Beruflich Dokumente

Kultur Dokumente

Strategic Dimensions of Digital Inclusion in The Next Decade-14 PDF

Hochgeladen von

arumugams_2Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Strategic Dimensions of Digital Inclusion in The Next Decade-14 PDF

Hochgeladen von

arumugams_2Copyright:

Verfügbare Formate

compendium 12 test:Layout 1 11/10/2012 12:05 PM Page 83

Strategic Dimensions of Digital Inclusion in the Next Decade

Dr K Srinivasa Rao General Manager Bank of Baroda

Banking industry worldwide acknowledges the fact that technology led banks have the ability to deliver superior banking services. Technology can also be customised and developed into a service bouquet to create a unique competitive differentiator. Its usage also helps the Banks in pricing the products competitively. Thus adoption and optimum application of technology in banks can be considered as a game changer to win the customers. The debut of technology in Indian banking system can be traced back to the rudimentary Automatic Ledger Posting Machines which passed through many phases to manifest ultimately to the present status. The state of the art, Core Banking System (CBS) of banks can be seen as a strategic invention to disseminate more broad based virtual banking services. Further it can be recalled that the actual foundation for induction of Computer Technology in the Indian Banking Sector was laid by Dr Rangarajan Committee's two reports in the years 1984 and 1989. Both the reports strongly recommended computerisation of banking operations at various levels while suggesting the appropriate architecture. As a sequel, the banks have gradually migrated from Local Area Network (LAN) to Wide Area Network (WAN) to facilitate integration of banking system across the country enabling inter-branch and interbank connectivity. It further led to the development of technology led alternate delivery channels. It also supports faster transfer of funds from one account of a bank to another account of the same bank/another bank without manual intervention through NEFT/RTGS. These developments led to creation of a digital awareness in banks and its users. This paper seeks to conceptualise the strategic road map to take the digital capability to a level from where the returns on investment on technology can flow. But this will need a recapitulation into the dynamics of digital journey of banks in the last decade that can pave way for deriving synergy in the coming years. Having made huge strategic investment in technology, it is essential to make technology work, more importantly to (i) deliver superior quality of customer service (ii) provide better economies of scale for ultimate reduction in cost of banking transactions (iii) assist with appropriate system driven MIS for banks decision support system (iv) fully automate flow of data from banks to regulators without human intervention, (v) enable banks to move away from

paper based banking to paperless digital banking era with a larger aspiration to help bring about ecological balance to do good to society. The paper therefore is divided into 5 sections. Section-I provides a recap of digital journey of banks in the last few years. Section-II will discuss the strategic actions so far taken to strengthen digital culture. Section-III will summarise the challenges in optimising usage of technology by customers. Section-IV will deal with some of the strategic initiatives needed to be taken to take the digital culture in banks to the next level. Section-V shall synthesise the strategic thoughts on meeting the long term broader aspirations of banks. Section-I 1.1 Recap of digital journey of banks The banking space in India has diverse participants. The banking led economy has the predominance of Public Sector Banks (PSBs) having around 70 percent market share. Remaining 30 percent is shared by the New Generation Private Sector Banks (NPSBs), Old Private Sector banks (OPBS) and Foreign Banks (FBs). It can be recalled that after the introduction of banking sector reforms in 1991, the Indian Banking sector has been opened up to private players. These set of new private banks have began operations in 1993-94. The advantage with the NPSBs is their latest entry into banking domain with the state of the technology having tech savvy young employees without any legacy issues. But PSBs have large chunk of their employees recruited way back at the time of expansion of banks led by nationalisation. Such senior staff having exposure with traditional banking tools had to reorient themselves to adopt technology to deliver value to the new generation customers. But PSBs have exhibited tremendous resilience and adaptability to change and could ward off the digital divide to a large extent. As a result, many young entrepreneurs and customers are looking at PSBs to flavor the digital banking on the lines of their private peers. The new banks and foreign banks have an inbuilt better digital capability due to their recent origin. But PSBs have worked hard in the last decade to reduce the digital divide and provide customers better technology led services. Thus the speed and reliability of information

