Beruflich Dokumente

Kultur Dokumente

Accounting Review and Tutorial Services in San Isidro, Nueva Ecija

Hochgeladen von

Eiuol Nhoj ArraeugseOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Accounting Review and Tutorial Services in San Isidro, Nueva Ecija

Hochgeladen von

Eiuol Nhoj ArraeugseCopyright:

Verfügbare Formate

ARTS

Accounting Review and Tutorial Services

San Isidro, Nueva Ecija

P1. 1013 up to P1. - 1017

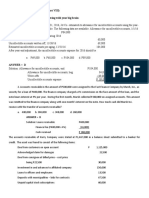

The following data pertain to Lincoln Corporation on December 31, 2011: Current account at Metrobank Current account at Allied Bank Payroll account Foreign bank account (in equivalent pesos) Savings deposit in a closed bank Postage Stamps Employees post dated check IOU from employees Credit Memo from a vendor for purchase return Travelers check Money Order Petty Cash fund (P4,000 in currency and expense receipts for P6,000) Pension Fund DAIF check of customer Customers check dated 1/1/12 Time Deposit 30 days Money market placement (due 6/30/12) Treasury bills, due 3/31/12 (purchased 12/31/11) Treasury bills, due 1/31/12 (purchased 2/1/11) 1. P 1,800,000 (100,000) 500,000 800,000 150,000 1,000 4,000 10,000 20,000 50,000 30,000 10,000 2,000,000 15,000 80,000 200,000 500,000 200,000 300,000

jloesguerra

The cash and cash equivalents as of December 31, 2011 is a. P2,784,000 b. P3,084,000 c. P3,784,000 d. P3,584,000

Ralf Corporation had the following account balances at December 31, 2011: Cash on hand and in bank Cash restricted for bonds payable due Time Deposit Savings deposit set aside for dividends 30,2012 P2,500,000 1,000,000 3,000,000 500,000

on June 30, 2012 payable on June

2.

The total amount to be reported as cash and cash equivalents as of December 31, 2011 is a. P7,000,000 b. P6,000,000 c. P6,500,000 d. P5,500,000

3.

On December 31, 2011, Alfonso Company had the following cash balances:

Cash in bank Petty cash fund Time deposit Savings deposit

P15,000,000 50,000 5,000,000 2,000,000

Cash in bank includes P500,000 of compensating balance against short term borrowing arrangement at December 31, 2011. The compensating balance is legally restricted as to withdrawal by Alfonso. A check of P300,000 dated January 15, 2012 in payment of accounts payable was recorded and mailed on December 31, 2011. In the current assets section of the December 31, 2011 statement of financial position, what amount should be reported as cash and cash equivalents? a. P21,850,000 c. P21,800,000

b. P16,850,000 4.

d. P14,850,000

On January 1, 2011, Tinoc Company borrows P2,000,000 from National Bank at 12% annual interest. In addition, Tinoc is required to keep a compensatory balance of P200,000 on deposit at National Bank which earn interest at 4%. The effective interest that Tinoc pays on its P2,000,000 loan is? a. 10.0% b. 11.6% c. 12.0% d. 12.9%

Cash in bank balance of William Co. on January 1, 2011 was P70,000 representing 35% paid-up Capital of its authorized share capital of P200,000. During the year you ascertained the following postings to some accounts, as follows:

Petty cash fund Accounts receivable trade Subscription receivable Delivery equipment Accounts payable trade Bank loan Accrued expenses Subscribed share capital Unissued share capital Authorized share capital Sales Purchases Expenses (including depreciation of P5,000 and accrued expenses of P1,500) 5.

Debit P 2,000 450,000 60,000 50,000 280,000 35,000

Credit P290,000 50,000 430,000 80,000 1,500 60,000 200,000 450,000

130,000

430,000

90,000

Cash in bank balance at December 31, 2011 was a. P41,500 b. P33,000 c. P34,500 d. P39,500

An office supplies enterprise, operating on a calendar year basis, has the following data in its accounting records: 01/01 P 47,000 101,000 82,000 68,000 12/31 P 93,000 116,000 63,000 1,150,000 900,000 200,000

Cash Inventory Accounts receivable Accounts payable Sales Cost of goods sold Operating expenses for December 31? a. P50,000 b. P66,000

6.

What is the expected cash balance

c. P76,000 d. P134,000

The Petty Cash fund of Guiguinto Company on December 31, 2011 is composed of the following: Coins and currencies Petty cash vouchers: Gasoline payments Supplies Cash advances to employees Employees check returned by bank marked NSF Check drawn by the company payable to the order of the petty cash custodian, representing her salary A sheet of paper with names of employees together with contribution for a birthday gift of a co-employee in the amount of Total P 14,000 3,000 1,000 2,000 5,000

20,000

__8,000 P 53,000

7.

