Beruflich Dokumente

Kultur Dokumente

Fall 2013 Optimal Bundle: Issue V

Hochgeladen von

Colennon0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

21 Ansichten2 SeitenThis is the product of the Pennsylvania State University Economics Association, and this issue is the 5th edition of the 2013 Fall semester.

Copyright

© Attribution Non-Commercial (BY-NC)

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenThis is the product of the Pennsylvania State University Economics Association, and this issue is the 5th edition of the 2013 Fall semester.

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

21 Ansichten2 SeitenFall 2013 Optimal Bundle: Issue V

Hochgeladen von

ColennonThis is the product of the Pennsylvania State University Economics Association, and this issue is the 5th edition of the 2013 Fall semester.

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 2

T HE P ENNSYLVANIA S TATE U NIVERSITY E CONOMICS A SSOCIATION P RESENTS :

T HE O PTIMAL B UNDLE

F ALL 2013:

WEEK OF

O CTOBER 3 RD

E DITOR : C OLE LENNON P RINT EDUCATION COORDINATOR C ONTRIBUTORS : B EN R OWLES , C ADY B OUCHER , C OLE L ENNON , L EAH G ALAMBA , R YAN S OSNADER

Upcoming Events: General Body Meeting: 10/03

BLS Jobless Claims Report: 10/03

PennStateEA.Weebly.com EA Homepage psueaeducation.blogspot.com Education Blog

OPERATION: DETROIT RESCUE

Detroit's declaration of bankruptcy on July 18th is now meeting a nationwide response. About 320 million dollars from the federal government will be deployed to reduce crime, revitalize infrastructure, and revamp housing. Nearly half of those funds will go toward demolishing buildings and redeveloping neighborhoods, while the remaining funds will go to projects such as repairing buses and creating public sector jobs. Private businesses, philanthropy groups, and state governments will assist in this effort. It represents a great start, but the city owes 18 billion dollars. More money is needed, as extraordinary problems require extraordinary responses.CL

CHECK OUT THE ARTICLES:

BLOOM.BG/1H7SXCK ; BIT.LY/18VYOK8

Detroit may sleep a little sounder than this tonight.

DEFLATING THE HELIUM MARKET

As of October 7th, the global market for helium could take a dive unless American politicians can come to an agreement. In 1925 a reserve was set up to supply inflation for airships. This reserve remained relevant through development of nuclear weapons, but all of the helium was sold in the mid-1990s in order to help pay off the $1.4 billion debt that the reserve caused. Now that the debt is paid off, federal funding for the reserve will be cut if an agreement is not made. With helium demand growing at 5% per year, will other nations such as Russia and Australia be able to pick up the slack?CB

Up, Up, and Away with Helium Funding?

Check out the Article: econ.st/18sIOYy

C OULD US CREDIT RATING FALL ?

U.S. Treasury Bonds, often considered one of the safest possible investments, could lose credibility in the eyes of ratings agencies due to the recent threat of a government shutdown. Standard & Poors, a rating agency, made headlines in 2011 by lowering the U.S.s rating to AA+ from AAA, the top rating. A further drop is possible due to the recent turmoil involving Congress inability to pass a budget. However, ratings agencies like Standard & Poors lost credibility due to the financial crisis, and their word is not as respected as it once was. For now, U.S. Treasuries are still considered very safe by many economists.RS

Check out the article: cnnmon.ie/19SXDRo

We may be hearing from them soon.

P ROTECT THIS HOUSE

A 2004 report estimated that 850,000 people are on the waiting list for the Section 8 Housing Choice Voucher, which helps low income families pay rent. The waiting list suggests that not enough federal housing expenditures are directed to helping the poor. Section 8, while more efficient than comparable federal housing initiatives, often does not provide enough support for families to move to higher income areas that often bring better jobs and education. A chief goal of Section 8 is to help families make such a move to lower poverty areas, but what effect does that have on the area that they leave? BR

This is a long waiting list.

