Beruflich Dokumente

Kultur Dokumente

FDI India Foreign Direct Investment Approval

Hochgeladen von

Jhunjhunwalas Digital Finance & Business Info LibraryCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

FDI India Foreign Direct Investment Approval

Hochgeladen von

Jhunjhunwalas Digital Finance & Business Info LibraryCopyright:

Verfügbare Formate

India FDI Foreign Direct Investment Approval

Dated 08-October-2013

Government Approves three Proposals of Foreign Direct Investment (FDI) Amounting to about Rs. 38.09 Crore

Further to para 9 of the Press Release dated August 6, 2013, wherein it was stated that decision on the six (6) proposals will be communicated separately, the Central Government has approved three (3) proposals of Foreign Direct Investment (FDI) amounting to Rs. 38.09 crore approximately.

Following three (3) proposals have been approved:

Sl. No.

Name of the applicant

Particulars of the proposal

FDI/NRI inflows (Rs. in crore)

1 M/s Migatronic India Post-Facto approval for setting-up a WoS foreign owned Private Limited, Chennai welding equipment company. 2 M/s Franklin Templeton A WoS foreign owned Asset Management Company to Asset Management act as an investment manager to various AIFs and to (India) Pvt. Ltd., Mumbai contribute the mandatory amounts specified under the SEBI (AIF) Regulations. 3 M/s Equitas Holdings Pvt. Increase in FDI percentage in an investing company by Ltd. way of transfer of shares from Resident to Non-resident shareholders.

The following two (2) proposals have been deferred:

2.00 (already brought in)

Nil

36.09

Sl. No

Name of the applicant

Particulars of the proposal

Castleton Investment Ltd., Mauritius; M/s GlaxoSmithKline Pte Ltd., Singapore M/s Eurecat India Catalyst Services Pvt. Ltd., Gujarat

NR to NR transfer of shares between the foreign promoter group companies of an Indian pharma company.

Capitalisation of payments made by foreign collaborator for securing lease of plot of land for its subsidiary in India in a company engaged in the business of catalysts used in oil and petrochemical plants.

The following one (01) proposal was withdrawn by the applicant: Sl. Name of the applicant No 1 M/s IL&FS Securities Services Ltd. Particulars of the proposal Merger of two Indian companies with the approval of Honble High Court Mumbai. The companies have some FDI and amongst the activities are those not included in the FDI policy.

Ministry of Finance Release 08-October-2013 14:46 IST

India FDI Foreign Direct Investment Approval

Dated 27-September-2013

LIST of FDI Approvals , Deferred , Rejected , Automatic Route , Withdrawn , Abeyance

Government Approves Fifteen (15) Proposals of Foreign Direct Investment Amounting to About Rs. 2000.49 Crore

Based on the recommendations of Foreign Investment Promotion Board (FIPB) in its meeting held on August 27, 2013, the Central Government has approved 15 proposals of Foreign Direct Investment (FDI) amounting to Rs. 2000.49 crore approximately. In addition, two proposals viz., M/s IDFC Trustee Company Ltd., as proposed Trustee for India Infrastructure Fund II, Mumbai and M/s Mylan Inc. USA amounting to Rs.10668.00 crore, have been recommended for consideration of Cabinet Committee on Economic Affairs (CCEA). Details of proposals considered in the Foreign Investment Promotion Board (FIPB) Meeting held on 27th August, 2013 : Following 15 (Fifteen) proposals have been approved :

Sl. Name of the applicant No.

Particulars of the proposal

FDI/NRI inflows (Rs. In crore)