The petty cash ledger account has an imprest balance of P50,000. What is the correct amount of petty cash on December 31, 2011?

a. P34,000 b. P14,000

c. P39,000 d. P42,000

The following data pertaining to the cash transactions and bank account of Mandirigma Company for the month of May are available to you: Cash balance, per records, May 31 Cash balance, per bank statement, 5/31 Bank service charge for May Debit memo for the cost of printed checks delivered by the bank Outstanding checks, May 31 Deposit of May 30 not recorded by bank until June 1 Proceeds of a bank loan of May 30 net of interest of P300 Proceeds from a customers promissory note, including interest of P100 Check No. 2772 issued to a supplier entered in the accounting records at P2,100 but deducted in the bank statement at an erroneous amount of Stolen check lacking an authorized signature, deducted from Mandirigmas account by the bank in error Customers check returned by the bank marked NSF; no entry has been made in the accounting records to record the returned check 8. What is the correct cash balance at May 31? a. P29,200 c. P30,000 b. P30,300 d. P30,900 The information below is from the books of the Seminole Corporation on June 30: Balance per bank statement P11,164 Receipts recorded but not yet deposited in the bank 1,340 Bank charges not recorded 16 Note collected by bank and not recorded on books 1,120 Outstanding checks 1,100 NSF checks not recorded on books nor redeposited 160 9. Assuming no errors were made, compute the cash balance per books on June 30 before any reconciliation adjustments a. P11,404 c. P10,460 b. P12,348 d. P10,220 The cash in bank account of S-Mart, Inc. for April showed an ending balance of P129,298. Deposits in transit on April 30 was P18,200. Outstanding checks as of April 30, were P59,435, including a P5,000 check which the bank had certified on April 27. During the month of April, the bank charged back NSF checks in the amount of P3,435 of which P1,835 had been redeposited by April 20. On April 23, the bank charged SMarts account for a P2,200 items which should have been charged against K-Mart, Inc., the proceeds from notes collected by the bank for S-Mart, Inc. was P7,548 and bank charges for this services was P18. 10. How much is the unadjusted balance per bank on April 30? a. P95,263 c. P173,663 b. P88,333 d. P169,263 Use the following information for the next two questions. Shown below is the bank reconciliation for YOUR Company for the month of May: Balance per bank, May 31 Add: Deposits in transit Total P75,000 12,000 87,000 P 17,194 31,948 109 125 6,728 4,880 5,700 8,100

1,200

800

760

Less: Outstanding checks Bank credit recorded in error Cash balance per books, May 31

P14,000 5,000

19,000 P68,000

The bank statement for the month of June contains the following data: Total deposits P55,000 Total charges, including an NSF check of P4,000 and a service charge of P200 48,000 All outstanding checks on May 31, including the bank credit, were cleared in the bank in June. There were outstanding checks of P15,000 and deposits in transit of P19,000 on June. 11. Cash receipts per books in June is a. P74,000 b. P43,000

c. P62,000 d. P48,000

12. Cash disbursements per books in June is a. P90,200 c. P44,800 b. P42,800 d. P39,800 Use the following information for the next two questions. Banaue Company deposits all receipts and makes all payments by checks. The following information is available from the cash records: May 31 Bank Reconciliation Balance per bank Add: Deposits in transit Deduct: Outstanding checks Balance per books

P262,460 21,000 (38,000) P245,460 Per Bank P279,950 107,840 111,000 30,000 350 Per Books P303,550 158,890 100,800 -0-0-

Month of June Results Balance June 30 June deposits June checks June note collected (not included in June deposits) June bank service charge June NSF check of a customer returned by the bank (recorded by bank as a charge)

9,000

-0-

13. The deposits in transit as of June 30 is a. P72,050 c. P51,050 b. P70,250 d. P42,050 14. The outstanding checks as of June 30 is a. P27,800 c. P37,150 b. P28,700 d. P31,750 On December 31, 2011 the account receivable control account of Ipil Ipil Co. had a balance of 181,000. An analysis of the account receivable account showed the following: Accounts known to be worthless Advance payments to creditors on Purchase Orders Advances to affiliated companies Customers accounts reporting credit balance arising from sales return Interest receivable on bonds Other trade accounts receivable unassigned Subscriptions receivable for ordinary share capital due in 30 days Trade accounts receivable assigned Trade installment receivable due 1 18 months, (including unearned finance charges, P2,000) Trade receivables from officers, due currently P 2,000 10,000 25,000 (15,000) 10,000 50,000 55,000 15,000

22,000 1,500

Trade accounts on which post dated checks are held (no entries were made receipts of checks

5,000

15. The correct balance of trade accounts receivable of Ipil Ipil on December 31, 2011 is a. P86,500 c. P91,500 b. P103,500 d. P206,000