C HECK

OUT THE ARTICLE : WAPO . ST /17 KW BV O

A N U NEQUAL P IECE OF THE A MERICAN P IE

For the first time in five years the average American's household income has ceased falling and the poverty rate has stopped rising. While these new statistics are encouraging, they are soured by the fact that 95% of these gains have gone to the wealthiest one percent of the population. America has by far the largest wealth inequality and the lowest social mobility of any Western country, and those contrasts seem to be growing more with every generation. Possible reasons for inequality in the US could be inefficiency in business or disparity in early education. Regardless of the cause, if something does not change soon the outcome will not be favorable for anyone.LG

The current piece may not be big enough.

Check out the Article:

econ.st/19iMsCl

Das könnte Ihnen auch gefallen

- Running on Empty: How the Democratic and Republican Parties Are Bankrupting Our Future and What Americans Can Do About ItVon EverandRunning on Empty: How the Democratic and Republican Parties Are Bankrupting Our Future and What Americans Can Do About ItBewertung: 3.5 von 5 Sternen3.5/5 (22)

- How A Debt Ceiling Crisis CouldDokument4 SeitenHow A Debt Ceiling Crisis Couldgangster91Noch keine Bewertungen

- How A Debt Ceiling Crisis Could Do More Harm Than The ShutdownDokument4 SeitenHow A Debt Ceiling Crisis Could Do More Harm Than The Shutdowngangster91Noch keine Bewertungen

- Christian Economics: The Integration of Capitalism, Socialism, and LaborismVon EverandChristian Economics: The Integration of Capitalism, Socialism, and LaborismNoch keine Bewertungen

- A Fiscal Cliff: New Perspectives on the U.S. Federal Debt CrisisVon EverandA Fiscal Cliff: New Perspectives on the U.S. Federal Debt CrisisNoch keine Bewertungen

- Breaking and Entering-How The Collapsing Economy Is Creating A New Crime Wave & What You Can Do About ItDokument24 SeitenBreaking and Entering-How The Collapsing Economy Is Creating A New Crime Wave & What You Can Do About Itjack007xrayNoch keine Bewertungen

- Cas Issue BriefDokument14 SeitenCas Issue Briefapi-284502790Noch keine Bewertungen

- The 2012 Index of Dependence On GovernmentDokument34 SeitenThe 2012 Index of Dependence On Governmentaustintexas1234Noch keine Bewertungen

- Educating Voters for Rebuilding America: National Goals and Balanced BudgetVon EverandEducating Voters for Rebuilding America: National Goals and Balanced BudgetNoch keine Bewertungen

- 6-17-14 US - ECON Total US Debt Soars To Nearly $60 TRN Foreshadows New Recession - RT USADokument7 Seiten6-17-14 US - ECON Total US Debt Soars To Nearly $60 TRN Foreshadows New Recession - RT USAtydeus23Noch keine Bewertungen

- Financial Report of the United States: The Official Annual White House ReportVon EverandFinancial Report of the United States: The Official Annual White House ReportBewertung: 5 von 5 Sternen5/5 (2)

- One Big Difference Between Chinese and American Households - Debt - ForbesDokument2 SeitenOne Big Difference Between Chinese and American Households - Debt - ForbesterencehkyungNoch keine Bewertungen

- Fall 2013 Optimal Bundle: Issue XIDokument2 SeitenFall 2013 Optimal Bundle: Issue XIColennonNoch keine Bewertungen

- The Freedom Agenda: Why a Balanced Budget Amendment is Necessary to Restore Constitutional GovernmentVon EverandThe Freedom Agenda: Why a Balanced Budget Amendment is Necessary to Restore Constitutional GovernmentNoch keine Bewertungen

- Summary: Back to Work: Review and Analysis of Bill Clinton's BookVon EverandSummary: Back to Work: Review and Analysis of Bill Clinton's BookNoch keine Bewertungen

- Story Five - Final DraftDokument7 SeitenStory Five - Final Draftapi-231692888Noch keine Bewertungen

