Beruflich Dokumente

Kultur Dokumente

Ifrs Illustrative Financial Statements Investment Funds Dec2011 8628

Hochgeladen von

xuhaibimCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Ifrs Illustrative Financial Statements Investment Funds Dec2011 8628

Hochgeladen von

xuhaibimCopyright:

Verfügbare Formate

IFRS

Illustrative nancial

statements:

Investment funds

December 2011

kpmg.com/ifrs

Contents

Financial statements

Statement of nancial position 3

Statement of comprehensive income 5

Statement of changes in net assets

attributable to holders of redeemable shares 7

Statement of cash ows 9

Notes to the nancial statements 11

Appendices

I Example disclosures for entities that early adopt

IFRS 9 Financial Instruments (October 2010) 79

II Example disclosures of segment reporting multiple

segment fund 91

III Example disclosures of open-ended fund with puttable

instruments classied as equity 99

IV Example disclosures of schedule of investments

unaudited 109

V Example disclosures of exposure to market risk

Value-at-Risk analysis 113

Technical guide 116

Contact us 118

2011 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.

Whats new?

Major changes from the December 2010 edition of Illustrative nancial statements: Investment funds are highlighted by a

double line border running down the left margin of the text within this document. The major change from the December 2010

edition is example disclosures for the early adoption of IFRS 9 Financial instruments issued in October 2010.

About this publication

These illustrative nancial statements have been produced by the KPMG International Standards Group (part of KPMG IFRG

Limited), and the views expressed herein are those of the KPMG International Standards Group.

Content

The purpose of this publication is to assist you in preparing annual nancial statements of an investment fund in accordance

with IFRSs. It illustrates one possible format of nancial statements for fund-specic entities based on a ctitious tax-exempt

open-ended single-fund investment company, which does not form part of a consolidated entity nor holds investments in

any subsidiaries, associates or joint venture entities. The companys redeemable shares are classied as nancial liabilities

and the management shares meet the denition of equity; the company is outside the scope of IFRS 8 Operating Segments.

The company is not a rst-time adopter of IFRSs (see Technical guide). Appendix I illustrates example disclosures for the

early adoption of IFRS 9. Appendix II provides an example of disclosures for a fund within the scope of IFRS 8 with multiple

reportable segments. Appendix III provides an example of disclosures for a fund whose puttable instruments are classied as

equity.

This publication reects IFRSs in issue at 20 December 2011 that are required to be applied by an entity with an annual period

beginning on 1 January 2011 (currently effective requirements). IFRSs that are effective for annual periods beginning after

1January 2011 (forthcoming requirements) have not been adopted early in preparing these illustrative nancial statements.

However, example disclosures for the early adoption of IFRS 9 are included in Appendix I. This publication focuses on disclosure

requirements that are specic to funds activities. For other disclosures that might be relevant, please refer to our publications

Illustrative nancial statements and Illustrative nancial statements: Banks.

This publication illustrates only the nancial statements component of a nancial report. However, typically a nancial report

will include at least some additional commentary by management, either in accordance with local laws and regulations or at the

election of the fund (see Technical guide).

When preparing nancial statements in accordance with IFRSs, a fund should have regard to its local legal and regulatory

requirements. This publication does not consider any requirements of a particular jurisdiction.

In response to the Financial Stability Board report Enhancing Market and Institutional Resilience the IASB established an Expert

Advisory Panel (the panel) to assist the IASB in reviewing best practices in the area of valuation techniques and formulating any

necessary additional guidance on valuation methods for nancial instruments and related disclosures when markets are no

longer active. The panel issued its nal report Measuring and disclosing the fair value of nancial instruments in markets that are

no longer active on 31 October 2008. Part 2 of the report contains guidance on disclosures. This publication does not illustrate

these disclosures, unless they are also required by IFRS 7. For an illustrative example of disclosures in the panels report and

explanatory notes see our publication Illustrative nancial statements: Banks published in July 2011.

IFRSs and their interpretation change over time. Accordingly, these illustrative nancial statements should not be used as a

substitute for referring to the standards and interpretations themselves.

References

The illustrative nancial statements are contained on the odd-numbered pages of this publication. The even-numbered pages

contain explanatory comments and notes on the disclosure requirements of IFRSs. The illustrative examples, together with the

explanatory notes, however, are not intended to be seen as a complete and exhaustive summary of all disclosure requirements

that are applicable under IFRSs. For an overview of all disclosure requirements that are applicable under IFRSs, see our

publication Disclosure checklist.

To the left of each item disclosed, a reference to the relevant currently effective standard is provided; generally the references

relate only to disclosure requirements, except that note 3 highlights some accounting requirements in relation to signicant

accounting policies. These illustrative nancial statements also contain references to our publication Insights into IFRS

(8thEdition).

2 | Illustrative nancial statements: Investment funds

2011 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.

Explanatory note

1. IAS 1.55, 58 Additional line items, headings and subtotals are presented separately in the statement of nancial

position when such presentation is relevant to an understanding of the entitys nancial position. The

judgement used is based on an assessment of the nature and liquidity of the assets, the function of

assets within the entity, as well as the amounts, nature and timing of liabilities. Additional line items

may include, e.g. prepayments.

IAS 1.57 IAS 1 does not prescribe the order or format in which an entity presents items. Additional line

items are included when the size, nature or function of an item or aggregation of similar items is

such that separate presentation is relevant to an understanding of the entitys nancial position and

the descriptions used, and the ordering of items or aggregation of similar items may be amended

according to the nature of the entity and its transactions to provide information that is relevant to an

understanding of an entitys nancial position.

2. IAS 1.60, 61 In these illustrative nancial statements we have presented assets and liabilities broadly in order of

liquidity. An entity also may present its assets and liabilities using a current/non-current classication

if such presentation provides reliable and more relevant information. For each asset and liability line

item that combines amounts expected to be recovered or settled within (1) no more than 12 months

after the end of the reporting period, and (2) more than 12 months after the end of the reporting

period, an entity discloses in the notes the amount expected to be recovered or settled after more

than 12 months.

3. IFRS 7.8 The carrying amounts of each of the categories of nancial assets and nancial liabilities are required

to be disclosed in either the statement of nancial position or the notes. In these illustrative nancial

statements this information is presented in the notes.

4. It has been assumed for the purpose of these illustrative nancial statements that management

shares issued by the Fund meet the denition of equity. Determination of whether an instrument

meets the denition of equity can be complex and is further discussed in our publication Insights into

IFRS (7.3.50 310).

5. IAS 32 IE32 In these illustrative nancial statements presentation of the statement of nancial position follows

the Example 7 in IAS 32.

6. IAS 39.48A,

AG72

In accordance with IAS 39 the best measure of fair value of a nancial asset and nancial liability

is a quoted price in an active market. The quoted price for an asset held is usually the current bid

price and for a liability held is the asking price. On the other hand, in accordance with the Funds

prospectus, the redemption amounts of the redeemable shares are calculated using the mid-market

prices of the Funds underlying investments/securities sold short.

Owing to the differences in the measurement bases of the Funds underlying investments/

securities sold short and the redemption amounts of the redeemable shares, a mismatch results

in the statement of nancial position giving rise to a presentation issue. In our view, one solution

may be to present the net assets attributable to holders of redeemable shares in a two-line format.

