Beruflich Dokumente

Kultur Dokumente

KJHVKJEQ

Hochgeladen von

auli716Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

KJHVKJEQ

Hochgeladen von

auli716Copyright:

Verfügbare Formate

Initiating coverage | FMCG

April 18, 2011

Britannia Industries

Tiger Zor

Britannia Industries (Britannia) is a dominant player in the Indian biscuits market with ~35% market share. The company has a balanced portfolio with seven super brands namely Tiger, Milk Bikis, Good Day, Treat, Marie Gold, 50-50 and NutriChoice. The stock currently trades at 0.8x its FY2013 EV/sales, which is at ~27% discount to its five-year average EV/Sales of ~1.1x and hence, is attractive. We Initiate Coverage on the stock with a Buy recommendation and a target price of `458, based on 22x P/E FY2013E EPS (1x EV/Sales). Revenue of Britannia on strong wicket, driven by higher volumes: We expect Britannia to register a ~14% CAGR in its top line, aided by high volumes and improving sales mix (Britannia has recently introduced premium products in the health and wellness space). The company has made significant efforts to provide premium biscuits under its brands Tiger and Treat at lower price points (`5 for a three-piece pack of cream biscuits). We believe this move will give consumers a choice to up trade from plain glucose variants as well as maintain affordability of biscuits for mass consumption. Hence, we expect volume growth for Britannia to be in line with the industry at ~6% over FY201113E, driven by low-price, valueadded products. Margins to improve on the back of cooling raw-material prices: Over the past one year, raw-material prices have been trending high, putting significant margin pressure on Britannia. However, prices of major commodities such as sugar and wheat have shown some signs of cooling in the past one month. While we have limited visibility on raw-material prices over the longer term, with the onset of normal monsoons, we do not expect a significant rise in the prices of these commodities going ahead. Moreover, we believe Britannias various costrationalisation methods and improving sales mix will aid operating margins from the current level of ~5% to 5.6% in FY2012E and 7% in FY2013E.

BUY

CMP Target Price

Investment Period

Stock Info Sector Market Cap (` cr) Beta 52 Week High / Low Avg. Daily Volume Face Value (`) BSE Sensex Nifty Reuters Code Bloomberg Code FMCG 4,506 0.3 535/322 19,793 2.0 19,091 5,729 BRIT.BO BRIT@IN

`377 `458

12 months

Shareholding Pattern (%) Promoters MF / Banks / Indian Fls FII / NRIs / OCBs Indian Public / Others 51.0 20.0 10.3 18.7

Abs. (%) Sensex Britannia

3m 0.0 5.7

1yr 8.5 14.4

3yr 14.0 45.5

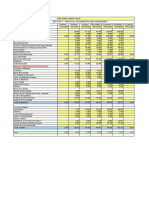

Key financials

Y/E March (` cr) Net sale % chg Net profit % chg EBITDA (%) EPS (`) P/E (x) P/BV (x) RoE (%) RoCE (%) EV/Sales (x) EV/EBITDA (x)

Source: Company, Angel Research

FY2010 3,425 9.0 116.5 (35.4) 4.8 9.8 38.7 11.4 27.7 15.0 1.3 26.7

FY2011E 4,150 21.2 124.9 7.2 4.6 10.5 36.1 10.0 29.6 17.1 1.1 23.3

FY2012E 4,763 14.8 170.7 36.6 5.6 14.3 26.4 8.9 35.7 23.9 0.9 16.6

FY2013E 5,415 13.7 248.3 45.5 7.0 20.8 18.1 7.4 44.5 41.6 0.8 11.6 Chitrangda Kapur

022-39357800 Extn: 6822 chitrangdar.kapur@angelbroking.com

Sreekanth P.V.S

022-39357800 Extn: 6841 sreekanth.s@angelbroking.com

Please refer to important disclosures at the end of this report

Britannia Industries | Initiating Coverage

Initiate Coverage with Buy and a target price of `458

We estimate operating margins to improve to 7% in FY2013E

We have factored in CAGR of 14.2%, 41.2%, and 41% CAGR in top line, EBITDA and earnings, respectively, for Britannia over FY201113E. The company has issued 8.25% coupon rate redeemable, non-convertible bonus debentures of face value `170 each, which will be redeemed in full on March 22, 2013. We do not expect the company to take any further debt and, hence, have factored in the same in our numbers. We expect Britannias cash balance to dwindle to ~`14cr in FY2013 as the company sells part of its investments to repay the bonus debentures in full at the end of FY2013.

Exhibit 1: Consensus vs. Angel estimates

(` cr) Top line Angel Consensus Diff (%) Net profit Angel Consensus Diff (%)

Source: Bloomberg, Angel Research

FY2012E 4,763 4,983 (4.4) 171 216 (20.8)

FY2013E 5,415 5,840 (7.3) 248 277 (10.5)

TP based on 22x P/E FY2013E EPS, 12% discount to 5-year avg.

