Beruflich Dokumente

Kultur Dokumente

Mid Term I

Hochgeladen von

chaos1989Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Mid Term I

Hochgeladen von

chaos1989Copyright:

Verfügbare Formate

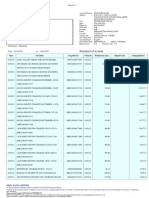

Name: Lubiane Incorvaia Test Midterm 1. A 2. C 3. B 4.

Accounts Receivable Fees Earned Accrued Fees [($18,000/5 months) x 8 months]

28,800 28,800

5. Unearned Fees Fees Earned Fees Earned ($10,250 - $3,125)

7,125 7,125

6. Gary's Tree Service Trial Balance Cash Supplies Accounts Payable Garry Ryan, Capital Wage Expense Machinery Wage Payable Service Revenue Rent Expense Unearned Expense Accumulated Depreciation - Machinery Prepaid Rent Garry Ryan, Drawing Debit 25,000 1,000 7,000 32,910 2,000 18,350 3,600 21,000 11,500 1,500 7,340 12,200 3,300 73,350 Credit

73,350

7.

a. $3,600 b. $300 c. $18,000 d. $750

8.

a. Revenues were understated by $19,100 ($8,900 + $10,200) b. Expenses were understated by $7,000

c. Net Income was understated by $12,100 ($8,900 + $10,200-$7,000)

9. Dec. 31

Depreciation Expense Accumulated Depreciation - office equip

1,400 1,400 2,650 2,650

31 Depreciation Expense Accumulated Depreciation - prod. Equip

10. Supplies Expense Supplies Supplies Used ($3,500-$350) 3,150 3,150

11. 31-Dec Insurance Expense Prepaid Insurance Insurance Expired [($1,500/12)x7] 12. Date Dec 31 Accounts Receivable Fees Earned Accrued Fees Supplies Expense Supplies Supplies Used ($4,750-$960)) Wages Expenses Wages Payable Accrued Wages Depreciation Expense Accum. Depreciation - Office Equip Depreciation on office equip. Rent Expense Prepaid rent Prepaid rent expired Description Post Ref. 875 875

31

31

13.

Description a. Supplies Expense Supplies Supplies Used [($245+$735)-$343)] Interest Expense Interest Interest paid [(12/100 x $17,000) / 6] Wages Expenses Wages Payable Accrued Wages ($5,500/2) Wages Expenses Wages Payable Accrued Wages ($650/4) d. Unearned Revenue Revenue Earned Revenue Earned [(60/100)x46,000)] Accounts Receivable Fees Earned Accrued Fees

Post Ref.

b.

c.

e.

14. a. Journal Date Nov Description 15 Cash Great Designs Company, Capital Invested cash in Advertising campaign 15 Accounts Payable Fees Paid Accrued Fees Post Ref.

Dec

b. 15.

Jounal Entries were prepared because fees were paid because the work was performed.

Nadia Company Income Statement

For the year ended December 31, 2014 Fees earned Total revenue Expenses: Wages Expense Rent Expense Utilities Expense Depreciation Expense Misc. Expense Total Expenses Net Income

10,930 10,930 2,450 1,900 1,475 1,150 975 7,950 $2,980

Nadia Company Statement of Owner's Equity For the year ended December 31, 2014 Nadia Porter, capital Net income for the year Less withdrawals Increase in owner's equity Nadia Porter, capital, December 31, 2014 13,000 2,980 700 2,280 10,720

Nadia Company Balance Sheet December 31, 2014 Assets Current Assets: Cash Accounts Receivable Prepaid Expenses Total current assets Property, plant, and equipment: Equipment Less accumulated depreciation Total Property, plant, and equipment: Total assets Current Liabilities: 5,130 3,300 420 $8,850

12,400 2,200

O 10,200 Nadia Porter, Capital

10,200 19,050 Total liabilities and owner's eq

16. Description a. Wages Expenses Wages Payable Accrued Wages [($22,000 / 5 days) x 2 days] Post Ref.

Wages Expenses Wages Payable Accrued Wages [($22,000 / 5 days) x 3 days] b. Insurance Expense Prepaid Insurance Insurance Expired ($18,000 + $5,300) Insurance Expense Prepaid Insurance Insurance Expired ($18,000 - $2,700) c.

