Beruflich Dokumente

Kultur Dokumente

17 Technical Analysis Review 270913

Hochgeladen von

ajayvmehtaOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

17 Technical Analysis Review 270913

Hochgeladen von

ajayvmehtaCopyright:

Verfügbare Formate

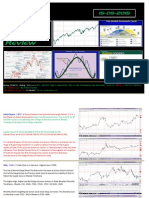

27-09-2013

Technical Analysis Review

Review_27/09/13 - ( Rating - 3/15 ) Negative - High Risk - Rupee is Breaking Down / Nifty on verge of Breaking into Down trend (Stage 4) / AD is -ve / TRIN is -ve / Net 52 WK Hi/Low is -ve / Bonds is +Ve (--) Big Picture is Negative. | 0 is extreme -ve | 1 is -ve | 2 is Netural | 3 is +ve | 4 is extreme +ve |

Indian Rupee - ( 0/4 ) Rupee's Breakout on All timeframes from Ascending triangle Pattern ( Consolidation Range was from 58.932 to 61.230 ). Measured Move Target of 61.734 has been achived & As $ is at lifetime High v/s Rupee, $ has entered a new Bull Maket in Rupee Depreciation.. Rupee has exceeded Measured move target & 100 % @ 66.386 Rupee has given a Fresh Breakdown from Top (Near Lifetime Highs) & Demand Zone . Rupee is Giving a Bounce from Demand Level. Supply Zone at 1) 69.228 (68.860) 68.578 2) 64.074 (63.669) 63.206 Demand Zone are at 1) 61.154 (60.720) 60.373 & 2) 59.368 (59.044) 58.688

It is Notable that $ Index is at Weekly Demand Zone & is testing Weekly Ascending Triangle, $ is expected to Raise against all Currencies (Trouble for Rupee) Also With Growing Crises senerio Green Buck (has been considered to be the Hedge (Preferred Vehicle For Cash). (* Note : This time around, This Process is Going to Hurt the Instution the Most.Time will Prove this Historic Process would FAIL & set the Financial world into a issue.

Nifty - ( 0/4 ) Move From 4500 (19-12-2011) to 5631 (22-02-2012) is Uptrend & there was retracement upto 4761 (61.8% Retracement) upto 05-06-2012 Market Restarted Uptrend from 4761 (05-06-2012) to 6110 (29-01-2013) There was correction from 6110 (29-01-2013) Upto 5477 (10-04-2013) After Entire Move from 5477 (10-04-2013) to 6229 (20-05-2013) There was correction in Uptrend (as Higher Low is formed at 5570 on 25-06-2013 after Neckline of 5950 of Fresh H & S is Broken Measured Decline is upto 5700 (78.6 % Rectracement of 5477 to 6229) Lower High Lower Low Trend (Down Trend from 6229 (20-05-2013) to 5565 (24-062013). Retest & Double Top Was From 5565 (24-06-2013) & Ended at 6077.79 ( 23-072013 ). Another Lower High is Created at 5742.29 (14-08-2013)

Previous Highs of 5742.29 (14-08-2013) & 6077.79 (23-07-2013) broken on Upside has been Rejected & Price is at 5833 (27-09-2013) & Started Move Down as This is a Parabolic Upmove & Not Like to Sustain Uptrend can resume only Price closes on Life time Highs Supply Levels are - 1) 5807 (5791) 5780 2) 6133 (6100) 6102 3) 6354 (6228.45) 6187.80 Demand Levels are 2) 5755.28 to 5714.63 3) 5550.13 (5506.50) 5474.97 4) 5276.86 5211.20 5) 5128.09 (5079.67) 5032.70 6) 4842.27 4770.73 Dimensions Price Major Trend line break from Historic Pivot lows of 2532 - 4534 - 4775 was broken on the down side ( Trendline Break is Now Tested with current Upmove ) Now Measured move of Break of Ascending Tringle is very very Low 3345 (50%) & 2864 (61.8%) Volume Volumes are in increasing Trend.In Oct series Nifty future shed 1.54 lakh position in Open Interest and this accounts to -0.86 % of Total Open Interest in Oct series.The Nifty Oct series is trading at 54.95 Rs premium to Underlying . In derivative cumulatively for all series contract Nifty future net shed 0.27 lakh position in open interest and this accounts to -0.14 % of Total Open Interest in all series and cumulatively trading in average premium of 93.27 Rs to Underlying. Indicators MCDA -Ve Trend RSI -Ve Trend Open Intrest (OI) NIFTY FUTURE-CMP(5888.15) is currently in SLIGHTLY BEAR trend.The open interest is also not increasing with trend so be careful and premium of share. In options activity mainly confined to lower puts even though put/call ratio is high At current price strike the activity is tilted to put side and ratio is still strong Hence is also increasing so sellers be cautious NIFTY PCR (Position Wise) - 1.03 & (Money Wise) - 0.5