We Initiate Coverage on Britannia with a Buy recommendation and a target price of `458, based on 22x FY2013E EPS of `20.8 (1x EV/sales). Britannia trades at 64% premium to Sensex (which is lower as compared to average three-year premium to Sensex of 82%), and in-line to its average five-year P/E of ~25x. Moreover, the stock is available at 0.8x FY2013E EV/sales, which is at ~27% discount to its five-year average EV/Sales of ~1.1x and, hence, is attractive. We value the stock at ~12% discount to its five-year average P/E to build a margin of safety from raw-material price pressures and arrive at a target price of `458, resulting in an upside of 21% from the current level.

April 18, 2011

Britannia Industries | Initiating Coverage

Exhibit 2: Trading at attractive 0.8x FY2013E EV/sales

8,000 7,000 6,000 5,000 4,000 3,000 2,000 1,000 Apr-05 EV Apr-06 1.5x Apr-07 1.25x Apr-08 1x Apr-09 Apr-10 Apr-11 0.5x

Exhibit 3: FY2012E P/E in line with its 5 yr avg. P/E

45.0 40.0 35.0 30.0 25.0 20.0 15.0 10.0 5.0 Nov-06 Nov-09 Aug-05 Mar-05 Mar-08 Aug-08 Feb-11 Sep-07 Sep-10 Jun-06 Jan-06 Apr-07 Jan-09 Jun-09 Apr-10

#

0.75x

Source: Company, Angel Research

Source: Company, Angel Research; Note: Blue line denotes its 5-yr avg. P/E

Exhibit 4: One-year forward P/E band

600 500

Exhibit 5: Britannias one-year return to the Sensex

180% 160% 140% 120% 100%

Sensex Britannia

Share Price (` )

400 300 200 100 -

Dec-05

Dec-06

Dec-07

Dec-08

Dec-09

Aug-05

Aug-06

Aug-07

Aug-08

Aug-09

Aug-10

Dec-10

Apr-05

Apr-06

Apr-07

Apr-08

Apr-09

Apr-10

80%

Oct-10

Sep-10

May-10

Nov-10

Dec-10

Aug-10

Feb-11

Jun-10

Jan-11

Jul-10

Series1

16x

20x

24x

28x

Source: Company, Angel Research

Source: Company, Angel Research

Exhibit 6: Relative Valuation

Company

Asian Paints Britannia Colgate Dabur GSKCHL GCPL HUL ITC Marico Nestle

Reco

Accumulate Buy Reduce Buy Reduce Buy Accumulate Accumulate Neutral Reduce

#

M.cap (` cr)

24,710 4,506 11,991 17,952 9,552 11,824 61,153 146,986 8,386 35,963

CMP (`)

2,576 377 882 103 2,271 365 280 190 137 3,730

TP (`)

2,767 458 837 123 2,144 431 304 205 145 3,490

Upside (%)

7.4 21.4 (5.1) 19.2 (5.6) 17.9 8.5 8.1 5.9 (6.4)

P/E (x) FY12E

24.6 26.4 26.0 23.0 27.4 21.3 24.7 25.1 28.1 36.8

Mar-10

EV/Sales (x) FY12E

2.7 0.9 4.5 3.3 3.1 3.1 2.6 5.7 2.6 4.9

RoE (%) FY12E

39.9 35.7 100.1 53.1 32.6 35.1 75.9 31.9 35.9 107.1

CAGR EPS

19.7 11.1 11.8 24.8 17.0 23.0 16.1 14.2 26.0 20.4

FY13E

20.5 18.1 23.2 20.1 23.3 18.7 21.2 22.2 21.7 31.0

FY13E

2.2 0.8 4.0 2.8 2.6 2.8 2.3 5.0 2.2 4.2

FY13E

37.6 44.5 87.2 46.4 31.5 26.2 77.9 30.6 29.6 107.4

Sale

17.1 14.2 13.5 23.2 17.4 15.2 13.2 13.5 11.9 16.0

Source: Angel Research; Note:

CAGR (%) over FY2011-13E; In case of Neutral recommendation TP=fair value

April 18, 2011

Mar-11

Britannia Industries | Initiating Coverage

Investment arguments

Revenue growth to be aided by higher volumes

Category growth indicates higher per capita biscuit consumption

Biscuit industry is the fastest growing FMCG category, witnessing double-digit value growth and increased per capita consumption The biscuit industry, which has been steadily recording double-digit value growth over FY200811, is the largest and the fastest growing FMCG category in India. The industry stands at ~`10,782cr in value and has recorded a 9.2% CAGR over FY200611. Biscuit volume growth is estimated to be at ~6% yoy in FY2011E (refer Exhibit 9), despite no significant change in distribution network (refer Exhibit 7), implying that the key reason for increased biscuit volumes is higher per capita consumption of biscuits to ~2.1kg/year (1.8kg/year in FY2009), with a 55% penetration level in the rural market and 85% penetration in the urban market.

