Beruflich Dokumente

Kultur Dokumente

Suraj Gir's Guess Paper For AISSCE-2008: Accountancy (67/1/2)

Hochgeladen von

Shalini SharmaOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Suraj Gir's Guess Paper For AISSCE-2008: Accountancy (67/1/2)

Hochgeladen von

Shalini SharmaCopyright:

Verfügbare Formate

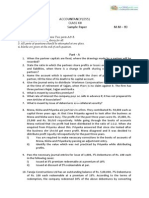

Suraj Girs Guess Paper for AISSCE-2008

Accountancy (67/1/2)

CLASS: XII MAX MARKS: 80 TIME ALLOWED: 3 Hrs

GENERAL INSTRUCTIONS: 1 This paper contains two parts A and B. 2 All parts of question should be attempted at one place. 3 Marks of each question are indicated against it. PART A (Accounting for Not For Profit Organisations, Partnership and Companies Accounts)

1 2

State any one point of distinction between Not for Profit Organisations and Profit Organisations Charu and Bharu are partners in a firm. Charu invests Rs 2,00,000 and Bharu Rs 3,00,000. The firm earns a profit of Rs 50,000, distribute the profit between Charus and Bharu. Distinguish between sacrifice ratio and gaining ratio State any two items that may appear on the Cr. Side of partner Capital account if capitals are fixed What is meant by Convertible Debentures ?

1 1

3 4 5 6

1 1 1 3

Show the amount of subscription in Income and Expenditure Account for the year 2001 Total Subscription received during the year as per Receipt and Payments Account is Rs 50,000? Additional information : 2000 2001 Outstanding Subscription Rs 10,000 Rs 15,000 Subscription Received in Advance Rs 12,000 Rs 10,000

Can a Company issue its share at a premium ? If , Yes, What are the ways for which the securities premium can be used ? State any three.

X Ltd issued 20,000 shares of Rs 10 each at 10% premium for public subscription. Full amount was payable on application. Applications were received on 30,000 shares. The directors decided to make a pro-rata allotment . Pass journal entries.

X,Y and Z are partners in a firm. They have credited their capital accounts by the interest on capitals @ 10% p.a. instead of 12% p.a. for the year. The capital balances of their capital, X Rs 3,00,000 ; Y Rs 2,00,000 and Z Rs 1,00,000. Pass the necessary adjusting entry with working notes. Ram, Mohan and Sohan were partners partners sharing profits and losses in the ratio of 5:3:2. 1

10

Their Fixed capitals were Rs 5,00,000; 3,00,000 and 2,00,000 respectively. As per the partnership deed interest on capital is to be provided at 10% p.a. Ram gave a guarantee of profit of Rs 25,000 in the year to Sohan . The profit of the firm was Rs 2,00,000 during the year. Prepare Profit and Loss Appropriation Account. 11 ABC Ltd forfeited 150 shares of Rs 10 each issued at a premium of Rs 5 per share , for non payment of allotment money of Rs 8 per share ( including premium of Rs 5 per share, first call of Rs 2 per share and final call of Rs 3 per share. Out of these 100 shares were reissued at Rs 14 per share. Give journal entries (a) S Ltd acquired assets of Rs 8,00,000 and liabilities of Rs 2,00,000 for purchased consideration of Rs 4,40,000. Purchase consideration was settled by issue of Debenture of 100 each at 10% premium. Pass journal entries. (b) Cona Gears Ltd converted 1000 15% Debentures of Rs 100 each into equity shares of Rs 20each issued at a premium of Rs 5 per share. Give necessary Journal entries on the conversion of Debentures. 13 From the following Receipt and Payments Account of a NGO, Prepare Income and Expenditure Account and Balance Sheet for the year ended Dec 31,2006 Receipts Cash in hand Subscription Donation Sale of Furniture ( Book value Rs 6000) Entrance Fees Life membership Fee Interest on Investment@5% for full year Amount Rs 68000 602000 30000 40000 8000 70000 Payments Salaries Traveling Expenses Stationery Rent Repair Books Purchased Building Purchased Cash in hand 50000 868000 Amount Rs 240000 60000 23000 160000 7000 60000 300000 18000 868000 4

