Beruflich Dokumente

Kultur Dokumente

Functions of The Bank

Hochgeladen von

afiffarhan2Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Functions of The Bank

Hochgeladen von

afiffarhan2Copyright:

Verfügbare Formate

Functions of the Bank In general , banks are menghimpum function of society and channeling funds back to the community

for various purposes or as a Financial intermediary . More specifically banks may serve as agents of trust , agent of development , agent of servies a. Agent of trust The main policy of banking activity is the belief ( trust ), both in union funds and channeling funds. Community will want to leave their funds in the bank when there is an element firmly based on trust . Community believe that the money will not be misused by the bank , the money will be managed well, the bank will not go bankrupt and pads when the promised savings can be pulled back from the bank . The bank itself will want to locate or channeling funds to the debtor or the community when there is an element firmly based on trust . The bank believes that the debtor will not menyalagunakan loan , the debtor will still manage a good loan funds , the debtor will have the ability to pay when due, and the debtor has to return the loan in good faith with other obligations at maturity . b . Agent of development People's economic activities in the monetary sector and the real sector can not be separated . The second sector is always interact and affect each other. Real sector will not be able to perform as well as the monetary sector is not working properly. Purports to be a compilation of bank activities and channeling much-needed funds for the sector smoothly This real economic losses . It allows the community bank activities do investment activities , distribution activities , as well as the activities of consumption goods and services , given that investment activity - distribution - consumption can not be released from the availability of the use of money . Kegiata smooth distribution - consumption investment is not lai is economic development activities . c . Agent of servies Besides doing assembly and distribution activities of the fund , the bank also provides other banking services offerings to the community. These banks offered services closely related to people's economic activities in general . Services may include , among others, remittance services , luggage valuables , giving bank guarantee, da settlement charges. The third function is expected to above bank gives a comprehensive and detailed account of the economic function of the bank , so the bank can be interpreted not only as an intermediary financial institution (financial intermediary intituton ) . In summary functions of banks can be divided into the following a. Gather funds to carry out its functions as an assembler of funds, then the bank has some great resources on line there are three sources, namely

( i ) Funds derived from the bank itself in the form of capital deposit stance time . ( ii ) The funds derived from wider society that is collected through efforts such as joint bank giro deposits , time deposits and tabanas . ( iii ) Funds sourced from financial institutions raised the funds in the form of loans and call money credit liquidity ( funds can be withdrawn at any time of the borrowing bank ) . b . Conduit or bank lender in its activities not only keep the funds raised , but for back channel utilization in the form of bank credit to masayarakat who need fresh funds to the effort. Of course in the implementation of this function will get the bank expected income in the form of revenue or the imposition of interest forms of credit. Credit extension would raise the risk , therefore should grant telitidan really fulfill the requirements . c . As a conduit of funds, the funds accumulated by the bank extended to society in the form of credit , letters of purchase costing and participation , ownership of fixed assets. d . As a server bank services in mengemban job as " remittance traffic server " . Perform other activities between the different activities remittance , collection , tourist checks , credit card and other service

Das könnte Ihnen auch gefallen

- Pencil EraserDokument1 SeitePencil Eraserafiffarhan2Noch keine Bewertungen

- Importance of ElectricityDokument1 SeiteImportance of Electricityafiffarhan2Noch keine Bewertungen

- History of CalculatorsDokument2 SeitenHistory of Calculatorsafiffarhan2Noch keine Bewertungen

- The Origins of The CalendarDokument4 SeitenThe Origins of The Calendarafiffarhan2Noch keine Bewertungen

- Marriage CounsellingDokument1 SeiteMarriage Counsellingafiffarhan2Noch keine Bewertungen

- The Introduction of Islamic Finance in MalaysiaDokument2 SeitenThe Introduction of Islamic Finance in Malaysiaafiffarhan2100% (1)

- Islamic Financial SystemDokument3 SeitenIslamic Financial Systemafiffarhan2Noch keine Bewertungen

- HISTORY AthleticsDokument3 SeitenHISTORY Athleticsafiffarhan267% (6)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- BST Candidate Registration FormDokument3 SeitenBST Candidate Registration FormshirazNoch keine Bewertungen

- Extent of The Use of Instructional Materials in The Effective Teaching and Learning of Home Home EconomicsDokument47 SeitenExtent of The Use of Instructional Materials in The Effective Teaching and Learning of Home Home Economicschukwu solomon75% (4)