Exhibit 7: Sale of small grocery retailers in FY2010 increased by 40bp yoy, implying increased impulse buying

Sale of biscuits by distribution format (%) Small grocery retailers Other grocery retailers Supermarkets/Hypermarkets Total

Source: Euromonitor International, Angel Research

FY2006 80.8 12.9 6.3 100.0

FY2007 80.4 12.8 6.8 100.0

FY2008 79.9 12.8 7.3 100.0

FY2009 80.5 11.1 8.4 100.0

FY2010 80.9 11.1 8.0 100.0

FY2011E 80.9 10.6 8.4 100.0

Britannia is a dominant player in the Indian biscuits market with a ~35% market share and a balanced portfolio with seven super brands namely Tiger, Milk Bikis, Good Day, Treat, Marie Gold, 50-50 and NutriChoice.

Exhibit 8: Britannia leads the pack in terms of brand market share

(%) Britannia Parle ITC (Sunfeast) Surya Foods & Agro Pvt. Ltd. (Priyagold) Cadbury India (Bytes) GSKCHL (Horlicks) Others

Source: Euromonitor International, Angel Research

FY2007 36.0 32.5 7.9 2.0 0.9 1.0 19.7

FY2008 36.2 31.4 10.0 2.0 1.1 0.8 18.5

FY2009 35.5 31.2 11.8 2.2 1.3 0.8 17.2

FY2010 34.9 33.0 11.5 2.3 1.4 0.7 16.2

Despite high cost of commodities such as sugar, milk and palm oil in FY201011 (refer Exhibit 11), Britannia was able to maintain its market leadership on account of its ability to distribute to rural areas as well as maintain minimal price increases (Britannia took a price increase of 510% across its portfolio in 1QFY2011).

Low-price, value-added products aid Britannias volume growth

Britannia reaching to the bottom of the pyramid to fuel volume growth Britannia has made significant efforts to provide premium biscuits under its brands Tiger and Treat at lower price points (`5 for a three-piece pack of cream biscuits). This move in our opinion will give consumers a choice to up trade from plain glucose variants as well as maintain affordability of biscuits for mass consumption. Hence, we expect volume growth for Britannia to be in line with the industry at ~6% over FY201113E, driven by low-price, value-added products.

April 18, 2011

Britannia Industries | Initiating Coverage

Exhibit 9: On-the-go consumption mantra to fuel volume growth, likely to grow in line with the industry

FY2006 FY2007 FY2008 FY2009 FY2010 FY2011E FY2012E FY2013E Biscuit volume (Industry) Growth (% yoy) Biscuit volume (Britannia) Growth (% yoy) Biscuit value (Industry) Growth (% yoy) Biscuit value (Britannia) Growth (% yoy) 1,676 6,101 347 850 916 7.8 430 24.0 6,653 9.0 2,091 24.8 1,048 14.4 442 2.8 7,494 12.7 2,330 11.4 1,167 11.4 477 7.9 8,770 17.0 2,738 17.5 1,244 6.6 478 0.2 9,746 11.1 2,928 6.9 1,321 6.2 520 8.9 10,782 10.6 3,539 20.9 1,398 5.8 553 6.3 11,159 3.5 4,027 13.8 1,476 5.6 582 5.3 11,674 4.6 4,558 13.2 16.1 13.5 12.1 4.1 8.4 5.8

#

FY2006-11 9.2

FY2011-13E 5.7

Source: Euromonitor International, Company, Angel Research; Note: Volume growth is measured in 000tonnes and value growth in `cr, # represents CAGR

Focus on niche realisations

New product launches and diverse product mix to improve realisations

product

categories

will

command

high

We expect Britannia to register a ~14% CAGR in its top line, aided by improving sales mix (Britannia has recently introduced premium products in the health and wellness space). Further, we have modeled in the 56% increase in the companys realisation on the back of recent price hikes (price hikes of 5-10% taken in 1QFY2011, further price hikes cannot be ruled out). We expect consumers up trading to value-added biscuits (positioned in the health and wellness space) from plain glucose variant of biscuits to support value growth.

Exhibit 10: Gross revenue breakup of Britannia

6,000 5,000 4,000 (`cr) 3,000 2,000 1,000 FY06 FY07 FY08 FY09 FY10 FY11E FY12E FY13E Others

Biscuits & High Protein Food Source: Company, Angel Research

Bread and Suji Toast

Cakes & Rusk

April 18, 2011

Britannia Industries | Initiating Coverage

Margins to improve on the back of cooling raw-material prices

Cooling raw-material prices to drive EBITDA margin expansion to 7% in FY2013 Over the past one year, raw-material prices have been trending high, putting significant margin pressure on Britannia. However, prices of major commodities such as sugar and wheat have shown some signs of cooling in the past one month. While we have limited visibility on raw-material prices over the longer term, with the onset of normal monsoons, we do not expect a significant rise in the prices of these commodities going ahead. Moreover, we believe the companys various cost rationalisation methods and improving sales mix will aid operating margins from the current level of ~5% to 5.6% in FY2012E and 7% in FY2013E.