M/s Grupo Massimo Dutti S.A., Spain proposes to form a JV in India to engage in retail trading of Massimo Duttibrand clothing, apparel, footwear, accessories, fragrances and cosmetic products. 2 M/s Michelin India An LLP with 99% FDI is proposed to be set up in tyreTamil Nadu Tyres Pvt. related R&D and testing by a Swiss Company Ltd., Tamil Nadu investing in Michelin tyre companies. 3 M/s Universal Salvage M/s Universal Salvage Ltd., proposes to set up an LLP Limited, England with 99.999% FDI in its own business domain of provision of auctioneering services of total loss/ used/damaged vehicles. 4 M/s Deep Care Health Fresh issue of 40% equity shares in an existing Pharma Pvt. Ltd., Gujarat Company, M/s Deep Care Health Private Limited to a foreign investor, M/s Rohto Pharmaceutical Company Limited, Japan for product diversification. 5 M/s Jubilant Pharma M/s Jubilant Pharma Pte Ltd, Singapore has sought Pte Ltd., Singapore approval for setting up a wholly owned subsidiary in India, which will engage in brownfield pharma activities. 6 M/s Laurus Labs Pvt. M/s Laurus Labs Private Limited, Hyderabad, a Ltd., Hyderabad foreign owned and controlled Indian company proposes to acquire shares held by two non-resident entities in an existing pharma company, M/s Viziphar Biosciences Private Limited. 7 M/s Premier Medical A brownfield Pharma company proposes infusion of Corporation Limited, further capital from its existing foreign investor. Mumbai 8 M/s Advanced Enzyme M/s Advanced Enzymes Technologies Limited, an Technologies Ltd., existing Pharma Company, proposes to receive foreign Mumbai investment pursuant to an IPO and an offer for sale. 9 M/s Ferring M/s Ferring BV (Foreign company) proposes to infuse Pharmaceuticals Pvt. additional capital into M/s Ferring Therapeutics Pvt. Ltd. Ltd. through its 100 % subsidiary M/s Ferring Pharmaceuticals Pvt. Ltd. 10 M/s Pama Machine M/s PAMA Machine Tools India Pvt. Ltd., a heavy Tools India Pvt. Ltd., engineering sector company, has sought post facto New Delhi approval for issuance of partly paid up shares to its foreign parent, M/s PAMA Spa, Italy. 11 M/s Axiom Consulting Approval has been sought for issue of shares at a prePvt. Ltd. agreed priceof an IT company to a director who is a foreign national. 12 M/s Endeka Ceramics M/s Endeka Ceramics India Private Limited, India Pvt. Ltd., Karnataka is a WOS of M/s Endeka Ceramics Holding Bangalore 1 SLU, Spain. It proposes to issue Compulsory Convertible Preference Shares (CCPS) in lieu of its parent meeting the expenses of its offshore bank

1 M/s Grupo Massimo Dutti, S.A.

2.13

0.049

6.38 ($ 9,99,990)

15.33

1145.10

0.45

90.00

200.00

48.90

0.77

0.19

Nil

guarantees being invoked. 13 M/s Fresenius Kabi India Private Limited 14 M/s Symbiotec Pharmalab Limited, Madhya Pradesh 15 M/s Lotus Surgical Specialities Private Limited, Mumbai M/s Fresenius Kabi India Private Limited, an existing pharma company proposes to issue equity shares to Fresenius Kabi AG, Germany, its parent company. An existing pharma sector company proposes to transfer and issue equity shares upto a maximum of 70.86% to a foreign company. M/s Lotus Surgical Specialities Private Limited, an investing company proposed to issue/transfer of shares to M/s Samara Capital Partners Fund II Limited (foreign investor) and make downstream investment in M/s Lotus Surgical Private Limited.

35.00

306.19

150.00

The following10 (Ten) proposals have been deferred : Sl. Name of the Particulars of the proposal No applicant 1 M/s XeoInfosoft Pvt. A software consultancy Company proposes to grant 50% ownership of Ltd., Bangalore equity to a Bangladeshi IT professional in order to tap his expertise. 2 M/s Australia Asia M/s Australia Asia Resources LLC, USA proposes to set up an LLP to Resources LLP, USA carry out marketing and technical support services for sale of thermal and metallurgical coals and related commodities. 3 M/s Marketvistas M/s Marketvistas Consumer Insights Private Limited, Mumbai, the Consumer Insights Investee company, engaged in market research has sought post-facto Pvt. Ltd., approval for issuance of partly paid up shares to M/s Rewhyer Limited, (SoniyaMahajani), UK. Mumbai 4 M/s JM Financial M/s JM Financial Limited, an Indian Core Investment company Limited, Mumbai proposes to issue warrants to Mr. Vikram Shankar Pandit, an NRI, on a preferential basis. 5 M/s OriflameIndia Post facto approval has been sought by M/s Oriflame India Pvt Ltd for Pvt Ltd amalgamation with its own group company M/s Silver Oak Laboratories Pvt Ltd, both involved in direct marketing of cosmetics and toiletries. 6 M/s P5 Asia Holding The applicant, a NR entity proposes to purchase 50% of the shares in Investments an existing broadcasting company with 100% FDI, from another (Mauritius) Limited, existing NR investor. Mauritius 7 M/s HBO India Pvt. An Indian company, viz., M/s HBO India Pvt. Ltd, New Delhi having Ltd., New Delhi foreign investment proposes to engage in the activities of down-linking non-news and current affairs television channels.

