Beruflich Dokumente

Kultur Dokumente

State Bank of India - India's Largest Bank

Hochgeladen von

sutanuprojectsOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

State Bank of India - India's Largest Bank

Hochgeladen von

sutanuprojectsCopyright:

Verfügbare Formate

11/11/2012

STATE BANK OF INDIA :: INDIA's LARGEST BANK

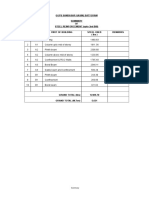

SBI NEW CAR LOAN SCHEME

SBI provide the best car loan scheme for you. Salient features:

No Advance EMI Longest repayment tenure (7 years) Lowest interest rates Lowest EMI LTV 85% of 'On Road Price' of car (includes registration, insurance and cost of accessories worth Rs 25000), 90% in case of Corporate Salary Package accounts Interest Calculated on Daily Reducing Balance Flexibility of payment of EMI anytime during the month No pre-payment penalty Free Accident insurance Optional SBI Life cover Overdraft facility available

Purpose For purchase of new passenger cars, Multi Utility Vehicles (MUVs) and SUVs. Eligibility To avail an SBI Car Loan, you should be :

Individual between the age of 21-65 years of age. Regular employee of State / Central Government, Public Sector Undertaking, Private company or a reputed establishment. Professionals, self-employed, businessmen, proprietary/partnership firms who is an income tax assessee. Person engaged in Agricultural and allied activities. Net Annual Income Rs. 2,50,000/- and above.

Loan Amount There is no upper limit for the amount of a car loan. A maximum loan amount of 48 times of Net Monthly Income or 4 times of Net Annual Income can be sanctioned. Documents Required You would need to submit the following documents along with the completed application form: 1. 2. 3. 4. 5. 6. Statement of Bank account of the borrower for last 6 months. 2 passport size photographs of borrower(s). A copy of passport /voters ID card/PAN card. Proof of residence. Latest salary-slip showing all deductions I.T. Returns/Form 16: 2 years for salaried employees and 2 years for professional/self-employed/businessmen duly accepted by the ITO wherever applicable

1/2

https://www.sbi.co.in/user.htm?action=print_section&lang=0&id=0,1,20,117,932

11/11/2012

STATE BANK OF INDIA :: INDIA's LARGEST BANK

7.

Proof of official address for non-salaried individuals

Margin 15% of the on road price (which includes vehicle registration charges, insurance, onetime road tax and accessories). Repayment You can enjoy the longest repayment period in the industry with us as long as 84 months. Reimbursement of costs of car purchased by own sources We also reimburse finance for the cars purchased out of own funds which are not more than 3 month old at rate of interest applicable to New Car. Interest Click here to view the interest rates Processing Fee 0.255% of loan amount, minimum Rs. 510/-, maximum Rs. 5100/(Till 31.12.12) Security As per Bank's extant instructions.

C opyright State Bank of India.

https://www.sbi.co.in/user.htm?action=print_section&lang=0&id=0,1,20,117,932

2/2

Das könnte Ihnen auch gefallen

- Paharpur Cooling Towers Ltd. Plot Plan For Ct-04: Main RoadDokument1 SeitePaharpur Cooling Towers Ltd. Plot Plan For Ct-04: Main RoadsutanuprojectsNoch keine Bewertungen

- Book 1Dokument5 SeitenBook 1sutanuprojectsNoch keine Bewertungen

- 2013 - NPH - Book - Preview, Man Hour Programme PDFDokument54 Seiten2013 - NPH - Book - Preview, Man Hour Programme PDFBilal Hussein SousNoch keine Bewertungen

- PlanningDokument9 SeitenPlanningsutanuprojectsNoch keine Bewertungen

- Safe StackingDokument24 SeitenSafe StackingcoolfireNoch keine Bewertungen

- Coverage Calculator Pipeline CoatingsDokument2 SeitenCoverage Calculator Pipeline CoatingssutanuprojectsNoch keine Bewertungen

- Egyptian Co Chemica Edile - TIGER - Expansive Mortar For Fracturing Rocks and ConcreteDokument4 SeitenEgyptian Co Chemica Edile - TIGER - Expansive Mortar For Fracturing Rocks and ConcretesutanuprojectsNoch keine Bewertungen

- Excel Gantt Chart Template TeamGanttDokument17 SeitenExcel Gantt Chart Template TeamGanttQazi KamalNoch keine Bewertungen

