Beruflich Dokumente

Kultur Dokumente

'09, March, at Loan Process

Hochgeladen von

sean_obrien9369Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

'09, March, at Loan Process

Hochgeladen von

sean_obrien9369Copyright:

Verfügbare Formate

State of Alaska, Department of Labor and Workforce Development

Division of Vocational Rehabilitation (DVR)

Assistive Technology Loan Fund

The AT Loan Fund was established to help improve the quality of life for

individuals with disabilities through a flexible loan option program that allows them

to purchase needed Assistive Technology (AT) to improve independence and

productivity which will decrease the need for public support. This option may

allow the customer to access a lower interest rate and/or longer term repayment

timelines based on their individual needs. Each loan recipient is legally obligated

to pay their loan back per the signed loan documentation. The State guarantees

90% of this loan while the commercial bank covers the remaining 10% guarantee.

A. Guidelines

• Maximum loan amount is $40,000

• Minimum loan amount is $2,500

• Interest Rate on AT loans is set with the maximum rate based on the

published Wall Street Journal Prime rate. The minimum rate depends

on the final approval of interest buy-down requests as noted above. The

rate is established on a case by case basis with the initial

recommendation made by the lending institution (Northrim Bank) and

reviewed and approved by the AT Loan Fund representative Sean

O’Brien at DVR).

• Qualified consumer may obtain a second loan from fund provided that

the existing loan is in good standing and the total of the two loans does

not exceed the maximum allowable loan amount.

B. Eligibility

• Must be a person with a disability, their representative(s) or parent

• Must be used to purchase Assistive Technology (AT) such as, but

not limited to vehicle modifications, housing modifications, durable

medical equipment, off the shelf customized products that improve

the quality of life for individual with disabilities

• Loans to purchase vehicles are not allowed

• For a loan to modify a vehicle to provide transportation for a person

with a disability, the applicant must have been employed for at least

ninety (90) days immediately preceding the date of the loan

application.

• Must be demonstrated that the AT requested has the potential to

improve that individual’s quality of life, independence, or ability to

function productively.

• Must work with other funding sources to ensure that the funding for

AT is not available through less expensive means before applying to

the AT Loan Fund for a loan. This includes funding through other

agencies or programs or eligibility for a conventional consumer loan,

notwithstanding extenuating factors.

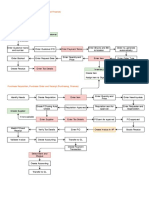

C. AT Loan Process

• The loan applicant and/or their legal representative contacts the DVR

representative for verification that individual or representative(s) is

eligible for the AT Loan Program. If they qualify, the DVR representative

notifies the participating Bank of the qualification.

• After the Bank receives the approval to proceed, Northrim will mail out

the Consumer Credit Application along with a self stamped envelope.

The completed application can then be mailed back or faxed back to

(907) 263 3219.

• Bank will underwrite received application and make a recommendation

to approve or decline based on AT Loan Fund Guidelines. Bank will

contact the AT Loan representative to discuss recommended decision.

• If declined, Bank will send out the Notice of Decline letter to borrower(s)

• If approved, the Bank and AT representative will determine the

appropriate rate and term based on individual needs and determine if

the request warrants a interest buy down consideration

• Bank will produce loan documents for approved request and

borrower(s) would sign the documentation at the most convenient

Northrim Bank Branch location. If there is not a convenient Northrim

Bank Branch, Loan can be completed using US Postal Service but

documents would require a notary for verification of signature.

• Bank to provide Payment coupons to cover installment schedule for

loan

• Bank to collect and process all payments from borrower(s)

• Approved Loan reported to the Credit Bureau

• If account reaches a past due status, Bank to send late notices and

make collection calls according to established guidelines

• Provide quarterly reporting to the State of Alaska on total amount

loaned, payments received and any delinquent accounts.

