Beruflich Dokumente

Kultur Dokumente

Econ Sp04 PDF

Hochgeladen von

zainabcomOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Econ Sp04 PDF

Hochgeladen von

zainabcomCopyright:

Verfügbare Formate

ME 489

Engineering Economics Exam

Spring 2004

Name: ________________________________________________________ (5 pts) You may use the FE Handout for Engineering Economics provided to complete this test. To get any partial credit, you must show your work. All work should be shown on these pages. Clearly mark your answer.

1. (15 Points) At the end of each year, a worker invests $2,000 into an account the draws 4% interest. The worker makes every payment for the next 30 years except for the payment at the end of year 10. That is, no money is invested at the end of year 10. How much money will be in the account at the end of the 30 years? a) b) $107,788 $108,568 c) d) $109,209 $112,170

1/6

ME 489

Engineering Economics Exam

Spring 2004

2.

(15 points) A car dealer is offering to a buyer one of two incentives: zero percent financing or $3,000 cash back. If the car price (before the incentives) is $25,000, find the following to compare the two options in terms of monthly payments. a. Financing through the dealer Find the monthly payment to the car dealer for a $25,000 loan at zero percent interest for 5 years.

b. Financing through a bank Find the monthly payment to a bank for a 5 year loan at 6% when the buyer finances the $22,000 cost through a bank (i.e. the buyer takes the $3,000 cash back incentive).

2/6

ME 489

Engineering Economics Exam

Spring 2004

3. (15 Points) On a piece of equipment, it is estimated that the service expense will be as follows: Maintenance Year 1 $300 2 $350 3 $400 4 $450 5 $500 What is the equivalent uniform annual maintenance cost for the machinery if the interest rate is 4%? a) b) $375.21 $396.08 c) d) $400.00 $576.48

3/6

ME 489

Engineering Economics Exam

Spring 2004

4. (15 Points) What is the annual equivalent cost of the following cash flow diagram? The interest rate is 10%. 0 1 2 3 $5k 4 5 6 7 $5k 8

$10k a) b) $8,572 $8,750 c) d) $8,815 $9,639

4/6

ME 489

Engineering Economics Exam

Spring 2004

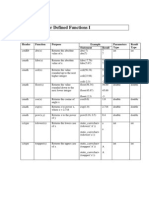

5. (15 points) The following alternatives are being considered for a lab project. Find the present worth for each option to support a project that requires 20 years of service. Assume the interest rate is 8%. Which option is less expensive in terms of present value? Option A $39,000 $2,000 $1,200 20 Option B $20,000 $4,000 $1,800 10

First Cost Salvage Value Annual Maintenance Useful Life (years)

5/6

ME 489

Engineering Economics Exam

Spring 2004

6.

(20 points) Determine the two equal deposits, the first deposit required now and the second deposit at the end of year 6, so that you can withdraw $2,000 at the end of each year for the next 12 years. Assume that money can earn 4% interest, compounded annually.

a) b)

$9,385 $10,302

c) d)

$10,484 $12,000

6/6

Das könnte Ihnen auch gefallen

- Wastewater Characteristics Physical ChemicalDokument31 SeitenWastewater Characteristics Physical ChemicalzainabcomNoch keine Bewertungen

- Gaza Concrete Structures Recycled Aggregate PerformanceDokument98 SeitenGaza Concrete Structures Recycled Aggregate Performancefandhiejavanov2009Noch keine Bewertungen

- Ce470 Hw1 SolDokument8 SeitenCe470 Hw1 SolzainabcomNoch keine Bewertungen

- Applying VE ConceptDokument164 SeitenApplying VE ConceptzainabcomNoch keine Bewertungen

- F13 CE470Ch5 Beam Shear DesignDokument16 SeitenF13 CE470Ch5 Beam Shear DesignzainabcomNoch keine Bewertungen

- BIS202 Test Bank NewDokument589 SeitenBIS202 Test Bank NewNaveed Karim BakshNoch keine Bewertungen

