Beruflich Dokumente

Kultur Dokumente

The Eight Steps of The Accounting Cycle

Hochgeladen von

Dana GoanOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

The Eight Steps of The Accounting Cycle

Hochgeladen von

Dana GoanCopyright:

Verfügbare Formate

The Eight Steps of the Accounting Cycle By Lita Epstein from Bookkeeping For Dummies 8 of 12 in Series: The Essentials

of Accounting Basics As a bookkeeper, you complete your work by completing the tasks of the accounting cycle. Its called a cycle because the accounting workflow is circular: entering transactions, manipulating the transactions through the accounting cycle, closing the books at the end of the accounting period, and then starting the entire cycle again for the next accounting period.

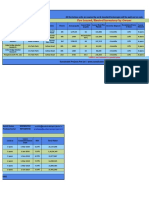

The accounting cycle has eight basic steps, which you can see in the following illustration. These steps are described in the list below.

Transactions

Financial transactions start the process. Transactions can include the sale or return of a product, the purchase of supplies for business activities, or any other financial activity that involves the exchange of the companys assets, the establishment or payoff of a debt, or the deposit from or payout of money to the companys owners.

Journal entries

The transaction is listed in the appropriate journal, maintaining the journals chronological order of transactions. The journal is also known as the book of original entry and is the first place a transaction is listed.

Posting

The transactions are posted to the account that it impacts. These accounts are part of the General Ledger, where you can find a summary of all the businesss accounts.

Trial balance

At the end of the accounting period (which may be a month, quarter, or year depending on a businesss practices), you calculate a trial balance.

Worksheet

Unfortunately, many times your first calculation of the trial balance shows that the books arent in balance. If thats the case, you look for errors and make corrections called adjustments, which are tracked on a worksheet.

Adjustments are also made to account for the depreciation of assets and to adjust for one-time payments (such as insurance) that should be allocated on a monthly basis to more accurately match monthly expenses with monthly revenues. After you make and record adjustments, you take another trial balance to be sure the accounts are in balance.

Adjusting journal entries

You post any corrections needed to the affected accounts once your trial balance shows the accounts will be balanced once the adjustments needed are made to the accounts. You dont need to make adjusting entries until the trial balance process is completed and all needed corrections and adjustments have been identified.

Financial statements

You prepare the balance sheet and income statement using the corrected account balances.

Closing the books

You close the books for the revenue and expense accounts and begin the entire cycle again with zero balances in those accounts.

As a businessperson, you want to be able to gauge your profit or loss on month by month, quarter by quarter, and year by year bases. To do that, Revenue and Expense accounts must start with a zero balance at the beginning of each accounting period. In contrast, you carry over Asset, Liability, and Equity account balances from cycle to cycle. The Accounting Cycle for a Small Business Eight Steps a Small Business Should Take to Complete the Accounting Cycle

From Rosemary Peavler, former About.com Guide Ads: Accounting Small Business Payroll Accounting Accounting Bookkeeping To Start a Small Business Financial Accounting Firm The accounting cycle for a small business begins with establishing the chart of accounts for that business and ends with closing the books for that business at the end of the accounting time period. The accounting cycle is a series of steps that the firm takes every accounting time period in order to take account of its financial transactions.

Here are the steps in the accounting cycle for a small business:

1. Develop the Chart of Accounts for your Small Business

stockfresh When you start a small business, develop a chart of accounts as part of setting up your accounting and bookkeeping system. The chart of accounts is an index of all the accounts where the company files its financial information.

Ads Home Bookkeeping

www.keepsoft.com Your personal financial secretary and advisor. Payroll Accounting System Accounting.TechnologyEvaluation.com Find the Right Accounting Software Free Vendor Comparison & Shortlist! Online Persuasion Course www.teachsales2me.com Get more people to say YES Special May offer - ONLY $2 2. The Source Document in an Accounting Transaction A source document in an accounting transaction is evidence that the transaction has occurred. It should be recorded as a journal entry as soon as possible. Examples are canceled checks, invoices, purchase orders, and other business documents.

3. Accounting Journal Entries When a small business makes a financial transaction, they make a journal entry in their accounting journal in order to record the transaction. There are actually two entries made - one is a debit to the appropriate account and the other is a credit.

4. Construct the General Ledger for your Small Business The general ledger is the main accounting record for your business. All of the business's financial transactions are taken from the general accounting journal and recorded in the general ledger in a summary form.

5. How to Prepare a Trial Balance After you complete your general ledger entries for an accounting cycle, the next step is to prepare a trial balance. A trial balance is the process of totaling the debits and credits from the general ledger to make sure they balance for the accounting period in question.

