Beruflich Dokumente

Kultur Dokumente

PilgrimAssignment grp13

Hochgeladen von

Ram MohanOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

PilgrimAssignment grp13

Hochgeladen von

Ram MohanCopyright:

Verfügbare Formate

Case facts Green wanted to figure out: Whether online customers are better for the bank.

r for the bank. Implications for online banking product. Data available: year end 1999 Customer profitability = (balance in deposit accounts)*(net interest spread)+(fees)+ (interest from loans)-(cost to serve) To improve customer profitability: Banks should charge for each transaction Encourage transaction migration to lower cost channels(online banking) Charging each transaction failed many times in the past. Analysis is to figure out the effects of online baking on customer profitability. Took a sample of 30,000 out of 5,000,000 customers. Average customer profitability = $111.50 Avg. customer profitability (online banking) = $116.67 Avg. customer profitability (offline banking) = $110.79 After running the regression analysis it is found that, the coefficient for online banking in the linear equation for profit is 22.45, which makes it a significant positive contributor to the profitability. It is also found that the effect of income bucket 8 and district 1100 can be neglected from calculation.

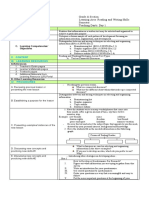

PILGRIM BANK CASE ANALYSIS We begin the analysis by deleting the data from sample which has missing Age or Income values. We are left with around 22000 customer records and we consider this sample for further analysis. Initially we divide the data into online users and offline users. Then we conduct a Hypothesis Testing between the two set of data to find if there is any significance difference in their means.

The calculated T value is 1.0088021111 which is less than the critical T value of 1.644890595. Hence the Null Hypothesis cannot be rejected and based on the above analysis we can say that currently Online customers are not significantly more profitable then Offline Customers. We analyse the profitability data for online and offline customers for each district mentioned: Considering the given sample it is apparent that except for the online customers in District 1200, offline customers are more profitable in rest of the two districts. Next we conduct a regression test on the data to know about the variables which can help the Bank increase its profitability

F-value: As the significance F-Value is very small, therefore the model developed is significant and the data and statistics achieved by this model can be accepted. R-Square value: The R-Square value for the model is .058 which is very low and means that there is very less correlation between the variables. This implies that the data does not fit the model very well and there are large variations in the data.

P-Value for a confidence level of 95%: If the p value is below .05 for a variable we can conclude that the beta is significant. In the case of online vs. offline, the p value is very low. This means that we have significant evidence to accept the model.

As per the above table: A co-efficient of 22.45 shows that for each customer moving from offline to online banking, the profit of bank increases by $ 22.45. Therefore, online usage shall be promoted. Customers in District 1100 are not profitable as per the regression analysis and therefore the Bank shall look for ways to increase its profit in those cities by increasing their customer base and encouraging people to use online facilities. Tenure does not have a significant effect on the profitability. It is restricted to only $4.

We found that there isnt a significance difference currently between the online and offline customers profitability but considering this regression model, we should definitely try to have more users online because it would help in increasing the Banks profitability.

The R square value is very small therefore this regression model is not very significant. As per the above regression data analysis table, age has a negative 0.0317 effect on Online usage which means that with increase in Age the online usage falls by 3.2% for the bank and thus if the bank targets younger people it could increase its profitability by having many online users. Also Income has almost 1% effect on online usage. Therefore, customers with high income would use online facilities more and therefore help in increasing profitability. Also, the data shows that People in District1200 prefer online banking more than the remaining districts. This was also shown in a table drawn earlier where averages for the three districts for online and offline usage was shown. But the fact that R square value is a mere 5.1% draws doubt about the credibility of the results.

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1091)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Tuv Sud Lifts and EscalatorsDokument2 SeitenTuv Sud Lifts and EscalatorsJazonNoch keine Bewertungen

- RWS 11.1.2 (Selecting and Organizing Info)Dokument2 SeitenRWS 11.1.2 (Selecting and Organizing Info)roxann djem sanglayNoch keine Bewertungen

- Safasf SDF GHFGH Try Rty Rtyfgha Asd Asd As FDGD Fge Rter As Dasd Asd Asd A SF SDGDFG DF HDF SDF SDF Asdf SD GHDFG HFG HDF GHDokument1 SeiteSafasf SDF GHFGH Try Rty Rtyfgha Asd Asd As FDGD Fge Rter As Dasd Asd Asd A SF SDGDFG DF HDF SDF SDF Asdf SD GHDFG HFG HDF GHRam MohanNoch keine Bewertungen

- Safasf SDF GHFGH Try Rty Rtyfgha As Dasd Asd Asd A SF SDGDFG DF HDFDokument1 SeiteSafasf SDF GHFGH Try Rty Rtyfgha As Dasd Asd Asd A SF SDGDFG DF HDFRam MohanNoch keine Bewertungen

- Safasf SDF GHFGH Try Rty Rtyfgha As Dasd Asd Asd A SF SDGDFG DF HDF SDF SDF Asdf SD GHDFG HFG HDF GHDokument1 SeiteSafasf SDF GHFGH Try Rty Rtyfgha As Dasd Asd Asd A SF SDGDFG DF HDF SDF SDF Asdf SD GHDFG HFG HDF GHRam MohanNoch keine Bewertungen

- Safasf SDF GHFGH Try Rty RtyfgDokument1 SeiteSafasf SDF GHFGH Try Rty RtyfgRam MohanNoch keine Bewertungen

