Beruflich Dokumente

Kultur Dokumente

The Siam Cement Public and Its Subsidiaries: Company Limited

Hochgeladen von

Mufidah 'mupmup'Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

The Siam Cement Public and Its Subsidiaries: Company Limited

Hochgeladen von

Mufidah 'mupmup'Copyright:

Verfügbare Formate

The Siam Cement Public Company Limited and its Subsidiaries

Annual consolidated financial statements and Audit Report of Certified Public Accountant

For the years ended 31 December 2011 and 2010

Audit Report of Certified Public Accountant

To the Shareholders of The Siam Cement Public Company Limited

I have audited the accompanying consolidated statements of financial position of The Siam Cement Public Company Limited and its subsidiaries as at 31 December 2011 and 2010, and the related consolidated income statements and statements of comprehensive income, and the related consolidated statements of changes in shareholders equity and cash flows for the years then ended. The Companys management is responsible for the correctness and completeness of information presented in these financial statements. My responsibility is to express an opinion on these financial statements based on my audits. I conducted my audits in accordance with generally accepted auditing standards. Those standards require that I plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. I believe that my audits provide a reasonable basis for my opinion. In my opinion, the financial statements referred to above present fairly, in all material respects, the consolidated financial positions of The Siam Cement Public Company Limited and its subsidiaries as at 31 December 2011 and 2010, and the consolidated results of their operations and their cash flows for the years then ended in accordance with Thai Financial Reporting Standards. As explained in notes 2, 3 and 4 to the financial statements, with effect from 1 January 2011, the Group has adopted certain new and revised financial reporting standards. The consolidated financial statements for the year ended 31 December 2010, which are included in the accompanying financial statements for comparative purposes, have been restated accordingly.

(Supot Singhasaneh) Certified Public Accountant Registration No. 2826

KPMG Phoomchai Audit Ltd. Bangkok 22 February 2012

The Siam Cement Public Company Limited and its Subsidiaries

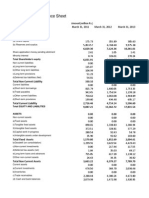

Consolidated statements of financial position As at 31 December 2011 and 2010

Assets

Note

2011

2010

(in thousand Baht) Current assets Cash and cash equivalents Short-term investments Trade receivables - Related parties - Other companies Receivables from and short-term loans to related parties Inventories Other current assets Total current assets Non-current assets Available-for-sale investments Investments in associates Investments in jointly-controlled entities Other long-term investments Long-term loans to related parties Investment properties Property, plant and equipment Goodwill Intangible assets Deferred tax assets Other non-current assets Total non-current assets Total assets 10 11 11 12 7 4, 13 14 15 15 16 17 25,637,774 54,773,433 973,628 3,229,205 401,273 1,594,667 156,683,108 2,510,925 4,011,039 3,852,212 4,307,034 257,974,298 374,738,115 10,484,852 39,750,575 957,569 3,250,036 392,927 1,604,598 150,378,388 1,169,915 3,627,769 2,504,331 4,075,743 218,196,703 359,218,866 7, 8 8 7 9 4,171,010 29,453,737 2,032,462 41,838,304 9,383,497 116,763,817 2,640,924 22,767,262 1,357,919 36,544,173 7,884,814 141,022,163 10 10 22,679,806 7,205,001 63,827,071 6,000,000

The accompanying notes are an integral part of these financial statements. 2

The Siam Cement Public Company Limited and its Subsidiaries

Consolidated statements of financial position As at 31 December 2011 and 2010

Liabilities and shareholders' equity

Note

2011

2010

(in thousand Baht) Current liabilities Bank overdrafts and short-term loans from financial institutions Trade payables - Related parties - Other companies Current portion of long-term debts Current portion of debentures Payables to and short-term loans from related parties Income tax payable Other current liabilities Total current liabilities Non-current liabilities Long-term debts Debentures Deferred tax liabilities Employee benefit liabilities Other non-current liabilities Total non-current liabilities Total liabilities 19 20 16 4, 21 22 28,156,126 69,838,851 2,511,243 3,898,763 912,724 105,317,707 211,769,550 27,643,146 84,853,756 2,623,343 421,162 1,024,712 116,566,119 199,648,611 19 20 7 7 2,102,911 23,300,414 4,304,707 39,910,384 133,467 4,177,102 12,464,904 106,451,843 2,139,170 20,830,073 7,210,571 24,878,434 198,243 9,802,573 9,356,949 83,082,492 18 20,057,954 8,666,479

The accompanying notes are an integral part of these financial statements. 3

The Siam Cement Public Company Limited and its Subsidiaries

Consolidated statements of financial position As at 31 December 2011 and 2010

Liabilities and shareholders' equity

Note

2011

2010

(in thousand Baht) Shareholders' equity Share capital Authorised share capital Issued and paid-up share capital Retained earnings Appropriated Legal reserve General reserve Unappropriated Other components of equity Total equity attributable to owners of the parent Non-controlling interests Total shareholders equity Total liabilities and shareholders' equity 24 24 160,000 10,516,000 128,738,156 (415,219) 140,198,937 22,769,628 162,968,565 374,738,115 160,000 10,516,000 120,027,532 1,213,880 133,117,412 26,452,843 159,570,255 359,218,866 23 23 1,600,000 1,200,000 1,600,000 1,200,000

The accompanying notes are an integral part of these financial statements. 4

The Siam Cement Public Company Limited and its Subsidiaries

Consolidated income statements For the years ended 31 December 2011 and 2010

Note

2011

2010

(in thousand Baht) Revenue from sales Cost of sales Gross profit Other income Profit before expenses Selling expenses Administrative expenses Total expenses Profit from operations Share of profit of associates and jointly-controlled entities Profit before finance costs and income tax expense Finance costs Profit before income tax expense Income tax expense Profit for the year Profit (loss) attributable to Owners of the parent Non-controlling interests 27,280,656 (3,534,987) 23,745,669 Basic earnings per share (in Baht) Attributable to owners of the parent 33 22.73 31.15 37,381,873 (123,258) 37,258,615 32 31 28 29 7, 27 7 7 368,578,679 (315,810,547) 52,768,132 10,894,137 63,662,269 (14,377,975) (18,760,383) (33,138,358) 30,523,911 6,773,943 37,297,854 (6,048,104) 31,249,750 (7,504,081) 23,745,669 301,323,130 (247,915,256) 53,407,874 24,416,383 77,824,257 (13,918,968) (16,407,102) (30,326,070) 47,498,187 8,390,035 55,888,222 (4,670,176) 51,218,046 (13,959,431) 37,258,615

The accompanying notes are an integral part of these financial statements. 5

The Siam Cement Public Company Limited and its Subsidiaries

Consolidated statements of comprehensive income For the years ended 31 December 2011 and 2010

2011

2010

(in thousand Baht) Profit for the year Other comprehensive income Foreign currency translation differences for foreign operations Net change in fair value of available-for-sale investments Defined benefit plan actuarial gains Share of other comprehensive income (loss) of associates and jointly-controlled entities Income tax on other comprehensive income Other comprehensive income (loss) for the year, net of income tax Total comprehensive income for the year Total comprehensive income (loss) attributable to Owners of the parent Non-controlling interests 25,677,723 (3,641,130) 22,036,593 39,986,523 (186,248) 39,800,275 (1,709,076) 22,036,593 2,541,660 39,800,275 (122,498) 1,223,396 177,977 (1,880,261) 192,362 (3,041,405) 39,069 (1,142,518) 5,386,462 23,745,669 37,258,615

The accompanying notes are an integral part of these financial statements. 6

The Siam Cement Public Company Limited and its Subsidiaries

Consolidated statements of changes in shareholders' equity For the years ended 31 December 2011 and 2010

Other components of equity Retained earnings Issued and paid-up Note share capital Appropriated Legal reserve General reserve Unappropriated Currency translation differences Share of other comprehensive Available-for-sale income (loss) investments of associates Total equity attributable to owners of the parent Noncontrolling interests Total shareholders equity

