Beruflich Dokumente

Kultur Dokumente

Ratios

Hochgeladen von

Prabhjot SeehraCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Ratios

Hochgeladen von

Prabhjot SeehraCopyright:

Verfügbare Formate

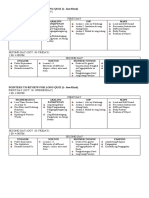

Ratio Analysis

United Phosphorous PVT LTD

Profitability Ratios

Operating Profit Margin(%)

10.83

13.33

14.3

12.74

13.7

Profit Before Interest And Tax

Margin(%)

Gross Profit Margin(%)

Net Profit Margin(%)

Return On Capital Employed(%)

Return On Net Worth(%)

Return on Long Term Funds(%)

6.6

6.82

5.1

7.47

6.19

8.47

8.6

8.92

6.72

8.3

6.47

8.94

10.12

10.53

4.97

9.41

6.97

9.99

8.48

8.74

6.51

7.8

9.43

7.96

9.55

10.09

6

9.81

8.58

10.47

Liquidity And Solvency Ratios

Current Ratio

Quick Ratio

Debt Equity Ratio

Long Term Debt Equity Ratio

1.96

2.41

0.61

0.42

2.37

2.57

0.41

0.31

2.32

2.95

1.08

0.96

3.39

3.35

1.12

1.08

2.76

2.99

1.12

1.03

Management Efficiency Ratios

Inventory Turnover Ratio

Debtors Turnover Ratio

Investments Turnover Ratio

Fixed Assets Turnover Ratio

Total Assets Turnover Ratio

Asset Turnover Ratio

6.67

2.46

6.67

2.36

0.85

0.76

6.66

2.7

6.66

2.08

0.74

0.67

8.59

3.43

8.59

2.04

0.67

0.69

10.92

3.66

10.92

1.84

0.69

0.67

4.94

4.02

4.94

1.85

0.65

0.68

62.08

2.5

4.7

75.86

59.09

2.5

4.92

75.92

68.15

2

3.41

48.9

56.54

2

4.12

43.71

49.43

1.5

3.55

41.35

Cash Flow Indicator Ratios

Dividend Payout Ratio Net Profit

Dividend Per Share

Earnings Per Share

Book Value

Ratio Analysis

Rashtriya Chemical & Fertilizers PVT LTD

Profitability Ratios

Operating Profit Margin(%)

Profit Before Interest And Tax

Margin(%)

7.95

6.21

6.74

5.71

7.9

5.37

3.89

4.6

3.79

6.76

Gross Profit Margin(%)

Net Profit Margin(%)

Return On Capital

Employed(%)

Return On Net Worth(%)

Return on Long Term

Funds(%)

5.44

4.02

3.99

3.77

4.7

4.34

3.84

4.09

6.86

2.48

11.62

11.92

12.62

11.47

15.25

12.18

9.53

12.78

22.55

12.65

18.21

17.32

16.99

14.41

38.65

Liquidity And Solvency Ratios

Current Ratio

Quick Ratio

1.03

1.67

1.26

1.26

1.43

1.38

1.25

1.74

1.13

1.43

Debt Equity Ratio

0.71

0.55

0.24

0.72

0.85

Long Term Debt Equity Ratio

0.09

0.13

0.11

0.14

0.08

Management Efficiency Ratios

Inventory Turnover Ratio

5.84

5.55

22.56

33.01

18.23

Debtors Turnover Ratio

3.03

4.48

6.31

4.27

5.72

Investments Turnover Ratio

5.84

5.55

22.56

33.01

18.23

Fixed Assets Turnover Ratio

1.88

1.85

1.71

1.82

2.93

Total Assets Turnover Ratio

1.71

1.92

2.22

1.79

2.71

Asset Turnover Ratio

1.87

2.2

1.95

1.81

2.85

34.46

1.5

5.09

42.69

36.01

1.4

4.52

39.36

28.77

1.1

4.44

36.46

30.13

1.1

4.26

33.3

36.6

1.2

3.84

30.33

Cash Flow Indicator Ratios

Dividend Payout Ratio Net

Dividend Per Share

Earnings Per Share

Book Value

Ratio Analysis

Shree Renuka Sugars LTD

Profitability Ratios

Operating Profit Margin(%)

9.34

11.61

11.76

16.82

13.31

Profit Before Interest And Tax

Margin(%)

6.83

9.32

10.27

14

11.23

Gross Profit Margin(%)