CONTACTS:

Assistive Technology Loan Fund

Sean O’Brien; e-mail: sean.obrien@alaska.gov

801 W. 10th St., Suite A

Juneau, Alaska 99801

1-800-478-2815 (toll free)

(907) 465-6969, fax: (907) 465-2856

Northrim Bank Contact:

Angela Freeman

2709 Spenard Road

P.O. Box 241489

Anchorage, Alaska 99524-1489

(907) 261-6206

(updated 03/12/09, SKO)

Das könnte Ihnen auch gefallen

- Consumer FinanceDokument36 SeitenConsumer FinanceAditya0% (1)

- Chapter 11 PDFDokument57 SeitenChapter 11 PDFswapnil kaleNoch keine Bewertungen

- Dashka Zulfiqar 18910 Fasiha Sagheer 18911Dokument5 SeitenDashka Zulfiqar 18910 Fasiha Sagheer 18911samreenNoch keine Bewertungen

- WITS Presentation - Avitha Nofal 11 November 2021Dokument29 SeitenWITS Presentation - Avitha Nofal 11 November 2021aviNoch keine Bewertungen

- Pre Sanction AppraisalDokument8 SeitenPre Sanction Appraisalpiyush kumar nandaNoch keine Bewertungen

- Description of Action TakenDokument2 SeitenDescription of Action TakenStephanie Lynn HitchcockNoch keine Bewertungen

- Chapter 6 Credit AnalysisDokument30 SeitenChapter 6 Credit AnalysisAngelie InducilNoch keine Bewertungen

- Money Matters.Dokument8 SeitenMoney Matters.Zuko NdodanaNoch keine Bewertungen

- Lecture # 20 Branch Banking in PakistanDokument55 SeitenLecture # 20 Branch Banking in PakistanImran YousafNoch keine Bewertungen

- Ypothecation OF Ovable Achinery Letter OF Credit Packing CreditDokument38 SeitenYpothecation OF Ovable Achinery Letter OF Credit Packing Creditdiksha_motwaniNoch keine Bewertungen

- CCC NotesDokument8 SeitenCCC NotesElla MendresNoch keine Bewertungen

- Terms and Conditions Personal Loan 1710164964727Dokument7 SeitenTerms and Conditions Personal Loan 1710164964727THENDRAL 05Noch keine Bewertungen

- Mitc-Sbi Skill Loan - Aug 2018 - 1Dokument1 SeiteMitc-Sbi Skill Loan - Aug 2018 - 1Aaquib KudchikarNoch keine Bewertungen

- Nderstanding AR Inancing: U F Y CDokument4 SeitenNderstanding AR Inancing: U F Y Ccalirican15Noch keine Bewertungen

- Loan PolicyDokument5 SeitenLoan PolicySoumya BanerjeeNoch keine Bewertungen

- File 319334Dokument23 SeitenFile 319334louise carinoNoch keine Bewertungen

- Print DocumentDokument2 SeitenPrint DocumentNakiel RoweNoch keine Bewertungen

- Letter of Credit Negotiation: Nazmul Karim, CDCSDokument7 SeitenLetter of Credit Negotiation: Nazmul Karim, CDCSNazmul KarimNoch keine Bewertungen

- Adverse Action NoticeDokument2 SeitenAdverse Action NoticeRohan DuncanNoch keine Bewertungen

- Personal Finance RisksDokument2 SeitenPersonal Finance RisksShoeb MohammedNoch keine Bewertungen

- Approval in PrincipalDokument2 SeitenApproval in PrincipalYang LiuNoch keine Bewertungen

- FNMNGT 3 Chapter 9 Credit ApplicationDokument18 SeitenFNMNGT 3 Chapter 9 Credit ApplicationArlyn BautistaNoch keine Bewertungen

- Ebl OriginalDokument18 SeitenEbl OriginalPushpa BaruaNoch keine Bewertungen

- A Study On Credit Management at District CoDokument86 SeitenA Study On Credit Management at District CoIMAM JAVOOR100% (2)

- Financing Residential PropertiesDokument27 SeitenFinancing Residential PropertiesShuYunNoch keine Bewertungen

- CreditmanagementDokument13 SeitenCreditmanagementArafatAdilNoch keine Bewertungen

- Monetary CreditDokument31 SeitenMonetary Creditmartin ngipolNoch keine Bewertungen

- Terms and Conditions Personal Loan 1687845092306Dokument7 SeitenTerms and Conditions Personal Loan 1687845092306vishal kademaniNoch keine Bewertungen

- Remote Mortgage Underwriter - Indecomm Global ServicesDokument2 SeitenRemote Mortgage Underwriter - Indecomm Global ServicesDaniel Sands0% (1)

- Credit and Collections Policy PDF FreeDokument7 SeitenCredit and Collections Policy PDF Freenevena.stankovic986Noch keine Bewertungen

- PDF DocumentDokument2 SeitenPDF DocumentSteven KellyNoch keine Bewertungen

- Application of UCP 600Dokument14 SeitenApplication of UCP 600Sudershan ThaibaNoch keine Bewertungen

