Beruflich Dokumente

Kultur Dokumente

Synopsis On MR

Hochgeladen von

anujhanda29Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Synopsis On MR

Hochgeladen von

anujhanda29Copyright:

Verfügbare Formate

AMITY UNIVERSITY -----UTTAR PRADESH-----

Amity Business School Synopsis of Market Research

SUBMITTED BY-: Anuj Handa - 43

Nitesh Rawat -17 Sachin Khatri -11 Dhananjay Adarsh PM Parth -42 -44

2) Topic Exploring the factors impacting the investment decision

3) Project Objectives To determine the various investment avenues available in India. To explore various factors that influence individuals investment decision. To gain knowledge about how demographics and investment decision are related.

4) Research Design The researchers propose to first conduct an intensive secondary research to understand the full impact and implication of the industry, to critically review the industry norms and reports, on which certain issues shall be selected, which the researchers feel remain unanswered or liable to change, this shall be further taken up in the next stage of exploratory research where focused group shall screen through. This stage shall help the researchers to restrict and select only the important question and issue, which inhabit growth and segmentation in the industry. These set of questions are then proposed to be studied under a descriptive research setting finally leading to formation of hypothesis and testing the same under causal research.

5) Types of Research On the basis of fundamental objectives of the research, marketing research projects are classified into two branches: Exploratory Research Conclusive Research

6) Data collection Technique Primary data Which is collected by new research called primary data. Questionnaire.

Secondary data Already existing data is called secondary data. I collected them by following method Internet. Books. Published Reports. 7)Data Interpretation Tools Following softwares has been used during analysis and compiling of data. SPSS Microsoft Excel Microsoft Word

Introduction Background of study

'It is not how much you save but where you invest it that counts'. Investor needs to explore various factors that influence investment before investing his wealth and also investor needs to know the value of his future profits in today's terms for all the investment opportunities. Only then can he make the best choice. 'Saving' is not consuming everything today and leaving something for tomorrow whereas 'Borrowing' is consuming more than what one has today, expecting to save more later to pay up for the excess consumption now. While 'saving' is being conservative and wise, 'borrowing' is being risky and foolish unless for a basic need. Hence, it makes sense to borrow only when one is sure that inthe future he will be able to save enough not only to pay up for his borrowings but also to see him through the days when he cannot earn. Saving is useful only if invested somewhere. Many individuals find investments to be fascinating because they can participate in the decision making process and see the results of their choices. Not all investments will be profitable, as investor wills not always make the correct investment decisions over the period of years However, you should earn a positive return on a diversified portfolio. Virtually everyone makes Investments. Even if the individual does not select specific assets such as stock, investments are still made through participation in pension plan, and employee saving programme or through purchase of life insurance or a home or by some other mode of investment like investing in Real Estate (Property) or in Banks or in

saving schemes of post offices. Each of this investment has common characteristics such as potential return and the risk you must bear.

Das könnte Ihnen auch gefallen

- SdsadasDokument3 SeitenSdsadasanujhanda29Noch keine Bewertungen

- Notice: Next Week. However The Scheduled Date and Time of Viva Voce of Eligible Students Will BeDokument1 SeiteNotice: Next Week. However The Scheduled Date and Time of Viva Voce of Eligible Students Will Beanujhanda29Noch keine Bewertungen

- CwsadqaDokument18 SeitenCwsadqaanujhanda29Noch keine Bewertungen

- MBA's Class of 2014 Final Placement: NoticeDokument2 SeitenMBA's Class of 2014 Final Placement: Noticeanujhanda29Noch keine Bewertungen

- CfweDokument23 SeitenCfweanujhanda29Noch keine Bewertungen

- Amity University:: Garvita JainDokument2 SeitenAmity University:: Garvita Jainanujhanda29Noch keine Bewertungen

- Project Mastersheet1Dokument3 SeitenProject Mastersheet1anujhanda29Noch keine Bewertungen

