Beruflich Dokumente

Kultur Dokumente

PT Indorama Synthetics TBK.: Summary of Financial Statement

Hochgeladen von

IshidaUryuuOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

PT Indorama Synthetics TBK.: Summary of Financial Statement

Hochgeladen von

IshidaUryuuCopyright:

Verfügbare Formate

PT Indorama Synthetics Tbk.

Head Office

Factory

Business

Company Status

Graha Irama 17th Floor

Jl. H.R Rasuna Said Blok X-1 Kav. 1-2

Kuningan, Jakarta 12950

Phone (021) 526-1555 (Hunting)

Fax (021) 526-1501, 526-1502, 526-1508

Website: www.indorama.com

Email: co@indorama.com

Telex 60989 INRAMA IA

Kembang Kuning, Ubrug, Jatiluhur

Po. Box 7, Purwakarta 41101 Jawa Barat

Phone (0264) 21235, 200-235

Fax (0264) 210-068

Email: pwr@indorama.com

Polyester Filament Yarn,

Spun Blended Yarn, PET Resin,

Polyester Staple Fiber and

Polyester Filament Fabric

PMDN

Financial Performance: Net income the company has

earned in 2010 amounted IDR 106.796 billion, increased from

net income from IDR 81.119 billion in 2009.

Brief History: PT Indorama Synthetics Tbk, commenced

commercial operations in 1976. It is the largest polyester producer in Indonesia and one of Indonesias largest exporters

with a total polyester manufacturing capacity of about 280,000

tons per annum.

The company is listed on the Indonesia Stock Exchanges.

In 2009, the companys sales was US$ 490 million and assets of

US$ 545 million.

The company positions its products directly into its markets and has created a unique identity for itself. The company

sells to the premium markets of North America and Europe

and the fast growing markets of South America, Asia, Australia

and the Middle East.

A continuous process of reinvestment and productivityenhancing programs have made PT Indorama one of the leading producers of polyester and its applications worldwide. This

strength combined with the benefits of a low-cost base, results

in a twofold advantage: premium quality at a low cost.

Our business is all about delivering superior quality, consistency and reliability with the right service every time. PT Indorama is involved in four businesses.

Apparel and Other Textile Products

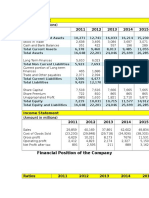

Summary of Financial Statement

(Million Rupiah)

2008

2009

2010

Total Assets

Current Assets

of which

Cash and cash equivalents

Time deposits

Trade receivables

Inventories

Non-Current Assets

of which

Fixed Assets-Net

Investments

6,675,957

2,382,401

5,123,263

2,029,655

5,085,915

2,214,185

136,998

761,025

437,417

827,255

4,293,556

65,456

660,350

414,205

678,815

3,093,608

98,096

624,875

654,302

766,649

2,871,730

3,852,148

7,470

3,068,343

6,390

2,837,436

6,086

Liabilities

Current Liabilities

of which

Trade payables

Taxes payable

Accrued expenses

Non-Current Liabilities

Minority Interests in Subsidiaries

4,005,523

2,262,491

2,723,915

1,815,202

2,491,352

2,034,889

1,502,068

1,015

56,901

1,743,032

n.a

1,469,518

2,092

40,951

908,713

n.a

1,646,096

30,920

39,832

456,463

29,038

Shareholders' Equity

Paid-up capital

Paid-up capital

in excess of par value

Retained earnings

2,670,434

1,754,382

2,399,348

1,506,045

2,565,525

1,440,516

10,038

906,014

8,617

884,686

8,242

1,116,767

Net Sales

Cost of Goods Sold

Gross Profit

Operating Expenses

Operating Profit

Other Income (Expenses)

Profit before Taxes

Profit after Taxes

6,064,262

5,580,946

483,316

393,934

89,382

(88,689)

692

81,119

4,605,512

4,311,825

293,687

255,074

38,613

(20,557)

18,056

106,796

5,546,887

4,979,728

567,159

324,614

242,545

35,940

278,485

233,092

Per Share Data (Rp)

Earnings per Share

Equity per Share

Dividend per Share

Closing Price

124

163

356

4,079

n.a

500

3,664

n.a

470

3,918

n.a

1,700

Financial Ratios

PER (x)

PBV (x)

Dividend Payout (%)