16. The unadjusted trial balance of John Company as at December 31, 2011 showed Account Receivable trade with a balance of P693,000. Investigation revealed that it included amounts due from officer P75,000; claim pending against freight company P9,000; and refund on insurance policy P4,500. According to the subsidiary ledger which have been thoroughly checked and rechecked, the trade accounts receivable totaled P600,000 (composed of current accounts P375,00; two-months or more P105,000). Responsible Officials have acknowledged definite uncollectibility of three month accounts with balance totaling P22,500; they have expressed doubt with respect to an additional P24,000 worth of accounts in the same category; and they consider all other accounts collectible. At what net realizable value should the Accounts Receivable trade be carried in the statement of financial position of the company as of December 31, 2011? a. P553,500 c. P577,500 b. P582,000 d. P558,000 17. On June 9, 2011, Pol Corp. sold merchandise with list price of P5,000 to Pot on account. Pol allowed trade discounts of 30% and 20%. Credit terms were 2/15, n/40 and the sale was made FOB shipping point. Pol accommodation. On June 25, 2011, Pol received from Pot a remittance in full payment amounting to a. P2,744 c. P2,944 b. P2,940 d. P3,000 18. The Pacifier Company uses the net price method of accounting for cash discounts. In one of its transactions on December 15, 2011, Pacifier sold merchandise with list price of P500,000 to client who was given a trade discount of 20% and 15% Credit terms were 2/10, n/30. The goods were shipped FOB Destination, Freight Collect. Total freight charges paid by the client amounted to P7,500. On December 20, 2011, the client returned damaged goods originally billed at P60,000. What is the net realizable value of this receivable on December 31, 2011? a. P272,500 c. P280,000 b. P274,400 d. P333,200 19. Dancing Shoes sold P21,000 of merchandise during the month of December, which was charged to a national credit card. On December 15, Dancing bills the independent national credit card company for the sales and is assessed a 5% service charge. On December 21, a customer returned merchandise originally sold for P2,000 and Dancing notifies the credit card company of the return. On December 29, 2011, the credit card company remitted amount owed to Dancing. How much was received by Dancing from the credit card company a. P21, 000 c. P19,000 b. P19,950 d. P18,050 20. Bangui Company provides for doubtful accounts expense at the rate of 3 percent of credit sales. The following data are available for last year: Allow. For Doubtful Accounts, Jan. P54,000 Accounts written off as uncollectible 60,000 Collection of accounts written off 15,000 Credit sales, year-ended December 31 3,000,000 The allowance for doubtful accounts balance at December 31, after adjusting entries should be a. b. P45,000 P84,000 c. P90,000 d. P99,000

21. On January 1, 2011, the balance of accounts receivable of Burgos Company was P5,000,000 and the balance of doubtful account on the same date was P800,000. The following data were gathered: Credit Sales P10,000,000 14,000,000 16,000,000 25,000,000 Write offs P250,000 400,000 650,000 1,100,000 Recoveries P20,000 30,000 50,000 145,000

2008 2009 2010 2011

Doubtful accounts are provided for as percentage of credit sales. The accountant calculates the percentage annually by using the experience of the three years prior to the current year. How much should be reported as 2011 doubtful accounts expense?

a. P750,000 c. P330,000 b. P812,500 d. P875,000 22. John Corp. has the following data relating to account s receivable for the year ended December 31, 2011: Accounts receivable, January 1, 2011 Allowance for doubtful accounts, 1/1/2011 Sales during the year, all on account, terms 2/10, 1/15, n/60 Cash received from customer during the year Accounts written off during the year P480,000 19,200 2,400,000 2,560,000 17,600

An analysis of cash received from customers during the year revealed that P1,411,200 was received from customers availing the 10 day discount period, P792,000 from customers availing the 15-day discount, P4,800 represented recovery of accounts written-off, and the balance was received from customer paying beyond discounts period. The allowance for doubtful accounts is adjusted so that it represent certain percentage of the outstanding account receivable at year end. The required percentage at December 31, 2011 is 125% of the rate used in December 31, 2010. The doubtful accounts expense for the year ended December 31, 2011 is a. P6,880 c. P8,720 b. P7,120 d. P8,960 23. The accounts receivable subsidiary ledger of Besao Corporation shows the following information: 12/31/11 Account Balance P140,720 83,680 122,400 180,560 126,400 69,600 Invoice Date Amount 12/06/11 P56,000 11/29/11 84,720 09/27/11 48,000 08/20/11 35,680 12/08/11 80,000 10/25/11 42,400 11/17/11 92,560 10/09/11 88,000 12/12/11 76,800 12/02/11 49,600 09/12/11 69,600

Customer Maybe, Inc. Perhaps Co. Pwede Corp. Perchance Co. Possibly Co. Luck, Inc.

