Beruflich Dokumente

Kultur Dokumente

Case Study No 2

Hochgeladen von

Ranjan RaiOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Case Study No 2

Hochgeladen von

Ranjan RaiCopyright:

Verfügbare Formate

Case Study No.

2 Study the following article and answer the questions given below: Mar 28, 2012 When FCCB turns ugly: Part I This is a first of a two article series on Foreign Currency Convertible Bonds (FCCBs). Many Indian companies issued FCCBs in 2007 which are due to redeem in 2012, and this has challenging implications. FCCBs have been in the limelight in India for some time now as an option for raising capital for meeting capital expenditure requirements. Initially it was in the news as a great tool for raising funds for meeting company's capex requirement. The advantage it offers relative to other debt instruments like straight bond is that being a foreign currency instrument, it carries lower interest rates. And it is better than pure equity which immediately dilutes equity base. With FCCBs, conversion to equity is only possible if certain conditions are met. However FCCBs, originally considered a boon, turned out to be a millstone around India Inc.'s neck. Since the Indian stock market is in bad shape, most of the bonds are up for redemption this year (2012). As a result, there will likely be a negative impact on the capital structure of the issuer companies. This article explains FCCBs and these developments. And, it also looks at the alternatives available to corporate India. A convertible bond is a mix between a debt and an equity instrument. It has the features of a bond, with regular interest payments to be made, and at maturity, the principal to be repaid. A convertible bond also has the attractive characteristic that, at or before maturity, the bondholder can convert the bonds into equitable equity shares in the company. The conversion price at which the bond will be changed into shares is decided beforehand. If the shares of the company never reach the predetermined conversion price, and the bond reaches its maturity, then the principal is repaid to the bondholder along with a redemption premium which ranges from 20% to 40%. A Foreign Currency Convertible Bond (FCCB) is a special type of convertible bond which is issued in a currency different from the issuer's domestic currency. Companies prefer issuing FCCBs as the interest rate on them is much lower than that on a regular "domestic" bond. For example, a company in India issues a bond in dollars with an interest rate of approximately 3%, which is much lower than an Indian currency bond rate of 9%.

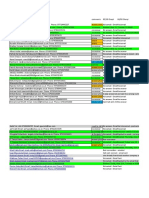

From the investors' perspective, they get the advantage of an instrument which offers debt, as well as, the additional value of an option to convert the bond to equity. It gives the investor upside potential by being able to convert to equity, and the debt element protects the downside. They are also assured return in form of fixed coupon rate payments. The biggest problem with FCCBs for bond issuers occurs when the share prices of the companies start heading south. During market crashes and bear periods, the conversion price of the FCCBs becomes many times higher than the current share price. This combined with a depreciating domestic currency can lead to devastating consequences. Current Scenario - Indian companies in a FCCB bind Between 2005 and 2010, Indian companies issued three and five year FCCBs worth USD $23bn of which USD $7.8bn (at redemption value) will mature in 2012. With stock prices in many cases significantly below conversion prices, conversion is unlikely. And so, redemption is the option for a vast majority of these issues. The following table lists Indian companies whose FCCBs are maturing in 2012. Company name Moser Baer Jaiprakash Asso Subex Subex Gtl Infra Hotel leela 3I Infotech Rajesh Exports Orchid Chemicals Era Infra Sterling Biotech Suzlon Energy Tata Motors FCCB size ($ m) 75 400 180 99 300 100 100 150 175 75 250 300 490 Current outstanding ($ m) 43 354 39 60 228 42 66 24 117 40 135 211 473 Conversion Redemption price value ($ m) (Rs/share) 60 524 53 85 321 61 94 35 168 60 184 307 624 408 165 656 80 53 72 166 67 348 159 163 97 181 Current price 18 82 26 26 11 34 16 122 180 141 10 29 276

Debt/Equity 3.56 2.74 2.59 2.59 1.99 1.79 1.77 1.58 1.57 1.57 1.45 1.38 1.38

Jsw Steel Tata Steel Tulip Telecom Prime Focus Strides Arcolab Firstsource Solutions Rolta India Uflex Mascon Global Plethico Pharma Educomp Solution