8 M/s INX Music Pvt. Ltd., Mumbai

M/s INX Music Private Limited, a company which aggregates and distributes music content for TV channels, having 70.85% indirect foreign investment proposes to undertake the additional activity of broadcasting of non-news and current affairs channels. The Coca-Cola Holding company in India, which is fully foreign owned, is seeking post-facto approval for FDI inducted in the holding company during 2010-2011. A NR company proposes to transfer its holding in an Indian Infrastructure company to its own group company before the completion of the 3 year lock-in-period.

9 M/s Hindustan CocaCola Holdings Pvt. Ltd. 10 M/s Dhanlaxmi Infrastructure Pvt. Ltd., Gujarat

The following 3 (Three) proposals have been rejected : Sl. No Name of the applicant Particulars of the proposal

1 M/s Rational M/s Rational Resources Ltd., Malta proposes to set up a WoS in India Resources Ltd., Malta to support adapting and localising land-based, mobile and online poker game. 2 M/s India- Pacific M/s India- Pacific Alliance Pvt Ltd has sought post facto approval for Alliance Pvt. Ltd., issuance of shares to Pacific Alliance Capital Group, USA against preMumbai operative expenses borne by its erstwhile group company, M/s Pacific Alliance International. 3 M/s Financial M/s Financial Software and Systems Private Limited, an Indian software and Systems financial software transaction processing solutions company, having Pvt. Ltd., Chennai 43.56% FDI proposes to engage in the additional activity of setting up, owning and operating White Label ATMs.

The following 3 (Three) proposals have been advised to access automatic route: Sl. No Name of the applicant Particulars of the proposal FDI/NRI inflows (Rs.in crore) 0.26

1 M/s Quest Global M/s Quest Global Defence Engineering Services Pvt Defence Engineering Ltd, Bengaluru (Investee Company) proposes to issue Services Pvt. Ltd., 26% equity to M/s Quest Global Services Pte Ltd.

Bengaluru

(foreign investor) to engage in defence-related IT and ITES engineering services. 2.5

2 M/s Boeing Cyprus M/s Boeing Cyprus Holdings Ltd, Cyprus proposes to Holdings Ltd., Cyprus form a WoS in India, to engage in technical and consultancy services in the defence sector. 3 M/s Eurocopter India M/s Eurocopter India Private Limited, a WoS of the Pvt. Ltd. (FC.II: French helicopter manufacturer, having obtained FC 86/2012) approval for 100% FDI in helicopter-related IT services, requests for deletion of two of the conditions mentioned in FC approval which were imposed as their clients included defence sector clients.

Nil

The following 02 (Two) proposals were withdrawn: Sl. No. Name of the applicant

1 M/s Aluchem Inc., USA 2 M/s Metalsa India Pvt. Ltd., New Delhi

The following 02 (Two) proposals have been recommended for the consideration of CCEA, as the investment involved in the proposals is above Rs.1200.00 crore: Sl. No Name of the applicant Particulars of the proposal FDI/NRI inflows (Rs. in crore)

1 M/s IDFC Trustee Company Ltd. As Proposed Trustee for India Infrastructure Fund II, Mumbai 2 M/s Mylan Inc. USA

An Indian company (M/s IDFC Trustee Company Ltd.) has sought approval to set up an AIF category I and for receiving contributions from international investors.

5500.00

A major US pharma group having Indian subsidiaries proposes to acquire another Indian pharma company engaged in manufacture of generic pharmaceutical products.

