Beruflich Dokumente

Kultur Dokumente

Printer Version - Board of Governors of The Federal Reserve System

Hochgeladen von

Simon_AquilesOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Printer Version - Board of Governors of The Federal Reserve System

Hochgeladen von

Simon_AquilesCopyright:

Verfügbare Formate

9/27/13

Printer Version - Board of Governors of the Federal Reserve System

Speech

GovernorJeremyC.Stein

Atthe"Banking,LiquidityandMonetaryPolicy,"aSymposiumSponsoredbytheCenterfor FinancialStudies,Frankfurt,Germany

September26,2013

Watchlive Letmestartbythankingtheorganizersforincludingmeinthisevent.It'sagreatpleasuretobehere withotheroldfriendsandcolleaguestopaytributetoRaghu,andtocongratulatehimnotonlyon winningtheDeutscheBankprizeforFinancialEconomics,butalsoonhisnewjobasgovernorofthe ReserveBankofIndia.It'sanunderstatementtosaythatRaghuhasafewchallengesonhishandsin thisnewrole,buthavingknownhimformorethan20years,Ican'timagineanybodybeingbetter equippedintermsofintellect,judgment,andstrengthofcharactertohandlethesechallenges. Iwouldliketotalkbrieflyaboutsomerecentresearchofmine,donejointlywithSamHansonof HarvardBusinessSchool,onthemonetarytransmissionmechanism.1 Aswillbecomeclear,ourwork isheavilyinfluencedbysomeofRaghu'searlierwriting,andinparticularhisfamous2005Jackson Holepaper.2 Afterdescribingwhatwefind,Iwilltrytodrawsomeconnectionstothecurrent monetarypolicyenvironmentaswellassomelessonsabouttheinterplayofmonetarypolicyand financialstability.Asalways,Iamspeakingformyself,andmyviewsarenotnecessarilysharedby othermembersoftheFederalOpenMarketCommittee(FOMC). Inourpaper,SamandIbeginbydocumentingthefollowingfactabouttheworkingofconventional monetarypolicy:Changesinthestanceofpolicyhavesurprisinglystrongeffectsonverydistant forwardrealinterestrates.Concretely,overasampleperiodfrom1999to2012,a100basispoint increaseinthe2yearnominalyieldonFOMCannouncementdaywhichwetakeasaproxyfora changeintheexpectedpathofthefederalfundsrateoverthefollowingseveralquartersisassociated witha42basispointincreaseinthe10yearforwardovernightrealrate,extractedfromtheyield curveforTreasuryinflationprotectedsecurities(TIPS).3 Ontheonehand,thisfindingisatoddswithstandardNewKeynesianmacromodels,inwhichthe centralbank'sabilitytoinfluencerealvariablesstemsfromgoodspricesthatarestickyinnominal terms.Insuchmodels,achangeinmonetarypolicyshouldhavenoeffectonforwardrealratesata horizonlongerthanthatoverwhichallpricescanadjust,anditseemsimplausiblethatthishorizon couldbeontheorderof10years.Ontheotherhand,theresultsuggeststhatmonetarypolicymay havemorekickthanisimpliedbythestandardmodel,preciselybecauselongtermrealratesarethe onesthataremostlikelytomatterforavarietyofinvestmentdecisions. Sowhatisgoingon?How,inaworldofeventuallyflexiblegoodsprices,ismonetarypolicyableto exertsuchapowerfulinfluenceonlongtermrealrates?Afirstclueisthatthemovementsindistant forwardrealratesthatwedocumentappeartoreflectchangesintermpremiums,asopposedto changesinexpectationsaboutshorttermrealratesfarintothefuture.Saiddifferently,iftheFedeases policytodayandyieldsonlongtermTIPsgodown,thisdoesnotmeanthattherealshortrateis expectedtobelower10yearsfromnowbutratherthatTIPshavegottenmoreexpensiverelativeto theexpectedfuturepathofshortrates.Thesechangesintermpremiumsthenappeartoreverse themselvesoverthefollowing6to12months. Thisobservationthenraisesthequestionofwhymonetarypolicymightbeabletoinfluencerealterm premiums.HereiswherewedrawourinspirationfromRaghu'swork,inparticularhishypothesisthat lownominalinterestratescancreateincentivesforcertaintypesofinvestorstotakeaddedriskinan effortto"reachforyield."Whileanemergingbodyofempiricalresearchinvestigatesthishypothesis inthecontextofcreditriskdocumentingthatbankstendtomakeriskierloanswhenratesarelow ourfocusisinsteadontheimplicationsofthereachforyieldmechanismonthepricingofinterestrate