The estimated bad debt rates below are based on the Corporations receivable collection experience. Age of accounts 0 30 days 31- 60 days 61- 90 days 91 120 days Over 120 days The allowance for doubtful Accounts had a credit balance adjustment. Rate 1% 1.5% 3% 10% 50% of P14,000 on December 31, 2011, before

The adjusting journal entry to adjust the allowance for doubtful accounts as of December 31, 2011 will include a debit to doubtful accounts expense of a. P52, 795 c. P24,795 b. P38,795 d. P14,000 24. Badoc Corporations Books disclosed the following information for the year ended December 31, 2011: Net credit sales P1,500,000 Net cash sales 240,000 Accounts Receivable at beginning of year 200,000 Accounts Receivable at end of year 400,000 Bandocs accounts receivable turnover is a. 3.75 times c. 4.35 times b. 5.00 times d. 5.80 times 25. Smart Company has P3,000,000 note receivable from sale of plant bearing interest at 12% per annum. The note is dated June 1, 2010. The note is payable is 3 annual installments of P1,000,000 plus interest on the unpaid balance every June 1, 2011. The initial principal and interest payments was made on June 1, 2011. The Interest income for 2011 is a. P300,000 b. P290,000

c. P210,000 d. P140,000

26. Bangkok Corporation sold a machine on July 1, 2011, the cash price of the machine is P79,000. The buyer signed a deferred payment contract that provides for a down payment of P10,000 and an 8-year note bearing interest at 10%. The note is to be paid in 8 equal annual payments. The payments are made on June 30 of each year, beginning June 30, 2012, the 8 equal annual payments is a. P14,808 c. P13,462 b. P12,934 d. P11,758 27. On January 1, 2011, Santayana Company sold a special machine that had a list price of P900,000. The buyer paid P100,000 cash and signed an P800,000 note. The note specified that it would be paid off in four equal annual payment of 274,565 each starting on December 31, 2011. The carrying amount of the receivable on December 31, 2011 is a. P525,435 c. P701,435 b. P637,435 d. P725,435 28. Silay Corporation sells a financial asset with a carrying amount of P100,000 for 143,000. On the date of sale, the entity enters amount into an agreement with the buyer to repurchase the asset in three months for P145,000. How much should be recognized as gain on sale? a. P45,000 c. P43,000 b. P2,000 d. P 0 29. Avent Company sells a financial assets with a carrying amount of P500,000 for P600,000 and simultaneously enters into a total return swap with the buyer under which the buyer will return any increase in value to Avent and Avent will pay the buyer interest plus compensation for any decrease in value of the investment. Avent expect the fair value of the financial asset to decrease by P40,000. How much should Avent recognize as gain on sale of financial asset? a. P600,000 c. P60,000 b. P100,000 d. P 0 30. Talisay Corporation sells a portfolio of short-term accounts receivables carried on its books at P2,100,000 for P2,000,000 and promises to pay up to P60,000 to compensate the buyer if and when any defaults occur. Expected credit losses are significantly less than P60,000, and there are no other significant risks. How much should be recognized as loss on sale of receivables? a. P160,000 c. P40,000 b. P100,000 d. P 0 Use the following information for the next two questions. Sipalay Co. assigned P500,000 of accounts receivable to Hinigaran Finance Co. as security for4 a loan of P420,000. Hinigaran charge a 2% commission on the amount of the loan; the interest rate on the note was 10%. During the first month, Sipalay collected P110,000 on assigned accounts after deducting P380 of discounts. Sipalay accepted returns P1,350 and wrote off assigned accounts totaling P3,700. 31. The amount of cash Sipalay received from Hinigaran at the time of the transfer was? a. P378,000 c. P410,000 b. P411,600 d. P420,000 32. Entries during the first month would include a a. Debit to cash of P110,380 b. Debit to bad debt expense of P3,700 c. Debit to allowance for doubtful accounts of P3,700 d. Debit to accounts receivable of P115,430 33. On July 1, 2011, Shaw Co. sold a machine costing P500,000 with accumulated depreciation of P380,000 on the date of sale. Shaw received as consideration for the a sale, a P300,000 noninterest bearing note, due July 1, 2014. There was no established exchange price for the equipment and the note had no ready market. The prevailing rate of interest for a note of this type at July 1, 2011 was 12% and 13% on December 31, 2011. In relation to this transaction, the total incom e to be recognized in Shaws 2011 profit or loss is? a. P180,000 c. P101,445 b. P119,165 d. P106,352 34. On December 30, 2011, Chang Co. sold a machine to Door Co. in exchange for a non interest-interest bearing note requiring ten annual payments of P10,000. Door made the first payment on December 30, 2011. The market interest rate for similar note at the date of issuance was 8%. Information on present value factors is as follows: Present Value Present Value of Ordinary Period of 1 at 8% Annuity of 1 at 8% 9 0.50 6.25 10 0.46 6.71 In its December 31, 2011 statement of financial position, what amount should Chang report as note receivable? a. P45,000 c. P62,500 b. P46,000 d. P67,100

35. On December 31, 2010, Sadangan Company finished consultation services and accepted in exchange a promissory note with a face value of P300,000, a due date of December 31, 2013, and a stated rate of 5%, with interest receivable at the end of each year. The fair value of the service is not readily available marketable. Under the circumstances, the note is considered to have an appropriate imputed rate of interest of 10%. The carrying amount of the note receivable as of December 31, 2011 is a. P300,000 c. P262,694 b. P273,963 d. P247,920

