Beruflich Dokumente

Kultur Dokumente

Scorpio Case

Hochgeladen von

Iliyas Ahmad KhanOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Scorpio Case

Hochgeladen von

Iliyas Ahmad KhanCopyright:

Verfügbare Formate

INDEX

S. No 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13.

Title

Introduction of case study Global automobile industry Indian automobile industries The success story of Scorpio Mahindra contexts Market reality Strategic approach A new product development called IDAM Global alliances for the best of the world inputs Competitive contexts Consumer contexts Strategic Branding Approach - Identifying the need gap and occupying it Challenges and Recommendations

INTRODUCTION

At the CNBC Auto car Award in January 2003 an event call the Oscar of the Indian Automobile industry- the car of the year 2003 was awarded to Scorpio, a SUV manufactured by Mahindra & Mahindra Ltd. 18 month after its launch in august 2002 M&M sold 35,000 Scorpio vehicles. The Global Automobile Industry:There are a number of trends that can be identified by examining the global automotive market, which can be divided into the following factors: Global Market Dynamics - The world's largest automobile manufacturers continue to invest into production facilities in emerging markets in order to reduce production costs. These emerging markets include Latin America, China, Malaysia and other markets in Southeast Asia. Establishment of Global Alliances - U.S. automakers, "The Big Three" (GM, Ford and Chrysler) have merged with, and in some cases established commercial strategic partnerships with other European and Japanese automobile manufacturers. Some mergers, such as the Chrysler Daimler-Benz merger, were initiated by the European automaker in a strategy to strengthen its position in the U.S. market. Overall, there has been a trend by the world automakers to expand in overseas markets. Industry Consolidation - Increasing global competition amongst the global manufacturers and positioning within foreign markets has divided the world's automakers into three tiers, the first tier being GM, Ford, Toyota, Honda and Volkswagen, and the two remaining tier manufacturers attempting to consolidate or merge with other lower tier automakers to compete with the first tier companies. 1st Tier Company Mergers - Volkswagen-Lamborghini; BMW-Rolls Royce 2nd Tier Company Mergers - Chrysler-Mercedes Benz; Renault-Nissan-Fiat 3rd Tier Company Mergers - Mazda-Mitsubishi; Kia-Volvo Source: http://www.loc.gov/rr/business/BERA/issue2/industry.html

The Indian Automobile industry:-

Until the early 1980 the industry was dominated by Hindustan motors and Premier Automobile Limited. In 1980 MUL (Maruti Udyog Limited) formed by the joint venture of Indian government and Suzuki to manufacture small cars. In 1983 MUL 800 launches and it was the turning point for the Indian Car market. It was the most affordable car on the market. In 1998 Hyundai Motor introduced Santro an economy car with 55 bhp at US$ 7,800 which directly compete with MUL Zen. Tata Motors entered in this segment with Tata Indica which was a great success. The Indian market in 2003 was mostly dominated by 1. 2. 3. 4. MUL Hyundai Tata Motors Mahindra and Mahindra

Top five global automakers in India:1. 2. 3. 4. 5. Hyundai Toyota Ford motors General Motors Volkswagen

The story of Scorpio:-

The Scorpio story started in 1997 with a vision - a vision to continue the domination of the Utility vehicle (UV) market in India; to be a global niche player. This vision also clarified that M&M would focus on the niche UV market and, hence, would not directly participate in the car market .Its founders passionately believed that Indians are second to none. They had a dream to make M&M known worldwide for the quality, durability and reliability of its products and services and at the same time play an active role in the development of the nation. The current management held this dream and vision as an integral part of their existence and that led them to set themselves a challenging goal of retaining their domestic market leadership with over 50 per cent market share of the Indian utility vehicle segment and create their name in the global market. Mahindra Context:Mahindra, hitherto a leader in the UV segment, was fast witnessing loss of market share. Global players were entering the auto market and aggressively launching products. The Mahindra share of business was largely from the semi urban and rural markets of India. A large contribution also came from institutional sales - army, police, paramilitary groups and other institutional groups .Though Mahindra had a wide product portfolio, what it was lacking was products that catered to the modern urban consumer needs. The markets where Mahindra was strong were stagnating. The urban markets where it did not have a product to offer were seeing all the growth and action. The Mahindra Image was a big barrier as well. Though it had positives as rugged, tough, reliable, economical vehicles, the brand was not seen as modern or technologically advanced. The negative parameters were uncomfortable, rough, not easy-to-drive, rural imagery, down market, fuddy-duddy, etc. Market Reality:The Indian automobile industry had undergone a radical change since the opening up of the its economy in 1991. By 1997, the Indian automobile market was probably one of the most open and competitive automobile markets in the world, with all major global players having a presence there. Most of the global players present in India had focused their business strategy in the passenger car segment with the exception of Toyota, whose entry strategy in the Indian market is through a Multi Utility Vehicle (MUV). Even the other global majors had realised the intensity of competition the passenger car segment and were now eyeing the utility vehicle segment. The products they planned to launch in the Indian market were all to be positioned in the urban market, making it a highly competitive market.