www.federalreserve.gov/printable.htm 1/5

9/27/13

Printer Version - Board of Governors of the Federal Reserve System

risk,alsoknownasdurationrisk.4 Thetheorywesketchinvolvesasetof"yieldoriented"investors.Weassumethattheseinvestors allocatetheirportfoliosbetweenshortandlongtermTreasurybondsand,indoingso,putsome weightnotjustonexpectedholdingperiodreturns,butalsooncurrentincome.Thispreferencefor currentyieldcouldbeduetoagencyoraccountingconsiderationsthatleadtheseinvestorstocare aboutshorttermmeasuresofreportedperformance.Areductioninshorttermnominalratesleads themtorebalancetheirportfoliostowardlongertermbondsinanefforttokeeptheiroverallyieldfrom decliningtoomuch.This,inturn,createsbuyingpressurethatraisesthepriceofthelongtermbonds andhencelowerslongtermyieldsandforwardrates. Thus,accordingtothistheory,aneasingofmonetarypolicyaffectslongtermrealratesnotviathe usualexpectationschannel,butratherviawhatmightbetermeda"recruitment"channelbycausing anoutwardshiftinthedemandcurveofyieldorientedinvestors,therebyinducingtheseinvestorsto takeonmoreinterestrateriskandtopushdowntermpremiums. Toprovidesomeevidencethatbearsonthetheory,welookatthematurityofsecuritiesheldby commercialbanks.Banksfitwithourconceptionofyieldorientedinvestorstotheextentthatthey careabouttheirreportedearningswhich,givenbankaccountingrulesforavailableforsalesecurities, arebasedoncurrentincomefromsecuritiesholdingsandnotmarktomarketchangesinvalue.And, indeed,wefindthatwhentheyieldcurvesteepens,banksincreasethematurityoftheirsecurities holdings.Moreover,themagnitudesoftheseportfolioshiftsarelargeintheaggregate,sothatifthey hadtobeabsorbedbyother,lessyieldorientedinvestors,theshiftscouldplausiblydrivechangesin marketwidetermpremiums.WealsofindthatprimarydealersintheTreasurymarketwho,unlike banks,mustmarktheirsecuritiesholdingstomarkettaketheothersideofthetrade,reducingthe maturityoftheirTreasuryholdingswhentheyieldcurvesteepens.5 Overall,Ireadthisevidenceassuggestingalbeittentativelythatsomemechanisminvolvingyield orientedinvestorsmayeventuallyturnouttobecentraltoourunderstandingofhowmonetarypolicy works,bothinordinaryandextraordinarytimes.WhenIsay"central,"Imeanthatthismechanism mayplayarolenotonlyindetermininghowmonetarypolicyinfluencesthepricingofcreditrisk,but alsoinhowitshapestherealandnominalyieldcurvesforcreditriskfreeTreasurysecurities.Of course,muchworkremainstobedonebeforestatementslikethesecanbemadewithanydegreeof confidence.ButIthinkthereisapromisingresearchagendahere,andonethatowesmuchtoRaghu's insights. Withtheseobservationsinmind,letmenowturntotheeventsofthepastfewmonthsinthebond market.Abriefsummarygoesasfollows:Longtermrealandnominalratesandtermpremiumsinthe UnitedStateswereverylowasofearlyMay,withthe10yearTreasuryyieldbottomingoutat1.63 percentatthebeginningofthemonth,withanassociatedtermpremiumestimatedtobeontheorderof negative0.80percent.6 The10yearTIPSyieldreachednegative0.72percentaroundthesametime.7 However,followingChairmanBernanke'sMay22testimonytotheJointEconomicCommitteeand afterourJune1819FOMCmeeting,yieldsrosesharply,withthenominalandreal10yearrates reaching2.61percentand0.60percent,respectively,asofJune25.8 Intheabsenceofasignificantshiftinpolicyfundamentals,anumberofobservershavehighlightedthe roleofavarietyofmarketdynamicsindrivingtheobservedchangesinyields.Thesefactorsinclude theunwindingofcarrytrades,tighteningofrisklimitsinthefaceofhighervolatility,convexity hedgingbyholdersofmortgagebackedsecurities,andlargeoutflowsfrombondfunds.Ibelievethese factorstohavebeenimportantcollectively,althoughitisdifficulttosayhowmuchofaneffectisdue toanyoneofthem. However,beyondtryingtounderstandthemarketdynamicsthatdrovechangesinratesoverthe periodfromMaythroughJune,itisalsousefultoaskaquestionaboutthestartinglevels:What explainswhyrealandnominalrateswereaslowastheywereatthebeginningofMay?Clearly,our accommodativepoliciesthecombinationofforwardguidanceandassetpurchasesplayedan importantrole.ButIwanttodrawakeydistinctionbetweentwoviewsofhowourpoliciesmight havemattered.OneviewwouldbethattheconfigurationofmarketratesinearlyMaywaslargelya directhydraulicoutcomeofourpolicies.Forexample,accordingtothisview,anominal10yearyield of1.63percentinearlyMaycouldbeexplainedtoafirstapproximationbasedontheexpectedpathof thefederalfundsrate,plusanegativetermpremiumthatwasitselfprimarilyafunctionofthe

