Beruflich Dokumente

Kultur Dokumente

Techno Economic

Hochgeladen von

Daniel Alejandro Jara PaineanOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Techno Economic

Hochgeladen von

Daniel Alejandro Jara PaineanCopyright:

Verfügbare Formate

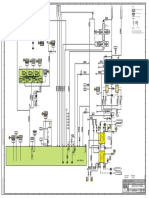

Techno-Economic Analysis for Innovation Valuation

OVERVIEW

Integrated financial modeling & simulation for high-risk / high-reward innovation valuation

www.sark7.com

This integrated techno-economic analysis process offers a framework for undertaking complex valuation to guide strategic decision making and to refine strategy. The method integrates Net Present Value (NPV), Monte Carlo simulation, and Real Options Analysis (ROA) to extrapolate the value of an innovation, particularly when new and uncertain markets are involved.

Keywords: techno-economic analysis, valuation, innovation, strategy, management of uncertainty, optimization, IP, R&D, NPV, ROA

SCOPE

1

Identifying business objectives, model artifacts, data & structure

Org Organizational identification of business needs, requirements, opportunities, challenges, risk tolerance, and key historical data. A highly segmented NPV model provides a skeleton. A Project tol Finance approach is utilized for value analysis, focusing on: 1) cash flows, 2) stakeholder Fin segmentation, and 3) explicit risk identification and allocation (i.e. partners, customers, financiers). seg

2 6 5 3

Revenue streams

2 MODEL

OPEX Costs CAPEX expenditures Financing

Providing insight into risks / opportunities via integrating probability & scenario analysis

NPV Model Monte Carlo Simulation Decision Tree Analysis Opportunity Analysis

4

7

RANGES

Static variables are extended to ranges (i.e. min, max, average; historical probability distributions) based upon historical data and experts. Key variables are enhanced according to an understanding of their probabilistic behavior, bringing insight to variable factors affecting capital/operating costs, revenue, economic factors, etc.

Static Net Present Value (NPV) analysis presents a highly linear and selective view of a prospect, often overlooking key opportunities and risks. The techno-economic model framework extends traditional Net Present Value (NPV) analysis via integrated Monte Carlo (probability) and Real Options Analysis (scenarios) to facilitate robust analysis of risks and opportunities. Continuously and iteratively refined, the model is an organizational artifact, bringing together diverse experts and stakeholders into a unified, structured conversation. Economy and transparency are key: the model must be as simple as possible with a clear audit path concerning key assumptions.

SIMULATE

Stakeholder componentization D/E mix Business structure

Integrated simulation gives direct insight into volatility & sensitivity

Combined, Monte Carlo simulation and Decision Tree results show expected ranges & sensitivities via risk-adjusted NPV outcomes. The highly-segmented model provides both roll-up and deep-dive insights into integrated strategic factors: Financial (granular): uncertainties, price variability, revenues, CAPEX/OPEX, market price elasticity, currency & interest rates, etc... Scenario-based (gross): investment, timing, scaling, POC cost/savings, risk strategies, commercialization/revenue strategies, financing, market, key risks, etc

SCENARIOES 4 S

Effect of timing on NPV

COSTS

INVESTMENT STRUCTURE

Financing terms REVENUES

Market

CAPEX OPEX COST OPTIMIZATION Commodity price analysis Scale analysis / comparison

Proof-ofconcept or straight to market?

NPV

SIMULATION

Gross and uncertain factors (both risks & opportunities) are added to the NPV model via a branching Decision Tree. Such factors could include: chance and cost of legal suit, chance of subsidy/grant, market size, R&D success/failure, chance of competitor entering, alternate strategies for commercialization (timing, scale, offering, licensing, partnering, sell). Decision Tree analysis allows for advanced like-to-like introspection regarding macro-level risks and opportunities.

price Market size simulation analysis Market REVENUE competition OPTIMIZATION simulation Price elasticity Alternate optimization scenarios (license, sell)

FINANCIAL Tax ENGINEERING Jurisdictional structure arbitrage Derivative Interest rate Grants & Currency hedging forecasting subsidies forecasting f

O 6 OPTIMIZE

Refine comparative scenarios by x o op optimizing structure, planning, timing

7 ITERATE

Review and validate: refine model via x r refined information and understandings

x Integrated simulation allows for formal volatility, sensitivity, and optimization analysis at both a gross and granular level (final NPV and component-level). Gaining insight into systemic dynamics, particular areas can be targeted for efficiency / exploitation. Structured scenarios can then be tailored to optimize profits and to reduce costs.