83

compendium 12 test:Layout 1 11/10/2012 12:05 PM Page 84

technology has supported creation of nationwide financial services, including ATMs (hailed by Paul Volker as the only useful innovation by the financial sector in the last three decades), electronic check and credit card processing, transfer of funds, and so on. 1.2 Digital developments in Indian Banks While these technological advancements are necessary to offer accurate, neat, faster and tidy banking services without much human intervention, the penetration of its usage is yet to reach commercial scale to provide return to banks on investment in technology. It is a long term aspiration to sell technology enablers to internal customers ie to staff and to external customers. Banks have just been able to shape up the technology infrastructure to provide a range of customised Technology led Alternate Delivery Channels (TADCs) such as ATMs, debit cards, POS terminals, hand held devices with Business Correspondents (BCs) internet banking, electronic purse, prepaid gift cards, and mobile banking etc. But their usage is still at a nascent stage despite every effort made by the banks to propagate them. Technology has the potentiality to cut operating cost only if the enabler is widely used by the bank customers. Though literacy in terms of numbers may be over 75 percent but the functional literacy is stated to be 40 percent and IT literacy is put abysmally at 6 percent. Out of the estimated population of 1.21 billion, around 70 million are supposed to be in a position to operate the TADCs of banks as against 600 million bank customers. 1.3 Quantitative dimensions of TADCs Besides the traditional expansion of brick and mortar bank branches, the technology brought to fore a multiple alternate delivery channels. It provided banking services to a large number of customers that are increasingly

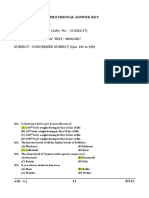

getting connected to the banking system under its ongoing financial inclusion project. In the same league, among the alternate delivery channels, the most popular and known mode has been the entry of Automated Teller Machines (ATMs). The growth of ATM network in the Indian banking space in the last few years has been much more significant reaching out to the interiors of the country. The data in Table-I on ATMs could provide us convincing trends in its expansion: It can be observed that year after year the number of ATMs is on the rise. It witnessed a growth of 24 percent during 2010-11. However, the percentage of off-site ATMs to total ATMs witnessed a marginal decline to 45.3 percent in 2010-11. More than 65 percent of the total ATMs belonged to the public sector banks as at end March 2011. At the same time, during 2010-11, the number of debit cards grew at the rate of 25 percent over the previous year indicating the appetite of account holders to access services of ATMS. In sync with the trend observed in case of ATMs, nearly three fourths of the total debit cards were issued by PSBs as at end March 2011. From the point of view of banking penetration, off-site ATMs have more relevance than on-site ATMs. Out of the total net increase in ATMs in 2010-11, 44 percent were off-site ATMs. Sixty three percent of the net addition of ATMs by new private sector banks and 98 percent of net addition of ATMs by foreign banks were at off-site locations in 2010-11. Almost 41 percent and 49 percent, respectively of the net addition of ATMs by PSBs and old private sector banks were also at off-site locations. The share of PSBs in outstanding debit cards witnessed an increase during the recent years, while that of new private sector banks and foreign banks witnessed a decline over the same period. However, in absolute terms, the number of outstanding debit cards witnessed an increase for new private sector banks during the recent

TABLE - I ATM NETWORK OF SCHEDULED COMMERCIAL BANKS 2005 2011

Source: Trends and Progress in Banking in India 20010-11, Reserve Bank of Indias Annual Publication.

