Beruflich Dokumente

Kultur Dokumente

Coal India Report

Hochgeladen von

kshtzsinghCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Coal India Report

Hochgeladen von

kshtzsinghCopyright:

Verfügbare Formate

A Financial Report On Coal India Ltd.

Done By- 1. Eshan Baruah. 2. Abhimanyu Mittal. 3. Khishitiz Singh.

Company Profile of Coal India Ltd. Coal India Limited (CIL) as an organized state owned coal mining corporate came into being in November 1975 with the government taking over private coal mines. With a modest production of 79 Million Tonnes (MTs) at the year of its inception CIL today is the single largest coal producer in the world. Operating through 81 mining areas CIL is an apex body with 7 wholly owned coal producing subsidiaries and 1 mine planning and consultancy company spread over 8 provincial states of India. CIL also fully owns a mining company in Mozambique christened as 'Coal India Africana Limitada'. CIL also manages 200 other establishments like workshops, hospitals etc. Further, it also owns 26 technical & management training institutes and 102 Vocational Training Institutes Centres. Indian Institute of Coal Management (IICM) as a state-of-the-art Management Training 'Centre of Excellence' - the largest Corporate Training Institute in India operates under CIL and conducts multi disciplinary management development programmes. CIL having fulfilled the financial and other prerequisites was granted the Maharatna recognition in April 2011. It is a privileged status conferred by Government of India to select state owned enterprises in order to empower them to expand their operations and emerge as global giants. So far, the select club has only five members out of 217 Central Public Sector Enterprises in the country.

Mission The Mission of Coal India Limited is to Produce planned quantity of coal Efficiently and Economically in an Eco-friendly manner with due regard to Safety, Conservation & Quality.

Balance Sheet

------------------- in Rs. Cr. ------------------Mar '12 12 mths Sources Of Funds Total Share Capital 6,316.36 Equity Share Capital 6,316.36 Share Application Money 0.00 Preference Share Capital 0.00 Reserves 13,248.39 Revaluation Reserves 0.00 Networth 19,564.75 Secured Loans 0.00 Unsecured 1,173.54 1,370.43 1,464.30 1,786.62 1,510.83 Loans Total Debt 1,173.54 Total Liabilities 20,738.29 Mar '12 12 mths Application Of Funds Gross Block Less: Accum. Depreciation Net Block Capital Work in Progress Investments Inventories Sundry Debtors Cash and Bank Balance Total Current Assets Loans and Advances Fixed Deposits Mar '11 12 mths

6,316.36 6,316.36 0.00 0.00 13,121.02 0.00 19,437.38 0.00

1,370.43 20,807.81 Mar '11 12 mths

408.98 387.46 295.42 289.13 113.56 98.33 60.75 55.67 6,541.19 6,319.17 18.51 35.70 0.01 0.00 15,302.72 373.37 15,321.24 409.07 8,675.46 9,484.74 0.00 11,286.14

Total CA, Loans & Advances Deffered Credit Current Liabilities Provisions Total CL & Provisions Net Current Assets Miscellaneous Expenses Total Assets Contingent Liabilities Book Value (Rs)

23,996.70 0.00 8,529.27 1,444.64 9,973.91 14,022.79 0.00 20,738.29 312.15 30.97

21,179.95 0.00 5,837.37 1,007.95 6,845.32 14,334.63 0.00 20,807.80 289.93 30.77

Key Financial Ratios of Coal India Mar '12 Investment Valuation Ratios Face Value Dividend Per Share Operating Profit Per Share (Rs) Net Operating Profit Per Share (Rs) Free Reserves Per Share (Rs) Bonus in Equity Capital Profitability Ratios Operating Profit Margin(%) Profit Before Interest And Tax Margin(%) Gross Profit Margin(%) Cash Profit Margin(%) Adjusted Cash Margin(%) Net Profit Margin(%) Adjusted Net Profit Margin(%) Return On Capital Employed(%) Return On Net Worth(%) Adjusted Return on Net Worth(%) Return on Assets Excluding Revaluations Return on Assets Including Revaluations Return on Long Term Funds(%) Mar '11

10.00 10.00 -0.18 0.66 ---28.02 -1.29 -29.69 85.69 85.69 84.73 84.73 43.29 41.22 41.65 30.97 30.97 43.29

10.00 3.90 -0.14 0.73 16.48 --19.20 -1.70 -20.41 82.60 82.60 85.35 85.35 23.92 24.30 23.48 30.77 30.77 23.92

Liquidity And Solvency Ratios Current Ratio Quick Ratio Debt Equity Ratio Long Term Debt Equity Ratio Debt Coverage Ratios Interest Cover Total Debt to Owners Fund Financial Charges Coverage Ratio Financial Charges Coverage Ratio Post Tax Management Efficiency Ratios Inventory Turnover Ratio Debtors Turnover Ratio Investments Turnover Ratio Fixed Assets Turnover Ratio Total Assets Turnover Ratio Asset Turnover Ratio

2.41 2.40 0.06 0.06 23.71 0.06 23.72 22.31

3.09 3.09 0.07 0.07 24.48 0.07 22.36 22.22

26.29 14.33 64,474.42 297,621.55 26.29 14.33 1.17 1.19 0.02 0.02 0.02 0.02

Average Raw Material Holding --Average Finished Goods Held -16.29 Number of Days In Working Capital 12,139.19 11,186.47 Profit & Loss Account Ratios Material Cost Composition 0.89 1.85 Imported Composition of Raw Materials Consumed --Selling Distribution Cost Composition -29.49 Expenses as Composition of Total Sales 0.02 1.67 Cash Flow Indicator Ratios Dividend Payout Ratio Net Profit 78.31 52.15 Dividend Payout Ratio Cash Profit 78.24 52.08 Earning Retention Ratio 22.50 46.05 Cash Earning Retention Ratio 22.56 46.12 AdjustedCash Flow Times 0.14 0.30

Mar '12 Earnings Per Share Book Value 12.77 30.97

Mar '11 7.48 30.77

Interpretation.

