Beruflich Dokumente

Kultur Dokumente

Bush Privatization Plan Could Devastate New York's Economy

Hochgeladen von

Citizen Action of New YorkOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Bush Privatization Plan Could Devastate New York's Economy

Hochgeladen von

Citizen Action of New YorkCopyright:

Verfügbare Formate

Bush Privatization Plan Could

Devastate New York’s Economy

Plan could take $33 to $55 billion out of the state’s

economy and plunge at least 332,000 New York

seniors into poverty

April 2005

1025 Connecticut Ave., NW #205 Washington, DC 20036

(202) 955-5665 www.ourfuture.org

Please purchase PDF Split-Merge on www.verypdf.com to remove this watermark.

Bush Privatization Plan Could Devastate

New York’s Economy

The Bush Social Security privatization plan could take $33 to $55 billion out of the

state’s economy. It could also plunge at least 332,000 New York seniors into poverty or

destroy Social Security as the broad-based social insurance program on which millions

of New Yorkers rely.

_________________________________________________________________________

Social Security provides vital guaranteed economic security to more than 47 million people,

including grandparents, parents and children nationwide. In New York, more than 3 million

people count on this earned benefit every month, including 2.5 million retirees, 371,000

disabled workers and 196,000 children who are survivors of workers who died.

Before Social Security, almost 50% of American seniors lived in poverty. Today, only 10% of

seniors spend their “golden years” below the poverty line because nearly all American workers

and their families have earned an inflation adjusted retirement benefit each month, for as long

as they live.1

In addition to the benefits that Social Security provides to New York families – it also fuels New

York’s economy. Fully $32.4 billion in individual income flows into New York’s economy from

Social Security each year – about $2.7 billion every month.2

Although President Bush has not yet provided the details of his Social Security reform plan, he

and other administration officials have spoken most positively about Option 2 from the report of

the President’s Commission to Strengthen Social Security.

This “Option II” plan included a proposal to change from “wage indexing” to “price indexing” in

calculating recipient’s initial Social Security retirement benefit. This change would dramatically

reduce Social Security’s guaranteed benefit for all beneficiaries, regardless of whether or not he

or she chooses a private account.3

In addition, those who choose to participate in the private accounts would be subject to a

reduction in their Social Security benefits at retirement by an amount equal to the amount

diverted if it had earned interest at the rate paid on Treasury bonds. The person choosing a

private account comes out with a greater benefit than the worker who did not elect a private

account, only if the rate of return on their account exceeds the Treasury bond rate. If the rate of

return on his/her investment were lower than the Treasury bond rate, the worker would receive

a second cut in benefits.4

Because Social Security is so important to the economic wellbeing of older Americans, these

reductions in benefits could increase senior poverty dramatically or increase significantly the

magnitude of government safety net expenditures. A generation of impoverished seniors would

place unprecedented demands on already stretched federal, state and local budgets –

squeezing out funds for other priorities. This would likely lead to higher state and local taxes to

pay the price of providing seniors with the healthcare, nutrition and housing that they would no

longer be able to afford themselves. If, on the other hand, a Social Security privatization plan

Bush Privatization Plan Could Devastate Institute for America’s Future

New York’s Economy Page 2

Please purchase PDF Split-Merge on www.verypdf.com to remove this watermark.

provides a minimum benefit that would keep low-income workers out of poverty, without

increasing Social Security revenues or taking other steps to ensure the solvency of the fund, it is

very likely that the benefits going to middle-income retirees will be reduced through “price

indexing” or other cutbacks. This would destroy Social Security’s effectiveness as the broad-

based Social Insurance program on which millions of New Yorkers rely.

A $33 Billion to $55 Billion “Hit” on the New York Economy

Social Security now replaces about 42.5 percent of the income a worker earned during a typical

year of his or her work life.5 This income is vital to helping maintain an adequate standard of

living for seniors. In a recent study, economist Christian Weller of the Center for American

Progress finds that if a privatization plan like the Commission to Strengthen Social Security’s

“Option 2” plan had been in place since 1940, the privatized Social Security system would have

done much worse by American workers and their families. 6

Fluctuations in the stock market would have yielded income replacement rates as low as 18

percent for people retiring in 1978 to as high as 39 percent for people retiring in 1999 at the

height of the dot com bubble.