84

compendium 12 test:Layout 1 11/10/2012 12:06 PM Page 85

years. On the whole, technology led banking channels are on a binge of growth. In addition to the increasing network of ATMs, many banks have been providing internet banking, telephone banking, mobile banking and the Point of Sale (POS) Terminals. Banks have also begun to provide hand held devices to the Business Correspondents (BCs) engaged in villages. With the rapid expansion of mobile and internet connectivity, the virtual delivery channels in due course would establish seamless connectivity with the people. There is a lot of marketing campaigns to encourage interbank usage of ATMs of different banks. Since five transactions in a month are free, even if some other banks ATM is used, customers can operate any banks ATMs for logging in their transactions. Visa, mastercard, maestro payment gateway is supplementing such usage bringing more convenience to the customers. The widespread presence of ATM kiosks in market/tourist spots is facilitating increased use of digital mode. The large scale penetration of home computers, supported by the presence of large number of internet kiosks, laptops, i-pads, mobiles have made digital banking more user friendly. It is also eco-friendly as paper usage could be reduced in providing accessing banking service through virtual mode. Thus technology led alternate delivery channels made faster inroads into the banking space altering the whole landscape of banking services. In this background, it will be highly challenging for the banks to woo their customers to use the technology for their routine transactions. The footfalls in the bank branches can then be to avail more value based advisory and discretionary services of banks going much beyond the transaction processing. It can be observed that while the decade 2000 - 2010 witnessed a spate of Technology acquisition, the decade ending 2020 should be able to see a metamorphosis in the banking with focus on Technology application from the angle of customers and banks. Section-II The strategic initiatives of the industry Besides moving on to CBS technology, banks have expanded the network of TADCs to make banking services available at more touch points. Business Correspondents have been provided with POS terminals as micro ATMs as part of its outreach program. The network of Ultra Small Branches (USBs) has been able to disseminate knowledge to customers at the grass root level to understand the nuances of using TADCs. With financial inclusion inundating fast into the rural habitations, the biometric devices are also put in place to reach technology to larger target group of customers. Financial literacy units are set up to share operational

knowledge on the banking products/TADCs in vernacular language to improve the levels of understanding. Regional Rural Banks (RRBs) have also been connected with CBS technology to enable linking them with the NEFT/RTGS payment network. The standard of IT governance has been improved with better policy back up and strategic monitoring working as a systemic device to improve digital culture. In order to improve the knowledge level of employees, more particularly in IT related areas, besides refunding tuition fees for IT related identified courses, some banks also provide incentives to successful employees who take up further studies in computer applications. Professional courses like CESA, BCA, and MCA are also encouraged to improve knowledge base. Several leading banks have set up in-house exclusive technology training institutes to expose more number of their employees to induct systematic user/application level knowledge. Senior level employees are sent to apex IT institutes like IDRBT, Hyderabad to enable them to guide the bank in policy planning to bring about improvements in IT competence both in terms of hardware/software. In order to align the process of work flows/decision making stream in sync with the technology, many banks have launched Business Process Re-engineering (BPR) projects. BPR can find methods to apply technology at work space to not only improve speed and efficiency but also simplify procedures. As a result of technology led innovations through BPR, one common development has been the centralisation of back office/ credit operations at a remote location so that branches of banks can focus on marketing, sales and services. More time with the branch team can develop a better sense of responsiveness to customer needs. BPR led to reduction of turnaround time in the delivery of credit and back office services such as issue of cheque book, opening of accounts, centralised cheque clearing and a host of non customer facing activities. The centralisation of cheque truncation has drastically reduced the collection time of the instruments. Collection of Customer Relationship Management (CRM) data, facility of online tracking of loan applications, submission of online statements, information to corporate office/regulators arise out of technology availability. Section-III Challenges/solutions technology in optimising use of

3.1 Inhibitions about the safety and security of TADCs While the banks have been making all out efforts to spread their technology network in the interior areas by setting up ATMs, Point of Sale Terminals (POS) etc, the paucity of penetration levels of Personal Computers