Dividend Yield (%)

4.03

0.12

n.a

n.a

2.88

0.13

n.a

n.a

4.78

0.43

n.a

n.a

Current Ratio (x)

Debt to Equity (x)

Leverage Ratio (x)

Gross Profit Margin (x)

Operating Profit Margin (x)

Net Profit Margin (x)

Inventory Turnover (x)

Total Assets Turnover (x)

ROI (%)

ROE (%)

1.05

1.50

0.60

0.08

0.01

0.04

6.75

0.91

2.06

5.06

1.12

1.14

0.53

0.06

0.01

0.04

6.35

0.90

2.06

5.06

1.09

0.97

0.49

0.10

0.04

0.04

6.50

1.09

2.06

5.06

PER =8.14x ; PBV = 0.92x (June 2011)

Financial Year: December 31

Public Accountant: Osman Bing Satrio & Co.

(million rupiah)

Shareholders

PT Irama Investama

HSBC Fund Services Clients

HSBC Private Bank (Suisse)

Indorama Holding (I) Pte., Ltd.

Public

Foreign

Local

194

49.00%

8.18%

5.05%

2.00%

27.79%

7.98%

Total Assets

Liabilities

Shareholders' Equity

Net Sales

Profit after Taxes

ROI (%)

ROE (%)

2011

2010

5,772,764

3,141,475

2,591,391

3,484,906

176,961

4,969,000

2,615,000

2,353,000

2,688,813

34,886

3.07

6.83

0.70

1.48

In June

Indonesian Capital Market Directory 2011

PT Indorama Synthetics Tbk.

Apparel and Other Textile Products

Board of Commissioners

President Commissioner Sri Prakash Lohia

Vice President Commissioners Seema Lohia, Humphrey R. Djemat

Commissioners Iman Sucipto Umar, Aarti Lohia

No

Type of Listing

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

First Issue

Partial Listing

Partial Listing

Bonus Shares

Partial Listing

Escrow Shares

Escrow Shares

Option Conversion

Bonus Shares

Right Issue

Company Listing

Escrow Shares

Option Conversion

Partial Listing

Convertible Bond

Founders Shares

Convertible Bond

Founders Shares

Stock Split

Bonus Shares

Company Listing

Board of Directors

President Director Amit Lohia

Directors V.S. Baldwa, Arun Taneja

Number of Employees 6,353

Listing Date

Trading Date

Number of Shares

per Listing

03-Aug-90

03-Aug-90

1991

23-Mar-92

11-Nov-92

1993

1994

1994

20-Feb-95

08-Jun-95

29-Jun-95

1995

1995

16-Oct-95

1995

1995

1996

1996

09-Dec-96

19-Dec-96

03-Nov-97

03-Aug-90

03-Feb-91

1991

30-Mar-92

11-Nov-92

1993

1994

1994

20-Feb-95

08-Jun-95

29-Jun-95

1995

1995

16-Oct-95

1995

1995

1996

1996

09-Dec-96

19-Dec-96

03-Nov-97

7,000,000

3,000,000

2,850,000

24,200,000

3,736,000

15,028,860

2,296,169

2,206,120

30,158,571

24,911,513

20,946,682

189,573

2,003,641

3,568,340

6,006,038

4,284,805

1,900,236

1,977,815

156,264,363

250,022,981

91,800,000

Total Listed

Shares

7,000,000

10,000,000

12,850,000

37,050,000

40,786,000

55,814,860

58,111,029

60,317,149

90,475,720

115,387,233

136,333,915

136,523,488

138,527,129

142,095,469

148,101,507

152,386,312

154,286,548

156,264,363

312,528,726

562,551,707

654,351,707

Underwriters PT PDFCI, PT Wardley James Capel Indonesia, PT INDOVEST, PT ASEAM

Stock Price, Frequency, Trading Days, Number and Value of Shares Traded and Market Capitalization

Stock Price and Traded Chart

Stock Price (Rp)

Million Shares

4,500

4,000

3,500

5

3,000

2,500

2,000

1,500

2

1,000

1

500

-

Jan-10 Feb-10 Mar-10 Apr-10 May-10 Jun-10 Jul-10 Aug-10 Sep-10 Oct-10 Nov-10 Dec-10 Jan-11 Feb-11 Mar-11 Apr-11 May-11 Jun-11

