Beruflich Dokumente

Kultur Dokumente

1CO2200A1008

Hochgeladen von

jotham_sederstr7655Originalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

1CO2200A1008

Hochgeladen von

jotham_sederstr7655Copyright:

Verfügbare Formate

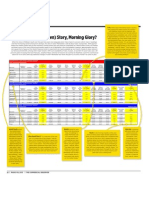

POSTINGS

Manhattan Office Market, Third Quarter 2013

he summer doldrums didnt hit Manhattan during the third quarter, as leasing activity continued to tick upward

in much of the market. Downtown Manhattan was the strongest performer of the citys three major submarkets

during that period, buoyed by healthy leasing in Class B stock and spillover from Midtown South. Tech continues

to be a major driver in all sectors of the market, as growing industry diversification is making up for lack of growth

in the financial services sector. Overall, Manhattan had a pretty good quarter, and thats despite the fact it is the

summer months and the third quarter is not high volume historically, summarized Don Noland, managing director

of research at Cushman & Wakefield. With the help of Mr. Noland and Jim Delmonte, director of research, The

Commercial Observer sheds some light on the third-quarter office market.

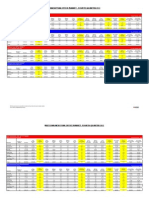

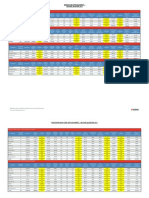

MANHATTAN OFFICE MARKET - THIRD QUARTER 2013

24%

$37: With rents for Class B space in

MANHATTAN OFFICE MARKET

Class A Statistical Summary

Number of

Buildings

Inventory

Total

Available

Space

Midtown

324

182,927,081

22,181,044

Midtown South

29

15,601,758

1,212,918

Submarket

Downtown

Totals

Midtown South approaching an average

of $60 per square foot, tenants are

searching out value elsewhere, including

Downtown, where Class B rental rates

Y-o-Y

Direct

average $37

per squareSublease

foot. Tech Direct

% Change

Available

Available

Vacancy

tenants

typically

Class B, so Rate

Space look atSpace

some of the overspill from Midtown

9.9%

17,642,375 to look

4,538,669

South is starting

downtown, 9.6%

92.8%

981,248

231,670

6.3%

Mr. Delmonte

said. MANHATTAN

Sublease

Vacancy

Rate

2.5%

1.5%

OFFICE

1.3%

: Year over year, leasing is up

more than 24 percent in Class A, putting

the market on track to outperform 2012 in

leasing activityand, as a consequence,

renewals are down. Renewals overall were

Total

Direct

Total

down

a little bitY-o-Y

from previous

quarters,Sublease

Vacancy

% Pt. Change

Wtd. Avg.

Wtd. Avg.

Wtd. Avg.

which

when

Rate tends to happen

Rentalthere

Rate is Rental Rate

Rental Rate

positive activity in the leasing market, Mr.

12.1% said. What

1.0% we have$74.77

$72.99

Noland

seen is that$61.04

7.8% are executing

3.4%

$81.73

$50.70

tenants

longer-term

leases.

MARKET

- THIRD

QUARTER

2013 $74.55

580,840

: The absorption rate in the Downtown

market is attributable to a number of larger transactions

that took place during the third quarter, including

220,000 square feet leased to New York Citys Third

Health

and 2013

Quarter

Hospitals Corporation at 55 Water Street. Downtown

Year-to-Date

Y-o-Y

Year-to-Date

Year-to-Date

wasY-o-Y

the best performer

of the

three major

markets with

% Change

Leasing

% Change

Direct Absorption

Total Absorption

healthy

in Class B andlarger transactions

taking Rate

leasing Activity

Rate

place, Mr. Noland said, adding that many tenants priced

1.7%Midtown9,142,794

29.7% to take(194,918)

out of

South are looking

advantage of(1,111,852)

12.3%value downtown.