Das könnte Ihnen auch gefallen

- CashDokument16 SeitenCashJemson YandugNoch keine Bewertungen

- Instruction. Encircle The Letter That Corresponds To Your Answer. Do Not Use Pencils. Avoid ErasuresDokument6 SeitenInstruction. Encircle The Letter That Corresponds To Your Answer. Do Not Use Pencils. Avoid ErasuresstillwinmsNoch keine Bewertungen

- Note Receivable Part 2Dokument7 SeitenNote Receivable Part 2Carlo VillanNoch keine Bewertungen

- Ia 2Dokument2 SeitenIa 2Nadine SofiaNoch keine Bewertungen

- Cash and Cash Equivalents (Theory and Problem)Dokument9 SeitenCash and Cash Equivalents (Theory and Problem)Kim Cristian MaañoNoch keine Bewertungen

- Actg 431 Quiz Week 7 Practical Accounting I (Part II) Inventories QuizDokument4 SeitenActg 431 Quiz Week 7 Practical Accounting I (Part II) Inventories QuizMarilou Arcillas PanisalesNoch keine Bewertungen

- Examination About Investment 7Dokument3 SeitenExamination About Investment 7BLACKPINKLisaRoseJisooJennieNoch keine Bewertungen

- Accounting for Bad Debts MethodsDokument5 SeitenAccounting for Bad Debts Methodshoneyjoy salapantanNoch keine Bewertungen

- Sarmiento, Shayne Angela - Exercises-Inventories P-1Dokument4 SeitenSarmiento, Shayne Angela - Exercises-Inventories P-1SHAYNE ANGELA SARMIENTONoch keine Bewertungen

- This Study Resource Was: Problem 1Dokument2 SeitenThis Study Resource Was: Problem 1Michelle J UrbodaNoch keine Bewertungen

- Intermediate Accounting - ReceivablesDokument3 SeitenIntermediate Accounting - ReceivablesDos Buenos100% (1)

- Cabael-Ae109-Proof of CashDokument4 SeitenCabael-Ae109-Proof of CashJanine MadriagaNoch keine Bewertungen

- 1-1-2017 Petty Cash FundDokument4 Seiten1-1-2017 Petty Cash FundMr. CopernicusNoch keine Bewertungen

- QuestionDokument1 SeiteQuestionJollybelleann MarcosNoch keine Bewertungen

- Required Ending Allowance For Doubtful AccountsDokument4 SeitenRequired Ending Allowance For Doubtful AccountsAngelica SamonteNoch keine Bewertungen

- PDF Chapter 2 Cash and Cash Equivalents Problems - CompressDokument2 SeitenPDF Chapter 2 Cash and Cash Equivalents Problems - CompresspehikNoch keine Bewertungen

- Pa1 1402Dokument11 SeitenPa1 1402Joris YapNoch keine Bewertungen

- Ama AccountingDokument3 SeitenAma AccountingGabriel JacaNoch keine Bewertungen

- Receivable - Q2Dokument3 SeitenReceivable - Q2Dymphna Ann CalumpianoNoch keine Bewertungen

- CPA Review: Cash and Cash Equivalents ProblemsDokument3 SeitenCPA Review: Cash and Cash Equivalents ProblemsLui100% (1)

- Notes Receivable - Ia 1Dokument4 SeitenNotes Receivable - Ia 1Aldrin CabangbangNoch keine Bewertungen

- CASH AND CASH EQUIVALENTS BALANCESDokument8 SeitenCASH AND CASH EQUIVALENTS BALANCESRonel CaagbayNoch keine Bewertungen

- ACt1104 Final Quiz No. 1wit AnsDokument7 SeitenACt1104 Final Quiz No. 1wit AnsDyenNoch keine Bewertungen

- Quiz VIII - ARDokument3 SeitenQuiz VIII - ARBLACKPINKLisaRoseJisooJennieNoch keine Bewertungen

- CashDokument7 SeitenCashhellohello100% (1)

- Cost AccountingDokument12 SeitenCost AccountingCamille G.Noch keine Bewertungen

- Calculate cash and cash equivalents from bank accounts, petty cash, and short-term investmentsDokument5 SeitenCalculate cash and cash equivalents from bank accounts, petty cash, and short-term investmentsJoventino NebresNoch keine Bewertungen

- Intermediate Accounting Iii - Final Examination 2 SEMESTER SY 2019-2020Dokument7 SeitenIntermediate Accounting Iii - Final Examination 2 SEMESTER SY 2019-2020ohmyme sungjaeNoch keine Bewertungen

- Drill - ReceivablesDokument7 SeitenDrill - ReceivablesMark Domingo MendozaNoch keine Bewertungen

- Intermediate Accounting 1 Inventories - Assignment A. Supply The Missing AmountsDokument5 SeitenIntermediate Accounting 1 Inventories - Assignment A. Supply The Missing AmountsGabriel Adrian ObungenNoch keine Bewertungen