Strategic Approach:With the above reality as a backdrop, M&M defined a two pronged strategy for the Automotive Sector Continue to dominate the rural and semi-urban market with a range of products catering to the needs for low cost mass transportation needs.* Develop a strong presence in the fast growing urban markets with a range of value for money products. To compete against the global players and also to meet its goal of developing a strong presence in the urban market, M&M embarked on Project Scorpio. M&M needed to work to its strengths and competencies. To find ways of side stepping the MNC competition for it did not have the deep pockets that global majors did. The implication was that the project cost had to be optimised to a fraction of what world majors would spend. The other direction was to develop a product which would provide great value and hence would be very affordable. A world class product which is also affordable is no mean task. It needs innovation and out-of-the-box thinking. The approach taken was to focus on and to prioritise what the customer

values the most and to excel at it. The broad objectives of the Project Scorpio were to create a new segment and retain market domination.

New Product Development -to create a world class Indian product M&M developed a new product to meet the above objectives and to create a world class product. Key achievements of the product development process were as follows unique process called IDAM best in the world tie-ups but in-house execution Customer focus from thought to finish A cross-functional, co-located, young, lean team lowest Project Costs Intensive Testing All new Manufacturing Set up A New Product Development Process called IDAM Integrated Design and Manufacturing (IDAM), is a product development process, which was adopted by M&M to streamline the delivery of a world class, zero-defect, trouble-free product to the customer. It encompasses the entire value chain starting and ending with the customer. This outside-in approach ensures that the product is designed around the customer and not vice versa. Unlike the traditional department structure, the IDAM team consisted of cross-functional teams ,co-located in the IDAM Centre in Mumbai. These teams had cross-functional strengths that cover every aspect of product development, from Design & Development, Testing & Validation and Manufacturing to Vendor Development and Marketing. Global Alliances for best of the world inputs M&M tied up with the best in the world in their respective areas of the global auto industry. M&M facilitated the development of these aggregates and played the role of an integrator. The vendors set up facilities in and around the factory. The end result was a fully indigenous product with international quality at affordable price. The most heartening of it all was the fact that not M&M a staunch follower of the IDAM concept but even logistic support companies, vendors dealers bought into it whole heartedly. This synchronicity in commitment aided implementation and guaranteed success. Mahindra didnt compromise on international quality and at the same time ensured that the product was fully Indian. Competitive Context The conventional UV market was too small in size. The UV market in urban markets was even smaller a percentage. The trend was that the UVs operating in the urban market were eating into the car share, primarily the cars which operated in the same price bracket. Qualis was taking market away from midsize cars. With these facts in place the whole of automobile market was studied in details. In the arena of cars, A-segment cars, which have been the leaders in terms of volumes and grew at the rate of 55.2 percent in the year 1999, were having a reduced growth rate of 34.2 percent in the year 2001. It was found that the fastest growing segment (growing at the rate of 42.9 per cent) in year 2001 was semi luxurious cars or B segment cars. And the luxurious car segment .C segment cars were also growing at a healthy rate of 14.2 percent in that year. However, super premium cars termed as segment D and E cars, were not growing at such healthy rates and did not offer volume in terms of number of cars sold. It was imperative for Scorpio to look beyond UVs. Apart from appealing to a typically UV buyer, it was also necessary to appeal to a wider target audience - prospective car buyers belonging to 5lakh and 5 lakh plus segment. The midsize car market (C class) which was in the Rs. Five to Seven lakh price bracket had grown in F00 at 36 per cent and in F01 at 22 per cent, and small luxury car segment (B class) which was up to Five lakh segment was also showing a healthy growth. Analysis showed that the volumes in the