- Habitat For Insanity": Share ThisDokument10 SeitenHabitat For Insanity": Share ThisAnonymous Feglbx5Noch keine Bewertungen

- Decoding US Govt Shutdown-VRK100-27Sep13Dokument4 SeitenDecoding US Govt Shutdown-VRK100-27Sep13RamaKrishna Vadlamudi, CFANoch keine Bewertungen

- America's Ticking Bankruptcy Bomb: How the Looming Debt Crisis Threatens the American Dream—and How We Can Turn the Tide Before It's Too LateVon EverandAmerica's Ticking Bankruptcy Bomb: How the Looming Debt Crisis Threatens the American Dream—and How We Can Turn the Tide Before It's Too LateBewertung: 4.5 von 5 Sternen4.5/5 (1)

- The Political Party That Will Create Jobs: February 26, 2011Dokument20 SeitenThe Political Party That Will Create Jobs: February 26, 2011James BradleyNoch keine Bewertungen

- Volume 1, Issue 13Dokument2 SeitenVolume 1, Issue 13gcuncensoredNoch keine Bewertungen

- Debt Time Bomb! Debt Mountains: The Financial Crisis and its Toxic Legacy for the Next Generation: A Christian PerspectiveVon EverandDebt Time Bomb! Debt Mountains: The Financial Crisis and its Toxic Legacy for the Next Generation: A Christian PerspectiveBewertung: 5 von 5 Sternen5/5 (1)

- Spring 2014 Optimal Bundle: Issue XVDokument2 SeitenSpring 2014 Optimal Bundle: Issue XVColennonNoch keine Bewertungen

- China and the US Foreign Debt Crisis: Does China Own the USA?Von EverandChina and the US Foreign Debt Crisis: Does China Own the USA?Noch keine Bewertungen

- National Debt ThesisDokument6 SeitenNational Debt Thesisbrandygranttallahassee100% (2)

- 2nd Research Draft Peer EditDokument5 Seiten2nd Research Draft Peer Editapi-240312420Noch keine Bewertungen

- Research Paper Final - Fouad SalehDokument13 SeitenResearch Paper Final - Fouad Salehapi-466403567Noch keine Bewertungen

- Politics, Economics and Investments: Don's ThoughtsVon EverandPolitics, Economics and Investments: Don's ThoughtsNoch keine Bewertungen

- The Paradox of Debt: A New Path to Prosperity Without CrisisVon EverandThe Paradox of Debt: A New Path to Prosperity Without CrisisNoch keine Bewertungen

- Gale Researcher Guide for: The Disappearing Middle Class in AmericaVon EverandGale Researcher Guide for: The Disappearing Middle Class in AmericaNoch keine Bewertungen

- American Rescue Plan Six Month ReportDokument8 SeitenAmerican Rescue Plan Six Month ReportJoecippNoch keine Bewertungen

- Spring 2014 Optimal Bundle: Issue XIIIDokument2 SeitenSpring 2014 Optimal Bundle: Issue XIIIColennonNoch keine Bewertungen

- American Profligacy and American PowerDokument6 SeitenAmerican Profligacy and American Powermatrixclown+scribdNoch keine Bewertungen

- Saving The American DreamDokument53 SeitenSaving The American DreamMichael ParrishNoch keine Bewertungen

- American Debt CrisisDokument5 SeitenAmerican Debt CrisisSuraj MotwaniNoch keine Bewertungen

- Into The Abyss: The Cycle of Debt DeflationDokument13 SeitenInto The Abyss: The Cycle of Debt DeflationRon HeraNoch keine Bewertungen

- Time To Borrow: Paul KrugmanDokument3 SeitenTime To Borrow: Paul KrugmanCristian EspinosaNoch keine Bewertungen

- Reinventing Economic and Financial PolicyDokument10 SeitenReinventing Economic and Financial PolicySFLDNoch keine Bewertungen

- False Profits: Recovering from the Bubble EconomyVon EverandFalse Profits: Recovering from the Bubble EconomyBewertung: 3 von 5 Sternen3/5 (2)