85

compendium 12 test:Layout 1 11/10/2012 12:06 PM Page 86

(PCs), Laptops, i-pads, and internet facilities etc has made many customers suffer from unknown fears of operating the systems. In the given circumstances, the views of Dr. Subba Rao would reflect the state of low penetration of banks and financial services across the country. The statistics on penetration of IT facilities in India are disheartening. People having debit cards comprise only 13 percent and those having credit cards a marginal 2 percent. Even these card-holders use very less often keeping the entire IT infrastructure unused. Hence, the banks need to guard against the apprehensions of customers to use the technology what can be called a technology barrier between the bank and the customer. As we all recognise, technology is a great enabler and provides us huge opportunities for making banking more efficient and more inclusive. At the same time, it is also faceless, and this absence of a human touch can be quite intimidating, if not threatening, to those just entering the banking network. Banks have to build knowledge sharing mechanism and take extra care to ensure that the even the poor are not driven away from banking because the technology interface is unfriendly. This requires training the frontline staff and managers as well as business correspondents on the human side of banking. We need to walk the extra mile to ensure that a comfort is provided to customers that TADCs are completely secured, safe and easy to operate so that they can be used to the optimum level. 3.2 Developing operating skills/knowledge of customers Besides speeding up issue of debit cards, enrolment to internet banking and mobile banking, we need to focus more on making customers familiar with the operational procedures of using TADCs. Braches should go one step ahead to brief the card holders about how to operate the systems on a continuous basis to make them convinced about the easiness to operate them. Thus dissemination of operational know-how should form part of process of issuing the password/ATM Debit cards etc in the most understandable form. Use of vernacular language and showing demonstration on the mobile ATM screens will be able to lend confidence. Development of user pamphlets in multiple languages, display of screen shots on the ATMs, cash dispensers, and on internet banking screens can improve the knowledge levels of customers. In every customers meet, we should conduct mock demonstration of usage of ATMS/internet/mobile banking system and educate the Business Correspondents (BC) in villages to familiarise the customers with the TADCs. Having set up infrastructure at a great cost, the next step is to take these services to customers in a big way. An inclusive effort to enroll more and more customers into the TADC network is essential to deliver value at economical price. We all know that it is cheaper to reach out to customers through technology instead of manual mode. The economies of scale can be obtained only if technology is put to extensive use.

3.3 Significance of after sale service The TADCs are normally unmanned facilities where the interaction is through computer interface. After the Debit card is issued, it is necessary for banks to strengthen the after sale service by entering into appropriate Service Level Agreements (SLAs) with the vendors to maintain the systems well. Operational excellence can be obtained only through well maintained trouble shooting mechanism. Right from refilling cash in ATMs, receipt dispensation, well maintained kiosks, issue of online Tpin, maintaining proper bandwidth, arranging proper power back up and a host of granular needs which put together rates the after sale service. Customer confidence can be built only through demonstration by drastically cutting the ATM outages, if they cannot altogether be eliminated. Similarly, call centers, help lines, VOIP facilities need to be kept always functional to infuse confidence of the users in the technology channels. Branches should also be made more responsive in attending to customer queries and in resolving them promptly to build a customer centric eco system. In fact the responsibility of the bank begins only after the service is sold to customers. The testing then begins. Once the confidence is developed, the customers would love to interact with technology rather than using the manual mode. Literacy level of customers and after sale service orientation can be combined to enhance the TADC usage levels significantly. Such a strategic approach can facilitate deepening the reach of TADCs, the future competitive differentiator. 3.4 The power back up Way forward, as the network of banks reach the unbanked villages under the overall financial inclusion agenda, providing electricity, repair, and maintenance facilities would pose as a major challenge. It is here, that banks have to work in unison. Better coordination, sharing of resources like universal Business Correspondents, space of Ultra small branches, network facilities have to be geared up. Government of India has also been proposing common RFPs and tendering of infrastructure. In the same way, even solar power back up can also be thought of as an alternative. Though initial investments may be high but as the banks have to operate on permanent basis with connectivity with their data centers, non conventional methods may be examined. UPS back up also needs continuous power supply for some time to recharge which may not be available in far flung areas. Hence, some strategic shift in power procurement will be necessary. Moreover, under the given IT infrastructure, banks have to remain connected with CBS platform for any transaction and stand alone banking is not possible. Generators currently used in many places may have their