6. How to Make Adjusting Entries in your Accounting Journals

Adjusting entries are made in your accounting journals at the end of an accounting period. The purpose of adjusting entries is to adjust revenues and expenses to the accounting period in which they actually occurred.

7. Prepare the Financial Statements One of the final steps in the accounting cycle is the preparation of the financial statements. The information from the accounting journal and the general ledger is used to develop the income statement, statement of retained earnings, balance sheet, and statement of cash flows -- in that order. Information from the previous statement is used to develop the next statement.

8. Closing Entries as Part of the Accounting Cycle Closing entries are journal entries made at the end of an accounting cycle to set the balance of temporary accounts to zero to begin the next accounting period. The accounts that are closed are revenue, expense, and drawing accounts. The assets, liabilities, and owner's equity accounts are not closed because their ending balances are the beginning balances for the next accounting period.

REPUBLIC OF THE PHILIPPINES COMMISSION ON AUDIT Commonwealth Avenue, Quezon City, Philippines

CIRCULAR No. 2002-002 Date June 18, 2002

TO : All Heads of National Government Agencies and All Others Concerned

SUBJECT : Prescribing the Manual on the New Government Accounting System (Manual Version) For Use in All National Government Agencies

1.0 Purpose

In line with COA Circular No. 2001-004 dated October 30, 2001, prescribing the New Government Accounting System (NGAS) in all national government agencies effective January 1, 2002, this manual on the NGAS (manual version) is hereby prescribed to ensure the proper accounting of all financial transactions of the National Government.

2.0 The Manual on the NGAS

The NGAS Manual in its manual version is composed of three volumes, namely:

Volume I The Accounting Policies.

It shows the basic features and policies on NGAS, the government accounting plan, discussion on the financial statements and other related records required and the illustrative journal entries.

Volume II The Accounting Books, Records, Forms and Reports.

It contains the various formats of the books of accounts, registries, records, forms and reports including instructions on their use.

Volume III The Chart of Accounts.

It includes the list of accounts and the definitions/ descriptions of each account.

3.0 Saving Clause

Cases not covered by this Circular shall be referred to the Office of the Chairman thru the Government Accounting and FMIS Office, this Commission, for resolution.

4.0 Repealing Clause

This manual replaces the Government Accounting and Auditing Manual (GAAM), Volume II, prescribed under COA Circular No. 91-368, dated December 19, 1991.

Likewise, all other circulars, orders, memoranda and existing rules and regulations inconsistent with the provisions of this Manual are hereby amended/ modified/revoked accordingly.

5.0 Effectivity Clause

This Circular shall take effect immediately.

--------------------------------------------------------------------------------

Manual on the NEW GOVERNMENT ACCOUNTING SYSTEM for National Government Agencies [ 1.06MB]

VOLUME I - The Accounting Policies VOLUME II - The Accounting Books, Records, Forms and Reports VOLUME III - The Chart of Accounts

[ << Back ]

Das könnte Ihnen auch gefallen

- Bookkeeping And Accountancy Made Simple: For Owner Managed Businesses, Students And Young EntrepreneursVon EverandBookkeeping And Accountancy Made Simple: For Owner Managed Businesses, Students And Young EntrepreneursNoch keine Bewertungen

- Bookkeeping 101 For Business Professionals | Increase Your Accounting Skills And Create More Financial Stability And WealthVon EverandBookkeeping 101 For Business Professionals | Increase Your Accounting Skills And Create More Financial Stability And WealthNoch keine Bewertungen

- Accounting CycleDokument4 SeitenAccounting CycleAmitNoch keine Bewertungen

- Accounting CycleDokument3 SeitenAccounting CycleMardy DahuyagNoch keine Bewertungen

- General AccountingDokument94 SeitenGeneral Accountingswaroopbaskey2100% (1)

- What Is Accounting?: Cash FlowsDokument4 SeitenWhat Is Accounting?: Cash FlowsMamun RezaNoch keine Bewertungen

- Accounting CycleDokument3 SeitenAccounting CycleShanta MathaiNoch keine Bewertungen

- Accounting Cycle: BusinessDokument6 SeitenAccounting Cycle: BusinessRenu KulkarniNoch keine Bewertungen

- The Accounting Cycle: 9-Step Accounting ProcessDokument3 SeitenThe Accounting Cycle: 9-Step Accounting ProcessLala ArdilaNoch keine Bewertungen

- Accounting Cycle StepsDokument4 SeitenAccounting Cycle StepsAntiiasmawatiiNoch keine Bewertungen