Exhibit 11: CMP of key raw materials below 4Q prices

1QFY2011 Palm oil (MYR/tonne) % qoq (palm oil) Wheat (`/quintal) % qoq (wheat) Sugar (`/100kg) % qoq (sugar) 2,529 (1.5) 1,173 (11.5) 2,856 (21.4) 2QFY2011 3QFY2011 2,639 4.3 1,230 4.9 2,749 (3.8) 3,268 23.8 1,281 4.1 3,006 9.3 4QFY2011 3,713 13.6 1,316 2.7 2,999 (0.2)

#

CMP (8.0)

3,415 1,211 (8.0) 2,890 (3.6)

Source: Bloomberg, Angel Research; Note: #Price as on April 7, 2011, MYR=Malaysia Ringgit

Exhibit 12: Lower raw-material prices to improve OPM

14.0 12.0 10.0 8.0 6.0 4.0 2.0 FY06 FY07 FY08 FY09 FY10 FY11E FY12E FY13E (OPM %) (NPM %) 8.5 5.9 7.4 4.9 5.8 3.4 3.0 3.6 4.6 9.0 8.4 11.7

Exhibit 13: Expect investments on brands to continue

450 400 350 300 (`cr) 6.3 6.2 7.0 6.8 7.9 7.4 7.4 9.0 7.3 8.0 7.0 6.0 391 4.0 3.0 2.0 1.0 FY06 FY07 FY08 FY09 FY10 FY11E FY12E FY13E Advt. cost/sales (%) 5.0 304 349

7.0 4.8 4.6 5.6

250 200 150 100 50 107 136 180 211 269

Advertisement expense

Source: Company, Angel Research

Source: Company, Angel Research

Financial outlook

Higher volumes and realisation to aid top line

During FY201113E, we expect Britannia to report strong top-line growth of 14.2%, driven largely by increased volumes and a 56% increase in realisations on account of absorption of the recent rate hikes. We expect Britannia to register volume growth in line with the industry at ~6% over the same period, driven largely by low-price, value-added products. While, we have factored a decrease in raw material price as % of sales as we do not expect the raw material to spike tremendously on account of onset of normal monsoons (forecasted), we still factor the raw material costs as % of sales almost in-line with FY2010 levels.

April 18, 2011

Britannia Industries | Initiating Coverage

Exhibit 14: Revenue Assumption

FY09 Biscuits & High Protein Food Revenue Growth (%) Volume Growth (%) Bread and Suji Toast Revenue Growth (%) Volume Growth (%) Cakes & Rusk Revenue Growth (%) Volume Growth (%) Others Revenue Growth (%) Gross Sales Total 23 49.9 3,143 30 32.9 3,425 39 30.0 4,150 49 25.0 4,763 54 10.0 5,415 14.2 17.3 99 28.0 9 12.0 119 21.1 11 19.3 144 21.1 13 16.4 174 20.8 15 17.3 212 21.7 18 18.1 17.7 increase in rusk throughput by way of both brownfield and greenfield projects Largely income from dairy business Incremental growth from national launch of Actimind, Tiger Zor, and Healthy Start 21.2 284 45.0 105 24.4 347 22.3 117 11.6 426 22.9 131 12.2 512 20.1 145 10.0 592 15.5 159 10.0 10.0 on the go consumption and relevant consumer activation is likely to drive growth 17.8 2,738 17.5 477 7.9 2,928 6.9 478 0.2 3,539 20.9 520 8.9 4,027 13.8 553 6.3 4,558 13.2 582 5.3 5.8 13.5 Rate hike absorption and introduction of premium niche products low price value added products to encourage up-trading from plain glucose variant biscuits FY10 FY11E FY12E FY13E

#

FY11-13E

Key Growth Drivers

Source: Company, Angel Research; Note: # CAGR (%), Volume growth in 000s tonnes and value growth in `cr

Exhibit 15: Expenditure Assumption

(`cr) Raw material % of sales Staff cost % of sales SG&A expenses % of sales Power cost % of sales EBITDA OPM (%) Interest Expense Reported PAT FY09 1,910 61.4 96 3.1 822 26.4 21 0.7 263 8.4 16 180 FY10 2,169 63.8 100 2.9 947 27.9 22 0.7 163 4.8 8 117

