Beruflich Dokumente

Kultur Dokumente

Int Rate Retail

Hochgeladen von

Princy GuptaOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Int Rate Retail

Hochgeladen von

Princy GuptaCopyright:

Verfügbare Formate

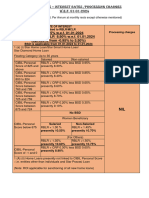

REVISED RATE OF INTEREST ON RETAIL CREDIT ADVANCES W.E.F. 15.05.2012 AS PER BASE RATE OF 10.50%SCHEME PARTICULARS OF INTEREST RATE.

Loan up to Rs.4.00 lac BR + 2.50% = Above Rs.4.00 Lacs & Upto Rs.7.50 Lacs BR + 3.00% = Education Loan Above Rs.7.50 Lacs BR + 2.50% = Education Loan to Serving Professionals / Executives and Defence Personnel for Part-time courses BR + 3.00% = UP TO 5 YEARS Housing Loans Above 5 & upto 15 yr Above 15 &upto 25 yr Granted At Up to Rs 30 lacs BR +0.25% =10.75% BR +0.25%= 10.75% BR+0.50%=11.00% Floating Rate

13.00% 13.50% 13.00% 13.50%

Above Rs.30-75 lacs Above Rs.75 lacs- Rs. 3.00 Crores Above Rs. 3.00 Crores

BR+0.50%=11.00% BR+0.50% =11.00% BR +0.75%=11.25% BR+0.75%= 11.25% BR +0.75%=11.25% BR+1.00% =11.50% Interest rate shall be decided by sanctioning authority on case-to-case basis.

Financing Of Earnest Money

Rate of interest for purchase of plot / flat/ house BR +1.50% = 12.00% In case borrower adjusts loan by disposing the plot or the loan, BR+7.00% = 17.50% From the date of allotment / end date account is not adjusted within stipulated period of the scheme. of stipulated period of the scheme, till liquidation of account. Car/Vehicle Loan SchemeIf loan is repayable within 3 years BR + 1.00% = 11.50% Personal Use. (Including Car If loan is repayable after 3 years BR + 1.25% = 11.75% loan to Corporate clients) Second Hand Car Loan If loan is repayable within 3 years BR + 3.00% = 13.50% Loan To Traders Scheme Loan upto Rs.50000 BR +1.75% = 12.25% Loan above Rs.50000 & upto Rs. 2.00 Lac BR +2.50% = 13.00% Above Rs 2 lac to Rs. 25.00 Lacs BR +2.75% = 13.25% Above Rs 25 Lacs to Rs.50 Lacs BR+2.50%=13.00% If Credit rating is A++ (1) BR+3.00%=13.50% If credit rating is A+ (2) BR+4.00%=14.50% If credit rating is A (3) BR+5.00%=15.50% If credit rating is below A (4,5,6&7) Personal Loan scheme BR +5.00% = 15.50% Loan to Pensioners Scheme BR +3.50 % = 14.00% Scheme For Financing Against Govt. Securities/LICs etc. Loan up to 50.00 lac (max) BR +2.00% = 12.50% MICRO & SMALL Women Entrepreneurs Scheme/ Financing Beauty Loan upto Rs.50000 BR +1.75% = 12.25% Parlors/ by Women Loan above Rs.50000 & upto Rs. 2.00 Lacs BR +2.00% = 12.50% Above Rs. 2.00 Lac & up to Rs. 10.00 Lacs BR +2.25% = 12.75%

MICRO & SMALL

Scheme For Financing Auto / Taxis

Loan upto Rs.50000 Loan above Rs.50000 & upto Rs. 2.00 Lac Above Rs 2 lac to Rs. 25.00 Lacs Above Rs 25 Lacs to Rs.50 Lacs

BR +1.75% = 12.25% BR +2.00% = 12.50% BR +2.25% = 12.75% BR+2.50%=13.00% If Credit rating is 1 BR+2.75%=13.25% If credit rating is 2 BR+3.00%=13.50% If credit rating is 3 BR+3.25%=13.75% If credit rating is 4 BR+3.50%=14.00% If credit rating is 5 BR+3.75%=14.25% If credit rating is 6 & below