Institute for Economic and Financial Research

195

Das könnte Ihnen auch gefallen

- AaliDokument2 SeitenAaliSeprinaldiNoch keine Bewertungen

- AcesDokument2 SeitenAcesIshidaUryuuNoch keine Bewertungen

- PT Kabelindo Murni TBK.: Summary of Financial StatementDokument2 SeitenPT Kabelindo Murni TBK.: Summary of Financial StatementIshidaUryuuNoch keine Bewertungen

- Financial StatementDokument2 SeitenFinancial StatementSolvia HasanNoch keine Bewertungen

- BramDokument2 SeitenBramIshidaUryuuNoch keine Bewertungen

- GGRM - Icmd 2011 (B02)Dokument2 SeitenGGRM - Icmd 2011 (B02)annisa lahjieNoch keine Bewertungen

- PT Agung Podomoro Land TBK.: Summary of Financial StatementDokument2 SeitenPT Agung Podomoro Land TBK.: Summary of Financial StatementTriSetyoBudionoNoch keine Bewertungen

- PT Ever Shine Tex TBK.: Summary of Financial StatementDokument2 SeitenPT Ever Shine Tex TBK.: Summary of Financial StatementIshidaUryuuNoch keine Bewertungen

- Summit Bank Annual Report 2012Dokument200 SeitenSummit Bank Annual Report 2012AAqsam0% (1)

- Banking Survey 2010Dokument60 SeitenBanking Survey 2010Fahad Paracha100% (1)

- AdesDokument2 SeitenAdesIshidaUryuuNoch keine Bewertungen

- Aali - Icmd 2010 (A01) PDFDokument2 SeitenAali - Icmd 2010 (A01) PDFArdheson Aviv AryaNoch keine Bewertungen

- ACAP-andhi Chandra PDFDokument1 SeiteACAP-andhi Chandra PDFSugihSubagjaNoch keine Bewertungen

- BIPPDokument2 SeitenBIPPPrince Hadhey VaganzaNoch keine Bewertungen

- University of The Punjab, Jhelum CampusDokument24 SeitenUniversity of The Punjab, Jhelum CampusMa AnNoch keine Bewertungen

- Financial Statement Analysis of Kohat Cement Company LimitedDokument67 SeitenFinancial Statement Analysis of Kohat Cement Company LimitedSaif Ali Khan BalouchNoch keine Bewertungen

- Ratios Analysis: Introduction To Business Finance Course Facilitator: Sir Sikandar TajDokument28 SeitenRatios Analysis: Introduction To Business Finance Course Facilitator: Sir Sikandar TajSaad SaleemNoch keine Bewertungen

- Broadening Connectivity, Widening Horizons.: Annual Report 2011 Pakistan Telecommunication Company LimitedDokument38 SeitenBroadening Connectivity, Widening Horizons.: Annual Report 2011 Pakistan Telecommunication Company LimitedFazal SajidNoch keine Bewertungen

- 2010 Annual ReportDokument84 Seiten2010 Annual ReportnaveenNoch keine Bewertungen

- Company Financial StatementsDokument49 SeitenCompany Financial StatementsStar ShinnerNoch keine Bewertungen

- Lucky Cement AnalysisDokument17 SeitenLucky Cement AnalysisMoeez KhanNoch keine Bewertungen

- Crescent Bahuman FinalDokument22 SeitenCrescent Bahuman FinalShahid Ashraf100% (1)

- Din Textile Limited ProjDokument34 SeitenDin Textile Limited ProjTaiba Akhlaq0% (1)

- Finance PDFDokument44 SeitenFinance PDFMahum ShabbirNoch keine Bewertungen

- IMT CeresDokument5 SeitenIMT CeresSukanya SahaNoch keine Bewertungen

- Performance by Segment: Net SalesDokument2 SeitenPerformance by Segment: Net SalesIvan ChpNoch keine Bewertungen

- WWW Giamm Org Index PHP Option Com - Fabrik&view Coal&itemid 788&id 003 - MergedDokument248 SeitenWWW Giamm Org Index PHP Option Com - Fabrik&view Coal&itemid 788&id 003 - MergedFummy OmnipotentNoch keine Bewertungen

- ITR - Free Translation Fibria 3t10Dokument85 SeitenITR - Free Translation Fibria 3t10FibriaRINoch keine Bewertungen