Debit 6,300

Credit

6,300

3,790 3,790

2,700 2,700

1,650 1,650

10,800 10,800

Debit 637

Credit

637

340 340

2,750 2,750

163 163

27,600 27,600

5,700 5,700

Debit 2,700

Credit

2,700

2,700 2,700

Liabilities Current Liabilities: Accounts payable Notes Payable Total liabilities $700.00 3,070 $3,770.00

Owner's Equity Nadia Porter, Capital Total liabilities and owner's equity 10,720 $14,490.00

Debit 8,800

Credit

8,800

13,200 13,200

23,300 23,300

15,300 15,300

Das könnte Ihnen auch gefallen

- Rodel's 2020 Income Tax Computation with Itemized DeductionsTITLE Mulry's 2020 Taxable Income and Tax Payable TITLE Sharon's Various 2020 Tax Computations as Resident, Non-Resident ETB and NETBDokument5 SeitenRodel's 2020 Income Tax Computation with Itemized DeductionsTITLE Mulry's 2020 Taxable Income and Tax Payable TITLE Sharon's Various 2020 Tax Computations as Resident, Non-Resident ETB and NETByezaquera100% (1)

- Of Alabang: Multiple ChoiceDokument8 SeitenOf Alabang: Multiple ChoiceLEE ANNNoch keine Bewertungen

- (02D) Demonstration Trial BalanceDokument22 Seiten(02D) Demonstration Trial BalanceGabriella JNoch keine Bewertungen

- Ac101 ch3Dokument21 SeitenAc101 ch3Alex ChewNoch keine Bewertungen

- Topic 2 ExercisesDokument6 SeitenTopic 2 ExercisesRaniel Pamatmat0% (1)

- 11 Deductions From Gross Income (Expenses in General, Interest Expense and Taxes)Dokument18 Seiten11 Deductions From Gross Income (Expenses in General, Interest Expense and Taxes)Clarisse PelayoNoch keine Bewertungen

- Chapter 2 Audit of CashDokument11 SeitenChapter 2 Audit of Cashadinew abeyNoch keine Bewertungen

- ADJUSTING Activities With AnswersDokument5 SeitenADJUSTING Activities With AnswersRenz RaphNoch keine Bewertungen

- Exercises Adjusting EntriesDokument3 SeitenExercises Adjusting EntriesFria Mae Aycardo AbellanoNoch keine Bewertungen

- Sales 140, 800 Less: Cost of Sales (84, 480) Gross ProfitDokument5 SeitenSales 140, 800 Less: Cost of Sales (84, 480) Gross ProfitMichaela KowalskiNoch keine Bewertungen

- CPA Firm Involved AdelphiaDokument2 SeitenCPA Firm Involved AdelphiaHenny FaustaNoch keine Bewertungen

- Straight Problems Income Tax Bsa2Dokument2 SeitenStraight Problems Income Tax Bsa2dimpy dNoch keine Bewertungen

- Required: 1. Predetermined Overhead Rate For The YearDokument3 SeitenRequired: 1. Predetermined Overhead Rate For The YearEevan SalazarNoch keine Bewertungen

- CHAPTER 11 Compensation IncomeDokument15 SeitenCHAPTER 11 Compensation IncomeGIRLNoch keine Bewertungen

- A-Standards of Ethical Conduct For Management AccountantsDokument4 SeitenA-Standards of Ethical Conduct For Management AccountantsChhun Mony RathNoch keine Bewertungen

- Solman PortoDokument26 SeitenSolman PortoYusuf Raharja0% (1)

- Sec Code of Corporate Governance AnswerDokument3 SeitenSec Code of Corporate Governance AnswerHechel DatinguinooNoch keine Bewertungen

