Beruflich Dokumente

Kultur Dokumente

Budget Ordinance 2013-2014

Hochgeladen von

Jesse Franklin SrCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Budget Ordinance 2013-2014

Hochgeladen von

Jesse Franklin SrCopyright:

Verfügbare Formate

MACON COUNTY, NORTH CAROLINA BUDGET ORDINANCE Fiscal Year 2013/2014 BE IT ORDAINED by the Board of Commissioners of Macon County,

North Carolina:

SECTION 1. The following amounts are hereby appropriated in the General Fund for the operation of the county government and its activities for the fiscal year beginning July 1, 2013, and ending June 30, 2014, in accordance with the chart of accounts heretofore established for this county: Governing Board Administration Finance Tax Supervision Mapping Tax Assessment Legal Human Resources Board of Elections Register of Deeds Information Technology Garage Buildings & Grounds Sheriff Courthouse Security NC Forest Service Contract Governors Highway Safety Law Enforcement Center Permitting, Planning, and Development Emergency Medical Service Emergency Management Services E911 Addressing Animal Control Airport Tourism Development Occupancy Tax Economic Development Cowee School Transit Services Soil Conservation Cooperative Extension Health Department Social Services Mental Health/Handicapped Juvenile Crime Prevention Council Veterans Services Senior Services Library Services Recreation Education Transfers to other funds Special Appropriations Non-Departmental Total Appropriations $ 202,974 456,316 515,870 589,822 175,609 396,644 100,000 159,998 256,274 291,791 980,765 305,390 1,974,146 4,051,336 186,981 74,115 57,994 1,819,665 556,818 2,958,540 1,055,557 155,229 266,035 40,000 481,500 101,450 122,990 1,329,040 183,158 223,360 5,011,372 5,717,486 168,993 112,432 90,693 701,379 999,390 1,369,107 8,538,549 3,577,173 85,000 704,529 47,145,470

SECTION 2. It is estimated that the following revenues will be available in the General Fund for the fiscal year beginning July 1, 2013, and ending June 30, 2014:

Tax Collections Gross Receipts Tax Local Option Sales Tax Payments in Lieu of Taxes Service Fees Health Programs JCPC Grants Social Services Revenues Transit Services Grants & Fees Veterans Affairs Senior Services Revenues & Fees Recreation Fees Interest Earnings Rentals ABC Funds Miscellaneous Income Fund Balance Appropriated Grants Transfers To General Fund Total Estimated Revenues

26,323,348 16,000 5,906,289 332,000 2,970,552 2,718,121 86,825 4,467,201 1,095,434 1,452 374,285 20,100 51,000 56,000 11,000 271,350 2,121,220 116,293 207,000 47,145,470

SECTION 3. The following amounts are hereby appropriated in the Debt Service Fund for the payment of principal and interest on the outstanding and anticipated debt of the county and the fees relating thereto for the fiscal year beginning July 1, 2013, and ending June 30, 2014: 2004 COPS 2004 SCC Campus/Library Installment Purchase Sanders Owens 5 -6 School Land 2008 School Issue QZAB East Franklin Fiscal Agency Fees Capital Equipment Debt 2010 Iotla Valley School QZAB - Nantahala School Technology Upgrades EMS Defibrillators QZAB - Highlands Little Tennessee Sewer Project Total Appropriations $ 1,744,875 386,259 215,415 1,398,025 105,590 2,580 103,850 1,351,388 212,355 309,778 78,059 150,000 149,240 6,207,414

SECTION 4. It is estimated that the following revenues will be available in the Debt Service Fund for fiscal year beginning July 1, 2013, and ending June 30, 2014: Transfer from General Fund Transfer from Schools Capital Reserve Fund Subsidy Refunds Town of Franklin Interest Fund Balance Appropriated Lottery Total Estimated Revenues $ 3,517,173 1,468,725 618,154 46,862 500 250,000 306,000 6,207,414

SECTION 5. The following amounts are hereby appropriated in the Schools Capital Reserve Fund for the fiscal year beginning July 1, 2013, and ending June 30, 2014: Transfer to Debt Service Fund Total Appropriations $ $ 1,468,725 1,468,725

SECTION 6. It is estimated that the following revenues will be available in the Schools Capital Reserve Fund for the year beginning July 1, 2013, and ending June 30, 2014: Local Option Sales Tax Total Estimated Revenues $ $ 1,468,725 1,468,725