www.federalreserve.gov/printable.htm 2/5

9/27/13

Printer Version - Board of Governors of the Federal Reserve System

cumulativeamountofdurationthatwewereexpectedtoremovefromthemarketviaourasset purchaseprogram.Let'scallthisthe"directFedcontrol"view. Analternativehypothesisisthatourpolicieswereindeedresponsiblefortheverylowleveloflong termrates,butinpartthroughamoreindirectchannel.Accordingtothisview,realandnominalterm premiumswerelownotjustbecausewewerebuyinglongtermbonds,butbecauseourpolicies inducedanoutwardshiftinthedemandcurveofotherinvestors,whichledthemtodomorebuying onourbehalfbecausewebothgavethemanincentivetoreachforyield,andatthesametime providedasetofimplicitassurancesthattampeddownvolatilityandmadeitfeelsafertolever aggressivelyinpursuitofthatextrayield.Inthespiritofmyearliercomments,let'scallthisthe"Fed recruitment"view. Itaketheeventsofthepastfewmonthstobeevidenceinfavoroftherecruitmentview.And,tobe clear,Idon'tmeanthisasacriticismofthesetofpoliciesthatwehaveinplace.Quitetothecontrary itcanbeusefultoenlisthelpwhenyouhaveabigjobtodo.Indeed,mywholepointintalkingabout theresearchIdescribedearlierwastounderscoremybeliefthatsomethinglikethisinvestor recruitmentmechanismiscentraltohowmonetarypolicyacquiresmuchofitstractionoverthereal economyeveninordinarytimes.Ofcourse,themagnitudeoftheeffecttheextentofdownward pressurethatwemayhavebeeninducingotherinvestorstoapplytothetermpremiumislikelyto havebeenmorenoteworthygiventheunprecedentedscopeofouroverallmonetaryaccommodation. Butinanimportantsense,thiseffectisjustapoweredupversionofwhatmakesgardenvariety monetarypolicywork. Again,theexistenceofthisrecruitmentchannelishelpfulwithoutit,Isuspectthatourpolicieswould haveconsiderablylesspotencyand,therefore,lessabilitytoprovideneededsupporttothereal economy.Atthesametime,anunderstandingofthischannelhighlightstheuncertaintiesthat inevitablyaccompanyit.IftheFed'scontroloflongtermratesdependsinsubstantialpartonthe inducedbuyingandsellingbehaviorofotherinvestors,ourgriponthesteeringwheelisnotastightas itotherwisemightbe.Evenifwemakeonlysmallchangestothepolicyparametersthatwecontrol directly,longtermratescanbesubstantiallymorevolatile.Andifwepushtherecruitsveryhardas wearguablyhaveoverthepastyearorsoitisprobablymorelikelythatwearegoingtoseeachange intheirbehaviorandhenceasharpmovementinratesatsomepoint.Thus,ifitisagoalofpolicyto pushtermpremiumsfardownintonegativeterritory,oneshouldbepreparedtoacceptthatthis approachmaybringwithitanelevatedconditionalvolatilityofratesandspreads. Whenwetalkabouttheinterplayofmonetarypolicyandfinancialstability,Ithinkthatthiskindof tradeoffisanimportantpartofwhatweshouldbebearinginmind.Indeed,maybetheterm"financial stability"isabitmisleading,becausetheriskscenariothatIamdescribingandthatmaybeamongthe mostrelevantwhenthinkingaboutthecostsandbenefitsofourcurrenthighlyaccommodative policiesneednotbeonethatissodramaticastocallintoquestiontheviabilityofanylargefinancial firmorthreatenanimportantpartofthemarket'sinfrastructure.Rather,onescenariotobeworried aboutmaysimplybeasharpincreaseinmarketwideratesandspreadsataninopportunetime,such thatitbecomesharderforustoachieveourdualmandateobjectives. Havingsaidallofthis,Ibelievewearecurrentlyinaprettygoodplacewithrespecttothepricingof interestraterisk.ThemovementinTreasuryratesthatwehaveseensinceearlyMayhasledto somewhattighterfinancialconditionsincertainsectorsmostnotablythemortgagemarketbuthas alsobroughttermpremiumscloserintolinewithhistoricalnorms,andtherebyhasarguablyreduced theriskofamoredamagingupwardspikeatsomefuturedate.Onnet,Ibelievetheadjustmenthas beenahealthyone. Finally,letmesayafewwordsaboutlastweek'sFOMCmeeting.Ivotedwiththemajorityofthe Committeetocontinueourassetpurchaseprogramatitscurrentflowrateof$85billionpermonth.It wasaclosecallforme,butIdidsobecauseIcontinuetosupportoureffortstocreateahighly accommodativemonetaryenvironmentsoastohelptherecoveryalongbyusingbothassetpurchases andourthresholdbasedapproachtoforwardguidance. Howshouldthepaceofpurchasesevolvegoingforward?TheChairmanlaidoutaframeworkfor windingdownpurchasesinhisJunepressconference.9 Withinthatframework,Iwouldhavebeen comfortablewiththeFOMC'sbeginningtotaperitsassetpurchasesattheSeptembermeeting.But whetherwestartinSeptemberorabitlaterisnotinitselfthekeyissuethedifferenceintheoverall amountofsecuritieswebuywillbemodest.Whatismuchmoreimportantisdoingeverythingwecan