The rst line would be the amount of the net assets attributable to holders of redeemable shares

measured in accordance with the prospectus, which reects the actual redemption amount at

which the redeemable shares would be redeemed at the reporting date, and the next line would

include an adjustment for the difference between this and the amount recognised in the statement

of nancial position. This reects the fact that for a fund with no equity all recognised income and

expense is attributed to holders of redeemable shares, which also means that if all the shares are

redeemed, then a dilution levy of such amount would be required. This issue is discussed in our

publication Insights into IFRS (7.6.220.60 75). The treatment in a fund with no equity is applied in

these illustrative nancial statements to a fund with minimal equity as equity holders are entitled to a

minimal xed monetary amount on liquidation and the remaining net assets are attributed to holders

of redeemable shares.

Illustrative nancial statements: Investment funds | 3

2011 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.

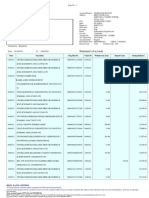

Statement of nancial position

1, 2, 3, 4, 5

IAS 1.10(a), 113 31 December 31 December

In thousands of euro Note 2011 2010

Assets

IAS 1.54(i) Cash and cash equivalents 51 71

IAS 1.54(d) Balances due from brokers 10 4,619 3,121

IAS 1.54(d) Receivables from reverse repurchase agreements 11 4,744 3,990

IAS 1.54(h) Other receivables 29 46

IAS 1.54(d) Non-pledged nancial assets at fair value through prot or loss 12 26,931 24,471

IAS 1.54(d), 39.37(a) Pledged nancial assets at fair value through prot or loss 12 2,691 2,346

Total assets 39,065 34,045

Equity

5

Share capital 13 10 10

Total equity 10 10

Liabilities

IAS 1.54(m) Balances due to brokers 10 143 275

IAS 1.54(m) Payables under repurchase agreements 11 2,563 2,234

IAS 1.54(k) Other payables 103 101

IAS 1.54(m) Financial liabilities at fair value through prot or loss 12 3,621 1,446

Total liabilities (excluding net assets attributable to

holders of redeemable shares) 6,430 4,056

IAS 1.6, 54(m), Net assets attributable to holders of redeemable

32.IE32 shares

6

14 32,625 29,979

Represented by:

Net assets attributable to holders of redeemable shares

(valued in accordance with prospectus)

6

32,647 29,996

Adjustment from mid-market prices to bid/ask-market prices

6

14 (22) (17)

32,625 29,979

The notes on pages 11 to 77 are an integral part of these nancial statements.

4 | Illustrative nancial statements: Investment funds

2011 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.

Explanatory note

1. IAS 1.81 Total comprehensive income is the changes in equity during a period other than those changes

resulting from transactions with owners in their capacity as owners, which is presented either in:

one statement, i.e. a statement of comprehensive income; or

two statements, i.e. a separate income statement and a statement beginning with prot or loss and

displaying components of other comprehensive income.

IAS 1.81(a) This illustration is based on a single statement of comprehensive income as the Fund has no other

components of other comprehensive income other than prot or loss for the period. For an example

of the two statements approach, please refer to our publication Illustrative nancial statements.

IAS 32.IE32 In these illustrative nancial statements presentation of the statement of comprehensive income

follows the Example 7 in IAS 32.

IFRS 7.20 Items of income and expense are offset only when required or permitted by an IFRS. IFRS 7 allows

the net presentation of certain gains and losses on nancial assets and nancial liabilities. This issue

is discussed in our publication Insights into IFRS (4.1.170).

IAS 1.85 An entity presents additional line items, headings and subtotals when this is relevant to an

understanding of its nancial performance.

2. IAS 1.99 An entity presents an analysis of expenses based on function or nature. Items are classied in

accordance with their nature or function regardless of materiality. In these illustrative nancial

statements, this analysis is based on the nature of expenses.

IAS 1.87 No items of income or expense may be presented as extraordinary. The nature and amounts of

material items are disclosed as a separate line item in the statement of comprehensive income or in

the notes. This issue is discussed in our publication Insights into IFRS (4.1.84 86).

3. IAS 1.82(a) IFRSs do not specify whether revenue should be presented only as a single line item in the

statement of comprehensive income, or whether an entity also may include the individual

components of revenue in the statement of comprehensive income, with a subtotal for revenue

from continuing operations. In these illustrative nancial statements, the most relevant measure

of revenue is considered to be the sum of interest income, dividend income, net foreign exchange

loss and net gain from nancial instruments at fair value through prot or loss. However, other

presentations are possible.

4. IFRS 7.20(c)(ii) Fee income and expense arising from trust and other duciary activities that result in the holding or

investing of assets on behalf of individuals, trusts, retirement benet plans and other institutions are

required to be disclosed. In these illustrative nancial statements this disclosure has been given in

the statement of comprehensive income. Alternatively, it may be given in the notes.

5. IAS 32.35, 40 Interest, dividends, gains and losses relating to a nancial instrument or a component that is a

nancial liability are recognised as income or expense in prot or loss. Because redeemable shares

are classied as nancial liabilities, any distributions on these shares are presented as nance costs.

Interest expense and dividends payable on securities sold short have been classied as operating

expense, but, depending on the facts and circumstances, presentation as part of nance cost is also

possible.

6. IAS 12.2 In our view, withholding taxes attributable to investment income (e.g. dividends received) should be

recognised as part of tax expense, with the investment income recognised on a gross basis. This

issue is discussed in our publication Insights into IFRS (3.13.420.30).

7. IAS 33.2, 3 An entity with publicly traded ordinary shares or in the process of issuing ordinary shares that are

to be publicly traded, should present basic and diluted earnings per share (EPS) in the statement

of comprehensive income. The requirements to present EPS only apply to those funds whose

ordinary shares are classied as equity. Nevertheless, some funds may wish to or may be required

by local regulations to present EPS. When an entity voluntarily presents EPS data, that data should

be calculated and presented in accordance with IAS 33. This issue is discussed in our publication

Insights into IFRS (5.3.370).

Illustrative nancial statements: Investment funds | 5

2011 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.

Statement of comprehensive income

1, 2

IAS 1.10(b), 81(a) For the year ended 31 December

In thousands of euro Note 2011 2010

Interest income

3

7 603 429

IAS 18.35(b)(v) Dividend income

3

272 229

IAS 1.35 Net foreign exchange loss

3

(19) (16)

IFRS 7.20(a) Net gain from nancial instruments at fair value through

prot or loss

3

8 3,251 2,397

IAS 1.82(a) Total revenue

3

4,107 3,039

IAS 1.99 Investment management fees

4

(478) (447)

IAS 1.99 Custodian fees

4

(102) (115)

IAS 1.99 Administration fees

4

(66) (62)

IAS 1.99 Directors fees (26) (15)

IAS 1.99 Transaction costs (54) (73)

IAS 1.99 Audit and legal fees (74) (67)

IFRS 7.20(b) Interest expense

5

(75) (62)

Dividend expense on securities sold short

5

(45) (19)

IAS 1.99 Other operating expenses (8) (41)

Total operating expenses (928) (901)

IAS 1.85 Operating prot before nance costs 3,179 2,138

IAS 32.40 Dividends to holders of redeemable shares

5

14 (178) (91)

IAS 1.82(b) Total nance costs (178) (91)

IAS 1.85 Increase in net assets attributable to holders of redeemable

shares before tax 3,001 2,047

IAS 1.82(d) Withholding tax expense

6

9 (45) (39)

IAS 1.6, 1.82(f), Increase in net assets attributable to holders of

32.IE32 redeemable shares 2,956 2,008

The notes on pages 11 to 77 are an integral part of these nancial statements.

