Beruflich Dokumente

Kultur Dokumente

6 28 08 To 8 21 12 Most of Cv08-01709 Carpentier Flanagan Ocr Opt A9

Hochgeladen von

NevadaGadflyOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

6 28 08 To 8 21 12 Most of Cv08-01709 Carpentier Flanagan Ocr Opt A9

Hochgeladen von

NevadaGadflyCopyright:

Verfügbare Formate

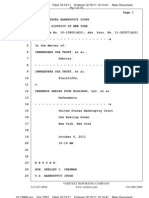

Case Information

Case Description: CV08-01709 - J CARPENTIER, ETAL/ AAMES FUNDING

CORP., ETAL(D7) - Non Jury -

Filing Date: 26-Jun-2008

Case Type: FC - FORECLOSURE

Status: NEF - Proof of Electronic Service

Case Cross Reference

Cross Reference Number

Case

Parties (top)

Seq Type Name

2 PLTF - Plaintiff CARPENTIER, JAMES S

3 PLTF - Plaintiff CARPENTIER, JOAN E

5 DEFT - Defendant AAMES FUNDING CORPORATION

DBA AAMES HOME LOAN,

7 DEFT - Defendant WINDSOR MANAGEMENT CO.,

8 DEFT - Defendant RESIDENTIAL CREDIT SOLUTIONS,

INC,

9 DEFT - Defendant QUALITY LOANS SERVICE

CORPORATION,

12 ATTY - Attorney Zimbelman, Esq., Eric

13 ATTY - Attorney Zimbelman, Esq., Eric

18 ATTY - Attorney Schuler-Hintz, Esq., Kristin A.

20 PROP - Pro

Per-Pltf/Pet/Appellant

ProPer Person,

Event

Information (top)

Date/Time Hearing Judge Event Description Outcome

1. 12-Jul-2012 at

14:40

Honorable

PATRICK FLANAGAN

S1 - Request for

Submission

S200 - Request for

Submission Complet

filed on: 21-Aug-2012

Extra Text:

2. 12-Mar-2012 at

16:50

Honorable

PATRICK FLANAGAN

S1 - Request for

Submission

S200 - Request for

Submission Complet

filed on: 20-Apr-2012

Extra Text:

3. 12-Jul-2010 at

10:35

Honorable

PATRICK FLANAGAN

S1 - Request for

Submission

S200 - Request for

Submission Complet

filed on: 15-Jul-2010

Extra Text:

4. 16-Nov-2009 at Honorable H844 - TRIAL - D845 - Vacated filed

Notice: This is NOT an Official Court Record

4. 16-Nov-2009 at

10:00

Honorable

PATRICK FLANAGAN

H844 - TRIAL -

NON JURY

D845 - Vacated filed

on: 15-Jun-2009

Extra Text: Notice

of Bankruptcy and

Automatic Stay filed

05.20.09

5. 24-Jun-2009 at

09:00

Honorable

PATRICK FLANAGAN

H756 -

PRE-TRIAL

CONFERENCE

D845 - Vacated filed

on: 15-Jun-2009

Extra Text: Notice

of Bankruptcy and

Automatic Stay filed

05.20.09

6. 19-Mar-2009 at

13:00

Honorable

PATRICK FLANAGAN

H820 - STATUS

HEARING

D435 - Heard ... filed

on: 19-Mar-2009

Extra Text:

7. 06-Mar-2009 at

13:30

Honorable

PATRICK FLANAGAN

H816 - STATUS

CONFERENCE

D844 - Vacated-Reset

filed on: 06-Mar-2009

Extra Text:

PLAINTIFF FAILED

TO APPEAR

8. 13-Feb-2009 at

15:30

Honorable

PATRICK FLANAGAN

H820 - STATUS

HEARING

D435 - Heard ... filed

on: 13-Feb-2009

Extra Text:

9. 13-Jan-2009 at

14:50

Honorable

PATRICK FLANAGAN

S1 - Request for

Submission

S200 - Request for

Submission Complet

filed on: 22-Jan-2009

Extra Text:

10. 08-Dec-2008 at

10:20

Honorable

CONNIE STEINHEIMER

S1 - Request for

Submission

S200 - Request for

Submission Complet

filed on: 13-Jan-2009

Extra Text: CASE

TRANSFERRED TO

DEPARTMENT 7

11. 17-Jul-2008 at

15:00

Honorable

CONNIE STEINHEIMER

H764 -

PRELIMINARY

INJUNCTION

D425 - Granted filed

on: 17-Jul-2008

Extra Text:

$1,000.00 BOND TO

REMAIN IN EFFECT

12. 17-Jul-2008 at

15:00

Honorable

CONNIE STEINHEIMER

H364 -

HEARING...

D802 - Set in Error

filed on: 07-Jul-2008

Extra Text:

13. 07-Jul-2008 at

16:30

Honorable

CONNIE STEINHEIMER

H364 -

HEARING...

D425 - Granted filed

on: 07-Jul-2008

Extra Text: TRO

GRANTED; ONE

THOUSAND DOLLAR

BOND TO BE

POSTED. HEARING

Notice: This is NOT an Official Court Record

TO EXTEND TRO SET.

Docket Entry

Information (top)

Docket Description Date Filed Extra Text

1. CHECK - **Trust

Disbursement

09-Sep-2013 Extra Text: A Disbursement of $1,000.00 on Check

Number 25723

2. NEF - Proof of

Electronic Service

05-Sep-2013 Extra Text: Transaction 3973125 - Approved By:

NOREVIEW : 09-05-2013:09:06:28

3. 2985 - Ord Return

Funds on Deposit

05-Sep-2013 Extra Text: TEMPORARY RESTRAINING ORDER

BOND - Transaction 3973100 - Approved By:

NOREVIEW : 09-05-2013:09:02:41

4. 2540 - Notice of

Entry of Ord

22-Aug-2012Extra Text: Transaction 3168375 - Approved By:

NOREVIEW : 08-22-2012:13:49:28

5. NEF - Proof of

Electronic Service

22-Aug-2012Extra Text: Transaction 3168382 - Approved By:

NOREVIEW : 08-22-2012:13:50:42

6. NEF - Proof of

Electronic Service

21-Aug-2012Extra Text: Transaction 3162518 - Approved By:

NOREVIEW : 08-21-2012:09:32:48

7. 3370 - Order ... 21-Aug-2012Extra Text: [GRANTING DEFENDANTS' MTN FOR

SANCTIONS; AND DENYING PLAINTIFFS' MTN

TO ALTER OR AMEND ORDER, OR NEW TRIAL,

OR PLED IN THE ALTERNATIVE, MOTION TO

SET ASIDE ORDER GRANTING SUMMARY

JUDGMENT - ks]

8. F140 - Adj

Summary Judgment

21-Aug-2012Extra Text:

9. NEF - Proof of

Electronic Service

21-Aug-2012Extra Text: Transaction 3166649 - Approved By:

NOREVIEW : 08-21-2012:16:38:16

10. 4300 -

Withdrawal of

Counsel

20-Aug-2012Extra Text: MOTION TO WITHDRAW AS COUNSEL

OF RECORD. ZACHARY COUGHLIN, ESQ.

WITHDRAWS AS COUNSEL OF RECORD FOR

PLAINTIFFS, JAMES AND JOAN CARPENTIER

ETAL - Transaction 3162061 - Approved By:

LMATHEUS : 08-21-2012:09:17:44

11. 1325 - ** Case

Reopened

12-Jul-2012 Extra Text:

12. NEF - Proof of

Electronic Service

12-Jul-2012 Extra Text: Transaction 3078448 - Approved By:

NOREVIEW : 07-12-2012:14:17:11

13. 3860 - Request

for Submission

12-Jul-2012 Extra Text: REQUEST FOR RULE 11 SANCTIONS

AND OPPOSITION TO MOTION TO ALTER OR

AMEND ORDER, OR NEW TRIAL OR PLED IN

THE ALTERNATIVE MOTION FOR

RECONSIDERATION - Transaction 3078304 -

Approved By: AZION : 07-12-2012:14:14:58

DOCUMENT TITLE: REQUEST FOR RULE 11

SANCTIONS AND OPPOSITION TO MOTION TO

ALTER OR AMEND ORDER, OR NEW TRIAL OR

Notice: This is NOT an Official Court Record

PLED IN THE ALTERNATIVE MOTION FOR

RECONSIDERATION PARTY SUBMITTING:

KRISTIN SCHULER-HINTZ ESQ DATE

SUBMITTED: 07-12-12 SUBMITTED BY: AZION

DATE RECEIVED JUDGE OFFICE:

14. NEF - Proof of

Electronic Service

05-Jun-2012 Extra Text: Transaction 2996834 - Approved By:

NOREVIEW : 06-05-2012:10:11:04

15. 2650 -

Opposition to ...