SECTION 7. The following amounts are hereby appropriated in the Fire District Tax Fund for the fiscal year beginning July 1, 2013, and ending June 30, 2014: Franklin Clarks Chapel Otto Cullasaja West Macon Scaly Mountain Burningtown/Iotla Cowee Nantahala Highlands Mountain Valley Total Appropriations $ 488,490 202,679 290,874 237,158 284,073 112,807 182,756 283,744 211,399 349,538 121,561 2,765,079

SECTION 8. The following tax rates, based upon an estimated collections rate of 95.85%, are hereby levied for the Fire Tax Districts for the fiscal year beginning July 1, 2013, and ending June 30, 2014. Rates are per $100 of assessed valuation of taxable property. Estimated Valuation 1,631,898,175 486,411,054 598,147,545 572,630,633 516,271,923 327,953,446 266,749,014 338,784,083 447,632,577 3,995,044,762 157,166,985

Fire District Franklin Clarks Chapel Otto Cullasaja West Macon Scaly Mountain Burningtown/Iotla Cowee Nantahala Highlands Mountain Valley Prior Years Taxes Total Estimated Revenues

Tax Rate 0.030 0.042 0.049 0.042 0.056 0.035 0.069 0.084 0.047 0.009 0.077

Levy 467,490 195,079 279,874 229,658 276,073 109,607 175,756 271,744 200,899 343,338 115,561 100,000 2,765,079

SECTION 9. The following amounts are hereby appropriated in the Emergency 911 Surcharge Fund for the fiscal year beginning July 1, 2013, and ending June 30, 2014: 911 Program Total Appropriations $ $ 322,181 322,181

SECTION 10. It is estimated that the following revenues will be available in the Emergency 911 Surcharge Fund for the fiscal year beginning July 1, 2013, and ending June 30, 2014: 911 Revenues Total Estimated Revenues $322,181 $322,181

SECTION 11. The following amounts are hereby appropriated in the Solid Waste Fund for the fiscal year beginning July 1, 2013, and ending June 30, 2014: Administration Convenience Centers Landfill Operations Highlands Transfer Station Operations Recycling Solid Waste Processing Debt Service Transfers to Closure/Post closure Reserve Total Appropriations $ 613,409 852,562 860,259 304,029 396,630 146,109 481,702 3,654,700

SECTION 12. It is estimated that the following revenues will be available in the Solid Waste Fund for the fiscal year beginning July 1, 2013, and ending June 30, 2014: Landfill Fees Tipping Fees Recycling Sales State Reimbursements Other Revenues Fund Balance Appropriated Total Estimated Revenues $ 1,850,000 1,100,000 350,000 103,000 1,700 250,000 3,654,700

SECTION 13. The following amount is appropriated in the Old Sites Closure/Post-Closure Fund for the fiscal year beginning July 1, 2013, and ending June 30, 2014: Post-Closure Expenditures Total Appropriations $ $ 215,510 215,510

SECTION 14. It is estimated that the following revenue will be available in the Old Sites Closure/Post-Closure Fund for the fiscal year beginning July 1, 2013, and ending June 30, 2014: Transfer from Solid Waste Fund Total Estimated Revenues $ $ 215,510 215,510

SECTION 15. The following amounts are appropriated in the Cell I Closure/Post-Closure Reserve Fund for the fiscal year beginning July 1, 2013, and ending June 30, 2014: Closure Reserve Post-Closure Reserve Remediation Reserve Total Appropriations $ 218,924 1,865 45,403 266,192

SECTION 16. It is estimated that the following revenue will be available in the Cell I Closure/Post-Closure Reserve Fund for fiscal year beginning July 1, 2013, and ending June 30, 2014: Transfer from Solid Waste Fund Total Estimated Revenues $ $ 266,192 266,192

SECTION 17. The following amount is appropriated in the Self-Insured Health Insurance Fund for the fiscal year beginning July 1, 2013, and ending June 30, 2014: Insurance Claims/Premium/Administration Total Appropriations $ $ 4,409,838 4,409,838

SECTION18. It is estimated that the following revenues will be available in the Self-Insured Health Insurance Fund for the fiscal year beginning July 1, 2013, and ending June 30, 2014:

Contributions from Other Funds Cobra/Retirees Contributions Interest Earnings Fund Balance Appropriated Total Estimated Revenues

3,196,248 23,000 1,800 1,188,790 4,409,838

SECTION 19. The Board of County Commissioners hereby levies a tax at the rate of 27.9 cents per one hundred dollars ($100.00) valuation of property listed as of January 1, 2013, for the purpose of raising revenue included in Tax Collections in the General Fund in Section 2 of this ordinance.