6 | Illustrative nancial statements: Investment funds

2011 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.

Explanatory note

1. IAS 1.106 A complete set of nancial statements comprises, as one of its statements, a statement of

changes in equity. However, as equity in the Fund is minimal and there were no changes in equity

balances, no statement of changes in equity is presented. Instead, a statement of changes in net

assets attributable to holders of redeemable shares is presented. Although IFRSs do not require

presentation of this statement, it may provide users of the nancial statements with relevant and

useful information with respect to the components underlying the movements in the net assets of

the Fund attributable to the holders of redeemable shares during the year.

2. IAS 1.110 When a change in accounting policy, either voluntarily or as a result of the initial application of a

standard, has an effect on the current period or any prior period, an entity presents the effects of

retrospective application or retrospective restatement recognised in accordance with IAS 8 in the

statement of changes in equity. These illustrative nancial statements do not demonstrate example

of IAS 8 disclosures; for an example of such disclosures, please refer to our publication Illustrative

nancial statements.

Illustrative nancial statements: Investment funds | 7

2011 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.

Statement of changes in net assets attributable to holders of

redeemableshares

1

IAS 1.106 For the year ended 31 December

In thousands of euro Note 2011 2010

Balance at 1 January 14 29,979 18,461

Increase in net assets attributable to holders of redeemable

shares 2,956 2,008

Contributions and redemptions by holders of redeemable

shares:

Issue of redeemable shares during the year 6,668 15,505

Redemption of redeemable shares during the year (6,978) (5,995)

Total contributions and redemptions by holders of

redeemable shares (310) 9,510

Balance at 31 December 14 32,625 29,979

The notes on pages 11 to 77 are an integral part of these nancial statements.

8 | Illustrative nancial statements: Investment funds

2011 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.

Explanatory note

1. IAS 7.18, 19 In these illustrative nancial statements cash ows from operating activities are presented using the

direct method, whereby major classes of cash receipts and payments related to operating activities

are disclosed. An entity also may present operating cash ows using the indirect method, whereby

prot or loss is adjusted for the effects of non-cash transactions, accruals and deferrals, and items

of income or expense associated with investing or nancing cash ows. For an example statement

of cash ows presenting operating cash ows using the indirect method see our publications

Illustrative nancial statements or Illustrative nancial statements: Banks.

IAS 7.43 When applicable, an entity discloses investing and nancing transactions that are excluded from the

statement of cash ows because they do not require the use of cash or cash equivalents in a way

that provides all relevant information about these activities.

2. IAS 7.33, 34 Interest paid and interest and dividends received are usually classied as operating cash ows for

a nancial institution. Dividends paid may be classied as a nancing cash ow as they represent

a cost of obtaining nancial resources. The Fund has adopted this classication for dividends paid

to the holders of redeemable shares. In these illustrative nancial statements dividends paid on

securities sold short are classied as operating cash ows as they result directly from holding short

positions as part of the operating activities of the Fund.

3. IAS 7.14(g), 15 In these illustrative nancial statements gross receipts from the sale of, and gross payments to

acquire, investment securities have been classied as components of cash ows from operating

activities as they form part of the Funds dealing operations.

IAS 7.16(g), (h) Receipts from and payments for futures, forwards, options and swap contracts are presented as

part of either investing or nancing activities, provided that they are not held for dealing or trading

purposes, in which case they are presented as part of operating activities. However, when a hedging

instrument is accounted for as a hedge of an identiable position, the cash ows of the hedging

instrument are classied in the same manner as the cash ows of the positions being hedged. This

issue is discussed in our publication Insights into IFRS (2.3.60.10).

If hedge accounting is not applied to a derivative instrument that is entered into as an economic

hedge, then in our view derivative gains and losses may be shown in the statement of

comprehensive income as either operating or nancing items depending on the nature of the item

being economically hedged. In our view, the possibilities for the presentation in the statement of

comprehensive income also apply to the presentation in the statement of cash ows. This issue is

discussed in our publication Insights into IFRS (7.8.220 225).

4. IAS 7.22 Cash ows from operating, investing or nancing activities may be reported on a net basis if the

cash receipts and payments are on behalf of customers and the cash ows reect the activities of

the customer, or when the cash receipts and payments for items concerned turn over quickly, the

amounts are large and the maturities are short.

Illustrative nancial statements: Investment funds | 9

2011 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.

Statement of cash ows

1

IAS 1.10(d), 113 For the year ended 31 December

In thousands of euro Note 2011 2010

IAS 7.10 Cash ows from operating activities

IAS 7.31, 33 Interest received

2

619 454

IAS 7.31, 33 Interest paid

2

(73) (63)

IAS 7.31, 33 Dividends received

2

227 228

IAS 7.31, 33 Dividends paid on securities sold short

2

(45) (19)

IAS 7.15 Proceeds from sale of investments

3

9,382 8,271

IAS 7.15 Purchase of investments

3

(10,613) (17,713)

IAS 7.15 Acquisition of investments

3

(10,613) (17,713)

IAS 7.22(b) Net non-dividend receipts/(payments) on securities sold short

4

629 (2)

IAS 7.22(b) Net receipts/(payments) from derivative activities

4

1,581 (3)

IAS 7.22(b) Net non-interest (payments)/receipts from repurchase

and reverse repurchase agreements

4

(428) 299

IAS 7.14 Operating expenses paid (808) (848)

Net cash from/(used in) operating activities 471 (9,396)

IAS 7.10, 21 Cash ows from nancing activities

IAS 7.17 Proceeds from issue of redeemable shares 14 6,668 15,505

IAS 7.17 Payments on redemption of redeemable shares 14 (6,978) (5,995)

IAS 7.34 Dividends paid to holders of redeemable shares

2

14 (178) (91)

Net cash (used in)/from nancing activities (488) 9,419

Net (decrease)/increase in cash and cash equivalents (17) 23

Cash and cash equivalents at 1 January 71 50

IAS 7.28 Effect of exchange rate uctuations on cash and cash equivalents (3) (2)

Cash and cash equivalents at 31 December 51 71

The notes on pages 11 to 77 are an integral part of these nancial statements.

10 | Illustrative nancial statements: Investment funds

2011 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.

Explanatory note

1. IAS 1.7 The notes include narrative descriptions or break-downs of amounts disclosed in the primary

statements. They also include information about items that do not qualify for recognition in the

nancial statements.

Illustrative nancial statements: Investment funds | 11

2011 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.

Notes to the nancial statements

1

Page

1. Reporting entity 13

2. Basis of preparation 13

3. Signicant accounting policies 15

4. Financial risk management 27

5. Use of estimates and judgements 55

6. Classications and fair values of nancial assets and liabilities 63

7. Interest income 65

8. Net gain from nancial instruments at fair value through prot or loss 65

9. Withholding tax expense 65

10. Balances due from/to brokers 67

11. Receivables from reverse repurchase agreements and payables

under repurchase agreements 67

12. Financial assets and nancial liabilities at fair value through prot or loss 69

13. Equity 69

14. Net assets attributable to holders of redeemable shares 71

15. Related parties and other key contracts 75

16. Subsequent events 77

12 | Illustrative nancial statements: Investment funds

2011 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.