- STM - Welding BookDokument5 SeitenSTM - Welding BookAlvin MoollenNoch keine Bewertungen

- Agfa CR 85-X: Specification Fuji FCR Xg5000 Kodak CR 975Dokument3 SeitenAgfa CR 85-X: Specification Fuji FCR Xg5000 Kodak CR 975Youness Ben TibariNoch keine Bewertungen

- Difference Between Mountain Bike and BMXDokument3 SeitenDifference Between Mountain Bike and BMXShakirNoch keine Bewertungen

- Information Security Chapter 1Dokument44 SeitenInformation Security Chapter 1bscitsemvNoch keine Bewertungen

- Missouri Courts Appellate PracticeDokument27 SeitenMissouri Courts Appellate PracticeGeneNoch keine Bewertungen

- Heavy LiftDokument4 SeitenHeavy Liftmaersk01Noch keine Bewertungen

- CodebreakerDokument3 SeitenCodebreakerwarrenNoch keine Bewertungen

- Functions of Commercial Banks: Primary and Secondary FunctionsDokument3 SeitenFunctions of Commercial Banks: Primary and Secondary FunctionsPavan Kumar SuralaNoch keine Bewertungen

- Instructions For Microsoft Teams Live Events: Plan and Schedule A Live Event in TeamsDokument9 SeitenInstructions For Microsoft Teams Live Events: Plan and Schedule A Live Event in TeamsAnders LaursenNoch keine Bewertungen

- NOP PortalDokument87 SeitenNOP PortalCarlos RicoNoch keine Bewertungen

- Termination LetterDokument2 SeitenTermination Letterultakam100% (1)

- 2016 066 RC - LuelcoDokument11 Seiten2016 066 RC - LuelcoJoshua GatumbatoNoch keine Bewertungen

- As 60068.5.2-2003 Environmental Testing - Guide To Drafting of Test Methods - Terms and DefinitionsDokument8 SeitenAs 60068.5.2-2003 Environmental Testing - Guide To Drafting of Test Methods - Terms and DefinitionsSAI Global - APACNoch keine Bewertungen

- MORIGINADokument7 SeitenMORIGINAatishNoch keine Bewertungen

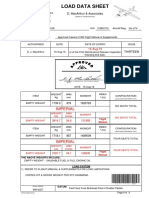

- Load Data Sheet: ImperialDokument3 SeitenLoad Data Sheet: ImperialLaurean Cub BlankNoch keine Bewertungen

- Test & Drain Valve Model 1000Dokument2 SeitenTest & Drain Valve Model 1000saifahmed7Noch keine Bewertungen

- X-17 Manual Jofra PDFDokument124 SeitenX-17 Manual Jofra PDFBlanca Y. Ramirez CruzNoch keine Bewertungen

- 199437-Unit 4Dokument36 Seiten199437-Unit 4Yeswanth rajaNoch keine Bewertungen

- Ces Presentation 08 23 23Dokument13 SeitenCes Presentation 08 23 23api-317062486Noch keine Bewertungen

- Tradingview ShortcutsDokument2 SeitenTradingview Shortcutsrprasannaa2002Noch keine Bewertungen

- PLT Lecture NotesDokument5 SeitenPLT Lecture NotesRamzi AbdochNoch keine Bewertungen

- A PDFDokument2 SeitenA PDFKanimozhi CheranNoch keine Bewertungen

- General Field Definitions PlusDokument9 SeitenGeneral Field Definitions PlusOscar Alberto ZambranoNoch keine Bewertungen

- 500 Logo Design Inspirations Download #1 (E-Book)Dokument52 Seiten500 Logo Design Inspirations Download #1 (E-Book)Detak Studio DesainNoch keine Bewertungen

- Proceedings of SpieDokument7 SeitenProceedings of SpieNintoku82Noch keine Bewertungen

- Dialog Suntel MergerDokument8 SeitenDialog Suntel MergerPrasad DilrukshanaNoch keine Bewertungen

- Capital Expenditure DecisionDokument10 SeitenCapital Expenditure DecisionRakesh GuptaNoch keine Bewertungen

- Astm E53 98Dokument1 SeiteAstm E53 98park991018Noch keine Bewertungen