12

Additional information : As on 1.1.06 Rs 10000 20000 12000 135000 160000 10000 31.12.06 Rs 32000 37000 8000 165000 80000 20000

i) Subscription received in advance ii) Outstanding subscription iii) Stock of Stationery iv) Books v) Furniture vi) Outstanding Rent

14

Iqbal and Kapoor are in partnership sharing profits and losses in 3:2. They insure their lives jointly for Rs.1,50,000 at an annual premium of Rs.6,800 to be debited to the business. Kapoor dies 3 months after the date of last balance sheet. According to the partnership deed, the legal personal of Kappor are entitled to the following payments: a) His capital as per the last balance sheet. 2

b) Interest on above capital at 3% per annum to the date of death. c) His share of profit to date of death calculated on the basis of last years profit. His drawing are to bear interest at an average rate of 2% on the amount irrespective of the period. The Net profits for the last 3 years, after premium, were Rs.20,000, Rs.25,000 and Rs.30,000 respectively. Kapoors capital was Rs.40,000 and his drawings to the date of death were Rs.5,000. Prepare Kapoors capital account and his executor account. 15 S ltd issued Rs 10,00,000 new capital divided into Rs 100 shares at a discount of Rs 10 per share payable as under: On application Rs 10 On Allotment the Balance including discount. Over Payment on application were applied towards sum due on allotment. Where no allotment was made the money to be returned in full. The issue was oversubscribed to the extent of 13000 shares. Application for 12000 shares were allotted only 2000 shares and applicants for 3000 shares were rejected All the money was duly received except a share holder of 300 shares who failed to pay allotment. These shares were forfeited by the directors and 200 shares of the forfeited shares were reissued at 10% discount. Pass the entries. Or Suman Fabrics Ltd issued Rs 50,00,000 shares of Rs 100 each at premium of Rs 20 per share and payable as Rs 20 on application, Rs 40 on allotment and balance on 1st call. Applications were received on 65,000 shares out which applications on 10,000 shares rejected and money on them sent back . Remaining shares and their money were adjusted on allotment. All the money was duly received except on 1000 shares held by B who failed to pay his allotment money and his shares were forfeited before 1st call. Pass journal entries in the books of Co. 16 Following the Balance Sheet P and Q share their profit in 3:2 respectively: Liabilities Sundry Creditors Capital Accounts: P 8000 Q 3500 Amount Rs 2500 Assets Land & Buildings Plant Sundry Debtors 2200 Less Provision 200 Stock Cash at Bank Amount Rs. 3500 4500 2000 3,500 500 14,000 8 8

11,500

14,000

They agree to admit R into partnership giving him a fifth share on the following terms a. The value of land and buildings to be increased by Rs.500. b. The value of plant to be increased to Rs.5500. c. Goodwill is to be valued at Rs 2000. 3

d. R to bring in capital to the extent of 1/5th of the total capital of the new firm after adjustments. Show the journal entries and the necessary ledger recording these adjustments and prepare the new Balance Sheet of the firm. Or The Balance Sheet of A,B and C on 31st Dec.,2002, the date of As retirement, was as follows: Liabilities Amount Assets Amount Rs. Rs Creditors 25,000 Goodwill 15000 Capitals Land & Buildings 40000 A 40000 B 40000 Plant & Machinery 28000 C 30000 Motor car 27000 Debtors 24000 Cash at Bank 1000 135,000 135000 The following terms have been agreed upon : a. Goodwill should be raised to Rs. 21000. b. The value of land & buildings be appreciated by Rs. 10000. c. Plant & Machinery be reduced to Rs.23000. d. Create a provision @ 5% on debtors for b& doubtful debts. e. A is paid Rs.13,500 by cash which is brought by B & C equally. f. The goodwill is not to be shown in new firm. Prepare:1. Revaluation A/C 2. Partners capital A/C 3. Bank A/C. 4. New Balance Sheet after As retirement.