325 875 150 55 100

274 382 97 55 80 925 191 97 22 50 75 79

392 471 140 79 116 1,182 267 135 26 65 109 111

953 731 227 111 462 661 92 369 145 13 484 590

778 472 96 46 596 93 10 96 123 0.91 345 193

1.36 1.28 1.26 1.06 1.08 0.82 0.73 0.68 0.66 0.64 0.50 0.46

Reliance Com 1,000 275 150 85 50 75 80

*As on March 21, 2012 Source: Bloomberg

What options do these companies facing redemptions in 2012 have? In the most likely scenario of "mass" redemptions of FCCBs in 2012, these companies will choose to exercise one or a mix of the options mentioned below: Repayment through existing cash & cash equivalents Repayment through operating cash flows Refinancing of debt Restructuring of FCCBs Issue of further equity to repay debt Buyback

In our next and last article of this FCCB series, we examine each of these options available to issuer companies who are in this FCCB redemption "bind". And, we will also look at the implications for bondholders.

When FCCBs turns ugly: Part II This is the second and last article in our series on Foreign Currency Conversion Bonds (FCCBs) in India. A FCCB is a special type of convertible bond which companies prefer to issue for raising funds for capital expenditure, as the interest rate on them is much lower than that on a regular "domestic" bond. In our previous article we outlined the benefits of FCCBs to both the issuer (lower interest rates) as well as the bondholder (fixed coupon rate with upside equity potential). We also highlighted that while FCCBs were originally considered a boon, when the markets went south, they turned out to be a millstone around India Inc.'s neck. Since the Indian stock market is in bad shape, most of the bonds are up for redemption this year - 2012. This has serious implications. In this second article we will discuss the various alternatives available to companies facing this difficult situation of FCCB redemption in 2012. The options available to companies confronted with FCCB redemption are: Restructuring of FCCBs: Restructuring of an FCCB usually means changing the maturity and interest rates, and will provide temporary relief to the issuing company. But, it depends on the acceptance of revised terms by the bondholders. For example: Tata Steel had FCCBs worth $875 million which were due in 2012, and had a yield-to-maturity of 5.15% The securities were convertible at Rs 733, and had a redemption premium of 23% in case they were not converted. When Tata Steel was faced with redemption, it offered 111 bonds for every 100 bonds previously held. The new FCCBs carried a lower yieldto-maturity of 4.5%, and the new FCCBs will mature in November 2014. The bonds are convertible into shares at Rs 605.53 each, and at a fixed exchange rate of Rs 46.36 to the dollar. This restructuring helped reduce Tata Steels interest costs and lowered repayment obligations. It should be noted that restructuring of FCCBs involving change in the conversion price is not permissible. The prevailing regulations allow an Indian company to buy back FCCBs: a. from existing foreign currency funds and/ or fresh External Commercial Borrowings (ECB) proceeds at a minimum discount of 8%; and b. from internal accruals with RBI approval at a minimum discount ranging from 10 to 20%. There is no cap on the quantum of buy back using foreign currency funds, nor fresh ECB. However, a buy back from internal accruals is capped at the range of USD $50-100 m. These Reserve Bank of India (RBI) regulations protect the country from experiencing significant foreign exchange outflows. Buyback: Buyback of FCCBs at a discount provides the Indian company an opportunity to substantially reduce their debt. Though, it does mean that the bondholder takes a hit on their FCCB investments. Premature redemption of FCCBs by way of buyback was permitted by RBI in December 2008, and recently, the RBI extended the window for buyback of FCCBs to March 31, 2012. Yet, only a few companies were able to capitalise on this opportunity due to the low