86

compendium 12 test:Layout 1 11/10/2012 12:06 PM Page 87

own limitations. Therefore banks will have to work out long term sustainable connectivity to provide uninterrupted banking services to masses. Solar power back up could be one possible solution that needs more coordination and networking among banks in the area. 3.5 Support services at rural centers Similarly, keeping in view the limitations of infrastructure facilities in rural centers, attending the maintenance work of branch infrastructure such as PCs, ATMs, connectivity, cash dispensers, POS terminals etc can pose a great challenge as banks expand their network. Non availability of motorable roads to villages may hinder the maintenance work. Hence all the banks will have to join together and coordinate with the vendors persuading them to create service hubs and provide trained manpower at nucleus points such as in the district headquarters to ensure that response time of vendors is improved. Physical movement of support and spares should be insisted with a high sense of compliance. But it cannot happen on standalone format. It has to be an intense coordinated effort. It will work out to vendors to provide such level of service if many of the banks put together can avail bulk of their services. With density of branches in unbanked areas increasing, the operational efficiency will be dependent on the level of maintenance of hardware and software. Support service needs to be smart to ramp up operational efficiency and to pursue digital inclusion on a mission mode. 3.6 Incentives to use technology Many banks have started providing reward point system against use of debit cards. Government has begun the process of providing cash subsidies through banking network in select district on experimental basis. These are good signs of digital inclusion. More and more customers will use the payment gateways and remit funds through NEFT/RTGS and shall avail of the remittance facilities on real time basis. Some banks have taken the green initiatives by persuading customers to use the POS terminals for their day to day cash needs. Banks have to introduce innovative methods to woo the customers to use the TADCs. While the reward points are one way, paper less savings accounts can be introduced to catch the youngsters who do not have much of payment obligations. At all college campuses, virtual savings account with no obligation for minimum balance can be introduced. All operations to be online with no cheque book facilities. The cheque book if issued could be charged. While remittances of up to INR 1 lac are now made free by most banks, the limit can be enhanced to encourage this mode. Similarly since electronic receipts into the accounts provide float funds, banks may encourage inward remittances by extending reward points.

Innovative methods need to be used to reward customers who use technology platform till such time that it becomes their life style. We can also open exclusive electronic branches in cities near college campuses on the model of Electronic Banking Service Units (EBSUs) opened in UAE. This will have a lounge with all electronic enablers like ATMs which accepts cash/makes payments. There will be cheque deposit machines, PCs to view the accounts, internet facilities to operate e-banking etc. Only one relationship manager is made available in the entire branch for coordination/maintenance of the branch. Such EBSUs will inculcate the culture of digital inclusion. There could be many other ways to reward the customers. A paperless account holder could be given ten to twenty five basis points of more interest or relaxation in number of transactions, preferred processing of loan applications/bancassurance products etc. Section-IV Strategic initiatives needed to take the digital status to next level 4.1 More focused intent to use the digital mode Though banks have made much headway in pushing technology to people in the last few years, lot needs to be done to further intensify the move. On the lines of RBI intent to promote digital culture, banks also need to design Digital Vision for say next 5 years enunciating the progress to be achieved every year. The road map and quantitative milestones should be well defined. Accordingly, banks need to institutionalise a robust policy framework to monitor their progress towards the digital inclusion. Corporate/Regional architecture should learn to have project approach to push technology. Separate monitoring verticals will have to be introduced to create and propagate the technology culture. This should have two distinct systems. The monitoring system should have dual systems, one for monitoring the usage of technology by in-house staff and second by customers. Staff should be persuaded to go paperless as far as possible. Briefing sessions should be held in the departments to discuss the scope of usage of technology in improving the quality of monitoring. The practical ways and means should be debated, discussed and practical applications have to be made available to staff to use MIS available in the systems. Banks also need to incentivise the staff to go electronic in their day to day work. Use of emails/internal messaging is only one part. They should be able to retrieve all control information directly from the CBS on to their PCs in soft form to do their work. Print outs/filing of physical copies should be confined to few. Banks need to devise a policy on the generation of reports and preservation for audit/inspection by internal/external agencies. Top management should be involved in