05-Jun-2012 Extra Text: OPPOSITION TO REQUEST FOR

SANCTIONS ETC. - Transaction 2996151 - Approved

By: LMATHEUS : 06-05-2012:10:09:32

16. NEF - Proof of

Electronic Service

17-May-2012Extra Text: Transaction 2961790 - Approved By:

NOREVIEW : 05-17-2012:16:35:36

17. 3870 - Request 17-May-2012Extra Text: RESIDENTIAL CREDIT SOLUTIONS,

INC AND QUALITY LOAN SERVICE CORP'S

REQUEST FOR RULE 11 SANCTIONS AND

OPPOSITION TO MOTION TO ALTER OR AMEND

ORDER, OR NEW TRIAL, OR PLED IN THE

ALTERNATIVE, MOTION FOR

RECONSIDERATION - Transaction 2961529 -

Approved By: SHAMBRIG : 05-17-2012:16:31:03

18. NEF - Proof of

Electronic Service

08-May-2012Extra Text: Transaction 2938457 - Approved By:

NOREVIEW : 05-08-2012:11:30:42

19. 2250 - Mtn Alter

or Amend Judgment

07-May-2012Extra Text: MOTION TO ALTER OR AMEND

ORDER, OR NEW TRIAL, OR PLED IN THE

ALTERNATIVE, MOTION FOR

RECONSIDERATION - Transaction 2937348 -

Approved By: LMATHEUS : 05-08-2012:11:25:36

20. NEF - Proof of

Electronic Service

23-Apr-2012 Extra Text: Transaction 2906618 - Approved By:

NOREVIEW : 04-23-2012:14:58:14

21. 2540 - Notice of

Entry of Ord

23-Apr-2012 Extra Text: Transaction 2906602 - Approved By:

NOREVIEW : 04-23-2012:14:55:09

22. 1315 - ** Case

Closed

20-Apr-2012 Extra Text:

23. NEF - Proof of

Electronic Service

20-Apr-2012 Extra Text: Transaction 2903896 - Approved By:

NOREVIEW : 04-20-2012:15:52:33

24. 3370 - Order ... 20-Apr-2012 Extra Text: Transaction 2903883 - Approved By:

NOREVIEW : 04-20-2012:15:50:22

25. NEF - Proof of

Electronic Service

12-Mar-2012Extra Text: Transaction 2817403 - Approved By:

NOREVIEW : 03-12-2012:10:47:41

26. 3860 - Request

for Submission

12-Mar-2012Extra Text: PLTFS EMERGENCY MOTION FOR

TRO/INJUNCTION OR PLED IN THE

ALTERNATIVE, MOTION TO SET ASIDE ORDER

GRANTING SUMMARY JUDGMENT - Transaction

2817321 - Approved By: MLAWRENC :

03-12-2012:10:45:06 DOCUMENT TITLE: PLTFS

EMERGENCY MOTION FOR TRO/INJUNCTION

OR PLED IN THE ALTERNATIVE, MOTION TO

SET ASIDE ORDER GRANTING SUMMARY

Notice: This is NOT an Official Court Record

JUDGMENT PARTY SUBMITTING: KRISTIN

SCHULER-HINTZ ESQ DATE SUBMITTED:

03-12-12 SUBMITTED BY: MLAWRENCE DATE

RECEIVED JUDGE OFFICE:

27. 1325 - ** Case

Reopened

12-Mar-2012Extra Text:

28. 4105 -

Supplemental ...

13-Jan-2012 Extra Text: SUPPLEMENT TO REPLY TO

OPPOSITION TO PLAINTIFF'S EMERGENCY

MOTION FOR TRO/INJUCTION; OR PLED IN THE

ALTERNATIVE; MOTION TO SET ASIDE ORDER

GRANTING SUMMARY JUDGMENT - Transaction

2698406 - Approved By: LMATHEUS :

01-13-2012:08:55:58

29. NEF - Proof of

Electronic Service

13-Jan-2012 Extra Text: Transaction 2698706 - Approved By:

NOREVIEW : 01-13-2012:08:58:45

30. NEF - Proof of

Electronic Service

11-Jan-2012 Extra Text: Transaction 2695276 - Approved By:

NOREVIEW : 01-11-2012:16:44:13

31. 3790 - Reply

to/in Opposition

11-Jan-2012 Extra Text: REPLY TO OPPOSITION TO

PLAINTIFF'S EMERGENCY MOTION FOR

TRO/INJUNCTION; OR PLED IN THE

ALTERNATIVE; MOTION TO SET ASIDE ORDER

GRANTING SUMMARY JUDGMENT - Transaction

2695149 - Approved By: LMATHEUS :

01-11-2012:16:41:28

32. NEF - Proof of

Electronic Service

04-Jan-2012 Extra Text: Transaction 2679391 - Approved By:

NOREVIEW : 01-04-2012:09:46:06

33. 2645 -

Opposition to Mtn ...

04-Jan-2012 Extra Text: RESIDENTIAL CREDIT SOLUTIONS,

INC AND QUALITY LOAN SERVICE COR'S

REQUEST FOR RULE 11 SANCTIONS AND

OPPOSITION TO EMERGENCY MOTION FOR

TRO/INJUNCTION OR IN THE ALTERNATIVE

MOTION TO SET ASIDE ORDER GRANTING

SUMMARY JUDGMENT - Transaction 2679368 -

Approved By: AZION : 01-04-2012:09:44:26

34. NEF - Proof of

Electronic Service

03-Jan-2012 Extra Text: Transaction 2676922 - Approved By:

NOREVIEW : 01-03-2012:08:48:40

35. 2222 - Mtn for

TRO

31-Dec-2011 Extra Text: EMERGENCY MOTION FOR

TRO/INJUNCTION OR PLED IN THE

ALTERNATIVE, MOTION TO SET ASIDE ORDER

GRANTING SUMMARY JUDGMENT - Transaction

2676622 - Approved By: AZION :

01-03-2012:08:45:55

36. 2520 - Notice of

Appearance

27-Oct-2011 Extra Text: ZACH COUGHLIN, ESQ. / JONI &

JOHN CARPENTIER

37. F140 - Adj

Summary Judgment

16-Jul-2010 Extra Text:

38. 3370 - Order ... 15-Jul-2010 Extra Text: Transaction 1600783 - Approved By:

NOREVIEW : 07-15-2010:11:22:08

Notice: This is NOT an Official Court Record

39. NEF - Proof of

Electronic Service

15-Jul-2010 Extra Text: Transaction 1600856 - Approved By:

NOREVIEW : 07-15-2010:11:25:26

40. NEF - Proof of

Electronic Service

15-Jul-2010 Extra Text: Transaction 1602300 - Approved By:

NOREVIEW : 07-15-2010:16:12:44

41. 2540 - Notice of

Entry of Ord

15-Jul-2010 Extra Text: Transaction 1602128 - Approved By:

AZION : 07-15-2010:16:04:14

42. NEF - Proof of

Electronic Service

12-Jul-2010 Extra Text: Transaction 1591836 - Approved By:

NOREVIEW : 07-12-2010:09:58:59

43. 3860 - Request

for Submission

12-Jul-2010 Extra Text: DEFT'S RESIDENTIAL CREDIT

SOLUTIONS INC, AND QUALITY LOAN SERVICE

CORPORATION'S MOTION FOR SUMMARY

JUDGMENT - Transaction 1591509 - Approved By:

AZION : 07-12-2010:09:57:40 DOCUMENT TITLE:

DEFT'S RESIDENTIAL CREDIT SOLUTIONS INC,

AND QUALITY LOAN SERVICE CORPORATION'S

MOTION FOR SUMMARY JUDGMENT PARTY

SUBMITTING: KRISTIN SCHULER-HINTZ ESQ

DATE SUBMITTED: 07-12-10 SUBMITTED BY:

AZION DATE RECEIVED JUDGE OFFICE:

44. 1325 - ** Case

Reopened

12-Jul-2010 Extra Text:

45. NEF - Proof of

Electronic Service

23-Jun-2010 Extra Text: Transaction 1559076 - Approved By:

NOREVIEW : 06-23-2010:12:03:58

46. PAYRC -

**Payment Receipted

23-Jun-2010 Extra Text: A Payment of $200.00 was made on

receipt DCDC278200.

47. $2200 - $Mtn for

Summary Judgment

23-Jun-2010 Extra Text: DEFT'S RESIDENTIAL CREDIT

SOLUTIONS, INC AND QUALITY LOAN SERVICE

CORP'S MOTION FOR SUMMARY JUDGMENT -

Transaction 1559053 - Approved By: AZION :

06-23-2010:12:01:34

48. 1360 - Certificate

of Service

05-Aug-2009Extra Text:

49. 1315 - ** Case

Closed

15-Jun-2009 Extra Text: NOTICE OF BANKRUPTCY AND

AUTOMATIC STAY FILED 05.20.09 BY

DEFENDANT AAMES FUNDING CORP.

50. 1030 - Affidavit

in Support...

09-Jun-2009 Extra Text: AFFIDAVIT IN SUPPORT OF MOTION

TO DISMISS OR INT THE ALTERNATIVE FOR

SUMMARY JUIDGMENT

51. 2315 - Mtn to

Dismiss ...

09-Jun-2009 Extra Text: DEFENDANTS' RESIDENTIAL CREDIT

SOLUTIONS, INC., AND QUALITY LOAN SERVICE

CORPORATION'S MOTION TO DISMISS OR IN

THE ALTERNATIVE FOR SUMMARY JUDGMENT

52. 2610 - Notice ... 09-Jun-2009 Extra Text: NOTICE OF LODGMENT IN

SUUPPORT OF MOTION TO DISMISS OR IN THE

ALTERNATIVE FOR SUMMARY JUDGMENT

53. 2610 - Notice ... 20-May-2009Extra Text: NOTICE OF BANKRUPTCY FILING

AND AUTOMATIC STAY

54. MDR - **Mail 01-May-2009Extra Text: MOTION TO DISMISS AND NOTICE OF

Notice: This is NOT an Official Court Record

54. MDR - **Mail

Desk Return Notes

01-May-2009Extra Text: MOTION TO DISMISS AND NOTICE OF

LODGEMENT REC'D THROUGH MAIL DESK

FROM DEFT'S RETURNED. DOCUMENTS DO

NOT COMPLY WITH RULE 10 (4) (6) (3)(F). yl

55. MIN -

***Minutes

26-Mar-2009Extra Text: STATUS HEARING - 3/19/09 -

Transaction 673139 - Approved By: NOREVIEW :

03-26-2009:11:04:08

56. MIN -

***Minutes

18-Feb-2009 Extra Text: STATUS CONFERENCE 2-13-09 -

Transaction 604358 - Approved By: NOREVIEW :

02-18-2009:12:40:32

57. 1312 - Case

Assignment

Notification

11-Feb-2009 Extra Text: CASE REASSIGNED TO DEPARTMENT

7 FROM DEPARTMENT 4 PER ADMINISTRATIVE

ORDER

58. 3242 - Ord

Setting Hearing

30-Jan-2009 Extra Text:

59. 2540 - Notice of

Entry of Ord

26-Jan-2009 Extra Text: Transaction 560474 - Approved By:

NDELGADO : 01-26-2009:08:49:52

60. 3005 - Ord

Withdrawal of

Counsel

22-Jan-2009 Extra Text:

61. 4105 -

Supplemental ...