- F13 - CE470Ch 2 - Tension MembersDokument39 SeitenF13 - CE470Ch 2 - Tension MemberszainabcomNoch keine Bewertungen

- Design of Members For Combined ForcesDokument27 SeitenDesign of Members For Combined ForceszainabcomNoch keine Bewertungen

- Nut & Bolt Connection DesignDokument16 SeitenNut & Bolt Connection DesignChandana KumaraNoch keine Bewertungen

- Ce470 Hw2 SolDokument6 SeitenCe470 Hw2 SolzainabcomNoch keine Bewertungen

- Ve 23Dokument40 SeitenVe 23zainabcomNoch keine Bewertungen

- VE DefinitionDokument136 SeitenVE DefinitionzainabcomNoch keine Bewertungen

- Excercises - SolutionDokument2 SeitenExcercises - SolutionzainabcomNoch keine Bewertungen

- Chapter 9 - Arrays - Handout 5Dokument5 SeitenChapter 9 - Arrays - Handout 5zainabcomNoch keine Bewertungen

- Chapter 6 - HandoutDokument5 SeitenChapter 6 - HandoutzainabcomNoch keine Bewertungen

- Chapter 9 - Arrays - Handout 3Dokument4 SeitenChapter 9 - Arrays - Handout 3zainabcomNoch keine Bewertungen

- Selected Solutions - 3Dokument3 SeitenSelected Solutions - 3zainabcomNoch keine Bewertungen

- Chapter 9 - Arrays - Handout 1Dokument4 SeitenChapter 9 - Arrays - Handout 1zainabcomNoch keine Bewertungen

- Selected Solbookutions - 2Dokument4 SeitenSelected Solbookutions - 2Jeremie YoungNoch keine Bewertungen

- Selected Solutions - 1Dokument2 SeitenSelected Solutions - 1zainabcomNoch keine Bewertungen

- General Equations of PlaneDokument2 SeitenGeneral Equations of PlanezainabcomNoch keine Bewertungen

- الإكسير في برمجة السي بلس بلسDokument285 Seitenالإكسير في برمجة السي بلس بلسأكبر مكتبة كتب عربية100% (3)

- 212-Chpt 8Dokument5 Seiten212-Chpt 8zainabcomNoch keine Bewertungen

- Sample Mt2 KeyDokument10 SeitenSample Mt2 KeyzainabcomNoch keine Bewertungen

- 212-Chpt 9Dokument5 Seiten212-Chpt 9zainabcomNoch keine Bewertungen

- 212-Chpt 4Dokument6 Seiten212-Chpt 4zainabcomNoch keine Bewertungen

- Quiz 2Dokument4 SeitenQuiz 2zainabcomNoch keine Bewertungen

- 212-Chpt 7Dokument6 Seiten212-Chpt 7zainabcomNoch keine Bewertungen

- 212-Chpt 5Dokument8 Seiten212-Chpt 5zainabcomNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Best of BestDokument57 SeitenBest of BestlimenihNoch keine Bewertungen

- Fundamentals of management essentialsDokument13 SeitenFundamentals of management essentialsTran Pham Quoc ThuyNoch keine Bewertungen

- Pre-COntract Cost ControlDokument3 SeitenPre-COntract Cost ControlYash TohoolooNoch keine Bewertungen

- Nursing Leadership and Management Working in Canadian Health Care OrganizationsDokument18 SeitenNursing Leadership and Management Working in Canadian Health Care OrganizationsHarpreet SinghNoch keine Bewertungen

- Location Information ManagementDokument16 SeitenLocation Information ManagementsandyjbsNoch keine Bewertungen

- Supply Chain Design and PlanningDokument21 SeitenSupply Chain Design and PlanningWaseem AbbasNoch keine Bewertungen

- Warehouse PlanningDokument3 SeitenWarehouse PlanningSoorajKrishnanNoch keine Bewertungen