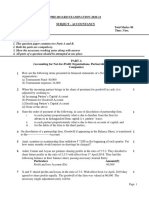

PART B ( Analysis of Financial Statements) 17 18 19 20 What is an ideal Current Ratio ? State whether there is Inflow or Outflow or No flow of cash when a Co. issues new shares ? State an example of Cash inflow from investing activities. Under which headings of the Balance Sheet of a Ltd Company as per the schedule VI of the Co Act,1956 following items will be shown: Share Premium, Unclaimed Dividend, Goodwill, Preliminary Expenditure, Debentures, Proposed Dividend Prepare a comparative income statement from the following information: 1991 Rs 4 1 1 1 3

21

4 1992 Rs

Sales 2,00,000 3,00,000 Gross Profit 40% 50% Operating Expenses 20% of Gross Profit for the years. Rate of Income Tax 50% for 1991 and 1992

22

From the following information , determine the opening and closing stock. Stock turnover 5 times, Total sales Rs 2,00,000 , Rate of gross profits on sales is 25%. Closing stock is more by Rs 4,000 than the opening stock.

23

From the following Balance Sheets, Prepare Cash Flow Statement for the year 2002.

Liabilities Creditors Loan Equity Capital Proposed Dividend General Reserve P&L A/c

2002 20,000 17,500 1,50,000 75,000 20,000 15,000 2,97,500

2003 40,000 9,500 2,00,000 50,000 35,000 24,000 3,58,500

Assets Goodwill Building Plant Debtors Stock Cash

2002 36,000 80,000 40,000 1,19,000 10,000 12,500

2003 20,000 60,000 1,00,000 1,54,500 15,000 9,000

2,97,500

3,58,500

Depreciation charged on plant was Rs. 10,000 and building Rs. 60,000.

Das könnte Ihnen auch gefallen

- Accountancy: Time Allowed: 3 Hours Maximum Marks: 80Dokument58 SeitenAccountancy: Time Allowed: 3 Hours Maximum Marks: 809chand3Noch keine Bewertungen

- Accountancy For Class XII Full Question PaperDokument35 SeitenAccountancy For Class XII Full Question PaperSubhasis Kumar DasNoch keine Bewertungen

- 12 Accountancy Sample Paper 2014 04Dokument6 Seiten12 Accountancy Sample Paper 2014 04artisingh3412Noch keine Bewertungen

- Class 12 Accountancy Solved Sample Paper 1 - 2012Dokument34 SeitenClass 12 Accountancy Solved Sample Paper 1 - 2012cbsestudymaterialsNoch keine Bewertungen

- XII - Accy. QP - Revision-15.2.14Dokument6 SeitenXII - Accy. QP - Revision-15.2.14devipreethiNoch keine Bewertungen

- Accounting For Partnership Firms: Short Answer Type QuestionsDokument8 SeitenAccounting For Partnership Firms: Short Answer Type QuestionssalumNoch keine Bewertungen

- Module-2 Sample Question PaperDokument18 SeitenModule-2 Sample Question PaperRay Ch100% (1)

- XII AccountancyDokument4 SeitenXII AccountancyAahna AcharyaNoch keine Bewertungen

- Accountancy (Accountancy (Accountancy (Accountancy (Delhi) Delhi) Delhi) Delhi)Dokument7 SeitenAccountancy (Accountancy (Accountancy (Accountancy (Delhi) Delhi) Delhi) Delhi)Bhoj SinghNoch keine Bewertungen

- Class 12 Accountancy Solved Sample Paper 2 - 2012Dokument37 SeitenClass 12 Accountancy Solved Sample Paper 2 - 2012cbsestudymaterialsNoch keine Bewertungen

- CBSE Class 12 Accountancy Sample Paper-01 (For 2013)Dokument7 SeitenCBSE Class 12 Accountancy Sample Paper-01 (For 2013)cbsestudymaterialsNoch keine Bewertungen

- Sample Paper 2 G 12 - Accountancy - SUMMER BREAKDokument9 SeitenSample Paper 2 G 12 - Accountancy - SUMMER BREAKpriya longaniNoch keine Bewertungen

- Class 12 Cbse Accountancy Sample Paper 2012 Model 2Dokument20 SeitenClass 12 Cbse Accountancy Sample Paper 2012 Model 2Sunaina RawatNoch keine Bewertungen