87

compendium 12 test:Layout 1 11/10/2012 12:06 PM Page 88

dispensing with multiplicity of report generation. Automated data flow should be ensured and ipads, laptops, desktops should be extensively used for internal control systems. Some departments should be declared virtual departments Experimentation of work from home should be encouraged to bring control functions of banks to laptops/ipads. Once internal staff is groomed to fully harness the potentiality of technology, software in use and CBS capability, they can convince the customers to go on electronic mode. The corporate/regional offices should use control matrix for monitoring digital usage in soft form through emails/sms with the nodal branches. The project offices should build up digital capability to connect with the field staff to monitor issue/usage of debit cards. The enrolment to e-banking/mobile banking should be monitored on virtual mode by remaining connected with the Regional Managers. The quality checks have to be conducted on the maintenance of ATMs and their downtime. Extraordinary results in digital usage cannot be obtained with routine efforts. The strategic intent of the bank to pursue digital inclusion needs to be evident in its continuing efforts and the entire staff should be made to join together in realising the strategic goal of the bank. Tracking the number of debit cards, internet/mobile banking enrolments should be monitored on hub and spokes model by the central offices of banks. Banks may identify young minds in every department as a change agent of technology who should play facilitating role for disseminating knowledge to employees and customers and also for creating a technology savvy culture. A comprehensive inclusive approach of the team at all levels can help speed up propagating technology in a large measure to achieve the ultimate reduction of transaction cost in the bank. 4.2 Tracking of changing aspirations of customers Technology enablers are created for customers. The perceived value of technology and products/services should meet the customer needs. Though a given level of technology is acquired to fulfill the needs of customers, it is essential to upgrade it in line with the changing customer needs. While offering the range of services and delivering the given value to customers, we need to understand their changing aspirations. A continuous feedback on the services and the move of the peer banks have to be kept in mind. Looking to the young profile of bank customers in future, face lift and fine tuning of services must be ensured. A mechanism has to be institutionalised to grasp the views of customers, more importantly of potential customers. Banks should conduct debates, competitions in the leading colleges, hold brain storming sessions on the profile of banking products and delivery channels to elicit the participants views. Surveys should be conducted to obtain public views. Summer projects may be awarded to college

students to talk to customers who visit the branches and elicit their perspectives and views on the products/services. When holding interviews, the opinion of candidates may be sought and captured for helping in modulating the policies of bank. The only way we understand customer aspirations is to talk to them and document their views in a format easy to factor in the policy documents. 4.3 Setting up digital intelligence division Visionary banks need to move forward for more robust positioning in the market. Making technology work for customers to deliver better value can be a great market differentiator. Besides selling TADCs, it is necessary to maintain an effective intelligence system to assess the developments in technology led products/services. The entry of latest enablers that can change the profile of products for creating differentiation needs to be captured. This would need creation of a digital intelligence division in the bank dedicated to proactively capture developments taking place in the domestic/international banking technology to help get a first mover advantage in customising the products in the market. The silent changes taking place in the technology field may make possible introduction of sophisticated products/services. Research needs to be conducted in the market to assess changes. Similarly in the technology area, the developments in the software, security levels, and protection devices may also be gathered from the market to better align the systems and procedures to become more digital friendly. It should be a strategic move to put in place a digital intelligence wing for factoring the latest developments. 4.4 Converting USBs/Financial Literacy Centers (FLCs) into IT knowledge hubs To disseminate knowledge on financial inclusion efforts, banks have set up a large number of FLCs and opened a new range of branches known as Ultra Small Branches (USBs) to establish better connect with the village community. Most of its activities are conducted in vernacular language or in Hindi. These infrastructure units are already operating. Hence synergy of their presence needs to be utilised for disseminating knowledge on operating IT systems. The support vendors may be persuaded to conduct briefing sessions in FLCs/USBs to a group of users on specific week days. The mobile ATM vans may also be used to share clippings on usage of technology and benefits of having banking relationships. Gram panchayat meetings should be addressed by BCs/USB heads to meet, greet and share information on banks products/services providing the consumers the confidence in using TADCs. IT knowledge sharing hubs should be created and used as an effective mode to reach out to people. Local Colleges/schools/institutes/ITIs may be engaged in dispensing knowledge on banking so