(in thousand Baht) Balance at 1 January 2010 Transactions with owners, recorded directly in shareholders equity Contributions by and distributions to owners of the parent Dividends Total contributions by and distributions to owners of the parent Changes in ownership interests in subsidiaries Acquisition of non-controlling interests without a change in control Acquisition of non-controlling interests with a change in control Total changes in ownership interests in subsidiaries Total transactions with owners, recorded directly in shareholders equity Comprehensive income for the year Profit or loss Other comprehensive income Total comprehensive income for the year Balance at 31 December 2010 1,200,000 160,000 10,516,000 37,381,873 37,381,873 120,027,532 (817,778) (817,778) (2,064,016) 3,244,451 3,244,451 3,243,556 177,977 177,977 34,340 37,381,873 2,604,650 39,986,523 133,117,412 (123,258) (62,990) (186,248) 26,452,843 37,258,615 2,541,660 39,800,275 159,570,255 (11,375,152) (11,375,152) (276,322) (11,651,474) 145,831 531,868 145,831 531,868 386,037 386,037 (11,375,152) (11,375,152) (808,190) (12,183,342) 35 (11,375,152) (11,375,152) (808,190) (12,183,342) 1,200,000 160,000 10,516,000 94,020,811 (1,246,238) (895) (143,637) 104,506,041 26,915,413 131,421,454

The accompanying notes are an integral part of these financial statements. 7

The Siam Cement Public Company Limited and its Subsidiaries

Consolidated statements of changes in shareholders' equity For the years ended 31 December 2011 and 2010

Other components of equity Retained earnings Issued and paid-up Note share capital Appropriated Legal reserve General reserve Unappropriated Currency translation differences Share of other comprehensive Available-for-sale income (loss) investments of associates Total equity attributable to owners of the parent Noncontrolling interests Total shareholders equity

(in thousand Baht) Balance at 1 January 2011 - as reported Impact of changes in accounting policy Balance at 1 January 2011 - restated Transactions with owners, recorded directly in shareholders' equity Contributions by and distributions to owners of the parent Dividends Total contributions by and distributions to owners of the parent Changes in ownership interests in subsidiaries Acquisition of non-controlling interests without a change in control Acquisition of non-controlling interests with a change in control Total changes in ownership interests in subsidiaries Total transactions with owners, recorded directly in shareholders' equity Comprehensive income for the year Profit or loss Other comprehensive income Total comprehensive income for the year Balance at 31 December 2011 1,200,000 160,000 10,516,000 27,280,656 26,166 27,306,822 128,738,156 241,052 241,052 (1,822,964) (1,747,653) (1,747,653) 1,495,903 (122,498) (122,498) (88,158) 27,280,656 (1,602,933) 25,677,723 140,198,937 (3,534,987) (106,143) (3,641,130) 22,769,628 23,745,669 (1,709,076) 22,036,593 162,968,565 (16,187,819) (16,187,819) 301,169 (15,886,650) 198,811 2,180,941 198,811 2,180,941 1,982,130 1,982,130 (16,187,819) (16,187,819) (1,879,772) (18,067,591) 35 (16,187,819) (16,187,819) (1,879,772) (18,067,591) 4 1,200,000 1,200,000 160,000 160,000 10,516,000 10,516,000 120,027,532 (2,408,379) 117,619,153 (2,064,016) (2,064,016) 3,243,556 3,243,556 34,340 34,340 133,117,412 (2,408,379) 130,709,033 26,452,843 (343,254) 26,109,589 159,570,255 (2,751,633) 156,818,622

The accompanying notes are an integral part of these financial statements. 8

The Siam Cement Public Company Limited and its Subsidiaries

Consolidated statements of cash flows For the years ended 31 December 2011 and 2010

2011

2010

(in thousand Baht) Cash flows from operating activities Profit for the year Adjustments for Depreciation and amortisation Interest income Interest expense Unrealised gain on foreign currency exchange Reversal of allowance for decline in value Dividend income Employee benefit expense Share of profit of associates and jointly-controlled entities Income tax expense Gain on sales of assets, allowance for doubtful accounts and others Profit provided by operating activities before changes in operating assets and liabilities Decrease (increase) in operating assets Trade receivables Receivables from related parties Inventories Other current assets Other non-current assets Net increase in operating assets (6,367,295) 385,842 (4,216,354) (747,669) 230,701 (10,714,775) (2,169,179) (365,417) (6,907,884) (1,830,474) 496,469 (10,776,485) 36,577,567 39,502,387 13,207,834 (1,894,165) 7,000,910 (843,234) (243,856) (2,668,231) 523,179 (6,773,943) 7,504,081 (2,980,677) 12,477,696 (484,314) 6,443,676 (1,014,873) (93,530) (2,458,868) (8,390,035) 13,959,431 (18,195,411) 23,745,669 37,258,615

The accompanying notes are an integral part of these financial statements. 9

The Siam Cement Public Company Limited and its Subsidiaries

Consolidated statements of cash flows For the years ended 31 December 2011 and 2010

Note

2011

2010

(in thousand Baht) Increase (decrease) in operating liabilities Trade payables Payables to related parties Other current liabilities Employee benefit liabilities Other non-current liabilities Net increase in operating liabilities Cash generated from the operations Income tax paid Net cash provided by operating activities Cash flows from investing activities Interest received Dividends received Short-term investments Available-for-sale investments Investments in associates, jointly-controlled entities and other companies Net cash outflow on acquisition of subsidiaries Proceeds from sales and return of investments Income tax paid from sales of investments Purchases of property, plant and equipment Proceeds from sales of property, plant and equipment Purchases of Intangible assets Loans to related parties Currency translation differences Net cash provided by (used in) investing activities 6 (14,002,571) (4,216,831) 29,810,996 (7,214,813) (13,409,341) 182,319 (761,396) 7,821 7,393 (46,092,770) (2,314,914) (1,456,113) 38,228,632 (13,719,981) 442,516 (975,694) 1,039,314 (636,729) 21,895,728 1,764,461 7,058,450 (997,776) (44,321,482) 780,819 6,507,878 (6,000,000) 1,058,058 (859) 2,684,796 (532,162) 31,684 3,241,517 29,104,309 (6,151,590) 22,952,719 4,272,479 (98,061) 934,979 5,659 (121,860) 4,993,196 33,719,098 (5,589,637) 28,129,461

The accompanying notes are an integral part of these financial statements. 10

The Siam Cement Public Company Limited and its Subsidiaries

Consolidated statements of cash flows For the years ended 31 December 2011 and 2010

2011

2010

(in thousand Baht) Cash flows from financing activities Borrowings Interest paid Increase in bank overdrafts and short-term loans from financial institutions Payments of short-term loans from related parties Proceeds from long-term debts Payments of long-term debts Proceeds from finance lease Proceeds from issuance of debentures Redemption of debentures Net decrease in borrowings Dividends paid Dividends paid to owners of the parent Dividends paid to non-controlling interests Total dividends paid Acquisition of non-controlling interests Net cash used in financing activities Net increase (decrease) in cash and cash equivalents Cash and cash equivalents at beginning of the year Cash and cash equivalents at end of the year Supplementary information for cash flows Non-cash transactions Outstanding payable from purchases of property 81,719 433,592 (16,187,819) (1,879,772) (18,067,591) 1,969,610 (18,007,214) (41,147,265) 63,827,071 22,679,806 (11,375,152) (814,563) (12,189,715) 270,599 (15,135,232) 34,889,957 28,937,114 63,827,071 11,061,574 (64,318) 5,001,877 (11,308,996) 360,689 24,920,934 (24,904,867) (1,909,233) 6,213,848 (176,705) 1,190,607 (3,972,229) 589,916 14,988,864 (14,967,424) (3,216,116) (6,976,126) (7,082,993)

The accompanying notes are an integral part of these financial statements. 11

The Siam Cement Public Company Limited and its Subsidiaries

Notes to the financial statements For the years ended 31 December 2011 and 2010

Note 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33

Contents General information Basis of preparation of the financial statements Changes in accounting policies Effect from first time adoption of Thai Financial Reporting Standards Significant accounting policies Acquisitions of business and disposals of investments Related parties Trade receivables Inventories Cash and cash equivalents and other investments Investments in associates and jointly-controlled entities Other long-term investments Investment properties Property, plant and equipment Goodwill and intangible assets Deferred tax assets (deferred tax liabilities) Other non-current assets Bank overdrafts and short-term loans from financial institutions Long-term debts Debentures Employee benefit liabilities Other non-current liabilities Share capital Reserves Segment information Operating results of business groups Other income Selling expenses Administrative expenses Employee benefit expenses Finance costs Income tax expense Basic earnings per share

12

The Siam Cement Public Company Limited and its Subsidiaries

Notes to the financial statements For the years ended 31 December 2011 and 2010

Note 34 35 36 37 38 39 40 41 42

Contents Agreements Dividends Financial instruments Commitments and contingent liabilities Capital management Other Events after the reporting period Thai Financial Reporting Standards (TFRS) not yet adopted Reclassification of accounts

13

The Siam Cement Public Company Limited and its Subsidiaries

Notes to the financial statements For the years ended 31 December 2011 and 2010

These notes form an integral part of the financial statements. The consolidated financial statements issued for Thai statutory and regulatory reporting purposes are prepared in the Thai and English languages, and were approved and authorised for issue by the audit committee, as appointed by the Board of Directors of the Company, on 22 February 2012.