In not a single year would such a privatized system have replaced more of a worker’s earnings

than the current Social Security system. Weller estimates that the national cost of maintaining

the income replacement levels for seniors under the current Social Security system would have

been some $1.1 trillion over the past 30 years.

Looking forward, Weller argues that if a privatization plan like “Option 2” is enacted, either

seniors will have to endure a dramatic reduction in their living standards or federal and state

governments will have to somehow help tomorrow’s seniors to replace the income that would

have come from Social Security. Weller estimates that the present value of the cost of bailing

out Social Security beneficiaries would be some $601 billion nationwide over the Social Security

planning horizon of 75 years. Weller estimates that if the states were to bear 80 percent of

those costs, the states would have to come up with $480 billion. However, given historical data

on stock market performance, Weller estimates there is a 20% chance that the costs of such a

bailout would actually be 67% higher.

Weller argues that one way for a state to prudently plan for such a scenario would be to

establish a state trust fund. He estimates that New York would have to put away at least $32.8

billion immediately to be able to provide retirees with a level of income that replaces the same

amount of their typical working paycheck that Social Security does today and a staggering $54.8

billion in order to be able to pay for the one in five chance that the stock market will perform

somewhat poorly.

At Least 332,000 New York Seniors May be Forced Into Poverty

Social Security is widely acclaimed as the nation’s most effective anti-poverty program. Income

from Social Security keeps more than 800,000 elderly New Yorkers out of poverty. This

reduces the elderly poverty rate in New York from 49.3% to 15.4%. Without Social Security,

over one million elderly New Yorkers would have incomes below the official poverty line. With

Bush Privatization Plan Could Devastate Institute for America’s Future

New York’s Economy Page 3

Please purchase PDF Split-Merge on www.verypdf.com to remove this watermark.

Social Security benefits added to income, the number of elderly poor in New York is reduced to

just over 373,000. When other governmental cash programs are taken into account, the

number of poor elderly New Yorkers falls even further to about 304,000.7

Currently, 1.1 million elderly individuals and couples in New York State rely on Social Security

checks for at least half of their total income. 571,000 of these elderly households depend on

these benefits for almost all – 90 percent or more – of their total income.8 Privatization would

cut benefits for all New York beneficiaries, including those teetering at the edge of poverty.

Today, the typical Social Security check for retirees in New York State is about $977 per

month.9 Data available from the Census Bureau shows that there were 332,000 New Yorkers

over the age of 65 living between 100 percent and 150 percent of the poverty line in 2003.10 If a

privatization plan similar to the Bush Commission’s “Option 2,” but without a minimum benefit,

were fully phased in today, many of these individuals would find themselves with incomes below

the poverty line. 11 If the federal and state governments continued to provide Supplemental

Security Income (SSI) benefits to all these individuals, program outlays for these programs

would soar. On the other hand, if the government reneges on its commitment to provide this

safety net, thousands would be forced to live in poverty.

Privatization Could Create a New Budget Crisis for New York

In aftermath of the Great Depression, the New York State Constitution was amended to require

the State to provide for the aid, care and support of the needy. If the privatization plan pushes

many more New Yorkers into poverty, increasing the number of residents who need to depend

on state programs for survival, it would put considerable new pressures on both state and local

budgets.

One example of a program which could become overburdened in this manner is Medicaid which

provides essential healthcare to the poor, including many elderly poor. In the 2005-2006 state

fiscal year, New York will spend an estimated $46 to $47 billion to provide essential health care

services to poor New Yorkers through Medicaid.12 Though half of this expense is covered by

the federal government, half comes from New York state and local governments. In 2003 -

2004, the state of New York spent more than $14.2 billion on Medicaid while county

governments spent another $6.3 billion.13

A dramatic increase in the number of poor New Yorkers eligible for this program would add a

significant budgetary burden to an already stressed system and impact the ability of state and

local governments to fund other priorities such as roads, nutrition, education and housing.

