Beruflich Dokumente

Kultur Dokumente

Harrison Motors Vs Navarra

Hochgeladen von

Pearl Angeli Quisido CanadaOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Harrison Motors Vs Navarra

Hochgeladen von

Pearl Angeli Quisido CanadaCopyright:

Verfügbare Formate

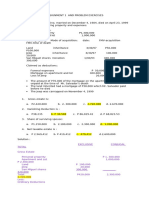

Harrison Motors vs Navarra (Canada) Facts: June of 1987 Harrison Motors Corporation through its president, Renato Claros,

sold two (2) Isuzu Elf trucks to private respondent Rachel Navarro, owner of RN Freight Lines, a franchise holder operating and maintaining a fleet of cargo trucks all over Luzon. Petitioner, a known importer, assembler and manufacturer, assembled the two (2) trucks using imported component parts. Prior to the sale, Renato Claros represented to private respondent that all the BIR taxes and customs duties for the parts used on the two (2) trucks had been paid for. 10 September 1987 the Bureau of Internal Revenue (BIR) and the Land Transportation Office (LTO) entered into a Memorandum of Agreement (MOA) which provided that prior to registration in the LTO of any assembled or re-assembled motor vehicle which used imported parts, a Certificate of Payment should first be obtained from the BIR to prove payment of all taxes required under existing laws. On 12 October 1987 the Bureau of Customs (BOC) issued Customs Memorandum Order No. 44-87 promulgating rules, regulations and procedure for the voluntary payment of duties and taxes on imported motor vehicles assembled by non-assemblers. Pursuant to the 10 September 1987 MOA between the BIR and the LTO, the BIR issued on 18 December 1987 Revenue Memorandum Order No. 44-87 which provided the procedure governing the processing and issuance of the Certificate of Payment of internal revenue taxes for purposes of registering motor vehicles. On 16 June 1988 the BIR, BOC and LTO entered into a tripartite MOA which provided that prior to the registration in the LTO of any locally assembled motor vehicle using imported component parts, a Certificate of Payment should first be obtained from the BIR and the BOC to prove that all existing taxes and customs duties have been paid. In December of 1988 government agents seized and detained the two (2) Elf trucks of respondent after discovering that there were still unpaid BIR taxes and customs duties thereon. The BIR and the BOC ordered private respondent to pay the proper assessments or her trucks would be impounded. Private respondent went to Claros to ask for the receipts evidencing payment of BIR taxes and customs duties; however, Claros refused to comply. Private respondent then demanded from Claros that he pay the assessed taxes and warned him that he would have to reimburse her should she be forced to pay for the assessments herself. Her demands were again ignored. MBut wanting to secure the immediate release of the trucks to comply with her business commitments, private respondent paid the assessed BIR taxes and customs duties amounting to P32,943.00. Consequently, she returned to petitioners office to ask for reimbursement, but petitioner again refused, prompting her to send a demand letter through her lawyer. When petitioner still ignored her letter, she filed a complaint for a sum of money on 24 September 1990 with the Regional Trial Court of Makati Trial Court: ordering petitioner to reimburse private respondent in the amount of P32,943.00 for the customs duties and internal revenue taxes the latter had to pay to discharge her two (2) Elf trucks from government custody. Petitioner was also required to pay P7,500.00 for attorneys fees plus the costs.[15] CA: sustained the lower court, hence this recourse of petitioner. Petitioners Arguments: a. that it was no longer obliged to pay for the additional taxes and customs duties imposed on the imported component parts by the Memorandum Orders and the two (2) Memoranda of Agreement since such administrative regulations only took effect after the execution of its contract of sale with private respondent. Holding it liable for payment of the taxes specified in the administrative regulations, which have the force and effect of laws, would not only violate the non-impairment clause of the Constitution but also the principle of non-retroactivity of laws provided in Art. 4 of the Civil Code.