MICRO & SMALL

Loans to Professionals (Except Doctors)

Loan upto Rs.50000 Loan above Rs.50000 & upto Rs. 2.00 Lac Above Rs 2 lac to Rs. 20.00 Lac Loan upto Rs.50000 Loan above Rs.50000 & upto Rs. 2.00 Lac Above Rs 2 lac to Rs. 25.00 Lacs Above Rs 25 Lacs to Rs.1.00 crore

BR +1.75% = 12.25% BR +2.00% = 12.50% BR +2.25% = 12.75%

MICRO & SMALL

Scheme for Loan to Doctors

BR +1.75% = 12.25% BR +2.00% = 12.50% BR +2.25% = 12.75% BR+2.50%=13.00% If Credit rating is 1 BR+2.75%=13.25% If credit rating is 2 BR+3.00%=13.50% If credit rating is 3 BR+3.25%=13.75% If credit rating is below 4 BR+3.50%=14.00% If credit rating is below 5 BR+3.75%=14.25% If credit rating is 6 & below BR +1.50% BR +2.50% BR +3.50% BR +5.00% BR +4.25% =12.00% =13.00% =14.00% =15.50% =14.75%

Advance Against Gold Jewellery

1.)Rate of Interest for Agriculture purpose Loan upto Rs.50000 Loan above Rs.50000 & upto Rs.2.00 Lacs Above Rs. 2.00 Lacs & upto Rs. 10.00 Lacs 2) Other than Agriculture purpose

OTLS

Das könnte Ihnen auch gefallen

- Canara BankDokument8 SeitenCanara BankKrithika SalrajNoch keine Bewertungen

- Estimated Inclusion: Tamil Nadu TripuraDokument9 SeitenEstimated Inclusion: Tamil Nadu TripuraNikunj JainNoch keine Bewertungen

- LoansDokument5 SeitenLoansshamsherbaNoch keine Bewertungen

- Credit Guarantee Fund Scheme For Micro and Small Enterprises (Cgmse)Dokument2 SeitenCredit Guarantee Fund Scheme For Micro and Small Enterprises (Cgmse)Santhosh santhuNoch keine Bewertungen

- Schemes of JK BankDokument8 SeitenSchemes of JK Bankigupta_4Noch keine Bewertungen

- Advance Class Notes On InterestDokument7 SeitenAdvance Class Notes On InterestNidhi Sandesh SharmaNoch keine Bewertungen

- Annexure I - Schedule of Interest Rates Applicable For Msmes and OthersDokument7 SeitenAnnexure I - Schedule of Interest Rates Applicable For Msmes and Othersnani kannaNoch keine Bewertungen

- MODIFIED Interest Rate 01974 2020 Agri Sector LoansDokument12 SeitenMODIFIED Interest Rate 01974 2020 Agri Sector Loansvenkat2674Noch keine Bewertungen

- Intt RateDokument15 SeitenIntt Ratecuteyogesh_khandelwal400Noch keine Bewertungen

- Interestrate RabdDokument4 SeitenInterestrate RabdPEDDI REDDYNoch keine Bewertungen

- A Ash Aye inDokument19 SeitenA Ash Aye inSamartha BedurNoch keine Bewertungen

- New Website Retail Loan Interest Rates 10032015Dokument2 SeitenNew Website Retail Loan Interest Rates 10032015Kabir RoshannNoch keine Bewertungen

- P Segment Loan Products at A GlanceDokument2 SeitenP Segment Loan Products at A GlanceShivam 'Singh' KaushikNoch keine Bewertungen

- Current and Savings Account Interest Rate: Personal AccountsDokument2 SeitenCurrent and Savings Account Interest Rate: Personal AccountsMd.Rashidul Alam Sorker RifatNoch keine Bewertungen

- Amendment To Service Provider Agreement 1Dokument3 SeitenAmendment To Service Provider Agreement 1myloan partnerNoch keine Bewertungen

- UntitledDokument5 SeitenUntitledRwings JeansNoch keine Bewertungen

- Personal Loan Scoring ModelDokument4 SeitenPersonal Loan Scoring ModelstraviNoch keine Bewertungen

- Interest RatesDokument18 SeitenInterest RatesPavit PandherNoch keine Bewertungen