General information

The Siam Cement Public Company Limited, the (Company), is incorporated in Thailand and has its registered office at 1 Siam Cement Road, Bangsue, Bangkok 10800, Thailand. The Company was listed on the Stock Exchange of Thailand on 25 April 1975. The Company and its subsidiaries, the (Group), is an industrial group which operates core businesses of chemicals, paper, cement, building materials and distribution. Details of the Companys subsidiaries, which have significant operations and were included in the consolidated financial statements, are as follows:

Direct /Indirect Holding (%) SCG Chemicals SCG Chemicals Co., Ltd. Thai Polyethylene Co., Ltd. Thai Polypropylene Co., Ltd. SCG Plastics Co., Ltd. SCG Performance Chemicals Co., Ltd. SCG Polyolefins Co., Ltd. Rayong Engineering and Plant Service Co., Ltd. Protech Outsourcing Co., Ltd. RIL 1996 Co., Ltd. Texplore Co., Ltd. Vina SCG Chemicals Co., Ltd. SCG Chemicals (Singapore) Pte. Ltd. (Incorporated in Singapore) Tuban Petrochemicals Pte. Ltd. (Incorporated in Singapore) Hexagon International, Inc. (Incorporated in USA) Rayong Pipeline Co., Ltd. Map Ta Phut Tank Terminal Co., Ltd. PT TPC Indo Plastic & Chemicals (Incorporated in Indonesia) Map Ta Phut Olefins Co., Ltd. 78 67 100 91 81 100 100 100 100 100 100 100 100 100 100 100 100 100 SCG Chemicals Alliance Petrochemical Investment (Singapore) Pte. Ltd. (Incorporated in Singapore) Rayong Olefins Co., Ltd. Rayong Olefins (Singapore) Pte. Ltd. (Incorporated in Singapore) Flowlab & Service Co., Ltd. Thai Plastic and Chemicals Public Company Limited TPC Paste Resin Co., Ltd. The Nawaplastic Industries (Saraburi) Co., Ltd. Nawa Plastic Industries Co., Ltd. Nawa Intertech Co., Ltd. Chemtech Co., Ltd. (Incorporated in Vietnam) Total Plant Service Co., Ltd. Minh Thai House Component Co., Ltd. (Incorporated in Vietnam) Viet-Thai Plastchem Co., Ltd. (Incorporated in Vietnam) TPC Vina Plastic and Chemicals Corporation Co., Ltd. (Incorporated in Vietnam) Siam Stabilizers and Chemicals Co., Ltd. 33 32 27 37 46 46 46 46 46 46 46 64 51 65 64 Direct /Indirect Holding (%)

14

The Siam Cement Public Company Limited and its Subsidiaries

Notes to the financial statements For the years ended 31 December 2011 and 2010

Direct /Indirect Holding (%) SCG Paper SCG Paper Public Company Limited Thai Paper Co., Ltd. Thai Union Paper Public Company Limited Siam Kraft Industry Co., Ltd. Thai Kraft Paper Industry Co., Ltd. Thai Union Paper Industry Co., Ltd. United Pulp and Paper Co., Inc. (Incorporated in Philippines) Siam Cellulose Co., Ltd. InfoZafe Co., Ltd. The Siam Pulp and Paper Holding Co., Ltd. The Siam Forestry Co., Ltd. Panas Nimit Co., Ltd. Thai Panason Co., Ltd. Thai Panadorn Co., Ltd. Thai Panaram Co., Ltd. Suanpa Rungsaris Co., Ltd. Siam Panawes Co., Ltd. Thai Panaboon Co., Ltd. Thai Wanabhum Co., Ltd. Phoenix Pulp & Paper Public Company Limited Phoenix Utilities Co., Ltd. Thai Cane Paper Public Company Limited SCG Cement SCG Cement Co., Ltd. The Concrete Products and Aggregate Co., Ltd. The Siam Cement (Kaeng Khoi) Co., Ltd. The Siam Cement (Ta Luang) Co., Ltd. The Siam Cement (Thung Song) Co., Ltd. The Siam Cement (Lampang) Co., Ltd. Siam Mortar Co., Ltd. The Siam White Cement Co., Ltd. The Siam Refractory Industry Co., Ltd. Cementhai Energy Conservation Co., Ltd. ECO Plant Services Co., Ltd.

(Formerly: SCI Plant Services Co., Ltd.)

Direct /Indirect Holding (%) SCG Paper Thai Containers Group Co., Ltd. Thai Containers Songkhla (1994) Co., Ltd. Thai Containers Khonkaen Co., Ltd. Thai Containers Rayong Co., Ltd. Thai Containers Saraburi Co., Ltd. Thai Containers (TCC) Co., Ltd. Vina Kraft Paper Co., Ltd. (Incorporated in Vietnam) TCG Rengo Subang (M) Sdn. Bhd. (Incorporated in Malaysia) TCG Rengo (S) Limited (Incorporated in Singapore) New Asia Industries Co., Ltd. (Incorporated in Vietnam) Alcamax Packaging (Vietnam) Co., Ltd. (Incorporated in Vietnam) AP Packaging (Hanoi) Co., Ltd. (Incorporated in Vietnam) Packamex (Vietnam) Co., Ltd. (Incorporated in Vietnam) Thai British Security Printing Public Company Limited Thai British Depost Co., Ltd. SCG Cement Buu Long Industry & Investment Joint Stock Company (Incorporated in Vietnam) PT Semen Jawa (Incorporated in Indonesia) Kampot Cement Co., Ltd. (Incorporated in Cambodia) The Concrete Products and Aggregate (Vietnam) Co., Ltd. (Incorporated in Vietnam) CPAC Lao Co., Ltd. (Incorporated in Laos) 70 70 69 55 45 Myanmar CPAC Service Co., Ltd. (Incorporated in Myanmar) CPAC Cambodia Co., Ltd. (Incorporated in Cambodia) PT CPAC Surabaya (Incorporated in Indonesia) Kampot Land Co., Ltd. (Incorporated in Cambodia) 75 91 95 99 49 25 69 69 69 69 69 69 69 69 69 69 69 69 69

98 98 98 98 98 98 98 98 98 98 98 98 98 98 98 98 98 98 98 98 98 85

100 100 100 100 100 100 100 100 100 100 100 100 100 100 100

Siam Research and Innovation Co., Ltd. SCI Eco Services Co., Ltd. CPAC Concrete Products (Cambodia) Co., Ltd. (Incorporated in Cambodia) Cementhai Building Materials (Singapore) Pte. Ltd. (Incorporated in Singapore)