b. that private respondent should be the one to pay the internal revenue taxes and customs duties. It claims that at the time the Memorandum Orders and the two (2) Memoranda of Agreement took effect the two (2) Elf trucks were already sold to private respondent, thus, it no longer owned the vehicles. Whatever payments private respondent made to the government after the sale were solely her concern and such burden should not be passed on to petitioner. c. that it had paid the taxes due on the imported parts otherwise it would not have been able to obtain their release from the BOC and to register the vehicles with the LTO. Issue (under warranty): WON Petitioner is liable for warranty.YES Ruling(under warranty): It is true that the ownership of the trucks shifted to private respondent after the sale. But petitioner must remember that prior to its consummation it expressly intimated to her that it had already paid the taxes and customs duties. Such representation shall be considered as a sellers express warranty under Art. 1546 of the Civil Code which covers any affirmation of fact or any promise by the seller which induces the buyer to purchase the thing and actually purchases it relying on such affirmation or promise.

It includes all warranties which are derived from express language, whether the language is in the form of a promise or representation. Presumably, therefore, private respondent would not have purchased the two (2) Elf trucks were it not for petitioners assertion and assurance that all taxes on its imported parts were already settled. This express warranty was breached the moment petitioner refused to furnish private respondent with the corresponding receipts since such documents were the best evidence she could present to the government to prove that all BIR taxes and customs duties on the imported component parts were fully paid. Without evidence of payment, she was powerless to prevent the trucks from being impounded. Under Art. 1599 of the Civil Code, once an express warranty is breached the buyer can accept or keep the goods and maintain an action against the seller for damages. This was what private respondent did. She opted to keep the two (2) trucks which she apparently needed for her business and filed a complaint for damages, particularly seeking the reimbursement of the amount she paid to secure the release of her vehicles. Ruling(based on other arguments. For recit ): a. Customs Memorandum Order No. 44-87 is concerned with the Rules, Regulations and Procedures in the Payment of Duties and Taxes on Imported Vehicles Locally Assembled by Non-Assemblers. It does not charge any new tax. It simply provides the procedure on how owners/consignees or their purchasers could voluntarily initiate payment for any unpaid customs duties on locally assembled vehicles using imported component parts. Neither does BIR Revenue Memorandum Order No. 44-87[19] exact any tax. It merely outlines the procedure which governs the processing and issuance of the Certificate of Payment of internal revenue taxes for purposes of registering motor vehicles with the LTO. What Sec. 10, Art. III, of the Constitution prohibits is the passage of a law which enlarges, abridges or in any manner changes the intention of the contracting parties. The Memorandum Orders and the two (2) Memoranda of Agreement do not impose any additional taxes which would unduly impair the contract of sale between petitioner and private respondent. Instead, these administrative regulations were passed to enforce payment of existing BIR taxes and customs duties at the time of importation. b. although private respondent is the one required by the administrative regulations to secure the Certificate of Payment for the purpose of registration, petitioner as the importer and the assembler/manufacturer of the two (2) Elf trucks is still the one liable for payment of revenue taxes and customs duties. Petitioners obligation to pay does not arise from the administrative regulations but from the tax laws existing at the time of importation. Hence, even if private respondent already owned the two (2) trucks when the Memorandum Orders and Memoranda of Agreement took effect, the fact remains that petitioner was still the one duty-bound to pay for the BIR taxes and customs duties. It is also quite obvious that as between petitioner, who is the importer-assembler/manufacturer, and private respondent, who is merely the buyer, it is petitioner which has the obligation to pay taxes to the BIR and the BOC. c. Non-sequitur. The fact that petitioner was able to secure the release of the parts from customs and to register the assembled trucks with the LTO does not necessarily mean that all taxes and customs duties were legally settled. As a matter of fact, the provisions of the two (2) Memoranda of Agreement clearly establish that the government is aware of the widespread registration of assembled motor vehicles with the LTO even if the taxes due on their imported component parts remain unpaid. Paragraph 1 of the 10 September 1987 MOA states -

Das könnte Ihnen auch gefallen

- Sales Harrison Motors To Moles Vs IacDokument4 SeitenSales Harrison Motors To Moles Vs IacMariaAyraCelinaBatacanNoch keine Bewertungen