11-Dec-2008 Extra Text: SUPPLEMENT TO THE AFFIDAVIT OF

JAMES M. WALSH IN SUPPORT OF MOTION TO

WITHDRAW - Transaction 494178 - Approved By:

MPURDY : 12-11-2008:08:41:49

62. MIN -

***Minutes

09-Dec-2008 Extra Text: PRELIMINARY INJUNCTION - 7/7/08 -

Transaction 491152 - Approved By: NOREVIEW :

12-09-2008:16:33:20

63. 3860 - Request

for Submission

05-Dec-2008 Extra Text: DOCUMENT TITLE: MOTION TO

WITHDRAW AS ATTORNEY - Transaction 484180 -

Approved By: CGALINDO : 12-05-2008:16:19:31

PARTY SUBMITTING: JAMES MICHAEL WALSH

DATE SUBMITTED: 12-08-08 SUBMITTED BY: C

GALINDO DATE RECEIVED JUDGE OFFICE:

12/10/08

64. 1835 - Joint Case

Conference Report

25-Nov-2008Extra Text: NRCP 16 JOINT CASE CONFERENCE

REPORT - Transaction 473505 - Approved By:

NDELGADO : 11-26-2008:08:22:16

65. 1250 -

Application for

Setting

23-Oct-2008 Extra Text: PRE-TRIAL CONFERENCE - 6/24/09 AT

9:00 A.M. NON-JURY TRIAL (2ND SET)-3 DAYS-

11/16/09

66. 2490 - Motion ... 14-Oct-2008 Extra Text: MOTION TO WITHDRAW AS

ATTORNEY OF RECORD - Transaction 409291 -

Approved By: AZION : 10-14-2008:10:42:16

67. 1030 - Affidavit

in Support...

14-Oct-2008 Extra Text: AFFIDVAIT OF JAMES M. WALSH IN

SUPPORT OF MOTION TO WITHDRAW -

Transaction 409291 - Approved By: AZION :

10-14-2008:10:42:16

68. 1120 - Amended 10-Oct-2008 Extra Text: PLAINTIFF'S AMENDED NOTICE OF

Notice: This is NOT an Official Court Record

68. 1120 - Amended

...

10-Oct-2008 Extra Text: PLAINTIFF'S AMENDED NOTICE OF

NRCP 16 EARLY CASE CONFERENCE AND

DEMAND FOR PRODUCTION - Transaction

405944 - Approved By: SSTINCHF :

10-10-2008:14:25:26

69. 1120 - Amended

...

10-Oct-2008 Extra Text: AMENDED NOTICE TO SET TRIAL:

10-23-08 AT 11:00 - Transaction 405944 - Approved

By: SSTINCHF : 10-10-2008:14:25:26

70. 2529 - Notice of

Early Case Conferenc

01-Oct-2008 Extra Text: PLAINTIFFS' NOTICE OF NRCP 16

EARLY CASE CONFERENCE AND DEMAND FOR

PRODUCTION - Transaction 389664 - Approved By:

NDELGADO : 10-01-2008:09:24:32

71. 2605 - Notice to

Set

01-Oct-2008 Extra Text: NOTICE TO SET TRIAL - Transaction

389664 - Approved By: NDELGADO :

10-01-2008:09:24:32

72. PAYRC -

**Payment Receipted

30-Sep-2008 Extra Text: A Payment of -$124.00 was made on

receipt DCDC212733.

73. $PLTF - $Addl

Plaintiff/Complaint

29-Sep-2008 Extra Text: QUALITY LOAN SERVICE

CORPORATION

74. $1560 - $Def 1st

Appearance - CV

29-Sep-2008 Extra Text: RESIDENTIAL CREDIT SOLUTIONS

INC

75. 1817 - Initial

Appear. Fee

Disclosure

29-Sep-2008 Extra Text: DEFENDANTS' QUALITY LOAN

SERVICE CORPORATION & RESIDENTIAL

CREDIT SOLUTIONS, INC'S INITIAL

APPEARANCE FEE DISCLOSURE

76. 1130 - Answer ... 29-Sep-2008 Extra Text: DEFENDANTS' QUALITY LOAN

SERVICE CORPORATION & RESIDENTIAL

CREDIT SOLUTIONS, INC'S ANSWER

77. 2610 - Notice ... 25-Sep-2008 Extra Text: NOTICE OF INTENT TO TAKE

DEFAULT - Transaction 382076 - Approved By:

CGALINDO : 09-25-2008:13:25:19

78. 3696 - Pre-Trial

Order

19-Sep-2008 Extra Text:

79. 2540 - Notice of

Entry of Ord

28-Aug-2008Extra Text: Transaction 343159 - Approved By:

MPURDY : 08-28-2008:13:17:35

80. A120 -

Exemption from

Arbitration

20-Aug-2008Extra Text: INJUNCTIVE RELIFE

81. 3105 - Ord

Granting ...

19-Aug-2008Extra Text: PRELIMINARY INJUNCTION

82. PAYRC -

**Payment Receipted

29-Jul-2008 Extra Text: A Payment of -$124.00 was made on

receipt DCDC206537.

83. $1560 - $Def 1st

Appearance - CV

22-Jul-2008 Extra Text: WINDSOR MANAGEMENT CO.

84. 1130 - Answer ... 22-Jul-2008 Extra Text: ANSWER AND AFFIRMATIVE

Notice: This is NOT an Official Court Record

84. 1130 - Answer ... 22-Jul-2008 Extra Text: ANSWER AND AFFIRMATIVE

DEFENSES OF WINDSOR MANAGEMETN CO.

AND ACCREDITED HOME LENNNDERS, INC. AS

SUCCESSOR IN INTEREST TO AAMES FUNDING

CORPORATION DBA AAMES HOME LOAN

85. $DEFT - $Addl

Def/Answer -

Prty/Appear

22-Jul-2008 Extra Text: AAMES FUNDING CORPORATION

DBA AAMES HOME LOAN

86. MIN -

***Minutes

21-Jul-2008 Extra Text: 07/17/08 PRELIMINARY INJUNCTION -

Transaction 289706 - Approved By: NOREVIEW :

07-21-2008:11:00:19

87. MIN -

***Minutes

21-Jul-2008 Extra Text: 7/17/08 EXHIBITS TO PRELIMINARY

INJUNCTION HEARING - Transaction 289717 -

Approved By: NOREVIEW : 07-21-2008:11:03:59

88. 1695 - **

Exhibit(s) ...

17-Jul-2008 Extra Text: PLAINTIFF'S 1 -12

89. 3720 - Proof of

Service

16-Jul-2008 Extra Text: Transaction 285896 - Approved By:

NDELGADO : 07-17-2008:08:10:13

90. 3720 - Proof of

Service

15-Jul-2008 Extra Text: SUMMONS, COMPLAINT AND EX

PARTE APPLICATION FOR TRO SERVED ON

QUALITY LOAN SERVICE CORPORATION ON

07/09/08 - Transaction 283117 - Approved By:

MPURDY : 07-15-2008:13:02:06

91. 3720 - Proof of

Service

15-Jul-2008 Extra Text: SUMMONS, COMPLAINT, EX PARTE

APPLICATION FOR TRO, OSC, TRO AND NOTICE

OF FILING BOND SERVED ON RESIDENTIAL

CREDIT SOLUTIONS, INC. ON 07/09/08 -

Transaction 283117 - Approved By: MPURDY :

07-15-2008:13:02:06

92. FIE -

**Document Filed in

Error

15-Jul-2008 Extra Text: 07/28/2008 - TPRINCE

93. TRO - **TRO

Cash Bond

14-Jul-2008 Extra Text:

94. 3355 - Ord to

Show Cause

08-Jul-2008 Extra Text: ORDER TO SHOW CAUSE AND

TEMPORARY RESTRAINING ORDER (PLAINTIFF

TO POST SECURITY IN THE SUM OF $1,000.00)

95. 2610 - Notice ... 08-Jul-2008 Extra Text: NOTICE OF FILING BOND: BOND IN

THE AMOUNT OF $1, 000. 00 JAMES M. WALSH

ESQ.

96. 3720 - Proof of

Service

08-Jul-2008 Extra Text: AAMES FUNDING CORPORATION dba

AAMES HOME LOAN SERVED ON 07/01/2008 BY

DELIVERING A COPY TO RESIDENT AGENT

NATIONAL REGISTERED AGENT and WINDSOR

MANAGEMENT COMPANY SERVED ON

07/01/2008 BY DELIVERING A COPY WITH

RESIDENT AGENT CORPORATION TRUST OF

NEVADA - Transaction 274235 - Approved By:

Notice: This is NOT an Official Court Record

TPRINCE : 07-08-2008:13:51:50

97. PAYRC -

**Payment Receipted

27-Jun-2008 Extra Text: A Payment of $171.00 was made on

receipt DCDC203383.

98. 1665 - Ex-Parte

Application...

27-Jun-2008 Extra Text: EX PARTE APPLICATION FOR

TEMPORARY RESTRAINING ORDER JAMES

CARPENTIER, ET AL

99. 4090 - **

Summons Issued

27-Jun-2008 Extra Text:

100. $1425 -

$Complaint - Civil

26-Jun-2008 Extra Text: JAMES S CARPENTIER - Transaction

261699 - Approved By: ASMITH :

06-27-2008:08:18:46

101. $DEFT - $Addl

Def/Answer -

Prty/Appear

26-Jun-2008 Extra Text: JOAN E CARPENTIER - Transaction

261699 - Approved By: ASMITH :

06-27-2008:08:18:46

Notice: This is NOT an Official Court Record

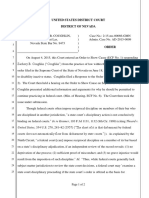

F I L E D

Electronically

06-26-2008:04:39:54 PM

Howard W. Conyers

Clerk of the Court

Transaction # 261699

1

2

3

4

5

6

7

8

9

10

11

12

13

l4

15

16

17

18

19

20

21

22

23

24

25

26

27

28

CODE: $1425

James M. Walsh, Esq.