This rate of tax is based upon an estimated total valuation of property for the purpose of taxation of $9,365,000,000, and an estimated collection rate of 96.72% for real/personal and 84.22% for motor vehicles.

SECTION 20. The Board of County Commissioners hereby levies a per unit assessment fee for the fiscal year beginning July 1, 2013, and ending June 30, 2014, on solid waste disposal based upon the following schedule: Residential Household/Mobile Home Commercial Buildings $72 $78

The Board of Commissioners authorizes the assessment amount to be printed on the Macon County Property Tax statement. The assessment is authorized to be collected in the same manner as property tax.

SECTION 21. The Board of Commissioners hereby levies a charge of $ 66.00 per ton for non-residential tipping fees for demolition and commercial waste. A charge of $ 10.00 per ton is levied for Materials Useful and a charge of $ 30.00 per ton is levied for brush and stumps. A charge of $8.75 per ton is levied for Highlands transfer fee to Macon County Landfill.

SECTION 22. The County Manager and/or Finance Director are hereby authorized to transfer appropriations within a fund as contained herein under the following conditions: a) The Finance Director may transfer amounts between objects of expenditure within a department. b) The County Manager may transfer amounts between departments.

c) The funding for approved reclassifications may be transferred from the budgeted reserve with the approval of the County Manager.

d) No revenues may be increased, no funds may be transferred from the Contingency account in the General Fund, and no transfers may be made between funds unless formal action is taken by the Board of Commissioners.

SECTION 23. The County Manager is hereby authorized to accept grant funding which has been previously approved for application by the Board of Commissioners, including any local match involved. The County Manager is authorized to execute any resulting grant documents. Also, the County Manager is authorized to enter into contracts for purchases of apparatus, supplies, materials, or equipment as described in G.S. 143-129(a) up to the limits stated therein for informal bidding which are within budgeted appropriations. The County Manager is authorized to enter into routine service contracts in the normal course of county operation within budgeted appropriations. Change Orders for capital project contracts previously approved by the Board of Commissioners may be approved by the County Manager up to the informal bidding limits referred to above, provided that sufficient funding is available. All contracts authorized by this ordinance are approved for signature by the Chairman of the Board of County Commissioners, the County Manager, and/or the Clerk to the Board of Commissioners as appropriate.

SECTION 24. Copies of this Budget Ordinance shall be furnished to the Clerk to the Board of Commissioners and to the Budget Officer and Finance Director to be kept on file by them for their direction in the disbursement of funds. Adopted this 17th day of June, 2013. _____________________________ Kevin Corbin Chairman, Board of Commissioners

_____________________________ C. Jack Horton Clerk to the Board of Commissioners

Das könnte Ihnen auch gefallen

- FY 2015 Budget ResolutionDokument10 SeitenFY 2015 Budget ResolutionFauquier NowNoch keine Bewertungen

- Wheeler VilleDokument16 SeitenWheeler VilleBethany BumpNoch keine Bewertungen

- Miag-Ao Iloilo ES2014Dokument5 SeitenMiag-Ao Iloilo ES2014Roi Baltazar BaylenNoch keine Bewertungen

- 2013 14 d156 Budget State Form 091013Dokument29 Seiten2013 14 d156 Budget State Form 091013api-233183949Noch keine Bewertungen

- Dolores Executive Summary 2013Dokument6 SeitenDolores Executive Summary 2013Lyrics DistrictNoch keine Bewertungen

- Proposed Budget RevisedDokument53 SeitenProposed Budget RevisedBesir AsaniNoch keine Bewertungen

- 2013 Manitoba Budget SummaryDokument44 Seiten2013 Manitoba Budget SummarytessavanderhartNoch keine Bewertungen

- Orient Fire District State Comptroller AuditDokument22 SeitenOrient Fire District State Comptroller AuditTimesreviewNoch keine Bewertungen

