Beruflich Dokumente

Kultur Dokumente

Budget India 12-13

Hochgeladen von

Kaustubh AgrawalCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Budget India 12-13

Hochgeladen von

Kaustubh AgrawalCopyright:

Verfügbare Formate

Budget 2013-14

P. Chidambaram will be presenting the Budget for the fiscal year 2013-14. The constant thing mounting enormous pressure on him is on how he will encourage growth while keeping the fiscal deficit and inflation at bay. Thus what his decisions are we can only see on the last day February. However if I was made the Finance Minister I would have focussed on the following policies-

1. Reduce the fiscal deficit The fiscal deficit for the year 2012-13 stood at 5.3% of the GDP. This has to be decreased significantly to levels of 4.5% of the GDP. The measures for carrying this out will be talked about below. 2. GrowthThe growth in the current year was very sloppy. It was at a decade low and so significant improvements have to be made in this regard. 3. SubsidiesA lot of money is spent on subsidies. Various things like oil, natural gas, fertilisers and energy are subsidised. This greatly increases the fiscal deficit. But at the same time it is absolutely necessary to provide subsidies to keep inflation in control. So we have to prioritize the sectors which should be given more amounts of subsidies. Oil and energy is extremely important as it is most susceptible to supply shocks. So expenditure on

fertilisers will have to be cut down. 4. DisinvestmentIncreased amount of stakes would be sold of PSUs. These are highly inefficient and privatising them would make them more efficient as well help in bringing down the fiscal deficit by a large amount. 5. Tax System The issue of GST has been stretched way too far. The implementation of this is very necessary. Only about 5% of the people in the country pay taxes. The tax base has to be increased. Also taxing the super-rich would mean lesser revenues earned from taxes since more people will resort to keeping black money rather than disclosing the amount of money which they actually have. 6. Changes in MarketsForeign institutional investment in corporate and infrastructural bonds. Security transaction tax on equities should also be removed. 7. Taxes on commoditiesTaxes on steel can be increased so as to protect the domestic steel producers from foreign competition. The growth in the auto sector shows how much the economy has really grown. The excise duty on cars and other vehicles should be decreased so as to stimulate growth. Remove import duty on thermal coal and introduce tax-free bonds for power sector.

8. SEZsMinimum Alternate Tax levied on SEZs, severely affecting foreign investments in India to be discontinued or reduced drastically. This would lend strategic benefits and ensure continued thrust on investments from companies with a long term focus on India. 9. The IT industryIncorporate policies and measures to develop the domestic software industry and also focus on encouraging software products segment in the country by protecting it from foreign competition in the domestic market. Promote Indian software products to develop more Intellectual property for India 10. CommunicationIncreasing penetration is by making it affordable to the enduser especially on mobile. Abolishing service tax on mobile internet/broadband services in Budget 2013-14 would make it affordable and boost penetration as well as help in empowerment of users through knowledge and information in non-metro as well as rural India. 11. Increase in spending in education and health care facilitiesThese are the areas where the government cant afford any reduction in expenditure. Quality education and health facility is very important for the growth of any country therefore if India wants to achieve long term growth then it should pay attention on these aspects.

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- India's Fight for Food Security at WTO Ministerial in BaliDokument5 SeitenIndia's Fight for Food Security at WTO Ministerial in BaliKaustubh AgrawalNoch keine Bewertungen

- PovertyDokument5 SeitenPovertyKaustubh AgrawalNoch keine Bewertungen

- Corporate Karzaa MaafiDokument6 SeitenCorporate Karzaa MaafiKaustubh AgrawalNoch keine Bewertungen

- UnemploymentDokument7 SeitenUnemploymentKaustubh AgrawalNoch keine Bewertungen

- Chap 10Dokument6 SeitenChap 10Kaustubh AgrawalNoch keine Bewertungen

- Marginal AnalysisDokument3 SeitenMarginal AnalysisKaustubh AgrawalNoch keine Bewertungen

- Impact of India's 2012 FDI Policy Relaxation in Multi-Brand RetailDokument4 SeitenImpact of India's 2012 FDI Policy Relaxation in Multi-Brand RetailKaustubh AgrawalNoch keine Bewertungen

- Indian Railway Organizational StructureDokument1 SeiteIndian Railway Organizational Structurethyvivek100% (2)

- Top 100 Busineess Scools IndaiDokument3 SeitenTop 100 Busineess Scools IndaiKidzee Manikonda100% (1)