Walsh, Baker & Rosevear, P.c.

Nevada State Bar No. 796

9468 Double R Blvd. Suite A

Reno, Nevada 89521

Telephone: (775) 853-0883

Attorney for Plaintiffs

IN THE SECOND JUDICIAL DISTRICT COURT OF THE STATE OF NEVADA

IN AND FOR WASHOE COUNTY

JAMES S. CARPENTIER; and

JOAN E. CARPENTIER,

Plaintiffs,

vs.

AAMES FUNDING CORPORATION

DBA AAMES HOME LOAN, a California

corporation; WINDSOR MANAGEMENT CO.,

a California corporation; RESIDENTIAL

CREDIT SOLUTIONS, INC, a Texas corporation;

QUALITY LOANS SERVICE CORPORATION,

a California corporation; and DOES I - XX, inclusive,

Defendants.

_______________________________________ 1

CASE NO.

DEPT NO.

COMPLAINT

COME NOW, Plaintiffs JAMES S. CARPENTIER and JOAN E. CARPENTIER, by and

through their attorney, James M .Walsh of Walsh, Esq. of Baker & Rosevear, PC, as and for their claims

for relief and hereby alleges and avers as follows.

FIRST CLAIM FOR RELIEF

1.

At all times mentioned herein, Plaintiffs James S. Carpentier and Joan E. Carpentier, hereinafter

collectively referred to as "CARPENTIER," are husband and wife residing in the County of Washoe,

State of Nevada.

2.

Defendants, DOES I through XX are fictitious names; that Plaintiffs are ignorant of the true

names of the individuals, corporations, co-partnerships, and associations so designated by said fictitious

names, and when the true names are discovered, Plaintiffs will seek leave to amend this Complaint and

1

1

2

3

4

5

6

7

8

9

10

11

12

13

l4

15

16

17

18

19

20

21

22

23

24

25

26

27

28

CODE: $1425

James M. Walsh, Esq.

Walsh, Baker & Rosevear, P.c.

Nevada State Bar No. 796

9468 Double R Blvd. Suite A

Reno, Nevada 89521

Telephone: (775) 853-0883

Attorney for Plaintiffs

IN THE SECOND JUDICIAL DISTRICT COURT OF THE STATE OF NEVADA

IN AND FOR WASHOE COUNTY

JAMES S. CARPENTIER; and

JOAN E. CARPENTIER,

Plaintiffs,

vs.

AAMES FUNDING CORPORATION

DBA AAMES HOME LOAN, a California

corporation; WINDSOR MANAGEMENT CO.,

a California corporation; RESIDENTIAL

CREDIT SOLUTIONS, INC, a Texas corporation;

QUALITY LOANS SERVICE CORPORATION,

a California corporation; and DOES I - XX, inclusive,

Defendants.

_______________________________________ 1

CASE NO.

DEPT NO.

COMPLAINT

COME NOW, Plaintiffs JAMES S. CARPENTIER and JOAN E. CARPENTIER, by and

through their attorney, James M .Walsh of Walsh, Esq. of Baker & Rosevear, PC, as and for their claims

for relief and hereby alleges and avers as follows.

FIRST CLAIM FOR RELIEF

1.

At all times mentioned herein, Plaintiffs James S. Carpentier and Joan E. Carpentier, hereinafter

collectively referred to as "CARPENTIER," are husband and wife residing in the County of Washoe,

State of Nevada.

2.

Defendants, DOES I through XX are fictitious names; that Plaintiffs are ignorant of the true

names of the individuals, corporations, co-partnerships, and associations so designated by said fictitious

names, and when the true names are discovered, Plaintiffs will seek leave to amend this Complaint and

1

1

2

3

4

proceedings herein to substitute the true name of said Defendants. Plaintiffs believe that each of the

Defendants designated herein as DOE is negligent or responsible in some manner for the events herein

referred to and negligently, carelessly, recklessly and in a manner that was grossly negligent and willful

and wanton, caused damages proximately thereby to the Plaintiffs as herein alleged.

5 3. At all times mentioned herein, CARPENTIER is the owner of certain real property commonly

6

7

8

9

10

11

12

13

l4

15

16

17

18

19

20

21

22

23

24

25

26

27

28

known as 2873 Sunny Slope Drive, Sparks Nevada 89434, Washoe County Assessors Parcel Number

030-091-12, hereinafter referred to as the "PROPERTY," and more particularly described as follow:

4.

LOT 6 OF LEWIS HOMES-SPARKS NO.5-A, ACCORDING TO THE MAP

THEREOF, FILED IN THE OFFICE OF THE COUNTY RECORDER OF WASHOE

COUNTY, STATE OF NEVADA ON JULY19, 1976, AS FILE NO. 417319 AND AS

TRACT MAP NO. 1587.

On or about May 4, 2005, CARPENTIER had an existing mortgage against the PROPERTY in

the approximate principal amount of $150,000.00

5. On or about May 4,2005, CARPENTIER was in default and in financial trouble with regard to

the existing first Deed of Trust in that James S. Carpentier became injured, was unable to work, was

receiving only workman's compensation payments, and Joan E. Carpentier at that time was unemployed.

6. On or about May 4,2005, CARPENTIER was unable to meet their current obligations under the

first Note and Deed of Trust.

7. CARPENTIER received a mail solicitation to refinance their property from Defendant Aames

Funding Corporation dba Aames Home Loan, hereinafter referred to as "AAMES."

8. CARPENTIER contacted Defendant AAMES, AAMES did represent to them tllat AAMES

could cure their financial troubles by refinancing the existing first obligation on the PROPERY, that

they would qualify for such a loan, and that they would generate sufficient funds to meet their

obligations even though Joan E. Carpentier was unemployed and James S. Carpentier received only

disability income.

9. In furtherance of the refinance, Defendant AAMES was required to make a loan application.

Said loan application was filled out by the representatives by Defendant AAMES and intentionally

misstated the income of CARPENTIER to be in excess of $6,000.00 per month. A copy of said loan

application is attached hereto and marked as Exhibit 1.

2

1 10.

The true fact was CARPENTIER received only $2400.00 per month, and the true fact was

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

known to Defendant AAMES.

11. Defendant AAMES made a loan to CARPENTIER in the amount of $170,800.00.

12. The loan made by Defendant AAMES was an adjustable rate which would require payments in

excess of$1400.00 per month.

13. At the time of making the loan and filling out the loan application by Defendant AAMES,

Defendant AAMES made the loan without determining or using any commercially reasonable means or

mechanism to determine CARPENTIER's ability to repay the loan and in fact knew or should have

known that CARPENTIER did not have the ability to repay the loan.

14. The $170,800.00 loan closed on or about May 4,2005, and, on or about that date,

CARPENTIER did make, execute and deliver a Deed of Trust securing repayment of the new loan. Sai

Deed of Trust having been given to Defendant Windsor Management Co., a California corporation, as

Trustee by James S. Carpentier and Joan E. Carpentier, husband and wife as joint tenants, as Trustors in

favor of Defendant Aames Funding Corporation dba Aames Home Loan, as Beneficiary. Said Deed of

Trust was recorded May 4,2005 as Document No. 3208651, Official Records of Washoe County. A

true and correct copy of said Deed of Trust is attached hereto and marked as Exhibit 2.

15. Since the recordation of said Deed of Trust, CARPENTIER has been unable to make all

payments called for under the terms and conditions of the Deed of Trust fuld PromissOlY Note which it

secures and have made known their inability to pay to Defendant AAMES.

16. Defendant AAMES has assigned the right to collect under the terms and conditions of the

Promissory Note and the Deed of Trust to Defendant Residential Credit Solutions, Inc., hereinafter

referred to as "RESIDENTIAL," as of May 31, 2007.

17. CARPENTIER has contacted Defendants AAMES and RESIDENTIAL in an attempt to again

refinance but infonned Defendants AAMES and RESIDENTIAL oftheir inability to qualifY, and

Defendants AAMES and/or RESIDENTIAL offered to provide them with false and fraudulent W2

Forms in order to meet financial requirements. CARPENTIER declined to participate in this loan fraud.

18. As a direct result of CARPENTIER's inability to make payments called for under the refinanced

loan, Quality Loan Service Corp on behalf of Defendant RESIDENTIAL and on further behalf of

3

1

2

3

4

5

6

7

8

9

Defendant AAMES did record a Notice of Breach and Default and of Election to Cause Sale of Real

Property Under Deed of Trust on March 12, 200S as Document No. 3629741, Official Records of

Washoe County. Said Notice of Breach and Default is attached hereto and marked as Exhibit 3.

19. Subsequent to the recordation of the Notice of Breach and Default, Defendant AAMES has

recorded a Notice of Trustee's Sale scheduling sale on the PROPERTY for July 9, 200S at the hour of

11 :OOam at the County Court House located at Virginia Street and Court Street in the City of Reno. The

Notice of Trustee's Sale was recorded June 19, 200S as Document No. 3661497, Official Records of

Washoe County. A true and con-ect copy of said Notice of Trustee's Sale is attached hereto and marked

as Exhibit 4.

10 20.

The actions of Defendant AAMES in failing to make a determination of CARPENTIER's ability

11

12

13

14

15

16

17

18

19

20

21

22

to repay the loan and inducing them to enter into said loan constitutes an unfair lending practice

pursuant to the provisions ofNRS 59SD.100.