- Emily New NewDokument4 SeitenEmily New Newapi-267401938Noch keine Bewertungen

- Spending: A. Uniqueness - Spending Decreasing Now, NASA Budgets Are ConstrainedDokument6 SeitenSpending: A. Uniqueness - Spending Decreasing Now, NASA Budgets Are ConstrainedAble90Noch keine Bewertungen

- September 20, 2010 PostsDokument512 SeitenSeptember 20, 2010 PostsAlbert L. PeiaNoch keine Bewertungen

- Guaranteed to Fail: Fannie Mae, Freddie Mac, and the Debacle of Mortgage FinanceVon EverandGuaranteed to Fail: Fannie Mae, Freddie Mac, and the Debacle of Mortgage FinanceBewertung: 2 von 5 Sternen2/5 (1)

- United States of America: Career Service Country GuidesDokument8 SeitenUnited States of America: Career Service Country GuidesJennifer JonesNoch keine Bewertungen

- The Deficit and the Public Interest: The Search for Responsible Budgeting in the 1980sVon EverandThe Deficit and the Public Interest: The Search for Responsible Budgeting in the 1980sNoch keine Bewertungen

- Plunder and Deceit: by Mark R. Levin | Key Takeaways, Analysis & ReviewVon EverandPlunder and Deceit: by Mark R. Levin | Key Takeaways, Analysis & ReviewNoch keine Bewertungen

- DC Cuts: How the Federal Budget Went from a Surplus to a Trillion Dollar Deficit in 10 YearsVon EverandDC Cuts: How the Federal Budget Went from a Surplus to a Trillion Dollar Deficit in 10 YearsNoch keine Bewertungen

- Spring 2014 Optimal Bundle: Issue XIDokument2 SeitenSpring 2014 Optimal Bundle: Issue XIColennonNoch keine Bewertungen

- Spring 2014 Optimal Bundle: Issue XVDokument2 SeitenSpring 2014 Optimal Bundle: Issue XVColennonNoch keine Bewertungen

- Spring 2014 Optimal Bundle: Issue XIIDokument2 SeitenSpring 2014 Optimal Bundle: Issue XIIColennonNoch keine Bewertungen

- Spring 2014 Optimal Bundle: Issue XIIIDokument2 SeitenSpring 2014 Optimal Bundle: Issue XIIIColennonNoch keine Bewertungen

- How Penn State Students Are Constrained by Student DebtDokument15 SeitenHow Penn State Students Are Constrained by Student DebtColennonNoch keine Bewertungen

- Spring 2014 Optimal Bundle: Issue XIVDokument2 SeitenSpring 2014 Optimal Bundle: Issue XIVColennonNoch keine Bewertungen

- Spring 2014 Optimal Bundle: Issue XIDokument2 SeitenSpring 2014 Optimal Bundle: Issue XIColennonNoch keine Bewertungen

- Spring 2014 Optimal Bundle: Issue XDokument2 SeitenSpring 2014 Optimal Bundle: Issue XColennonNoch keine Bewertungen

- Spring 2014 Optimal Bundle: Issue VDokument2 SeitenSpring 2014 Optimal Bundle: Issue VColennonNoch keine Bewertungen

- Spring 2014 Optimal Bundle: Issue IXDokument2 SeitenSpring 2014 Optimal Bundle: Issue IXColennonNoch keine Bewertungen

- Spring 2014 Optimal Bundle: Issue VIIIDokument2 SeitenSpring 2014 Optimal Bundle: Issue VIIIColennonNoch keine Bewertungen

- Spring 2014 Optimal Bundle: Issue VIDokument2 SeitenSpring 2014 Optimal Bundle: Issue VIColennonNoch keine Bewertungen

- Spring 2014 Optimal Bundle: Issue IVDokument2 SeitenSpring 2014 Optimal Bundle: Issue IVColennonNoch keine Bewertungen

- Spring 2014 Optimal Bundle: Issue VIIDokument2 SeitenSpring 2014 Optimal Bundle: Issue VIIColennonNoch keine Bewertungen