- 2015 South Euclid, Ohio Budget (Final Council Draft)Dokument128 Seiten2015 South Euclid, Ohio Budget (Final Council Draft)seoversightNoch keine Bewertungen

- Saratoga Springs City School District: Fund BalanceDokument13 SeitenSaratoga Springs City School District: Fund BalanceBethany BumpNoch keine Bewertungen

- Wakefield Finance Presentation April 15, 2015Dokument20 SeitenWakefield Finance Presentation April 15, 2015Wakefield MassachusettsNoch keine Bewertungen

- PSFR Exam GuideDokument31 SeitenPSFR Exam Guideathancox5837Noch keine Bewertungen

- Fiscal Year 2012-13 Adopted Budget: 260 North San Antonio Road, Suite A Santa Barbara, CA 93110 805-961-8800Dokument31 SeitenFiscal Year 2012-13 Adopted Budget: 260 North San Antonio Road, Suite A Santa Barbara, CA 93110 805-961-8800Besir AsaniNoch keine Bewertungen

- State Comptroller's Audit of The The Hendrick Hudson School District's Financial ConditionDokument11 SeitenState Comptroller's Audit of The The Hendrick Hudson School District's Financial ConditionCara MatthewsNoch keine Bewertungen

- Advance Gov't&nfp AssignmentDokument5 SeitenAdvance Gov't&nfp AssignmentHabte Debele100% (3)

- Resident's Guide: Volume 1 FY2013Dokument15 SeitenResident's Guide: Volume 1 FY2013ChicagoistNoch keine Bewertungen

- Newtown CT 2014-15 BudgetDokument317 SeitenNewtown CT 2014-15 BudgetGary JeanfaivreNoch keine Bewertungen

- New - Haven - FY 2015-16 Mayors Budget1Dokument419 SeitenNew - Haven - FY 2015-16 Mayors Budget1Helen BennettNoch keine Bewertungen

- Fourth Quarter FY 2012-13 Performance Reportt 09-10-13Dokument10 SeitenFourth Quarter FY 2012-13 Performance Reportt 09-10-13L. A. PatersonNoch keine Bewertungen

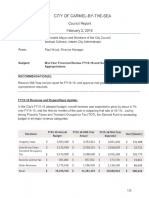

- City of Carmel-By-The-Sea: Council Report February 2, 2016Dokument6 SeitenCity of Carmel-By-The-Sea: Council Report February 2, 2016L. A. PatersonNoch keine Bewertungen

- Assabet Budgets-How Much Does It Cost To Run? Marlborough Council, 1-23-12 AgendaDokument67 SeitenAssabet Budgets-How Much Does It Cost To Run? Marlborough Council, 1-23-12 AgendaourmarlboroughNoch keine Bewertungen

- 2013-14 Proposed FInal BudgetDokument23 Seiten2013-14 Proposed FInal BudgetPress And JournalNoch keine Bewertungen

- HB-SB76 Presentation To Senate Finance 10-15-2013Dokument29 SeitenHB-SB76 Presentation To Senate Finance 10-15-2013shadowchbNoch keine Bewertungen

- Flora Executive Summary 2013Dokument3 SeitenFlora Executive Summary 2013Drei GoNoch keine Bewertungen

- 2918 - Quarterly Financial Update Q2-2016Dokument6 Seiten2918 - Quarterly Financial Update Q2-2016Brad TabkeNoch keine Bewertungen

- 2013 Proposed Program Budget: Village of Grafton, WisconsinDokument42 Seiten2013 Proposed Program Budget: Village of Grafton, Wisconsinsschuster4182Noch keine Bewertungen

- Dutchess County AuditDokument15 SeitenDutchess County AuditDaily FreemanNoch keine Bewertungen

- Dps 2015 Audit Cafr FinalDokument148 SeitenDps 2015 Audit Cafr FinalChrisNoch keine Bewertungen

- Town of Galway: Financial OperationsDokument17 SeitenTown of Galway: Financial OperationsdayuskoNoch keine Bewertungen

- Public Accounts 2013-14 SaskatchewanDokument270 SeitenPublic Accounts 2013-14 SaskatchewanAnishinabeNoch keine Bewertungen

- MVCA BudgetResolutionFY2010-11MVCADokument2 SeitenMVCA BudgetResolutionFY2010-11MVCArichtrackerNoch keine Bewertungen

