Beruflich Dokumente

Kultur Dokumente

Argentina - Effective Rate of Value Added Tax

Hochgeladen von

Eduardo PetazzeOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Argentina - Effective Rate of Value Added Tax

Hochgeladen von

Eduardo PetazzeCopyright:

Verfügbare Formate

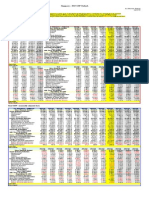

Argentina - Effective rate of value added tax

by Eduardo Petazze

In Argentina, the effective rate of value added tax, according to official data published GDP estimates, are located around

12.7% of value added at basic prices of taxable goods and services.

Between 1993 and 2003, the effective rate was around 8% of the taxable amount.

Argentina Value Added Tax and the Gross Value Added (adjusted tax basis)

Goods and

% of

million

Public

Services

Taxable

GVA

Imports

Exports

Other

VAT

current pesos

services

taxable

GDP data

2000

263,218.9

33,070.1

31,223.7

17,802.7

14,451.5 232,811.3

19,008.5

8.16%

2001

250,888.5

27,603.9

31,112.4

17,117.2

14,231.7 216,031.0

16,233.3

7.51%

2002

294,804.5

41,792.3

88,718.3

16,866.9

11,807.2 219,204.3

16,468.1

7.51%

2003

351,599.1

55,310.6

97,476.9

18,846.2

13,455.5 277,131.1

22,021.6

7.95%

2004

412,306.4

82,233.3 115,075.4

21,337.8

16,277.8 341,848.8

32,086.5

9.39%

2005

489,786.1 102,072.2 133,346.0

26,620.9

20,046.7 411,844.7

38,276.0

9.29%

2006

600,256.0 125,862.8 162,035.5

33,628.7

24,861.6 505,593.0

49,044.0

9.70%

2007

740,316.2 165,230.2 200,079.8

43,697.8

30,629.9 631,138.8

65,124.4

10.32%

2008

939,505.6 213,269.0 252,771.8

58,186.4

38,343.5 803,472.9

84,264.7

10.49%

2009

1,046,915.4 183,300.3 244,568.8

73,169.5

47,883.8 864,593.5

90,843.1

10.51%

2010

1,311,074.9 265,451.5 313,149.5

91,605.9

54,990.9 1,116,780.1 120,152.1

10.76%

2011

1,670,096.0 359,773.6 401,992.4 119,634.7

64,762.1 1,443,480.4 157,333.3

10.90%

2012

1,952,021.2 376,669.2 426,670.1 153,281.1

76,722.8 1,672,016.4 195,723.3

11.71%

Goods and

% of

million

Public

Services

Taxable

GVA

Imports

Exports

Other

VAT

current pesos

services

taxable

GDP data

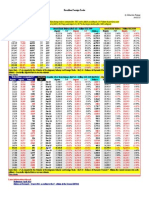

2008H1

909,488.0 203,661.6 236,959.1

52,282.9

34,758.1 789,149.4

79,686.6

10.10%

2009H1

1,001,593.2 162,232.4 230,334.1

66,942.0

45,571.4 820,978.0

85,625.4

10.43%

2010H1

1,244,236.4 235,004.2 287,716.6

84,643.4

52,037.8 1,054,842.8 109,048.2

10.34%

2011H1

1,613,576.5 326,800.7 370,385.0 109,799.0

62,010.2 1,398,182.9 145,028.8

10.37%

2012H1

1,881,923.8 352,338.7 401,304.6 144,544.9

74,515.3 1,613,897.6 178,850.6

11.08%

2013H1

2,317,594.3 450,447.3 476,137.2 180,531.3 103,118.2 2,008,254.9 254,568.2

12.68%

Goods and

% of

million

Public

Services

Taxable

GVA

Imports

Exports

Other

VAT

current pesos

services

taxable

GDP data

2012Q1

1,687,540.0 333,859.6 363,981.2 141,415.8

66,045.5 1,449,957.1 173,897.0

11.99%

2012Q2

2,076,307.6 370,817.8 438,628.0 147,674.1

82,985.2 1,777,838.1 183,804.2

10.34%

2012Q3

1,960,490.0 412,514.9 474,586.7 156,048.5

73,742.4 1,668,627.3 203,947.8

12.22%

2012Q4

2,083,747.1 389,484.7 429,484.6 167,986.1

84,118.1 1,791,643.0 221,244.3

12.35%

2013Q1

2,010,910.9 402,561.4 396,310.7 177,671.4

84,620.6 1,754,869.6 248,191.8

14.14%

2013Q2

2,624,277.8 498,333.3 555,963.7 183,391.2 121,615.9 2,261,640.2 260,944.6

11.54%

Note: The statutory rate of value added tax in Argentina is 21%

Das könnte Ihnen auch gefallen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- India - Index of Industrial ProductionDokument1 SeiteIndia - Index of Industrial ProductionEduardo PetazzeNoch keine Bewertungen