- Spring 2014 Optimal Bundle: Issue IIIDokument2 SeitenSpring 2014 Optimal Bundle: Issue IIIColennonNoch keine Bewertungen

- Spring 2014 Optimal Bundle: Issue IIDokument2 SeitenSpring 2014 Optimal Bundle: Issue IIColennonNoch keine Bewertungen

- Fall 2013 Optimal Bundle: Issue IXDokument2 SeitenFall 2013 Optimal Bundle: Issue IXColennonNoch keine Bewertungen

- Fall 2013 Optimal Bundle: Issue XIVDokument2 SeitenFall 2013 Optimal Bundle: Issue XIVColennonNoch keine Bewertungen

- Fall 2013 Optimal Bundle: Issue XIDokument2 SeitenFall 2013 Optimal Bundle: Issue XIColennonNoch keine Bewertungen

- Spring 2014 Optimal Bundle: Issue IDokument2 SeitenSpring 2014 Optimal Bundle: Issue IColennonNoch keine Bewertungen

- Fall 2013 Optimal Bundle: Issue XIIDokument2 SeitenFall 2013 Optimal Bundle: Issue XIIColennonNoch keine Bewertungen

- Fall 2013 Optimal Bundle: Issue XIIIDokument2 SeitenFall 2013 Optimal Bundle: Issue XIIIColennonNoch keine Bewertungen

- Fall 2013 Optimal Bundle: Issue XDokument2 SeitenFall 2013 Optimal Bundle: Issue XColennonNoch keine Bewertungen

- Fall 2013 Optimal Bundle: Issue IIDokument2 SeitenFall 2013 Optimal Bundle: Issue IIColennonNoch keine Bewertungen

- Fall 2013 Optimal Bundle: Issue VIIIDokument2 SeitenFall 2013 Optimal Bundle: Issue VIIIColennonNoch keine Bewertungen

- Fall 2013 Optimal Bundle: Issue VIIDokument2 SeitenFall 2013 Optimal Bundle: Issue VIIColennonNoch keine Bewertungen

- Fall 2013 Optimal Bundle: Issue VIDokument2 SeitenFall 2013 Optimal Bundle: Issue VIColennonNoch keine Bewertungen

- Fall 2013 Optimal Bundle: Issue IIIDokument2 SeitenFall 2013 Optimal Bundle: Issue IIIColennonNoch keine Bewertungen

- Fall 2013 Optimal Bundle: Issue IVDokument2 SeitenFall 2013 Optimal Bundle: Issue IVColennonNoch keine Bewertungen

- NumaConcert ManualDokument96 SeitenNumaConcert ManualPippo GuarneraNoch keine Bewertungen

- Hospital Management System DatabaseDokument18 SeitenHospital Management System DatabasesamdhathriNoch keine Bewertungen

- Southport Minerals CombinedDokument20 SeitenSouthport Minerals CombinedEshesh GuptaNoch keine Bewertungen

- TreeSize Professional - Folder Contents of - CDokument1 SeiteTreeSize Professional - Folder Contents of - CHenrique GilNoch keine Bewertungen

- AW-NB037H-SPEC - Pegatron Lucid V1.3 - BT3.0+HS Control Pin Separated - PIN5 - Pin20Dokument8 SeitenAW-NB037H-SPEC - Pegatron Lucid V1.3 - BT3.0+HS Control Pin Separated - PIN5 - Pin20eldi_yeNoch keine Bewertungen

- Instructions For The Safe Use Of: Web LashingsDokument2 SeitenInstructions For The Safe Use Of: Web LashingsVij Vaibhav VermaNoch keine Bewertungen

- SMPLEDokument2 SeitenSMPLEKla AlvarezNoch keine Bewertungen

- Siemens C321 Smart LockDokument2 SeitenSiemens C321 Smart LockBapharosNoch keine Bewertungen

- Web Server ProjectDokument16 SeitenWeb Server Projectمعتز العجيليNoch keine Bewertungen