Explanatory note

1. If nancial statements are prepared on the basis of national accounting standards that are modied

or adapted from IFRSs and are made publicly available by publicly traded companies, then the

International Organization of Securities Commissions (IOSCO) has recommended including the

following minimum disclosures:

a clear and unambiguous statement of the reporting framework on which the accounting policies

are based;

a clear statement of the entitys accounting policies on all material accounting areas;

an explanation of where the respective accounting standards can be found;

a statement explaining that the nancial statements are in compliance with IFRSs as issued by the

IASB, if this is the case; and

a statement explaining in what regard the standards and the reporting framework used differ from

IFRSs as issued by the IASB, if this is the case.

2. IAS 1.36 When the entity changes the end of its reporting period and annual nancial statements are

presented for a period longer or shorter than one year, it discloses the reason for the change and the

fact that comparative amounts presented are not entirely comparable.

In this and other cases an entity may wish to present pro forma information that is not required by

IFRSs, e.g. pro forma comparative nancial statements prepared as if the change in the end of the

reporting period were effective for all periods presented. The presentation of pro forma information is

discussed in our publication Insights into IFRS (2.1.80).

3. IAS 1.19, 20, 23 In the extremely rare circumstances in which management concludes that compliance with a

requirement of a standard or an interpretation would be so misleading that it would conict with the

objective of nancial statements set out in the Conceptual Framework for Financial Reporting, an

entity may depart from the requirement if the relevant regulatory framework requires or otherwise

does not prohibit such a departure. Extensive disclosures are required in these circumstances.

4. IAS 10.17 An entity discloses the date when the nancial statements were authorised for issue and who gave

that authorisation. If the entitys owners or others have the power to amend the nancial statements

after their issue, then the entity discloses that fact.

5. IAS 1.25, 10.16 Taking account of specic requirements in its jurisdiction, an entity discloses any material

uncertainties related to events or conditions that may cast signicant doubt upon the entitys ability

to continue as a going concern, whether they arise during the period or after the end of the reporting

period.

6. IAS 21.53, 54 If the nancial statements are presented in a currency different from the entitys functional currency,

then the entity discloses that fact, its functional currency, and the reason for using a different

presentation currency. If there is a change in the functional currency, then the entity discloses that

fact together with the reason for the change.

7. IAS 1.122124 An entity discloses the judgements, apart from those involving estimations, that management has

made in the process of applying the entitys accounting policies and that have the most signicant

effect on the amounts recognised in the nancial statements. The examples that are provided in

IAS1 indicate that such disclosure is based on qualitative data.

IAS 1.125, 129 An entity discloses the assumptions that it has made about the future, and other major sources

of estimation uncertainty at the reporting date, that have a signicant risk of resulting in a material

adjustment to the carrying amounts of assets and liabilities within the next nancial year. The

examples that are provided in IAS 1 indicate that such disclosure is based on quantitative data, e.g.

appropriate discount rates.

Illustrative nancial statements: Investment funds | 13

2011 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.

Notes to the nancial statements

IAS 1.10(e), 51(a), 1. Reporting entity

(b), 1.138(a), (b)

[Name] (the Fund) is a company domiciled in [country]. The address of the Funds registered ofce

is [address]. The Funds shares are not traded in a public market and it does not le its nancial

statements with a securities commission or other regulatory organisation for the purpose of issuing

any class of instruments in a public market.

The Fund is an open-ended investment fund primarily involved in investing in a highly diversied

portfolio of equity securities issued by companies listed on major European stock exchanges and on

the New York Stock Exchange (NYSE), unlisted companies, unlisted investment funds, international

derivatives and investment grade debt securities with the objective of providing shareholders with

above average returns over the medium to long term.

IAS 1.138(a), (b) The investment activities of the Fund are managed by XYZ Capital Limited (the investment manager)

and the administration of the Fund is delegated to ABC Fund Services Limited (the administrator).

IAS 1.112(a) 2. Basis of preparation

1

(a) Statement of compliance

IAS 1.16 The nancial statements of the Fund as at and for the year ended 31 December 2011

2

have been

prepared in accordance with International Financial Reporting Standards (IFRSs).

3

IAS 10.17 The nancial statements were authorised for issue by the board of directors on [date].

4

(b) Basis of measurement

5

IAS 1.117(a) The nancial statements have been prepared on the historical cost basis except for nancial

instruments at fair value through prot or loss, which are measured at fair value.

(c) Functional and presentation currency

6

IAS 1.51(d), (e) These nancial statements are presented in euro, which is the Funds functional currency. All nancial

information presented in euro has been rounded to the nearest thousand.

(d) Use of estimates and judgements

7

The preparation of the nancial statements in conformity with IFRSs requires management to

make judgements, estimates and assumptions that affect the application of accounting policies and

the reported amounts of assets, liabilities, income and expenses. Actual results may differ from

these estimates.

Estimates and underlying assumptions are reviewed on an ongoing basis. Revisions to accounting

estimates are recognised in the period in which the estimates are revised and in any future

periods affected.

IAS 1.122, 125 Information about assumptions and estimation uncertainties that have a signicant risk of resulting

in a material adjustment within the next nancial year, as well as critical judgements in applying

accounting policies that have the most signicant effect on the amounts recognised in the nancial

statements are included in notes 4 and 5.

14 | Illustrative nancial statements: Investment funds

2011 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.

Explanatory note

1. When a change in accounting policy is the result of the adoption of a new, revised or amended

IFRS, an entity applies the specic transitional requirements in that IFRS. However, in our view

an entity nonetheless should comply with the disclosure requirements of IAS 8 to the extent that

the transitional requirements do not include disclosure requirements. Even though it could be

argued that the disclosures are not required because they are set out in the IAS 8 requirements for

voluntary changes in accounting policy, we believe that they are necessary in order to give a fair

presentation. This issue is discussed in our publication Insights into IFRS (2.8.10). For an example

of disclosures relating to a change in accounting policy see our publication Illustrative nancial

statements.

2. IAS 8.28, 29 When a change in accounting policy, either voluntarily or as a result of the initial application of a

standard, has an effect on the current period or any prior period, an entity discloses, among other

things, the amount of the adjustment for each nancial statement line item affected.

IAS 8.49 If any prior period errors are corrected in the current years nancial statements, then an entity

discloses:

the nature of the prior period error;

to the extent practicable, the amount of the correction for each nancial statement line item

affected, and, if IAS 33 applies to the entity, basic and diluted earnings per share for each prior period

presented;

the amount of the correction at the beginning of the earliest prior period presented; and

if retrospective restatement is impracticable for a particular prior period, then the circumstances

that led to the existence of that condition and a description of how and from when the error has

been corrected.

3. IAS 1.117(b) The accounting policies describe each specic accounting policy that is relevant to an understanding

of the nancial statements.

IAS 8.5 Accounting policies are the specic principles, bases, conventions, rules and practices that an entity

applies in preparing and presenting nancial statements.

4. The accounting policies disclosed in these illustrative nancial statements reect the facts and

circumstances of the ctitious open-ended single-fund investment company on which these nancial

statements are based. They should not be relied upon for a complete understanding of IFRSs and

should not be used as a substitute for referring to the standards and interpretations themselves. The

accounting policy disclosures appropriate for an entity depend on the facts and circumstances of that

entity, including the accounting policy choices an entity makes, and may differ from the disclosures

illustrated in these illustrative nancial statements.