- 10-Casiguran Aurora 2010 Part1-Notes To FSDokument9 Seiten10-Casiguran Aurora 2010 Part1-Notes To FSKasiguruhan AuroraNoch keine Bewertungen

- Ithaca Budget NarrativeDokument42 SeitenIthaca Budget NarrativeTime Warner Cable NewsNoch keine Bewertungen

- Note 5 - Pension and Other Benefit Plans (Continued)Dokument1 SeiteNote 5 - Pension and Other Benefit Plans (Continued)Nacho BMNoch keine Bewertungen

- EBZS 2015 Final Audit Report PDFDokument13 SeitenEBZS 2015 Final Audit Report PDFRecordTrac - City of OaklandNoch keine Bewertungen

- PHS 2013 FinancialsDokument16 SeitenPHS 2013 FinancialsBob MackinNoch keine Bewertungen

- ICAEW Financial Accounting Questions March 2015 To March 2016 (SPirate)Dokument49 SeitenICAEW Financial Accounting Questions March 2015 To March 2016 (SPirate)Ahmed Raza Mir100% (4)

- 2014-2015 City of Sacramento Budget OverviewDokument34 Seiten2014-2015 City of Sacramento Budget OverviewCapital Public RadioNoch keine Bewertungen

- Audit Report - State 911 DepartmentDokument29 SeitenAudit Report - State 911 DepartmentShira SchoenbergNoch keine Bewertungen

- Summary of 2014-15 Taylor Budget ChangesDokument2 SeitenSummary of 2014-15 Taylor Budget ChangesDavid KomerNoch keine Bewertungen

- FY 13-14 Fiscal HighlightsDokument144 SeitenFY 13-14 Fiscal HighlightsRepNLandryNoch keine Bewertungen

- DCF February 2014Dokument6 SeitenDCF February 2014Rachel E. Stassen-BergerNoch keine Bewertungen

- Summary of AFSCME Tentative MOUDokument5 SeitenSummary of AFSCME Tentative MOUjon_ortizNoch keine Bewertungen

- Mati City Executive Summary 2014Dokument6 SeitenMati City Executive Summary 2014Heart Trixie Tacder SalvaNoch keine Bewertungen

- Proposed FY 2015 NC BudgetDokument166 SeitenProposed FY 2015 NC BudgetThunder PigNoch keine Bewertungen

- Topic 5 Tutorial QuestionsDokument3 SeitenTopic 5 Tutorial QuestionsPardeep Ramesh AgarvalNoch keine Bewertungen

- Auburn Statement of Revenue and ExpendituresDokument15 SeitenAuburn Statement of Revenue and ExpendituresthesacnewsNoch keine Bewertungen

- Ed1-2Dokument44 SeitenEd1-2Parents' Coalition of Montgomery County, MarylandNoch keine Bewertungen

- Roxas Isabela ES2016Dokument4 SeitenRoxas Isabela ES2016J JaNoch keine Bewertungen

- General Brown Financial Report - Nov. 2014Dokument16 SeitenGeneral Brown Financial Report - Nov. 2014Watertown Daily TimesNoch keine Bewertungen

- Notes To Financial StatementsDokument11 SeitenNotes To Financial Statementsdemos reaNoch keine Bewertungen

- Iasb Policy Reference Manual Section 4 - Operational ServicesDokument29 SeitenIasb Policy Reference Manual Section 4 - Operational Servicesdist57Noch keine Bewertungen

- Hr4348conference Cbo ReportDokument8 SeitenHr4348conference Cbo ReportPeggy W SatterfieldNoch keine Bewertungen

- Saratoga CoDokument16 SeitenSaratoga CoDennis YuskoNoch keine Bewertungen

- Maricopa Cty 6-30-05 Mangmt Ltr1Dokument16 SeitenMaricopa Cty 6-30-05 Mangmt Ltr1tonygoprano2850Noch keine Bewertungen

- Suffolk County Executive Steve Bellone's 2013 Proposed BudgetDokument1.132 SeitenSuffolk County Executive Steve Bellone's 2013 Proposed BudgetSuffolk TimesNoch keine Bewertungen

- Alicia Executive Summary 2014Dokument6 SeitenAlicia Executive Summary 2014Gier Rizaldo BulaclacNoch keine Bewertungen

- Bull2013 8Dokument1 SeiteBull2013 8jspectorNoch keine Bewertungen

- Money Matters: Local Government Finance in the People's Republic of ChinaVon EverandMoney Matters: Local Government Finance in the People's Republic of ChinaNoch keine Bewertungen