- Manager, ICICI Bank V Prakash Kaur and OrsDokument10 SeitenManager, ICICI Bank V Prakash Kaur and Orsarunav_guha_royroyNoch keine Bewertungen

- Welcome Letter 33875975Dokument3 SeitenWelcome Letter 33875975Raj KumarNoch keine Bewertungen

- Credit Ombud. Presentation To FSCA CED. 19 July 2021Dokument38 SeitenCredit Ombud. Presentation To FSCA CED. 19 July 2021aviNoch keine Bewertungen

- Terms and Condition Personal LoanDokument1 SeiteTerms and Condition Personal LoanSasmita PanigrahyNoch keine Bewertungen

- Banking Assignment FinalDokument12 SeitenBanking Assignment FinalNazmul HaqueNoch keine Bewertungen

- Terms and Conditions Personal Loan 1694167502237Dokument9 SeitenTerms and Conditions Personal Loan 1694167502237LAXMIDHAR BEHERANoch keine Bewertungen

- IDFC FIRST Bank Limited (Formerly IDFC Bank Limited)Dokument7 SeitenIDFC FIRST Bank Limited (Formerly IDFC Bank Limited)Sarath KumarNoch keine Bewertungen

- Lesson 3 - Credit ProcessDokument6 SeitenLesson 3 - Credit ProcessRachel Ann RazonableNoch keine Bewertungen

- DisclosureDokument4 SeitenDisclosurejohnmanueldevopsNoch keine Bewertungen

- Credit CommitteeDokument4 SeitenCredit CommitteeNiel BearNoch keine Bewertungen

- 803 20200218 111928 PDFDokument7 Seiten803 20200218 111928 PDFlaxmangosavi100% (1)

- Crédit À La ConsoDokument23 SeitenCrédit À La ConsoNhật Minh Nguyễn ĐặngNoch keine Bewertungen

- Welcome Letter 131706428Dokument3 SeitenWelcome Letter 131706428rupesh.gunjan90823Noch keine Bewertungen

- 08 Chapter-02Dokument35 Seiten08 Chapter-02Manoj ValaNoch keine Bewertungen

- Unit-6: Commercial & Industrial LendingDokument28 SeitenUnit-6: Commercial & Industrial LendingRaaz Key Run ChhatkuliNoch keine Bewertungen

- IDFC FIRST Bank Limited (Formerly IDFC Bank Limited)Dokument7 SeitenIDFC FIRST Bank Limited (Formerly IDFC Bank Limited)Sarath KumarNoch keine Bewertungen

- Unit III MBF22408T Credit Risk and Recovery ManagementDokument22 SeitenUnit III MBF22408T Credit Risk and Recovery ManagementSheetal DwevediNoch keine Bewertungen

- Chapter 18Dokument4 SeitenChapter 18Alex GuNoch keine Bewertungen

- Credit Terms and Conditions: Interest RatesDokument11 SeitenCredit Terms and Conditions: Interest RatesMounicha AmbayecNoch keine Bewertungen

- Mortgage Loans in IndiaDokument11 SeitenMortgage Loans in IndiaDebobrata MajumdarNoch keine Bewertungen

- Loan Management PolicyDokument11 SeitenLoan Management Policyvinayak_cNoch keine Bewertungen

- Consumer Credit 2021Dokument2 SeitenConsumer Credit 2021Finn KevinNoch keine Bewertungen

- Adverse Action NoticeDokument2 SeitenAdverse Action Noticemazeo2023Noch keine Bewertungen

- Chapter 4 - Consumer CreditDokument35 SeitenChapter 4 - Consumer CredithaziqNoch keine Bewertungen

- University Courtyard Apartments Rental CriteriaDokument2 SeitenUniversity Courtyard Apartments Rental CriteriaAce Of SpadesNoch keine Bewertungen

- Loan Policy 1Dokument13 SeitenLoan Policy 1Vijay GangwaniNoch keine Bewertungen

- Case Study On Letter of CreditDokument9 SeitenCase Study On Letter of CreditPrahant KumarNoch keine Bewertungen

- Chapter - 1 An Introduction To Indian Banking SystemDokument27 SeitenChapter - 1 An Introduction To Indian Banking Systemprasad pawleNoch keine Bewertungen

- Kfs Credit CardsDokument4 SeitenKfs Credit CardsVijayakumar C SNoch keine Bewertungen