5. IFRS 7.B5(e) An entity discloses how the statement of comprehensive income amounts are determined, e.g.

whether net gains and losses of nancial assets and liabilities measured at fair value through prot or

loss include interest and dividend income.

IFRS 7.20(b) In these illustrative statements interest income for nancial assets at fair value through prot or

loss is presented separately from net gain from nancial instruments at fair value through prot or

loss. However, other presentations, e.g. inclusion of interest income with the gain from nancial

instruments at fair value through prot or loss, are permitted.

6. The method of calculating the effective interest rate is discussed in our publication Insights into IFRS

(7.6.290).

Illustrative nancial statements: Investment funds | 15

2011 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.

Notes to the nancial statements

2. Basis of preparation (continued)

(e) Changes in accounting policies

1, 2

There were no changes in the accounting policies of the Fund during the year.

IAS 1.112(a), 3. Signicant accounting policies

3, 4

117(a), (b)

The accounting policies set out below have been applied consistently to all periods presented in

these nancial statements.

(a) Foreign currency

IAS 21.21, 23(a) Transactions in foreign currencies are translated into euro at the exchange rate at the dates of the

transactions. Monetary assets and liabilities denominated in foreign currencies at the reporting date

are retranslated into euro at the exchange rate at that date.

IAS 21.23 Non-monetary assets and liabilities denominated in foreign currencies that are measured at fair value

are retranslated into euro at the exchange rate at the date that the fair value was determined.

Foreign currency differences arising on retranslation are recognised in prot or loss as net foreign

exchange loss, except for those arising on nancial instruments at fair value through prot or loss,

which are recognised as a component of net gain from nancial instruments at fair value through

prot or loss.

IFRS 7.B5(e) (b) Interest

5, 6

IAS 18.35(b)(iii) Interest income and expense, including interest income from non-derivative nancial assets at fair

value through prot or loss, are recognised in prot or loss, using the effective interest method.

The effective interest rate is the rate that exactly discounts the estimated future cash payments and

receipts through the expected life of the nancial instrument (or, when appropriate, a shorter period)

to the carrying amount of the nancial instrument. When calculating the effective interest rate, the

Fund estimates future cash ows considering all contractual terms of the nancial instrument, but

not future credit losses. Interest received or receivable, and interest paid or payable are recognised in

prot or loss as interest income and interest expense, respectively.

IFRS 7.21, B5(e) (c) Dividend income and dividend expense

Dividend income is recognised in prot or loss on the date that the right to receive payment is

established. For quoted equity securities this is usually the ex-dividend date. For unquoted equity

securities this is usually the date when the shareholders have approved the payment of a dividend.

Dividend income from equity securities designated as at fair value through prot or loss is recognised

in prot or loss as a separate line item.

The Fund incurs expenses on short positions in equity securities equal to the dividends due on these

securities. Such dividend expense is recognised in prot or loss as operating expense when the

shareholders right to receive payment is established.

IFRS 7.B5(e) (d) Dividends to holders of redeemable shares

Dividends payable to holders of redeemable shares are recognised in prot or loss as nance costs

when they are authorised and no longer at the discretion of the Fund. [Provide more detail to reect

the circumstances of the particular fund].

16 | Illustrative nancial statements: Investment funds

2011 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.

Explanatory note

1. IFRS 7.B5(e) In these illustrative nancial statements net gain from nancial instruments at fair value through

prot or loss includes:

gains and losses, other than interest and dividend income, on nancial assets and nancial liabilities

designated as at fair value through prot or loss;

gains and losses, other than dividends payable on securities sold short classied as held for trading;

and

gains and losses on all derivatives.

However, other presentations are possible, e.g. this line also could include interest and dividend

income, interest expense and dividends on securities sold short.

2. In our view, an entity may apply any reasonable cost allocation method to determine the cost of

nancial assets sold that are part of a homogeneous portfolio (e.g. average cost or rst-in, rst-

out). The selected method should be applied consistently. This issue is discussed in our publication

Insights into IFRS (7.5.290.50 60).

3. IFRS 7.28 An entity discloses the following in respect of any day one gain or loss:

an accounting policy; and

the aggregate difference still to be recognised in prot or loss, and a reconciliation between the

opening and closing balance thereof.

4. IAS 39.9, 11A Financial assets or liabilities (other than those classied as held for trading) may be designated upon

initial recognition as at fair value through prot or loss, in any of the following circumstances, if they:

eliminate or signicantly reduce a measurement or recognition inconsistency (accounting

mismatch) that would otherwise arise from measuring assets and liabilities or recognising the gains

or losses on them on different bases;

are part of a group of nancial assets and/or nancial liabilities that is managed and for which

performance is evaluated and reported to key management on a fair value basis in accordance with a

documented risk management or investment strategy; or

are hybrid contracts in which an entity is permitted to designate the entire contract at fair value

through prot or loss.

IAS 39.AG4B These illustrative nancial statements demonstrate the fair value option for debt securities and

equity investments that are managed and evaluated on a fair value basis as part of the Funds

documented investment strategy.

Illustrative nancial statements: Investment funds | 17

2011 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.

Notes to the nancial statements

3. Signicant accounting policies (continued)

IFRS 7.21, B5(e) (e) Net gain from nancial instruments at fair value through prot or loss

1

Net gain from nancial instruments at fair value through prot or loss includes all realised and

unrealised fair value changes and foreign exchange differences, but excludes interest and dividend

income, and dividend expense on securities sold short.

Net realised gain from nancial instruments at fair value through prot or loss is calculated using the

average cost method.

2

IFRS 7.21 (f) Fees and commission expenses

Fees and commission expenses are recognised in prot or loss as the related services are

performed.

(g) Tax

IAS 12.2 Under the current system of taxation in [insert name of the country of domicile] the Fund is exempt

from paying income taxes. The Fund has received an undertaking from [insert name of the relevant

government body] of [insert name of the country of domicile] exempting it from tax for a period of

[insert number of] years up till [insert year of expiry].

However, some dividend and interest income received by the Fund are subject to withholding tax

imposed in certain countries of origin. Income that is subject to such tax is recognised gross of the

taxes and the corresponding withholding tax is recognised as tax expense.

IFRS 7.21 (h) Financial assets and nancial liabilities

IAS 39.14, 38 (i) Recognition and initial measurement

3

IFRS 7.B5(c) Financial assets and liabilities at fair value through prot or loss are recognised initially on the trade

date, which is the date that the Fund becomes a party to the contractual provisions of the instrument.

Other nancial assets and liabilities are recognised on the date they are originated.

Financial assets and nancial liabilities at fair value through prot or loss are recognised initially at fair

value, with transaction costs recognised in prot or loss. Financial assets or nancial liabilities not

at fair value through prot or loss are recognised initially at fair value plus transaction costs that are

directly attributable to their acquisition or issue.

(ii) Classication

The Fund classies nancial assets and nancial liabilities into the following categories:

Financial assets at fair value through prot or loss:

Held for trading derivative nancial instruments

Designated as at fair value through prot or loss debt securities and equity investments.

4

Financial assets at amortised cost:

Loans and receivables cash and cash equivalents, balances due from brokers, receivables from

reverse repurchase agreements and other receivables.

Financial liabilities at fair value through prot or loss:

Held for trading securities sold short and derivative nancial instruments.

Financial liabilities at amortised cost:

Other liabilities balances due to brokers, payables under repurchase agreements, redeemable

shares and other payables.

18 | Illustrative nancial statements: Investment funds

2011 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.