Sentiments Sentiments are now Positive as current Pullback has Broken Previous Swing Highs in Down trend, Due to Sharp Pullback Traders are forced to cut their Short Position,Once Trend Resumes, Panik will get created for getting out of Long Positions Risk Reward would be favourable on Sell Side. Earnings are mostly -ve are expected TIme After Previous F&O expiry (@ 5882 ) Nifty could now build Short Position due to Sharp Pullback Rally.. As per Nifty's 56 Day Cycle Trend changed to up after (02-092013) & Now Expected to Reverse to Down side with Momentum (+56Days) ( Next Date 28-10-2013 )..... Mid month Reversal date of 17-10-2013 ( Sudden Red Candle Appeared with shift in Momumtum )..... Quaterlies Settlement is on 3rd Friday ( 20-122013) Previous on 20-09-2013 was Huge Bearish P & F Chart No Signal. There is Resistance at 5950 & Support at 5800.Post Strong Exhaustion Pullback in Downtrend. Breadth Charts - ( 0/3 ) (Rating 1 for Each +ve) Advance Decline Line (0/1) If the Nifty is rising but the number of stocks advancing is dropping, then the trend is in trouble and may pause soon or even reverse. AD Line is Not Rising with increase in Nifty, indicates Strength in Down trend But some Balance in AD needs to be achieved. Midcaps are Falling with Deciling Momentum ( After Recovery from Over Sold Levels ) But some Large caps & All Index Heavy Weights are Declining with Huge Momentum & Breakdowns

Trader's Index (TRIN Chart) (0/1) To Incorporate Volume of Advance Decline Analysis - TRIN is unusual in that it moves opposite to the Nifty TRIN is a ratio where 1.0 means selling and buying pressure are equal TRIN BELOW 1.0 (More Volume in stocks that are advancing) & Above 1.0 (More Volume in stocks that are Declining SMA Trin is Between 0.9 & 1.0 indicated Strength in Pullback & space for more stocks to Decline even tho Nifty is Rising,The series of Lower Highs in SMA10 of TRIN has been Restored with Inverse H & S & indicates -Ve strength

NSE Net Monthly High & Low (0/1) More Stocks in the index making new highs versus new lows if Number is Reducing Trend is in Trouble.The Rising New Highs indicate Markets Buying pressure is accelerating (Environment & Trend) is Positive There is a downward slope as "Valleys of 52 week Highs" has been broken on upside is now Restored indicating Strength in Down Trend. The "Troughs of stocks Hitting 52 Week Lows" Should increase in case of strong Down Trend

India Vix Volatility Index (or Fear Index or VIX) is a weighted measure of the implied volatility.Market Makers hedge the market Play, the Down Volume is always a factor & used in Direct Corelation with the VIX & They Together have Indirect corelation with Index ie Vix & DVol is Down; Market will move Up AND Vix & DVol is Up;Market will move Down.Indirect relation between Vix & DVOL leads to Sidewise Index VIX is Breaking Down from 52 week High to 24.73. Fear/ Volitality is decreasing with Down Trend indicating strength in stage 4...Volume is also High.... Indian Bonds (3/4) Indirect Correlation with Stock Market; Money Flows from Bonds to Stock for Short term Maturity (Mkt Goes up) & Vice Versa. Shorter Period = Lower Rate (Controlled by Centeral Bank & Indirect relation to Stock Market) + Longer Period = Higher Rate (Controlled by Market) All Bonds indicating Down Turn. 3 Year Rate is Higher than 10 Year Rate has been Rectifed & Correct Relation of 30Y ROI > 10Y ROI > 3Y ROI is achived (Caution Money is Moving to Short term Bond Market from Share Market indicates Weekness in Economy & Flight to safety ) .. . Under Asset Rotation from Risk on (Equity Market) to Risk off (Bond Market - Security Backed by Govt) & with Devalution of Rupee the Dollar Outage is gaining strength ( Increase of Returns in 100% Govt secured Bonds).Also Yield Returns in India are more than corrosponding Bonds in Developed Markets. 10 Y 30 Y 3Y