- History of Phosphoric Acid Technology (Evolution and Future Perspectives)Dokument7 SeitenHistory of Phosphoric Acid Technology (Evolution and Future Perspectives)Fajar Zona67% (3)

- University of Nottingham Department of Architecture and Built EnvironmentDokument43 SeitenUniversity of Nottingham Department of Architecture and Built EnvironmentDaniahNoch keine Bewertungen

- 1100D Fuel System Installation Guide PDFDokument18 Seiten1100D Fuel System Installation Guide PDFjAVIER GARCIA MORIANANoch keine Bewertungen

- 1634 - Gondola Head Super - Structure and Side Wall - ENDokument8 Seiten1634 - Gondola Head Super - Structure and Side Wall - ENmohammadNoch keine Bewertungen

- Induction-Llgd 2022Dokument11 SeitenInduction-Llgd 2022Phạm Trúc QuỳnhNoch keine Bewertungen

- WS-250 4BB 60 Cells 40mm DatasheetDokument2 SeitenWS-250 4BB 60 Cells 40mm DatasheetTejash NaikNoch keine Bewertungen

- PT Shri Krishna Sejahtera: Jalan Pintu Air Raya No. 56H, Pasar Baru Jakarta Pusat 10710 Jakarta - IndonesiaDokument16 SeitenPT Shri Krishna Sejahtera: Jalan Pintu Air Raya No. 56H, Pasar Baru Jakarta Pusat 10710 Jakarta - IndonesiaihsanlaidiNoch keine Bewertungen

- God Save The Queen Score PDFDokument3 SeitenGod Save The Queen Score PDFDarion0% (2)

- Lab 1Dokument8 SeitenLab 1Нурболат ТаласбайNoch keine Bewertungen

- Grant Miller Resume-ColliersDokument3 SeitenGrant Miller Resume-ColliersDeven GriffinNoch keine Bewertungen

- Prestressed ConcreteDokument9 SeitenPrestressed ConcreteDiploma - CE Dept.Noch keine Bewertungen

- Stress and Strain - Axial LoadingDokument18 SeitenStress and Strain - Axial LoadingClackfuik12Noch keine Bewertungen

- Order To Cash Cycle Group 1Dokument4 SeitenOrder To Cash Cycle Group 1AswinAniNoch keine Bewertungen

- Multiage Education in Small School SettingsDokument19 SeitenMultiage Education in Small School SettingsMichelle Ronksley-PaviaNoch keine Bewertungen

- Lecture 3 - Marriage and Marriage PaymentsDokument11 SeitenLecture 3 - Marriage and Marriage PaymentsGrace MguniNoch keine Bewertungen

- (Rajagopal) Brand Management Strategy, Measuremen (BookFi) PDFDokument317 Seiten(Rajagopal) Brand Management Strategy, Measuremen (BookFi) PDFSneha SinghNoch keine Bewertungen

- ANNEX C LIST OF EXCEPTIONS (Non-Disslosure of Information)Dokument3 SeitenANNEX C LIST OF EXCEPTIONS (Non-Disslosure of Information)ryujinxxcastorNoch keine Bewertungen

- LS Series Hand Crimping ToolsDokument4 SeitenLS Series Hand Crimping ToolsbaolifengNoch keine Bewertungen

- Mobile Fire Extinguishers. Characteristics, Performance and Test MethodsDokument28 SeitenMobile Fire Extinguishers. Characteristics, Performance and Test MethodsSawita LertsupochavanichNoch keine Bewertungen

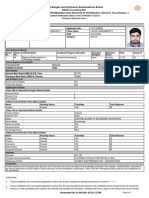

- West Bengal Joint Entrance Examinations Board: Provisional Admission LetterDokument2 SeitenWest Bengal Joint Entrance Examinations Board: Provisional Admission Lettertapas chakrabortyNoch keine Bewertungen

- CRITERIA-GuideRail & Median BarriersDokument15 SeitenCRITERIA-GuideRail & Median BarriersMartbenNoch keine Bewertungen