- Union Bank vs. Sps Tiu DigestDokument3 SeitenUnion Bank vs. Sps Tiu DigestCaitlin KintanarNoch keine Bewertungen

- Sehwani vs. In-N-Out BurgerDokument2 SeitenSehwani vs. In-N-Out BurgerEunice Panopio LopezNoch keine Bewertungen

- Mirant Vs CaroDokument1 SeiteMirant Vs CaroAce QuebalNoch keine Bewertungen

- Calimlim-Canullas vs. Hon. Willelmo FortunDokument2 SeitenCalimlim-Canullas vs. Hon. Willelmo FortunI.G. Mingo MulaNoch keine Bewertungen

- Sun Life v. Tan Kit - LOANDokument2 SeitenSun Life v. Tan Kit - LOANElca Javier100% (1)

- Stages in A Contract of Sale (Philippines)Dokument11 SeitenStages in A Contract of Sale (Philippines)Dianne MendozaNoch keine Bewertungen

- G.R. No. 214122Dokument6 SeitenG.R. No. 214122katNoch keine Bewertungen

- Universal International Investment V Ray Burton Dev CorpDokument1 SeiteUniversal International Investment V Ray Burton Dev CorpEmilio PahinaNoch keine Bewertungen

- Republic v. LittonDokument2 SeitenRepublic v. Littond2015memberNoch keine Bewertungen

- SM8 - Case 20 - JollibeeDokument10 SeitenSM8 - Case 20 - JollibeeTheresa UyNoch keine Bewertungen

- Clarin Vs Rulona G.R. No. L-30786Dokument2 SeitenClarin Vs Rulona G.R. No. L-30786Ferdinand UyNoch keine Bewertungen

- Domiciano A. Aguas vs. Conrado G. de Leon and CA DigestDokument2 SeitenDomiciano A. Aguas vs. Conrado G. de Leon and CA Digesttalla aldoverNoch keine Bewertungen

- LAW 3 03 - Handout - 1 PDFDokument12 SeitenLAW 3 03 - Handout - 1 PDFMelchie RepospoloNoch keine Bewertungen

- Sales Digest Batch 2Dokument6 SeitenSales Digest Batch 2Joannalyn Libo-onNoch keine Bewertungen

- Coca - Cola Bottlers, Phils., Inc. (CCBPI), Naga Plant v. Gomez and GaliciaDokument1 SeiteCoca - Cola Bottlers, Phils., Inc. (CCBPI), Naga Plant v. Gomez and GaliciaCheCheNoch keine Bewertungen

- Tupaz V CA and BPIDokument2 SeitenTupaz V CA and BPIjonbelzaNoch keine Bewertungen

- Puma vs. IACDokument2 SeitenPuma vs. IACEnzo RegondolaNoch keine Bewertungen

- GOODYEAR PHILIPPINES v. SyDokument5 SeitenGOODYEAR PHILIPPINES v. SyShiela MagnoNoch keine Bewertungen

- PNB V Rodriguez Case DigestDokument17 SeitenPNB V Rodriguez Case DigestYasha Min HNoch keine Bewertungen

- Mcdonald Vs MacjoyDokument12 SeitenMcdonald Vs MacjoyMike E DmNoch keine Bewertungen

- Instruction Learned:: Unsupervised by The Employer. Article 82 Which Defines Field Personnel. Hence, in Deciding WhetherDokument2 SeitenInstruction Learned:: Unsupervised by The Employer. Article 82 Which Defines Field Personnel. Hence, in Deciding WhetherKeithMounirNoch keine Bewertungen

- Southern Motors, Inc. v. Moscosco (G.R. No. L-14475, May 30, 1961)Dokument2 SeitenSouthern Motors, Inc. v. Moscosco (G.R. No. L-14475, May 30, 1961)Lorie Jean UdarbeNoch keine Bewertungen

- Lapitan v. Scandia (Nature of Coa Rescission)Dokument3 SeitenLapitan v. Scandia (Nature of Coa Rescission)alyssa_castillo_20Noch keine Bewertungen