- CBSE Class 12 Accountancy Sample Paper-03 (For 2014)Dokument17 SeitenCBSE Class 12 Accountancy Sample Paper-03 (For 2014)cbsestudymaterialsNoch keine Bewertungen

- 3hr Paper 4feb 2010Dokument3 Seiten3hr Paper 4feb 2010Bhawna BhardwajNoch keine Bewertungen

- Accountancy 12th Class PaperDokument5 SeitenAccountancy 12th Class PaperSanjana SinghNoch keine Bewertungen

- Sample Paper (Cbse) - 2009 Accountancy - XiiDokument5 SeitenSample Paper (Cbse) - 2009 Accountancy - XiiJanine AnzanoNoch keine Bewertungen

- 9 Partnership Question 21Dokument11 Seiten9 Partnership Question 21kautiNoch keine Bewertungen

- Accounts Holiday HW 1Dokument4 SeitenAccounts Holiday HW 1AlishbaNoch keine Bewertungen

- CBSE Class 12 Accountancy Sample Paper With Marking Scheme 2013Dokument5 SeitenCBSE Class 12 Accountancy Sample Paper With Marking Scheme 2013Manish SahuNoch keine Bewertungen

- 10 Sample PaperDokument41 Seiten10 Sample Papergaming loverNoch keine Bewertungen

- 29Dokument3 Seiten29sharathk916Noch keine Bewertungen

- WBHSCMock 2Dokument4 SeitenWBHSCMock 2Smita AdhikaryNoch keine Bewertungen

- CBSE 12th Accountancy 2010 Unsolved Paper Delhi BoardDokument7 SeitenCBSE 12th Accountancy 2010 Unsolved Paper Delhi Boardbrainhub50Noch keine Bewertungen

- Question Bank Accountancy (055) Class XiiDokument5 SeitenQuestion Bank Accountancy (055) Class XiiDHIRENDRA KUMARNoch keine Bewertungen

- Delhi Public School: ACCOUNTANCY - (Subject Code: 055)Dokument4 SeitenDelhi Public School: ACCOUNTANCY - (Subject Code: 055)AbhishekNoch keine Bewertungen

- Sample Paper 4Dokument6 SeitenSample Paper 4Ashish BatraNoch keine Bewertungen

- Accountancy Sample Question PaperDokument20 SeitenAccountancy Sample Question PaperrahulNoch keine Bewertungen

- CBSE Class 12 Accountancy Sample Paper-02 (For 2012)Dokument20 SeitenCBSE Class 12 Accountancy Sample Paper-02 (For 2012)cbsesamplepaperNoch keine Bewertungen

- Question Bank CH-Retirement and DeathDokument6 SeitenQuestion Bank CH-Retirement and Deathsuchitasingh1106Noch keine Bewertungen

- Sample Paper 2013 Class XII Subject Accountancy: Time: 3hours Maximum Marks: 80 General InstructionsDokument8 SeitenSample Paper 2013 Class XII Subject Accountancy: Time: 3hours Maximum Marks: 80 General Instructions9chand3Noch keine Bewertungen

- Class XII Commerce (1) GGBDokument10 SeitenClass XII Commerce (1) GGBAditya KocharNoch keine Bewertungen

- AccountDokument67 SeitenAccountchamalix100% (1)

- Saint Hood Convent School Assignment Ch.3 (Change in Profit Sharing Ratio Among The Existing Partners)Dokument3 SeitenSaint Hood Convent School Assignment Ch.3 (Change in Profit Sharing Ratio Among The Existing Partners)Abhishek SharmaNoch keine Bewertungen

- Isc Accounts 5 MB: (Three HoursDokument7 SeitenIsc Accounts 5 MB: (Three HoursShivam SinghNoch keine Bewertungen

- Partnership and Non-For-Profit OrganisationsDokument4 SeitenPartnership and Non-For-Profit OrganisationsJoshi DrcpNoch keine Bewertungen

- Accountancy Model QuestionsDokument19 SeitenAccountancy Model QuestionsSunil Kumar AgarwalaNoch keine Bewertungen