5168.00

Decision in the following 1 (One) proposal has been kept in abeyance : Sl. Name of the applicant Particulars of the proposal No 1 M/s Cardolite Specialty Conversion of a wholly foreign owned Indian Company into an LLP Chemicals India Pvt. to be engaged in making industrial products using cashew nutshell Ltd., Chennai liquid technology, followed by further infusion of capital. Ministry of Finance released 27-September-2013 17:53 IST

******

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- MSMEs or Micro Small and Medium Enterprses Share in India Exports 2013-2014Dokument4 SeitenMSMEs or Micro Small and Medium Enterprses Share in India Exports 2013-2014Jhunjhunwalas Digital Finance & Business Info LibraryNoch keine Bewertungen

- India's Coal Reserves To Last 100 YearsDokument3 SeitenIndia's Coal Reserves To Last 100 YearsJhunjhunwalas Digital Finance & Business Info LibraryNoch keine Bewertungen

- #IndiaStockExchange #BSE Update On 24th June 2015Dokument2 Seiten#IndiaStockExchange #BSE Update On 24th June 2015Jhunjhunwalas Digital Finance & Business Info LibraryNoch keine Bewertungen

- India's Wheat Production From 2010 To 2014Dokument4 SeitenIndia's Wheat Production From 2010 To 2014Jhunjhunwalas Digital Finance & Business Info LibraryNoch keine Bewertungen

- India's Crude Steel Production Estimate For 2014 To 2017Dokument3 SeitenIndia's Crude Steel Production Estimate For 2014 To 2017Jhunjhunwalas Digital Finance & Business Info LibraryNoch keine Bewertungen

- India Crude Steel Production From 2011-2014Dokument4 SeitenIndia Crude Steel Production From 2011-2014Jhunjhunwalas Digital Finance & Business Info LibraryNoch keine Bewertungen

- India's Per Capita Food Grain For 2014Dokument3 SeitenIndia's Per Capita Food Grain For 2014Jhunjhunwalas Digital Finance & Business Info LibraryNoch keine Bewertungen

- Foreign Direct Investment in Equity Market in IndiaDokument4 SeitenForeign Direct Investment in Equity Market in IndiaJhunjhunwalas Digital Finance & Business Info LibraryNoch keine Bewertungen

- India Coir Trade From April To October 2014Dokument4 SeitenIndia Coir Trade From April To October 2014Jhunjhunwalas Digital Finance & Business Info LibraryNoch keine Bewertungen

- India's Diamond Reserves With Diamond Trade Update For 2014Dokument6 SeitenIndia's Diamond Reserves With Diamond Trade Update For 2014Jhunjhunwalas Digital Finance & Business Info LibraryNoch keine Bewertungen

- Foreign Institutional Investors Investment in India During 2014-15 Until 27th November 2014Dokument3 SeitenForeign Institutional Investors Investment in India During 2014-15 Until 27th November 2014Jhunjhunwalas Digital Finance & Business Info LibraryNoch keine Bewertungen

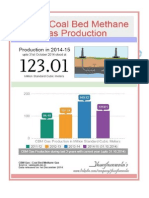

- India's Coal Bed Methane Production For Last 3 Years With Current Year 2014-15 (Upto 31 Oct 2014)Dokument3 SeitenIndia's Coal Bed Methane Production For Last 3 Years With Current Year 2014-15 (Upto 31 Oct 2014)Jhunjhunwalas Digital Finance & Business Info LibraryNoch keine Bewertungen

- India's UREA Trade On 2013-14 and 2014-15 Up To November 2014.Dokument3 SeitenIndia's UREA Trade On 2013-14 and 2014-15 Up To November 2014.Jhunjhunwalas Digital Finance & Business Info LibraryNoch keine Bewertungen

- India's Rice Trade For 2014Dokument5 SeitenIndia's Rice Trade For 2014Jhunjhunwalas Digital Finance & Business Info LibraryNoch keine Bewertungen

- India's Coal Production For Last 5 Years Upto October 2014Dokument2 SeitenIndia's Coal Production For Last 5 Years Upto October 2014Jhunjhunwalas Digital Finance & Business Info LibraryNoch keine Bewertungen

- Commercially Operating Nuclear Reactors in The World at The End of 2013Dokument4 SeitenCommercially Operating Nuclear Reactors in The World at The End of 2013Jhunjhunwalas Digital Finance & Business Info LibraryNoch keine Bewertungen