The Growing Trend of Unfunded Mandates on New York

New York is also suffering from the disturbing trend of unfunded mandates imposed on the

states by the federal government. Since 2002, New York has been confronted with a gap of

$13 billion for programs and services mandated by the federal government, but not adequately

funded by the federal government. This hardship on the states spans the range of government

programs. For example, the Individuals with Disabilities Education Act is under-funded by $2.8

billion, and the No Child Left Behind Act remains under-funded by almost $3 billion. 14

Bush Privatization Plan Could Devastate Institute for America’s Future

New York’s Economy Page 4

Please purchase PDF Split-Merge on www.verypdf.com to remove this watermark.

This problem of “passing the buck” continues to get worse each year. In his 2006 budget, the

president proposes cuts of $6.1 billion from the federally funded portion of total Medicaid costs

for New York over the next 10 years, which would leave the state with the difficult choice of

either denying healthcare to its most vulnerable citizens or adding to the billions it already

spends on the program.15

In addition to Medicaid, the President’s 2006 budget proposes cuts over the next four years in

many program areas. According to the Center on Budget and Policy Priorities analysis of what

these cuts would mean for New York, the president’s budget proposes a $29 million cut to the

Low-Income Home Energy Assistance program, cuts of $44 million to the Women, Infant &

Children Supplemental Nutrition program, and almost $216 million in cuts to Children and

Family Services programs (including Head Start and Services for Abused & Neglected

children).16

Social Security privatization could create a massive new demand for state services by creating

a new generation of poor New York seniors. If, on the other hand, a Social Security

privatization plan provides a minimum benefit that would keep low-income workers out of

poverty, without increasing Social Security revenues or taking other steps to ensure the

solvency of the fund, there will be a tremendous squeeze on the benefits going to middle-

income retirees. Such a development would do great damage to the state’s economy and

destroy Social Security’s effectiveness as the broad-based social insurance program on which

millions of New Yorkers rely.

Christian Weller, PhD., Senior Economist, Center for American Progress, provided technical

assistance for this report. Trudi Renwick and Frank Mauro of the Fiscal Policy Institute

contributed to this report.

ENDNOTES

1

U.S. Census Bureau, Income, Poverty and Health Insurance Status in the United States: 2003 (P60-226), Table 3.

http://www.census.gov/hhes/www/poverty.html

2

Social Security Administration, OASDI Beneficiaries by State and County, 2003. Table 3: Amount of Benefits in

current-payment status, by state or other area, type of benefit, and sex of beneficiaries aged 65 or older, December

2003 (in thousands of dollars); http://www.ssa.gov/policy/docs/statcomps/oasdi_sc/2003/table3.html

3

For estimates of guaranteed benefit cuts due this change in indexing, see Jason Furman, “An Analysis of

Using “Progressive Price Indexing to Set Social Security Benefits, Center for Budget and Policy Priorities,

March 21, 2005.

4

For a description of how private accounts would work, see Jason Furman, “How the Individual Accounts in the

President’s New Plan Would Work,“ Center on Budget and Policy Priorities, February 4,2005. http://www.cbpp.org/2-

3-05socsec2.htm

5

Social Security Administration (2004). Annual Report of the Trustees of the Federal Old-Age,

Survivorship, and Disability Insurance Programs. Washington, DC: SSA.

Bush Privatization Plan Could Devastate Institute for America’s Future

New York’s Economy Page 5

Please purchase PDF Split-Merge on www.verypdf.com to remove this watermark.

6

Center for American Progress, “Social Security Privatization: The Mother of All Unfunded Mandates,” 2005.

7

Fiscal Policy Institute, “Social Security, the Nation’s Most Effective Safety Net Program, Keeps More than 800,000

Elderly New Yorkers out of Poverty”, November, 2004. http://www.fiscalpolicy.org/downloads/SocialSecurity.pdf

8

Economic Policy Institute, “Social Security and the Income of the Elderly,” Issue Brief #206; March 23, 2005.

www.epinet.org.

9

Social Security Online, State Statistics, December 2003;

http://www.ssa.gov/policy/docs/quickfacts/state_stats/index.html

10

U.S. Census Bureau’s Current Population Survey, Annual Demographic Survey, March Supplement;

http://pubdb3.census.gov/macro/032004/pov/new46_135150_06.htm.