692,956

38.9%

13,388

56,511

better

47

47,750,122

6,180,149

43.1%

5,540,319

639,830

11.6%

12.9%

3.8%

$51.65

$33.51

$50.71

12.2%

2,115,979

1.7%

(2,297,550)

(2,391,679)

400

246,278,961

29,574,111

17.7%

24,163,942

5,410,169

9.8%

2.2%

12.0%

1.6%

$69.75

$57.34

$68.40

2.0%

11,951,729

24.1%

(2,479,080)

(3,447,020)

Y-o-Y

% Change

Direct

Available

Space

Sublease

Available

Space

Direct

Vacancy

Rate

Sublease

Vacancy

Rate

Total

Vacancy

Rate

Y-o-Y

% Pt. Change

Direct

Wtd. Avg.

Rental Rate

Sublease

Wtd. Avg.

Rental Rate

Total

Wtd. Avg.

Rental Rate

Y-o-Y

% Change

Year-to-Date

Leasing

Activity

Y-o-Y

% Change

Year-to-Date

Direct Absorption

Rate

Year-to-Date

Total Absorption

Rate

7.1%

9.9%

(253,294)

(194,918)

(382,653)

(1,111,852)

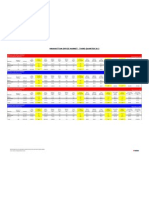

MANHATTAN OFFICE MARKET

Class B

A Statistical Summary

Submarket

Third Quarter 2013

Number of

Buildings

Inventory

Total

Available

Space

43,931,134

182,927,081

4,665,247

22,181,044

Midtown

326

324

4,199,705

17,642,375

465,542

4,538,669

9.6%

1.1%

2.5%

0.8%

1.0%

$49.93

$74.77

$46.00

$61.04

$49.77

$72.99

9.6%

1.7%

1,848,158

9,142,794

-10.1%

29.7%

Midtown South

188

29

29,530,966

15,601,758

2,674,351

1,212,918

36.7%

92.8%

2,369,735

981,248

304,616

231,670

8.0%

6.3%

1.0%

1.5%

9.1%

7.8%

2.4%

3.4%

$59.65

$81.73

$54.69

$50.70

$59.39

$74.55

20.0%

12.3%

1,260,266

692,956

-27.0%

38.9%

(782,120)

13,388

(666,526)

56,511

Downtown

56

47

27,183,015

47,750,122

2,168,747

6,180,149

-27.4%

43.1%

1,807,091

5,540,319

361,656

639,830

6.6%

11.6%

1.3%

8.0%

12.9%

-2.8%

3.8%

$37.00

$51.65

$26.00

$33.51

$36.24

$50.71

4.7%

12.2%

1,686,366

2,115,979

44.7%

1.7%

732,747

(2,297,550)

580,840

(2,391,679)

570

400

100,645,115

246,278,961

9,508,345

29,574,111

2.2%

17.7%

8,376,531

24,163,942

1,131,814

5,410,169

8.3%

9.8%

1.1%

2.2%

9.4%

12.0%

0.3%

1.6%

$49.89

$69.75

$41.95

$57.34

$49.39

$68.40

15.4%

2.0%

4,794,790

11,951,729

-3.1%

24.1%

(302,667)

(2,479,080)

(468,339)

(3,447,020)

Total

Available

Space

Y-o-Y

% Change

Direct

Available

Space

Sublease

Available

Space

Direct

Vacancy

Rate

Sublease

Vacancy

Rate

Total

Vacancy

Rate

Y-o-Y

% Pt. Change

Direct

Wtd. Avg.

Rental Rate

Sublease

Wtd. Avg.

Rental Rate

Total

Wtd. Avg.

Rental Rate

Y-o-Y

% Change

Year-to-Date

Leasing

Activity

Y-o-Y

% Change

Year-to-Date

Direct Absorption

Rate

Totals

10.6%

12.1%

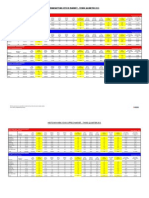

MANHATTAN OFFICE MARKET

Class C

B Statistical Summary

Submarket

Number of

Buildings

Inventory

Third Quarter 2013

Year-to-Date

Total Absorption

Rate

Midtown

150

326

15,815,466

43,931,134

752,437

4,665,247

-6.5%

7.1%

596,226

4,199,705

156,211

465,542

3.8%

9.6%

1.0%

1.1%

4.8%

10.6%

-0.3%

0.8%

$39.71

$49.93

$28.08

$46.00

$39.01

$49.77

4.2%

9.6%

423,373

1,848,158

-29.2%

-10.1%

74,135

(253,294)