- Home Loan Interest RateDokument1 SeiteHome Loan Interest RatemoneyfinderindiaNoch keine Bewertungen

- Home Loans Interest Rates: Agents Login Insurance DealsDokument4 SeitenHome Loans Interest Rates: Agents Login Insurance DealsPrasoon SinghNoch keine Bewertungen

- Interest Rates: Type Interest Rate Savings AccountDokument16 SeitenInterest Rates: Type Interest Rate Savings Accountrohanfyaz00Noch keine Bewertungen

- Processing Fees / Charges - SME ProductsDokument17 SeitenProcessing Fees / Charges - SME ProductsSanjay KumarNoch keine Bewertungen

- Brac Bank Deposit Interest RateDokument2 SeitenBrac Bank Deposit Interest RateSohel RanaNoch keine Bewertungen

- Borrow Against Fixed Deposit: Rate of InterestDokument2 SeitenBorrow Against Fixed Deposit: Rate of InterestRajesh KumarNoch keine Bewertungen

- Indian Oversea Bank and Development Credit Bank of India: Presented by Group 10Dokument13 SeitenIndian Oversea Bank and Development Credit Bank of India: Presented by Group 10Karan GujralNoch keine Bewertungen

- Special Rate of Interest For MSME Cir DT 26.09.2017 UBIDokument2 SeitenSpecial Rate of Interest For MSME Cir DT 26.09.2017 UBIAjoydeep DasNoch keine Bewertungen

- Fixed Deposit Interest Rates - Best FD Rates of Top Banks in IndiaDokument15 SeitenFixed Deposit Interest Rates - Best FD Rates of Top Banks in IndiaebeanandeNoch keine Bewertungen

- RBI ROI FormatDokument8 SeitenRBI ROI Formatsrinivas.rmbaNoch keine Bewertungen

- Consumer Awareness ProjectDokument30 SeitenConsumer Awareness ProjectJNV_DVG38% (21)

- InterestRateofRural AgriBusinessDokument4 SeitenInterestRateofRural AgriBusinesssatyanarayana kosuriNoch keine Bewertungen

- SolveDokument2 SeitenSolveKaushik BNoch keine Bewertungen

- Personal Loan - Governement emDokument2 SeitenPersonal Loan - Governement emrajesh.dhawan74Noch keine Bewertungen

- Time Value of MoneyDokument37 SeitenTime Value of MoneyDarrell PhilipNoch keine Bewertungen

- Brokerage Rates For Dec 2012Dokument6 SeitenBrokerage Rates For Dec 2012Sumeet AmareNoch keine Bewertungen

- RBI Format ROI PDokument8 SeitenRBI Format ROI PSrikanth ReddyNoch keine Bewertungen

- Dsa Handbook2018Dokument19 SeitenDsa Handbook2018Dayalan A100% (3)

- Eligibility:: Please Click Retail Credit Interest RatesDokument8 SeitenEligibility:: Please Click Retail Credit Interest RatesPriya S MurthyNoch keine Bewertungen

- Rbi Format Roi PCDokument11 SeitenRbi Format Roi PCSumeet TripathiNoch keine Bewertungen

- Sme RoiDokument1 SeiteSme RoiSanjay KumarNoch keine Bewertungen

- ServicechargesCADDokument8 SeitenServicechargesCADdixeshNoch keine Bewertungen

- Rbi Format Roi PCDokument10 SeitenRbi Format Roi PCsriramNoch keine Bewertungen

- IBS Session 1 With SolutionDokument16 SeitenIBS Session 1 With SolutionMOHD SHARIQUE ZAMANoch keine Bewertungen

- Car Loan Interest RateDokument9 SeitenCar Loan Interest RateOnkar ChavanNoch keine Bewertungen

- Personal Account Interest Rate: (Golden Benefits)Dokument4 SeitenPersonal Account Interest Rate: (Golden Benefits)Md Ashikur RahmanNoch keine Bewertungen

- RBI Format ROI PCDokument8 SeitenRBI Format ROI PCom vermaNoch keine Bewertungen

- UnderwritingDokument74 SeitenUnderwritingAnandjit PatnaikNoch keine Bewertungen