- Recording Transactions in a Property Appraisal Business WorksheetDokument1 SeiteRecording Transactions in a Property Appraisal Business WorksheetKizaru50% (2)

- Accounting 111B (Journalizing)Dokument3 SeitenAccounting 111B (Journalizing)Yrica100% (1)

- Cash AssignmentDokument2 SeitenCash AssignmentRocelyn OrdoñezNoch keine Bewertungen

- Financial Accounting and Reporting: INVENTORIES (Part 1Dokument9 SeitenFinancial Accounting and Reporting: INVENTORIES (Part 1DyenNoch keine Bewertungen

- Notes ReceiDokument2 SeitenNotes ReceiDIANE EDRANoch keine Bewertungen

- Worsksheet #1Dokument4 SeitenWorsksheet #1Sharmin ReulaNoch keine Bewertungen

- Inacc 1 Chap 3 Act PDFDokument12 SeitenInacc 1 Chap 3 Act PDFSharmin Reula50% (2)

- Mod 04 - Trade A - RDokument2 SeitenMod 04 - Trade A - RMARY GRACE VARGAS0% (1)

- Intermediate AccountingDokument6 SeitenIntermediate AccountingMary Angeline LopezNoch keine Bewertungen

- BSA 7 - Interest Income and Impairment of Held-to-Maturity InvestmentDokument2 SeitenBSA 7 - Interest Income and Impairment of Held-to-Maturity InvestmentGray JavierNoch keine Bewertungen

- 1 LiabilitiesDokument39 Seiten1 LiabilitiesDiana Faith TaycoNoch keine Bewertungen

- AssignmentDokument2 SeitenAssignmentspongebob squarepantsNoch keine Bewertungen

- ACC421 Chapter 18 Questions and AnswersDokument11 SeitenACC421 Chapter 18 Questions and AnswersNhel AlvaroNoch keine Bewertungen

- Joint & by ProductsDokument10 SeitenJoint & by Productsharry severino0% (1)

- 33Dokument2 Seiten33yes yesnoNoch keine Bewertungen

- Bank Reconciliation Problems SolvedDokument4 SeitenBank Reconciliation Problems Solvedsharielles /Noch keine Bewertungen

- The Correct Answer Is: P105,000Dokument5 SeitenThe Correct Answer Is: P105,000cindy100% (2)

- BANK RECON and PROOF OF CASHDokument2 SeitenBANK RECON and PROOF OF CASHJay-an AntipoloNoch keine Bewertungen

- Inventories Opening ClosingDokument16 SeitenInventories Opening ClosingKristine PunzalanNoch keine Bewertungen

- Audit Prob Cash AnsDokument7 SeitenAudit Prob Cash AnsNoreen BinagNoch keine Bewertungen

- Prelim Review Docx 427399963 Prelim ReviewDokument42 SeitenPrelim Review Docx 427399963 Prelim ReviewMarjorie PalmaNoch keine Bewertungen

- Remarkable Company - Audit On ReceivablesDokument2 SeitenRemarkable Company - Audit On ReceivablesShr BnNoch keine Bewertungen

- Borrowing Cost CH 25 Ia Ppe GGDokument4 SeitenBorrowing Cost CH 25 Ia Ppe GGZes ONoch keine Bewertungen

- ACAE 22 Job Order Costing with SpoilageDokument2 SeitenACAE 22 Job Order Costing with SpoilageNick ivan AlvaresNoch keine Bewertungen

- Financial Asset at Fair Value Problem 21-1 (IFRS) : Solution 21-1 Answer CDokument15 SeitenFinancial Asset at Fair Value Problem 21-1 (IFRS) : Solution 21-1 Answer CAngelo PayawalNoch keine Bewertungen

- AlagangWency - Partnersip Dissolution Short QuizDokument1 SeiteAlagangWency - Partnersip Dissolution Short QuizKristian Paolo De LunaNoch keine Bewertungen

- Tweak Corporation Determined The Value in Use of The Unit To Be P535Dokument6 SeitenTweak Corporation Determined The Value in Use of The Unit To Be P535elsana philipNoch keine Bewertungen

- Handouts 1 P1Dokument3 SeitenHandouts 1 P1Cristopher IanNoch keine Bewertungen

- Compilation FARDokument7 SeitenCompilation FARAlexandria SomethingNoch keine Bewertungen

- Accounting - 1st Quiz Cash and Cash Equivalent 2011Dokument2 SeitenAccounting - 1st Quiz Cash and Cash Equivalent 2011Louie De La Torre40% (5)

- The Perfect Points of Entrance ExplainedDokument1 SeiteThe Perfect Points of Entrance ExplainedEiuol Nhoj Arraeugse100% (3)

- Imm5484e PDFDokument1 SeiteImm5484e PDFEiuol Nhoj ArraeugseNoch keine Bewertungen

- Janitorial Services Terms of ReferenceDokument11 SeitenJanitorial Services Terms of ReferenceEiuol Nhoj ArraeugseNoch keine Bewertungen