- The Financial Death Spiral of the United States Postal Service ...Unless?Von EverandThe Financial Death Spiral of the United States Postal Service ...Unless?Noch keine Bewertungen

- Obama's 2008 Plan For VeteransDokument4 SeitenObama's 2008 Plan For VeteransJesse Franklin SrNoch keine Bewertungen

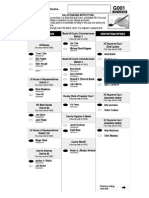

- 2014 Macon County NC Voter RecommendationsDokument2 Seiten2014 Macon County NC Voter RecommendationsJesse Franklin SrNoch keine Bewertungen

- Fracking Frequently Asked QuestionsDokument2 SeitenFracking Frequently Asked QuestionsJesse Franklin SrNoch keine Bewertungen

- Macon County Schools SummaryDokument4 SeitenMacon County Schools SummaryJesse Franklin SrNoch keine Bewertungen

- Macon County (NC) Commissioners' Split-VotesDokument11 SeitenMacon County (NC) Commissioners' Split-VotesJesse Franklin SrNoch keine Bewertungen

- Macon County, NC, 2015 Budget Message PDFDokument15 SeitenMacon County, NC, 2015 Budget Message PDFJesse Franklin SrNoch keine Bewertungen

- NCDOT A-9 Project FAQsDokument2 SeitenNCDOT A-9 Project FAQsJesse Franklin SrNoch keine Bewertungen

- Macon County NC Comprehensive Financial Audit Report - June 30, 2013Dokument180 SeitenMacon County NC Comprehensive Financial Audit Report - June 30, 2013Jesse Franklin SrNoch keine Bewertungen

- The READY Accountability Report: 2012-13 Growth and Performance of North Carolina Public SchoolsDokument9 SeitenThe READY Accountability Report: 2012-13 Growth and Performance of North Carolina Public SchoolsJesse Franklin SrNoch keine Bewertungen

- Contact List of Politicians and Media For Franklin, NC Area.Dokument2 SeitenContact List of Politicians and Media For Franklin, NC Area.Jesse Franklin SrNoch keine Bewertungen

- Heathcare - Where Next?Dokument18 SeitenHeathcare - Where Next?Jesse Franklin SrNoch keine Bewertungen

- 2012-2013 Budget OrdinanceDokument6 Seiten2012-2013 Budget OrdinanceJesse Franklin SrNoch keine Bewertungen

- RFP Visioning RFP June 2012Dokument12 SeitenRFP Visioning RFP June 2012Jesse Franklin SrNoch keine Bewertungen

- A0009 Project Costs-StatusDokument1 SeiteA0009 Project Costs-StatusJesse Franklin SrNoch keine Bewertungen

- Macon County NC Comprehensive Financial Audit Report - June 30, 2009Dokument179 SeitenMacon County NC Comprehensive Financial Audit Report - June 30, 2009Jesse Franklin SrNoch keine Bewertungen

- Return ExcessDokument2 SeitenReturn ExcessJesse Franklin SrNoch keine Bewertungen

- SWC Regional Visioning Effort - Fact SheetDokument1 SeiteSWC Regional Visioning Effort - Fact SheetJesse Franklin SrNoch keine Bewertungen

- Macon County NC Comprehensive Financial Audit Report - June 30, 2010Dokument172 SeitenMacon County NC Comprehensive Financial Audit Report - June 30, 2010Jesse Franklin SrNoch keine Bewertungen

- Macon County NC Comprehensive Financial Audit Report - June 30, 2011Dokument180 SeitenMacon County NC Comprehensive Financial Audit Report - June 30, 2011Jesse Franklin SrNoch keine Bewertungen

- NC Guide To Open Gov't and Public RecordsDokument12 SeitenNC Guide To Open Gov't and Public RecordsJesse Franklin SrNoch keine Bewertungen

- 2012-2013 Budget OrdinanceDokument6 Seiten2012-2013 Budget OrdinanceJesse Franklin SrNoch keine Bewertungen

- 2012-2013 Budget OrdinanceDokument6 Seiten2012-2013 Budget OrdinanceJesse Franklin SrNoch keine Bewertungen