- Amity Business School: Sports PeriodDokument1 SeiteAmity Business School: Sports Periodanujhanda29Noch keine Bewertungen

- Amity University - Amity Business School: Revised NoticeDokument2 SeitenAmity University - Amity Business School: Revised Noticeanujhanda29Noch keine Bewertungen

- DFGDokument3 SeitenDFGanujhanda29Noch keine Bewertungen

- Logistics and Global Commodity Chains: Jean-Paul RodrigueDokument43 SeitenLogistics and Global Commodity Chains: Jean-Paul Rodrigueanujhanda29Noch keine Bewertungen

- ScxsaDokument15 SeitenScxsaanujhanda29Noch keine Bewertungen

- Revised Notice - Campus Recruitment - Summer Placements: March 5, 2013Dokument2 SeitenRevised Notice - Campus Recruitment - Summer Placements: March 5, 2013anujhanda29Noch keine Bewertungen

- Project Mastersheet1Dokument3 SeitenProject Mastersheet1anujhanda29Noch keine Bewertungen

- WDWDokument3 SeitenWDWanujhanda29Noch keine Bewertungen

- Mbas, Class of 2014: NoticeDokument2 SeitenMbas, Class of 2014: Noticeanujhanda29Noch keine Bewertungen

- EffweDokument1 SeiteEffweanujhanda29Noch keine Bewertungen

- FDFDDDokument6 SeitenFDFDDanujhanda29Noch keine Bewertungen

- FDFDDDokument6 SeitenFDFDDanujhanda29Noch keine Bewertungen

- FDFGDDDokument53 SeitenFDFGDDanujhanda29Noch keine Bewertungen

- Amity University - UTTAR PRADESH - Amity Business SchoolDokument2 SeitenAmity University - UTTAR PRADESH - Amity Business Schoolanujhanda29Noch keine Bewertungen

- Da8dduflex Summer PlacementsDokument2 SeitenDa8dduflex Summer Placementsanujhanda29Noch keine Bewertungen

- SdaDokument2 SeitenSdaanujhanda29Noch keine Bewertungen

- Geert Hofstede Cultural DimensionsDokument4 SeitenGeert Hofstede Cultural DimensionsKiran RaoNoch keine Bewertungen

- Amity Business SchoolDokument3 SeitenAmity Business Schoolanujhanda29Noch keine Bewertungen

- Summer Internship Project Report OnDokument7 SeitenSummer Internship Project Report Onanujhanda29Noch keine Bewertungen

- MBA's Class of 2014: Uttar PradeshDokument2 SeitenMBA's Class of 2014: Uttar Pradeshanujhanda29Noch keine Bewertungen

- EdcfewDokument33 SeitenEdcfewanujhanda29Noch keine Bewertungen

- DSFDFFDokument3 SeitenDSFDFFanujhanda29Noch keine Bewertungen

- HCL Technologies Is Visiting ABS For Campus Recruitment On Friday, 06-Dec-2013Dokument1 SeiteHCL Technologies Is Visiting ABS For Campus Recruitment On Friday, 06-Dec-2013rohitk225Noch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (120)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Profit & Loss Pre and Post Incorporation - QBDokument16 SeitenProfit & Loss Pre and Post Incorporation - QBHindutav aryaNoch keine Bewertungen

- HDFC Bank Credit Cards GSTIN: 33AAACH2702H2Z6 HSN Code - 9971Dokument1 SeiteHDFC Bank Credit Cards GSTIN: 33AAACH2702H2Z6 HSN Code - 9971Kuldeep SheoranNoch keine Bewertungen

- Compare & Contrast Among Merger, Acquisition, Joint Venture & Strategic AlliancesDokument5 SeitenCompare & Contrast Among Merger, Acquisition, Joint Venture & Strategic Alliancest_jabin100% (15)

- Capital GainsDokument27 SeitenCapital GainsdeepakadhanaNoch keine Bewertungen

- Financial Management Capitalization P-2Dokument12 SeitenFinancial Management Capitalization P-2api-3747098100% (2)