www.federalreserve.gov/printable.htm 3/5

9/27/13

Printer Version - Board of Governors of the Federal Reserve System

toensurethatthisdifficulttransitionisimplementedinastransparentandpredictableamanneras possible.Onthisfront,Ithinkitissafetosaythattheremayberoomforimprovement. Achievingthedesiredtransparencyandpredictabilitydoesn'trequirethatthewinddownhappenina waythatisindependentofincomingdata.ButIdothinkthat,atthisstageoftheassetpurchase program,therewouldbeagreatdealofmeritintryingtofindawaytomakethelinktoobservable dataasmechanicalaspossible.Forthisreason,mypersonalpreferencewouldbetomakefuturestep downsacompletelydeterministicfunctionofalabormarketindicator,suchastheunemploymentrate orcumulativepayrollgrowthoversomeperiod.Forexample,onecouldcutmonthlypurchasesbya setamountforeachfurther10basispointdeclineintheunemploymentrate.10 Obviouslythe unemploymentrateisnotaperfectsummarystatisticforourlabormarketobjectives,butIbelievethat thisapproachwouldhelptoreduceuncertaintyaboutourreactionfunctionandtheattendantmarket volatility.Moreover,wewouldstillretaintheflexibilitytorespondtoothercontingencies(suchas declinesinlaborforceparticipation)viaourothermoreconventionalpolicytoolnamely,thepathof shorttermrates. Thankyouverymuch.Ilookforwardtoyourquestions. 1.SeeSamuelG.HansonandJeremyC.Stein(2012),"MonetaryPolicyandLongTermRealRates (PDF),"FinanceandEconomicsDiscussionSeries201246(Washington:BoardofGovernorsofthe FederalReserveSystem,July).Returntotext 2.SeeRaghuramG.Rajan(2005),"HasFinancialDevelopmentMadetheWorldRiskier?(PDF) " inTheGreenspanEra:LessonsfortheFuture,ASymposiumSponsoredbytheFederalReserve BankofKansasCity,JacksonHole,Wyoming,August2527,2005(KansasCity:FederalReserve BankofKansasCity),pp.31369.Returntotext 3.OurfindingscanbeillustratedwiththeeventsofJanuary25,2012.OnthatdatetheFOMC changeditsforwardguidance,indicatingthatitexpectedtoholdthefederalfundsratenearzero "throughlate2014,"whereasithadpreviouslyonlystatedthatitexpectedtodoso"throughmid 2013."Inresponsetothisannouncement,theexpectedpathofshorttermnominalratesfell significantlyfromtwotofiveyearsout,withthe2yearnominalyielddropping5basispointsandthe 5yearnominalyieldfalling14basispoints.Morestrikingly,10yearand20yearrealforwardrates declinedby5basispointsand9basispoints,respectively.Returntotext 4.Theideathatbankstakeonmorecreditriskwhenratesarelowisexploredin,forexample,Gabriel Jimnez,StevenOngena,JosLuisPeydr,andJessSaurina(forthcoming),"HazardousTimesfor MonetaryPolicy:WhatDo23MillionBankLoansSayabouttheEffectsofMonetaryPolicyon CreditRiskTaking?(PDF) "Econometrica.Returntotext 5.PrimarydealersarebrokerdealerfirmsthatserveastradingcounterpartiesoftheFederalReserve BankofNewYorkinitsimplementationofmonetarypolicy.Returntotext 6.The10yearnominalratehit1.63percentonMay2,2013.TheKimWrighttermpremiumwas estimatedtobenegative0.78percentonthisday.(Formoreinformationonthetermpremium,see DonH.KimandJonathanH.Wright(2005),"AnArbitrageFreeThreeFactorTermStructureModel andtheRecentBehaviorofLongTermYieldsandDistantHorizonForwardRates(PDF),"Finance andEconomicsDiscussionSeries200533(Washington:BoardofGovernorsoftheFederalReserve System,August).Returntotext 7.The10yearrealratehitnegative0.72percentonApril26,2013.Returntotext 8.SeeBenS.Bernanke(2013),"TheEconomicOutlook,"statementbeforetheJointEconomic Committee,U.S.Congress,May22andBoardofGovernorsoftheFederalReserveSystem(2013), "FederalReserveIssuesFOMCStatement,"pressrelease,June19.Returntotext 9.InformationontheChairman'sJune19,2013,pressconferenceisavailableontheBoard'swebsite. Returntotext 10.Tobeclear,Iamsketchingoutabroadconcept,andmanydetailswouldneedtobefilledinto