15

The Siam Cement Public Company Limited and its Subsidiaries

Notes to the financial statements For the years ended 31 December 2011 and 2010

Direct /Indirect Holding (%) SCG Building Materials SCG Building Materials Co., Ltd. The Siam Fibre-Cement Co., Ltd. The Fibre-Cement Products (Lampang) Co., Ltd. Tip Fibre-Cement Co., Ltd. SCG Landscape Co., Ltd. Siam Fiberglass Co., Ltd. Cementhai Gypsum Co., Ltd. Cementhai Ceramics Co., Ltd. Thai Ceramic Co., Ltd. The Siam Ceramic Group Industries Co., Ltd. Cementhai Home Services Co., Ltd. Gemago Co., Ltd. (Formerly: Thai Ceramic Power Co., Ltd.) Cementhai Gypsum (Singapore) Pte. Ltd. (Incorporated in Singapore) Cementhai Roof Holdings Philippines, Inc. (Incorporated in Philippines) Cementhai Ceramic (Singapore) Pte. Ltd. (Incorporated in Singapore) Cementhai Ceramics Philippines Holdings, Inc. (Incorporated in Philippines) PT KIA Serpih Mas (Incorporated in Indonesia) PT KIA Keramik Mas (Incorporated in Indonesia) 94 94 100 100 100 100 100 100 100 100 100 100 100 100 100 100 100 100 SCG Building Materials PT Keramika Indonesia Assosiasi Tbk (Incorporated in Indonesia) Sosuco and Group (2008) Co., Ltd. Saraburirat Co., Ltd. PT Surya Siam Keramik (Incorporated in Indonesia) The CPAC Roof Tile Co., Ltd. Thai Ceramic Roof Tile Co., Ltd. Thai Ceramic Holding Co., Ltd. CPAC Monier (Cambodia) Co., Ltd. (Incorporated in Cambodia) CPAC Monier Vietnam Co., Ltd. (Incorporated in Vietnam) Quality Construction Products Public Company Limited Q-Con Eastern Co., Ltd. Thai-German Ceramic Industry Public Company Limited Sosuco Ceramic Co., Ltd. SCG-Sekisui Sales Co., Ltd. CPAC Monier Philippines, Inc. (Incorporated in Philippines) PT Siam-Indo Gypsum Industry (Incorporated in Indonesia) PT Siam-Indo Concrete Products (Incorporated in Indonesia) SCG Distribution SCG Distribution Co., Ltd. SCG Trading Co., Ltd. SCG Network Management Co., Ltd. SCG Logistics Management Co., Ltd. SCG Trading Services Co., Ltd. SCG Sourcing Co., Ltd. SCG Experience Co., Ltd. SCG Skills Development Co., Ltd. SCG Trading Australia Pty. Ltd. (Formerly: Cementhai SCT (Australia) Pty. Ltd.) (Incorporated in Australia) SCG Trading Guangzhou Co., Ltd. (Formerly: Cementhai SCT (Guangzhou) Ltd.) (Incorporated in China) 100 100 100 100 100 100 100 100 100 100 SCG Distribution SCG Trading Hong Kong Limited (Formerly: Cementhai SCT (Hong Kong) Ltd.) (Incorporated in China) SCG Trading (Jordan) L.L.C. (Formerly: Cementhai SCT (Jordan) L.L.C.) (Incorporated in Jordan) SCG Trading Philippines Inc. (Formerly: Cementhai SCT (Philippines) Inc.) (Incorporated in Philippines) SCG Singapore Trading Pte. Ltd. (Formerly: Cementhai SCT (Singapore) Pte. Ltd.) (Incorporated in Singapore) SCG Trading USA Inc. (Formerly: Cementhai SCT (U.S.A.), Inc.) (Incorporated in U.S.A )

Direct /Indirect Holding (%)

93 90 83 80 75 75 75 75 75 68 68 61 54 51 50 50 50

100

100

100

100

100

16

The Siam Cement Public Company Limited and its Subsidiaries

Notes to the financial statements For the years ended 31 December 2011 and 2010

Direct /Indirect Holding (%) SCG Distribution SCG Trading (M) Sdn. Bhd. (Incorporated in Malaysia) PT SCG Trading Indonesia (Formerly: PT Cementhai SCT Indonesia) (Incorporated in Indonesia) SCG Trading Vietnam Co., Ltd. (Formerly: SCT Logistics (Vietnam) Co., Ltd.) (Incorporated in Vietnam) SCG Trading Lao Co., Ltd. (Formerly: SCT (Vientiane) Co., Ltd.) (Incorporated in Laos) SCG Marketing Philippines Co., Ltd. (Incorporated in Philippines) SCG investment and others Cementhai Holding Co., Ltd. Cementhai Property (2001) Public Company Limited Property Value Plus Co., Ltd. SCG Accounting Services Co., Ltd. 100 100 100 100 100 100 100 100 100 SCG Distribution PT Kokoh Inti Arebama Tbk (Incorporated in Indonesia) SCG Trading (Cambodia) Co., Ltd.

Direct /Indirect Holding (%)

99

(Formerly: Cementhai SCT (Cambodia) Co., Ltd.) (Incorporated in Cambodia) SCGT Malaysia Sdn. Bhd. (Formerly: Cementhai SCT (Malaysia) Sdn. Bhd.) (Incorporated in Malaysia) Siam Cement Myanmar Trading Ltd. (Incorporated in Myanmar) SCG Trading Emirates L.L.C (Formerly: Cementhai SCT Emirates (L.L.C)) (Incorporated in United Arab Emirates) SCG investment and others SCG Legal Counsel Limited Bangsue Management Co., Ltd. Cementhai Captive Insurance Pte. Ltd. (Incorporated in Singapore) 100 100 100 49 60 69 75

Details of the Companys subsidiaries which are insignificant operations or in the process of liquidation and were included in the consolidated financial statements are as follows:

Direct /Indirect Holding (%) The CPAC Ready Mixed Concrete (South) Co., Ltd. SCG Holding Co., Ltd. The Nawaloha Foundry Bangpakong Co., Ltd. Bangsue Industry Co., Ltd. The Siam Iron and Steel Co., Ltd. Dhara Pipe Co., Ltd. CMT Services Co., Ltd. Cementhai Management Services Co., Ltd. Siam Nawaphan Co., Ltd. Siam Paraffins Co., Ltd. 100 100 100 100 100 100 100 100 100 100 SCG Corporation S.A. (Incorporated in Panama) Cementhai Paper (Singapore) Pte. Ltd. (Incorporated in Singapore) Siam TPC Co., Ltd. Siam TPC (Singapore) Pte. Ltd. (Incorporated in Singapore) Myanmar CPAC Trading Co., Ltd. (Incorporated in Myanmar) Thai Containers Trading Co., Ltd. 70 69 78 100 78 100 Direct /Indirect Holding (%)

Most of the above subsidiaries are established in Thailand unless otherwise stated. There was no material change in the percentage of holding from 2010. During 2011, the Group acquired the ordinary shares of PT Keramika Indonesia Assosiasi Tbk , PT Kokoh Inti Arebama Tbk which are incorporated in Indonesia, and Alcamax Packaging (Vietnam) Co., Ltd. and Buu Long Industry & Investment Joint Stock Company which are incorporated in Vietnam and included these companies in the Groups consolidated financial statements in 2011 as discussed in note 6. 17

The Siam Cement Public Company Limited and its Subsidiaries

Notes to the financial statements For the years ended 31 December 2011 and 2010

2

(a)

Basis of preparation of the financial statements

Statement of compliance The consolidated financial statements are prepared in accordance with Thai Financial Reporting Standards (TFRS) and guidelines promulgated by the Federation of Accounting Professions (FAP), applicable rules and regulations of the Thai Securities and Exchange Commission. During 2010 and 2011, the FAP issued the following new and revised Thai Financial Reporting Standards (TFRS) relevant to the Groups operations and effective for accounting periods beginning on or after 1 January 2011: TFRS TAS 1 (revised 2009) TAS 2 (revised 2009) TAS 7 (revised 2009) TAS 8 (revised 2009) TAS 10 (revised 2009) TAS 11 (revised 2009) TAS 16 (revised 2009) TAS 17 (revised 2009) TAS 18 (revised 2009) TAS 19 TAS 23 (revised 2009) TAS 24 (revised 2009) TAS 27 (revised 2009) TAS 28 (revised 2009) TAS 31 (revised 2009) TAS 33 (revised 2009) TAS 34 (revised 2009) TAS 36 (revised 2009) TAS 37 (revised 2009) TAS 38 (revised 2009) TAS 40 (revised 2009) TFRS 3 (revised 2009) TFRS 5 (revised 2009) TFRIC 15 FAP s announcement no. 17/2554 Topic Presentation of Financial Statements Inventories Statement of Cash Flows Accounting Policies, Changes in Accounting Estimates and Errors Events after the Reporting Period Construction Contracts Property, Plant and Equipment Leases Revenue Employee Benefits Borrowing Costs Related Party Disclosures Consolidated and Separate Financial Statements Investments in Associates Interests in Joint Ventures Earnings per Share Interim Financial Reporting Impairment of Assets Provisions, Contingent Liabilities and Contingent Assets Intangible Assets Investment Property Business Combinations Non-current Assets Held for Sale and Discontinued Operations Agreements for the Construction of Real Estate Transitional Procedures for Other Long-term Employee Benefits

18

The Siam Cement Public Company Limited and its Subsidiaries

Notes to the financial statements For the years ended 31 December 2011 and 2010

The adoption of these new and revised TFRS has resulted in changes in the Groups accounting policies. The effects of these changes are disclosed in note 4. In addition to the above new and revised TFRS, the FAP has issued during 2010 a number of other new and revised TFRS which are expected to be effective for financial statements beginning on or after 1 January 2013 and have not been adopted in the preparation of these consolidated financial statements. These new and revised TFRS are disclosed in note 41. (b) Basis of measurement The consolidated financial statements have been prepared on the historical cost basis except for the following material items in the consolidated statement of financial position:

-

financial instruments at fair value through profit or loss are measured at fair value; available-for-sale financial assets are measured at fair value; the present value of the defined benefit obligation.