- Non Banking Financial CompaniesDokument20 SeitenNon Banking Financial CompaniesLav Chaudhary0% (1)

- First Quiz On Liquidity and Solvency Ratios PDFDokument2 SeitenFirst Quiz On Liquidity and Solvency Ratios PDFRandy ManzanoNoch keine Bewertungen

- Asset Liability Management IN Abhuydaya Bank: Amol PatilDokument14 SeitenAsset Liability Management IN Abhuydaya Bank: Amol Patilpari0000Noch keine Bewertungen

- Importance of Financial Planning PDFDokument11 SeitenImportance of Financial Planning PDFsnsahuNoch keine Bewertungen

- Supplementary Life Insurance - Enrolment FormDokument1 SeiteSupplementary Life Insurance - Enrolment FormjeevaNoch keine Bewertungen

- Paychecks Crossword PuzzleDokument1 SeitePaychecks Crossword Puzzleapi-2760115920% (3)

- Quiz Discontinued OperationDokument2 SeitenQuiz Discontinued OperationRose0% (1)

- Income and Business TaxationDokument6 SeitenIncome and Business Taxationomega shtNoch keine Bewertungen

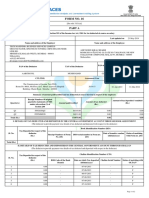

- Form No. 16: Part ADokument2 SeitenForm No. 16: Part AasifNoch keine Bewertungen

- Upwork FinancialDokument19 SeitenUpwork FinancialVvb SatyanarayanaNoch keine Bewertungen

- HaitongInternationalResearchLimited TorrentPharmaceuticals (TRPIN) - GalloperNon-LineargrowththroughMA (Published712020) Jan 29 2020 PDFDokument120 SeitenHaitongInternationalResearchLimited TorrentPharmaceuticals (TRPIN) - GalloperNon-LineargrowththroughMA (Published712020) Jan 29 2020 PDFHarshitNoch keine Bewertungen

- Stop ForeclosureDokument7 SeitenStop ForeclosureRicharnellia-RichieRichBattiest-Collins0% (1)

- Money Market InstrumentsDokument46 SeitenMoney Market InstrumentsAadi1187100% (3)

- AP-5903 - PPE & Intangibles PDFDokument19 SeitenAP-5903 - PPE & Intangibles PDFkayeNoch keine Bewertungen

- Module-1 BusinessDokument6 SeitenModule-1 BusinessAP ABHILASHNoch keine Bewertungen

- Conceptual Framework: Objective of Financial ReportingDokument47 SeitenConceptual Framework: Objective of Financial Reporting버니 모지코Noch keine Bewertungen

- Certified Public Accountant Course Book Unit 1 FinanceDokument297 SeitenCertified Public Accountant Course Book Unit 1 Financeumer12100% (2)

- Chapt 2 Treasury StructureDokument6 SeitenChapt 2 Treasury StructureinexpugnabilNoch keine Bewertungen

- Midterm Examination For AC11N: ProblemDokument1 SeiteMidterm Examination For AC11N: ProblemLeica JaymeNoch keine Bewertungen

- DeductionsDokument31 SeitenDeductionsJane Tuazon50% (2)

- Section 3 - SwapsDokument49 SeitenSection 3 - SwapsEric FahertyNoch keine Bewertungen

- Cambridge International General Certificate of Secondary EducationDokument20 SeitenCambridge International General Certificate of Secondary EducationAung Zaw HtweNoch keine Bewertungen

- 06 Notes - Loan Amortization PDFDokument4 Seiten06 Notes - Loan Amortization PDFAlberto ElquetedejoNoch keine Bewertungen

- Crowd Funding AssignmentDokument9 SeitenCrowd Funding AssignmentneyazzahraNoch keine Bewertungen

- Contract Costing LMS UEWDokument32 SeitenContract Costing LMS UEWPrince Nanaba EphsonNoch keine Bewertungen