http://stockcharts.com/h-sc/ui

Commodities (Negative Correlation) $CRB has made a Double top & Distribution Pattern (Downtrend has emerged), Commodities Crude Has Broken uptrend ( Bulltrap was set for ascending Triangle breakout on weekly chart ), Post Pullback, Gold has broken Down again ... ( Equity Markets Rally has Dangers Due to Reduced Economic Growth (& Reduced Commodity Demand) & Geo Political Tensions are also increasing,Now Commodities are to Resume Down Trend as Major banks are set to Move out of Physical Commodity Markets. (Excess Supply Over Demand) Group 1 - Oil + Gas -> 33% Weight Group 2 - Natural Gas + Metal + Corn + Soya -> 42% Weight Group 3 - Others -> 25% Weight

Currency Markets (Positive Coorrelation) Dollar is the Only Appriciating Currency & has Reached Demand Zone (Breakout of Ascending Triangle on weekly Timeframe) & Hence Some Currencies are Reaching Supply Zone. Japan Yen Aussie $ are Depriciating & Market are trying to Rebuild (Distribution) after Fed's Stance of No Tapering in QE, Hints at Liquidity Reversal is on Hold (Market failed to Build Gains on Good News & has Declined on Next Day..... Hence Global markets are in Risk Off Mode .. Currency War has Reached Phase II where Every Currency (Developed & Other Emerging Mkt Currencies ) are depreciating against $ to take advantage of investment in safe Govt Secured Bond

World Markets (Positive Coorrelation) Chinese Recover is Slow with raised concerns on liquidity & Devalued Yunan & US Markets has weekly Breakdown (Markets are Distributing Stocks on Good News are now Ferouscliously Selling.Europe CAG DAX are Near Resistance & FTSE have given Fresh Breaking Downs (Global Markets are Now at Resistance. Syncronisation in BreakDowns is seen after Creating Bearish Patterns (Some Double Tops).Also Global Liquidity is Drying,interest Rates are increasing ..All Equity Markets are on Risk OFF Mode

http:// in.advf n.com /world

The Mighty 10 Index - Top Sector & Index weighted % Wise ( 0/10 ) Extremely Negative INDEX HDFC DBR from Demand Zone to Test 200 SMA - Death Cross - Y FINANCE ICICIBANK Drop From Supply Level - Death cross - Y ENERGY RELIANCE Down from Top of Range - Golden Cross - Y IT INFY Distribution Rounding Top - Golden Cross - Y FMCG ITC Bounce from 200DMA Inverse H&S (Up From Weekly Support) - Golden Cross - Y AUTO TATAMOTORS Top of Range into Weekly Supply Zone - Golden Cross - Y PHARMACEUTICALS SUNPHARMA Right Shoulder @ Weekly & Retest of Top Done (With Lower High) Golden Cross - Y CAPITAL GOODS L&T Pullback in Downtrend (Up From Weekly Support) - Death Cross - Y METALS TATASTEEL Pullback from Lows in Downtrend - Death Cross - Y CEMENT ULTRACEMCO Pullback in Downtrend (Up From Weekly Support) - Death Cross - Y

NB: These notes are just personal musings on the markets, trends etc, as a sort of reminder to me on what I thought of them at a particular point in time. They are not predictions and none should rely on them for any investment decisions. Readers Discretion Expected. Advocate to Consult Your Financial Advisor before any Investment as Investment in any market may be Lost in its Entirety. Strictly for Entertainment Purpose Only.