88

compendium 12 test:Layout 1 11/10/2012 12:06 PM Page 89

that significance of having banking relationship based on technology can be highlighted in every forum. Section-V Conclusion It can be observed that in the post reform regime, the Indian banking system has acquired a robust digital infrastructure capable of disseminating technology led virtual banking services to customers akin to the global standards. The only challenge is to optimise its usage to deliver value in terms of improved efficiency at reduced overhead costs. This will require a multi pronged approach. The bank leadership should focus on inspiring management at every level to use technology led data to improve the quality of decisions. Every staff should be led to maximise use of digital tools to improve flow of quality information and work towards improving the data integrity. Specific strategic and operational action will be necessary to promote use of technology by (i) staff (ii) customers and other (iii) stake holders. Keeping in view the payment system vision 2012-15 of RBI and in order to accomplish the vision of a less-cash society, if not cashless society, the key elements of a modern and widespread payment system are: Accessibility, Availability, Awareness, Acceptability, Affordability, Assurance and Appropriateness (7 As). Since the entire eco system of banks will forge alliance with the various agencies to encourage use of electronic mode, RBIs vision will help banks to go for better digital inclusion. Hence, a much wider and more planned dissemination of knowledge needs to be institutionalised in banks to connect larger customer segment with TADCs. Banks will need to work towards developing a well entrenched digital culture.

References: 1. Anand Sinha: Deputy Governor, Reserve Bank of India, A speech on Technology in banking in pursuit of excellence Delivered at the Institute for Development and Research in Banking Technology (IDBRT), Hyderabad, 4 August 2011. 2. Killion Fox: Africas mobile Economic Revolution The observer, Sunday July 24, 2011 3. Mittal, R.K.& Sanjay (2007), Technology in Banking Sector: Issues and Challenges Vinimay, Jan March 2010, pp-18 4. Padmanabhan, G. Executive Director, Reserve Bank of India- Comments made on July 29, 2011 at the Annual conference on Secured Banking 2011, Mumbai. 5. Report on Trend and Progress of Banking in India 2009-10 Reserve Bank of India, Mumbai 6. Report on The human capital key : Unlocking a golden decade in Indian Banking A publication of McKinsey & Company on financial services August 2010 7. Report on Indian Banking 2020 Making the decades promise come true, Boston consulting Group (BCG) report, Sept 2010. 8. Report of Reserve Bank of India on PAYMENT SYSTEMS IN INDIA VISION 2012-15 9. Report on Being five star in Productivity Road map for excellence in Indian Banking, Boston consulting group August 2011 10. Subba Rao (Dr.) Governor, Reserve Bank of India - speech on Harnessing Technology to Bank the Unbanked at the Banking Technology Excellence Awards 2009 at the IDRBT Hyderabad, June 18, 2010.

89

compendium 12 test:Layout 1 11/10/2012 12:06 PM Page 90

90

Das könnte Ihnen auch gefallen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Measures For FloodsDokument4 SeitenMeasures For FloodsMutsitsikoNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- FM Testbank-Ch18Dokument9 SeitenFM Testbank-Ch18David LarryNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- MikoritkDokument6 SeitenMikoritkChris Jonathan Showip RouteNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Model No. TH-65JX850M/MF Chassis. 9K56T: LED TelevisionDokument53 SeitenModel No. TH-65JX850M/MF Chassis. 9K56T: LED TelevisionRavi ChandranNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Catch Up RPHDokument6 SeitenCatch Up RPHபிரதீபன் இராதேNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Text Extraction From Image: Team Members CH - Suneetha (19mcmb22) Mohit Sharma (19mcmb13)Dokument20 SeitenText Extraction From Image: Team Members CH - Suneetha (19mcmb22) Mohit Sharma (19mcmb13)suneethaNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- M.Sc. Steel Structures LEC. #7 Plastic Analysis and Design: Dr. Qasim Shaukat KhanDokument43 SeitenM.Sc. Steel Structures LEC. #7 Plastic Analysis and Design: Dr. Qasim Shaukat KhanSSNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Math ExamDokument21 SeitenMath ExamedgemarkNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Net Pert: Cable QualifierDokument4 SeitenNet Pert: Cable QualifierAndrés Felipe Fandiño MNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- NCDC-2 Physical Health Inventory Form A4Dokument6 SeitenNCDC-2 Physical Health Inventory Form A4knock medinaNoch keine Bewertungen