#

FY11E 2,663 64.8 116 2.8 1,113 27.1 29 0.7 187 4.6 41 125

FY12E 3,017 64.0 132 2.8 1,271 27.0 33 0.7 262 5.6 41 171

FY13E 3,385 63.1 150 2.8 1,413 26.4 38 0.7 376 7.0 41 248

FY11-13E 12.7 Expect cooling of raw material going ahead, with the onset of normal monsoons 13.8 12.6 Modeling 13% CAGR to support new product launches. Expect brand investments to sustain 14.2 Modeled flat as a % of sales 41.7 Increased due to issue of bonus debenture (8.25% coupon rate)

(0.2) 41.0

Source: Company, Angel Research; Note: CAGR (%)

April 18, 2011

Britannia Industries | Initiating Coverage

Key concerns

Volatility in agri-based commodities: We have modeled in an improvement in the companys EBITDA margins to 7% in FY2013E, on the backdrop of cooling agri-based commodities. However, the extreme volatile nature of agri-based commodities can act as a bottleneck in Britannias margin expansion and growth. Economic growth: Any slowdown in Indias economic growth story could lead to down trading of products such as biscuits (not a primary food item). This could lead to loss of sales and further affect margins as Britannia has many premium products in its basket. Higher food inflation is also a major concern for the company. New product launches: Britannias foray into breakfast cereals and other premium products could lead to tighter margins as new products demand lot of efforts on the marketing front. Higher ad spends and other promotional activities can pull down margins.

Company background

Britannia is one of the foremost food companies in India, with presence in biscuits, dairy products, breads and has recently forayed into breakfast cereals category with the launch of Healthy Start. The company derives ~85% of its revenues from biscuits and have formidable brands such as Tiger (glucose biscuits), Treat (cream biscuits), 50-50 (crackers), Good Day (premium cookies and its highest selling brand) and Nutrichoice (premium high fiber biscuits). Britannia forayed into dairy business in 2002 through its subsidiary Britannia New Zealand foods Pvt. Ltd. (BNZF), which was run as a JV with Fonterra, worlds second largest dairy company. In 2009, Britannia acquired Fonterras 49% stake and BNZF was renamed as Britannia Dairy Pvt. Ltd. (BDPL), which became a wholly owned subsidiary of Britannia. BDPL offers dairy products, including cheese, dairy whitener, yoghurt, butter and ghee. The company marked its presence in retail bakery business with51% acquisition of Bangalore based food retailer, DailyBread.

Exhibit 16: Britannias FY2010 sales mix

10.1% 3.5% 0.9%

85.5%

Biscuits & High Protein Food

Source: Company, Angel Research

Bread

Cakes & Rusk

Others

April 18, 2011

Britannia Industries | Initiating Coverage

Profit and Loss Statement

Y/E March (` cr) Gross sales Less: Excise duty Net Sales Total operating income % chg Total Expenditure Cost of Materials Advertising Exp (Incl Prom) Personnel Others EBITDA % chg (% of Net Sales) Depreciation& Amort EBIT % chg (% of Net Sales) Interest & other Charges Other Income (% of PBT) Share in profit of Asso Recurring PBT % chg Prior Period & Extra Exp/(Inc.) PBT (reported) Tax (% of PBT) PAT (reported) Add: Share of earnings of ass Less: Minority interest (MI) PAT after MI (reported) ADJ. PAT % chg (% of Net Sales) Basic EPS (`) Fully Diluted EPS (`) % chg FY2009 3,143 31 3,112 3,112 20.4 2,849 1,910 211 96 632 263 13.4 8.4 33 229 13.1 7.4 16 40 15.8 253 4.1 20.63 233 52 20.6 201 201 180 (5.6) 5.8 15.1 15.1 (5.6) FY2010 3,425 23 3,401 3,401 9.3 3,238 2,169 269 100 701 163 (37.8) 4.8 38 126 (45.2) 3.7 8 56 32.3 174 (31.4) 52.87 121 4 2.5 169 169 117 (35.4) 3.4 9.8 9.8 (35.4) FY2011E 4,150 41 4,108 4,108 20.8 3,921 2,663 304 116 838 187 14.5 4.6 42 145 15.0 3.5 41 66 38.9 169 (2.8) 169 44 26.0 125 125 125 7.2 3.0 10.5 10.5 7.2 FY2012E 4,763 48 4,715 4,715 14.8 4,453 3,017 349 132 955 262 40.2 5.6 47 215 48.9 4.6 41 57 24.5 231 36.6 231 60 26.0 171 171 171 36.6 3.6 14.3 14.3 36.6 FY2013E 5,415 54 5,361 5,361 13.7 4,986 3,385 391 150 1,059 376 43.3 7.0 52 323 50.1 6.0 41 54 16.0 336 45.5 336 87 26.0 248 248 248 45.5 4.6 20.8 20.8 45.5