- RETAIL - Interest For Retail Loans - MCLR - Service Charges - From Web On 25082018Dokument12 SeitenRETAIL - Interest For Retail Loans - MCLR - Service Charges - From Web On 25082018Harish YadavNoch keine Bewertungen

- Home Loan EMI Fall Due To Rate Cut: Lender Interest Rate (%) Processing Fee Max Tenure (Yrs)Dokument2 SeitenHome Loan EMI Fall Due To Rate Cut: Lender Interest Rate (%) Processing Fee Max Tenure (Yrs)Rajesh KumarNoch keine Bewertungen

- State Bank of India: Bank Name Floating Interest Rate Processing Fee Prepayment ChargesDokument13 SeitenState Bank of India: Bank Name Floating Interest Rate Processing Fee Prepayment Chargesjohn_muellorNoch keine Bewertungen

- Interest Rates For Last 10 Yr For Major SME ProductsDokument6 SeitenInterest Rates For Last 10 Yr For Major SME Productssharad1996Noch keine Bewertungen

- All Bank Interest RatesDokument6 SeitenAll Bank Interest RatesSanket ChouguleNoch keine Bewertungen

- Housing Loan DetailsDokument9 SeitenHousing Loan DetailsPandurangbaligaNoch keine Bewertungen

- Template - Restructuring-Tax Computation-BER-Salary Tracker For FY 2015-16 - CKDokument9 SeitenTemplate - Restructuring-Tax Computation-BER-Salary Tracker For FY 2015-16 - CKajaykrsinghpintuNoch keine Bewertungen

- Time Value of MoneyDokument76 SeitenTime Value of Moneyrhea agnesNoch keine Bewertungen

- FL Tax BasicsDokument10 SeitenFL Tax Basicsalvarez.jayden1207Noch keine Bewertungen

- Welcome: Tax & Investment Planning SeminarDokument31 SeitenWelcome: Tax & Investment Planning Seminarnir205Noch keine Bewertungen

- Rates AtglanceDokument3 SeitenRates AtglanceNikita JainNoch keine Bewertungen

- Power Recruitment - Process NoteDokument2 SeitenPower Recruitment - Process NoteAdarsh RasalNoch keine Bewertungen

- Icici Bank Loan RateDokument4 SeitenIcici Bank Loan RaterushidudeNoch keine Bewertungen

- EmpanelmentDokument2 SeitenEmpanelmentPrincy GuptaNoch keine Bewertungen

- Shri Manoj GulatiDokument7 SeitenShri Manoj GulatiPrincy GuptaNoch keine Bewertungen

- 9907 Ghaziabad Postmoc Balance Sheet Format 30 06 2013Dokument21 Seiten9907 Ghaziabad Postmoc Balance Sheet Format 30 06 2013Princy GuptaNoch keine Bewertungen

- 10 Crores & AboveDokument1 Seite10 Crores & AbovePrincy GuptaNoch keine Bewertungen

- Swalamban National Pension SchemeDokument125 SeitenSwalamban National Pension Schemegrimreaper09Noch keine Bewertungen

- Format Stock Audit DataDokument1 SeiteFormat Stock Audit DataPrincy GuptaNoch keine Bewertungen

- Indian Rupee Symbol - Update To Microsoft Software Products For New Indian Rupee SymbolDokument3 SeitenIndian Rupee Symbol - Update To Microsoft Software Products For New Indian Rupee SymbolPrincy GuptaNoch keine Bewertungen

- GeetaDokument5 SeitenGeetaPrincy GuptaNoch keine Bewertungen

- TNPSCDokument13 SeitenTNPSCmani_aarthiNoch keine Bewertungen

- DosaDokument15 SeitenDosaPrincy GuptaNoch keine Bewertungen

- Ies (Ese) - 2012 Answers:: General Ability TestDokument1 SeiteIes (Ese) - 2012 Answers:: General Ability TestNitesh GoyalNoch keine Bewertungen

- Holi Day FormDokument1 SeiteHoli Day FormPrincy GuptaNoch keine Bewertungen

- Accruals and Prepayments ExamplesDokument3 SeitenAccruals and Prepayments ExamplesRameen FatimaNoch keine Bewertungen