- National Bank of Pakistan: Standalone Financial Statements For The Quarter Ended September 30, 2010Dokument36 SeitenNational Bank of Pakistan: Standalone Financial Statements For The Quarter Ended September 30, 2010Ghulam AkbarNoch keine Bewertungen

- Standalone Consolidated Audited Financial Results For The Year Ended March 31, 2011Dokument1 SeiteStandalone Consolidated Audited Financial Results For The Year Ended March 31, 2011Santosh VaishyaNoch keine Bewertungen

- Financial Statements: Nine Months Ended 31 March, 2009Dokument22 SeitenFinancial Statements: Nine Months Ended 31 March, 2009Muhammad BakhshNoch keine Bewertungen

- Profit and Loss Account For The Year Ended March 31, 2010: Column1 Column2Dokument11 SeitenProfit and Loss Account For The Year Ended March 31, 2010: Column1 Column2Karishma JaisinghaniNoch keine Bewertungen

- Series-A Investment Opportunity: International Payments Service ProviderDokument3 SeitenSeries-A Investment Opportunity: International Payments Service ProviderDhiraj KhotNoch keine Bewertungen

- Fame Export 1Dokument42 SeitenFame Export 1sharedcaveNoch keine Bewertungen

- PTCL Accounts 2009 (Parent)Dokument48 SeitenPTCL Accounts 2009 (Parent)Najam U SaharNoch keine Bewertungen

- PT Gudang Garam TBK.: (Million Rupiah) 2005 2006 2007Dokument2 SeitenPT Gudang Garam TBK.: (Million Rupiah) 2005 2006 2007patriaNoch keine Bewertungen

- Reports 6Dokument18 SeitenReports 6Asad ZamanNoch keine Bewertungen

- Financial Position of The Engro FoodsDokument2 SeitenFinancial Position of The Engro FoodsJaveriarehanNoch keine Bewertungen

- 2Q10 ITR Free Translation FIBRIADokument74 Seiten2Q10 ITR Free Translation FIBRIAFibriaRINoch keine Bewertungen

- CMNPDokument2 SeitenCMNPIsni AmeliaNoch keine Bewertungen

- Ashok Leyland Annual Report 2012 2013Dokument108 SeitenAshok Leyland Annual Report 2012 2013Rajaram Iyengar0% (1)

- IBF Term ReportDokument12 SeitenIBF Term ReportSaad A MirzaNoch keine Bewertungen

- ICI Pakistan Limited: Balance SheetDokument28 SeitenICI Pakistan Limited: Balance SheetArsalan KhanNoch keine Bewertungen

- PTI Financial Statement For Financial Year 2013-14Dokument7 SeitenPTI Financial Statement For Financial Year 2013-14PTI Official100% (3)

- Letter To Shareholders and Financial Results September 2012Dokument5 SeitenLetter To Shareholders and Financial Results September 2012SwamiNoch keine Bewertungen

- TcidDokument2 SeitenTciddennyaikiNoch keine Bewertungen

- AFS Project RemianingDokument16 SeitenAFS Project RemianingmustafakarimNoch keine Bewertungen

- Kingsbury AR - 2012 PDFDokument52 SeitenKingsbury AR - 2012 PDFSanath FernandoNoch keine Bewertungen

- Bextex LTD Report (Ratio Analysis)Dokument17 SeitenBextex LTD Report (Ratio Analysis)Mahbubur Rahman100% (3)

- Kraft Australia HoldingsDokument9 SeitenKraft Australia HoldingsVarun GuptaNoch keine Bewertungen

- Ghani Glass10Dokument67 SeitenGhani Glass10Aamir Inam BhuttaNoch keine Bewertungen

- Financial ComparisonDokument2 SeitenFinancial ComparisonSushil ShresthaNoch keine Bewertungen

- FABM Globe PaperDokument18 SeitenFABM Globe PaperJulian AlbaNoch keine Bewertungen

- ACT310Dokument9 SeitenACT310limon islamNoch keine Bewertungen

- Annual Financial Statements 2007Dokument0 SeitenAnnual Financial Statements 2007hyjulioNoch keine Bewertungen

- Enterprise Valuation of BEACON Pharmaceuticals Limited: Submitted ToDokument35 SeitenEnterprise Valuation of BEACON Pharmaceuticals Limited: Submitted ToMD.Thariqul Islam 1411347630Noch keine Bewertungen