(29,065)

(382,653)

Midtown South

214

188

20,156,303

29,530,966

1,092,517

2,674,351

-35.3%

36.7%

895,908

2,369,735

196,609

304,616

4.4%

8.0%

1.0%

5.4%

9.1%

-2.5%

2.4%

$46.18

$59.65

$47.69

$54.69

$46.29

$59.39

5.3%

20.0%

790,180

1,260,266

-11.4%

-27.0%

2,054

(782,120)

(106,933)

(666,526)

Downtown

Totals

72

56

9,923,197

27,183,015

861,094

2,168,747

35.4%

-27.4%

836,085

1,807,091

25,009

361,656

8.4%

6.6%

0.3%

1.3%

8.7%

8.0%

2.5%

-2.8%

$35.10

$37.00

$38.50

$26.00

$35.11

$36.24

10.4%

4.7%

467,168

1,686,366

-35.9%

44.7%

9,442

732,747

15,476

580,840

436

570

45,894,966

100,645,115

2,706,048

9,508,345

-13.5%

2.2%

2,328,219

8,376,531

377,829

1,131,814

5.1%

8.3%

0.8%

1.1%

5.9%

9.4%

-0.7%

0.3%

$40.54

$49.89

$38.97

$41.95

$40.71

$49.39

2.2%

15.4%

1,680,721

4,794,790

-24.2%

-3.1%

85,631

(302,667)

(120,522)

(468,339)

Y-o-Y

% Change

Direct

Available

Space

Sublease

Available

Space

Direct

Vacancy

Rate

Sublease

Vacancy

Rate

Total

Vacancy

Rate

Y-o-Y

% Pt. Change

Direct

Wtd. Avg.

Rental Rate

Sublease

Wtd. Avg.

Rental Rate

Total

Wtd. Avg.

Rental Rate

Y-o-Y

% Change

Year-to-Date

Leasing

Activity

Y-o-Y

% Change

Year-to-Date

Direct Absorption

Rate

Year-to-Date

Total Absorption

Rate

(1,523,570)

(29,065)

MANHATTAN OFFICE MARKET

Overall

Class C Statistical Summary

Submarket

Third Quarter 2013

Number of

Buildings

Inventory

Total

Available

Space

Midtown

800

150

242,673,681

15,815,466

27,598,728

752,437

8.9%

-6.5%

22,438,306

596,226

5,160,422

156,211

9.2%

3.8%

2.1%

1.0%

11.4%

4.8%

0.9%

-0.3%

$69.53

$39.71

$59.69

$28.08

$68.41

$39.01

3.0%

4.2%

11,414,325

423,373

17.6%

-29.2%

(374,077)

74,135

Midtown South

431

214

65,289,027

20,156,303

4,979,786

1,092,517

16.5%

-35.3%

4,246,891

895,908

732,895

196,609

6.5%

4.4%

1.1%

1.0%

7.6%

5.4%

1.1%

-2.5%

$61.26

$46.18

$51.57

$47.69

$60.34

$46.29

22.8%

5.3%

2,743,402

790,180

-12.0%

-11.4%

(766,678)

2,054

(716,948)

(106,933)

Downtown

175

72

84,856,334

9,923,197

9,209,990

861,094

16.0%

35.4%

8,183,495

836,085

1,026,495

25,009

9.6%

8.4%

1.2%

0.3%

10.9%

8.7%

1.5%

2.5%

$46.79

$35.10

$31.31

$38.50

$46.00

$35.11

15.5%

10.4%

4,269,513

467,168

7.4%

-35.9%

(1,555,361)

9,442

(1,795,363)

15,476

1406

436

392,819,042

45,894,966

41,788,504

2,706,048

11.3%

-13.5%

34,868,692

2,328,219

6,919,812

377,829

8.9%

5.1%

1.8%

0.8%

10.6%

5.9%

1.1%

-0.7%

$63.19

$40.54

$54.62

$38.97

$62.51

$40.71

6.3%

2.2%

18,427,240

1,680,721

9.7%

-24.2%

(2,696,116)

85,631

(4,035,881)

(120,522)

Y-o-Y

% Change

Direct

Available

Space

Sublease

Wtd. Avg.