- Harrison Vs NavarroDokument1 SeiteHarrison Vs NavarroCherry SormilloNoch keine Bewertungen

- Sales Finals Case DigestDokument33 SeitenSales Finals Case DigestJereca Ubando JubaNoch keine Bewertungen

- CSCST Vs MisterioDokument12 SeitenCSCST Vs MisterioLee SomarNoch keine Bewertungen

- Tanglao Vs ParungaoDokument3 SeitenTanglao Vs ParungaoKym Buena-Regado100% (1)

- The Role of Accountants in Nation Building Through TaxationDokument2 SeitenThe Role of Accountants in Nation Building Through TaxationJoshua Ryan CanatuanNoch keine Bewertungen

- PUP vs. GHRCDokument3 SeitenPUP vs. GHRCryan kiboshNoch keine Bewertungen

- Fin101 QuizDokument6 SeitenFin101 QuizAlan MakasiarNoch keine Bewertungen

- MIGHTY CORPORATION and LA CAMPANA FABRICA DE TABACODokument3 SeitenMIGHTY CORPORATION and LA CAMPANA FABRICA DE TABACOPhi SalvadorNoch keine Bewertungen

- Estanislao Vs CA - DigestDokument2 SeitenEstanislao Vs CA - DigestJohn Leo SolinapNoch keine Bewertungen

- 01 Dizon v. Gaborro, 83 SCRA 688 (1978)Dokument15 Seiten01 Dizon v. Gaborro, 83 SCRA 688 (1978)Marc VirtucioNoch keine Bewertungen

- Autozentrum Alabang, Inc. v. Spouses Bernardo, G.R. No. 214122, June 8, 2016Dokument14 SeitenAutozentrum Alabang, Inc. v. Spouses Bernardo, G.R. No. 214122, June 8, 2016Mak FranciscoNoch keine Bewertungen

- 66 Unilever Phil V CA and P&GDokument2 Seiten66 Unilever Phil V CA and P&GLee Sung YoungNoch keine Bewertungen

- Victorias Milling V Ong SuDokument2 SeitenVictorias Milling V Ong Suepic failNoch keine Bewertungen

- Cuanan V. People G.R. No. 181999 183001 SEPTEMBER 2, 2009 FactsDokument1 SeiteCuanan V. People G.R. No. 181999 183001 SEPTEMBER 2, 2009 FactsVener MargalloNoch keine Bewertungen

- The Heirs of The Vendee A Retro With Respect Only To Their Respective Shares, Whether The Thing Be Undivided or It HasDokument1 SeiteThe Heirs of The Vendee A Retro With Respect Only To Their Respective Shares, Whether The Thing Be Undivided or It HasCMLNoch keine Bewertungen

- Tomas KDokument11 SeitenTomas KMae BungabongNoch keine Bewertungen

- Phil Pharmawealth V Pfizer, Inc. and Pfizer (Phil.) Inc.Dokument3 SeitenPhil Pharmawealth V Pfizer, Inc. and Pfizer (Phil.) Inc.Celinka ChunNoch keine Bewertungen

- Handson CaseDokument5 SeitenHandson CaseNimra BalouchNoch keine Bewertungen

- Case Digest GuarantyDokument23 SeitenCase Digest GuarantyRachel AndreleeNoch keine Bewertungen

- Quiroga Vs Parsons Hardware 1918Dokument3 SeitenQuiroga Vs Parsons Hardware 1918kwikkwikNoch keine Bewertungen

- GalvezDokument1 SeiteGalvezellaNoch keine Bewertungen

- Chapter 5 General ProvisionDokument3 SeitenChapter 5 General ProvisionSteffany RoqueNoch keine Bewertungen

- Article 1911 and 2 Case DigestsDokument3 SeitenArticle 1911 and 2 Case DigestsBetNoch keine Bewertungen

- Petitioner vs. vs. Respondents: First DivisionDokument7 SeitenPetitioner vs. vs. Respondents: First DivisionKarl OdroniaNoch keine Bewertungen