- On The Dot Trading Statement of Financial Position As of December 31 2017 2016 Increase (Decrease) AmountDokument3 SeitenOn The Dot Trading Statement of Financial Position As of December 31 2017 2016 Increase (Decrease) AmountRuthNoch keine Bewertungen

- A Short Review On Basic FinanceDokument4 SeitenA Short Review On Basic FinanceJed AoananNoch keine Bewertungen

- INCOME TAX | Final Tax, Passive Income, Non-ResidentsDokument14 SeitenINCOME TAX | Final Tax, Passive Income, Non-ResidentsShane Mark CabiasaNoch keine Bewertungen

- Chapter 1&2 Introduction To Business Taxes & Vat On Sale of Goods or PropertiesDokument6 SeitenChapter 1&2 Introduction To Business Taxes & Vat On Sale of Goods or PropertiesBSA3Tagum Marilet100% (1)

- Naqdown Final QuestionsDokument16 SeitenNaqdown Final QuestionsDiether ManaloNoch keine Bewertungen

- 100 % 36 Units Per Day 50 Trucks Per Day 100 % 100 % 36 Units Per Day 40 Trucks Per Day 100 %Dokument6 Seiten100 % 36 Units Per Day 50 Trucks Per Day 100 % 100 % 36 Units Per Day 40 Trucks Per Day 100 %Cherie Soriano AnanayoNoch keine Bewertungen

- Chapter 1Dokument20 SeitenChapter 1Coursehero PremiumNoch keine Bewertungen

- Guabna Aldyn Bookkeeping TransactionsDokument40 SeitenGuabna Aldyn Bookkeeping TransactionsSHIENNA MAE ALVIS100% (1)

- Compensation Income Tax RulesDokument7 SeitenCompensation Income Tax RulesTriciaNoch keine Bewertungen

- Tax Term Quiz TheoriesDokument6 SeitenTax Term Quiz TheoriesRena Jocelle NalzaroNoch keine Bewertungen

- 01 The Accountancy ProfessionDokument8 Seiten01 The Accountancy ProfessionKristine TiuNoch keine Bewertungen

- Subsequent Measurement Accounting Property Plant and EquipmentDokument60 SeitenSubsequent Measurement Accounting Property Plant and EquipmentNatalie SerranoNoch keine Bewertungen

- Evaluating Firm Performance - ReportDokument5 SeitenEvaluating Firm Performance - ReportJeane Mae BooNoch keine Bewertungen

- Responsibility AccountingDokument3 SeitenResponsibility AccountinglulughoshNoch keine Bewertungen

- Maximizing Income from Two Part-Time Jobs with Simplex MethodDokument21 SeitenMaximizing Income from Two Part-Time Jobs with Simplex MethodJohn Rovic GamanaNoch keine Bewertungen

- CPA Review School of The Philippines Manila First Pre-Board Solutions TaxationDokument8 SeitenCPA Review School of The Philippines Manila First Pre-Board Solutions TaxationLive LoveNoch keine Bewertungen

- Assignment 10 Partnership DissolutionDokument8 SeitenAssignment 10 Partnership DissolutionSova ShockdartNoch keine Bewertungen

- Chapter 8 Consolidation IDokument18 SeitenChapter 8 Consolidation IAkkama100% (1)

- Formation of DD and EE partnershipDokument3 SeitenFormation of DD and EE partnershipmiss independent100% (1)

- Acrev 422 AfarDokument19 SeitenAcrev 422 AfarAira Mugal OwarNoch keine Bewertungen

- ACC1003 Practice QuestionsDokument6 SeitenACC1003 Practice Questionsmeera abdullahNoch keine Bewertungen

- Income Tax Basic Questions and SolutionsDokument28 SeitenIncome Tax Basic Questions and SolutionsbamberoNoch keine Bewertungen

- Job Costing Finished Goods InventoryDokument46 SeitenJob Costing Finished Goods InventoryNavindra JaggernauthNoch keine Bewertungen

- Limitation of Taxation Power A. Inherent Limilations: Resident Citizen and Domestic CorporationDokument5 SeitenLimitation of Taxation Power A. Inherent Limilations: Resident Citizen and Domestic CorporationEunice JusiNoch keine Bewertungen