The universal NPV basis allows for like-to-like comparisons across a diverse strategic portfolio. Comparative strategies can be refined: structured financing, hybrid models (i.e. licensing, risk sharing), scaling, timing, tax, etc. Implicit stakeholder perceptions & assumptions are made explicit & verified throughout development and refinement of the model.

Das könnte Ihnen auch gefallen

- 2009, Joon, Site-specific raw seawater quality impact study on SWRO process for optimizing operation of the pressurized stepDokument18 Seiten2009, Joon, Site-specific raw seawater quality impact study on SWRO process for optimizing operation of the pressurized stepDaniel Alejandro Jara PaineanNoch keine Bewertungen

- 1997, Wilf, Design consequences of recent improvements in membrane performanceDokument7 Seiten1997, Wilf, Design consequences of recent improvements in membrane performanceDaniel Alejandro Jara PaineanNoch keine Bewertungen

- 1995, Malley, The Use of Selective and Direct DAF For Removal of Particulate Contaminants in Drinking Water TreatmentDokument9 Seiten1995, Malley, The Use of Selective and Direct DAF For Removal of Particulate Contaminants in Drinking Water TreatmentDaniel Alejandro Jara PaineanNoch keine Bewertungen

- Eliminacion de SolidosDokument47 SeitenEliminacion de SolidosIgnacNoch keine Bewertungen

- Role of Heat Treatment On The Performance of Polymers As Iron Oxide DispersantsDokument9 SeitenRole of Heat Treatment On The Performance of Polymers As Iron Oxide DispersantsLuis RebolledoNoch keine Bewertungen

- 1986, Adin, Pretreatment of Seawater by Flocculation and Settling For Particulates Removal PDFDokument16 Seiten1986, Adin, Pretreatment of Seawater by Flocculation and Settling For Particulates Removal PDFDaniel Alejandro Jara PaineanNoch keine Bewertungen

- Corrosion Guide - Stainless Internation NickelDokument20 SeitenCorrosion Guide - Stainless Internation NickelJohn BurkeNoch keine Bewertungen

- 10 Reverse OsmosisDokument15 Seiten10 Reverse OsmosisDaniel Alejandro Jara PaineanNoch keine Bewertungen

- Optimization of Seawater RO Systems Design: DesalinationDokument8 SeitenOptimization of Seawater RO Systems Design: DesalinationRavi PrasadNoch keine Bewertungen

- Paidar2016, MembraneDokument69 SeitenPaidar2016, MembraneDaniel Alejandro Jara PaineanNoch keine Bewertungen

- 1995, Edzwald, Principles and Applications of Dissolved Air Flotation PDFDokument23 Seiten1995, Edzwald, Principles and Applications of Dissolved Air Flotation PDFDaniel Alejandro Jara PaineanNoch keine Bewertungen

- 1995, Edzwald, Principles and Applications of Dissolved Air Flotation PDFDokument23 Seiten1995, Edzwald, Principles and Applications of Dissolved Air Flotation PDFDaniel Alejandro Jara PaineanNoch keine Bewertungen

- 2018, Fane, A Grand Challenge For Membrane Desalination More Water, Less CarbonDokument9 Seiten2018, Fane, A Grand Challenge For Membrane Desalination More Water, Less CarbonDaniel Alejandro Jara PaineanNoch keine Bewertungen

- 1986, Adin, Pretreatment of Seawater by Flocculation and Settling For Particulates Removal PDFDokument16 Seiten1986, Adin, Pretreatment of Seawater by Flocculation and Settling For Particulates Removal PDFDaniel Alejandro Jara PaineanNoch keine Bewertungen