- 79 NFF Industrial Corporation vs. G & L Associated BrokerageDokument1 Seite79 NFF Industrial Corporation vs. G & L Associated BrokerageJemNoch keine Bewertungen

- Section 23 Negotiable Instruments LawDokument5 SeitenSection 23 Negotiable Instruments LawJanneil Monica MoralesNoch keine Bewertungen

- Gsis Vs ManaloDokument1 SeiteGsis Vs ManaloKarl Marxcuz Reyes100% (1)

- 6 Contracts Consent 1 10Dokument84 Seiten6 Contracts Consent 1 10Louella JandaNoch keine Bewertungen

- CASE #110 Philippine Steel Coating Corp. vs. Eduard Quinones G.R. No. 194533, April 19, 2017 FactsDokument2 SeitenCASE #110 Philippine Steel Coating Corp. vs. Eduard Quinones G.R. No. 194533, April 19, 2017 FactsHarleneNoch keine Bewertungen

- Multiple Choice: Identify The Choice That Best Completes The Statement or Answers The QuestionDokument11 SeitenMultiple Choice: Identify The Choice That Best Completes The Statement or Answers The QuestionJinx Cyrus RodilloNoch keine Bewertungen

- ABS-CBN vs. Phil. Multi-Media SystemDokument2 SeitenABS-CBN vs. Phil. Multi-Media SystemVel June De LeonNoch keine Bewertungen

- Mr. Wee Sion Ben Vs SemexcoDokument3 SeitenMr. Wee Sion Ben Vs SemexcoAnthlyn PelesminoNoch keine Bewertungen

- Sehwani Inc vs. IN-N-OUT Burger IncDokument1 SeiteSehwani Inc vs. IN-N-OUT Burger IncAdrian Kit Osorio100% (1)

- Harrison Motors Corporation V Rachel A. NavarroDokument2 SeitenHarrison Motors Corporation V Rachel A. NavarroJohn YeungNoch keine Bewertungen

- Harrison Motors Corporation, Petitioner, vs. Rachel A. NAVARRO, RespondentDokument14 SeitenHarrison Motors Corporation, Petitioner, vs. Rachel A. NAVARRO, RespondentBelle FabeNoch keine Bewertungen

- 628 Harrison Motors Corp v. NavarroDokument1 Seite628 Harrison Motors Corp v. NavarroJulius ManaloNoch keine Bewertungen

- Affidavit of One and The Same Person EditedDokument4 SeitenAffidavit of One and The Same Person EditedNeill Matthew Addison Ortiz54% (13)

- The Cocktail Signifies Your Thirst To Learn and by That Thirst, Life Will Satisfy You With Not Just WhatDokument1 SeiteThe Cocktail Signifies Your Thirst To Learn and by That Thirst, Life Will Satisfy You With Not Just WhatPearl Angeli Quisido CanadaNoch keine Bewertungen

- Notice VacateDokument1 SeiteNotice VacatePearl Angeli Quisido CanadaNoch keine Bewertungen

- The Book of WitnessesDokument2 SeitenThe Book of WitnessesPearl Angeli Quisido CanadaNoch keine Bewertungen

- Workshop Risk Registry SampleDokument7 SeitenWorkshop Risk Registry SamplePearl Angeli Quisido CanadaNoch keine Bewertungen

- Copyright FormDokument2 SeitenCopyright FormbartpersNoch keine Bewertungen

- Guidelines Designation Supervision RA9593Dokument39 SeitenGuidelines Designation Supervision RA9593Pearl Angeli Quisido CanadaNoch keine Bewertungen

- General ProvisionsDokument14 SeitenGeneral ProvisionsPearl Angeli Quisido CanadaNoch keine Bewertungen

- 1stpage CorpocasesDokument55 Seiten1stpage CorpocasesPearl Angeli Quisido CanadaNoch keine Bewertungen

- Labor LawDokument36 SeitenLabor LawPearl Angeli Quisido CanadaNoch keine Bewertungen