Rental Rate

Total

Wtd. Avg.

to-date

Rental

Rate

Totals

MANHATTAN OFFICE MARKET

Overall Statistical Summary

7.6%

Submarket

Midtown

Midtown South

Downtown

Totals

Total

: Though the vacancy

rate

Available

Number of

in Midtown

South

is up more

than 1

Space

Buildings

Inventory

Third Quarter 2013

percent year over year, New Yorks

800 submarket

242,673,681

27,598,728

8.9%

hottest

continues

to have

431

65,289,027

4,979,786

the lowest

vacancy

rate in the

nation. 16.5%

175

84,856,334

9,209,990

16.0%

Its such a vibrant market right now,

and 1406

rents are 392,819,042

still rising, and

youre still 11.3%

41,788,504

seeing a lot of activity, Mr. Noland said.

I think for the foreseeable future that

will continue to continue to be true.

22,438,306

4,246,891

8,183,495

34,868,692

22|OCTOBER 8, 2013|COMMERCIAL OBSERVER

NOTE: Only space that can be occupied within six months from the end of the current month is included in statistics.

Source: Cushman and Wakefield Research Services

10.6%

Sublease

Direct

: The Vacancy

overall

Available

vacancy

rate in Manhattan

Space

Rate

did tick up 1.1 percent year

9.2%

over 5,160,422

year to 10.6 percent,

732,895

6.5%

influenced

by the large

1,026,495

9.6%

blocks of space being put

on the

markets, including

6,919,812

8.9%

Barclays space at 200 Park

Avenue and 133,000 square

feet at 601 West 26th Street.

Sublease

Vacancy

Rate

2.1%

1.1%

1.2%

1.8%

$60.34

Total

Y-o-Y

:

Vacancy

% Pt. Change

Rate Midtown South

Direct

Rents

in

Wtd. Avg.

continue

Rental Rate

to push higher, up

0.9% year over

$69.53

percent

1.1%

$61.26

year overall

to $60.34

10.9%

1.5%

$46.79

per square foot. The

South market

10.6%Midtown 1.1%

$63.19

continues to tighten, and

rents continue to be very

high, Mr. Noland noted.

11.4%22.8

7.6%

$59.69

$51.57

$31.31

$54.62

18,427,240

Y-o-Y

Year-to-Date

Y-o-Y

: Overall

year- % Change

% Change

Leasing

leasingactivity inActivity

Manhattan

of nearly 18.5 million square feet is

$68.41

3.0%increasing

11,414,325

indicative

of the

power of 17.6%

$60.34

22.8%

2,743,402

the

technology

sector. Weve

seen the-12.0%

$46.00

15.5%

4,269,513

7.4%

financial services industry really be slow

in$62.51

terms of expansion

and

growth in the

6.3%

18,427,240

9.7%

marketplace, but tech has been driving

a lot of what has been happening in

Manhattan, Mr. Noland said.

Year-to-Date

Direct Absorption

Rate

Year-to-Date

Total Absorption

Rate

(374,077)

(1,523,570)

(766,678)

(716,948)

(1,555,361)

(1,795,363)

(2,696,116)

(4,035,881)

Das könnte Ihnen auch gefallen

- Emerging FinTech: Understanding and Maximizing Their BenefitsVon EverandEmerging FinTech: Understanding and Maximizing Their BenefitsNoch keine Bewertungen

- Launching A Digital Tax Administration Transformation: What You Need to KnowVon EverandLaunching A Digital Tax Administration Transformation: What You Need to KnowNoch keine Bewertungen

- NYC Stats 4Q12Dokument5 SeitenNYC Stats 4Q12Anonymous Feglbx5Noch keine Bewertungen

- 1CO1900A0716Dokument1 Seite1CO1900A0716jotham_sederstr7655Noch keine Bewertungen

- NYC Stats 3Q12Dokument5 SeitenNYC Stats 3Q12Anonymous Feglbx5Noch keine Bewertungen

- Manhattan Stats Q3 2013Dokument5 SeitenManhattan Stats Q3 2013Anonymous Feglbx5Noch keine Bewertungen