April 18, 2011

Britannia Industries | Initiating Coverage

Balance sheet

Y/E March (` cr) SOURCES OF FUNDS Equity Share Capital Share Capital suspense account Reserves& Surplus Shareholders Funds Minority Interest Total Loans Deferred Tax Liability Total Liabilities APPLICATION OF FUNDS Gross Block Less: Acc. Depreciation Net Block Capital Work-in-Progress Goodwill Investments Current Assets Cash Loans & Advances Other Current liabilities Net Current Assets Mis. Exp. not written off Total Assets

FY2009 FY2010 FY2011E FY2012E FY2013E

24 801 825 25 10 860 512 234 278 6 423 539 41 195 14 413 126 27 860

24 372 396 430 (7) 819 548 266 282 12 491 521 23 190 14 486 36 819

24 425 449 429 (7) 871 642 309 333 13 431 674 27 226 20 580 93 871

24 483 507 429 (7) 929 720 355 364 15 431 808 72 252 25 688 119 929

24 584 608 23 (7) 623 806 408 398 17 161 842 14 279 35 795 48 623

Cash flow statement Y/E March (` cr) Profit before tax Depreciation Change in Working Capital Interest / Dividend (Net) Direct taxes paid Payment of VRS Profit on sale of invst/FA (Net) Others Cash Flow from Operations (Inc.)/ Dec. in Fixed Assets (Inc.)/ Dec. in Investments Cash Flow from Investing Inc./(Dec.) in loans Dividend Paid (Incl. Tax) Interest/Dividend paid (Net) Cash Flow from Financing Inc./(Dec.) in Cash Opening Cash balances Closing Cash balances FY2009 233 33 0.5 (5) 52 (3) 7 35 233 (55) (42) (97) (81) 59 (1) (139) (3) 44 41 FY2010 121 38 108 (25) 73 27 12 (4) 179 (42) (68) (109) (2) 105 (21) (87) (17) 41 23 FY2011E 169 42 9 2 44 9 (53) 116 (96) 60 (36) (1) 70 6 (77) 3 23 27 FY2012E 231 47 25 4 60 (34) 212 (80) (80) 78 8 (87) 46 27 72 FY2013E 336 52 18 16 87 (31) 303 (88) 270 182 (406) 117 20 (543) (58) 72 14

April 18, 2011

10

Britannia Industries | Initiating Coverage

Key Ratios

Y/E March Valuation Ratio (x) P/E (on FDEPS) P/CEPS P/BV Dividend yield (%) EV/Sales EV/EBITDA EV / Total Assets Per Share Data (`) EPS (Basic) EPS (fully diluted) Cash EPS DPS Book Value Returns (%) RoCE Angel ROIC (Pre-tax) RoE Turnover ratios (x) Asset Turnover (Gross Block) Inventory / Sales (days) Receivables (days) Payables (days) Wrkg cap cycle (ex-cash) (days) 6.1 30 6 31 19 6.2 29 4 34 7 6.4 33 4 36 9 6.6 33 4 35 9 6.7 33 4 35 8 26.7 22.3 25.4 15.0 15.2 27.7 17.1 13.1 29.6 23.9 18.7 35.7 41.6 32.6 44.5 15.1 15.1 19.6 8.0 69.0 9.8 9.8 17.3 5.0 33.2 10.5 10.5 14.0 5.2 37.5 14.3 14.3 18.2 8.0 42.5 20.8 20.8 25.2 10.6 50.9 25.0 19.2 5.5 1.4 1.4 16.6 5.1 38.7 21.8 11.4 1.3 1.3 26.7 5.3 36.1 26.9 10.0 1.1 1.1 23.3 5.0 26.4 20.7 8.9 0.9 0.9 16.6 4.7 18.1 15.0 7.4 0.8 0.8 11.6 7.0 FY2009 FY2010 FY2011E FY2012E FY2013E

April 18, 2011

11

Britannia Industries | Initiating Coverage

Research Team Tel: 022 - 39357800

E-mail: research@angelbroking.com

Website: www.angelbroking.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement 1. Analyst ownership of the stock 2. Angel and its Group companies ownership of the stock 3. Angel and its Group companies' Directors ownership of the stock 4. Broking relationship with company covered

Britannia No No No No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Returns):

Buy (> 15%) Reduce (-5% to 15%)

Accumulate (5% to 15%) Sell (< -15%)

Neutral (-5 to 5%)

April 18, 2011

12

Britannia Industries | Initiating Coverage

6th Floor, Ackruti Star, Central Road, MIDC, Andheri (E), Mumbai- 400 093. Tel: (022) 39357800