(c)

Presentation currency The consolidated financial statements are prepared and presented in Thai Baht. All financial information presented in Thai Baht has been rounded to the nearest million unless otherwise stated.

(d)

Use of estimates and judgements The preparation of consolidated financial statements in conformity with TFRS requires management to make judgements, estimates and assumptions that affect the application of accounting policies and the reported amounts of assets, liabilities, income and expenses. Actual results may differ from these estimates. Estimates and underlying assumptions are reviewed on an ongoing basis. Revisions to accounting estimates are recognised in the period in which estimates are revised and in any future periods affected. Information about significant areas of estimation uncertainty and critical judgements in applying accounting policies that have the most significant effect on the amount recognised in the financial statements is included in the following notes: Note 6 Note 8, 9, 10, 11, 12, 13, 14 and 15 Note 16, 32 Note 21 Note 37 Acquisition of business Measurement of the recoverable amounts of each asset and cash-generating units containing goodwill Utilisation of tax losses, current and deferred tax Discount rate, salary increase rate, employee turnover rate and mortality rate Provisions and contingent liabilities

19

The Siam Cement Public Company Limited and its Subsidiaries

Notes to the financial statements For the years ended 31 December 2011 and 2010

3

(a)

Changes in accounting policies

Overview From 1 January 2011, consequent to the adoption of new and revised TFRS as set out in note 2, the Group has changed its accounting policies in the following areas: Presentation of financial statements Accounting for business combinations Accounting for acquisitions of non-controlling interests Accounting for property, plant and equipment Accounting for investment properties Accounting for employee benefits

Details of new accounting policies for the Group are summarised in note 3 (b) to 3 (g) as follows: (b) Presentation of financial statements The Group has adopted TAS 1 (revised 2009) Presentation of Financial Statements. Under the revised TAS, a set of financial statements comprises: Statement of financial position; Statement of comprehensive income; Statement of changes in shareholders equity; Statement of cash flows; and Notes to the financial statements

As a result, the Group separately presents other comprehensive income from the statement of changes in shareholders equity and presents those transactions in the statement of comprehensive income. Comparative information has been re-presented so that it also is in conformity with the revised standard. (c) Accounting for business combinations The Group has adopted TFRS 3 (revised 2009) Business Combinations and TAS 27 (revised 2009) Consolidated and Separate Financial Statements for all business combinations on or after 1 January 2011. The new policy has been applied prospectively from 1 January 2011 in accordance with the transitional provisions of the revised TFRS. The Group measures goodwill at the acquisition date as: the fair value of the consideration transferred; plus the recognised amount of any non-controlling interests in the acquiree; plus if the business combination is achieved in stages, the acquisition date fair value of the acquirers previously held equity interest in the acquiree; less the net recognised amount (generally fair value) of the identifiable assets acquired and liabilities assumed. When the net amount is negative, a bargain purchase gain is recognised immediately in profit or loss.

20

The Siam Cement Public Company Limited and its Subsidiaries

Notes to the financial statements For the years ended 31 December 2011 and 2010

In a business combination achieved in stages, the acquirer shall remeasure its previously held equity interest in the acquiree at its acquisition date fair value and recognise the resulting gain or loss, if any, in profit or loss. The consideration transferred does not include amounts related to the settlement of pre-existing relationships. Costs related to the acquisition, other than those associated with the issue of debt or equity securities, that the Group incurs in connection with a business combination are expensed as incurred. Any contingent consideration payable is recognised at fair value at the acquisition date. If the contingent consideration is classified as equity, it is not remeasured and settlement is accounted for within equity. Otherwise, subsequent changes to the fair value of the contingent consideration are recognised in profit or loss or in other comprehensive income. (d) Accounting for acquisitions of non-controlling interests The Group has adopted TAS 27 (revised 2009) Consolidated and Separate Financial Statements for accounting for changes in ownership interest in subsidiary after control is obtained. The new policy has been applied prospectively from 1 January 2011 in accordance with the transitional provisions of the revised TAS. Changes in a parents ownership interest in a subsidiary that do not result in the loss of control are accounted for within equity. When an entity loses control of a subsidiary, any gain or loss is recognised in profit or loss. (e) Accounting for property, plant and equipment The Group has adopted TAS 16 (revised 2009) Property, Plant and Equipment in determining and accounting for the cost and depreciable amount of property, plant and equipment. The principal changes introduced by the revised TAS 16 and affecting the Group are that (i) costs of asset dismantlement, removal and restoration have to be included as asset costs and subject to annual depreciation; (ii) the depreciation charge has to be determined separately for each significant part of an asset; and (iii) in determining the depreciable amount, the residual value of an item of assets has to be measured at the amount estimated receivable currently for the asset if the asset were already of the age and in the condition expected at the end of its useful life. Furthermore, the residual value and useful life of an asset have to be reviewed at least at each financial year-end. The changes have been applied prospectively in accordance with the transitional provisions of the revised TAS, except that consideration of the costs of asset dismantlement, removal and restoration, have been applied retrospectively. (f) Accounting for investment properties The Group has adopted TAS 40 (revised 2009) Investment Property. Under the revised TAS, investment property is defined as properties which are held to earn rental income, for capital appreciation or for both, but not for sale in the ordinary course of business, use in the production or supply of goods or services or for administrative purposes.

21

The Siam Cement Public Company Limited and its Subsidiaries

Notes to the financial statements For the years ended 31 December 2011 and 2010

The Group has selected the cost model for accounting for its investment properties under the revised TAS and disclosed investment properties in the financial statements separately from other property, plant and equipment. The change in accounting policy has been applied to reclassify the comparative financial statements. From 1 January 2011, the depreciable amount and useful life of the investment property have been reassessed in accordance with the requirements of TAS 16 (revised 2009) see note 3 (e). These changes in accounting policy in this regard have been applied prospectively in accordance with the transitional provisions of TAS 16 (revised 2009).

(g)

Accounting for employee benefits

The Group has adopted TAS 19 Employee Benefits. Under the new policy, the Groups obligation in respect of post-employment benefits under defined benefit plans and other long-term employee benefits is recognised in the financial statements based on calculations by a qualified actuary using the projected unit credit method. Previously, this obligation was recognised as incurred. The Group has opted to record the entire amount of this liability as an adjustment to retained earnings as at 1 January 2011, in accordance with the transitional provisions of TAS 19 as disclosed in note 4.

Effect from first time adoption of Thai Financial Reporting Standards

From 1 January 2011, consequent to the adoption of new and revised TFRS, the Group has affected to the financial statements as follows: Year 2011 (in million Baht) Consolidated statement of financial position Retained earnings at 31 December 2010 as reported Decrease in investments in associates Increase in deferred tax assets Increase in employee benefit liabilities Decrease in non-controlling interests Retained earnings at 1 January 2011 The Group has disclosed the additional details of TAS 19 Employee Benefits in note 21. Year 2010 Before reclassification Consolidated statement of financial position Inventories Investment properties Property, plant and equipment Other non-current assets 36,917 151,400 4,147 (373) 1,605 (1,022) (210) 36,544 1,605 150,378 3,937 After Reclassification reclassification (in million Baht) 120,028 (200) 854 (3,406) 343 117,619

22

The Siam Cement Public Company Limited and its Subsidiaries

Notes to the financial statements For the years ended 31 December 2011 and 2010

Significant accounting policies

The accounting policies set out below have been applied consistently to all periods presented in these financial statements except as explained in note 3, which addresses changes in accounting policies.