- Macon County NC Comprehensive Financial Audit Report - June 30, 2012Dokument178 SeitenMacon County NC Comprehensive Financial Audit Report - June 30, 2012Jesse Franklin SrNoch keine Bewertungen

- Case Fair Oster: EconomicsDokument23 SeitenCase Fair Oster: EconomicsElleMhnaNoch keine Bewertungen

- Public Policy Course Outline Prof. Tarun DasDokument32 SeitenPublic Policy Course Outline Prof. Tarun DasProfessor Tarun DasNoch keine Bewertungen

- Financial Accounting Thesis TopicsDokument5 SeitenFinancial Accounting Thesis TopicsNaomi Hansen100% (2)

- Ivo Welch Corporate Finance Chap14Dokument32 SeitenIvo Welch Corporate Finance Chap14Laercio MusicaNoch keine Bewertungen

- Shareholder's EquityDokument31 SeitenShareholder's EquityAmmie Lemie100% (2)

- The Case Against Modern Monetary TheoryDokument2 SeitenThe Case Against Modern Monetary TheoryAndres LakeNoch keine Bewertungen

- Training Material On West Bengal Service RulesDokument99 SeitenTraining Material On West Bengal Service Rulesp2c9100% (2)

- 2010 CMA Part 2 Section B: Corporate FinanceDokument326 Seiten2010 CMA Part 2 Section B: Corporate FinanceAhmed Magdi0% (1)

- Saving, Investment and The Financial SystemDokument47 SeitenSaving, Investment and The Financial SystemKaifNoch keine Bewertungen

- Warren E. Buffett, 2005: Case Studies in FinanceDokument2 SeitenWarren E. Buffett, 2005: Case Studies in FinanceNakonoaNoch keine Bewertungen

- Registration of Documents PDFDokument10 SeitenRegistration of Documents PDFks manjuNoch keine Bewertungen

- AssignmentDokument13 SeitenAssignmentAftab UddinNoch keine Bewertungen

- FBL3N - GL Account Line Item DisplayDokument4 SeitenFBL3N - GL Account Line Item DisplayP RajendraNoch keine Bewertungen

- Testimony of Brian MoynihanDokument5 SeitenTestimony of Brian MoynihanDealBookNoch keine Bewertungen

- Innocents Abroad Currencies and International Stock ReturnsDokument39 SeitenInnocents Abroad Currencies and International Stock ReturnsShivaniNoch keine Bewertungen

- Isae 3400Dokument9 SeitenIsae 3400baabasaamNoch keine Bewertungen

- 38882333Dokument283 Seiten38882333SuZan TimilsinaNoch keine Bewertungen

- Step by Step Sap GL User ManualDokument109 SeitenStep by Step Sap GL User Manualkapil_73Noch keine Bewertungen

- Chapter 2 - Solved ProblemsDokument26 SeitenChapter 2 - Solved ProblemsDiptish RamtekeNoch keine Bewertungen

- Sbi Balance SheetDokument5 SeitenSbi Balance SheetNirmal BhagatNoch keine Bewertungen

- Haberberg and Rieple: Strategic ManagementDokument20 SeitenHaberberg and Rieple: Strategic ManagementMilan MisraNoch keine Bewertungen

- Convertible DebtDokument10 SeitenConvertible DebtrajaNoch keine Bewertungen

- CREDITS FinalsDokument6 SeitenCREDITS FinalsLara DelleNoch keine Bewertungen

- Answer Sample Problems Cash1-12Dokument4 SeitenAnswer Sample Problems Cash1-12Anonymous wwLoDau1aNoch keine Bewertungen

- FM Project ReportDokument16 SeitenFM Project Reportharitha hnNoch keine Bewertungen

- Pension Rules & Regulation - EngDokument4 SeitenPension Rules & Regulation - EngMinsannNoch keine Bewertungen

- 4 L GST Certificate New PDFDokument3 Seiten4 L GST Certificate New PDFSuhas SuviNoch keine Bewertungen

- Rubberized Abaca PP - FIDADokument16 SeitenRubberized Abaca PP - FIDARegilu SalazarNoch keine Bewertungen

- Depreciation - WikipediaDokument10 SeitenDepreciation - Wikipediapuput075Noch keine Bewertungen

- Review On Financial Statement AnalysisDokument6 SeitenReview On Financial Statement AnalysisDanica VetuzNoch keine Bewertungen