automobile industry were coming from B and C segment cars. This meant that the mid size car market was the competitive arena for Scorpio for it to attaint he volume growth and market share it was looking for. It was decided that the offer had to appeal to segment C buyer and should be aspiration for segment B buyers. Therefore, an analysis of the offers of all the segment C cars and the relevant UVs was done. The entire vehicle is feature packed within a price range of Rs. 6-8 Lakhs. All of them, including UVs, are with a proposition of luxury and comfort, with no differentiation. Implication: With this analysis it came out clearly that the positioning of Scorpio has to be such that it should communicate that the vehicle is better than any of these cars and is a better buy in terms of money. Consumer Context Having defined the competitive framework, the next task undertaken was that of analyzing the consumer. Consumer segments of B and C category car buyers were analyzed in terms of their expectations from a car, their perceptions about cars and their relationship. Proprietary techniques of research, of the advertising agency Interface Communications, like Mind & Mood, ICON and VIP were used to understand this consumer. The findings were size matters- big size stands for status Consumers seek latest technology Imagery but at affordable prices The sheer thrill and passion of driving an SUV Power of the vehicle makes a statement But along with the others, luxury was a very important parameter .The Key Consumer Insight that emerged from all the consumer analysis and which was used for strategy development was Consumers want to consume premium imagery at prices affordable to them Strategic Branding Approach - Identifying the need gap and occupying it There existed a gap that wasnt tapped. There was no SUV in the country that the masses could buy. To make SUVs a mass concept in India - UVs needed to be seen as comfortable, easy-for-city driving and should have imagery comparable to international brands. Therefore, as a strategy it was decided that Scorpio would not take the traditional UV imagery of tough, off-roading and 4x4. A 4x4 approach would be a very niche category and would not generate numbers. To appeal to a car buyer, the Scorpio needed to be seen as a car that offers much more A Scorpio had to be seen as providing car-like driving pleasure and at the same time providing the edge over cars in space, power, style, fuel efficiency, luxury and comfort. In short, to provide status of a Pajero (international SUV) at the price of midsize car The Scorpio product package offered Superior technology, Dynamic Looks, Car-like product and great value for the price Value Proposition for Scorpio to capture the identified need -gap, the value proposition of Scorpio was defined as -Car plus Rational benefits:- World class vehicle, good looks, car like comfort, great value Emotional benefits Ownership experience of thrill, excitement and power Relational benefits: Young modern, premium, city companion / extension of lifestyle. Brand Promise: Luxury of a car. Thrill of an SUV This brand positioning addresses the key consumer Insight and the product delivers the promise. The position is also a unique proposition, which will help the brand have a distinct image in the consumers mind.

Challenges:-

1. How to establish in global market 2. How to compete with the global giant companies 3. How to carry the success story of Scorpio further

Recommendation: 1. The company should first enter in Asian market like Pakistan, Bangladesh, Thailand , Nepal, and then expand further 2. The company should follow the same strategy of R&D and manufacturing in global markets. 3. M&M should make a global impact by acquisitions and stakes. 4. M&Ms entry into China will also be a better step for them, and can be done thru Geelys JV or through JV with other company. 5. The global demand for rugged UVs can be filled by the help of the Scorpio and Bolero.

Das könnte Ihnen auch gefallen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Assignment Banyan TreeDokument8 SeitenAssignment Banyan TreeIliyas Ahmad KhanNoch keine Bewertungen

- Unilever CaseDokument2 SeitenUnilever CaseIliyas Ahmad Khan100% (1)

- Telecom Game TheoryDokument24 SeitenTelecom Game TheoryIliyas Ahmad Khan100% (2)

- Food Processing IndustryDokument14 SeitenFood Processing IndustryIliyas Ahmad KhanNoch keine Bewertungen

- AfpDokument4 SeitenAfpIliyas Ahmad KhanNoch keine Bewertungen

- Classic Failure FORD EdselDokument4 SeitenClassic Failure FORD EdselIliyas Ahmad KhanNoch keine Bewertungen

- AfpDokument4 SeitenAfpIliyas Ahmad KhanNoch keine Bewertungen

- Cola War Assignment QuestionDokument4 SeitenCola War Assignment QuestionIliyas Ahmad Khan100% (1)

- McKinsey 7Dokument3 SeitenMcKinsey 7Iliyas Ahmad KhanNoch keine Bewertungen

- Summary of The Article The Core Competence of The CorporationDokument2 SeitenSummary of The Article The Core Competence of The CorporationIliyas Ahmad Khan67% (3)

- McDonald's Is China Lovin's It Case AnalysisDokument9 SeitenMcDonald's Is China Lovin's It Case AnalysisIliyas Ahmad KhanNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Camber AngleDokument2 SeitenCamber AngleBabu RajamanickamNoch keine Bewertungen

- CJ5 M38a1Dokument4 SeitenCJ5 M38a1Davistine Vijayant LiddleNoch keine Bewertungen