(a)

Basis of consolidation The consolidated financial statements relate to the Group and the Groups interests in associates and jointly-controlled entities. Significant intra-group transactions between the Company and its subsidiaries are eliminated on consolidation. Subsidiaries Subsidiaries are entities controlled by the Group. Control exists when the Group has the power, directly or indirectly, to govern the financial and operating policies of an entity so as to obtain benefits from its activities. The financial statements of subsidiaries are included in the consolidated financial statements from the date that control commences until the date that control ceases. The accounting policies of subsidiaries have been changed where necessary to align them with the policies adopted by the Group. Losses applicable to non-controlling interests in a subsidiary are allocated to non- controlling interests even if doing so causes the non- controlling interests to have a deficit balance. Associates and jointly-controlled entities Associates are entities in which the Group has significant influence, but not control, over the financial and operating policies. Significant influence is presumed to exist when the Group holds between 20% and 50% of the voting power of another entity. Jointly-controlled entities are those entities over whose activities the Group has joint control, established by contractual agreement and requiring unanimous consent for strategic financial and operating decisions. Investments in associates and jointly-controlled entities are accounted for in the consolidated financial statements using the equity method and are recognised initially at cost. The cost of the investment includes transaction costs. The consolidated financial statements include the Groups share of profit or loss and other comprehensive income of associates and jointly-controlled entities on an equity accounted basis after adjustments to align the accounting policies with those of Group, from the date that significant influence or joint control commences until the date that significant influence or joint control ceases. When the Groups share of losses exceeds its interest in an associate and jointly-controlled entity, the Groups carrying amount is reduced to nil and recognition of further losses is discontinued except to the extent that the Group has incurred legal or constructive obligations or made payments on behalf of the associate and jointly-controlled entity.

23

The Siam Cement Public Company Limited and its Subsidiaries

Notes to the financial statements For the years ended 31 December 2011 and 2010

Loss of control Upon the loss of control in subsidiary, the Group derecognises the assets and liabilities, any noncontrolling interests and the other components of shareholders equity related to the subsidiary. Any surplus or deficit arising on the loss of control is recognised in profit or loss. If the Group retains any interest in the previous subsidiary, then such interest is measured at fair value at the date that control is lost. Subsequently it is accounted for as an equity-accounted investee or as an available-for-sale financial asset depending on the level of influence retained. Business combinations The accounting policy for business combinations has been changed from 1 January 2011. See note 3(c) for details. The Group applies the acquisition method for all business combinations other than those with entities under common control. Control is the power to govern the financial and operating policies of an entity so as to obtain benefits from its activities. In assessing control, the Group takes into consideration potential voting rights that currently are exercisable. The acquisition date is the date on which control is transferred to the acquirer. Judgment is applied in determining the acquisition date and determining whether control is transferred from one party to another. Goodwill is measured as the fair value of the consideration transferred including the recognized amount of any non-controlling interest in the acquiree, less the net recognised amount (generally fair value) of the identifiable assets acquired and liabilities assumed, all measured as of the acquisition date. Consideration transferred includes the fair values of the assets transferred, liabilities incurred by the Group to the previous owners of the acquiree, and equity interests issued by the Group. Consideration transferred also includes the fair value of any contingent consideration and sharebased payment awards of the acquiree that are replaced mandatorily in the business combination. When share-based payment awards exchanged (replacement awards) for awards held by the acquirees employees (acquirees awards) relate to past services, then a part of the market-based measure of the awards replaced is included in the consideration transferred. If they require future services, then the difference between the amount included in consideration transferred and the market-based measure of the replacement awards is treated as post-combination compensation cost. A contingent liability of the acquiree is assumed in a business combination only if such a liability represents a present obligation and arises from a past event, and its fair value can be measured reliably. The Group measures any non-controlling interest at its proportionate interest in the identifiable net assets of the acquiree. Transaction costs that the Group incurs in connection with a business combination, such as legal fees, and other professional and consulting fees are expensed as incurred.

24

The Siam Cement Public Company Limited and its Subsidiaries

Notes to the financial statements For the years ended 31 December 2011 and 2010

(b)

Cash and cash equivalents Cash and cash equivalents in the statement of cash flows comprise cash balances, call deposits and highly liquid short-term investments. Bank overdrafts that are repayable on demand are a component of financing activities for the purpose of the statement of cash flows.

(c)

Trade and other accounts receivable Trade and other accounts receivable are stated at their invoice value less allowance for doubtful accounts. The allowance for doubtful accounts is assessed primarily on analysis of payment histories and future expectations of customer payments. Bad debts are written off when incurred.

(d)

Inventories The Group values its inventories at cost and net realisable value, whichever is lower. Cost is calculated as follows: Finished goods Merchandise Goods in process Raw materials, spare parts, stores, supplies and others - at standard cost which approximates current production cost - at average cost - at standard cost which includes raw materials, variable labour and manufacturing overhead costs. - at average cost

Cost comprises all costs of purchase, costs of conversion and other costs incurred in bringing the inventories to their present location and condition. In the case of manufactured inventories and goods in process, cost includes an appropriate share of overheads based on normal operating capacity. Net realisable value is the estimated selling price in the ordinary course of business less the estimated costs to complete and to make the sale. (e) Investments Investments in associates and jointly-controlled entity Investments in associates and jointly-controlled entity are accounted for using the equity method. Investments in other debt and other equity securities Debt securities and marketable equity securities held for trading are classified as current assets and are stated at fair value, with any resultant gain or loss recognised in profit or loss. Debt securities that the Group has the positive intent and ability to hold to maturity are classified as held-to-maturity investments, which are stated at amortised cost less any accumulated impairment losses. The difference between the acquisition cost and redemption value of such debt securities is amortised using the effective interest rate method over the period to maturity.

25

The Siam Cement Public Company Limited and its Subsidiaries

Notes to the financial statements For the years ended 31 December 2011 and 2010

Debt securities and marketable equity securities, other than those securities held for trading or intended to be held to maturity, are classified as available-for-sale investments. Available-for-sale investments are, subsequent to initial recognition, stated at fair value, and changes therein, other than accumulated impairment losses and foreign currency differences on available-for-sale monetary items, are recognised directly in equity. Impairment losses and foreign exchange differences are recognised in profit or loss. When these investments are derecognised, the cumulative gain or loss previously recognised directly in equity is recognised in profit or loss. Where these investments are interest-bearing, interest calculated using the effective interest method is recognised in profit or loss. Equity securities which are not marketable are stated at cost less any accumulated impairment losses. The fair value of financial instruments classified as held-for-trading and available-for-sale is determined as the quoted bid price at the reporting date. Disposal of investments On disposal of an investment, the difference between net disposal proceeds and the carrying amount together with the associated cumulative gain or loss that was reported in equity is recognised in profit or loss. If the Group disposes of part of its holding of a particular investment, the deemed cost of the part sold is determined using the weighted average method applied to the carrying amount of the total holding of the investment. (f) Investment properties Investment properties are properties which are held to earn rental income, for capital appreciation or for both, but not for sale in the ordinary course of business, use in the production or supply of goods or services or for administrative purposes. Investment properties are stated at cost less accumulated depreciation and accumulated impairment losses. Cost includes expenditure that is directly attributable to the acquisition of the investment property. The cost of self-constructed investment property includes the cost of materials and direct labour, and other costs directly attributable to bringing the investment property to a working condition for its intended use and capitalised borrowing costs. Depreciation is charged to profit or loss on a straight-line basis over the estimated useful lives of each property. The estimated useful lives are as follows: Land Improvements Buildings and structures Reclassification to property, plant and equipment When the use of an investment property changes such that it is reclassified as property, plant and equipment, its carrying amount at the date of reclassification becomes its cost for subsequent accounting. 5 20 years 5 30 years

26

The Siam Cement Public Company Limited and its Subsidiaries

Notes to the financial statements For the years ended 31 December 2011 and 2010

(g)

Finance lease The Group entered into sale and lease back agreements for certain machinery and equipment, resulting in a finance lease. Excess of sales proceeds over the carrying amount is not immediately recognised as income. Instead it is deferred and amortised over the lease term. The Group recognised finance leases as assets and liabilities in the consolidated statement of financial position at amounts equal at the inception of the lease to the fair value of the leased property. Lease payments are apportioned between the finance charge and the reduction of the outstanding liabilities. The finance charge is allocated to the periods during the lease term so as to produce a constant periodic rate of interest on the remaining balance of the liability for each period.