21. CARPENTIER has been damaged as a direct and proximate result of unfair lending practices of

Defendants AAMES and RESIDENTIAL, and CARPENTIER is entitled to damages and treble

damages pursuant to the provisions ofNRS 59SD.11 O.

22. CARPENTIER is entitled to their attorney fees pursuant to the provisions ofNRS

59SD.110(2)(b).

23. CARPENTIER is further entitled to an offset against all sums owed under the Promissory Note

secured by the Deed of Trust as herein alleged pursuant to the provisions ofNRS 59SD.l1 0(3).

24. CARPENTIER is further entitled to have this court cure any existing default of the home loan

and cancel the pending foreclosure and Trustee's Sale pursuant to the provisions ofNRS 59SD.ll 0(3).

SECOND CLAIM FOR RELIEF

23 25.

Plaintiffs incorporate herein by this reference Paragraph 1 through Paragraph 24 of this

24

25

26

27

28

Complaint as though fully set forth herein.

26. As a direct and proximate result ofthe actions of Defendants AAMES and RESIDENTIAL,

CARPENTIER is in danger of loosing their interest in unique real property by virtue of the foreclosure

sale.

4

1 27.

CARPENTIER is entitled to a temporary restraining order, preliminary injunction and permanent

2

injunction precluding Defendants from conducting a foreclosure sale of the PROPERTY.

3 28.

4

estate.

5

6

7

8

9

10

11

12

13

14

CARPENTIER lacks adequate remedy of law due to the unique character of their interest in real

WHEREFORE, Plaintiffs pray for judgment as follows:

1.

2.

3.

4.

5.

6.

For damages in excess of$10,000;

For treble damages;

For temporary restraining order, preliminary injunction and permanent injunction barring

foreclosure ofthe Deed of Trust recorded in favor of Defendant AAMES.

F or attorneys fee;

For costs of suit herein inculTed; and

For such other and further relief as this court may deem proper.

The undersigned does hereby affirm that the Complaint, filed in the above-referenced matter,

does not contain the social security number of any person.

15

Dated of June, 2008.

16

17

18

19

es M .Walsh, Esq.

20

Attorney for Plaintiffs

21

22

23

24

25

26

27

28

5

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

VERIFICATION

STATE OF NEVADA )

):ss

COUNTY WASHOE )

Under penalty of perjury, the undersigned JAMES S. CARPENTIER and JOAN E.

CARPENTIER declare:

1. They are the Plaintiffs named in the foregoing Complaint;

2. They know the contents thereof and that the pleading is true and correct to their

knowledge except for those matters stated on information and belief and, as to such

matters, they believe them to be true.

DATED tIns 2.Ld

4L

day of June, 2008.

ES S. Cp.RPENTIER

SUBSCRIBED and SWORN to before me

day of June, 2008 by

JAMES S. CARPENTIER and JOAN E. CARPENTIER.

TRACY L. KING g

23 NO

g Notary Public - State of Nevada

Appointmeni Recorded in Washoe County i

24

E No: 02-73990-2 - Expires April 1. 2010

'lIIIIIIUllnnllllllnn'llllt1III,."gl.I","nUU'"IIIII"11ItllllllllllllllllllnflillUII;

25

26

27

28

6

'<t!llEGL..

=- 0 QI(I('f)C

_ om .... 2

,- 1111(\1..-1-

,-(")0....0

=N

n

- r-cnlSl

-", -

;;;;;;;;iiiii QIJ...OO

-" "

_Olf)O

=OlWN

, =mE_

_ IaN

_ ""N

;;:;::;;;ii. CI ......

-,,"

-

-'"

"

>-

w

,= I... >-

-

,_ woc

=O'I ..... U::I

-<>>- 0

= r-z .... u

-_wo

=00.... .... 41

_

-

..... IIIC

O'J03C

8 ...

'"

....

"'

0

...

...

'"

-l

'"

00

-l

'"

'"

'"

;>

"'

..:

;>

'"' '"

:>!

"'

z

Oil

z

Z

'"

o:!

'"

0

,'"'

OJ

'" OJ

00

'"

OJ

OJ

...

'"

..,

z

..,

OJ

..,

::

..,

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

CODE: 1130

ERIC B. ZIMBELMAN, ESQ.

Nevada Bar No. 9407

PEEL BRIMLEY LLP

ORIGINAL

3333 E. Serene Avenue, Suite 200

Henderson, Nevada 89074-6571

(702) 990-7272

Attorneys for Aames Home Lenders, Inc

And Windsor Management Co ..

F I LED

IN THE SECOND JUDICIAL DISTRICT COURT OF THE STATE OF NEVADA

IN AND FOR THE COUNTY OF WASHOE

JAMES S. CARPENTIER; and JOAN E.

CARPENTIER, husband and wife,

Plaintiff,

vs.

AAMES FUNDING CORPORATION DBA

AAMES HOME LOAN, a California

corporation; WINDSOR MANAGEMENT CO.,

a California corporation; RESIDENTIAL

CREDIT SOLUTIONS, INC., a Texas

corporation; QUALITY LOANS SERVICE

CORPORATION, a California corporation; ;

DOES I-XX, inclusive,

Defendants .

CASE NO.: CV08-0l709

DEPT. NO.: 4

ANSWER AND AFFFIRMATIVE

DEFENSES OF WINDSOR

MANAGEMENT CO. AND

ACCREDITED HOME LENNDERS,

INC. AS SUCCESSOR IN INTEREST

TO AAMES FUNDING CORPORATION

DBA AAMES HOME LOAN

Defendants WINDSOR MANAGEMENT CO. and AAMES FUNDING

CORPORATION DBA AAMES HOME LOAN. ("Aames"), appearing through its successor in

interest ACCREDITED HOME LENDERS, INC., by and through their counsel, Peel Brimley

LLP, hereby reply to the Amended Complaint of James S. Carpentier and Joan E. Carpentier

("Carpentier") as follows:

1. Answering Paragraph 1 of the Amended Complaint, Aames and Windsor are

without knowledge or information sufficient to form a belief as to the truth of the allegations

contained therein and therefore deny same.

2. Answering Paragraph 2 of the Amended Complaint, Aames and Windsor are

without knowledge or information sufficient to form a belief as to the truth of the allegations

contained therein and therefore deny same.

1

2

3

4

5

6

7

8

9

10

11

0.".

12

0 ....

"'0

=-"''''

......... 00

13

tf.l

r

~

;.. '" '"

'" " ~

14 ...l<"

::."'!;!

;: z __

= '" z 15

:;l ~

~ o o a

~ ~ S

16

=- z

~ '"

t

17

18

19

20

21

22

23

24

25

26

27

28

3. Answering Paragraph 3 of the Amended Complaint, Aames and Windsor are

without knowledge or information sufficient to form a belief as to the truth of the allegations

contained therein and therefore deny same.

4. Answering Paragraph 4 of the Amended Complaint, Aames and Windsor are

without knowledge or information sufficient to form a belief as to the truth of the allegations

contained therein and therefore deny same.

5. Answering Paragraph 5 of the Amended Complaint, Aames and Windsor are

without knowledge or information sufficient to form a belief as to the truth of the allegations

contained therein and therefore deny same.

6. Answering Paragraph 6 of the Amended Complaint, Aames and Windsor are

without knowledge or information sufficient to form a belief as to the truth of the allegations

contained therein and therefore deny same.

7. Answering Paragraph 7 of the Amended Complaint, Aames and Windsor are

without knowledge or information sufficient to form a belief as to the truth of the allegations

contained therein and therefore deny same .

8. Answering Paragraph 8 of the Amended Complaint, Aames and Windsor are

without knowledge or information sufficient to form a belief as to the truth of the allegations

contained therein and therefore deny same.

9. Answering Paragraph 9 of the Amended Complaint, Aames and Windsor are

without knowledge or information sufficient to form a belief as to the truth of the allegations

contained therein and therefore deny same.

10. Answering Paragraph 10 of the Amended Complaint, Aames and Windsor are

without knowledge or information sufficient to form a belief as to the truth of the allegations

contained therein and therefore deny same.

11. Answering Paragraph 11 of the Amended Complaint, Aames and Windsor admit

that Aames made a loan to Carpentier in the amount of $170,800.00.

12. Answering Paragraph 12 of the Amended Complaint, Aames and Windsor are

without knowledge or information sufficient to form a belief as to the truth of the allegations

- 2 -

1

2

3

4

5

6

7

8

9

10

11

8 .... 12

"'S

I'."'=-

.... ""00

13

'1

,.. '" Q

'" ,..

14

Oi z

15

'" 00

'" ...

16

.., z

.., ..

17

18

19

20

21

22

23

24

25

26

27

28

contained therein and therefore deny same.

13. Answering Paragraph 13 of the Amended Complaint, Aames and Windsor deny

the allegations.

14. Answering Paragraph 14 of the Amended Complaint, Aames and Windsor are

without knowledge or information sufficient to form a belief as to the truth of the allegations

contained therein and therefore deny same.

15. Answering Paragraph 15 of the Amended Complaint, Aames and Windsor are

without knowledge or information sufficient to form a belief as to the truth of the allegations

contained therein and therefore deny same.

16. Answering Paragraph 16 of the Amended Complaint, Aames and Windsor are

without knowledge or information sufficient to form a belief as to the truth of the allegations

contained therein and therefore deny same.

17. Answering Paragraph 17 of the Amended Complaint, Aames and Windsor are

without knowledge or information sufficient to form a belief as to the truth of the allegations

contained therein and therefore deny same .

18. Answering Paragraph 18 of the Amended Complaint, Aames and Windsor are

without knowledge or information sufficient to form a belief as to the truth of the allegations

contained therein and therefore deny same.

19. Answering Paragraph 19 of the Amended Complaint, Aames and Windsor are

without knowledge or information sufficient to form a belief as to the truth of the allegations

contained therein and therefore deny same.

29. Answering Paragraph 20 of the Amended Complaint, Aames and Windsor deny

the allegations contained therein.

