Beruflich Dokumente

Kultur Dokumente

Form - 13-14

Hochgeladen von

Morgan ThomasOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Form - 13-14

Hochgeladen von

Morgan ThomasCopyright:

Verfügbare Formate

Investment Declaration Form for FY

S.NO. 1 Rent Paid / Payable for: April 2013 May 2013 June 2013 July 2013 August 2013 September 2013 October 2013 November 2013 December 2013 January 2014 February 2014 March 2014 TOTAL S.NO.

PARTICULARS

PARTICULARS Interest on Housing Loan u/s 24 (If the house is self occupied and the loan was taken before April 1999). Bankers Certificate to be submitted Interest on Housing Loan u/s 24 (If the house is self occupied and the loan was taken on or after April 1999). Bankers Certificate to be submitted

Interest on Housing Loan u/s 24 (Let out/ Deemed to be let out) Bankers Certificate to be submitted [if the property is LET OUT - Rental Income need to be specified] S.NO. PARTICULARS 3 Medical Allowance

Sec 80D (Medi Claim Policy & Preventive health check up)

Sec 80DD (Maintenance including Medical treatment of dependant person with disability)

Sec 80DDB (Medical treatment for specified diseases or ailments) - Self / Dependents

Sec 80E (Education Loan)

Sec 80U (For person with a disability)

S.NO.

PARTICULARS

9 10 11 12 13 14 15 16 17 18 19 20 21 22

Life Insurance Premium Public Provident Fund (PPF) Voluntary Provident Fund (VPF) Pension Fund Contribution National Savings Certificate (NSC) Interest Accrued on NSC (Reinvested) Unit Linked Insurance Policy (ULIP) Equity Linked Savings Schemes (ELSS) - Mutual Funds Payment of Tuition fees for Children (Max 2 Children) Principal repayment of Housing Loan Registration charges incurred for Buying House (I year Only) Infrastructure Bonds Bank Fixed Deposit for 5 Years & above Post office Term Deposit for 5years & above TOTAL

S.NO. 23

PARTICULARS a) Interest Income from Savings A.c (Banks & Post office only) b)

c) d) S.NO. 24 PARTICULARS

Income From Previous Employer (Joined after 01/04/2013) a) Income after exemptions b) Provident Fund (PF) c) Professional Tax (PT) d) Tax deducted at source (TDS) I here by declare that Information as stated above is true and correct . I also authorize the company to recover tax (TDS

proceedings for any misstatements in the declaration or proofs submitted herewith if they are inconsistent with the requirem

Date: Place:

a) Date of actual possession of property [which can be validated by 'Possession Certificate' issued by builder/municipal authorities etc.] b) Amortisation of pre-construction period interest (if any) incurred [which needs to be considered during Current FY 2013 - 14]

c) Information towards the House Property (LET OUT ) - In case of more than 1 Let out House Prop % of Owner Ship House Property i) House Property 1 ii) House Property 2 iii) House Property 3 iv) House Property 4

Guidelines to FILL

1. Metro CityMumbai / Delhi / Calcutta / Chennai 2. Non MetroAll City Other Cities 3. Please fill in and submit the same along with the Supporting documents 4. All the HRA Bills / Medical Bills / LTA Bills / Provisional Loan Certificate for House from Banker - should be ORIGINAL

5. Provisional Loan Certificate for House from Banker - should be submitted in respect All the properties declared by employee in the above table

6. As per the provisions of the Income Tax Act 1961 - HRA Exemption will not be provided, if the Employee is staying at his SELF OCCUPIED House Property [if the Employee has claimed BOTH HRA & Interest on Self Occupied HP - For Tax Declaration ONLY one among them will be considered] 7. In case of Self Occupied / Let Out House Property the Employee has to mention the "Interest on Housing Loan" / "Principal repaid Amount" Please mention - Full amount of "Interest" / "Principal" along with the % of Owner ship

Form for FY 2013-14

Remarks

Amount declared by you in the Declaration form AMOUNT RS.

Metro Metro Metro

Please Fill in (Metro / Non Metro)

Please enter your Monthly Rent details as per the Rent Receipt / Lease Deed. Note:If the Employee is paying the rent below Rs.3000/per month, he/she need not furnish the Rent Receipts (Circular No:8/2007 Dt: 05.Dec.2007).