www.federalreserve.gov/printable.htm 4/5

9/27/13

Printer Version - Board of Governors of the Federal Reserve System

makeitoperationalsuchas,whattodoiftheunemploymentratefallsinonemonthandthenlater rises.Returntotext Returntotop

www.federalreserve.gov/printable.htm

5/5

Das könnte Ihnen auch gefallen

- Plight of the Fortune Tellers: Why We Need to Manage Financial Risk DifferentlyVon EverandPlight of the Fortune Tellers: Why We Need to Manage Financial Risk DifferentlyBewertung: 3.5 von 5 Sternen3.5/5 (9)

- ARoisenzvit - Understanding and Regulating Banks PDFDokument48 SeitenARoisenzvit - Understanding and Regulating Banks PDFCarlos CarboneNoch keine Bewertungen

- The New Global Road Map: Enduring Strategies for Turbulent TimesVon EverandThe New Global Road Map: Enduring Strategies for Turbulent TimesBewertung: 5 von 5 Sternen5/5 (1)

- Corporate Debt Restructuring in Emerging Markets: A Practical Post-Pandemic GuideVon EverandCorporate Debt Restructuring in Emerging Markets: A Practical Post-Pandemic GuideNoch keine Bewertungen

- Money, Banking, and the Business Cycle: Volume II: Remedies and Alternative TheoriesVon EverandMoney, Banking, and the Business Cycle: Volume II: Remedies and Alternative TheoriesNoch keine Bewertungen

- Financial Market Bubbles and Crashes, Second Edition: Features, Causes, and EffectsVon EverandFinancial Market Bubbles and Crashes, Second Edition: Features, Causes, and EffectsNoch keine Bewertungen

- The Great Demographic Reversal: Ageing Societies, Waning Inequality, and an Inflation RevivalVon EverandThe Great Demographic Reversal: Ageing Societies, Waning Inequality, and an Inflation RevivalNoch keine Bewertungen

- The Handbook of Global Shadow Banking, Volume II: The Future of Economic and Regulatory DynamicsVon EverandThe Handbook of Global Shadow Banking, Volume II: The Future of Economic and Regulatory DynamicsNoch keine Bewertungen

- Douglas Cumming, Lars Hornuf (Eds.) - The Economics of Crowdfunding - Startups, Portals and Investor Behavior-Palgrave Macmillan (2018)Dokument291 SeitenDouglas Cumming, Lars Hornuf (Eds.) - The Economics of Crowdfunding - Startups, Portals and Investor Behavior-Palgrave Macmillan (2018)Yousania SimbiakNoch keine Bewertungen

- Fault Lines: How Hidden Fractures Still Threaten The World EconomyDokument14 SeitenFault Lines: How Hidden Fractures Still Threaten The World Economyprasenjit_baishyaNoch keine Bewertungen

- The Federal Reserve and the Financial CrisisVon EverandThe Federal Reserve and the Financial CrisisBewertung: 4.5 von 5 Sternen4.5/5 (13)

- Download Central Banking In Turbulent Times Tuomas Valimaki full chapterDokument67 SeitenDownload Central Banking In Turbulent Times Tuomas Valimaki full chapterjuanita.byers160100% (2)

- Capacity Building in Developing and Emerging Countries: From Mindset Transformation to Promoting Entrepreneurship and Diaspora InvolvementVon EverandCapacity Building in Developing and Emerging Countries: From Mindset Transformation to Promoting Entrepreneurship and Diaspora InvolvementElie ChrysostomeNoch keine Bewertungen

- Fault Lines Review #2Dokument2 SeitenFault Lines Review #2Pramod Govind SalunkheNoch keine Bewertungen

- The Financial Advisor M&A Guidebook: Best Practices, Tools, and Resources for Technology Integration and BeyondVon EverandThe Financial Advisor M&A Guidebook: Best Practices, Tools, and Resources for Technology Integration and BeyondNoch keine Bewertungen