Das könnte Ihnen auch gefallen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- 3.1 70. Exercise Loan Schedule UnsolvedDokument8 Seiten3.1 70. Exercise Loan Schedule UnsolvedAniket KarnNoch keine Bewertungen

- Electronic Commerce: Session 7: Processing Payments On-Line and The Fulfilment PhaseDokument45 SeitenElectronic Commerce: Session 7: Processing Payments On-Line and The Fulfilment PhaseKajal SainiNoch keine Bewertungen

- SLTF FormDokument7 SeitenSLTF FormFelix MaccarthyNoch keine Bewertungen

- Capital StructureDokument38 SeitenCapital StructureShil ShambharkarNoch keine Bewertungen

- (Accaglobalbox - Blogspot.com) Consolidation and Cash FLows SBR CompleteDokument12 Seiten(Accaglobalbox - Blogspot.com) Consolidation and Cash FLows SBR Completets tanNoch keine Bewertungen

- Chapter 15 HW SolutionDokument5 SeitenChapter 15 HW SolutionZarifah FasihahNoch keine Bewertungen

- How A Creditcard Is ProcessedDokument5 SeitenHow A Creditcard Is Processedkk81Noch keine Bewertungen

- Note Exam Law 299Dokument5 SeitenNote Exam Law 299nurulfahizah50% (2)

- Rate of Return Analysis: Single Alternative: Gra W HillDokument99 SeitenRate of Return Analysis: Single Alternative: Gra W HillalfaselNoch keine Bewertungen

- 21-Spring 2019 - FA - SA - Sp-19Dokument8 Seiten21-Spring 2019 - FA - SA - Sp-19Muhammad KashifNoch keine Bewertungen

- Jamuna Bank LTD: Daily Statement of AffairsDokument3 SeitenJamuna Bank LTD: Daily Statement of AffairsArman Hossain WarsiNoch keine Bewertungen

- 10000003728Dokument32 Seiten10000003728Chapter 11 DocketsNoch keine Bewertungen

- CompleteFreedom 0066 22oct2022Dokument5 SeitenCompleteFreedom 0066 22oct2022bigman walthoNoch keine Bewertungen

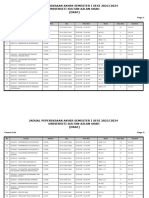

- Jadual Peperiksaan Akhir Semester I Sesi 2023/2024 Universiti Sultan Azlan Shah (DRAF)Dokument53 SeitenJadual Peperiksaan Akhir Semester I Sesi 2023/2024 Universiti Sultan Azlan Shah (DRAF)WajdiNoch keine Bewertungen

- Chap. 7-9 Summary For Written ReportDokument22 SeitenChap. 7-9 Summary For Written ReportMJNoch keine Bewertungen

- Research Paper On NBFCDokument7 SeitenResearch Paper On NBFCgw1nm9nb100% (1)

- Analysis of Section 139 A IT Act 1961Dokument13 SeitenAnalysis of Section 139 A IT Act 1961padam jainNoch keine Bewertungen

- Ec 1745 Fall 2008 Problem Set 1Dokument2 SeitenEc 1745 Fall 2008 Problem Set 1tarun singhNoch keine Bewertungen

- Chapter - 6: Economic Value Addition (EvaDokument12 SeitenChapter - 6: Economic Value Addition (EvameenudarakNoch keine Bewertungen

- 026 - D - Dhairya ShahDokument15 Seiten026 - D - Dhairya ShahDHAIRYA09Noch keine Bewertungen

- Untitled Form - Google FormsDokument4 SeitenUntitled Form - Google FormsPavan RoochandaniNoch keine Bewertungen

- Assignment 1 Fin 3010 Spring 2006Dokument11 SeitenAssignment 1 Fin 3010 Spring 2006Tutorsglobe Educational ServicesNoch keine Bewertungen

- What Is Spread Betting (Good) PDFDokument4 SeitenWhat Is Spread Betting (Good) PDFMyriam GrissaNoch keine Bewertungen

- Eight Days A Week PDFDokument439 SeitenEight Days A Week PDFRita D'HaeneNoch keine Bewertungen

- Chaper 2 - Investments by Bodie 12th EditionDokument3 SeitenChaper 2 - Investments by Bodie 12th EditionIvan Meléndez MejíaNoch keine Bewertungen

- Study Note 1 Fundamental of AccountingDokument54 SeitenStudy Note 1 Fundamental of Accountingnaga naveenNoch keine Bewertungen

- Cash App - Statement 2020Dokument4 SeitenCash App - Statement 2020ss ds67% (3)

- BD5 SM12Dokument10 SeitenBD5 SM12didiajaNoch keine Bewertungen

- Online Banking - Bank LoginDokument16 SeitenOnline Banking - Bank LoginonliebankingNoch keine Bewertungen

- The Regulation of Social Housing OutcomeDokument22 SeitenThe Regulation of Social Housing OutcomeJulia da Costa AguiarNoch keine Bewertungen