- PCAB List of Licensed Contractors for CFY 2019-2020 as of 25 November 2019Dokument804 SeitenPCAB List of Licensed Contractors for CFY 2019-2020 as of 25 November 2019Reynan Reyes100% (5)

- 2010.12.01 HGDG 2nd Edition PDFDokument195 Seiten2010.12.01 HGDG 2nd Edition PDFReihannah Paguital-Magno100% (1)

- Advanced-CARP Book PDFDokument112 SeitenAdvanced-CARP Book PDFEiuol Nhoj ArraeugseNoch keine Bewertungen

- The Audacity of Hope: Policy & Politics January 2017Dokument4 SeitenThe Audacity of Hope: Policy & Politics January 2017Eiuol Nhoj ArraeugseNoch keine Bewertungen

- CONTRACTOR FINAL PAYMENT CERTIFICATE FORMDokument2 SeitenCONTRACTOR FINAL PAYMENT CERTIFICATE FORMJuanbon Padadawan100% (3)

- Get Motoring!: A Comparison of Mini 4WD MotorsDokument1 SeiteGet Motoring!: A Comparison of Mini 4WD MotorsIan Eldrick Dela CruzNoch keine Bewertungen

- International Tax: Philippines Highlights 2017Dokument4 SeitenInternational Tax: Philippines Highlights 2017Tony MorganNoch keine Bewertungen

- Reading Camp Activity 1Dokument2 SeitenReading Camp Activity 1Eiuol Nhoj ArraeugseNoch keine Bewertungen

- Tax Volume4Series26 PDFDokument5 SeitenTax Volume4Series26 PDFEiuol Nhoj ArraeugseNoch keine Bewertungen

- Kymco requests BIR deadline extensionDokument1 SeiteKymco requests BIR deadline extensionEiuol Nhoj Arraeugse94% (16)

- Taxpayer Information For Single Prop. Trade Name Registered Address Tin. No. OwnerDokument2 SeitenTaxpayer Information For Single Prop. Trade Name Registered Address Tin. No. OwnerEiuol Nhoj ArraeugseNoch keine Bewertungen

- January 2014 Journal Entries and Financial StatementsDokument6 SeitenJanuary 2014 Journal Entries and Financial StatementsEiuol Nhoj ArraeugseNoch keine Bewertungen

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDokument48 SeitenBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledEiuol Nhoj ArraeugseNoch keine Bewertungen

- How My Brother Leon Brought Home A WifeDokument6 SeitenHow My Brother Leon Brought Home A WifeCamille LopezNoch keine Bewertungen

- Engagement - Webworx SSSDokument2 SeitenEngagement - Webworx SSSEiuol Nhoj ArraeugseNoch keine Bewertungen

- College of The Immaculate Concepcion Cabanatuan City: JloesguerraDokument34 SeitenCollege of The Immaculate Concepcion Cabanatuan City: JloesguerraEiuol Nhoj ArraeugseNoch keine Bewertungen

- Taxation 2011 Bar Exam QuestionnaireDokument16 SeitenTaxation 2011 Bar Exam QuestionnaireAlly BernalesNoch keine Bewertungen

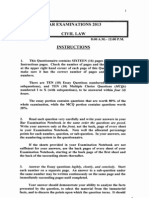

- Civil LawDokument16 SeitenCivil LawThe Supreme Court Public Information Office100% (2)

- Political LawDokument364 SeitenPolitical LawJingJing Romero100% (99)

- Philhealth ER2-Employer Report of EmployeesDokument2 SeitenPhilhealth ER2-Employer Report of EmployeesAimee F75% (24)

- POLiTICAL LAW REVIEW - Alobba PDFDokument7 SeitenPOLiTICAL LAW REVIEW - Alobba PDFEiuol Nhoj ArraeugseNoch keine Bewertungen

- San Beda College of Law: 54 M A C LDokument25 SeitenSan Beda College of Law: 54 M A C LEiuol Nhoj ArraeugseNoch keine Bewertungen

- San Beda College of Law: 54 M A C LDokument25 SeitenSan Beda College of Law: 54 M A C LEiuol Nhoj ArraeugseNoch keine Bewertungen

- Taxation LawDokument13 SeitenTaxation LawThe Supreme Court Public Information Office100% (2)

- Tax Alert - 2012 - MarDokument3 SeitenTax Alert - 2012 - MarEiuol Nhoj ArraeugseNoch keine Bewertungen

- Accounting Services AgreementDokument2 SeitenAccounting Services AgreementEiuol Nhoj Arraeugse50% (2)

- IUMC - Management Accounting - Fall 2019 - QuizDokument2 SeitenIUMC - Management Accounting - Fall 2019 - QuizM Usama Ahmed KhanNoch keine Bewertungen

- Lotusxbt Trading ModelDokument8 SeitenLotusxbt Trading ModelNassim Alami MessaoudiNoch keine Bewertungen