Metro Metro Metro Metro Metro Metro Metro Metro Metro

0

MAXIMUM LIMIT (RS.) Upto Rs. 30000/(If Self Occupied) AMOUNT RS. REMARKS

Provisional Certificate issued by the Banker showing the Interest Part

Max Limit - Rs. 1,50,000/(If Self Occupied)

Provisional Certificate issued by the Banker showing the Interest Part Rental Income for the Period April 2013 - March 2013 Municipal Taxes PAID by the owner (employee) during the financial year Medical expenses incurred for family: (Family includes spouse, children and dependent

- No Limit (If Let Out) MAXIMUM LIMIT (RS.) Rs.15,000/- per annum AMOUNT RS.

REMARKS

Medical Insurance Premium PAID by Employee: - on the health of employee, spouse, and dependent children. [Rs.20,000/- In case employee is a Senior Citizen] (i.e., 60 years or more). Payment made by an employee for preventive health check-up of self, spouse, dependent children during the financial year is eligible for maximum deduction of Rs 5000. Note: The amount paid is within the overall limits ( Rs. 15000/Rs. 20000).

Rs. 15,000/- (or) Rs.20,000/-

Additional Amount of Rs.15,000/Medical Insurance Premium PAID by Employee on the

health of parents (even not dependent on employee) . [Rs.20,000/- In the case parents are Senior Citizen]i.e., 60 years or more

Rs. 15,000/- (or) Rs.20,000/-

payment made by an employee for preventive health check-up of parents during the financial year is eligible for maximum deduction of Rs 5000. Note: The amount paid is within the overall limits ( Rs. 15000/Rs. 20000). Here Employee gets fixed amount of deduction. If employee has incurred any expenditure / deposited in

Rs. 50,000/- (Rs.1,00,000/- for Severe disability)

Rs. 40,000/(Rs. 60,000/- for Senior Citizen )

Here Employee gets deduction: Lower of the following: i). Amount incurred or ii). Rs.40,000/- (or Rs.60,000/- if expenses incurred for senior citizen i.e,60 years or more ) (Form 10-I obtained from Medical Authority has to be submitted) Interest on Loan taken for Higher Education: Amount paid by employee during the financial year on loan taken for higher education of - Employee, spouse or children of employee or students for whom employee is a legal guardian Benefit Period: Current Period + Next 7 years Here Employee gets fixed amount of deduction. (Form 10-IA obtained from

No limit (only Interest Portion)

Rs.50,000/- (Rs.1,00,000/- for Severe disability) Amount declared by you in the Declaration form AMOUNT Rs.

MAX BENEFIT PERMISSIBLE (RS.)

REMARKS

Self , Spouse & Children only Self , Spouse & Children only will be additionally deducted from salary Self only Self only Self only Self , Spouse & Children only Self only Two children only Self & Joint a/c holder Self only Self only Self only Self only

Maximum amount eligible for Deduction under section 80C & 80CCC Categories is Rs.1,00,000/-

AMOUNT

AMOUNT

Form 16 or Tax computation from previous employer should be furnished

any to recover tax (TDS) from my salary based on the PROOFS Submitted by me. I am personally liable to Income Tax

sistent with the requirement of Income Tax Act, 1961.

Signature of the Employee

horities etc.] (Amount)

Let out House Property Rental Income Per Annum Muncipal Taxes Per Principal portion paid Annum in the Financial Year

n the above table

LF OCCUPIED House Property

epaid Amount"

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Dan Simon 2016 W2 PDFDokument2 SeitenDan Simon 2016 W2 PDFAnonymous ndTTXL80MnNoch keine Bewertungen

- Radical America - Vol 15 No 5 - 1981 - September OctoberDokument80 SeitenRadical America - Vol 15 No 5 - 1981 - September OctoberIsaacSilverNoch keine Bewertungen

- AICPA Released Questions REG 2015 ModerateDokument21 SeitenAICPA Released Questions REG 2015 ModerateKhalil JacksonNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Excel Spreadsheet For Mergers and Acquisitions ValuationDokument6 SeitenExcel Spreadsheet For Mergers and Acquisitions Valuationisomiddinov100% (2)