- Barbending ScheduleDokument7 SeitenBarbending ScheduleSureshKumarNoch keine Bewertungen

- Cover Letter Administrative Sample: Julie Zhang, B.A 2 Bloor Street St. E, Toronto, Ontario M2S 3G3Dokument1 SeiteCover Letter Administrative Sample: Julie Zhang, B.A 2 Bloor Street St. E, Toronto, Ontario M2S 3G3sutanuprojectsNoch keine Bewertungen

- Salary Negotiations - The Initial Offer and Your Response - Business InsiderDokument2 SeitenSalary Negotiations - The Initial Offer and Your Response - Business InsidersutanuprojectsNoch keine Bewertungen

- Data SheetDokument7 SeitenData SheetsutanuprojectsNoch keine Bewertungen

- Shuttering Design and Cost ComparisonsDokument5 SeitenShuttering Design and Cost ComparisonsBala SubramanianNoch keine Bewertungen

- Plummer BlockDokument66 SeitenPlummer BlockmmkattaNoch keine Bewertungen

- WoodDokument13 SeitenWoodsutanuprojectsNoch keine Bewertungen

- Hand BookDokument79 SeitenHand BookumeshnihalaniNoch keine Bewertungen

- SKF Seize Resistant Bearing: Design AdvantagesDokument2 SeitenSKF Seize Resistant Bearing: Design AdvantagessutanuprojectsNoch keine Bewertungen

- FORMULA: General-Purpose Mineral Analysis Recalculation: IntroDokument2 SeitenFORMULA: General-Purpose Mineral Analysis Recalculation: IntroAriz Joelee ArthaNoch keine Bewertungen

- Kolon Ayağı Ve Ankraj Bulonu Hesabı 1Dokument14 SeitenKolon Ayağı Ve Ankraj Bulonu Hesabı 1magxstone100% (2)

- Fenaflex Tyre CouplingsDokument12 SeitenFenaflex Tyre CouplingsGUZMANNoch keine Bewertungen

- Global Logistics Partner: US/Metric Conversion TablesDokument1 SeiteGlobal Logistics Partner: US/Metric Conversion TableslakshmiescribdNoch keine Bewertungen

- Density of Some Common Building MaterialsDokument26 SeitenDensity of Some Common Building MaterialssutanuprojectsNoch keine Bewertungen

- One Way Slab Steel QuantityDokument1 SeiteOne Way Slab Steel QuantityNicusor-constructNoch keine Bewertungen

- "Density = mass/volume (ρ=m/V) - So V=m/ρ and has units (kilograms) / (kilograms per cubic meter) =cubic meterDokument1 Seite"Density = mass/volume (ρ=m/V) - So V=m/ρ and has units (kilograms) / (kilograms per cubic meter) =cubic metersutanuprojectsNoch keine Bewertungen

- Check If Dissemination Should Be at RTD Rate or 100% and Choose at C18Dokument8 SeitenCheck If Dissemination Should Be at RTD Rate or 100% and Choose at C18sutanuprojectsNoch keine Bewertungen

- Spectro ReportDokument2 SeitenSpectro ReportsutanuprojectsNoch keine Bewertungen

- Transformer Sizing CalculationDokument6 SeitenTransformer Sizing CalculationAvijnan Mitra100% (3)

- Conveyor CalculationDokument32 SeitenConveyor CalculationsutanuprojectsNoch keine Bewertungen

- CPCBDokument77 SeitenCPCBSreedhar Patnaik.MNoch keine Bewertungen

- Piping Design PresentationDokument40 SeitenPiping Design PresentationArun Zac100% (2)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- 10 Floor Building For Fire FightingDokument3 Seiten10 Floor Building For Fire FightingAL BURJ AL THAKINoch keine Bewertungen

- 29 May - STEERING SYSTEMSDokument24 Seiten29 May - STEERING SYSTEMSHarry DaogaNoch keine Bewertungen

- Log WAUZZZ8E17A065331 317700kmDokument6 SeitenLog WAUZZZ8E17A065331 317700kmAleX 2.0Noch keine Bewertungen

- WEBASTO - Repair Shop Manual - ThermoTOP - 14417990441Dokument48 SeitenWEBASTO - Repair Shop Manual - ThermoTOP - 14417990441Pawel JPNoch keine Bewertungen