- Late Registration of Live BirthDokument1 SeiteLate Registration of Live BirthPearl Angeli Quisido CanadaNoch keine Bewertungen

- Cases On ExtinguishmentDokument1 SeiteCases On ExtinguishmentPearl Angeli Quisido Canada0% (1)

- Credtrans QuizDokument3 SeitenCredtrans QuizPearl Angeli Quisido CanadaNoch keine Bewertungen

- RDO No. 82 - Cebu City SouthDokument109 SeitenRDO No. 82 - Cebu City SouthPearl Angeli Quisido Canada50% (2)

- Course Registration FormDokument1 SeiteCourse Registration FormJoma ManualNoch keine Bewertungen

- Individual Faculty Questionnaire - PaascuDokument4 SeitenIndividual Faculty Questionnaire - PaascuPearl Angeli Quisido CanadaNoch keine Bewertungen

- R.A. No. 4917Dokument1 SeiteR.A. No. 4917netortizNoch keine Bewertungen

- Sunday Monday Tuesday Wednesday Thursday Friday SaturdayDokument2 SeitenSunday Monday Tuesday Wednesday Thursday Friday SaturdayPearl Angeli Quisido CanadaNoch keine Bewertungen

- CDR ACR I-Card IssuanceDokument1 SeiteCDR ACR I-Card IssuancechachiNoch keine Bewertungen

- Taxation 1 TSN 1st ExamDokument39 SeitenTaxation 1 TSN 1st ExamPearl Angeli Quisido CanadaNoch keine Bewertungen

- Location PlanDokument2 SeitenLocation PlanPearl Angeli Quisido CanadaNoch keine Bewertungen

- PIL (Torreon)Dokument69 SeitenPIL (Torreon)Pearl Angeli Quisido CanadaNoch keine Bewertungen

- Pals Ethics 2015Dokument43 SeitenPals Ethics 2015Law School FilesNoch keine Bewertungen

- Law On Obligations and Contracts 2 Quiz - BSBA June 22, 2017Dokument1 SeiteLaw On Obligations and Contracts 2 Quiz - BSBA June 22, 2017Pearl Angeli Quisido CanadaNoch keine Bewertungen

- If You Are Too Lazy To PlowDokument2 SeitenIf You Are Too Lazy To PlowPearl Angeli Quisido CanadaNoch keine Bewertungen

- Obli ART 1232Dokument44 SeitenObli ART 1232Pearl Angeli Quisido CanadaNoch keine Bewertungen

- 2015 Download Cover For RegistrationDokument1 Seite2015 Download Cover For RegistrationRegina MuellerNoch keine Bewertungen

- 5th God BrochureDokument6 Seiten5th God BrochurePearl Angeli Quisido CanadaNoch keine Bewertungen

- LEGETH Case DigestsDokument8 SeitenLEGETH Case DigestsPearl Angeli Quisido CanadaNoch keine Bewertungen

- 2006-2015 J.velascoDokument78 Seiten2006-2015 J.velascoPearl Angeli Quisido CanadaNoch keine Bewertungen

- YASHDokument15 SeitenYASHyashNoch keine Bewertungen

- Financial Accounting & Managerial Accounting ComparedDokument4 SeitenFinancial Accounting & Managerial Accounting Comparedellehcim0017100% (1)

- OD328636244353646100Dokument3 SeitenOD328636244353646100ankit ojhaNoch keine Bewertungen

- Chapter 1 Answer KeyDokument18 SeitenChapter 1 Answer KeyZohaib SiddiqueNoch keine Bewertungen

- DVFA Scorecard For German Corporate GovernanceDokument7 SeitenDVFA Scorecard For German Corporate GovernanceVinayNoch keine Bewertungen

- PSM Auditing (Presentation)Dokument25 SeitenPSM Auditing (Presentation)kanakarao1100% (1)

- MARICAR MAQUIMOT TechnopreneurshipDokument58 SeitenMARICAR MAQUIMOT TechnopreneurshipMaricar MaquimotNoch keine Bewertungen