- 1CO1800A0402Dokument1 Seite1CO1800A0402jotham_sederstr7655Noch keine Bewertungen

- CompStak Effective Rent ReportDokument2 SeitenCompStak Effective Rent ReportCRE ConsoleNoch keine Bewertungen

- M&A Trend Report: Q1-Q3 2013: JapanDokument3 SeitenM&A Trend Report: Q1-Q3 2013: JapanKPNoch keine Bewertungen

- Atlanta Office Market Report Q3 2011Dokument2 SeitenAtlanta Office Market Report Q3 2011Anonymous Feglbx5Noch keine Bewertungen

- Full Sal Surv 09Dokument12 SeitenFull Sal Surv 09Elie Edmond IranyNoch keine Bewertungen

- What's The (Downtown) Story, Morning Glory?: Downtown New York Office Market-February 2013Dokument1 SeiteWhat's The (Downtown) Story, Morning Glory?: Downtown New York Office Market-February 2013jotham_sederstr7655Noch keine Bewertungen

- The Real Report Q3 Ending 2011, Bridge Commercial PropertiesDokument6 SeitenThe Real Report Q3 Ending 2011, Bridge Commercial PropertiesScott W JohnstoneNoch keine Bewertungen

- Manhattan PDFDokument2 SeitenManhattan PDFAnonymous Feglbx5Noch keine Bewertungen

- City of Houston Public Neighborhood PresentationDokument50 SeitenCity of Houston Public Neighborhood PresentationOrganizeTexasNoch keine Bewertungen

- Nyc PDFDokument5 SeitenNyc PDFAnonymous Feglbx5Noch keine Bewertungen

- Working Capital Management Ratiosof Tata Motors LimitedDokument11 SeitenWorking Capital Management Ratiosof Tata Motors Limitedakshay chavanNoch keine Bewertungen

- 2013 q1 Global Financial Avisory MaDokument39 Seiten2013 q1 Global Financial Avisory Maanshuljain785Noch keine Bewertungen

- 3Q11 Raleigh Office ReportDokument2 Seiten3Q11 Raleigh Office ReportAnonymous Feglbx5Noch keine Bewertungen

- JLL PDFDokument18 SeitenJLL PDFAnonymous Feglbx5Noch keine Bewertungen

- 3M Company: 20.1 15.0 Recent Price P/E Ratio Relative P/E Ratio Div'D YLDDokument1 Seite3M Company: 20.1 15.0 Recent Price P/E Ratio Relative P/E Ratio Div'D YLDasdzxcv1234Noch keine Bewertungen

- Q3 2012 OfficeSnapshotDokument2 SeitenQ3 2012 OfficeSnapshotAnonymous Feglbx5Noch keine Bewertungen

- Midtown South, Northbound Rents: PostingsDokument1 SeiteMidtown South, Northbound Rents: Postingsjotham_sederstr7655Noch keine Bewertungen

- Team 06 - Assignment 01Dokument10 SeitenTeam 06 - Assignment 01Nilisha DeshbhratarNoch keine Bewertungen

- Presentation 1Q13Dokument17 SeitenPresentation 1Q13Multiplan RINoch keine Bewertungen

- Press ReleaseDokument3 SeitenPress Releasesat237Noch keine Bewertungen

- Earnings ReleaseDokument15 SeitenEarnings ReleaseMultiplan RINoch keine Bewertungen

- Marketview: Greensboro/Winston-Salem IndustrialDokument5 SeitenMarketview: Greensboro/Winston-Salem Industrialapi-273306257Noch keine Bewertungen

- Audited Financial Results March 2009Dokument40 SeitenAudited Financial Results March 2009Ashwin SwamiNoch keine Bewertungen

- Mixed Use JK PDFDokument9 SeitenMixed Use JK PDFAnkit ChaudhariNoch keine Bewertungen

- Raport P2-B1-4Dokument39 SeitenRaport P2-B1-4Petrina OanaNoch keine Bewertungen

- Accounting Newport IndustryDokument10 SeitenAccounting Newport IndustryAlexander Quizana AguirreNoch keine Bewertungen

- 2012 EOY Industrial-OfficeDokument32 Seiten2012 EOY Industrial-OfficeWilliam HarrisNoch keine Bewertungen