21. Answering Paragraph 21 of the Amended Complaint, Aames and Windsor deny

the allegations contained therein.

22. Answering Paragraph 22 of the Amended Complaint, Aames and Windsor deny

the allegations contained therein.

23. Answering Paragraph 23 of the Amended Complaint, Aames and Windsor deny

- 3 -

1

2

3

4

5

6

7

8

9

10

11

g ....

12

Nli:;

",,,,,,,

...l"'" 13

~ ~ <

;>0 ~ C:)

~ > ~

14

..l < '"

:;! .. z

;: z

= "' z

15 c

. . . i ~ ~

, ' ~

'" .",

16

",r.lQ

.., Z

.., ..

;:;=

17

18

19

20

21

22

23

24

25

26

27

28

the allegations contained therein.

24. Answering Paragraph 24 of the Amended Complaint, Aames and Windsor deny

the allegations contained therein.

25. Answering the Paragraph 25 of the Amended Complaint, no response is required

of Aames or Windsor thereto, hut Aames and Windsor incorporate hy reference their responses to

the preceding paragraphs of this Answer.

26. Answering Paragraph 26 of the Amended Complaint, Aames and Windsor are

without knowledge or information sufficient to form a belief as to the truth of the allegations

contained therein and therefore deny same.

27. Answering Paragraph 27 of the Amended Complaint, Aames and Windsor deny

the allegations contained therein.

28. Answering Paragraph 28 of the Amended Complaint, Aames and Windsor deny

the allegations contained therein.

AFFIRMATIVE DEFENSES

Having Answered Carpentier's Complaint, Aames and Windsor hereby assert the

following Affirmative Defenses:

FIRST AFFIRMATIVE DEFENSE

Carpentier's Complaint herein fails to state a claim against Aames or Windsor, upon

which relief can be granted.

SECOND AFFIRMATIVE DEFENSE

Carpentier is estopped from pursuing any claim against Aames or Windsor

THIRD AFFIRMATIVE DEFENSE

Any claim of Carpentier is barred by the doctrine of laches.

FOURTH AFFIRMATIVE DEFENSE

The claims alleged by Carpentier are barred by the applicable Nevada statutes of

limitation.

FIFTH AFFIRMATIVE DEFENSE

The claims alleged by Carpentier are barred by the statute of frauds.

-4-

1

2

3

4

5

6

7

8

9

10

11

g.,.

12

~ ~ ~

....l .... '"

13

~ ~ <

" "' Q

"' >

14

' <C >

~ "' ~

'" z

<'l ::Hi

15

"' gj

'"''''

"' .",

"'",Q

16

.... z

.... '"

;:j=

17

18

19

20

21

22

23

24

25

26

27

28

SIXTH AFFIRMATIVE DEFENSE

Aames and Windsor are informed, believe, and thereon allege that if any contract,

obligation, or addendum, as alleged in Carpentier's Complaint on file herein, have been entered

into, any duty of performance of Aames and Windsor are excused by reason of a breach of

condition precedent by Carpentier.

SEVENTH AFFIRMATIVE DEFENSE

Aames and Windsor are informed, believes, and thereon alleges that if any contract,

obligation, or addendum, as alleged in Carpentier's Complaint on file herein, have been entered

into, any duty of performance of Aames and Windsor are excused by reason of a breach of

condition subsequent by Carpentier.

EIGHTH AFFIRMATIVE DEFENSE

Aames and Windsor are informed, believes, and thereon alleges that if any contract,

obligation, or addendum, as alleged in Carpentier's Complaint on file herein, have been entered

into, any duty of performance of Aames and Windsor are excused by reason of a breach of an

implied condition by Carpentier.

NINTH AFFIRMATIVE DEFENSE

The claims alleged by Carpentier are barred by the parol evidence rule.

TENTH AFFIRMATIVE DEFENSE

Carpentier failed to mitigate its damages, if any, and therefore, any recovery awarded to

Carpentier against Aames or Windsor should be reduced by that amount not mitigated.

ELEVENTH AFFIRMATIVE DEFENSE

Carpentier is barred by the doctrine of unclean hands and by its own failure to deal in

good faith and deal fairly with Aames and/or Windsor.

TWELFTH AFFIRMATIVE DEFENSE

By virtue of the acts, deeds, conduct and/or the failure or omission to act under the

circumstances, Carpentier has waived its rights, if any existed, to assert any claims against Aames

and Windsor.

- 5 -

1

2

3

4

5

6

7

8

9

10

11

=..,.

12

=t--

""= .... "'0>

..,l"QO

13

~ ~ <

,. '" "

'" > <t

14

' ~

:. '" z

iii Z

= : : l ~ 15

..s ~ ~

'" . '"

~ ~

16

.... ..,z

.., '"

;:p::

17

18

19

20

21

22

23

24

25

26

27

28

THIRTEENTH AFFIRMATIVE DEFENSE

The damages that are alleged to have been incurred by Carpentier, if any, were the direct

result in whole or in part, of Carpentier's own intentional, willful, and/or negligent acts and

deeds.

FOURTEENTH AFFIRMATIVE DEFENSE

The claims of Carpentier as alleged in the Complaint, and the loss and damage, if any in

fact exist, are the direct and proximate result of the acts, deeds, omission or failure to act, or the

conduct of parties known and unknown, over whom Aames and Windsor had no control, nor the

right, duty or obligation to control.

FIFTEENTH AFFIRMATIVE DEFENSE

Carpentier approved of acts which are the subject matter of Carpentier's Complaint and

consequently is barred from recovering against Aames and Windsor.

SIXTEENTH AFFIRMATIVE DEFENSE

Damages alleged by Carpentier are speculative and not foreseeable within the terms of the

contract.

SEVENTEENTH AFFIRMATIVE DEFENSE

Carpentier has failed to plead fraud, mistake, malice, intent, knowledge, or any other

condition of mind with requisite particularity as is required by of Nevada Rules of Civil

Procedure, Rule 9(f).

EIGHTEENTH AFFIRMATIVE DEFENSE

Aames and Windsor incorporates by reference each and every affirmative defense set

forth in Nevada Rules of Civil Procedure, Rule 8(c) as if fully set forth herein

NINETEENTH AFFIRMATIVE DEFENSE

Some of the foregoing Affirmative Defenses have been plead for purposes of non-waiver.

Aames and Windsor have not concluded discovery in this matter and under Rule 11 of the

Nevada Rules of Civil Procedure specifically reserve the right to amend this Answer to include

additional Affirmative Defenses and Cross-Claims and Counter-Claims if discovery of facts so

warrant.

- 6 -

1

2

3

4

5

6

7

8

9

10

11

g".

12

"'""'''''

13

00:, -ot

,. '" "

'" > <:

14

..l<>

:;: '"

:2 z

="';Z:

15

" 0 "' 00

..l 'Jl "

'" . '"

"' ... " 16

"-..,;z:

..,,,,

;;;=

17

18

19

20

21

22

23

24

25

26

27

28

PRAYER FOR REUEF

WHEREFORE, Aames and Windsor respectfully request this Court enter judgment as

follows:

1. That Plaintiffs take nothing by virtue of this complaint;

2. That Plaintiffs' complaint be dismissed with prejudice;

3. For an award of reasonable attorney's fees and costs of suit; and

4. For such other and further relief as the Court may deem just and proper.

Dated this&aay of July, 2008.

PEEL BRIMLEY LLP

Nevada Bar No. 9407

- 7 -

3333 E. Serene Avenue, Suite 200

Henderson, Nevada 89074-6571

Attorneys for Aames Home Lenders, inc

And Windsor Management Co ..

1

2

3

4

5

6

7

8

9

10

11

0..,

12

0"

"'0

13

'"" 0 <

;.l Q

-- > <

::l<> 14

= ;.l z

15 0: 0

. '" '"

... <IJ 0:

'" .;.l

;.l r.l Q

16

""",z

",,,,

;::;:c

17

18

19

20

21

22

23

24

25

26

27

28

AFFIRMATION

Pursuant to NRS 239B.030

The undersigned does hereby affirm that the preceding (insert document name) filed in

District Court Case number

Does not contain the social security number of any person.

-OR-

D Contains the social security number of a person as required by:

A. A specific state or federal law, to wit:

(State specific law)

-OR-

B. For the administration of a public program or for an application for a federal or

state grant.

July 25, 2008

Date

Cary B. Domina. Esq.

Print Name

Associate

Title

- 8 -

, .

1

2

3

4

5

6

7

8

9

10

11

g ...

12

",r--

...l'""" 13

Ul '"'t

>- r.J =

>

14

::;; "' z

:i z

15

"' i2

.",

g:",c

16

'" z

'" '"

17

18

19

20

21

22

23

24

25

26

27

28

CERTIFICATE OF SERVICE

Pursuant to NRCP 5(b), I certify that I am an employee of PEEL BRIMLEY LLP and that

on thisc:J ,L..f-ctay of July, 2008 I caused the above and foregoing document entitled ANSWER

AND AFFIRMATIVE DEFENSES OF AAMES FUNDING CORPORATION DBA

AAMES HOME LOAN to be served as follows:

[k( by placing same to be deposited for mailing in the United States Mail, in a sealed

envelope upon which first class postage was prepaid in Las Vegas, Nevada; and/or

D pursuant to EDCR 7.26, to be sent via facsimile; and/or

D to be hand-delivered;

to the party(ies) and/or attorney(s) listed below at the address and/or facsimile number indicated

below:

James M. Walsh, Esq.

Walsh, Baker & Rosevear, P.C.

9468 Double R Blvd. Suite A

Reno, Nevada 89521

Attorneys for James S. Carpentier and

Joan E. Carpentier

An Employee of Peel Brimley LLP

- 8 -

CASE NO. CV08-01709 TITLE: J. CARPENTER, ET AL. VS. AAMES FUNDING CORPORATION, ET

AL.