- Spring Rates, Wheel Rates, Motion Ratios and Roll Stiffness Session 5Dokument43 SeitenSpring Rates, Wheel Rates, Motion Ratios and Roll Stiffness Session 5Vijay Pawar100% (1)

- Window StickerDokument1 SeiteWindow Stickerjbdietz2021Noch keine Bewertungen

- ART e SeriesDokument54 SeitenART e Seriesdavi100% (3)

- Maruti Suzuki Versa DX - BS IIIDokument8 SeitenMaruti Suzuki Versa DX - BS IIISoumi ChattopadhyayNoch keine Bewertungen

- AUTO Sale Numbers Oct-SeptDokument61 SeitenAUTO Sale Numbers Oct-SeptNihar DutiaNoch keine Bewertungen

- Manitou - MT 1235 PDFDokument2 SeitenManitou - MT 1235 PDFWalter BustamanteNoch keine Bewertungen

- 2009-2010 HDK CATALOGUE Vol.12 - копияDokument125 Seiten2009-2010 HDK CATALOGUE Vol.12 - копияAbigail Raymond50% (4)

- Cornwall Fire and Rescue Service Fleet List September 2021Dokument12 SeitenCornwall Fire and Rescue Service Fleet List September 2021Manikanta Sai KumarNoch keine Bewertungen

- BDM Multy ProgrammersDokument8 SeitenBDM Multy ProgrammersIng. Alejandro NarvaezNoch keine Bewertungen

- Detroit Diesel Dd15 Oil Coolant Filter Housing A4721804010 For Sale Online Ebay PDFDokument1 SeiteDetroit Diesel Dd15 Oil Coolant Filter Housing A4721804010 For Sale Online Ebay PDFRamiro Ordonez-huitzNoch keine Bewertungen

- Mitsubishi Cedia Brochure 542Dokument2 SeitenMitsubishi Cedia Brochure 542cediaNoch keine Bewertungen

- International Case NanoDokument2 SeitenInternational Case NanoAmit JainNoch keine Bewertungen

- LK 1 - Jacking and Blocking - OKDokument5 SeitenLK 1 - Jacking and Blocking - OKNengah Saputra WijayaNoch keine Bewertungen

- Listings: Ref NoDokument6 SeitenListings: Ref NoFaizan Hussain (9287)Noch keine Bewertungen

- Case Study - Ward School BusDokument1 SeiteCase Study - Ward School Busyosty100% (1)

- DiagramaAudiA72010 UpDokument1.558 SeitenDiagramaAudiA72010 UpCarlos Garcia GodoyNoch keine Bewertungen

- Electronic Stability Program (ESP)Dokument3 SeitenElectronic Stability Program (ESP)george_mudura1Noch keine Bewertungen

- EPA GuideDokument65 SeitenEPA GuideArr KaraszNoch keine Bewertungen

- Scirocco-Brochure UKDokument19 SeitenScirocco-Brochure UKbbobykimNoch keine Bewertungen

- 2014 Fiat 500l Pop 1.4l Turbo Fluid CapacitiesDokument1 Seite2014 Fiat 500l Pop 1.4l Turbo Fluid CapacitiesRubenNoch keine Bewertungen

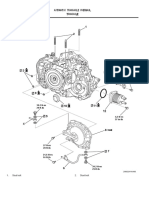

- Apply Automatic Transmission Fluid To All Moving Parts Before InstallationDokument2 SeitenApply Automatic Transmission Fluid To All Moving Parts Before InstallationvbNoch keine Bewertungen

- Kia Sportage ANCAP PDFDokument3 SeitenKia Sportage ANCAP PDFcarbasemyNoch keine Bewertungen

- All Wiring Diagrams For Ford Explorer XLT Vs 2013Dokument132 SeitenAll Wiring Diagrams For Ford Explorer XLT Vs 2013Mikael Mwango Musanya0% (1)

- Manual Horquilla PDFDokument61 SeitenManual Horquilla PDFCORTO-MALTESNoch keine Bewertungen

- Ducati Cat Accessori ENGDokument35 SeitenDucati Cat Accessori ENGJoão MarrazesNoch keine Bewertungen

- Vag Option CodesDokument177 SeitenVag Option CodesKarniNoch keine Bewertungen

- Department Equipment Class Equipment CountDokument3 SeitenDepartment Equipment Class Equipment CountYash Mhatre100% (1)

- VASS SignatoriesDokument15 SeitenVASS SignatoriesEhtesham KhatriNoch keine Bewertungen