- 7 The Accounting CycleDokument3 Seiten7 The Accounting Cycleapi-299265916Noch keine Bewertungen

- Accounting CycleDokument5 SeitenAccounting CycleMikaela JuanNoch keine Bewertungen

- Accounting ExerciseDokument14 SeitenAccounting ExerciseDima Abboud100% (2)

- Module 3 CFAS PDFDokument7 SeitenModule 3 CFAS PDFErmelyn GayoNoch keine Bewertungen

- Week 002-003-Module Review of Financial Statement Preparation, Analysis and InterpretationDokument12 SeitenWeek 002-003-Module Review of Financial Statement Preparation, Analysis and InterpretationWenzel ManaigNoch keine Bewertungen

- The Accounting CycleDokument3 SeitenThe Accounting Cycleliesly buticNoch keine Bewertungen

- Faa U2Dokument10 SeitenFaa U2kztrmfbc8wNoch keine Bewertungen

- Research Paper - AccountingDokument7 SeitenResearch Paper - AccountingYayoNoch keine Bewertungen

- Accounting ProcessDokument5 SeitenAccounting ProcessValNoch keine Bewertungen

- The Accounting Cycle: 9-Step Accounting Process InshareDokument3 SeitenThe Accounting Cycle: 9-Step Accounting Process InshareBTS ARMYNoch keine Bewertungen

- Accounting CycleDokument2 SeitenAccounting CycleMa. Aizey TorresNoch keine Bewertungen

- The Accounting Cycle: 1. TransactionsDokument2 SeitenThe Accounting Cycle: 1. TransactionsJonalyn MontecalvoNoch keine Bewertungen

- Financial Accounting: Daksh Gautam 22/834 Topic: Accounting ProcessDokument13 SeitenFinancial Accounting: Daksh Gautam 22/834 Topic: Accounting ProcessDaksh GautamNoch keine Bewertungen

- Review of The Accounting ProcessDokument18 SeitenReview of The Accounting ProcessRoyceNoch keine Bewertungen

- The Accounting Cycle: 9-Step Accounting ProcessDokument2 SeitenThe Accounting Cycle: 9-Step Accounting Processfazal rahmanNoch keine Bewertungen

- What Is Accounting and What Is Its Purpose? What Is Its Role in Decision-Making?Dokument4 SeitenWhat Is Accounting and What Is Its Purpose? What Is Its Role in Decision-Making?Jpoy RiveraNoch keine Bewertungen

- Accounting Records and System: The Chart of Accounts Debit and Credit The Accounting Process Transaction AnalysisDokument27 SeitenAccounting Records and System: The Chart of Accounts Debit and Credit The Accounting Process Transaction Analysiscluadine dineros100% (1)

- Accounting CycleDokument30 SeitenAccounting CycleJenelle RamosNoch keine Bewertungen

- Chapter 4 NotesDokument8 SeitenChapter 4 NotesLex XuNoch keine Bewertungen

- Steps in Accounting CycleDokument16 SeitenSteps in Accounting CycleMuhammad AyazNoch keine Bewertungen

- What Is The Accounting Cycle?: Financial Statements BookkeeperDokument4 SeitenWhat Is The Accounting Cycle?: Financial Statements Bookkeepermarissa casareno almueteNoch keine Bewertungen

- Entrepreneurship: Quarter 2: Module 7 & 8Dokument15 SeitenEntrepreneurship: Quarter 2: Module 7 & 8Winston MurphyNoch keine Bewertungen

- What Is The Accounting Cycle?Dokument4 SeitenWhat Is The Accounting Cycle?GOT MLNoch keine Bewertungen

- The Accounting Cycle: 9-S Tep Accounting ProcessDokument11 SeitenThe Accounting Cycle: 9-S Tep Accounting ProcessLovely Mae LacasteNoch keine Bewertungen

- Accounting OverviewDokument13 SeitenAccounting OverviewMae AroganteNoch keine Bewertungen

- UntitledDokument4 SeitenUntitledJeco OlarveNoch keine Bewertungen

- Accounting CycleDokument9 SeitenAccounting Cyclerakshit konchadaNoch keine Bewertungen

- Introduction: The Accounting Process Is A Series of Activities That BeginsDokument20 SeitenIntroduction: The Accounting Process Is A Series of Activities That BeginsMiton AlamNoch keine Bewertungen

- 1.3 AccountingDokument4 Seiten1.3 Accountingnez.829.aNoch keine Bewertungen

- Flow Chart - Accounting CycleDokument11 SeitenFlow Chart - Accounting Cyclematthew mafaraNoch keine Bewertungen