- India's Import and Export Update For September and December 2014Dokument16 SeitenIndia's Import and Export Update For September and December 2014Jhunjhunwalas Digital Finance & Business Info LibraryNoch keine Bewertungen

- India's Methane Hydrates Reserves 25th November 2014Dokument3 SeitenIndia's Methane Hydrates Reserves 25th November 2014Jhunjhunwalas Digital Finance & Business Info LibraryNoch keine Bewertungen

- Indians Railways Revenue Earnings With Freight Traffic During April To October 2014Dokument18 SeitenIndians Railways Revenue Earnings With Freight Traffic During April To October 2014Jhunjhunwalas Digital Finance & Business Info LibraryNoch keine Bewertungen

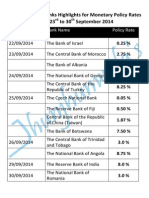

- Global Central Banks Highlights For Monetary Policy Rates For October 2014Dokument31 SeitenGlobal Central Banks Highlights For Monetary Policy Rates For October 2014Jhunjhunwalas Digital Finance & Business Info LibraryNoch keine Bewertungen

- Foreign Investment Promotion Board Approves 12 Proposals of Foreign Direct Investment in India As On 19th December 2014Dokument27 SeitenForeign Investment Promotion Board Approves 12 Proposals of Foreign Direct Investment in India As On 19th December 2014Jhunjhunwalas Digital Finance & Business Info LibraryNoch keine Bewertungen

- India's Kharif and Rabi Crops Area Coverage For October and January 2014Dokument10 SeitenIndia's Kharif and Rabi Crops Area Coverage For October and January 2014Jhunjhunwalas Digital Finance & Business Info LibraryNoch keine Bewertungen

- India's Mineral Production in Month of August 2014Dokument3 SeitenIndia's Mineral Production in Month of August 2014Jhunjhunwalas Digital Finance & Business Info LibraryNoch keine Bewertungen

- Fuel Price Change For Petrol, Diesel, and JetFuel in IndiaDokument11 SeitenFuel Price Change For Petrol, Diesel, and JetFuel in IndiaJhunjhunwalas Digital Finance & Business Info LibraryNoch keine Bewertungen

- India's Tourism Sector Performance For January and October 2014Dokument15 SeitenIndia's Tourism Sector Performance For January and October 2014Jhunjhunwalas Digital Finance & Business Info LibraryNoch keine Bewertungen

- India's Index of Eight Core Industries From June To November 2014Dokument57 SeitenIndia's Index of Eight Core Industries From June To November 2014Jhunjhunwalas Digital Finance & Business Info Library100% (1)

- India Tax Collection From April To November 2014Dokument11 SeitenIndia Tax Collection From April To November 2014Jhunjhunwalas Digital Finance & Business Info LibraryNoch keine Bewertungen

- India 'S Total Kharif Crop Sowing Area As On July and August 2014Dokument6 SeitenIndia 'S Total Kharif Crop Sowing Area As On July and August 2014Jhunjhunwalas Digital Finance & Business Info LibraryNoch keine Bewertungen

- Global Central Banks Highlights For Monetary Policy Rates From 23rd To 30th September 2014Dokument11 SeitenGlobal Central Banks Highlights For Monetary Policy Rates From 23rd To 30th September 2014Jhunjhunwalas Digital Finance & Business Info LibraryNoch keine Bewertungen

- Indian Currency Rupee Exchange Rate of 19 Foreign Currencies Relating To Import and Export Goods From July To September 2014Dokument5 SeitenIndian Currency Rupee Exchange Rate of 19 Foreign Currencies Relating To Import and Export Goods From July To September 2014Jhunjhunwalas Digital Finance & Business Info LibraryNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Account Statement 12-10-2023T22 26 37Dokument1 SeiteAccount Statement 12-10-2023T22 26 37muawiyakhanaNoch keine Bewertungen

- Introduction to Accounting EquationDokument1 SeiteIntroduction to Accounting Equationcons theNoch keine Bewertungen

- Human Resource Management: Unit - IDokument6 SeitenHuman Resource Management: Unit - IpavanstvpgNoch keine Bewertungen

- Labour Law Notes GeneralDokument55 SeitenLabour Law Notes GeneralPrince MwendwaNoch keine Bewertungen