- Midterm Exam-Adjusting EntriesDokument5 SeitenMidterm Exam-Adjusting EntriesHassanhor Guro BacolodNoch keine Bewertungen

- Independent Contractor ApplicationDokument4 SeitenIndependent Contractor Applicationamir.workNoch keine Bewertungen

- Accounting Multiple Choice Questions ExplainedDokument10 SeitenAccounting Multiple Choice Questions ExplainedSarannya PillaiNoch keine Bewertungen

- Multiple Choice Questions AccountsDokument3 SeitenMultiple Choice Questions AccountsSanchit Taksali0% (1)

- Deposit Confirmation/Renewal AdviceDokument1 SeiteDeposit Confirmation/Renewal Advicedeepak pandeyNoch keine Bewertungen

- Feeling Good: If That Wouldn't Be Too Much TroubleDokument1 SeiteFeeling Good: If That Wouldn't Be Too Much TroubleMorgan ThomasNoch keine Bewertungen

- #Ffi% Q (Dokument40 Seiten#Ffi% Q (Morgan ThomasNoch keine Bewertungen

- Birthday Special: Funniest Rajnikanth Jokes (TOP 15)Dokument1 SeiteBirthday Special: Funniest Rajnikanth Jokes (TOP 15)Morgan ThomasNoch keine Bewertungen

- Shri Guru Charan SaroojaDokument7 SeitenShri Guru Charan SaroojaMorgan ThomasNoch keine Bewertungen

- Sai AshtotharamDokument8 SeitenSai AshtotharamMorgan ThomasNoch keine Bewertungen

- Feeling Good: Playboy of Puerto BanusDokument1 SeiteFeeling Good: Playboy of Puerto BanusMorgan ThomasNoch keine Bewertungen

- Feeling Good: If That Wouldn't Be Too Much TroubleDokument1 SeiteFeeling Good: If That Wouldn't Be Too Much TroubleMorgan ThomasNoch keine Bewertungen

- Kaala Bhairav AshtakamDokument4 SeitenKaala Bhairav AshtakamMorgan ThomasNoch keine Bewertungen

- Feeling Good: If That Wouldn't Be Too Much TroubleDokument1 SeiteFeeling Good: If That Wouldn't Be Too Much TroubleMorgan ThomasNoch keine Bewertungen

- Archu Poultry FarmDokument1 SeiteArchu Poultry FarmMorgan ThomasNoch keine Bewertungen

- Feeling Good: Eng PhrasesDokument1 SeiteFeeling Good: Eng PhrasesMorgan ThomasNoch keine Bewertungen

- Feeling Good: Eng PhrasesDokument1 SeiteFeeling Good: Eng PhrasesMorgan ThomasNoch keine Bewertungen

- Techniques in EltDokument70 SeitenTechniques in EltMorgan ThomasNoch keine Bewertungen

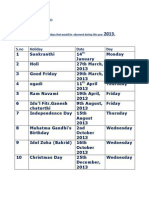

- Holidays 2013Dokument2 SeitenHolidays 2013Morgan ThomasNoch keine Bewertungen

- Holidays 2013Dokument2 SeitenHolidays 2013Morgan ThomasNoch keine Bewertungen

- Circular - List of Holidays - 2013Dokument1 SeiteCircular - List of Holidays - 2013Morgan ThomasNoch keine Bewertungen

- Focus On AnalysisDokument1 SeiteFocus On AnalysisMorgan ThomasNoch keine Bewertungen

- Holidays 2013Dokument2 SeitenHolidays 2013Morgan ThomasNoch keine Bewertungen

- Focus On AnalysisDokument10 SeitenFocus On AnalysisMorgan ThomasNoch keine Bewertungen

- Focus On AnalysisDokument16 SeitenFocus On AnalysisMorgan ThomasNoch keine Bewertungen

- Focus On AnalysisDokument18 SeitenFocus On AnalysisMorgan ThomasNoch keine Bewertungen

- Focus On AnalysisDokument3 SeitenFocus On AnalysisMorgan ThomasNoch keine Bewertungen