- Can Q3 FY09 FinancialResultsDokument42 SeitenCan Q3 FY09 FinancialResultsAppu Moments MatterNoch keine Bewertungen

- Earnings Conference Call 3Q12Dokument26 SeitenEarnings Conference Call 3Q12Multiplan RINoch keine Bewertungen

- Drop in Leasing Volume While Asking Rents Reach New Record: News ReleaseDokument5 SeitenDrop in Leasing Volume While Asking Rents Reach New Record: News ReleaseAnonymous 28PDvu8Noch keine Bewertungen

- Global Ma h1 LeagDokument39 SeitenGlobal Ma h1 LeagSohini Mo BanerjeeNoch keine Bewertungen

- Results Conference CallDokument14 SeitenResults Conference CallLightRINoch keine Bewertungen

- Autos - Pent-Up Demand in OctDokument8 SeitenAutos - Pent-Up Demand in OctTariq HaqueNoch keine Bewertungen

- $1,000,000 Mortgage Total Cost Analysis Jumbo Report Peter BoyleDokument2 Seiten$1,000,000 Mortgage Total Cost Analysis Jumbo Report Peter BoylePeter BoyleNoch keine Bewertungen

- Results Press Release For December 31, 2016 (Result)Dokument6 SeitenResults Press Release For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Q3 2009 MoneyTree Report FinalDokument7 SeitenQ3 2009 MoneyTree Report FinaledwardreynoldsNoch keine Bewertungen

- Nada Data 2010 f2Dokument21 SeitenNada Data 2010 f2colinsox007Noch keine Bewertungen

- Idea Cellular LTD: Key Financial IndicatorsDokument4 SeitenIdea Cellular LTD: Key Financial IndicatorsGanesh DeshiNoch keine Bewertungen

- Executive Summary: Positive Momentum: Building SpotlightDokument6 SeitenExecutive Summary: Positive Momentum: Building SpotlightScott W. JohnstoneNoch keine Bewertungen

- Comfort - JPMDokument8 SeitenComfort - JPMTerence Seah Pei ChuanNoch keine Bewertungen

- Pilgrim BankDokument6 SeitenPilgrim BankSatyajeet JaiswalNoch keine Bewertungen

- Miami Office Insight Q3 2013Dokument4 SeitenMiami Office Insight Q3 2013Bea LorinczNoch keine Bewertungen

- Bloomberg Q1 2012 M&a Global League TablesDokument39 SeitenBloomberg Q1 2012 M&a Global League TablesMandeep SoorNoch keine Bewertungen

- Ijcrt 222819Dokument9 SeitenIjcrt 222819Lovely BaluNoch keine Bewertungen

- Tech Mahindra, 7th February, 2013Dokument12 SeitenTech Mahindra, 7th February, 2013Angel BrokingNoch keine Bewertungen

- Assignment 1 Group5Dokument6 SeitenAssignment 1 Group5Bhavya S. LadhaniNoch keine Bewertungen

- Marketbeat: Office SnapshotDokument1 SeiteMarketbeat: Office Snapshotapi-150283085Noch keine Bewertungen

- Marketinsightshcmc q3 2014 enDokument27 SeitenMarketinsightshcmc q3 2014 enTran Duc DungNoch keine Bewertungen

- Lyon Real Estate Press Release January 2012Dokument2 SeitenLyon Real Estate Press Release January 2012Lyon Real EstateNoch keine Bewertungen

- Results CompiledDokument41 SeitenResults CompiledlifeeeNoch keine Bewertungen

- Mahindra Satyam, 4th February, 2013Dokument12 SeitenMahindra Satyam, 4th February, 2013Angel BrokingNoch keine Bewertungen

- Global Financial Advisory Mergers & Acquisitions Rankings 2013Dokument40 SeitenGlobal Financial Advisory Mergers & Acquisitions Rankings 2013Ajay SamuelNoch keine Bewertungen

- FSA Assignment 2Dokument16 SeitenFSA Assignment 2Daniyal ZafarNoch keine Bewertungen

- Advertising and Personal SellingDokument20 SeitenAdvertising and Personal Sellingaryansachdeva2122002Noch keine Bewertungen