- Alagappa University DDE BBM First Year Financial Accounting Exam - Paper3Dokument5 SeitenAlagappa University DDE BBM First Year Financial Accounting Exam - Paper3mansoorbariNoch keine Bewertungen

- Unit 2 Partmership Firms FundamentsDokument10 SeitenUnit 2 Partmership Firms FundamentsSunlight SirSundeepNoch keine Bewertungen

- CBSEDokument3 SeitenCBSEKaran Veer SinghNoch keine Bewertungen

- Sample Question Paper 2022-23 Acc XiiDokument12 SeitenSample Question Paper 2022-23 Acc XiiTûshar ThakúrNoch keine Bewertungen

- Ad Account Question PaperDokument3 SeitenAd Account Question PaperAbdul Lathif0% (1)

- Sardar Patel University BBA (ITM) (NC) II Semester Examination Wednesday, 20 March 2013 3 - 5 PM UM02CBBI02/08 - Corporate Accounting I Total Marks: 60 Note: (A) Figures To The Right Indicate MarksDokument3 SeitenSardar Patel University BBA (ITM) (NC) II Semester Examination Wednesday, 20 March 2013 3 - 5 PM UM02CBBI02/08 - Corporate Accounting I Total Marks: 60 Note: (A) Figures To The Right Indicate MarksRiteshHPatelNoch keine Bewertungen

- Accountancy Previous QuestionsDokument4 SeitenAccountancy Previous QuestionsmurthyNoch keine Bewertungen

- 12 Accountancy 2023-24Dokument37 Seiten12 Accountancy 2023-24chiragdahiya0602Noch keine Bewertungen

- TRDokument15 SeitenTRBhaskar BhaskiNoch keine Bewertungen

- Ghss Koduvayur Higher Secondary Model Examination 2011 Accountancy With Computerised AccountingDokument3 SeitenGhss Koduvayur Higher Secondary Model Examination 2011 Accountancy With Computerised Accountingsharathk916Noch keine Bewertungen

- Accountancy SQP PDFDokument8 SeitenAccountancy SQP PDFInder Singh NegiNoch keine Bewertungen

- 2020 12 SP AccountancyDokument21 Seiten2020 12 SP AccountancySaroj ViswariNoch keine Bewertungen

- QP Class Xii AccountancyDokument8 SeitenQP Class Xii AccountancyRKS TECHNoch keine Bewertungen

- Class 12 Accounts CA Parag GuptaDokument368 SeitenClass 12 Accounts CA Parag GuptaJoel Varghese0% (1)

- Partnership Fundamentals 2Dokument6 SeitenPartnership Fundamentals 2sainimanish170gmailcNoch keine Bewertungen

- XII ACC Holiday HomeworkDokument3 SeitenXII ACC Holiday HomeworkGaurav SainNoch keine Bewertungen

- Long Answer Type QuestionDokument75 SeitenLong Answer Type Questionincome taxNoch keine Bewertungen

- Model Examination Feb 2010-2011: Computerised AccountingDokument3 SeitenModel Examination Feb 2010-2011: Computerised Accountingsharathk916Noch keine Bewertungen

- Accounts XiiDokument12 SeitenAccounts XiiTanya JainNoch keine Bewertungen

- c2 Partnership ProblemsDokument6 Seitenc2 Partnership ProblemsSiva SankariNoch keine Bewertungen

- SHV in 2015 - 0 PDFDokument38 SeitenSHV in 2015 - 0 PDFBruno CesarNoch keine Bewertungen

- MKT318m SyllabusDokument54 SeitenMKT318m SyllabusBích DânNoch keine Bewertungen

- Assignment Case StudyDokument2 SeitenAssignment Case Studyjein_am100% (2)

- Master Plan Amritsar - 2031: Guru Ramdas School of Planning, Guru Nanak Dev University, Amritsar (Punjab)Dokument31 SeitenMaster Plan Amritsar - 2031: Guru Ramdas School of Planning, Guru Nanak Dev University, Amritsar (Punjab)Säbrinä ShukrìNoch keine Bewertungen