This page has been left blank intentionally.

Illustrative nancial statements: Investment funds | 19

2011 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.

Notes to the nancial statements

3. Signicant accounting policies (continued)

(h) Financial assets and nancial liabilities (continued)

(ii) Classication (continued)

IAS 39.9, AG15 A nancial instrument is classied as held for trading, if:

it is acquired or incurred principally for the purpose of selling or repurchasing it in the near term;

on initial recognition it is part of a portfolio that is managed together and for which there is

evidence of a recent pattern of short-term prot taking; or

it is a derivative, other than a designated and effective hedging instrument.

IAS 39.9 The Fund has designated certain nancial assets as at fair value through prot or loss when the

assets are managed, evaluated and reported internally on a fair value basis.

A non-derivative nancial asset with xed or determinable payments may be classied as a loan

and receivable unless it is quoted in an active market, or it is an asset for which the holder may not

recover substantially all of its initial investment, other than because of credit deterioration.

Note 6 provides a reconciliation of line items in the statement of nancial position to the categories

of nancial instruments, as dened by IAS 39.

IAS 39.58 (iii) Amortised cost measurement

The amortised cost of a nancial asset or liability is the amount at which the nancial asset or

liability is measured at initial recognition, minus principal repayments, plus or minus the cumulative

amortisation using the effective interest method of any difference between the initial amount

recognised and the maturity amount, minus any reduction for impairment.

IAS 39.48 (iv) Fair value measurement

Fair value is the amount for which an asset could be exchanged, or a liability settled, between

knowledgeable, willing parties in an arms length transaction on the measurement date.

IAS 39.48A When available, the Fund measures the fair value of an instrument using quoted prices in an active

market for that instrument. A market is regarded as active if quoted prices are readily and regularly

available and represent actual and regularly occurring market transactions on an arms length basis.

If a market for a nancial instrument is not active, then the Fund establishes fair value using a

valuation technique. Valuation techniques include using recent arms length transactions between

knowledgeable, willing parties (if available), reference to the current fair value of other instruments

that are substantially the same, discounted cash ow analyses and option pricing models. The chosen

valuation technique makes maximum use of market inputs, relies as little as possible on estimates

specic to the Fund, incorporates all factors that market participants would consider in setting a price,

and is consistent with accepted economic methodologies for pricing nancial instruments. Inputs

to valuation techniques reasonably represent market expectations and measures of the risk-return

factors inherent in the nancial instrument. The Fund calibrates valuation techniques and tests them

for validity using prices from observable current market transactions in the same instrument or based

on other available observable market data.

20 | Illustrative nancial statements: Investment funds

2011 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.

This page has been left blank intentionally.

Illustrative nancial statements: Investment funds | 21

2011 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.

Notes to the nancial statements

3. Signicant accounting policies (continued)

(h) Financial assets and nancial liabilities (continued)

IAS 39.48 (iv) Fair value measurement (continued)

IFRS 7.28(a) The best evidence of the fair value of a nancial instrument at initial recognition is the transaction

price, i.e. the fair value of the consideration given or received, unless the fair value of that

instrument is evidenced by comparison with other observable current market transactions in the

same instrument (i.e. without modication or repackaging) or based on a valuation technique

whose variables include only data from observable markets. When transaction price provides the

best evidence of fair value at initial recognition, the nancial instrument is initially measured at

the transaction price and any difference between this price and the value initially obtained from a

valuation model is subsequently recognised in prot or loss on an appropriate basis over the life of

the instrument but not later than when the valuation is supported wholly by observable market data

or the transaction is closed out.

Assets and long positions are measured at a bid price; liabilities and securities sold short are

measured at an asking price.

IFRS 7.B5E All changes in fair value, other than interest and dividend income and expense, are recognised in

prot or loss as part of net gain from nancial instruments at fair value through prot or loss.

(v) Impairment

IFRS 7.B5(f) A nancial asset not classied at fair value through prot or loss is assessed at each reporting date to

determine whether there is objective evidence of impairment. A nancial asset or a group of nancial

assets is impaired if there is objective evidence of impairment as a result of one or more events

that occurred after the initial recognition of the asset(s), and that loss event(s) had an impact on the

estimated future cash ows of that asset(s) that can be estimated reliably.

IAS 39.65 Objective evidence that nancial assets are impaired includes signicant nancial difculty of the

borrower or issuer, default or delinquency by a borrower, restructuring of amount due on terms that

the Fund would not consider otherwise, indications that a borrower or issuer will enter bankruptcy, or

adverse changes in the payment status of the borrowers.

IAS 39.65, 66 An impairment loss in respect of a nancial asset measured at amortised cost is calculated as the

difference between its carrying amount and the present value of the estimated future cash ows

discounted at the assets original effective interest rate. Losses are recognised in prot or loss and

reected in an allowance account against receivables. Interest on the impaired asset continues to

be recognised. When an event occurring after the impairment was recognised causes the amount of

impairment loss to decrease, the decrease in impairment loss is reversed through prot or loss.

22 | Illustrative nancial statements: Investment funds

2011 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.

Explanatory note

1. IAS 1.35 Gains and losses arising from a group of similar transactions are reported on a net basis, e.g. foreign

currency gains and losses or gains and losses arising on nancial instruments held for trading.

However, such gains and losses are reported separately if they are material.

Illustrative nancial statements: Investment funds | 23

2011 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.

Notes to the nancial statements

3. Signicant accounting policies (continued)

(h) Financial assets and nancial liabilities (continued)

IAS 39.1542 (vi) Derecognition

The Fund derecognises a nancial asset when the contractual rights to the cash ows from the

asset expire, or it transfers the rights to receive the contractual cash ows in a transaction in which

substantially all the risks and rewards of ownership of the nancial asset are transferred or in which

the Fund neither transfers nor retains substantially all the risks and rewards of ownership and does

not retain control of the nancial asset. Any interest in such transferred nancial assets that is

created or retained by the Fund is recognised as a separate asset or liability.

On derecognition of a nancial asset, the difference between the carrying amount of the asset (or

the carrying amount allocated to the portion of the asset derecognised), and consideration received

(including any new asset obtained less any new liability assumed) is recognised in prot or loss.

The Fund enters into transactions whereby it transfers assets recognised on its statement of nancial

position, but retains either all or substantially all of the risks and rewards of the transferred assets or

a portion of them. If all or substantially all risks and rewards are retained, then the transferred assets

are not derecognised. Transfers of assets with retention of all or substantially all risks and rewards

include securities lending and repurchase transactions.

The Fund derecognises a nancial liability when its contractual obligations are discharged, cancelled

or expire.

(vii) Offsetting

IAS 32.42 Financial assets and liabilities are offset and the net amount presented in the statement of nancial

position when, and only when, the Fund has a legal right to offset the amounts and it intends either

to settle on a net basis or to realise the asset and settle the liability simultaneously.

Income and expenses are presented on a net basis only when permitted under IFRSs, e.g. for gains

and losses arising from a group of similar transactions, such as gains and losses from nancial

instruments at fair value through prot or loss.

1

(viii) Specic instruments

IAS 7.46 Cash and cash equivalents

Cash and cash equivalents comprise deposits with banks and highly liquid nancial assets with

maturities of three months or less from the acquisition date that are subject to an insignicant risk of

changes in their fair value and are used by the Fund in the management of short-term commitments,

other than cash collateral provided in respect of derivatives, securities sold short and securities

borrowing transactions.