- TripleDigitBoom 1CO3200A1217Dokument1 SeiteTripleDigitBoom 1CO3200A1217jotham_sederstr7655Noch keine Bewertungen

- The Plan 1 CO4600 A1210Dokument1 SeiteThe Plan 1 CO4600 A1210jotham_sederstr7655Noch keine Bewertungen

- Postings 1CO2000A1217Dokument1 SeitePostings 1CO2000A1217jotham_sederstr7655Noch keine Bewertungen

- The Plan: 308 Malcolm X BoulevardDokument1 SeiteThe Plan: 308 Malcolm X Boulevardjotham_sederstr7655Noch keine Bewertungen

- Dumbo 1 CO3400 A1210Dokument1 SeiteDumbo 1 CO3400 A1210jotham_sederstr7655Noch keine Bewertungen

- Dumbo 1 CO3400 A1210Dokument1 SeiteDumbo 1 CO3400 A1210jotham_sederstr7655Noch keine Bewertungen

- 1WTC 1co3400a1217Dokument1 Seite1WTC 1co3400a1217jotham_sederstr7655Noch keine Bewertungen

- The Plan 1203Dokument1 SeiteThe Plan 1203jotham_sederstr7655Noch keine Bewertungen

- PostingsDokument1 SeitePostingsjotham_sederstr7655Noch keine Bewertungen

- The Plan: 59Th Street-Columbus CircleDokument1 SeiteThe Plan: 59Th Street-Columbus Circlejotham_sederstr7655Noch keine Bewertungen

- Postings 1203Dokument1 SeitePostings 1203jotham_sederstr7655Noch keine Bewertungen

- The Plan 1203Dokument1 SeiteThe Plan 1203jotham_sederstr7655Noch keine Bewertungen

- Postings 1 Co 2300 A 1119Dokument1 SeitePostings 1 Co 2300 A 1119jotham_sederstr7655Noch keine Bewertungen

- ThePlan 1CO4200A1119Dokument1 SeiteThePlan 1CO4200A1119jotham_sederstr7655Noch keine Bewertungen

- 1CO4200A1105Dokument1 Seite1CO4200A1105jotham_sederstr7655Noch keine Bewertungen

- 1CO2200A1029Dokument1 Seite1CO2200A1029jotham_sederstr7655Noch keine Bewertungen

- Expanding The City's Biggest Historic District, Again: PostingsDokument1 SeiteExpanding The City's Biggest Historic District, Again: Postingsjotham_sederstr7655Noch keine Bewertungen

- 1CO1800A1112Dokument1 Seite1CO1800A1112jotham_sederstr7655Noch keine Bewertungen

- The Plan: 501 Seventh AvenueDokument1 SeiteThe Plan: 501 Seventh Avenuejotham_sederstr7655Noch keine Bewertungen

- 1CO4200A1022Dokument1 Seite1CO4200A1022jotham_sederstr7655Noch keine Bewertungen

- 1CO3800A1008Dokument1 Seite1CO3800A1008jotham_sederstr7655Noch keine Bewertungen

- 1CO4200A1022Dokument1 Seite1CO4200A1022jotham_sederstr7655Noch keine Bewertungen

- 1CO2000A1022Dokument1 Seite1CO2000A1022jotham_sederstr7655Noch keine Bewertungen

- 1CO2400A1001Dokument1 Seite1CO2400A1001jotham_sederstr7655Noch keine Bewertungen

- Barclays Center'S First Year, by The Numbers: PostingsDokument1 SeiteBarclays Center'S First Year, by The Numbers: Postingsjotham_sederstr7655Noch keine Bewertungen

- The Plan: 1051 Third AvenueDokument1 SeiteThe Plan: 1051 Third Avenuejotham_sederstr7655Noch keine Bewertungen

- 1CO3800A0924Dokument1 Seite1CO3800A0924jotham_sederstr7655Noch keine Bewertungen

- The Plan: 402 West 13th StreetDokument1 SeiteThe Plan: 402 West 13th Streetjotham_sederstr7655Noch keine Bewertungen

- 1CO2000A0910Dokument1 Seite1CO2000A0910jotham_sederstr7655Noch keine Bewertungen

- SCI1001 Lab 7 MarksheetDokument2 SeitenSCI1001 Lab 7 Marksheetnataliegregg223Noch keine Bewertungen