liquidity in FCCBs. Buybacks are supported by the government, as they reduce potential forex outflow. For example: <>Jubilant Life Sciences had raised more than USD $275 m by selling FCCBs overseas. The conversion price for bonds maturing on May 2010 was fixed at Rs 377.9, and for those maturing on May 2011 was fixed at Rs 588.9. However, the stock price tanked to 150. As a result, Jubilant repurchased FCCBs worth USD $48.3 m due in 2010 and 2011 for an aggregate cash amount of USD $40.55 m. In-fact it offered to buy back its entire outstanding FCCBs of about USD $248 m in the second tranche, but received poor response, and so could it purchased only USD $48.3 m. This was because the tender offer was much below the conversion price. Repayment through existing cash, cash equivalents and operating cash flows: If bond issuers have sufficient cash and cash equivalents on their balance sheet, they can use this to repay the FCCB holders. This payment is done at full redemption value as opposed to Buybacks, which can be executed at a discounted rate and so the latter is more beneficial to bond issuers. Refinancing of debt: The issuer takes new debt through banks. RBI has permitted issuers to avail of fresh ECB or FCCBs to finance the redemption of an existing FCCB under certain conditions. Availing of this alternative, will lead to higher interest rates and add to existing debt burden. Issue of additional new equity to repay debt: The FCCB issuer can raise additional funds through dilution of equity to repay the incremental debt assumed to redeem the FCCB. This route might be a possibility for companies with high promoter holding, since the detrimental impact of dilution can be palatable. Though, in general, promoters are understandably reluctant to dilute their stake and that of other existing shareholders. 2012 India Inc.s FCCBs - A Disaster in the making Many of India Inc.s FCCBs will mature in 2012. However, since stock prices have tanked and conversion of debt to equity cannot take place, companies are confronted with redemptions. This will negatively impact cash flow and increase their debt/equity ratios. Overall, it is a great lesson for India Inc. to deal with the "black swan event" of stock prices falling much below FCCB conversion levels. By not thinking this scenario of market prices being lower than conversion prices, they did not anticipate the risk of non conversion of FCCBs. Now, India Inc should accept the huge error they have made due to their blind spot, and be prepared for the worst case scenario before making any new investments. For retail investors, before investing in a stock, it would be prudent for to look at the extent of debt companies are carrying, and the degree of exposure to FCCBs. Additional insights on how the company will cope with the pending crisis can be gleaned by studying how funds raised through FCCBs are being used. Companies that have used FCCB proceeds to fund inorganic growth or acquisitions at exuberant valuations could be in for a more than a spot of trouble. Acquisitions take a while to fructify, and in this environment of FCCBs being redeemed, these companies will experience a severe strain on their cash-flows and earnings.

Investors beware. We believe, "black swan or not", that there is an impending disaster for the companies in India Inc. that have FCCBs maturing in 2012, and that have high debt/equity ratios. And these companies are likely only now realizing the consequences of their actions. By Equitymaster - A leading independent research initiative focused on providing wellresearched and unbiased opinions on BSE and NSE Stocks. Questions: 1. 2. 3. 4. Explain the concept of FCCB in details. (meaning and process of FCCBs) What are the advantages of raising money through FCCBs for the company issuing it? What are the risks for a company raising money through issue of FCCBs? For a company which has issued FCCBs, what happens if there is a significant crash in the market price of its equity shares? 5. In such a case, what options does such a company have?

---Enjoy---

Das könnte Ihnen auch gefallen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Assignment 02: Initial Public Offerings ProcessDokument4 SeitenAssignment 02: Initial Public Offerings ProcessRanjan RaiNoch keine Bewertungen

- Assignment 02 TMDokument3 SeitenAssignment 02 TMRanjan RaiNoch keine Bewertungen

- Assignment 01 BankingDokument4 SeitenAssignment 01 BankingRanjan RaiNoch keine Bewertungen

- Assignment 02 M and ADokument2 SeitenAssignment 02 M and ARanjan RaiNoch keine Bewertungen

- No 2 B LawDokument19 SeitenNo 2 B LawRanjan RaiNoch keine Bewertungen

- Om Assignment 02Dokument1 SeiteOm Assignment 02Ranjan RaiNoch keine Bewertungen

- Proper Control Over EmployeesDokument2 SeitenProper Control Over EmployeesRanjan RaiNoch keine Bewertungen

- Risk ManagementDokument2 SeitenRisk ManagementRanjan RaiNoch keine Bewertungen

- Om Case 6Dokument2 SeitenOm Case 6Ranjan RaiNoch keine Bewertungen

- What Are The Main Functions of Reserve Bank of IndiaDokument12 SeitenWhat Are The Main Functions of Reserve Bank of IndiaRanjan RaiNoch keine Bewertungen

- The Pros and Cons of Treasury Central Is at IonDokument5 SeitenThe Pros and Cons of Treasury Central Is at IonfairyzNoch keine Bewertungen

- Economy NewsDokument2 SeitenEconomy NewsRanjan RaiNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Tax Accounting Jones CH 4 HW SolutionsDokument7 SeitenTax Accounting Jones CH 4 HW SolutionsLolaLaTraileraNoch keine Bewertungen

- The Website Design Partnership FranchiseDokument5 SeitenThe Website Design Partnership FranchiseCheryl MountainclearNoch keine Bewertungen