- Chloride Contamination of The Water Steam Power Plant PDFDokument15 SeitenChloride Contamination of The Water Steam Power Plant PDFDiniNoch keine Bewertungen

- Chloride Contamination of The Water Steam Power Plant PDFDokument15 SeitenChloride Contamination of The Water Steam Power Plant PDFDiniNoch keine Bewertungen

- 2018, Fane, A Grand Challenge For Membrane Desalination More Water, Less CarbonDokument9 Seiten2018, Fane, A Grand Challenge For Membrane Desalination More Water, Less CarbonDaniel Alejandro Jara PaineanNoch keine Bewertungen

- 2018, Sanches, Microbial Diversity in Biofilms From Reverse Osmosis Membranes A Short Review of PDFDokument10 Seiten2018, Sanches, Microbial Diversity in Biofilms From Reverse Osmosis Membranes A Short Review of PDFDaniel Alejandro Jara PaineanNoch keine Bewertungen

- Mod 4lect 2Dokument34 SeitenMod 4lect 2Daniel Alejandro Jara PaineanNoch keine Bewertungen

- Paidar2016, MembraneDokument69 SeitenPaidar2016, MembraneDaniel Alejandro Jara PaineanNoch keine Bewertungen

- 1980, Brunelle, Colloidal Fouling of Reverse Osmosis MembranesDokument9 Seiten1980, Brunelle, Colloidal Fouling of Reverse Osmosis MembranesDaniel Alejandro Jara PaineanNoch keine Bewertungen

- Detection of Escherichia Coli in Biofilms From Pipe Samples and Coupons in Drinking Water Distribution NetworksDokument9 SeitenDetection of Escherichia Coli in Biofilms From Pipe Samples and Coupons in Drinking Water Distribution NetworksDaniel Alejandro Jara PaineanNoch keine Bewertungen

- 1999, Vilgritter, Removal of Natural Organic Matter by Coagulation-Flocculation A Pyrolysis-GC-MS StudyDokument6 Seiten1999, Vilgritter, Removal of Natural Organic Matter by Coagulation-Flocculation A Pyrolysis-GC-MS StudyDaniel Alejandro Jara PaineanNoch keine Bewertungen

- 1987, Alrqobah, Optimization of Chemical Pretreatment For Reverse Osmosis (RO) Seawater DesalinationDokument8 Seiten1987, Alrqobah, Optimization of Chemical Pretreatment For Reverse Osmosis (RO) Seawater DesalinationDaniel Alejandro Jara PaineanNoch keine Bewertungen

- Ebrahim 2001Dokument13 SeitenEbrahim 2001Daniel Alejandro Jara Painean100% (1)

- 0 06400 77813 01 - 0Dokument1 Seite0 06400 77813 01 - 0Daniel Alejandro Jara PaineanNoch keine Bewertungen

- 2016, Sarai, An Operational and Economic Study of A Reverse Osmosis Desalination System For Potable Water and Land IrrigationDokument11 Seiten2016, Sarai, An Operational and Economic Study of A Reverse Osmosis Desalination System For Potable Water and Land IrrigationDaniel Alejandro Jara PaineanNoch keine Bewertungen

- Duan 2009Dokument12 SeitenDuan 2009Daniel Alejandro Jara PaineanNoch keine Bewertungen

- Yoon 2013Dokument7 SeitenYoon 2013Daniel Alejandro Jara PaineanNoch keine Bewertungen

- Hardness Test Kit InstructionsDokument2 SeitenHardness Test Kit InstructionsDaniel Alejandro Jara PaineanNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- ZECO Audited Results For FY Ended 31 Dec 13Dokument1 SeiteZECO Audited Results For FY Ended 31 Dec 13Business Daily ZimbabweNoch keine Bewertungen

- Bank Audit Process and TypesDokument33 SeitenBank Audit Process and TypesVivek Tiwari50% (2)

- Performance of Indian Overseas Bank After Merger With Bharat Overseas BankDokument5 SeitenPerformance of Indian Overseas Bank After Merger With Bharat Overseas BankROHIT MAHAJANNoch keine Bewertungen