- Strabag 2010Dokument174 SeitenStrabag 2010MarkoNoch keine Bewertungen

- Pawn Shop Revenues World Summary: Market Values & Financials by CountryVon EverandPawn Shop Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryVon EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Tobacco Manufactures: Ranking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)Dokument1 SeiteTobacco Manufactures: Ranking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)IshidaUryuuNoch keine Bewertungen

- Adhesive PDFDokument1 SeiteAdhesive PDFIshidaUryuuNoch keine Bewertungen

- Cement: Ranking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)Dokument1 SeiteCement: Ranking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)IshidaUryuuNoch keine Bewertungen

- Securities: Ranking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)Dokument1 SeiteSecurities: Ranking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)IshidaUryuuNoch keine Bewertungen

- Stone, Clay, Glass and Concrete Products: Ranking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)Dokument1 SeiteStone, Clay, Glass and Concrete Products: Ranking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)IshidaUryuuNoch keine Bewertungen

- Directory 2011Dokument88 SeitenDirectory 2011Davit Pratama Putra KusdiatNoch keine Bewertungen

- JPRS - Icmd 2009 (B11)Dokument4 SeitenJPRS - Icmd 2009 (B11)IshidaUryuuNoch keine Bewertungen

- Indr - Icmd 2009 (B04)Dokument4 SeitenIndr - Icmd 2009 (B04)IshidaUryuuNoch keine Bewertungen

- Myrx - Icmd 2009 (B04)Dokument4 SeitenMyrx - Icmd 2009 (B04)IshidaUryuuNoch keine Bewertungen

- PT Ever Shine Tex TBK.: Summary of Financial StatementDokument2 SeitenPT Ever Shine Tex TBK.: Summary of Financial StatementIshidaUryuuNoch keine Bewertungen

- Bima PDFDokument2 SeitenBima PDFIshidaUryuuNoch keine Bewertungen

- PT Nusantara Inti Corpora TBKDokument2 SeitenPT Nusantara Inti Corpora TBKIshidaUryuuNoch keine Bewertungen

- PT Chandra Asri Petrochemical TBKDokument2 SeitenPT Chandra Asri Petrochemical TBKIshidaUryuuNoch keine Bewertungen

- YpasDokument2 SeitenYpasIshidaUryuuNoch keine Bewertungen

- Adhesive PDFDokument1 SeiteAdhesive PDFIshidaUryuuNoch keine Bewertungen

- Cables: Ranking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)Dokument1 SeiteCables: Ranking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)IshidaUryuuNoch keine Bewertungen

- Animal FeedDokument1 SeiteAnimal FeedIshidaUryuuNoch keine Bewertungen

- Construction: Ranking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)Dokument1 SeiteConstruction: Ranking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)IshidaUryuuNoch keine Bewertungen

- Ranking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)Dokument1 SeiteRanking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)IshidaUryuuNoch keine Bewertungen

- Automotive and Allied Products: Ranking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)Dokument1 SeiteAutomotive and Allied Products: Ranking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)IshidaUryuuNoch keine Bewertungen

- Agriculture PDFDokument1 SeiteAgriculture PDFIshidaUryuuNoch keine Bewertungen

- UnvrDokument2 SeitenUnvrIshidaUryuuNoch keine Bewertungen

- AbbaDokument2 SeitenAbbaIshidaUryuuNoch keine Bewertungen

- PT Unitex TBK.: Summary of Financial StatementDokument2 SeitenPT Unitex TBK.: Summary of Financial StatementIshidaUryuuNoch keine Bewertungen

- PT Kalbe Farma TBK.: Summary of Financial StatementDokument2 SeitenPT Kalbe Farma TBK.: Summary of Financial StatementIshidaUryuuNoch keine Bewertungen

- VoksDokument2 SeitenVoksIshidaUryuuNoch keine Bewertungen

- YpasDokument2 SeitenYpasIshidaUryuuNoch keine Bewertungen

- PT Multi Bintang Indonesia TBK.: Summary of Financial StatementDokument2 SeitenPT Multi Bintang Indonesia TBK.: Summary of Financial StatementIshidaUryuuNoch keine Bewertungen

- Study of Risk Perception and Potfolio Management of Equity InvestorsDokument58 SeitenStudy of Risk Perception and Potfolio Management of Equity InvestorsAqshay Bachhav100% (1)