- Turkey - Gross Domestic Product, Outlook 2016-2017Dokument1 SeiteTurkey - Gross Domestic Product, Outlook 2016-2017Eduardo PetazzeNoch keine Bewertungen

- China - Demand For Petroleum, Energy Efficiency and Consumption Per CapitaDokument1 SeiteChina - Demand For Petroleum, Energy Efficiency and Consumption Per CapitaEduardo PetazzeNoch keine Bewertungen

- U.S. Employment Situation - 2015 / 2017 OutlookDokument1 SeiteU.S. Employment Situation - 2015 / 2017 OutlookEduardo PetazzeNoch keine Bewertungen

- Highlights, Wednesday June 8, 2016Dokument1 SeiteHighlights, Wednesday June 8, 2016Eduardo PetazzeNoch keine Bewertungen

- U.S. New Home Sales and House Price IndexDokument1 SeiteU.S. New Home Sales and House Price IndexEduardo PetazzeNoch keine Bewertungen

- Analysis and Estimation of The US Oil ProductionDokument1 SeiteAnalysis and Estimation of The US Oil ProductionEduardo PetazzeNoch keine Bewertungen

- China - Price IndicesDokument1 SeiteChina - Price IndicesEduardo PetazzeNoch keine Bewertungen

- Germany - Renewable Energies ActDokument1 SeiteGermany - Renewable Energies ActEduardo PetazzeNoch keine Bewertungen

- WTI Spot PriceDokument4 SeitenWTI Spot PriceEduardo Petazze100% (1)

- Commitment of Traders - Futures Only Contracts - NYMEX (American)Dokument1 SeiteCommitment of Traders - Futures Only Contracts - NYMEX (American)Eduardo PetazzeNoch keine Bewertungen

- Reflections On The Greek Crisis and The Level of EmploymentDokument1 SeiteReflections On The Greek Crisis and The Level of EmploymentEduardo PetazzeNoch keine Bewertungen

- South Africa - 2015 GDP OutlookDokument1 SeiteSouth Africa - 2015 GDP OutlookEduardo PetazzeNoch keine Bewertungen

- India 2015 GDPDokument1 SeiteIndia 2015 GDPEduardo PetazzeNoch keine Bewertungen

- México, PBI 2015Dokument1 SeiteMéxico, PBI 2015Eduardo PetazzeNoch keine Bewertungen

- U.S. Federal Open Market Committee: Federal Funds RateDokument1 SeiteU.S. Federal Open Market Committee: Federal Funds RateEduardo PetazzeNoch keine Bewertungen

- US Mining Production IndexDokument1 SeiteUS Mining Production IndexEduardo PetazzeNoch keine Bewertungen

- Singapore - 2015 GDP OutlookDokument1 SeiteSingapore - 2015 GDP OutlookEduardo PetazzeNoch keine Bewertungen

- China - Power GenerationDokument1 SeiteChina - Power GenerationEduardo PetazzeNoch keine Bewertungen

- Mainland China - Interest Rates and InflationDokument1 SeiteMainland China - Interest Rates and InflationEduardo PetazzeNoch keine Bewertungen

- Highlights in Scribd, Updated in April 2015Dokument1 SeiteHighlights in Scribd, Updated in April 2015Eduardo PetazzeNoch keine Bewertungen

- USA - Oil and Gas Extraction - Estimated Impact by Low Prices On Economic AggregatesDokument1 SeiteUSA - Oil and Gas Extraction - Estimated Impact by Low Prices On Economic AggregatesEduardo PetazzeNoch keine Bewertungen

- US - Personal Income and Outlays - 2015-2016 OutlookDokument1 SeiteUS - Personal Income and Outlays - 2015-2016 OutlookEduardo PetazzeNoch keine Bewertungen

- European Commission, Spring 2015 Economic Forecast, Employment SituationDokument1 SeiteEuropean Commission, Spring 2015 Economic Forecast, Employment SituationEduardo PetazzeNoch keine Bewertungen

- Brazilian Foreign TradeDokument1 SeiteBrazilian Foreign TradeEduardo PetazzeNoch keine Bewertungen

- United States - Gross Domestic Product by IndustryDokument1 SeiteUnited States - Gross Domestic Product by IndustryEduardo PetazzeNoch keine Bewertungen

- Chile, Monthly Index of Economic Activity, IMACECDokument2 SeitenChile, Monthly Index of Economic Activity, IMACECEduardo PetazzeNoch keine Bewertungen

- Japan, Population and Labour Force - 2015-2017 OutlookDokument1 SeiteJapan, Population and Labour Force - 2015-2017 OutlookEduardo PetazzeNoch keine Bewertungen

- South Korea, Monthly Industrial StatisticsDokument1 SeiteSouth Korea, Monthly Industrial StatisticsEduardo PetazzeNoch keine Bewertungen

- Japan, Indices of Industrial ProductionDokument1 SeiteJapan, Indices of Industrial ProductionEduardo PetazzeNoch keine Bewertungen