- Holley - FR-80457SA - 600 CFM Street Warrior Carburetor Google ShoppingDokument1 SeiteHolley - FR-80457SA - 600 CFM Street Warrior Carburetor Google ShoppingJoe reiderNoch keine Bewertungen

- Daftar Barang Yang Sudah Datang Di SMKN 1 Cikande No. Nama Alat JMLH STNDokument6 SeitenDaftar Barang Yang Sudah Datang Di SMKN 1 Cikande No. Nama Alat JMLH STNKhoirul MunirNoch keine Bewertungen

- Maintenance Intervals: When RequiredDokument3 SeitenMaintenance Intervals: When RequiredSain MezaNoch keine Bewertungen

- Yanmar Parts Catalog 4LHA-STEDokument107 SeitenYanmar Parts Catalog 4LHA-STEAzael Enrique Vergara Gonzalez100% (1)

- Manual de Partes Genie Z60Dokument242 SeitenManual de Partes Genie Z60Carlos ReyesNoch keine Bewertungen

- Spsebs1202 SeriesDokument38 SeitenSpsebs1202 SeriesJuple My IguanaNoch keine Bewertungen

- TVS HLX125 CatalogueDokument7 SeitenTVS HLX125 CatalogueMK Auto100% (2)

- Hydraulic Schematic PDFDokument2 SeitenHydraulic Schematic PDFAtaa AssaadNoch keine Bewertungen

- 4016TRG Feature and Benefits - Rev3Dokument8 Seiten4016TRG Feature and Benefits - Rev3bagusNoch keine Bewertungen

- European Ls Dyna Conference Invitation and Conference Agenda PDFDokument17 SeitenEuropean Ls Dyna Conference Invitation and Conference Agenda PDFmadcow_scribdNoch keine Bewertungen

- D8R 9emDokument4 SeitenD8R 9emlilikNoch keine Bewertungen

- Porsche 911 Carrera (Type 996) Service Manual: 1999-2005 - Complete IndexDokument11 SeitenPorsche 911 Carrera (Type 996) Service Manual: 1999-2005 - Complete IndexBentley Publishers33% (12)

- Parker Catalog f1Dokument104 SeitenParker Catalog f1Hydraulic SolutionNoch keine Bewertungen

- Product Leaflet - 12V 114Ah1.45kWhDokument2 SeitenProduct Leaflet - 12V 114Ah1.45kWhramshukla2001Noch keine Bewertungen

- ld20d Brochure 28-11-2022Dokument9 Seitenld20d Brochure 28-11-2022SandeepNoch keine Bewertungen

- ZF Transmission ZF s5 47 Troubleshooting GuideDokument22 SeitenZF Transmission ZF s5 47 Troubleshooting GuideManuel Acuña HernandezNoch keine Bewertungen

- Vag305 Manual enDokument32 SeitenVag305 Manual encjbuc100% (2)

- 150kN Stand Alone - 2009 Until 31-12-2009Dokument1 Seite150kN Stand Alone - 2009 Until 31-12-2009Adakole ObekaNoch keine Bewertungen

- Employee Relation and Communication Nishan Company AutomobileDokument103 SeitenEmployee Relation and Communication Nishan Company Automobiledeepak GuptaNoch keine Bewertungen

- WSE 80-01-507 - 80-01-537 - 80-01-907 - 80-01-937 - Instruction Manual - Ed. 513Dokument226 SeitenWSE 80-01-507 - 80-01-537 - 80-01-907 - 80-01-937 - Instruction Manual - Ed. 513Centrifugal Separator100% (1)

- G1190bev11 353 PDFDokument33 SeitenG1190bev11 353 PDFRogérioFreitasNoch keine Bewertungen

- Robeta Pricelist 2020 9 ANGDokument5 SeitenRobeta Pricelist 2020 9 ANGopodecanoNoch keine Bewertungen

- BWTS 2014 Performance Turbo Catalog PDFDokument68 SeitenBWTS 2014 Performance Turbo Catalog PDFАндрей СтрилецNoch keine Bewertungen

- L177 Operating Manual enDokument230 SeitenL177 Operating Manual enGioeNoch keine Bewertungen

- Btvted Research PaperDokument34 SeitenBtvted Research Paperhomerjudesatuito568Noch keine Bewertungen

- Soft Starter SiemensDokument1 SeiteSoft Starter SiemensaleksandarlaskovNoch keine Bewertungen