- 1303南亞 1091210 NomuraDokument9 Seiten1303南亞 1091210 NomuraDeron LaiNoch keine Bewertungen

- Understanding The Gold Silver RatioDokument7 SeitenUnderstanding The Gold Silver RatioVIKAS ARORANoch keine Bewertungen

- Maraston Marble Corporation Is Considering A Merger With The ConDokument1 SeiteMaraston Marble Corporation Is Considering A Merger With The ConAmit Pandey0% (1)

- Sec.15 - IFRS For SME'sDokument11 SeitenSec.15 - IFRS For SME'sDan danNoch keine Bewertungen

- Complete Trading Journal For ShareDokument3 SeitenComplete Trading Journal For ShareHaslina Mohd SallehNoch keine Bewertungen

- 01 Valuation ModelsDokument24 Seiten01 Valuation ModelsMarinaGorobeţchiNoch keine Bewertungen

- 24Dokument3 Seiten24Abhishek AgrawalNoch keine Bewertungen

- Global M A Activity Latest BCG Perpsective 1569564066Dokument36 SeitenGlobal M A Activity Latest BCG Perpsective 1569564066l0ngj0hnsilv3rNoch keine Bewertungen

- AP Preweek (B44)Dokument62 SeitenAP Preweek (B44)LeiNoch keine Bewertungen

- 123trading BooksDokument200 Seiten123trading Booksrajesh bhosale33% (3)

- ChennaiDokument41 SeitenChennaiJAJNoch keine Bewertungen

- Marcellus CCP DirectDokument32 SeitenMarcellus CCP DirectSuyash BhiseNoch keine Bewertungen

- Depreciation Is A Term Used Reference To TheDokument14 SeitenDepreciation Is A Term Used Reference To TheMuzammil IqbalNoch keine Bewertungen

- NVCA Yearbook 2012Dokument122 SeitenNVCA Yearbook 2012Justin GuoNoch keine Bewertungen

- Transaction Request For Purchase / Switch / Redemption: Key Partner / Distributor InformationDokument1 SeiteTransaction Request For Purchase / Switch / Redemption: Key Partner / Distributor Informationvinodmapari105Noch keine Bewertungen

- General Motors Transactional Translational ExposuresDokument5 SeitenGeneral Motors Transactional Translational ExposuresRaghavendra Somasundaram100% (3)

- Investment in Associate-HandoutDokument9 SeitenInvestment in Associate-HandoutPhoeza Espinosa VillanuevaNoch keine Bewertungen

- Ethics in PracticeDokument14 SeitenEthics in PracticedanielktingNoch keine Bewertungen

- Banking Sector Reforms - Narasimham Committee - Main RecommendationsDokument13 SeitenBanking Sector Reforms - Narasimham Committee - Main RecommendationsSakthirama Vadivelu0% (1)

- All The Primary Dealers (PDS) in Government Securities MarketDokument3 SeitenAll The Primary Dealers (PDS) in Government Securities MarketPrasad NayakNoch keine Bewertungen

- 12 Capital Budgeting v2Dokument4 Seiten12 Capital Budgeting v2Celine GalvezNoch keine Bewertungen

- 1 An Introduction Investing and ValuationDokument19 Seiten1 An Introduction Investing and ValuationEmmeline ASNoch keine Bewertungen

- 2point2 Capital - Investor Update Q1 FY22Dokument6 Seiten2point2 Capital - Investor Update Q1 FY22Anil GowdaNoch keine Bewertungen

- Solution Maf503 - Jan 2018Dokument8 SeitenSolution Maf503 - Jan 2018anis izzatiNoch keine Bewertungen

- Cases in Finance 3rd Edition Demello Solutions ManualDokument8 SeitenCases in Finance 3rd Edition Demello Solutions ManualCindyCurrydwqzr100% (85)

- Fabm Week 2 FinalsDokument8 SeitenFabm Week 2 FinalsDaniella Dela Peña100% (1)

- 5 - Phuket Beach Hotel FCF SolutionDokument11 Seiten5 - Phuket Beach Hotel FCF SolutionpayalkhndlwlNoch keine Bewertungen

- Business Plan GuidelinesDokument2 SeitenBusiness Plan GuidelinesJeankoreanaNoch keine Bewertungen