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (120)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- EasyLanguage EssentialsDokument143 SeitenEasyLanguage EssentialsLuís Phillipe Moraes WongNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Secrets To Predicting Market DirectionDokument64 SeitenSecrets To Predicting Market Directionchandramouuli89% (9)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- LarryWilliamsIndicators PDFDokument26 SeitenLarryWilliamsIndicators PDFLola WeiNoch keine Bewertungen

- What Is Open InterestDokument17 SeitenWhat Is Open InterestBhasker Nifty100% (2)

- I CT Material ReferenceDokument96 SeitenI CT Material Referencefsolomon100% (19)

- V3 - 4 The Ultimate OscillatorDokument5 SeitenV3 - 4 The Ultimate OscillatorErezwaNoch keine Bewertungen

- Bill McLaren - Foundations For Successful Trading - ManualDokument75 SeitenBill McLaren - Foundations For Successful Trading - ManualJNEVINS100% (5)

- Insider Trading 911..unresolved, by Lars SchallDokument36 SeitenInsider Trading 911..unresolved, by Lars Schalljkim3334270100% (2)

- Open InterestDokument9 SeitenOpen InterestAmbikesh ChauhanNoch keine Bewertungen

- Open Interest, MaxPain & Put Call Ratio (PCR) Z-Connect by ZerodhaDokument43 SeitenOpen Interest, MaxPain & Put Call Ratio (PCR) Z-Connect by ZerodhaSingh SudipNoch keine Bewertungen

- What Is Open InterestDokument2 SeitenWhat Is Open InterestiddrxNoch keine Bewertungen

- Technical Analysis of The Financial MarketsDokument27 SeitenTechnical Analysis of The Financial Marketsgavin henning100% (1)

- 112 Technical Analysis Review 310715Dokument7 Seiten112 Technical Analysis Review 310715ajayvmehtaNoch keine Bewertungen

- 112 Technical Analysis Review 310715Dokument7 Seiten112 Technical Analysis Review 310715ajayvmehtaNoch keine Bewertungen

- 112 Technical Analysis Review 310715Dokument7 Seiten112 Technical Analysis Review 310715ajayvmehtaNoch keine Bewertungen

- 112 Technical Analysis Review 310715Dokument7 Seiten112 Technical Analysis Review 310715ajayvmehtaNoch keine Bewertungen

- 112 Technical Analysis Review 310715Dokument7 Seiten112 Technical Analysis Review 310715ajayvmehtaNoch keine Bewertungen

- 112 Technical Analysis Review 310715Dokument7 Seiten112 Technical Analysis Review 310715ajayvmehtaNoch keine Bewertungen

- 112 Technical Analysis Review 310715Dokument7 Seiten112 Technical Analysis Review 310715ajayvmehtaNoch keine Bewertungen

- 112 Technical Analysis Review 310715Dokument7 Seiten112 Technical Analysis Review 310715ajayvmehtaNoch keine Bewertungen

- 112 Technical Analysis Review 310715Dokument7 Seiten112 Technical Analysis Review 310715ajayvmehtaNoch keine Bewertungen

- 112 Technical Analysis Review 310715Dokument7 Seiten112 Technical Analysis Review 310715ajayvmehtaNoch keine Bewertungen

- 112 Technical Analysis Review 310715Dokument7 Seiten112 Technical Analysis Review 310715ajayvmehtaNoch keine Bewertungen

- 82 Technical Analysis Review 261214Dokument7 Seiten82 Technical Analysis Review 261214ajayvmehtaNoch keine Bewertungen

- 112 Technical Analysis Review 310715Dokument7 Seiten112 Technical Analysis Review 310715ajayvmehtaNoch keine Bewertungen

- 112 Technical Analysis Review 310715Dokument7 Seiten112 Technical Analysis Review 310715ajayvmehtaNoch keine Bewertungen

- 112 Technical Analysis Review 310715Dokument7 Seiten112 Technical Analysis Review 310715ajayvmehtaNoch keine Bewertungen

- 112 Technical Analysis Review 310715Dokument7 Seiten112 Technical Analysis Review 310715ajayvmehtaNoch keine Bewertungen