- Benefits: Employees TPI-theoryDokument2 SeitenBenefits: Employees TPI-theorylollaNoch keine Bewertungen

- Advertisement For Recruitment of Consultants For NpmuDokument13 SeitenAdvertisement For Recruitment of Consultants For NpmuMohaideen SubaireNoch keine Bewertungen

- Case Study CVP AnalysisDokument6 SeitenCase Study CVP AnalysisIdha RahmaNoch keine Bewertungen

- SNIUKAS, Marc - How To Make Business Model Innovation HappenDokument28 SeitenSNIUKAS, Marc - How To Make Business Model Innovation HappenRildo Polycarpo OliveiraNoch keine Bewertungen

- Sample GAIN Benchmarking Survey ReportDokument11 SeitenSample GAIN Benchmarking Survey ReportVeena Hingarh0% (1)

- Difference Between Entrepreneur and ManagerDokument3 SeitenDifference Between Entrepreneur and ManagerJoylyn CarisosaNoch keine Bewertungen

- 18-10-2022-Activity Based BudgetingDokument32 Seiten18-10-2022-Activity Based Budgeting020Abhisek KhadangaNoch keine Bewertungen

- Roti Canai Cikgu RestaurantDokument26 SeitenRoti Canai Cikgu Restaurantsarah 2403100% (2)

- Activity Design - Civil Service Month 2023Dokument2 SeitenActivity Design - Civil Service Month 2023JanJan BoragayNoch keine Bewertungen

- Supply Chain Strategy of MArk and Spencer by AmirDokument15 SeitenSupply Chain Strategy of MArk and Spencer by AmirsatexNoch keine Bewertungen

- Company Basic DataDokument3 SeitenCompany Basic DataZeeshan MallikNoch keine Bewertungen

- Strategy ImplementationDokument30 SeitenStrategy ImplementationThabiso DaladiNoch keine Bewertungen

- NurulhaziraResume 05072017Dokument3 SeitenNurulhaziraResume 05072017nurulhaziraNoch keine Bewertungen

- Demand Management Techniques for Service FirmsDokument23 SeitenDemand Management Techniques for Service FirmsJerrie GeorgeNoch keine Bewertungen

- Project Milestone 2 - Outline Group 8Dokument9 SeitenProject Milestone 2 - Outline Group 8api-622062757Noch keine Bewertungen

- 6.7.1 Evaluating The Quality of Statistics Produced by The Philippine Statistics Authority Using TheDokument25 Seiten6.7.1 Evaluating The Quality of Statistics Produced by The Philippine Statistics Authority Using TheGITA SAFITRINoch keine Bewertungen

- Goal Congruence: Dr. Aayat FatimaDokument17 SeitenGoal Congruence: Dr. Aayat FatimaKashif TradingNoch keine Bewertungen

- Youth Enterprise Development Fund Board ReportDokument72 SeitenYouth Enterprise Development Fund Board ReportThe Star KenyaNoch keine Bewertungen

- 12 CFT - 21-BID-024 - FEED 2.0 ANNEX XI - Quality Management - VF FinalDokument3 Seiten12 CFT - 21-BID-024 - FEED 2.0 ANNEX XI - Quality Management - VF FinalbarryNoch keine Bewertungen

- Assignment - Env403Dokument6 SeitenAssignment - Env403Mahadi HasanNoch keine Bewertungen

- Case StudyDokument5 SeitenCase StudyChris VNoch keine Bewertungen

- Term Paper Report On Hindustan Unilever Limited (HUL) : Submitted To Venkatesh Akella SirDokument12 SeitenTerm Paper Report On Hindustan Unilever Limited (HUL) : Submitted To Venkatesh Akella SirMeghana NaiduNoch keine Bewertungen

- Kotler Krasher 2018 PDFDokument98 SeitenKotler Krasher 2018 PDFRitvik YadavNoch keine Bewertungen