- Exercises-SClast SolvedDokument7 SeitenExercises-SClast SolvedSarah GherdaouiNoch keine Bewertungen

- Regional Sales Manager Operations Director in New Orleans LA Resume Marc GonickDokument2 SeitenRegional Sales Manager Operations Director in New Orleans LA Resume Marc GonickMarcGonickNoch keine Bewertungen

- EA405 D 01Dokument8 SeitenEA405 D 01Ilvita MayasariNoch keine Bewertungen

- Drill-9 EecoDokument17 SeitenDrill-9 EecoTine AbellanosaNoch keine Bewertungen

- Management Leading and Collaborating in A Competitive World 12th Edition Bateman Snell Konopaske Solution ManualDokument76 SeitenManagement Leading and Collaborating in A Competitive World 12th Edition Bateman Snell Konopaske Solution Manualamanda100% (24)

- DepartmentationDokument9 SeitenDepartmentationArjunsingh HajeriNoch keine Bewertungen

- 151333-121838 20200331 PDFDokument8 Seiten151333-121838 20200331 PDFNizam ShamatNoch keine Bewertungen

- SFP SciDokument28 SeitenSFP SciAcads PurpsNoch keine Bewertungen

- Ch6-2008 CISA ReviewCourseDokument58 SeitenCh6-2008 CISA ReviewCourseJoeFSabaterNoch keine Bewertungen

- Industrial Relations & Labour Laws: ObjectivesDokument40 SeitenIndustrial Relations & Labour Laws: ObjectivesAditya KulkarniNoch keine Bewertungen

- A Study On Customer Preference Towards Branded Jewellery: Dr. Aarti Deveshwar, Ms. Rajesh KumariDokument9 SeitenA Study On Customer Preference Towards Branded Jewellery: Dr. Aarti Deveshwar, Ms. Rajesh KumariArjun BaniyaNoch keine Bewertungen

- The Measurement of Service Quality With Servqual For Different Domestic Airline Firms in TurkeyDokument12 SeitenThe Measurement of Service Quality With Servqual For Different Domestic Airline Firms in TurkeySanjeev PradhanNoch keine Bewertungen

- Sameer Amale, Mohsin Dalvi - Industrial Relations and Collective Bargaining, Ethics and Justice in HRMDokument71 SeitenSameer Amale, Mohsin Dalvi - Industrial Relations and Collective Bargaining, Ethics and Justice in HRMmohsindalvi87Noch keine Bewertungen

- Principle of MarketingDokument16 SeitenPrinciple of MarketingahmedbariNoch keine Bewertungen

- PasarLaut PDFDokument39 SeitenPasarLaut PDFSantoso Muhammad ImanNoch keine Bewertungen

- Canara BankDokument84 SeitenCanara BankKiran Chandrashekar100% (1)

- Income From Business/ProfessionDokument3 SeitenIncome From Business/Professionubaid7491Noch keine Bewertungen

- Mau CV Xin Viec Bang Tieng AnhDokument3 SeitenMau CV Xin Viec Bang Tieng AnhThanh VkNoch keine Bewertungen

- EAB Management Operations - Assignment BriefDokument5 SeitenEAB Management Operations - Assignment BriefTakahiro DaikiNoch keine Bewertungen

- 16 Quintanar v. CCDokument3 Seiten16 Quintanar v. CCIELTSNoch keine Bewertungen

- Brand Extension ArticleDokument2 SeitenBrand Extension Articlepuneetgoyal9281Noch keine Bewertungen

- Digital Economy and Development of E-CommerceDokument4 SeitenDigital Economy and Development of E-CommerceEditor IJTSRDNoch keine Bewertungen

- Bar Questions and Answers in Mercantile Law (Repaired)Dokument208 SeitenBar Questions and Answers in Mercantile Law (Repaired)Ken ArnozaNoch keine Bewertungen

- SLBMDokument11 SeitenSLBMkurdiausha29Noch keine Bewertungen

- TBChap 003Dokument8 SeitenTBChap 003s aladwaniNoch keine Bewertungen

- Product Recall SOPDokument3 SeitenProduct Recall SOPvioletaflora81% (16)