- Unit 2 Lab Manual ChemistryDokument9 SeitenUnit 2 Lab Manual ChemistryAldayne ParkesNoch keine Bewertungen

- Sound Culture: COMS 350 (001) - Winter 2018Dokument12 SeitenSound Culture: COMS 350 (001) - Winter 2018Sakshi Dhirendra MishraNoch keine Bewertungen

- CTY1 Assessments Unit 6 Review Test 1Dokument5 SeitenCTY1 Assessments Unit 6 Review Test 1'Shanned Gonzalez Manzu'Noch keine Bewertungen

- Practice For Those Who Are DyingDokument10 SeitenPractice For Those Who Are DyingBecze István / Stephen Becze100% (1)

- Jingle KKKKDokument80 SeitenJingle KKKKCristina Joy Valdez AndresNoch keine Bewertungen

- Diec Russias Demographic Policy After 2000 2022Dokument29 SeitenDiec Russias Demographic Policy After 2000 2022dawdowskuNoch keine Bewertungen

- MKTG4471Dokument9 SeitenMKTG4471Aditya SetyaNoch keine Bewertungen

- MSDS Blattanex GelDokument5 SeitenMSDS Blattanex GelSadhana SentosaNoch keine Bewertungen

- Keong Mas ENGDokument2 SeitenKeong Mas ENGRose Mutiara YanuarNoch keine Bewertungen

- 4 Thematic AnalysisDokument32 Seiten4 Thematic Analysisapi-591181595Noch keine Bewertungen

- AllisonDokument3 SeitenAllisonKenneth RojoNoch keine Bewertungen

- Gprs/Umts: IAB Workshop February 29 - March 2, 2000 Jonne Soininen NokiaDokument34 SeitenGprs/Umts: IAB Workshop February 29 - March 2, 2000 Jonne Soininen NokiaSajid HussainNoch keine Bewertungen

- Strama-Ayala Land, Inc.Dokument5 SeitenStrama-Ayala Land, Inc.Akako MatsumotoNoch keine Bewertungen

- Musical Notes and SymbolsDokument17 SeitenMusical Notes and SymbolsReymark Naing100% (2)

- Solar SystemDokument3 SeitenSolar SystemKim CatherineNoch keine Bewertungen

- B B B B: RRRR RRRRDokument24 SeitenB B B B: RRRR RRRRAnonymous TeF0kYNoch keine Bewertungen

- XT 125Dokument54 SeitenXT 125ToniNoch keine Bewertungen

- Chapter 9 &10 - Gene ExpressionDokument4 SeitenChapter 9 &10 - Gene ExpressionMahmOod GhNoch keine Bewertungen

- Lesson PlansDokument9 SeitenLesson Plansapi-238729751Noch keine Bewertungen

- Swati Bajaj ProjDokument88 SeitenSwati Bajaj ProjSwati SoodNoch keine Bewertungen

- 2 - (Accounting For Foreign Currency Transaction)Dokument25 Seiten2 - (Accounting For Foreign Currency Transaction)Stephiel SumpNoch keine Bewertungen

- Pronoun AntecedentDokument4 SeitenPronoun AntecedentJanna Rose AregadasNoch keine Bewertungen

- The Municipality of Santa BarbaraDokument10 SeitenThe Municipality of Santa BarbaraEmel Grace Majaducon TevesNoch keine Bewertungen

- COPARDokument21 SeitenCOPARLloyd Rafael EstabilloNoch keine Bewertungen

- Articles About Gossip ShowsDokument5 SeitenArticles About Gossip ShowssuperultimateamazingNoch keine Bewertungen

- Mse Return DemonstrationDokument7 SeitenMse Return DemonstrationMaggay LarsNoch keine Bewertungen

- Second and Third Round Table Conferences NCERT NotesDokument2 SeitenSecond and Third Round Table Conferences NCERT NotesAanya AgrahariNoch keine Bewertungen

- Philosophies PrinceDokument4 SeitenPhilosophies PrincePrince CuetoNoch keine Bewertungen

- Milton Terry Biblical HermeneuticsDokument787 SeitenMilton Terry Biblical HermeneuticsFlorian100% (3)