- Kvs BalvatikaDokument11 SeitenKvs Balvatikaanbu selvanNoch keine Bewertungen

- Independence Act 1947Dokument23 SeitenIndependence Act 1947Muqadsa ZainebNoch keine Bewertungen

- Marge Data March 2019Dokument526 SeitenMarge Data March 2019Parveen SinghNoch keine Bewertungen

- Media Languagetype Genre First Name MidDokument24 SeitenMedia Languagetype Genre First Name MidSachin BangeraNoch keine Bewertungen

- List of Pupils Selected For Provisional Admission in Science StreamDokument6 SeitenList of Pupils Selected For Provisional Admission in Science StreamAhanNoch keine Bewertungen

- PM CA July Week 1Dokument6 SeitenPM CA July Week 1CheenaNoch keine Bewertungen

- Description: The Hungry Tide Takes Place in The Sundarbans, A Vast and Ever-ChangingDokument10 SeitenDescription: The Hungry Tide Takes Place in The Sundarbans, A Vast and Ever-ChangingRam ManoharNoch keine Bewertungen

- Registration details for West Bengal State University studentsDokument17 SeitenRegistration details for West Bengal State University studentsSamir SharmaNoch keine Bewertungen

- BJNBMDokument21 SeitenBJNBMGons JanjuaNoch keine Bewertungen

- Civics Class-6 L-1Dokument3 SeitenCivics Class-6 L-1RamakantaSahooNoch keine Bewertungen

- List of Famous Caves in India PDFDokument4 SeitenList of Famous Caves in India PDFRohit Singh RajputNoch keine Bewertungen

- Essay Is The World Witnessing Reverse GlobalizationDokument7 SeitenEssay Is The World Witnessing Reverse GlobalizationAfnan TariqNoch keine Bewertungen

- Section 2 NotesDokument75 SeitenSection 2 NotesOmar AdnanNoch keine Bewertungen

- Participating: The Syrian Speakers of SanskritDokument4 SeitenParticipating: The Syrian Speakers of SanskritRaizo SinnedNoch keine Bewertungen

- VOL081Dokument512 SeitenVOL081GivemedegunJoe100% (1)

- Assam-Meghalaya DisputeDokument3 SeitenAssam-Meghalaya DisputeJainam ShahNoch keine Bewertungen

- Asoka The GreatDokument15 SeitenAsoka The GreatShashank KulkarniNoch keine Bewertungen

- EconomicHisIndia2 Romesh Dutt 1903Dokument325 SeitenEconomicHisIndia2 Romesh Dutt 1903smallverysmallNoch keine Bewertungen

- Making money the main aim of lifeDokument43 SeitenMaking money the main aim of lifenehaNoch keine Bewertungen

- KGFDokument3 SeitenKGFVamsi ReddyNoch keine Bewertungen

- RajyotsavaDokument2 SeitenRajyotsavanewtomatocastleNoch keine Bewertungen

- Gono 520Dokument4 SeitenGono 520apseeds tanukuNoch keine Bewertungen

- Internal Security NCRB ReportDokument8 SeitenInternal Security NCRB ReportZeba HasanNoch keine Bewertungen

- A Summer Training Report On JKR Resort & Spa, Rameshwaram Submitted by Reg. No: 911520631002Dokument47 SeitenA Summer Training Report On JKR Resort & Spa, Rameshwaram Submitted by Reg. No: 911520631002Mohamed Fathima BA EnglishNoch keine Bewertungen

- India Our Beautiful Country - W.S 4Dokument2 SeitenIndia Our Beautiful Country - W.S 4Liza MusthafaNoch keine Bewertungen

- Outlay On Major Schemes: Ééºiééê Ébée Évé) ºéæ Ééäéêvéié Évé) +éxéöàééxé +éxéöàééxé +éxéöàééxéDokument3 SeitenOutlay On Major Schemes: Ééºiééê Ébée Évé) ºéæ Ééäéêvéié Évé) +éxéöàééxé +éxéöàééxé +éxéöàééxéRajat JadhavNoch keine Bewertungen

- Chronology of India ShippingDokument30 SeitenChronology of India ShippingChaitu Un PrediCtbleNoch keine Bewertungen

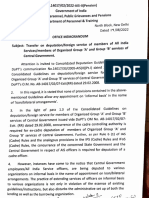

- DoPT No Loan 17.8.2022Dokument3 SeitenDoPT No Loan 17.8.20223authors threeauthorsNoch keine Bewertungen