- GladioDokument28 SeitenGladioPedro Navarro SeguraNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- How Muslim Inventors Changed The WorldDokument4 SeitenHow Muslim Inventors Changed The WorldShadab AnjumNoch keine Bewertungen

- BS 215-2-1970-Aluminium Conductors and Aluminium Conductors Steel-Reinforced For Overhead Power TransmissionDokument16 SeitenBS 215-2-1970-Aluminium Conductors and Aluminium Conductors Steel-Reinforced For Overhead Power TransmissionDayan Yasaranga100% (2)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Annex A - Scope of WorkDokument4 SeitenAnnex A - Scope of Workمهيب سعيد الشميريNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Skilled Worker Overseas FAQs - Manitoba Immigration and Economic OpportunitiesDokument2 SeitenSkilled Worker Overseas FAQs - Manitoba Immigration and Economic OpportunitieswesamNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Dash8 200 300 Electrical PDFDokument35 SeitenDash8 200 300 Electrical PDFCarina Ramo LakaNoch keine Bewertungen

- MotorsDokument116 SeitenMotorsAmália EirezNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Pepperberg Notes On The Learning ApproachDokument3 SeitenPepperberg Notes On The Learning ApproachCristina GherardiNoch keine Bewertungen

- Previous Papers GPSC Veterinary Officer AHI Advt. No. 33 2016 17 Date of Preliminary Test 08 01 2017 Subject Concerned Subject Que 101 To 300 Provisional Key PDFDokument18 SeitenPrevious Papers GPSC Veterinary Officer AHI Advt. No. 33 2016 17 Date of Preliminary Test 08 01 2017 Subject Concerned Subject Que 101 To 300 Provisional Key PDFDrRameem Bloch100% (1)

- Historical Perspective of OBDokument67 SeitenHistorical Perspective of OBabdiweli mohamedNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Category (7) - Installation and Maintenance of Instrumentation and Control SystemsDokument3 SeitenCategory (7) - Installation and Maintenance of Instrumentation and Control Systemstafseerahmed86Noch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Nuttall Gear CatalogDokument275 SeitenNuttall Gear Catalogjose huertasNoch keine Bewertungen

- University of Southern Philippines Foundation. College of Engineering and ArchitectureDokument7 SeitenUniversity of Southern Philippines Foundation. College of Engineering and ArchitectureJason OwiaNoch keine Bewertungen

- Investing in Granada's Property Market - Gaspar LinoDokument1 SeiteInvesting in Granada's Property Market - Gaspar LinoGaspar LinoNoch keine Bewertungen

- Name of The Business-Rainbow Blooms LLC. Executive SummaryDokument17 SeitenName of The Business-Rainbow Blooms LLC. Executive SummaryAhamed AliNoch keine Bewertungen

- D.O. 221-A - Application Form (Renewal)Dokument1 SeiteD.O. 221-A - Application Form (Renewal)Karl PagzNoch keine Bewertungen

- EPA Section 608 Type I Open Book ManualDokument148 SeitenEPA Section 608 Type I Open Book ManualMehdi AbbasNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Thompson, Damon - Create A Servitor - How To Create A Servitor and Use The Power of Thought FormsDokument49 SeitenThompson, Damon - Create A Servitor - How To Create A Servitor and Use The Power of Thought FormsMike Cedersköld100% (5)

- Piping Class Spec. - 1C22 (Lurgi)Dokument9 SeitenPiping Class Spec. - 1C22 (Lurgi)otezgidenNoch keine Bewertungen

- Serenity RPG Firefly Role Playing Game PDFDokument225 SeitenSerenity RPG Firefly Role Playing Game PDFNathaniel Broyles67% (3)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)