11

Author’s analysis based on estimated 50% cut in guaranteed benefits as per the Center on Budget and Policy

Priorities estimates. An income of 150 percent of the poverty line is approximately $13,590 per year. If a 50 percent

cut to the typical guaranteed Social Security benefit were taken from that level of income, individuals would be left

with incomes of approximately $7,700 per year – well below the federal poverty level of $9,060.

12

New York State, 2005-06 Executive Budget, Overview Volume, January 18, 2005, page 147. Note: the State

Legislature has adopted some but not all of the benefit reductions and other cost savings recommended by the

Governor in conjunction with this Executive Budget.

13

New York State Division of the Budget, as cited in “No quick cure for what ails,” Albany Times Union, April

10, 2005, p. 1.

14

Center on Budget and Policy Priorities, “Passing Down the Deficit: Federal Policies Contribute to the Severity of the

State Fiscal Crisis,” August 18, 2004.

15

Families USA, Federal Dollars Cut Over 10 Years Under the President’s Plan, by State,” February 7, 2005.

http://www.familiesusa.org/site/DocServer/BudgetStatementAttachment_1-dollars_cut.pdf?docID=7601

16

Center on Budget and Policy Priorities, "Where Would the Cuts Be Made Under the President's Budget?" February

28, 2005.

Bush Privatization Plan Could Devastate Institute for America’s Future

New York’s Economy Page 6

Please purchase PDF Split-Merge on www.verypdf.com to remove this watermark.

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- How To Sleep BetterDokument9 SeitenHow To Sleep BetterMariaNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Psychiatric Clinical SkillsDokument376 SeitenPsychiatric Clinical SkillsSamuel Agunbiade100% (5)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Adult Psychodiagnostic Chart 2012 1.7 PDFDokument3 SeitenThe Adult Psychodiagnostic Chart 2012 1.7 PDFMF LeblancNoch keine Bewertungen

- 2022 Mart YÖKDİL YÖKDİL - Fen BilimleriDokument17 Seiten2022 Mart YÖKDİL YÖKDİL - Fen BilimleriErdal Bozkurt100% (2)

- Jonathan Glover-Alien LandscapesDokument448 SeitenJonathan Glover-Alien LandscapesIrina Soare100% (1)

- Net Jets Pilot & Benefits PackageDokument4 SeitenNet Jets Pilot & Benefits PackagedtoftenNoch keine Bewertungen

- Capital Region Health Coverage Outreach and Enrollment Summit AgendaDokument4 SeitenCapital Region Health Coverage Outreach and Enrollment Summit AgendaCitizen Action of New YorkNoch keine Bewertungen

- Letter To IDCDokument2 SeitenLetter To IDCCitizen Action of New YorkNoch keine Bewertungen

- Voting & InequalityDokument31 SeitenVoting & InequalityCitizen Action of New York100% (1)

- How Many?: A Numbers Guide For Lame Duck Fence Sitting Anti Fair Share Millionaires Over Middle Class Members of CongressDokument14 SeitenHow Many?: A Numbers Guide For Lame Duck Fence Sitting Anti Fair Share Millionaires Over Middle Class Members of CongressCitizen Action of New YorkNoch keine Bewertungen

- Legal Corruption - CWF On EspadaDokument4 SeitenLegal Corruption - CWF On EspadaJimmyVielkindNoch keine Bewertungen

- A Proud Progressive New York or A Declining Empire State?Dokument4 SeitenA Proud Progressive New York or A Declining Empire State?Citizen Action of New YorkNoch keine Bewertungen

- Organizations Write Majority Leader Skelos & Senate in Support of Public Financing of ElectionsDokument2 SeitenOrganizations Write Majority Leader Skelos & Senate in Support of Public Financing of ElectionsCitizen Action of New YorkNoch keine Bewertungen

- Donovan Again Betrays Ethics and Wall Street ReformsDokument1 SeiteDonovan Again Betrays Ethics and Wall Street ReformsCitizen Action of New YorkNoch keine Bewertungen

