bewertungen

- Overview of SAP ISRDokument18 SeitenOverview of SAP ISRGOVINDRAJNoch keine Bewertungen

- CE Principles of Accounts 1999 PaperDokument8 SeitenCE Principles of Accounts 1999 Paperapi-3747191Noch keine Bewertungen

- Comandos Ccna SecurityDokument26 SeitenComandos Ccna SecurityRobtech opsNoch keine Bewertungen

- Kyc Format BPCDokument2 SeitenKyc Format BPCrevathy0% (1)

- 4 Exam Part 2Dokument4 Seiten4 Exam Part 2RJ DAVE DURUHANoch keine Bewertungen

- WWW Scribd Com Document 632664200 Shree RedingtonDokument8 SeitenWWW Scribd Com Document 632664200 Shree RedingtonPriyanka YadavNoch keine Bewertungen

- John D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthVon EverandJohn D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthBewertung: 4 von 5 Sternen4/5 (20)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaVon EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaBewertung: 4.5 von 5 Sternen4.5/5 (14)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaVon EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaBewertung: 3.5 von 5 Sternen3.5/5 (8)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNVon Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNBewertung: 4.5 von 5 Sternen4.5/5 (3)

- Mind over Money: The Psychology of Money and How to Use It BetterVon EverandMind over Money: The Psychology of Money and How to Use It BetterBewertung: 4 von 5 Sternen4/5 (24)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialVon EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNoch keine Bewertungen

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisVon EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisBewertung: 5 von 5 Sternen5/5 (6)

- Creating Shareholder Value: A Guide For Managers And InvestorsVon EverandCreating Shareholder Value: A Guide For Managers And InvestorsBewertung: 4.5 von 5 Sternen4.5/5 (8)

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingVon EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingBewertung: 4.5 von 5 Sternen4.5/5 (17)

- The 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamVon EverandThe 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamNoch keine Bewertungen

- Ready, Set, Growth hack:: A beginners guide to growth hacking successVon EverandReady, Set, Growth hack:: A beginners guide to growth hacking successBewertung: 4.5 von 5 Sternen4.5/5 (93)

- An easy approach to trading with bollinger bands: How to learn how to use Bollinger bands to trade online successfullyVon EverandAn easy approach to trading with bollinger bands: How to learn how to use Bollinger bands to trade online successfullyBewertung: 3 von 5 Sternen3/5 (1)

- Mastering the VC Game: A Venture Capital Insider Reveals How to Get from Start-up to IPO on Your TermsVon EverandMastering the VC Game: A Venture Capital Insider Reveals How to Get from Start-up to IPO on Your TermsBewertung: 4.5 von 5 Sternen4.5/5 (21)

- Product-Led Growth: How to Build a Product That Sells ItselfVon EverandProduct-Led Growth: How to Build a Product That Sells ItselfBewertung: 5 von 5 Sternen5/5 (1)

- Applied Corporate Finance. What is a Company worth?Von EverandApplied Corporate Finance. What is a Company worth?Bewertung: 3 von 5 Sternen3/5 (2)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialVon EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialBewertung: 4.5 von 5 Sternen4.5/5 (32)

- Warren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorVon EverandWarren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorNoch keine Bewertungen

- Buffett's 2-Step Stock Market Strategy: Know When To Buy A Stock, Become A Millionaire, Get The Highest ReturnsVon EverandBuffett's 2-Step Stock Market Strategy: Know When To Buy A Stock, Become A Millionaire, Get The Highest ReturnsBewertung: 5 von 5 Sternen5/5 (1)

- Value: The Four Cornerstones of Corporate FinanceVon EverandValue: The Four Cornerstones of Corporate FinanceBewertung: 5 von 5 Sternen5/5 (2)

- Venture Deals: Be Smarter Than Your Lawyer and Venture CapitalistVon EverandVenture Deals: Be Smarter Than Your Lawyer and Venture CapitalistBewertung: 4 von 5 Sternen4/5 (32)

- Finance Secrets of Billion-Dollar Entrepreneurs: Venture Finance Without Venture Capital (Capital Productivity, Business Start Up, Entrepreneurship, Financial Accounting)Von EverandFinance Secrets of Billion-Dollar Entrepreneurs: Venture Finance Without Venture Capital (Capital Productivity, Business Start Up, Entrepreneurship, Financial Accounting)Bewertung: 4 von 5 Sternen4/5 (5)

- The Wall Street MBA, Third Edition: Your Personal Crash Course in Corporate FinanceVon EverandThe Wall Street MBA, Third Edition: Your Personal Crash Course in Corporate FinanceBewertung: 4 von 5 Sternen4/5 (1)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistVon EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistBewertung: 4.5 von 5 Sternen4.5/5 (73)

- The Value of a Whale: On the Illusions of Green CapitalismVon EverandThe Value of a Whale: On the Illusions of Green CapitalismBewertung: 5 von 5 Sternen5/5 (2)