Receivables and payables under repurchase agreements and securities lent and borrowed

IAS 39.AG51(a)(c) When the Fund purchases a nancial asset and simultaneously enters into an agreement to resell the

same or substantially similar asset at a xed price on a future date (reverse repo), the arrangement

is accounted for as a loan and receivable, recognised in the statement of nancial position as

receivables from reverse repurchase agreements, and the underlying asset is not recognised in the

Funds nancial statements.

24 | Illustrative nancial statements: Investment funds

2011 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.

Explanatory note

1. IAS 1.31 When new standards, amendments to standards and interpretations will have no, or no material,

effect on the nancial statements of the entity, it is not necessary to list them as such a disclosure

will not be material.

2. See Appendix I for example disclosures on the early adoption of IFRS 9.

3.

The following standards, interpretations and amendments have been issued with effective dates

relating to periods beginning on or after 1 January 2011.

In October 2010 the IASB issued Disclosures Transfers of Financial Assets (Amendments to

IFRS7) with an effective date of 1 July 2011.

In October 2010 the IASB issued IFRS 9 (2010) which superseded the previous version that was

issued in November 2009 (IFRS 9 (2009)). In December 2011 the IASB issued amendment to

IFRS 9 that extended the effective date of the standard to annual period beginning on or after

1January 2015 and modied its transitional provisions so that entities that initially apply IFRS 9 in

periods beginning:

before 1 January 2012 need not restate prior periods and are not required to provide alternative

disclosures specied in the standard;

on or after 1 January 2012 and before 1 January 2013 must elect to either restate prior periods or

to provide alternative disclosures; or

on or after 1 January 2013 must provide alternative disclosures and do not need to restate prior

periods.

See Appendix I for an illustrative example of the early adoption of IFRS 9.

In December 2010 the IASB issued Deferred Tax: Recovery of Underlying Assets Amendments

to IAS 12 with an effective date of 1 January 2012.

In May 2011 the IASB issued IFRS 10 Consolidated Financial Statements, IFRS 11 Joint

Arrangements, IFRS 12 Disclosure of Interests in Other Entities and IFRS 13 Fair Value

Measurement, which all have an effective date of 1 January 2013. The IASB also issued IAS27

Separate Financial Statements (2011), which supersedes IAS 27 (2008) and IAS 28 Investments in

Associates and Joint Ventures (2011), which supersedes IAS 28 (2008). All these standards have

an effective date of 1January 2013.

In June 2011 the IASB issued Presentation of Items of Other Comprehensive Income

(Amendments to IAS 1 Presentation of Financial Statements) with an effective date of 1 July

2012. For example disclosures for entities that early adopt the amendments, please refer to

Appendix III in our publication Illustrative nancial statements.

In June 2011 the IASB issued an amended IAS 19 Employee Benets, with an effective date of

1January 2013.

Illustrative nancial statements: Investment funds | 25

2011 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.

Notes to the nancial statements

3. Signicant accounting policies (continued)

(h) Financial assets and nancial liabilities (continued)

(viii) Specic instruments (continued)

Receivables and payables under repurchase agreements and securities lent and borrowed

(continued)

When the Fund sells a nancial asset and simultaneously enters into an agreement to repurchase

the same or similar asset at a xed price on a future date (repo), the arrangement is accounted

for as a borrowing, recognised in the statement of nancial position as payables under repurchase

agreements, and the underlying asset continues to be recognised in the Funds nancial statements.

Securities borrowed by the Fund are not recognised in the statement of nancial position. If the

Fund subsequently sells the borrowed securities, the arrangement is accounted for as a short sold

position, recognised in the statement of nancial position as nancial liabilities at fair value through

prot or loss, classied as held for trading and measured at fair value through prot or loss. Cash

collateral for borrowed securities is included within balances due from brokers.

IAS 39.AG51(a) Securities lent by the Fund are not derecognised from the Funds statement of nancial position.

The Fund discloses cash collateral pledged by the borrower in note 11. When the counterparty has

the rights to sell or repledge the securities, the Fund reclassies them in the statement of nancial

position as pledged nancial assets at fair value through prot or loss.

Receivables from reverse repurchase agreements and payables under repurchase agreements are

subsequently measured at amortised cost.

Redeemable shares

The Fund classies nancial instruments issued as nancial liabilities or equity instruments in

accordance with the substance of the contractual terms of the instruments.

The Fund has two classes of redeemable shares in issue: Class A and Class B that rank pari passu in

all material respects and have the same terms and conditions other than [list down the differences

in terms between the Class A shares and Class B shares, e.g. management fee rate, incentive fees

etc.]. The redeemable shares provide investors with the right to require redemption for cash at a

value proportionate to the investors share in the Funds net assets, after deduction of the nominal

amount of equity share capital, at each monthly [daily/quarterly] redemption date and also in the

event of the Funds liquidation.

The redeemable shares are classied as nancial liabilities and are measured at the present value

of the redemption amounts. In accordance with the Funds prospectus, the redemption amounts of

the individual redeemable shares are calculated using the mid-market prices of the Funds underlying

investments/securities sold short. However, in accordance with the Funds accounting policies, assets

and long positions are measured at a bid price and liabilities and securities sold short are measured at

the asking price (see note 3(h)(iv)). The adjustment from mid-market prices basis to bid-ask prices is

included in computing the total redemption amount of the redeemable shares and is presented as an

adjustment in the statement of nancial position.

IAS 8.30, 31 (i) New standards and interpretations not adopted

1, 2, 3

A number of new standards, amendments to standards and interpretations are effective for annual

periods beginning after 1 January 2011, and have not been applied in preparing these nancial

statements. None of these are expected to have a signicant effect on the measurement of the

amounts recognised in the nancial statements of the Fund. However, IFRS 9 will change the

classication of nancial assets.

26 | Illustrative nancial statements: Investment funds

2011 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.

Explanatory note

1. IFRS 7.1, 31 An entity discloses information that enables users of its nancial statements to evaluate the nature

and extent of risks arising from nancial instruments to which it is exposed at the end of and during

the reporting period. Those risks typically include, but are not limited to, credit risk, liquidity risk and

market risk.

IFRS 7.33 For each type of risk, an entity discloses:

(1) the exposures to risk and how they arise;

(2) its objectives, policies and processes for managing the risk and the methods used to measure

the risk; and

(3) any changes in (1) or (2) from the previous period.

IFRS 7.32A

An entity makes qualitative disclosures in the context of quantitative disclosures that enables users

to link related disclosures and hence form an overall picture of the nature and extent of risks arising

from nancial instruments. Interaction between qualitative and quantitative disclosures contributes

to disclosure of information in a way that better enables users to evaluate an entitys exposure to

risks.

IFRS 7.B6 The disclosures required by IFRS 7.3141 in respect of the nature and extent of risks arising from

nancial instruments are either presented in the nancial statements or incorporated by cross-

reference from the nancial statements to another statement, such as a management commentary

or risk report, that is available to users of the nancial statements on the same terms as the nancial

statements and at the same time. The location of these disclosures may be guided by local laws.

In these illustrative nancial statements, these disclosures have been presented in the nancial

statements.

IFRS 7 requires only risk disclosures for nancial instruments. Financial risk exposures from non-

nancial instruments, e.g. credit risk from operating leases, are disclosed separately if an entity

chooses to disclose its entire nancial risk position.