Research Team Fundamental: Sarabjit Kour Nangra Vaibhav Agrawal Shailesh Kanani Sageraj Bariya Srishti Anand Bhavesh Chauhan Jai Sharda Sharan Lillaney Naitik Mody Chitrangda Kapur Amit Vora V Srinivasan Mihir Salot Pooja Jain Yaresh Kothari Shrinivas Bhutda Sreekanth P.V.S Hemang Thaker Nitin Arora Ankita Somani Varun Varma Vasant Lohiya Poonam Sanghvi Technicals: Shardul Kulkarni Mileen Vasudeo Derivatives: Siddarth Bhamre Jaya Agarwal Institutional Sales Team: Mayuresh Joshi Abhimanyu Sofat Pranav Modi Jay Harsora Meenakshi Chavan Gaurang Tisani Production Team: Simran Kaur Bharat Patil Dilip Patel Research Editor Production Production simran.kaur@angelbroking.com bharat.patil@angelbroking.com dilipm.patel@angelbroking.com VP - Institutional Sales AVP - Institutional Sales Sr. Manager Manager Dealer Dealer mayuresh.joshi@angelbroking.com abhimanyu.sofat@angelbroking.com pranavs.modi@angelbroking.com jayr.harsora@angelbroking.com meenakshis.chavan@angelbroking.com gaurangp.tisani@angelbroking.com Head - Derivatives Derivative Analyst siddarth.bhamre@angelbroking.com jaya.agarwal@angelbroking.com Sr. Technical Analyst Technical Analyst shardul.kulkarni@angelbroking.com vasudeo.kamalakant@angelbroking.com VP-Research, Pharmaceutical VP-Research, Banking Infrastructure Fertiliser, Mid-cap IT, Telecom Metals, Mining Mid-cap Mid-cap Mid-cap FMCG, Media Research Associate (Oil & Gas) Research Associate (Cement, Power) Research Associate (Logistics, Shipping) Research Associate (Metals & Mining) Research Associate (Automobile) Research Associate (Banking) Research Associate (FMCG, Media) Research Associate (Capital Goods) Research Associate (Infra, Real Estate) Research Associate (IT, Telecom) Research Associate (Banking) Research Associate (Banking) Research Associate (Pharma) sarabjit@angelbroking.com vaibhav.agrawal@angelbroking.com shailesh.kanani@angelbroking.com sageraj.bariya@angelbroking.com srishti.anand@angelbroking.com bhaveshu.chauhab@angelbroking.com jai.sharda@angelbroking.com sharanb.lillaney@angelbroking.com naitiky.mody@angelbroking.com chitrangdar.kapur@angelbroking.com amit.vora@angelbroking.com v.srinivasan@angelbroking.com mihirr.salot@angelbroking.com pooja.j@angelbroking.com yareshb.kothari@angelbroking.com shrinivas.bhutda@angelbroking.com sreekanth.s@angelbroking.com hemang.thaker@angelbroking.com nitin.arora@angelbroking.com ankita.somani@angelbroking.com varun.varma@angelbroking.com vasant.lohiya@angelbroking.com poonam.sanghvi@angelbroking.com

Angel Broking Ltd: BSE Sebi Regn No : INB 010996539 / CDSL Regn No: IN - DP - CDSL - 234 - 2004 / PMS Regn Code: PM/INP000001546 Angel Securities Ltd:BSE: INB010994639/INF010994639 NSE: INB230994635/INF230994635 Membership numbers: BSE 028/NSE:09946

Angel Capital & Debt Market Ltd: INB 231279838 / NSE FNO: INF 231279838 / NSE Member code -12798 Angel Commodities Broking (P) Ltd: MCX Member ID: 12685 / FMC Regn No: MCX / TCM / CORP / 0037 NCDEX : Member ID 00220 / FMC Regn No: NCDEX / TCM / CORP / 0302

April 18, 2011

13

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Private Placement Bonds-A Valuable AlternativeDokument6 SeitenPrivate Placement Bonds-A Valuable AlternativeEnergyte BaldonadoNoch keine Bewertungen

- Lecture 11 - Balance Sheet Analysis Duff & Phelps ROE Vs ROCDokument11 SeitenLecture 11 - Balance Sheet Analysis Duff & Phelps ROE Vs ROCJohn Aldridge Chew100% (2)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Federal Contracts Bidders ListDokument7 SeitenFederal Contracts Bidders ListJAGUAR GAMINGNoch keine Bewertungen

- BNP Paribas Inflation Linked MarketsDokument72 SeitenBNP Paribas Inflation Linked Marketsk121212Noch keine Bewertungen

- Financial Instruments (2021)Dokument17 SeitenFinancial Instruments (2021)Tawanda Tatenda Herbert100% (1)

- Learning Objectives: c04.qxd 6/2/06 2:53 PM Page 124Dokument54 SeitenLearning Objectives: c04.qxd 6/2/06 2:53 PM Page 124Eric M. KathenduNoch keine Bewertungen

- How To Use ADXDokument7 SeitenHow To Use ADXhunghl972680% (5)