- Russia Business: Analyze the Economy, Understand the Society, Manage EffectivelyVon EverandRussia Business: Analyze the Economy, Understand the Society, Manage EffectivelyNoch keine Bewertungen

- Impact of Country of Origin in HRM CompaDokument54 SeitenImpact of Country of Origin in HRM CompaABU RASEL MIANoch keine Bewertungen

- Banking Corrupt Practices: Looters and Protectors (Indian Edition)Von EverandBanking Corrupt Practices: Looters and Protectors (Indian Edition)Noch keine Bewertungen

- The Selectiveness of The EntrepreneurialDokument28 SeitenThe Selectiveness of The Entrepreneurialsilas gundaNoch keine Bewertungen

- Baumol Entrepreneurship in Economic TheoryDokument9 SeitenBaumol Entrepreneurship in Economic TheoryDavid GleiserNoch keine Bewertungen

- Download The Handbook Of Global Shadow Banking Volume I From Policy To Regulation 1St Ed Edition Luc Nijs full chapterDokument67 SeitenDownload The Handbook Of Global Shadow Banking Volume I From Policy To Regulation 1St Ed Edition Luc Nijs full chapterpatricia.mozingo467100% (2)

- Can Finance Save the World?: Regaining Power over Money to Serve the Common GoodVon EverandCan Finance Save the World?: Regaining Power over Money to Serve the Common GoodNoch keine Bewertungen

- 12 01 09 Rochester Economic SeminarDokument8 Seiten12 01 09 Rochester Economic SeminarZerohedgeNoch keine Bewertungen

- Central Bankers at the End of Their Rope?: Monetary Policy and the Coming DepressionVon EverandCentral Bankers at the End of Their Rope?: Monetary Policy and the Coming DepressionNoch keine Bewertungen

- The Slow Lane: Why Quick Fixes Fail and How to Achieve Real ChangeVon EverandThe Slow Lane: Why Quick Fixes Fail and How to Achieve Real ChangeNoch keine Bewertungen

- Envoping: Or Interacting with the Operating Environment During the ''Age of Regulation''Von EverandEnvoping: Or Interacting with the Operating Environment During the ''Age of Regulation''Noch keine Bewertungen

- Navigating The Boom/Bust Cycle: An Entrepreneur's Survival GuideDokument42 SeitenNavigating The Boom/Bust Cycle: An Entrepreneur's Survival GuideCharlene Kronstedt100% (1)

- Term Paper On Banking and FinanceDokument4 SeitenTerm Paper On Banking and Financeafdtbwkhb100% (1)

- The Basel II Risk Parameters: Estimation, Validation, Stress Testing - with Applications to Loan Risk ManagementVon EverandThe Basel II Risk Parameters: Estimation, Validation, Stress Testing - with Applications to Loan Risk ManagementBewertung: 1 von 5 Sternen1/5 (1)

- Central Bank Lessons from the Global Financial CrisisDokument14 SeitenCentral Bank Lessons from the Global Financial Crisisrahul3006Noch keine Bewertungen

- Literature Review Banking CrisisDokument6 SeitenLiterature Review Banking Crisisjizogol1siv3100% (1)

- Occupy the Solution Not Wall Street: Managing Systemic Bad Debt with System Gap TheoryVon EverandOccupy the Solution Not Wall Street: Managing Systemic Bad Debt with System Gap TheoryNoch keine Bewertungen

- To Be A Fed ChairmanDokument8 SeitenTo Be A Fed ChairmanZerohedgeNoch keine Bewertungen

- Leading Through Uncertainty: How Umpqua Bank Emerged from the Great Recession Better and Stronger than EverVon EverandLeading Through Uncertainty: How Umpqua Bank Emerged from the Great Recession Better and Stronger than EverNoch keine Bewertungen

- Blockchain, Artificial Intelligence and Financial Services: Implications and Applications for Finance and Accounting ProfessionalsVon EverandBlockchain, Artificial Intelligence and Financial Services: Implications and Applications for Finance and Accounting ProfessionalsNoch keine Bewertungen

- Radical Business Agility: Navigating Through Uncertain TimesVon EverandRadical Business Agility: Navigating Through Uncertain TimesNoch keine Bewertungen

- The Hausman-Rodrick - Valesco - HRV - FrameworkDokument13 SeitenThe Hausman-Rodrick - Valesco - HRV - Frameworkshobandeolatunji100% (2)

- The New Value Investing: How to Apply Behavioral Finance to Stock Valuation Techniques and Build a Winning PortfolioVon EverandThe New Value Investing: How to Apply Behavioral Finance to Stock Valuation Techniques and Build a Winning PortfolioBewertung: 3 von 5 Sternen3/5 (4)