- Accounting Cycle StepsDokument3 SeitenAccounting Cycle Stepsjewelmir100% (1)

- New Microsoft Office Word DocumentDokument2 SeitenNew Microsoft Office Word DocumentFarooq HaiderNoch keine Bewertungen

- Accounts (1) FinalDokument28 SeitenAccounts (1) FinalManan MullickNoch keine Bewertungen

- Accounting CycleDokument4 SeitenAccounting Cycleadeebaa480Noch keine Bewertungen

- Accounting Cycle PaperDokument3 SeitenAccounting Cycle PaperMaribel PuigNoch keine Bewertungen

- Flow Chart - Trial Balance - WikiAccountingDokument6 SeitenFlow Chart - Trial Balance - WikiAccountingmatthew mafaraNoch keine Bewertungen

- The BeginnerDokument4 SeitenThe BeginnerSyra CeladaNoch keine Bewertungen

- What Is JournalizsdfvingDokument12 SeitenWhat Is JournalizsdfvingJames BlackNoch keine Bewertungen

- Rac 101 - Journals and LedgersDokument13 SeitenRac 101 - Journals and LedgersKevin TamboNoch keine Bewertungen

- Accounting Cycle DefinedDokument3 SeitenAccounting Cycle DefinedMichele RogersNoch keine Bewertungen

- Basics of Cost AccountingDokument21 SeitenBasics of Cost AccountingRose DallyNoch keine Bewertungen

- 01 Accounting ProcessDokument23 Seiten01 Accounting ProcessPrincess Ann BilogNoch keine Bewertungen

- ACC 003 - Fundamentals of Accounting Part 2 Lesson Title: Review The Accounting Cycle Lesson Objectives: ReferencesDokument2 SeitenACC 003 - Fundamentals of Accounting Part 2 Lesson Title: Review The Accounting Cycle Lesson Objectives: ReferencesRochelle Joyce CosmeNoch keine Bewertungen

- Steps in The Accounting CycleDokument3 SeitenSteps in The Accounting CycleAklilu TadesseNoch keine Bewertungen

- What Is The Accounting CycleDokument2 SeitenWhat Is The Accounting CycleSHREE KRISHNA TUTORIALSNoch keine Bewertungen

- Acc201 Su2Dokument5 SeitenAcc201 Su2Gwyneth LimNoch keine Bewertungen

- Accounting Software: Why Is The General Ledger Important?Dokument11 SeitenAccounting Software: Why Is The General Ledger Important?Sherin ThomasNoch keine Bewertungen

- Understanding AccountingDokument20 SeitenUnderstanding Accountingrainman54321Noch keine Bewertungen

- The Accounting Cyc: 1. Identify TransactionsDokument8 SeitenThe Accounting Cyc: 1. Identify TransactionsEnatnesh DegagaNoch keine Bewertungen

- Accounting CycleDokument2 SeitenAccounting CycleDNLNoch keine Bewertungen

- Zero Base BudgetingDokument10 SeitenZero Base BudgetingDana GoanNoch keine Bewertungen

- Appellant.: THE PEOPLE OF THE PHILIPPINES, Plaintiff-Appellee, vs. EMELITO SITCHON y TAYAG, AccusedDokument122 SeitenAppellant.: THE PEOPLE OF THE PHILIPPINES, Plaintiff-Appellee, vs. EMELITO SITCHON y TAYAG, AccusedDana GoanNoch keine Bewertungen

- ART4 #7 Case Digest On People V. Estrada (333 Scra 699 (2000) )Dokument23 SeitenART4 #7 Case Digest On People V. Estrada (333 Scra 699 (2000) )Dana GoanNoch keine Bewertungen

- Quality Management System and ISODokument15 SeitenQuality Management System and ISODana Goan100% (1)

- Pia Cayetano: Goan, Danielle Beatrice S. Villanueva, Ruben RochelleDokument11 SeitenPia Cayetano: Goan, Danielle Beatrice S. Villanueva, Ruben RochelleDana GoanNoch keine Bewertungen

- Final PaperDokument105 SeitenFinal PaperDana GoanNoch keine Bewertungen

- Early Man: Sean Pitman, MD March 2006Dokument73 SeitenEarly Man: Sean Pitman, MD March 2006Dana GoanNoch keine Bewertungen

- Pia CayetanoDokument5 SeitenPia CayetanoDana GoanNoch keine Bewertungen

- Women LitDokument8 SeitenWomen LitDana GoanNoch keine Bewertungen

- Cases On Police PowerDokument4 SeitenCases On Police PowerDana GoanNoch keine Bewertungen