- Sample Question Paper Economics (030) Class XIIDokument4 SeitenSample Question Paper Economics (030) Class XIIMitesh SethiNoch keine Bewertungen

- ACCP303 Accounting for Special Transactions Prefinals ReviewDokument9 SeitenACCP303 Accounting for Special Transactions Prefinals ReviewAngelica RubiosNoch keine Bewertungen

- Chapter 11: Media Basics: Principle: Media in A World of ChangeDokument48 SeitenChapter 11: Media Basics: Principle: Media in A World of Changejobin jacobNoch keine Bewertungen

- ReSA CPA Review Batch 41 Inventory Management TechniquesDokument7 SeitenReSA CPA Review Batch 41 Inventory Management TechniquesCarlo AgravanteNoch keine Bewertungen

- Demand EstimationDokument3 SeitenDemand EstimationMian UsmanNoch keine Bewertungen

- CFA Level I Revision Day IIDokument138 SeitenCFA Level I Revision Day IIAspanwz SpanwzNoch keine Bewertungen

- Brand Building: Understanding Core Identity, Extended Identity and Brand PersonalityDokument66 SeitenBrand Building: Understanding Core Identity, Extended Identity and Brand PersonalityRyan MehrotraNoch keine Bewertungen

- Userbased ValueDokument18 SeitenUserbased ValueNovariNoch keine Bewertungen

- Factors Influencing Global Marketing Policy of ColgateDokument8 SeitenFactors Influencing Global Marketing Policy of Colgatesayam siddiquegmail.comNoch keine Bewertungen

- CA 03 - Cost Accounting CycleDokument6 SeitenCA 03 - Cost Accounting CycleJoshua UmaliNoch keine Bewertungen

- Marketing Plan of NestleDokument11 SeitenMarketing Plan of NestleAbdullah Khan50% (2)

- Consumer and Business Markets: Lesson 3.4Dokument22 SeitenConsumer and Business Markets: Lesson 3.4willsonjohndrewfNoch keine Bewertungen

- Understanding The Time Value of MoneyDokument13 SeitenUnderstanding The Time Value of MoneyDaniel HunksNoch keine Bewertungen

- 2022F-EPM-1113 Day-5 Unit-3.1 Assignemnt On Value Delivery-AODADokument10 Seiten2022F-EPM-1113 Day-5 Unit-3.1 Assignemnt On Value Delivery-AODArahulpavithrannNoch keine Bewertungen

- Accounts Manipulation A Literature Review and Proposed Conceptual FrameworkDokument12 SeitenAccounts Manipulation A Literature Review and Proposed Conceptual FrameworkafdtlgezoNoch keine Bewertungen

- TOPIC 5-Budgetary PlanningDokument73 SeitenTOPIC 5-Budgetary PlanningDashania GregoryNoch keine Bewertungen

- Analysing Effectiveness of Point of Purchase Display On Consumer Purchases in Bigbazaar, HebbalDokument8 SeitenAnalysing Effectiveness of Point of Purchase Display On Consumer Purchases in Bigbazaar, HebbalShiv HanchinamaniNoch keine Bewertungen

- CHAPTER 1 5 Online Marketing of LazadaDokument50 SeitenCHAPTER 1 5 Online Marketing of LazadaLarry Diaz44% (9)

- CAPITAL BUDGETING REPORTDokument86 SeitenCAPITAL BUDGETING REPORTtulasinad123Noch keine Bewertungen

- Chapter 14Dokument46 SeitenChapter 14Nguyen Hai Anh100% (1)

- Test Bank Principles of Cost Accounting 16th Edition VanderbeckDokument75 SeitenTest Bank Principles of Cost Accounting 16th Edition VanderbeckNhel AlvaroNoch keine Bewertungen

- Investment Ideas - Capital Market Assumptions (CMA) Methodology - 5 July 2012 - (Credit Suisse) PDFDokument24 SeitenInvestment Ideas - Capital Market Assumptions (CMA) Methodology - 5 July 2012 - (Credit Suisse) PDFQuantDev-MNoch keine Bewertungen

- Questions For The Spotify Case StudyDokument2 SeitenQuestions For The Spotify Case StudyAnirudh GuptaNoch keine Bewertungen

- Muhammad Adeel Aziz - ResumeDokument3 SeitenMuhammad Adeel Aziz - ResumeAdeel AzizNoch keine Bewertungen

- ISBPlacements Report 2023Dokument24 SeitenISBPlacements Report 2023Gaurav RawatNoch keine Bewertungen

- MRK - Fall 2023 - HRM619 - 4 - MC220205002Dokument7 SeitenMRK - Fall 2023 - HRM619 - 4 - MC220205002hssdj2hfdmNoch keine Bewertungen

- O.M File 4Dokument50 SeitenO.M File 4Kristoffer AngNoch keine Bewertungen

- Assignment of Retailing Management Submitted To Sir Asim JameelDokument5 SeitenAssignment of Retailing Management Submitted To Sir Asim JameelUsman HabibNoch keine Bewertungen