- Investors and Markets: Portfolio Choices, Asset Prices, and Investment AdviceVon EverandInvestors and Markets: Portfolio Choices, Asset Prices, and Investment AdviceBewertung: 3.5 von 5 Sternen3.5/5 (5)

- Money Makers: Inside the New World of Finance and BusinessVon EverandMoney Makers: Inside the New World of Finance and BusinessNoch keine Bewertungen

- Derivatives and Internal Models: Modern Risk ManagementVon EverandDerivatives and Internal Models: Modern Risk ManagementNoch keine Bewertungen

- International Dissertation AbstractDokument4 SeitenInternational Dissertation AbstractCustomPapersOnlineSaltLakeCity100% (1)

- What Every Entrepreneur Ought to Know About Business & Banking: A Practical ApproachVon EverandWhat Every Entrepreneur Ought to Know About Business & Banking: A Practical ApproachNoch keine Bewertungen

- Bos Lamers Purice 2017Dokument62 SeitenBos Lamers Purice 2017AdolfNoch keine Bewertungen

- After the Flood: How the Great Recession Changed Economic ThoughtVon EverandAfter the Flood: How the Great Recession Changed Economic ThoughtNoch keine Bewertungen

- Download Contemporaneous Event Studies In Corporate Finance Methods Critiques And Robust Alternative Approaches 1St Ed Edition Jau Lian Jeng full chapterDokument68 SeitenDownload Contemporaneous Event Studies In Corporate Finance Methods Critiques And Robust Alternative Approaches 1St Ed Edition Jau Lian Jeng full chaptersharon.dunnagan654100% (2)

- Too Big Has Failed: Lessons from Previous Financial CrisesDokument15 SeitenToo Big Has Failed: Lessons from Previous Financial CrisesjrodascNoch keine Bewertungen

- Diksha Seminar ReportDokument25 SeitenDiksha Seminar ReportGaurav SinghNoch keine Bewertungen

- Thinking with the Eye's Mind: Decision Making and Planning in a Time of DisruptionVon EverandThinking with the Eye's Mind: Decision Making and Planning in a Time of DisruptionBewertung: 1 von 5 Sternen1/5 (1)

- Getting Back to Business: Why Modern Portfolio Theory Fails Investors and How You Can Bring Common Sense to Your PortfolioVon EverandGetting Back to Business: Why Modern Portfolio Theory Fails Investors and How You Can Bring Common Sense to Your PortfolioNoch keine Bewertungen

- TsaaDokument12 SeitenTsaaHuỳnh Trí ĐạiNoch keine Bewertungen

- Making Better Decisions: Balancing Conflicting CriteriaVon EverandMaking Better Decisions: Balancing Conflicting CriteriaNoch keine Bewertungen

- Proposal MunnaDokument11 SeitenProposal Munnamunna tamangNoch keine Bewertungen

- OMFIF EY Central Banking Report 1Dokument60 SeitenOMFIF EY Central Banking Report 1Shubham PandeyNoch keine Bewertungen

- Modern Engineering mathematics-CRC Press (2018) PDFDokument851 SeitenModern Engineering mathematics-CRC Press (2018) PDFSimon_Aquiles75% (4)

- Kahneman (1986) Rational Choice and The Framing of DecisionsDokument29 SeitenKahneman (1986) Rational Choice and The Framing of DecisionsSimon_AquilesNoch keine Bewertungen

- The Single-Engine Global Economy by Nouriel Roubini - Project SyndicateDokument5 SeitenThe Single-Engine Global Economy by Nouriel Roubini - Project SyndicateSimon_AquilesNoch keine Bewertungen

- List of Math SymbolsDokument164 SeitenList of Math SymbolsBob CaNoch keine Bewertungen

- Printer Version - Federal Reserve Bank of New York - 01Dokument2 SeitenPrinter Version - Federal Reserve Bank of New York - 01Simon_AquilesNoch keine Bewertungen

- List of Math SymbolsDokument164 SeitenList of Math SymbolsBob CaNoch keine Bewertungen

- Federal Reserve Tools For Managing Rates and ReservesDokument43 SeitenFederal Reserve Tools For Managing Rates and ReservesSteven HansenNoch keine Bewertungen

- NEW Opportunities Intermediate TESTs BookDokument12 SeitenNEW Opportunities Intermediate TESTs BookJo Albornoz64% (11)

- Mitt's Gray Areas - NYTimesDokument3 SeitenMitt's Gray Areas - NYTimesSimon_AquilesNoch keine Bewertungen

- Web Aggregator SyllabusDokument5 SeitenWeb Aggregator Syllabussam franklinNoch keine Bewertungen

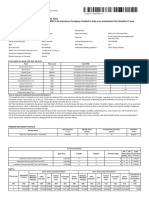

- Certificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasDokument2 SeitenCertificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasWeng Tuiza EstebanNoch keine Bewertungen