- Session 2 - Modeling With VensimDokument28 SeitenSession 2 - Modeling With Vensimyashashree barhateNoch keine Bewertungen

- 1-INTRODUCTION (Personal Finance Basics and Time Value of Money)Dokument29 Seiten1-INTRODUCTION (Personal Finance Basics and Time Value of Money)Haliyana HamidNoch keine Bewertungen

- Bajaj Auto SM - PPTDokument46 SeitenBajaj Auto SM - PPTWaibhav KrishnaNoch keine Bewertungen

- Problem StatementDokument4 SeitenProblem StatementABHISHEK CHAUDHURINoch keine Bewertungen

- Chapter 3 - Valuing BondsDokument37 SeitenChapter 3 - Valuing BondsDeok NguyenNoch keine Bewertungen

- Summary of Final Income TaxDokument7 SeitenSummary of Final Income TaxeysiNoch keine Bewertungen

- Ketan KumarDokument55 SeitenKetan KumarNikith KumarNoch keine Bewertungen

- Form 26ASDokument3 SeitenForm 26ASHarshil MehtaNoch keine Bewertungen

- State and Non State InstitutionDokument23 SeitenState and Non State InstitutionFrnz Jrry BqlrNoch keine Bewertungen

- Hire PurchaseDokument11 SeitenHire PurchaseUITMQSNoch keine Bewertungen

- P1-PB. Sample Preboard Exam PDFDokument12 SeitenP1-PB. Sample Preboard Exam PDFClaudine DuhapaNoch keine Bewertungen

- 2011 Spring FIN 331-007 2nd-Solution KeyDokument4 Seiten2011 Spring FIN 331-007 2nd-Solution KeyBrendan GitauNoch keine Bewertungen

- 3 Chapter 3 Financial Institutions and Their Operations Lecture NotesDokument133 Seiten3 Chapter 3 Financial Institutions and Their Operations Lecture NotesAnimaw Yayeh100% (4)

- Support Guide03BF-Wk04Dokument33 SeitenSupport Guide03BF-Wk04ranbr17Noch keine Bewertungen

- Free Zone ActDokument19 SeitenFree Zone ActTIMOREGHNoch keine Bewertungen

- Mills Estruturas e Serviços de Engenharia S.ADokument51 SeitenMills Estruturas e Serviços de Engenharia S.AMillsRINoch keine Bewertungen

- Treasury ManagementDokument10 SeitenTreasury ManagementSankar RajagopalNoch keine Bewertungen

- Commission NotesDokument2 SeitenCommission Notesivanjade627Noch keine Bewertungen

- Lesson 5 - Mortgage UpdatedDokument46 SeitenLesson 5 - Mortgage Updatedrara wongNoch keine Bewertungen

- RTPS AccountingDokument316 SeitenRTPS AccountingKish VNoch keine Bewertungen

- Chapter 3 National Income Complete PDF-2Dokument67 SeitenChapter 3 National Income Complete PDF-2shivam kumarNoch keine Bewertungen

- Bond Analysis and ValuationDokument76 SeitenBond Analysis and ValuationMoguche CollinsNoch keine Bewertungen

- ECO561 EconomicsDokument14 SeitenECO561 EconomicsG JhaNoch keine Bewertungen

- SAP Finance Step by Step GuideDokument373 SeitenSAP Finance Step by Step GuideVenu Naik BhukyaNoch keine Bewertungen

- Chapter 9 Ohio UniversityDokument36 SeitenChapter 9 Ohio UniversityMona A HassanNoch keine Bewertungen

- Sample Paper 2 PDFDokument12 SeitenSample Paper 2 PDFKeemie PolackNoch keine Bewertungen

- MITS5501 Software Quality, Change Management and Testing: Case StudyDokument21 SeitenMITS5501 Software Quality, Change Management and Testing: Case StudyBeenish YousafNoch keine Bewertungen

- Chapter 15 and 16 IA Valix Sales Type LeaseDokument13 SeitenChapter 15 and 16 IA Valix Sales Type LeaseMiko ArniñoNoch keine Bewertungen

- How To Get A Plot in Midc Industrial AreaDokument9 SeitenHow To Get A Plot in Midc Industrial Areabakulharia100% (4)