- Masaniello ProgressivoDokument24 SeitenMasaniello ProgressivoPavanNoch keine Bewertungen

- Hospital Supply, IncDokument3 SeitenHospital Supply, Incmade3875% (4)

- Accpd9629e 2023Dokument5 SeitenAccpd9629e 2023wordsinditeNoch keine Bewertungen

- Corporate Governance in MalaysiaDokument19 SeitenCorporate Governance in Malaysiakhorteik100% (1)

- Bankin and Fin Law Relationship Between Bank and Its CustomersDokument6 SeitenBankin and Fin Law Relationship Between Bank and Its CustomersPersephone WestNoch keine Bewertungen

- SFM PDFDokument731 SeitenSFM PDFRam IyerNoch keine Bewertungen

- Financial Market.Dokument65 SeitenFinancial Market.CHARAK RAYNoch keine Bewertungen

- PreviewDokument4 SeitenPreviewJoshua PerumalaNoch keine Bewertungen

- ACC 123 Quiz 1Dokument16 SeitenACC 123 Quiz 1hwo50% (2)

- Public Trust Registration Office: Trust Accounts Submission Verification FormDokument1 SeitePublic Trust Registration Office: Trust Accounts Submission Verification FormHashtag ComputersNoch keine Bewertungen

- LESSON 8 - Purpose of BanksDokument5 SeitenLESSON 8 - Purpose of BanksChirag HablaniNoch keine Bewertungen

- Buffalo Accounting Go-Live ChecklistDokument16 SeitenBuffalo Accounting Go-Live ChecklistThach DoanNoch keine Bewertungen

- UMKC Econ431 Fall 2012 SyllabusDokument25 SeitenUMKC Econ431 Fall 2012 SyllabusMitch GreenNoch keine Bewertungen

- Technical Analysis of MahindraDokument3 SeitenTechnical Analysis of MahindraRipunjoy SonowalNoch keine Bewertungen

- Cambridge IGCSE: Accounting For Examination From 2020Dokument12 SeitenCambridge IGCSE: Accounting For Examination From 2020Abdallah OmarNoch keine Bewertungen

- Profit Sharing PDFDokument19 SeitenProfit Sharing PDFGadisNoch keine Bewertungen

- Tata Group - M&ADokument24 SeitenTata Group - M&Aankur_khushu66100% (1)

- Summary of "Contemporary Strategy"Dokument12 SeitenSummary of "Contemporary Strategy"MostakNoch keine Bewertungen

- Full Download Government and Not For Profit Accounting Concepts and Practices 7th Edition Granof Test BankDokument19 SeitenFull Download Government and Not For Profit Accounting Concepts and Practices 7th Edition Granof Test Bankwelked.gourami8nu9d100% (23)

- Book4time 25.06.2020 PDFDokument1 SeiteBook4time 25.06.2020 PDFCira ShotadzeNoch keine Bewertungen

- PayslipDokument1 SeitePayslipprathmeshNoch keine Bewertungen

- Borang CIMB Jan 2023Dokument15 SeitenBorang CIMB Jan 2023anuaraqNoch keine Bewertungen

- Form 16 Part BDokument4 SeitenForm 16 Part BDharmendraNoch keine Bewertungen

- Mabcredit BrochureDokument15 SeitenMabcredit BrochurealfredogoncalvesjrNoch keine Bewertungen

- Pontoon PLC A Case StudyDokument6 SeitenPontoon PLC A Case Studyparthasarathi_inNoch keine Bewertungen

- Urban Water Tariff GhanaDokument15 SeitenUrban Water Tariff GhanaBonzibit ZibitNoch keine Bewertungen

- Payroll Summary For The Month of AugustDokument46 SeitenPayroll Summary For The Month of AugustAida MohammedNoch keine Bewertungen

- Sustainable Pre Leased 06122019Dokument2 SeitenSustainable Pre Leased 06122019vaibhav vermaNoch keine Bewertungen

- ISA-400-Audit Risk, ISA-550-Related Parties ISA-600-Groups Audit, and ISA-620-Using The Work of An Auditor's ExpertDokument18 SeitenISA-400-Audit Risk, ISA-550-Related Parties ISA-600-Groups Audit, and ISA-620-Using The Work of An Auditor's ExpertSohaib BilalNoch keine Bewertungen

- Bad Debts - CE and DSE - AnswerDokument3 SeitenBad Debts - CE and DSE - AnswerKwan Yin HoNoch keine Bewertungen