- DMS User Guide Glossary Terms ModuleDokument122 SeitenDMS User Guide Glossary Terms ModuleNagarajuPosaNoch keine Bewertungen

- UBI Loan InsuranceDokument13 SeitenUBI Loan InsuranceSuraj Pratap PhalkeNoch keine Bewertungen

- Stockyard Days 2018Dokument16 SeitenStockyard Days 2018Lillie NewspapersNoch keine Bewertungen

- Acca F6 UkDokument60 SeitenAcca F6 Ukm2mlckNoch keine Bewertungen

- Letter of Intent For Joint Pole Agreement For Fiber Optic CableDokument2 SeitenLetter of Intent For Joint Pole Agreement For Fiber Optic Cablereinhardmoral27Noch keine Bewertungen

- Benefit Illustration for HDFC SL ProGrowth FlexiDokument3 SeitenBenefit Illustration for HDFC SL ProGrowth FlexiFuse BulbNoch keine Bewertungen

- Affiliated Business Arrangement Disclosure Statement: Grandmas HouseDokument1 SeiteAffiliated Business Arrangement Disclosure Statement: Grandmas Houseapi-542747003Noch keine Bewertungen

- FOSFA Contract 811Dokument11 SeitenFOSFA Contract 811Ozlem MepNoch keine Bewertungen

- Lease Telecom BWI447 A DouglassHighDokument32 SeitenLease Telecom BWI447 A DouglassHighParents' Coalition of Montgomery County, MarylandNoch keine Bewertungen

- Market Share P Vs PuDokument5 SeitenMarket Share P Vs PuSai SuryaNoch keine Bewertungen

- RA PSPCL Question PaperDokument27 SeitenRA PSPCL Question Paperankur sehgalNoch keine Bewertungen

- Insurance Note Taking GuideDokument2 SeitenInsurance Note Taking Guideapi-252988764Noch keine Bewertungen

- Financial ServicesDokument20 SeitenFinancial ServicesProjNoch keine Bewertungen

- Taxation of IndividualsDokument18 SeitenTaxation of IndividualsŁÖVË GÄMËNoch keine Bewertungen

- Deloitte CH en Ifrs 17 Webinar 3febDokument23 SeitenDeloitte CH en Ifrs 17 Webinar 3febЙоанна ЗNoch keine Bewertungen

- 13 Swot Analysis of Life Insurance SectorDokument19 Seiten13 Swot Analysis of Life Insurance Sectorisaac setabiNoch keine Bewertungen

- IR PERSPECTIVE ON INDUSTRIAL RELATIONSDokument32 SeitenIR PERSPECTIVE ON INDUSTRIAL RELATIONSyogeshmanujaNoch keine Bewertungen

- Variable Reviewer12346Dokument17 SeitenVariable Reviewer12346jeffNoch keine Bewertungen

- Question No. 1 - C: Rey Ocampo Online Ap Diagnostic ExamDokument6 SeitenQuestion No. 1 - C: Rey Ocampo Online Ap Diagnostic ExamBernadette PanicanNoch keine Bewertungen

- Congressional Research Service: Piracy Off The Horn of AfricaDokument31 SeitenCongressional Research Service: Piracy Off The Horn of AfricaTheRoyalScamNoch keine Bewertungen

- HR INDEXDokument43 SeitenHR INDEXanjalipatel226Noch keine Bewertungen

- Philamcare Health Systems, Inc. vs. Court of Appeals (DIGEST)Dokument2 SeitenPhilamcare Health Systems, Inc. vs. Court of Appeals (DIGEST)Ann Catalan100% (1)

- Wo 0802mylawang (FT1292 Sec 2.20) Kerja Repair JambatanDokument14 SeitenWo 0802mylawang (FT1292 Sec 2.20) Kerja Repair JambatanEncik ComotNoch keine Bewertungen

- 7 Application of Expected Value and Variance of A Discrete Random VariableDokument6 Seiten7 Application of Expected Value and Variance of A Discrete Random VariableRhyzen Dane Martinez GacayanNoch keine Bewertungen

- Finance Circular No 2 Swaziland 2013Dokument19 SeitenFinance Circular No 2 Swaziland 2013Richard RooneyNoch keine Bewertungen

- Module 9 Transport InsuranceDokument234 SeitenModule 9 Transport InsuranceAung NaingNoch keine Bewertungen

- Finance Act 2013 Edition IIIDokument72 SeitenFinance Act 2013 Edition IIIAbdul Basit KtkNoch keine Bewertungen

- July 12 AuctionDokument27 SeitenJuly 12 AuctionramszlaiNoch keine Bewertungen