(h)

Property, plant and equipment Owned assets Property, plant and equipment are stated at cost less accumulated depreciation and accumulated impairment losses. Cost includes expenditure that is directly attributable to the acquisition of the asset. The cost of self-constructed assets includes the cost of materials and direct labour, any other costs directly attributable to bringing the assets to a working condition for their intended use, the costs of dismantling and removing the items and restoring the site on which they are located, and capitalised borrowing costs. Purchased software that is integral to the functionality of the related equipment is capitalised as part of that equipment. When parts of an item of property, plant and equipment have different useful lives, they are accounted for as separate items (major components) of property, plant and equipment. Gains and losses on disposal of an item of property, plant and equipment are determined by comparing the proceeds from disposal with the carrying amount of property, plant and equipment, and are recognised net within other income or expense in profit or loss. Leased assets Leases in terms of which the Group substantially assumes all the risk and rewards of ownership are classified as finance leases. Property, plant and equipment acquired by way of finance leases is capitalised at the lower of its fair value or the present value of the minimum lease payments at the inception of the lease, less accumulated depreciation and accumulated impairment losses. Lease payments are apportioned between the finance charges and reduction of the lease liability so as to achieve a constant rate of interest on the remaining balance of the liability. Finance charges are charged directly to the profit or loss. Subsequent costs The cost of replacing a part of an item of property, plant and equipment is recognised in the carrying amount of the item if it is probable that the future economic benefits embodied within the part will flow to the Group, and its cost can be measured reliably. The carrying amount of the replaced part is derecognised. The costs of the day-to-day servicing of property, plant and equipment are recognised in profit or loss as incurred.

27

The Siam Cement Public Company Limited and its Subsidiaries

Notes to the financial statements For the years ended 31 December 2011 and 2010

Depreciation Depreciation is calculated based on the depreciable amount, which is the cost of an asset, or other amount substituted for cost, less its residual value. Depreciation is charged to profit or loss on a straight-line basis over the estimated useful lives of each component of an item of property, plant and equipment. The estimated useful lives are as follows: Land improvements Buildings and structures - SCG Chemicals - SCG Paper - SCG Cement Plant, machinery and equipment - SCG Chemicals - SCG Paper - SCG Cement Transportation equipment Furniture, fixtures and office equipment 5 - 33 5 - 25 20 - 30 5 - 20 5 - 25 3 - 20 5 - 20 3 - 20 3 - 20 years years years years years years years years years

For two subsidiaries, Phoenix Pulp & Paper Public Company Limited and Thai Cane Paper Public Company Limited, depreciation of property, plant and equipment have been computed by the following methods over the periods as follows: - Phoenix Pulp & Paper Public Company Limited Land improvements Buildings and structures - Acquired prior to 1 January 2002 - Acquired from 1 January 2002 Machinery and equipment Certain machinery and equipment Furniture, fixtures and office equipment Transportation equipment - Thai Cane Paper Public Company Limited Land improvements Buildings and structures Production machinery - Kanchanaburi Mill Prachinburi Mill 5 - 20 years 5, 20 years Depreciation method Straight-line Straight-line 5 - 30 years 30 20, 25, 30 15 5 - 25 3, 5 5 years years years years years years Depreciation method Straight-line Sinking Fund Straight-line Sinking Fund Straight-line Straight-line Straight-line

Machinery and equipment Furniture and fixtures Transportation equipment

Estimated production capacity of 1.92 million tons Estimated production capacity of 5.25 million tons 5 - 15 years Straight-line 5, 10 years Straight-line 5, 10 years Straight-line

28

The Siam Cement Public Company Limited and its Subsidiaries

Notes to the financial statements For the years ended 31 December 2011 and 2010

The effect of using the above different depreciation policies on the consolidated financial statements is insignificant. Depreciation expense for the finance lease assets is charged as expense for each accounting period. The depreciation policy for leased assets is consistent with that for depreciable assets that are owned. No depreciation is provided on freehold land or assets under construction. Depreciation methods, useful lives and residual values are reviewed at each financial year-end and adjusted if appropriate. (i) Goodwill and intangible assets Goodwill Goodwill that arises upon the acquisition of subsidiaries is included in intangible assets. The measurement of goodwill at initial recognition is described in note 5 (a). Subsequent to initial recognition, goodwill is measured at cost less accumulated impairment losses. In respect of equityaccounted investees, the carrying amount of goodwill is included in the carrying amount of the investment, and an impairment loss on such an investment is not allocated to any asset, including goodwill, that forms part of the carrying amount of the equity-accounted investee. Research and development Expenditure on research activities, undertaken with the prospect of gaining new scientific or technical knowledge and understanding, is recognised in profit or loss as incurred. Development activities involve a plan or design for the production of new or substantially improved products and processes. Development expenditure is capitalised only if development costs can be measured reliably, the product or process is technically and commercially feasible, future economic benefits are probable, and the Group intends to and has sufficient resources to complete development and to use or sell the asset. The expenditure capitalised includes the cost of materials, direct labour, overhead costs that are directly attributable to preparing the asset for its intended use, and capitalised borrowing costs. Other development expenditure is recognised in profit or loss as incurred. Capitalised development expenditure is measured at cost less accumulated amortisation and accumulated impairment losses. Other intangible assets Other intangible assets that are acquired by the Group, which have finite useful lives, are stated at cost less accumulated amortisation and accumulated impairment losses. Subsequent expenditure Subsequent expenditure is capitalised only when it increases the future economic benefits embodied in the specific asset to which it relates. All other expenditure, including expenditure on internally generated goodwill and brands, is recognised in profit or loss as incurred.

29

The Siam Cement Public Company Limited and its Subsidiaries

Notes to the financial statements For the years ended 31 December 2011 and 2010

Amortisation Amortisation is calculated over the cost of the asset, or other amount substituted for cost, less its residual value. Amortisation is recognised in profit or loss on a straight-line basis over the estimated useful lives of intangible assets, other than goodwill, from the date that they are available for use, since this most closely reflects the expected pattern of consumption of the future economic benefits embodied in the asset. The estimated useful lives are as follows: Licence fees Software licences Others term of agreements 3 - 10 years 2 - 20 years

Amortisation methods, useful lives and residual values are reviewed at each financial year-end and adjusted if appropriate. (j) Impairment The carrying amounts of the Groups assets are reviewed at each reporting date to determine whether there is any indication of impairment. If any such indication exists, the assets recoverable amounts are estimated. For goodwill and intangible assets that have indefinite useful lives or are not yet available for use, the recoverable amount is estimated each year at the same time. An impairment loss is recognised if the carrying amount of an asset or its cash-generating unit exceeds its recoverable amount. The impairment loss is recognised in profit or loss unless it reverses a previous revaluation credited to equity, in which case it is charged to equity. When a decline in the fair value of an available-for-sale financial asset has been recognised directly in equity and there is objective evidence that the value of the asset is impaired, the cumulative loss that had been recognised directly in equity is recognised in profit or loss even though the financial asset has not been derecognised. The amount of the cumulative loss that is recognised in profit and loss is the difference between the acquisition cost and current fair value, less any impairment loss on that financial asset previously recognised in profit or loss. Calculation of recoverable amount The recoverable amount of the Groups investments in held-to-maturity securities and receivables carried at amortised cost is calculated as the present value of estimated future cash flows, discounted at the original effective interest rate. Receivables with a short duration are not discounted. The recoverable amount of a non-financial asset is the greater of the assets value in use and fair value less costs to sell. In assessing value in use, the estimated future cash flows are discounted to their present value using a pre-tax discount rate that reflects current market assessments of the time value of money and the risks specific to the asset.