- Asd Asd As DD F GDF GH FG HF G HJH JF GH Rty Ty TRDokument1 SeiteAsd Asd As DD F GDF GH FG HF G HJH JF GH Rty Ty TRRam MohanNoch keine Bewertungen

- Annexure - A 2BHK - SMALL (B1&B2) : Crescent Lake Homes - Price Chart & Payment ScheduleDokument3 SeitenAnnexure - A 2BHK - SMALL (B1&B2) : Crescent Lake Homes - Price Chart & Payment ScheduleRam MohanNoch keine Bewertungen

- Answers To Probability Related Problems From Problem Set and SlidesDokument3 SeitenAnswers To Probability Related Problems From Problem Set and SlidesRam MohanNoch keine Bewertungen

- Qualitative ForecastingDokument29 SeitenQualitative ForecastingMuhammad AsimNoch keine Bewertungen

- Ashleys Lesson Plan For Corner Grocery SongDokument3 SeitenAshleys Lesson Plan For Corner Grocery Songapi-241454734Noch keine Bewertungen

- NFDN 2004 Professional PortfolioDokument2 SeitenNFDN 2004 Professional Portfolioapi-32048921050% (2)

- SANHS ESIP 2023 2025 FinalDokument21 SeitenSANHS ESIP 2023 2025 FinaljosephNoch keine Bewertungen

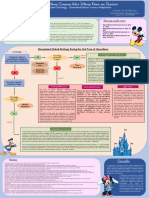

- Disneyland - Globalization Strategy PresentationDokument1 SeiteDisneyland - Globalization Strategy PresentationHanim Tahir50% (2)

- A Study To Evaluate Pranayama On Bio Physiological Parameters Among Patients With Bronchial Asthma at NMCH, NelloreDokument4 SeitenA Study To Evaluate Pranayama On Bio Physiological Parameters Among Patients With Bronchial Asthma at NMCH, NelloreInternational Journal of Innovative Science and Research TechnologyNoch keine Bewertungen

- Methodology in Business Ethics Research A Review PDFDokument15 SeitenMethodology in Business Ethics Research A Review PDFMercedes Baño HifóngNoch keine Bewertungen

- Performance Monitoring and Coaching FormDokument2 SeitenPerformance Monitoring and Coaching FormVinCENtNoch keine Bewertungen

- TCS PDFDokument179 SeitenTCS PDFSudhir SinghNoch keine Bewertungen

- Research ProposalDokument7 SeitenResearch ProposalKurva UshaNoch keine Bewertungen

- An ESP Needs Analysis: Addressing The Needs of English For Informatics EngineeringDokument18 SeitenAn ESP Needs Analysis: Addressing The Needs of English For Informatics EngineeringChairul RizalNoch keine Bewertungen

- Learner Analysis Data DiscussionDokument5 SeitenLearner Analysis Data Discussionapi-345451244Noch keine Bewertungen

- BA Final ReportDokument28 SeitenBA Final ReportRiyaNoch keine Bewertungen

- (IJCST-V3I3P47) : Sarita Yadav, Jaswinder SinghDokument5 Seiten(IJCST-V3I3P47) : Sarita Yadav, Jaswinder SinghEighthSenseGroupNoch keine Bewertungen

- The Broad Problem Area and Defining The Problem StatementDokument20 SeitenThe Broad Problem Area and Defining The Problem StatementWan Harith IrfanNoch keine Bewertungen

- HSBC Knowledge Centre - SWOT AnalysisDokument6 SeitenHSBC Knowledge Centre - SWOT Analysismahmud.kabirNoch keine Bewertungen

- Reflection EssayDokument3 SeitenReflection Essayapi-287498187Noch keine Bewertungen

- EIQ16 Emotional Intelligence QuestionnaireDokument7 SeitenEIQ16 Emotional Intelligence QuestionnaireVimalNoch keine Bewertungen

- Study of Applications of Underwater Wireless Sensor NetworksDokument4 SeitenStudy of Applications of Underwater Wireless Sensor NetworksPadmaja VenkataramanNoch keine Bewertungen

- Bacher 2002 Cluster AnalysisDokument199 SeitenBacher 2002 Cluster Analysisgeovana_lorena630Noch keine Bewertungen

- English GrammarDokument30 SeitenEnglish GrammarBelén Pérez DíazNoch keine Bewertungen

- Allocation Analyst ResumeDokument5 SeitenAllocation Analyst Resumeafjwoovfsmmgff100% (2)

- Soyoung CVDokument6 SeitenSoyoung CVapi-477306025Noch keine Bewertungen

- Analysis of Connections and Fasteners To Determine Disassembly and Strength CharacteristicsDokument15 SeitenAnalysis of Connections and Fasteners To Determine Disassembly and Strength CharacteristicsLeandro González De CeccoNoch keine Bewertungen

- ATC 115 Preliminary CoverDokument188 SeitenATC 115 Preliminary Covertecanasio100% (1)

- Chapter 02 (Measures of Central Tendency)Dokument167 SeitenChapter 02 (Measures of Central Tendency)Javid QuadirNoch keine Bewertungen

- Project AssignmentDokument2 SeitenProject AssignmentyehunebekeleNoch keine Bewertungen

- Forecasting Models - PPTDokument57 SeitenForecasting Models - PPTPRITI DASNoch keine Bewertungen