- Lantana Reno (12.29.22)Dokument9 SeitenLantana Reno (12.29.22)anne kristine restonNoch keine Bewertungen

- Executive Summary: Chapter-1Dokument68 SeitenExecutive Summary: Chapter-1Satish PenumarthiNoch keine Bewertungen

- CSEC Tourism QuestionDokument2 SeitenCSEC Tourism QuestionJohn-Paul Mollineaux0% (1)

- Make Up Exam 2022-2023Dokument3 SeitenMake Up Exam 2022-2023Donia RidaneNoch keine Bewertungen

- Fabm1 q3 Mod7 Journalizing FinalDokument32 SeitenFabm1 q3 Mod7 Journalizing FinalAdonis Zoleta Aranillo88% (8)

- Mcis - GSCDokument1 SeiteMcis - GSCPachaippan PachaiNoch keine Bewertungen

- Urban MobilityDokument2 SeitenUrban MobilityHafiey EyzaNoch keine Bewertungen

- Daftar PustakaDokument3 SeitenDaftar PustakaFaisal Al IdrusNoch keine Bewertungen

- Transportation and Public Service Law 2020.A PrelimDokument100 SeitenTransportation and Public Service Law 2020.A PrelimRoland Ron Bantilan100% (1)

- Shabeer - Oracle Fusion Finance Functional ConsultantDokument6 SeitenShabeer - Oracle Fusion Finance Functional Consultantahmed.ebsappsNoch keine Bewertungen

- Module2-Future Wireless Satellite Broadband - Next Generation WiFi and Satellite Broadband AccessDokument66 SeitenModule2-Future Wireless Satellite Broadband - Next Generation WiFi and Satellite Broadband AccessismaelNoch keine Bewertungen

- User Manual For Hardware TokenDokument2 SeitenUser Manual For Hardware TokenFarjana Akter EityNoch keine Bewertungen

- Cost of CRR SLRRDokument18 SeitenCost of CRR SLRRSomesh SrivastavaNoch keine Bewertungen

- Mobile Bill Mar 171491713959Dokument1.061 SeitenMobile Bill Mar 171491713959Lisamoni 786Noch keine Bewertungen

- Prepayment of Your Personal Loan Account:XXXXXXXXXXXX4785Dokument2 SeitenPrepayment of Your Personal Loan Account:XXXXXXXXXXXX4785Daniel GnanaselvamNoch keine Bewertungen

- Bajaj Finserv AvishekDokument83 SeitenBajaj Finserv AvishekArup Kumar SenNoch keine Bewertungen

- SDX 6000 SeriesDokument6 SeitenSDX 6000 SeriesHakob DadekhyanNoch keine Bewertungen

- Abhibus AW5695630162Dokument2 SeitenAbhibus AW5695630162hemanth sheelamshettiNoch keine Bewertungen

- Tarjeta de Credito y DebitoDokument19 SeitenTarjeta de Credito y DebitoviaraNoch keine Bewertungen

- Financial LiabilitiesDokument4 SeitenFinancial LiabilitiesNicah AcojonNoch keine Bewertungen

- Ticket Booking SystemDokument5 SeitenTicket Booking SystemsaddiqueNoch keine Bewertungen

- Invoice August 2017-1743413Dokument1 SeiteInvoice August 2017-1743413Anthony ArmstrongNoch keine Bewertungen

- Tvl-Computer Systems Servicing-Grade 12: Let Us DiscoverDokument6 SeitenTvl-Computer Systems Servicing-Grade 12: Let Us DiscoverDan Gela Mæ MaYoNoch keine Bewertungen

- Cloud Computing NotesDokument2 SeitenCloud Computing NotessacbansalNoch keine Bewertungen

- BSP Cir. 1075 - Amendments To Regulations On Financial Audit of Non-Bank Financial LnstitutionsDokument39 SeitenBSP Cir. 1075 - Amendments To Regulations On Financial Audit of Non-Bank Financial LnstitutionsdignaNoch keine Bewertungen

- Sales Order and Purchase OrderDokument1 SeiteSales Order and Purchase OrderAarti GuptaNoch keine Bewertungen

- CCNA 1 v7 Modules 8 - 10 - Communicating Between Networks Exam AnswersDokument31 SeitenCCNA 1 v7 Modules 8 - 10 - Communicating Between Networks Exam Answerswafa hopNoch keine Bewertungen

- XLSXDokument20 SeitenXLSXashibhallau100% (3)