- 1.6 Program AdministrationDokument56 Seiten1.6 Program Administration'JeoffreyLaycoNoch keine Bewertungen

- Charlemagne Command ListDokument69 SeitenCharlemagne Command ListBoardkingZeroNoch keine Bewertungen

- Tle 9 Module 1 Final (Genyo)Dokument7 SeitenTle 9 Module 1 Final (Genyo)MrRightNoch keine Bewertungen

- Pharmaceutical Microbiology NewsletterDokument12 SeitenPharmaceutical Microbiology NewsletterTim SandleNoch keine Bewertungen

- Best Practices in Developing High PotentialsDokument9 SeitenBest Practices in Developing High PotentialsSuresh ShetyeNoch keine Bewertungen

- SWOT AnalysisDokument6 SeitenSWOT AnalysisSSPK_92Noch keine Bewertungen

- Math 1 6Dokument45 SeitenMath 1 6Dhamar Hanania Ashari100% (1)

- Technical Manual: 110 125US 110M 135US 120 135UR 130 130LCNDokument31 SeitenTechnical Manual: 110 125US 110M 135US 120 135UR 130 130LCNKevin QuerubinNoch keine Bewertungen

- Theories of Economic Growth ReportDokument5 SeitenTheories of Economic Growth ReportAubry BautistaNoch keine Bewertungen

- NCR Minimum WageDokument2 SeitenNCR Minimum WageJohnBataraNoch keine Bewertungen

- Salva v. MakalintalDokument2 SeitenSalva v. MakalintalGain DeeNoch keine Bewertungen

- Reading TPO 49 Used June 17 To 20 10am To 12pm Small Group Tutoring1Dokument27 SeitenReading TPO 49 Used June 17 To 20 10am To 12pm Small Group Tutoring1shehla khanNoch keine Bewertungen

- Faida WTP - Control PhilosophyDokument19 SeitenFaida WTP - Control PhilosophyDelshad DuhokiNoch keine Bewertungen

- Saic-M-2012 Rev 7 StructureDokument6 SeitenSaic-M-2012 Rev 7 StructuremohamedqcNoch keine Bewertungen

- Characteristics of Planetary Candidates Observed by Kepler, IIDokument106 SeitenCharacteristics of Planetary Candidates Observed by Kepler, IIRick FeedNoch keine Bewertungen

- Shares and Share CapitalDokument50 SeitenShares and Share CapitalSteve Nteful100% (1)

- Revenue Management Session 1: Introduction To Pricing OptimizationDokument55 SeitenRevenue Management Session 1: Introduction To Pricing OptimizationDuc NguyenNoch keine Bewertungen

- Chapter03 - How To Retrieve Data From A Single TableDokument35 SeitenChapter03 - How To Retrieve Data From A Single TableGML KillNoch keine Bewertungen

- Gujarat Technological UniversityDokument2 SeitenGujarat Technological UniversityBhavesh PatelNoch keine Bewertungen

- Oddball NichesDokument43 SeitenOddball NichesRey Fuego100% (1)

- Bench VortexDokument3 SeitenBench VortexRio FebriantoNoch keine Bewertungen

- Cara Membuat Motivation LetterDokument5 SeitenCara Membuat Motivation LetterBayu Ade Krisna0% (1)

- Occupational Therapy in Mental HealthDokument16 SeitenOccupational Therapy in Mental HealthjethasNoch keine Bewertungen

- SCHEDULE OF FEES - FinalDokument1 SeiteSCHEDULE OF FEES - FinalAbhishek SunaNoch keine Bewertungen

- Simplified Concrete Modeling: Mat - Concrete - Damage - Rel3Dokument14 SeitenSimplified Concrete Modeling: Mat - Concrete - Damage - Rel3amarNoch keine Bewertungen

- Tank Emission Calculation FormDokument12 SeitenTank Emission Calculation FormOmarTraficanteDelacasitosNoch keine Bewertungen

- Business-Model Casual Cleaning ServiceDokument1 SeiteBusiness-Model Casual Cleaning ServiceRudiny FarabyNoch keine Bewertungen

- Perhitungan Manual Metode Correlated Naïve Bayes Classifier: December 2020Dokument6 SeitenPerhitungan Manual Metode Correlated Naïve Bayes Classifier: December 2020andreas evanNoch keine Bewertungen