IFRS 7.35, IG20 If the quantitative data at the reporting date are not representative of an entitys risk exposure during

the year, then an entity provides further information that is representative, e.g. the entitys average

exposure to risk during the year. For example, the IFRS7 implementation guidance indicates that

if an entity typically has a large exposure to a particular currency but unwinds that position at the

reporting date, then it might present a graph that shows the currency exposure at various times

during the period, or disclose the highest, lowest and average exposures.

2. In these illustrative nancial statements the disclosures in respect of nancial risk management have

been presented to illustrate different potential scenarios and situations that an entity may encounter

in practice. An entity tailors its respective disclosures for the specic facts and circumstances

relative to its business and risk management practices, and also takes into account the signicance

of its exposure to risks from the use of nancial instruments.

3. IFRS 7.3, 5 The disclosure requirements of IFRS 7 are limited to nancial instruments that fall within the scope

of that standard; therefore, operational risks that do not arise from the entitys nancial instruments

are excluded from the requirements.

4. IAS 1.134 The entity discloses information that enables users of its nancial statements to evaluate its

objectives, policies and processes for managing capital.

Illustrative nancial statements: Investment funds | 27

2011 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.

Notes to the nancial statements

3. Signicant accounting policies (continued)

IAS 8.30, 31 (i) New standards and interpretations not adopted (continued)

The standard is not expected to have an impact on the measurement basis of the nancial assets

since the majority of the Funds nancial assets are measured at fair value through prot or loss.

IFRS 9 deals with recognition, derecognition, classication and measurement of nancial assets and

nancial liabilities. Its requirements represent a signicant change from the existing requirements in

IAS 39 in respect of nancial assets. The standard contains two primary measurement categories for

nancial assets: at amortised cost and fair value. A nancial asset would be measured at amortised

cost if it is held within a business model whose objective is to hold assets in order to collect

contractual cash ows, and the assets contractual terms give rise on specied dates to cash ows

that are solely payments of principal and interest on the principal outstanding. All other nancial

assets would be measured at fair value. The standard eliminates the existing IAS 39 categories of

held to maturity, available for sale and loans and receivables.

For an investment in an equity instrument that is not held for trading, the standard permits an

irrevocable election, on initial recognition, on an individual share-by-share basis, to present all fair

value changes from the investment in other comprehensive income. No amount recognised in other

comprehensive income would ever be reclassied to prot or loss. However, dividends on such

investments are recognised in prot or loss, rather than other comprehensive income unless they

clearly represent a partial recovery of the cost of the investment. Investments in equity instruments

in respect of which an entity does not elect to present fair value changes in other comprehensive

income would be measured at fair value with changes in fair value recognised in prot or loss.

The standard requires that derivatives embedded in contracts with a host that is a nancial asset

within the scope of the standard are not separated; instead the hybrid nancial instrument is

assessed in its entirety as to whether it should be measured at amortised cost or fair value.

IFRS 9.B5.7.5, IFRS 9 requires that the effects of changes in credit risk of liabilities designated as at fair value

B5.7.8 through prot or loss are presented in other comprehensive income unless such treatment

would create or enlarge an accounting mismatch in prot or loss, in which case all gains or

losses on that liability are presented in prot or loss. Other requirements of IFRS 9 relating to

classication and measurement of nancial liabilities are unchanged from IAS 39.

The requirements of IFRS 9 relating to derecognition are unchanged from IAS 39.

The standard is effective for annual periods beginning on or after 1 January 2015. Earlier application is

permitted. The Fund does not plan to adopt this standard early.

IFRS 7.31 4. Financial risk management

1, 2

(a) Introduction and overview

IFRS 7.31, 32 The Fund has exposure to the following risks from nancial instruments:

credit risk

liquidity risk

market risk

operational risk.

3

IFRS 7.33 This note presents information about the Funds exposure to each of the above risks, the Funds

objectives, policies and processes for measuring and managing risk, and the Funds

management of capital.

4

28 | Illustrative nancial statements: Investment funds

2011 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.

Explanatory note

1. IFRS 7.34 IFRS 7 requires the disclosure of summary quantitative data on credit risk to be based on information

provided internally to the entitys key management personnel, as dened in IAS 24, e.g. the entitys

board of directors or chief executive. An entity explains how those data are determined. This issue is

discussed in our publication Insights into IFRS (7.8.340).

The standard also requires specic additional disclosures to be made unless covered by the

information provided to management.

IFRS 7.35, IG20 If the quantitative data at the reporting date are not representative of an entitys risk exposure during

the year, then an entity provides further information that is representative, e.g. the entitys average

exposure to risk during the year.

The example shown in these illustrative nancial statements in relation to credit risk assumes

that the primary bases for reporting to key management personnel on credit risk is monitoring of

credit ratings of counterparties to debt securities, reverse repurchase and derivatives transactions,

brokers and bankers and industry concentration of debt securities. However, other presentations

arepossible.

Illustrative nancial statements: Investment funds | 29

2011 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.

Notes to the nancial statements

4. Financial risk management

(continued)

(a) Introduction and overview (continued)

(i) Risk management framework

IFRS 7.31 The Fund maintains positions in a variety of derivative and non-derivative nancial instruments in

accordance with its investment management strategy. [Insert description of the Funds investment

strategy as outlined in the Funds prospectus]. The Funds investment portfolio comprises listed

and unlisted equity and debt securities, derivative nancial instruments and investments in unlisted

investment funds.

The Funds investment manager has been given a discretionary authority to manage the assets in

line with the Funds investment objectives. Compliance with the target asset allocations and the

composition of the portfolio is monitored by the board of directors on a [daily/weekly/monthly] basis.

In instances where the portfolio has diverged from target asset allocations, the Funds investment

manager is obliged to take actions to rebalance the portfolio in line with the established targets,

within prescribed time limits.

During 2011 higher levels of market volatility persisted across all asset classes. Uncertainty over the

levels of borrowing by governments in the major economies and concerns over the performance of

sovereign debt in the Eurozone substantially increased market volatility. The largest impact resulted

from the general widening of credit spreads. The Fund sought to mitigate the market and credit risk

by diversifying away from exposures to countries with the highest uncertainty and volatility and

through increased diversication of its investment portfolio.

The Fund does not have a direct exposure to the sovereign risk of Eurozone countries. Exposures to

other Eurozone counterparties are as follows:

Debt Equity

In thousands of euro securities investments Derivatives Total

2011

Germany 4,568 3,789 156 8,513

France 3,038 2,145 82 5,265

Spain 1,154 2,282 26 3,462

Portugal 925 115 16 1,056

9,685 8,331 280 18,296

Debt Equity

In thousands of euro securities investments Derivatives Total

2010

Germany 4,489 2,825 136 7,450

France 2,039 2,125 56 4,220

Spain 3,138 1,311 24 4,473

Portugal 915 114 9 1,038

10,581 6,375 225 17,181

IFRS 7.33 (b) Credit risk

1

Credit risk is the risk that a counterparty to a nancial instrument will fail to discharge an obligation

or commitment that it has entered into with the Fund, resulting in a nancial loss to the Fund. It

arises principally from debt securities held, and also from derivative nancial assets, cash and cash

equivalents, balances due from brokers and receivables from reverse repurchase agreements. For

risk management reporting purposes the Fund considers and consolidates all elements of credit risk

exposure (such as individual obligor default risk, country and sector risk).

30 | Illustrative nancial statements: Investment funds