- Rich Angelie Muñez - Assignment 4 Adjusting EntriesDokument2 SeitenRich Angelie Muñez - Assignment 4 Adjusting EntriesRich Angelie MuñezNoch keine Bewertungen

- DocxDokument13 SeitenDocxMingNoch keine Bewertungen

- Accounting For Petty Cash FundDokument20 SeitenAccounting For Petty Cash FundLily of the ValleyNoch keine Bewertungen

- Chapter 2Dokument9 SeitenChapter 2royette ladicaNoch keine Bewertungen

- Midterm - Exam PDFDokument16 SeitenMidterm - Exam PDFLouisse Marie Catipay100% (1)

- Concepts of Income, Gross Income, and Compensation IncomeDokument61 SeitenConcepts of Income, Gross Income, and Compensation IncomeMeden Robrigado-LabogNoch keine Bewertungen

- Why a Statement of Cash Flows is Critical for Business SuccessDokument5 SeitenWhy a Statement of Cash Flows is Critical for Business SuccesskajsdkjqwelNoch keine Bewertungen

- May 28, 2015-CH 10-Basic Income Tax Patterns-Valencia & RoxasDokument18 SeitenMay 28, 2015-CH 10-Basic Income Tax Patterns-Valencia & RoxasgoerginamarquezNoch keine Bewertungen

- Lecture-3 On Classification of IncomeDokument14 SeitenLecture-3 On Classification of Incomeimdadul haqueNoch keine Bewertungen

- General Provisions: The Law On PartnershipDokument38 SeitenGeneral Provisions: The Law On PartnershipJoe P PokaranNoch keine Bewertungen

- Introduction To Business Taxes: September 4, 2020Dokument20 SeitenIntroduction To Business Taxes: September 4, 2020Bancas YvonNoch keine Bewertungen

- Partnership FormationDokument3 SeitenPartnership FormationJules AguilarNoch keine Bewertungen

- Module Part I Preface To UNIT I PDFDokument43 SeitenModule Part I Preface To UNIT I PDFsvpsNoch keine Bewertungen

- Midterm Exam - Part 1Dokument4 SeitenMidterm Exam - Part 1Andres, Rebecca PaulaNoch keine Bewertungen

- Sol. Man. - Chapter 1 - The Accounting Process - Ia Part 1a - 2020 EditionDokument12 SeitenSol. Man. - Chapter 1 - The Accounting Process - Ia Part 1a - 2020 EditionChristine Jean MajestradoNoch keine Bewertungen

- This Study Resource Was: 'Chapter 2Dokument7 SeitenThis Study Resource Was: 'Chapter 2Premium AccountsNoch keine Bewertungen

- Aescartin/Tlopez/Jpapa: Mobile Telephone GmailDokument7 SeitenAescartin/Tlopez/Jpapa: Mobile Telephone GmailReynalyn BarbosaNoch keine Bewertungen

- Answer To Homework QuestionsDokument102 SeitenAnswer To Homework QuestionsDhanesh SharmaNoch keine Bewertungen

- Recorte Apis 1Dokument35 SeitenRecorte Apis 1ENZO SEBASTIAN GARCIA ANDRADENoch keine Bewertungen

- Premachandra and Dodangoda v. Jayawickrema andDokument11 SeitenPremachandra and Dodangoda v. Jayawickrema andPragash MaheswaranNoch keine Bewertungen

- Management of Financial Services (MB 924)Dokument14 SeitenManagement of Financial Services (MB 924)anilkanwar111Noch keine Bewertungen

- NTA Doorman Diversion Warning Letter June 2008Dokument2 SeitenNTA Doorman Diversion Warning Letter June 2008TaxiDriverLVNoch keine Bewertungen

- Unit 1. The Political Self: Developing Active Citizenship Exercise 1.0. Politics, Society, and You (Pg. 1 of 3)Dokument2 SeitenUnit 1. The Political Self: Developing Active Citizenship Exercise 1.0. Politics, Society, and You (Pg. 1 of 3)Rafael VillegasNoch keine Bewertungen