30

The Siam Cement Public Company Limited and its Subsidiaries

Notes to the financial statements For the years ended 31 December 2011 and 2010

Reversals of impairment An impairment loss in respect of financial asset is reversed if the subsequent increase in recoverable amount can be related objectively to an event occurring after the impairment loss was recognised in profit or loss. An impairment loss in respect of goodwill is not reversed. Impairment losses recognised in prior periods in respect of other non-financial assets is assessed at each reporting date for any indications that the loss has decreased or no longer exists. An impairment loss is reversed if there has been a change in the estimates used to determine the recoverable amount. An impairment loss is reversed only to the extent that the assets carrying amount does not exceed the carrying amount that would have been determined, net of accumulated depreciation or accumulated amortisation, if no impairment loss had been recognised. (k) Trade and other accounts payable Trade and other accounts payable are stated at cost. (l) Employee benefits Defined contribution plans A defined contribution plan is a post-employment benefit under which an entity pays fixed contributions into a separate entity and will have no legal or constructive obligation to pay further amounts. Obligations for contributions to defined contribution pension plans are recognised as an employee benefit expense in profit or loss in the periods during which services are rendered by employees. Defined benefit plans A defined benefit plan is a post-employment benefit other than a defined contribution plan. The Groups net obligation in respect of defined benefit plans is calculated separately for each plan by estimating the amount of future benefit that employees have earned in return for their service in the current and prior periods; that benefit is discounted to determine its present value. Any unrecognised past service costs are deducted. The discount rate is the yield at the reporting date on government bonds that have maturity dates approximating the terms of the Groups obligations and that are denominated in the same currency in which the benefits are expected to be paid. The calculation is performed by a qualified actuary using the projected unit credit method. When the benefits of a plan are improved, the portion of the increased benefit relating to past service by employees is recognised in profit or loss on a straight-line basis over the average period until the benefits become vested. To the extent that the benefits vest immediately, the expense is recognised immediately in profit or loss. The Group recognises all actuarial gains and losses arising from defined benefit plans in other comprehensive income and all expenses related to defined benefit plans in profit or loss. Other long-term employee benefits The Groups net obligation in respect of long-term employee benefits other than defined benefit plans is the amount of future benefit that employees have earned in return for their service in the current and prior periods; that benefit is discounted to determine its present value. The discount rate is the yield at the reporting date on government bonds that have maturity dates approximating the terms of the Groups obligations. The calculation is performed using the projected unit credit method. Any actuarial gains and losses are recognised in profit or loss in the period in which they arise. 31

The Siam Cement Public Company Limited and its Subsidiaries

Notes to the financial statements For the years ended 31 December 2011 and 2010

Short-term employee benefits Short-term employee benefit obligations are measured on an undiscounted basis and are expensed as the related service is provided. A liability is recognised for the amount expected to be paid under short-term cash bonus or profitsharing plans if the Group has a present legal or constructive obligation to pay this amount as a result of past service provided by the employee, and the obligation can be estimated reliably. (m) Provisions A provision is recognised if, as a result of a past event, the Group has a present legal or constructive obligation that can be estimated reliably, and it is probable that an outflow of economic benefits will be required to settle the obligation. Provisions are determined by discounting the expected future cash flows at a pre-tax rate that reflects current market assessments of the time value of money and the risks specific to the liability. The unwinding of the discount is recognised as finance cost. (n) Revenue Revenue excludes value added taxes and is arrived at after deduction of trade discounts. Sale of goods and services rendered Revenue is recognised in profit or loss when the significant risks and rewards of ownership have been transferred to the buyer. No revenue is recognised if there is continuing management involvement with the goods or there are significant uncertainties regarding recovery of the consideration due, associated costs or the probable return of goods. Service income is recognised as services are provided. Interest and dividend income Interest income is recognised in profit or loss as it accrues. Dividend income is recognised in profit or loss on the date the Groups right to receive payments is established, which in the case of quoted securities is usually the ex-dividend date. Service fee Service fee income is recognised on an accrual basis in accordance with the terms of agreement. (o) Expenses Lease payments Payments made under operating leases are recognised in profit or loss on a straight line basis over the term of the lease. Lease incentives received are recognised in profit or loss as an integral part of the total lease expense, over the term of lease. Contingent lease payments are accounted for by revising the minimum lease payments over the remaining term of the lease when the lease adjustment is confirmed.

32

The Siam Cement Public Company Limited and its Subsidiaries

Notes to the financial statements For the years ended 31 December 2011 and 2010

Finance costs Finance costs comprise interest expense on borrowings, unwinding of the discount on provisions and contingent consideration, losses on disposal of available-for-sale financial assets, dividends on preference shares classified as liabilities, fair value losses on financial assets at fair value through profit or loss, impairment losses recognised on financial assets (other than trade receivables), and losses on hedging instruments that are recognised in profit or loss. Borrowing costs that are not directly attributable to the acquisition, construction or production of a qualifying asset are recognised in profit or loss using the effective interest method. Early retirement expense The Group offered certain qualifiable employees the option to take early retirement from the Group. Eligible employees who accept the offer are paid a lump sum amount which is calculated based on a formula using their final months pay, number of years of service or the number of remaining months before normal retirement as variables. The Group records expenses on early retirement upon mutual acceptance. (p) Income tax Income tax expense on the profit or loss for the year comprises current and deferred tax. Current and deferred tax are recognised in profit or loss except to the extent that it relates to items recognised directly in equity or in other comprehensive income. Current tax Current tax is the expected tax payable or receivable on the taxable income or loss for the year, using tax rates enacted or substantially enacted at the reporting date, and any adjustment to tax payable in respect of previous years. Deferred tax Deferred tax is recognised in respect of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for taxation purposes. Deferred tax is not recognised for the following temporary differences: the initial recognition of goodwill; the initial recognition of assets or liabilities in a transaction that is not a business combination and that affects neither accounting nor taxable profit or loss; and differences relating to investments in subsidiaries and joint ventures to the extent that it is probable that they will not reverse in the foreseeable future. Deferred tax is measured at the tax rates that are expected to be applied to the temporary differences when they reverse, using tax rates enacted or substantively enacted at the reporting date. In determining the amount of current and deferred tax, the Group takes into account the impact of uncertain tax positions and whether additional taxes and interest may be due. The Group believes that its accruals for tax liabilities are adequate for all open tax years based on its assessment of many factors, including interpretations of tax law and prior experience. This assessment relies on estimates and assumptions and may involve a series of judgements about future events. New information may become available that causes the Group to change its judgement regarding the adequacy of existing tax liabilities; such changes to tax liabilities will impact tax expense in the period that such a determination is made.

33

The Siam Cement Public Company Limited and its Subsidiaries

Notes to the financial statements For the years ended 31 December 2011 and 2010

Deferred tax assets and liabilities are offset if there is a legally enforceable right to offset current tax liabilities and assets, and they relate to income taxes levied by the same tax authority on the same taxable entity, or on different tax entities, but they intend to settle current tax liabilities and assets on a net basis or their tax assets and liabilities will be realised simultaneously. A deferred tax asset is recognised to the extent that it is probable that future taxable profits will be available against which the temporary differences can be utilised. Deferred tax assets are reviewed at each reporting date and reduced to the extent that it is no longer probable that the related tax benefit will be realised. (q) Foreign currencies Foreign currency transactions Transactions in foreign currencies are translated at the foreign exchange rates ruling at the dates of the transactions. Monetary assets and liabilities denominated in foreign currencies at the reporting date are translated to Thai Baht at the foreign exchange rates ruling at that date. Foreign exchange differences arising on translation are recognised in profit or loss. Non-monetary assets and liabilities measured at cost in foreign currencies are translated to Thai Baht using the foreign exchange rates ruling at the dates of the transactions. Non-monetary assets and liabilities measured at fair value in foreign currencies are translated to Thai Baht at the foreign exchange rates ruling at the dates that fair value was determined. Foreign entities The assets and liabilities of foreign entities are translated to Thai Baht at the foreign exchange rates ruling at the reporting date. Goodwill and fair value adjustments arising on the acquisition of foreign entities are stated at exchange rates ruling on transaction dates. The revenues and expenses of foreign entities are translated to Thai Baht at rates approximating the foreign exchange rates ruling at the dates of the transactions and using the weighted average method. Foreign exchange differences arising on translation are recognised in other comprehensive income and presented in other components of equity until disposal of the investments. When the settlement of a monetary item receivable from or payable to a foreign operation is neither planned nor likely in the foreseeable future, foreign exchange gains and losses arising from such a monetary item are considered to form part of a net investment in a foreign operation and are recognised in other comprehensive income, and presented in other components of equity until disposal of the investment.

34

The Siam Cement Public Company Limited and its Subsidiaries

Notes to the financial statements For the years ended 31 December 2011 and 2010

(r)

Derivative financial instruments Financial assets and financial liabilities carried on the statement of financial position include cash and cash equivalents, trade and other accounts receivable and payable, long-term receivables, loans, investments, borrowings and debentures. The Group operates internationally and is exposed to risks from changes in interest and foreign exchange rates. The Group uses derivative financial instruments to mitigate those risks. All gains and losses on hedge transactions are recognised in profit or loss in the same period as the exchange differences on the items covered by the hedge.

Acquisitions of business and disposals of investments