- Merrill Lynch Financial Analyst BookletDokument2 SeitenMerrill Lynch Financial Analyst Bookletbilly93Noch keine Bewertungen

- An Evaluation of The Customers' Satisfaction of Social Islami Bank Limited: A Study On Savar Branch Submitted ToDokument44 SeitenAn Evaluation of The Customers' Satisfaction of Social Islami Bank Limited: A Study On Savar Branch Submitted ToHafiz Al AsadNoch keine Bewertungen

- 2020 Specimen Paper 1Dokument10 Seiten2020 Specimen Paper 1mohdportmanNoch keine Bewertungen

- 264354822072023INDEL4SB22220720231808Dokument9 Seiten264354822072023INDEL4SB22220720231808tsmlaserdelhiNoch keine Bewertungen

- Fa Ii. ObjDokument5 SeitenFa Ii. ObjSonia ShamsNoch keine Bewertungen

- As and Guidance NotesDokument94 SeitenAs and Guidance NotesSivasankariNoch keine Bewertungen

- Question Paper Mba 2018Dokument15 SeitenQuestion Paper Mba 2018Karan Veer SinghNoch keine Bewertungen

- Banking License ApplicationDokument22 SeitenBanking License ApplicationFrancNoch keine Bewertungen

- Valuation of BondsDokument7 SeitenValuation of BondsHannah Louise Gutang PortilloNoch keine Bewertungen

- Company Registration in EthiopiaDokument121 SeitenCompany Registration in Ethiopiadegu kassaNoch keine Bewertungen

- Eo 398-2005 PDFDokument2 SeitenEo 398-2005 PDFDalton ChiongNoch keine Bewertungen

- 333333Dokument3 Seiten333333Levi OrtizNoch keine Bewertungen

- Motivation Letter MoibDokument2 SeitenMotivation Letter MoibMeheret AshenafiNoch keine Bewertungen

- Estimating Air Travel Demand Elasticities Final ReportDokument58 SeitenEstimating Air Travel Demand Elasticities Final Reportch umairNoch keine Bewertungen

- 4 Novozymes - Household - Care - Delivering Bioinnovation PDFDokument7 Seiten4 Novozymes - Household - Care - Delivering Bioinnovation PDFtmlNoch keine Bewertungen

- Adjudication Order in Respect of Brooks Laboratories Ltd. and Others in The Matter of IPO of Brooks Laboratories LTDDokument40 SeitenAdjudication Order in Respect of Brooks Laboratories Ltd. and Others in The Matter of IPO of Brooks Laboratories LTDShyam SunderNoch keine Bewertungen

- Barriers To Entry: Resilience in The Supply ChainDokument3 SeitenBarriers To Entry: Resilience in The Supply ChainAbril GullesNoch keine Bewertungen

- Tesalt India Private LimitedDokument16 SeitenTesalt India Private LimitedSaiganesh JayakaranNoch keine Bewertungen

- FFCDokument17 SeitenFFCAmna KhanNoch keine Bewertungen

- Online Banking and E-Crm Initiatives A Case Study of Icici BankDokument4 SeitenOnline Banking and E-Crm Initiatives A Case Study of Icici BankMani KrishNoch keine Bewertungen

- CRM Industry LandscapeDokument26 SeitenCRM Industry LandscapeAdityaHridayNoch keine Bewertungen

- Etr Template ExampleDokument56 SeitenEtr Template ExampleNur Fadhlin SakinaNoch keine Bewertungen

- Customer Journey MappingDokument10 SeitenCustomer Journey MappingpradieptaNoch keine Bewertungen

- Unit 12: MARKETING: Section 1: Reading Pre-Reading Tasks Discussion - Pair WorkDokument6 SeitenUnit 12: MARKETING: Section 1: Reading Pre-Reading Tasks Discussion - Pair WorkChân ÁiNoch keine Bewertungen

- Orange Book 2nd Edition 2011 AddendumDokument4 SeitenOrange Book 2nd Edition 2011 AddendumAlex JeavonsNoch keine Bewertungen

- Running Head: Ethical and Legal Principles On British AirwaysDokument8 SeitenRunning Head: Ethical and Legal Principles On British AirwaysDyya EllenaNoch keine Bewertungen