DATE, JUDGE

OFFICERS OF

COURT PRESENT APPEARANCES-HEARING CONT'D TO

7/7/08

HONORABLE

CONNIE

STEINHEIMER

DEPT. NO.4

R. Cotter

(Clerk)

Not Reported

(Reporter)

PRELIMINARY INJUNCTION

J ames Michael Walsh, Esq., present on behalf of the Plaintiffs.

Discussion ensued regarding Ex Parte Application for Temporary

Restraining Order previously filed by counsel Walsh, and status of the

Defendant Windsor Management Company.

COURT ENTERED ORDER granting Temporary Restraining Order. Plaintiff

shall post a One Thousand Dollar (1,000.00) bond and Counsel Walsh shall

serve the Order on all parties no later than J uly 14, 2008. Preliminary

Injunction hearing set.

7/17/08

3:00 p.m.

Preliminary

Injunction

F I L E D

Electronically

12-09-2008:04:32:40 PM

Howard W. Conyers

Clerk of the Court

Transaction # 491152

CASE NO. CV08-01709 J CARPENTIER ET AL V AAMES FUNDING CORP ET AL

DATE, J UDGE

OFFICERS OF

COURT PRESENT APPEARANCES-HEARING ________________

2/13/09

HONORABLE

PATRICK

FLANAGAN

DEPT. NO. 7

M. Conway

(Clerk)

S. Koetting

(Reporter)

STATUS HEARING

J . Carpentier was present in Court acting in Proper Persona.

Kristin Schuler-Hintz, Esq. was present telephonically on behalf of Defendants

Residential Credit Solutions who were not present.

Eric Zimbelman, Esq. was present telephonically on behalf of Defendants Windsor

Management Co and Aames Funding Corporation.

4:02 p.m. Court convened with Court, counsel and the plaintiff present.

J oan Carpentier addressed the Court and advised that she plans on retaining new

counsel.

Counsel Schuler-Hintz addressed the Court and feels that a settlement conference may

be beneficial. Counsel Zimbelman concurred.

COURT ORDERED: Matter continued for Status Hearing, set for March 6, 2009 at

1:30 p.m. to report on counsel and to set a settlement conference. Counsel Schuler-

Hintz and Zimbelman may attend telephonically.

4:10 p.m. Court stood in recess.

F I L E D

Electronically

02-18-2009:12:40:08 PM

Howard W. Conyers

Clerk of the Court

Transaction # 604358

F I L E D

Electronically

10-14-2008:07:31:22 AM

Howard W. Conyers

Clerk of the Court

Transaction # 409291

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

CODE: 2490

James M. Walsh, Esq.

Walsh, Baker & Rosevear, P.e.

Nevada State Bar No. 796

9468 Double R Blvd. Suite A

Reno, Nevada 89521

Telephone: (775) 853-0883

Attorney for Plaintiffs

IN THE SECOND JUDICIAL DISTRICT COURT OF THE STATE OF NEVADA

IN AND FOR WASHOE COUNTY

JAMES S. CARPENTIER; and

JOAN E. CARPENTIER,

Plaintiffs,

vs.

AAMES FUNDING CORPORATION

DBA AAMES HOME LOAN, a California

corporation; WINDSOR MANAGEMENT CO.,

a California corporation; RESIDENTIAL

CREDIT SOLUTIONS, INC, a Texas corporation;

QUALITY LOANS SERVICE CORPORATION,

a California corporation; and DOES I - XX, inclusive,

Defendants.

~ /

CASE NO. CV08-01709

DEPT NO. 4

MOTION TO WITHDRAW AS ATTORNEY OF RECORD

COMES NOW, James M. Walsh of WALSH, BAKER & ROSEVEAR, P.C. and hereby file

this motion to withdraw as attorney of record in the above entitled action. This Motion is made pursuan

to the provisions of Supreme Court Rule 46 and is based upon the papers and pleadings and the point

and authority filed herewith.

Counsel for Plaintiffs James S. Carpentier and Joan E. Carpentier hereby moves this court for an

order allowing him to withdraw on the grounds of Plaintiffs' inability to pay incurred attorney fees and

costs to date due and owing an unpaid sum of$6,285.76. The vast majority of which is 75 days past

due.

Based upon the foregoing it is respectfully requested that Counsel's motion be granted.

1

1

The undersigned does hereby affirm that the Motion to Withdraw as Attorney of Record, filed i

2

Case No. CV08-01709, does not contain the social security number of any person.

DATED this of October 2008.

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

2

1

2

3

4

5

6

7

8

9

10

11

12

l3

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

CERTIFICATE OF SERVICE

Pursuant to NRCP 5(b), I, the undersigned, declare under penalty of perjury, that I am

employee of WALSH, BAKER & ROSEVEAR that I am over the age of eighteen (18) years, and that

am not a party to, nor interested in, this action. On the __ day of October, 2008, I caused to b

served a true and correct copy of the MOTION TO WITHDRA W AS ATTORNEY OF RECORJ) on al

parties to this action by placing an original or true copy thereof in a sealed envelope placed fo

collection and mailing in the United States Mail, at Reno, Nevada postage paid, following the ordinar

course of business practices addressed as follows:

Eric B. Zimbelman, Esq.

PEEL BRIMLEY LLP

3333 E. Serene Avenue, Suite 200

Henderson, Nevada 89074-6571

Fax#702-990-7273

Attorney for Defendant Aames Home Lenders, Inc

& Windsor Management Co.

Kristin Schuler-Hintz, Esq.

MCCARTHY & HOLTHUS, LLP

811 South Sixth Street

Las Vegas, Nevada 89101

Fax#866-339-5691

Attorney for Residential Credit Solutions

& Quality Loan Service

James & Joan Carpentier

2873 Sunny Slope Dr.

Sparks, Nevada 89434

That there is a regular communication by mail between the place of mailing and the place

so addressed.

I declare under penalty of perjury that the foregoing is true and correct.

Executed this K day of October, 2008, at Reno, Nevada.

J n n j ~

an ll:mployeGfWlllsh, Baker & Rosevear

3

F I L E D

Electronically

10-14-2008:07:31:22 AM

Howard W. Conyers

Clerk of the Court

Transaction # 409291

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

CODE: 1030

James M. Walsh, Esq.

Walsh, Baker & Rosevear, P.e.

Nevada State Bar No. 796

9468 Double R Blvd. Suite A

Reno, Nevada 89521

Telephone: (775) 853-0883

Attorney for Plaintiffs

IN THE SECOND JUDICIAL DISTRICT COURT OF THE STATE OF NEVADA

IN AND FOR WASHOE COUNTY

JAMES S. CARPENTIER; and

JOAN E. CARPENTIER,

Plaintiffs,

vs.

AAMES FUNDING CORPORATION

DBA AAMES HOME LOAN, a California

corporation; WINDSOR MANAGEMENT CO.,

a California corporation; RESIDENTIAL

CREDIT SOLUTIONS, INC, a Texas corporation;

QUALITY LOANS SERVICE CORPORATION,

a California corporation; and DOES I - XX, inclusive,

Defendants.

CASE NO. CV08-01709

DEPT NO. 4

/

AFFIDAVIT OF JAMES M. WALSH IN SUPPORT OF MOTION TO WITHDRAW

20 STATE OF NEVADA )

)ss

21 COUNTYOFWASHOE )

22

23

24

25

26

27

28

I, James M. Walsh, hereby swear under penalty of perjury, that the following assertions are true

of my own personal knowledge as follows:

1.

2.

3.

4.

P.C.

I am the attorney for Plaintiffs in the above-entitled action.

I have represented the Plaintiffs since the filing ofthe complaint in June 26, 2008.

There is currently due and unpaid in attorney fees and costs in the amount of$6,285.76.

Plaintiffs receive monthly invoices showing the balance owing to Walsh, Baker & Rosevear,

1

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

The undersigned does hereby affirm that the Affidavit of James M Walsh in Support of th

Motion to Withdraw, filed in Case No. CV08-01709, does not contain the social security number of an

person. ._ /

Dated thiy-' day of October, 2008.

SUBSCRIBED and SWORN before me

. day of October, 2008.

2

ie AMIEJUVE I

:. Notary Public Stata of Nevada i

I App.imm Coon1y !

1 . No: 04-117328-2 E>j>IresMardl 3, 2012 !

(",,,,,,,,,,,,,,"'''''''''""''"'''''"11111111,,,,,,,,,,,,,,,,,,,,,,,'''''''''''"111111'''

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

CERTIFICATE OF SERVICE

Pursuant to NRCP 5(b), I, the undersigned, declare under penalty of perjury, that I am a

employee of WALSH, BAKER & ROSEVEAR that I am over the age of eighteen (18) years, and that

am not a party to, nor interested in, this action. On the Il-\fI'- day of October, 2008, I caused to b

served a true and correct copy of the AFFIDA VIT OF JAMES M. WALSH IN SUPPORT 0

MOTION TO WITHDRAW AS ATTORNEY OF RECORD on all parties to this action by placing a

original or true copy thereof in a sealed envelope placed for collection and mailing in the United State

Mail, at Reno, Nevada postage paid, following the ordinary course of business practices addressed a

follows:

Eric B. Zimbelman, Esq.

PEEL BRIMLEY LLP

3333 E. Serene Avenue, Suite 200

Henderson, Nevada 89074-6571

Fax#702-990-7273

Attorney for Defendant Aames Home Lenders, Inc

& Windsor Management Co.

Kristin Schuler-Hintz, Esq.

MCCARTHY & HOLTHUS, LLP

811 South Sixth Street

Las Vegas, Nevada 89101

Fax#866-339-5691

Attorney for Residential Credit Solutions

& Quality Loan Service

James & Joan Carpentier

2873 Sunny Slope Dr.

Sparks, Nevada 89434

That there is a regular communication by mail between the place of mailing and the place

so addressed.

I declare under penalty of perjury that the foregoing is true and correct.

Executed this \ L\*' day of October, 2008, at Reno, Nevada.