- Test Bank For The Economics of Money Banking and Financial Markets 7th Canadian Edition Mishkin DownloadDokument30 SeitenTest Bank For The Economics of Money Banking and Financial Markets 7th Canadian Edition Mishkin Downloadariananavarrofkaeicyprn100% (16)

- A Study of Distribution Channel of Batteries For Exide Industries LimitedDokument61 SeitenA Study of Distribution Channel of Batteries For Exide Industries Limitedauli716Noch keine Bewertungen

- ULTIMATE Sample Paper 3Dokument22 SeitenULTIMATE Sample Paper 3Vansh RanaNoch keine Bewertungen

- E Commerce November 2020Dokument28 SeitenE Commerce November 2020auli716Noch keine Bewertungen

- Sentiment Analysis of Reviews For E-Shopping Websites: Dr. U Ravi BabuDokument4 SeitenSentiment Analysis of Reviews For E-Shopping Websites: Dr. U Ravi Babuauli716Noch keine Bewertungen

- E-Commerce in India A Case Study of Amazon Flipkart IndiaDokument74 SeitenE-Commerce in India A Case Study of Amazon Flipkart Indiaauli716Noch keine Bewertungen

- 2 Vol 1 Issue8 ZenDokument16 Seiten2 Vol 1 Issue8 Zenauli716Noch keine Bewertungen

- KjqheiuyDokument11 SeitenKjqheiuyauli716Noch keine Bewertungen

- FdhytuiDokument136 SeitenFdhytuiauli716Noch keine Bewertungen

- SERVIQUALBFDfdDokument49 SeitenSERVIQUALBFDfdauli716Noch keine Bewertungen

- Chapter 4 CLC StudentDokument33 SeitenChapter 4 CLC StudentLinh HoangNoch keine Bewertungen

- KEYDokument7 SeitenKEYMinh Thuy NguyenNoch keine Bewertungen

- Analysis of Stock Portfolio Performance With SharpeDokument4 SeitenAnalysis of Stock Portfolio Performance With SharpeFatimah AzzahraNoch keine Bewertungen

- SDokument3 SeitenSBiplob K. Sannyasi0% (1)

- Accounting Info+Financial StatementsDokument31 SeitenAccounting Info+Financial StatementsSage WilliamsNoch keine Bewertungen

- Accounting For Special Transactions ReviewerDokument6 SeitenAccounting For Special Transactions ReviewerKaye Mariz TolentinoNoch keine Bewertungen

- Intl LiquidityDokument3 SeitenIntl LiquidityAshneet BhasinNoch keine Bewertungen

- 2020 NoertjahyanaDokument9 Seiten2020 NoertjahyanaAli AzizNoch keine Bewertungen

- Mutual Funds: Project Report OnDokument40 SeitenMutual Funds: Project Report OnShilpi_Mathur_7616Noch keine Bewertungen

- CMA Data Analysis - BranchDokument9 SeitenCMA Data Analysis - BranchKunal SinghNoch keine Bewertungen

- Additional Exercises - 21Dokument9 SeitenAdditional Exercises - 21Gega XachidENoch keine Bewertungen

- Musa Moshref and Shaniqua Hollins Have Operated A Successful FirmDokument2 SeitenMusa Moshref and Shaniqua Hollins Have Operated A Successful FirmMuhammad ShahidNoch keine Bewertungen

- Akash Gupta Minor Project Bajaj Finserv (1) FinalDokument64 SeitenAkash Gupta Minor Project Bajaj Finserv (1) FinalAkash AggarwalNoch keine Bewertungen

- News Oct 2009Dokument21 SeitenNews Oct 2009Financial HubNoch keine Bewertungen

- VUL MOck 2Dokument10 SeitenVUL MOck 2Franz JosephNoch keine Bewertungen

- Aliber TheoryDokument2 SeitenAliber TheoryAndreea BarbuNoch keine Bewertungen

- Difference Between Profitability Vs LiquidityDokument5 SeitenDifference Between Profitability Vs LiquidityAbdul KhanNoch keine Bewertungen

- Solution of Amalgamation - Home AssignmentDokument32 SeitenSolution of Amalgamation - Home Assignmentlucky_mugal786Noch keine Bewertungen

- Acme IPODokument314 SeitenAcme IPOankitpa13Noch keine Bewertungen

- PR - Order in The Matter of M/s. Phenix Properties LimitedDokument2 SeitenPR - Order in The Matter of M/s. Phenix Properties LimitedShyam SunderNoch keine Bewertungen

- LCCI Level 1 Certificate in Bookkeeping ASE20091 Resource Booklet Nov 2019Dokument8 SeitenLCCI Level 1 Certificate in Bookkeeping ASE20091 Resource Booklet Nov 2019ringotgNoch keine Bewertungen

- Midterm Exam Portfoliomanagement Fall 2019Dokument3 SeitenMidterm Exam Portfoliomanagement Fall 2019eya feguiriNoch keine Bewertungen