- Republic Act No. 7638: December 9, 1992Dokument13 SeitenRepublic Act No. 7638: December 9, 1992Clarisse TingchuyNoch keine Bewertungen

- Evolving Principles of Dominant Position and Predatory Pricing in the Telecommunication Sector (1)Dokument20 SeitenEvolving Principles of Dominant Position and Predatory Pricing in the Telecommunication Sector (1)Aryansh SharmaNoch keine Bewertungen

- M. C. Mehta V. Union of IndiaDokument14 SeitenM. C. Mehta V. Union of Indiashort videosNoch keine Bewertungen

- Thomas T. Scambos, Jr. v. Jack G. Petrie Robert Watson, 83 F.3d 416, 4th Cir. (1996)Dokument2 SeitenThomas T. Scambos, Jr. v. Jack G. Petrie Robert Watson, 83 F.3d 416, 4th Cir. (1996)Scribd Government DocsNoch keine Bewertungen

- MSDS for Concrete Curing Compound Estocure WBDokument3 SeitenMSDS for Concrete Curing Compound Estocure WBSyerifaizal Hj. MustaphaNoch keine Bewertungen

- People vs Solayao ruling on admission of homemade firearm evidenceDokument1 SeitePeople vs Solayao ruling on admission of homemade firearm evidenceMaria Victoria Dela TorreNoch keine Bewertungen

- StarBus - UTC Online 4.0Dokument1 SeiteStarBus - UTC Online 4.0Jitendra BhandariNoch keine Bewertungen

- LTC ApllDokument4 SeitenLTC ApllSimranNoch keine Bewertungen

- 0452 w16 Ms 13Dokument10 Seiten0452 w16 Ms 13cheah_chinNoch keine Bewertungen

- History of Freemasonry Throughout The World Vol 6 R GouldDokument630 SeitenHistory of Freemasonry Throughout The World Vol 6 R GouldVak AmrtaNoch keine Bewertungen

- CIA Triangle Review QuestionsDokument11 SeitenCIA Triangle Review QuestionsLisa Keaton100% (1)

- Notice: Valid Existing Rights Determination Requests: Daniel Boone National Forest, KY Existing Forest Service Road UseDokument5 SeitenNotice: Valid Existing Rights Determination Requests: Daniel Boone National Forest, KY Existing Forest Service Road UseJustia.comNoch keine Bewertungen

- Cins Number DefinitionDokument3 SeitenCins Number DefinitionJohnny LolNoch keine Bewertungen

- 0 PDFDokument1 Seite0 PDFIker Mack rodriguezNoch keine Bewertungen

- Activity 7 Online Activity GERIZALDokument5 SeitenActivity 7 Online Activity GERIZALKc Kirsten Kimberly MalbunNoch keine Bewertungen

- 13 GARCIA v. VILLARDokument1 Seite13 GARCIA v. VILLARGSSNoch keine Bewertungen

- GST Registration CertificateDokument3 SeitenGST Registration CertificateChujja ChuNoch keine Bewertungen

- Social Studies - Part 1Dokument96 SeitenSocial Studies - Part 1Jedel GonzagaNoch keine Bewertungen

- Nutanix Support GuideDokument29 SeitenNutanix Support GuideEko PrasetyoNoch keine Bewertungen

- Camper ApplicationDokument4 SeitenCamper ApplicationClaire WilkinsNoch keine Bewertungen

- Traffic CitationsDokument1 SeiteTraffic Citationssavannahnow.comNoch keine Bewertungen

- Pathalgadi Movement and Adivasi RightsDokument5 SeitenPathalgadi Movement and Adivasi RightsDiXit JainNoch keine Bewertungen

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDokument4 SeitenStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceSiraj PNoch keine Bewertungen

- Bioavailabilitas & BioekivalenDokument27 SeitenBioavailabilitas & Bioekivalendonghaesayangela100% (1)

- Cornell Notes Financial AidDokument3 SeitenCornell Notes Financial AidMireille TatroNoch keine Bewertungen