- Hewlett PackardDokument31 SeitenHewlett PackardAamir Awan0% (2)

- 2023 08 16 - StatementDokument5 Seiten2023 08 16 - Statementumrankamran530Noch keine Bewertungen

- Reliance Letter PadDokument60 SeitenReliance Letter PadAnonymous V9E1ZJtwoENoch keine Bewertungen

- Sharpe's ModelDokument58 SeitenSharpe's ModelTausif R Maredia100% (1)

- FFBL's Financial Management and OperationsDokument20 SeitenFFBL's Financial Management and OperationsSunny KhanNoch keine Bewertungen

- How To Value A Startup Without RevenueDokument5 SeitenHow To Value A Startup Without RevenueTejinder SinghNoch keine Bewertungen

- Preparation of Road and River Transport Strategy Note For South SudanDokument2 SeitenPreparation of Road and River Transport Strategy Note For South SudanPPPnewsNoch keine Bewertungen

- Strong Tie RatiosDokument2 SeitenStrong Tie RatiosHans WeirlNoch keine Bewertungen

- Select City Walk (Tarun)Dokument15 SeitenSelect City Walk (Tarun)Tarun BatraNoch keine Bewertungen

- Income Tax Payment Challan: PSID #: 34336315Dokument1 SeiteIncome Tax Payment Challan: PSID #: 34336315kashif shahzadNoch keine Bewertungen

- Fund Flow Statement - Nature, Preparation, AnalysisDokument22 SeitenFund Flow Statement - Nature, Preparation, AnalysisNikita 07Noch keine Bewertungen

- Forex Literature ReviewDokument6 SeitenForex Literature Reviewafmzhpeloejtzj100% (1)

- Easy Pinjaman Ekspres PDSDokument4 SeitenEasy Pinjaman Ekspres PDSFizz FirdausNoch keine Bewertungen

- SSS Disbursement Account Enrollment Module RemindersDokument2 SeitenSSS Disbursement Account Enrollment Module Remindersgemvillarin100% (3)

- What is Bitcoin? The Beginner's Guide to Understanding BitcoinDokument4 SeitenWhat is Bitcoin? The Beginner's Guide to Understanding BitcoinDevonNoch keine Bewertungen

- Earn an MBA at UKM's Graduate School of BusinessDokument2 SeitenEarn an MBA at UKM's Graduate School of BusinessMohd Fadzly Engan0% (1)

- Financing Health Care: Concepts, Challenges and Practices: April 28 - May 9, 2014Dokument2 SeitenFinancing Health Care: Concepts, Challenges and Practices: April 28 - May 9, 2014J.V. Siritt ChangNoch keine Bewertungen

- Gold Pecker Official Setup GuideDokument4 SeitenGold Pecker Official Setup GuideRei MaNoch keine Bewertungen

- OBYC Different Transaction Like BSX, GBBDokument3 SeitenOBYC Different Transaction Like BSX, GBBIgnacio Luzardo AlvezNoch keine Bewertungen

- DocxDokument12 SeitenDocxDiscord YtNoch keine Bewertungen

- Annual Report KIJA 2015 56 - 63Dokument210 SeitenAnnual Report KIJA 2015 56 - 63David Susilo NugrohoNoch keine Bewertungen

- Integrated Accounting SystemsDokument15 SeitenIntegrated Accounting SystemsSanjeev JayaratnaNoch keine Bewertungen

- Time Value Ipc NewDokument77 SeitenTime Value Ipc NewParvesh AghiNoch keine Bewertungen

- Acc 3 - RRNDDokument27 SeitenAcc 3 - RRNDHistory and EventNoch keine Bewertungen

- Sbi Service Rules 2015Dokument25 SeitenSbi Service Rules 2015Jeeban MishraNoch keine Bewertungen

- Advanced Accounting 7e Hoyle - Chapter 1Dokument47 SeitenAdvanced Accounting 7e Hoyle - Chapter 1Leni Rosiyani100% (8)

- Switzerland's Central Bank and Financial SystemDokument13 SeitenSwitzerland's Central Bank and Financial SystemNikhilNoch keine Bewertungen