- Organizations Write Speaker Silver & Assembly in Support of Public Financing of ElectionsDokument2 SeitenOrganizations Write Speaker Silver & Assembly in Support of Public Financing of ElectionsCitizen Action of New YorkNoch keine Bewertungen

- NYPIRG ReportDokument34 SeitenNYPIRG ReportnreismanNoch keine Bewertungen

- A Smart Gym Framework: Theoretical ApproachDokument6 SeitenA Smart Gym Framework: Theoretical ApproachciccioNoch keine Bewertungen

- Herbicides ToxicityDokument51 SeitenHerbicides ToxicityAdarshBijapurNoch keine Bewertungen

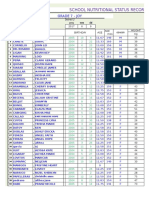

- School Nutritional Status Record: Grade 7 - JoyDokument4 SeitenSchool Nutritional Status Record: Grade 7 - JoySidNoch keine Bewertungen

- Head StartDokument49 SeitenHead StartDavid BernalNoch keine Bewertungen

- Knee Pain and The Internal Arts: Correct Alignment (Standing)Dokument7 SeitenKnee Pain and The Internal Arts: Correct Alignment (Standing)Gabriel PedrozaNoch keine Bewertungen

- Steps To Reduce Drug Abuse 1800 11 0031 National Toll Free Drug de Addiction Helpline NumberDokument4 SeitenSteps To Reduce Drug Abuse 1800 11 0031 National Toll Free Drug de Addiction Helpline NumberimranNoch keine Bewertungen

- Baby Led-WeaningDokument7 SeitenBaby Led-WeaningsophieNoch keine Bewertungen

- Project Proposal: A. Project Tittle: "Operation Cleanliness"Dokument8 SeitenProject Proposal: A. Project Tittle: "Operation Cleanliness"Mike Avila100% (1)

- Starlight ProgramsDokument12 SeitenStarlight Programsllacara@nncogannett.comNoch keine Bewertungen

- Columbia-Presbyterian Patient Safety StudyDokument9 SeitenColumbia-Presbyterian Patient Safety StudyKathleen Beatty100% (1)

- PulseoximetryDokument2 SeitenPulseoximetryRakshith NagarajaiahNoch keine Bewertungen

- Redfern Mianscum LetterDokument6 SeitenRedfern Mianscum LettermediaindigenaNoch keine Bewertungen

- PSC Question BankDokument9 SeitenPSC Question BankFaisal qblp100% (29)

- National Programme For Prevention and Control of FluorosisDokument49 SeitenNational Programme For Prevention and Control of FluorosisveereshNoch keine Bewertungen

- CCL-81 Product Sheet - VeroDokument5 SeitenCCL-81 Product Sheet - VeroKrishnan KrishnanNoch keine Bewertungen

- Recent EMF Papers PDFDokument394 SeitenRecent EMF Papers PDFAndi Kurniawan100% (1)

- Tumor AngiogenesisDokument35 SeitenTumor AngiogenesisDoni Mirza KurniawanNoch keine Bewertungen

- Module 5 Safety and Health at WorkDokument42 SeitenModule 5 Safety and Health at Workdoidoi80% (5)

- Using The Childrens Play Therapy Instrument CPTIDokument12 SeitenUsing The Childrens Play Therapy Instrument CPTIFernando Hilario VillapecellínNoch keine Bewertungen

- Normal GFR in ChildDokument8 SeitenNormal GFR in ChildbobbypambudimdNoch keine Bewertungen

- Nursing Care Plan: Phinma University of PangasinanDokument1 SeiteNursing Care Plan: Phinma University of PangasinanShaira De La CruzNoch keine Bewertungen

- Republic of The Philippines Davao Oriental State College of Science and TechnologyDokument4 SeitenRepublic of The Philippines Davao Oriental State College of Science and Technologydinheadnursing09Noch keine Bewertungen

- Invenia ABUS USA Brochure Feb2016Dokument14 SeitenInvenia ABUS USA Brochure Feb2016Asim AliNoch keine Bewertungen

- Task Exposure AnalysisDokument24 SeitenTask Exposure AnalysisDaren Bundalian RosalesNoch keine Bewertungen