- Technical Analysis Review: 2 Is NeutralDokument7 SeitenTechnical Analysis Review: 2 Is NeutralajayvmehtaNoch keine Bewertungen

- 112 Technical Analysis Review 310715Dokument7 Seiten112 Technical Analysis Review 310715ajayvmehtaNoch keine Bewertungen

- 112 Technical Analysis Review 310715Dokument7 Seiten112 Technical Analysis Review 310715ajayvmehtaNoch keine Bewertungen

- 112 Technical Analysis Review 310715Dokument7 Seiten112 Technical Analysis Review 310715ajayvmehtaNoch keine Bewertungen

- 82 Technical Analysis Review 261214Dokument7 Seiten82 Technical Analysis Review 261214ajayvmehtaNoch keine Bewertungen

- 82 Technical Analysis Review 261214Dokument7 Seiten82 Technical Analysis Review 261214ajayvmehtaNoch keine Bewertungen

- 82 Technical Analysis Review 261214Dokument7 Seiten82 Technical Analysis Review 261214ajayvmehtaNoch keine Bewertungen

- 112 Technical Analysis Review 310715Dokument7 Seiten112 Technical Analysis Review 310715ajayvmehtaNoch keine Bewertungen

- 112 Technical Analysis Review 310715Dokument7 Seiten112 Technical Analysis Review 310715ajayvmehtaNoch keine Bewertungen

- 82 Technical Analysis Review 261214Dokument7 Seiten82 Technical Analysis Review 261214ajayvmehtaNoch keine Bewertungen

- 82 Technical Analysis Review 261214Dokument7 Seiten82 Technical Analysis Review 261214ajayvmehtaNoch keine Bewertungen

- 82 Technical Analysis Review 261214Dokument7 Seiten82 Technical Analysis Review 261214ajayvmehtaNoch keine Bewertungen

- 82 Technical Analysis Review 261214Dokument7 Seiten82 Technical Analysis Review 261214ajayvmehtaNoch keine Bewertungen

- 82 Technical Analysis Review 261214Dokument7 Seiten82 Technical Analysis Review 261214ajayvmehtaNoch keine Bewertungen

- Trading Future IndexDokument17 SeitenTrading Future IndexGene BenterNoch keine Bewertungen

- 4 - Derivative Concept SummaryDokument39 Seiten4 - Derivative Concept SummaryDeepika JhaNoch keine Bewertungen

- CurrencyDokument10 SeitenCurrencysandeepNoch keine Bewertungen

- Field ListDokument140 SeitenField ListSergio CostopulosNoch keine Bewertungen

- SSRN Id288123Dokument43 SeitenSSRN Id288123sandy_skvvNoch keine Bewertungen

- Problem Set 1Dokument14 SeitenProblem Set 1mariaNoch keine Bewertungen

- LT R Guidebook 053112Dokument99 SeitenLT R Guidebook 053112MarketsWikiNoch keine Bewertungen

- HW Solutions1Dokument6 SeitenHW Solutions1LeftoverLinguine100% (2)

- CME Group Daily Bulletin GlossaryDokument2 SeitenCME Group Daily Bulletin GlossaryavadcsNoch keine Bewertungen

- 1565329296117Dokument241 Seiten1565329296117ishuch24Noch keine Bewertungen

- Angel Broking ProjectDokument35 SeitenAngel Broking ProjectAnand VyasNoch keine Bewertungen

- Commodity Derivatives and Risk Management - AssessmentDokument4 SeitenCommodity Derivatives and Risk Management - AssessmentLokesh manglaNoch keine Bewertungen

- Shekhar Notes Manual Notes For Iris PlusDokument34 SeitenShekhar Notes Manual Notes For Iris Plusvimal989700% (1)

- Future TerminologyDokument9 SeitenFuture TerminologyavinishNoch keine Bewertungen

- Interest Rate FuturesDokument22 SeitenInterest Rate FuturesHerojianbuNoch keine Bewertungen

- Commodities AssignmentDokument10 SeitenCommodities AssignmentjyotiNoch keine Bewertungen