- Information Resource ManagementDokument39 SeitenInformation Resource ManagementHiko Saba100% (1)

- MoaDokument5 SeitenMoaRaghvirNoch keine Bewertungen

- Final Project Ratio AnalysisDokument60 SeitenFinal Project Ratio AnalysissatishgwNoch keine Bewertungen

- Chinese Accounting VocabDokument3 SeitenChinese Accounting Vocabzsuzsaprivate7365100% (1)

- Insurance Notes For MidtermsDokument29 SeitenInsurance Notes For MidtermsAnne Lorraine Pongos CoNoch keine Bewertungen

- Case: Valdes vs. RTC, G.R. No. 122749. July 31, 1996facts:: Carino V. CarinoDokument10 SeitenCase: Valdes vs. RTC, G.R. No. 122749. July 31, 1996facts:: Carino V. CarinoArgel Joseph CosmeNoch keine Bewertungen

- Application For Obtaining Mutation/Transefer of PropertyDokument2 SeitenApplication For Obtaining Mutation/Transefer of Propertym rajmohanraoNoch keine Bewertungen

- IA GuidelinesDokument23 SeitenIA GuidelinesNguyen Vu DuyNoch keine Bewertungen

- Dr. Myo Min Oo: Ph.D. (New Orleans), D.Min. (Indiana), M.S.B. (Notre Dame)Dokument28 SeitenDr. Myo Min Oo: Ph.D. (New Orleans), D.Min. (Indiana), M.S.B. (Notre Dame)Marlar ShweNoch keine Bewertungen

- Wilson - Lowi - Policy Types - FinalDokument40 SeitenWilson - Lowi - Policy Types - FinalHiroaki OmuraNoch keine Bewertungen

- Market Beats PPT 18.11.11Dokument49 SeitenMarket Beats PPT 18.11.11Sheetal ShelkeNoch keine Bewertungen

- Invoicing 110 v12 - 2Dokument46 SeitenInvoicing 110 v12 - 2Tamizharasan JNoch keine Bewertungen

- Pranoy Mazumdar - ResumeDokument3 SeitenPranoy Mazumdar - ResumePranoy MazumdarNoch keine Bewertungen

- Capital Budgeting Decision Criteria: 2002, Prentice Hall, IncDokument59 SeitenCapital Budgeting Decision Criteria: 2002, Prentice Hall, IncMarselinus Aditya Hartanto TjungadiNoch keine Bewertungen

- Application of Demand and SupplyDokument60 SeitenApplication of Demand and SupplyJody Singco CangrejoNoch keine Bewertungen

- Symbion, Inc. Sued For Anti-Kickback Whistleblower Retaliation!Dokument58 SeitenSymbion, Inc. Sued For Anti-Kickback Whistleblower Retaliation!Mark Anchor AlbertNoch keine Bewertungen

- Answers To Assignment 1 and Problem Exercises Taxation2Dokument4 SeitenAnswers To Assignment 1 and Problem Exercises Taxation2Dexanne BulanNoch keine Bewertungen

- Swot Analysis: StrengthDokument4 SeitenSwot Analysis: StrengthYee 八婆50% (2)

- Swot Analysis R&D: NPD Stages and ExplanationDokument3 SeitenSwot Analysis R&D: NPD Stages and ExplanationHarshdeep BhatiaNoch keine Bewertungen

- Rencana Bisnis Art Box Creative and Coworking SpaceDokument2 SeitenRencana Bisnis Art Box Creative and Coworking SpacesupadiNoch keine Bewertungen

- Fabio Penuela ResumeDokument5 SeitenFabio Penuela Resumedayro herreraNoch keine Bewertungen

- Appendix 4A: Net Present Value: First Principles of FinanceDokument14 SeitenAppendix 4A: Net Present Value: First Principles of FinanceQuynh NguyenNoch keine Bewertungen

- Concept Paper On GD & PIDokument9 SeitenConcept Paper On GD & PIjigishhaNoch keine Bewertungen