3

F I L E D

Electronically

12-11-2008:08:18:40 AM

Howard W. Conyers

Clerk of the Court

Transaction # 494178

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

CODE: 1030

James M. Walsh, Esq.

Walsh, Baker & Rosevear, P.C.

Nevada State BarNo. 796

9468 Double R Blvd. Suite A

Reno, Nevada 89521

Telephone: (775) 853-0883

Attorney for Plaintiffs

IN THE SECOND JUDICIAL DISTRICT COURT OF THE STATE OF NEVADA

IN AND FOR WASHOE COUNTY

JAMES S. CARPENTIER; and

JOAN E. CARPENTIER,

Plaintiffs,

vs.

AAMES FUNDING CORPORATION

DBA AAMES HOME LOAN, a California

corporation; WINDSOR MANAGEMENT CO.,

a California corporation; RESIDENTIAL

CREDIT SOLUTIONS, INC, a Texas corporation;

QUALITY LOANS SERVICE CORPORATION,

a California corporation; and DOES I - XX, inclusive,

Defendants.

CASE NO. CV08-01709

DEPT NO. 4

I

SUPPLEMENT TO THE AFFIDAVIT OF JAMES M. WALSH

STATE OF NEVADA

COUNTY OF WASHOE

IN SUPPORT OF MOTION TO WITHDRAW

)

)ss

)

I, James M. Walsh, hereby swear under penalty of perjury, that the following assertions are true

of my own personal knowledge as follows:

26 1. The last known address of the Plaintiffs is as follows:

27

28

2873 Sunny Slope Dr.

Sparks, Nevada 89434

1

1

The undersigned does hereby affirm that the Supplement to the Affidavit of James M. Walsh i

2

Support of the Motion to Withdraw, filed in Case No. CV08-01709, does not contain the social securi

3

number of any person.

4

Dated of December, 2008.

5

6

7

8

9

10

11

lu ......... m .. '''''"ntUt''''''''' .. m'''''''j' .. II.u''''''''''''' .. '' .. ''n'''' ... '''''l

'. AMIE JUVE "

i Notary Public State of Nevada

i. . I

! No: 04-87328-2 Expires Mardi 3, 2012 !

.m"",,,.,,,,,,,,"n""",,, ..... ,,,,,,,,,n"U'""""'UII,,,,,,,,,It.,,,,,,,,,,,,,,,,,

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

2

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

CERTIFICATE OF SERVICE

Pursuant to NRCP 5(b), I, the undersigned, declare under penalty of petjury, that I am a

employee of WALSH, BAKER & ROSEVEAR that I am over the age of eighteen (18) years, and that

am not a party to, nor interested in, this action. On the i lor-- day of December, 2008, I caused to b

served a true and correct copy of the SUPPLEMENT TO THE AFFIDA VIT OF JAMES M. WALS

IN SUPPORT OF MOTION TO WITHDRAW AS ATTORNEY OF RECORD on all parties to thi

action by placing an original or true copy thereof in a sealed envelope placed for collection and mailin

in the United States Mail, at Reno, Nevada postage paid, following the ordinary course of busines

practices addressed as follows:

Eric B. Zimbelman, Esq.

PEEL BRIMLEY LLP

3333 E. Serene Avenue, Suite 200

Henderson, Nevada 89074-6571

Fax#702-990-7273

Attorney for Defendant Aames Home Lenders, Inc

& Windsor Management Co.

Kristin Schuler-Hintz, Esq.

MCCARTHY & HOLTHUS, LLP

811 South Sixth Street

Las Vegas, Nevada 89101

Fax#866-339-5691

Attorney for Residential Credit Solutions

& Quality Loan Service

James & Joan Carpentier

2873 Sunny Slope Dr.

Sparks, Nevada 89434

That there is a regular communication by mail between the place of mailing and the place

so addressed.

I declare under penalty of petjury that the foregoing is true and correct.

Executed this \\-\V--' day of December, 2008, at Reno, Nevada.

3

-"i:>.

,_ cr:J .....

,_ woe

=rn ..... u::I

-Of- a

I

'=I"--z .... u

=80.. .... 0)

_ IO::!...O

=a:.a ..... .J:

_QUIIlVJU

.... 01;10

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

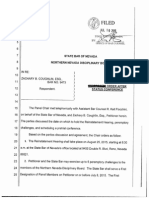

CODE: 3005

James M. Walsh, Esq.

Walsh, Baker & Rosevear, P.C.

Nevada State Bar No. 796

9468 Double R Blvd. Suite A

Reno, Nevada 89521

Telephone: (775) 853-0883

Attorney for Plaintiffs

F I LED

JAN 22 2009

IN THE SECOND JUDICIAL DISTRICT COURT OF THE STATE OF NEVADA

IN AND FOR WASHOE COUNTY

JAMES S. CARPENTIER; and

JOAN E. CARPENTIER,

Plaintiffs,

vs.

AAMES FUNDING CORPORATION

DBA AAMES HOME LOAN, a California

corporation; WINDSOR MANAGEMENT CO.,

a California corporation; RESIDENTIAL

CREDIT SOLUTIONS, INC, a Texas corporation;

QUALITY LOANS SERVICE CORPORATION,

a California corporation; and DOES I - XX, inclusive,

Defendants.

_________________________________ 1

CASE NO. CV08-01709

DEPT. NO.7

ORDER FOR WITHDRAW OF COUNSEL

The motion of James M. Walsh, Esq. to withdraw as attorney of record for Plaintiffs having been

made and unopposed is hereby granted, and that Plaintiffs are substituted in pro per. Their last known

mailing address is 2873 Sunny Slope Drive, Sparks, Nevada 89434.

DATED this of January, 2009.

Respectfully Submitted By:

28 James M. Walsh, Esq.

WALSH, BAKER & ROSEVEAR, P .C.

Nevada State Bar No. 796

9468 Double R Blvd., Ste. A

Reno, Nevada 89521

Phone (775) 853-0883

1

\

. .

" ;."

Original

FILED

1 MOTJ

Kristin A. Schuler-Hintz, Esq., Nevada SBN 7171

2 McCarthy & Holthus, LLP

09. JUN -9 AM 10: S9

'" .'Co" 811 South Sixth Street

iiiiiiiiiiiilDq,<I.-;:'

_ Las Vegas, NV 89101

Iii"';! 5 Phone (702) 685-0329 Ext. 3748

_ Fax (866) 339-5691

KHintz@mccarthyholthus.com

iiiiiiiiiiiiiiiO .....

Attorney for DEFENDANTS' Residential Credit Solutions, Inc. & Quality Loan Servic

-

= w Corporation

===

- (k::l ....

- woe

=01 ...... 0::1

.... 8

,

=00. .... 01

- Ict::LO

;;;;;;;;;;;;;ID'([..-.J:

U--'03l

10

11

12

13

14

15

16

. 17

18

19

20

21

22

23

24

25

IN THE SECOND JUDICIAL DISTRICT COURT OF THE STATE OF NEVADA

IN AND FOR WASHOE COUNTY

JAMES S. CARPENTIER; and JOAN E. )

CARPENTIER, )

Plaintiffs )

vs. )

AAMES FUNDING CORPORATION DBA )

AAMES HOME LOAN, a California )

corporation; WINDSOR MANAGEMENT

CO. , a California corporation; . )

RESIDENTIAL CREDIT SOLUTIONS, INC.,)

a TEXAS corporation; QUALITY LOAN )

SERVICE CORPORATION, a California )

Corporation; and DOES I - XX, inclusive, )

Defendants )

Case No.: CV08-0l709

Department No: 4

DEFENDANTS' RESIDENTIAL CREDIT

SOLUTIONS, INC. AND QUALITY

LOAN SERVICE CORPORATION'S

MOTION TO DISMISS OR IN THE

ALTERNATIVE FOR SUMMARY

JUDGMENT

COMES NOW Defendants Residential Credit Solutions, Inc., and Quality Loan Servic

Corporation, by and through their counsel of record, Kristin A. Schuler-Hintz, Esq., of McCarth

& Holthus, LLP, and moves the Court to Dismiss Plaintiff's Complaint with prejudice or in th

alternative for Summary Judgment.

This Motion is brought pursuant to NRCP 12(b)(5) for failure to state a claim for relie

against the Defendants.

This Motion is based upon this Notice, the attached Memorandum of Points an

Authorities, and upon all pleadings and documents herein, as well as any argument that may be

III

Nv08-2636

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

presented at the hearing of this, or any other motions/matters; the Court is requested to tak

judicial notice as appropriate_

Dated: 5/26/2009

NOTICE OF MOTIO ' ,

PLEASE TAKE NOTICE that the undersigned will bring the foregoing Motion t

Dismiss or in the alternative for SUlllffiary Judgment on for hearing on the --------1

day of _________ " 2009 at the hour of ____ amfpm, in Department 4 or a

soon thereafter as my be heard_

Dated: 5/26/2009

~

,MEMORANDUM OF P

I.

SUMMARY OF THE ARGUMENT

Plaintiffs James S. Carpentier and Joan E. Carpentier ("Plaintiffs") complaint cont .

almost no factual allegations against answering Defendants Residential Credit Solutions, Inc.

("RESIDENTIAL") and Quality Loan Service Corporation ("QUALITY), while alleging a wid

variety of unsupported claims for relief.

Plaintiff's complaint, to the extent it is intelligible seeks to stop the foreclosure sale of th

real property commonly known as 2873 Sunny Slope Drive, Sparks, NY 89434 ("Subjec

Property"), alleging unfair lending practices by Defendant AAMES Funding Corporatio

23 ("AAMES") and RESIDENTIAL; intentional misrepresentation by AAMES

24

RESIDENTIAL; and negligence by the DOE Defendants.

25

QUALITY as a Defendant, but fails to specifically allege a single cause of action agains

QUALITY. Furthermore, as set forth herein, the statutory requirements ofNRS 107.080 relativ

Nv08-2636

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22