- Focus On AnalysisDokument1 SeiteFocus On AnalysisMorgan ThomasNoch keine Bewertungen

- Focus On AnalysisDokument14 SeitenFocus On AnalysisMorgan ThomasNoch keine Bewertungen

- Focus On AnalysisDokument9 SeitenFocus On AnalysisMorgan ThomasNoch keine Bewertungen

- Focus On AnalysisDokument5 SeitenFocus On AnalysisMorgan ThomasNoch keine Bewertungen

- Focus On AnalysisDokument6 SeitenFocus On AnalysisMorgan ThomasNoch keine Bewertungen

- Storyboarding 101: Turning Concepts Into Visual FormsDokument1 SeiteStoryboarding 101: Turning Concepts Into Visual FormsMorgan ThomasNoch keine Bewertungen

- Focus On AnalysisDokument1 SeiteFocus On AnalysisMorgan ThomasNoch keine Bewertungen

- Commissioner of Internal Revenue vs. ST Luke's Medical CenterDokument1 SeiteCommissioner of Internal Revenue vs. ST Luke's Medical CenterTJ Dasalla GallardoNoch keine Bewertungen

- Google 10k 2015Dokument3 SeitenGoogle 10k 2015EliasNoch keine Bewertungen

- Tax Revenue Performance in KenyaDokument47 SeitenTax Revenue Performance in KenyaMwangi MburuNoch keine Bewertungen

- ACC 105 SyllabusDokument2 SeitenACC 105 Syllabusnaamsagar2019Noch keine Bewertungen

- CintholDokument3 SeitenCintholSarvesh SharmaNoch keine Bewertungen

- Chapter 17Dokument10 SeitenChapter 17Neriza maningasNoch keine Bewertungen

- DCP Financial AccountingDokument9 SeitenDCP Financial AccountingIntekhab AslamNoch keine Bewertungen

- Date: 27th December 2018 Emp ID: ESMA-14922 Mr. S N Sathish Kumar S/o MR Narayanappa K MDokument6 SeitenDate: 27th December 2018 Emp ID: ESMA-14922 Mr. S N Sathish Kumar S/o MR Narayanappa K MPradeep GowdaNoch keine Bewertungen

- 5 10 12a 6ADokument12 Seiten5 10 12a 6AVidya1986Noch keine Bewertungen

- Direct Tax Laws & International Taxation Mock Test Paper SeriesDokument11 SeitenDirect Tax Laws & International Taxation Mock Test Paper SeriesDeepsikha maitiNoch keine Bewertungen

- Acc. 101-True or False and IdentificationDokument9 SeitenAcc. 101-True or False and IdentificationAuroraNoch keine Bewertungen

- Ak 1991884221-1560333289 PDFDokument1 SeiteAk 1991884221-1560333289 PDFKuchibhotla Madhava SastryNoch keine Bewertungen

- List of Ledger AccountDokument4 SeitenList of Ledger AccountAnanthvasanthaNoch keine Bewertungen

- Chapter 1Dokument24 SeitenChapter 1Nayan Kc100% (1)

- Business Plan For The LAUSD's Aviation Branch of The North Valley Service Area of SchoolsDokument2 SeitenBusiness Plan For The LAUSD's Aviation Branch of The North Valley Service Area of SchoolsLos Angeles Daily NewsNoch keine Bewertungen

- Aptitude 1Dokument12 SeitenAptitude 1Sathishkumar PalanippanNoch keine Bewertungen

- Cre8 Corp's Organizational StructureDokument5 SeitenCre8 Corp's Organizational StructureJhobelle JovellanoNoch keine Bewertungen

- Tanzania Revenue Authority: Institute of Tax Administration PGDT ExecutivesDokument33 SeitenTanzania Revenue Authority: Institute of Tax Administration PGDT ExecutivesMoud KhalfaniNoch keine Bewertungen

- ACCT 100-Principles of Financial Accounting - Atifa Dar - Omair HaroonDokument7 SeitenACCT 100-Principles of Financial Accounting - Atifa Dar - Omair HaroonAbdelmonim Awad OsmanNoch keine Bewertungen

- Slice and DiceDokument153 SeitenSlice and Dicejunohcu310Noch keine Bewertungen