6.85

9.32

10.28

14.03

11.24

0.8

1.32

7.43

6.41

5.27

11.92

9.71

16.44

12.4

12.18

2.89

4.71

23.17

11.55

15.08

Return on Long Term Funds(%)

11.92

9.71

18.53

14.48

14.48

Liquidity And Solvency Ratios

Current Ratio

Quick Ratio

Debt Equity Ratio

Long Term Debt Equity Ratio

0.76

0.27

1.11

1.11

1.92

0.67

2.42

2.42

0.71

0.42

0.96

0.74

1.15

0.88

1.04

0.77

0.9

1.15

1.6

1.22

Management Efficiency Ratios

Inventory Turnover Ratio

Debtors Turnover Ratio

Investments Turnover Ratio

Fixed Assets Turnover Ratio

Total Assets Turnover Ratio

Asset Turnover Ratio

3.15

36.54

3.15

1.96

1.7

1.29

3.76

25.84

3.76

2.08

1.04

--

5.19

26.23

5.19

3.06

1.58

1.82

2.42

29.22

2.42

1.59

0.87

1.07

12.77

40.26

12.77

2.26

1.08

1.35

75.75

0.77

26.71

0.5

92.82

1.25

26.64

1

19.06

6.12

26.54

1

25.83

4.53

39.24

1

7.5

3.36

22.35

0.2

Net Profit Margin(%)

Return On Capital Employed(%)

Return On Net Worth(%)

Cash Flow Indicator Ratios

Dividend Payout Ratio Net Profit

Earnings Per Share

Book Value

Dividend Per Share

Ratio Analysis

Vikas WSP LTD

Profitability Ratios

Operating Profit Margin(%)

Profit Before Interest And Tax

Margin(%)

Gross Profit Margin(%)

Net Profit Margin(%)

Return On Capital

Employed(%)

Return On Net Worth(%)

20.06

27.95

34.14

37.74

40.43

18.46

18.49

11.83

23.69

23.74

14.51

26.67

26.68

22.37

31.12

31.13

26.1

34.57

34.59

33.17

35.11

24.65

21.9

14.47

14.19

13.14

15.89

14.77

17.11

17.38

Return on Long Term Funds(%)

38.77

23.37

14.66

16.18

18.14

Liquidity And Solvency Ratios

Current Ratio

Quick Ratio

Debt Equity Ratio

1.4

1.46

0.11

1.21

0.96

0.09

1.44

2.36

0.1

1.72

2.24

0.11

1.01

2.04

0.06

--

0.02

0.07

0.09

--

Management Efficiency Ratios

Inventory Turnover Ratio

Debtors Turnover Ratio

7.74

17.2

4

12.03

15.42

12.58

18.05

18.09

9.85

9.16

Investments Turnover Ratio

7.74

15.42

18.05

9.85

Fixed Assets Turnover Ratio

Total Assets Turnover Ratio

Asset Turnover Ratio

2.5

1.88

2.15

0.93

0.92

0.97

0.5

0.53

0.57

0.5

0.51

0.56

0.55

0.49

0.53

Cash Flow Indicator Ratios

Dividend Payout Ratio Net

Profit

Earnings Per Share

Book Value

Dividend Per Share

4.66

25.07

101.66

1

10.32

11.25

77.76

1

3.27

8.89

67.67

0.25

6.7

8.73

59.07

0.5

6.61

8.94

51.41

0.5

Long Term Debt Equity Ratio

Ratio nalysis

Rallis Brother India

Profitability Ratios

Operating

Profit

Margin(%)

Profit

Before

Interest

And Tax

Margin(%)

15.35

17.69

17.53

18.74

15.74

13.06

15.32

15.59

16.34

12.95

Gross Profit Margin(%)

13.17

15.39

15.91

16.66

13.03

Cash Profit Margin(%)

11.09

12.89

13.06

14.11

11.25

Net Profit Margin(%)

8.94

8.56

11.69

11.22

8.36

Adjusted Net Profit Margin(%)

8.94

8.56

11.69

11.22

8.36

Return On Capital Employed(%)

29.5

28

31.82

38.14

26.94

Return On Net Worth(%)

19.2

18.31

25.07

23.36

25.51

Return on Long Term Funds(%)

29.5

29.37

32.35

38.28

32.61

Liquidity And Solvency Ratios

Current Ratio

Quick Ratio

Debt Equity Ratio

Long Term Debt Equity Ratio

1.09

0.65

0.01

0.01

1.04

0.57

0.2

0.15

1.1

0.56

0.18

0.16

1.07

0.54

0.02

0.02

1

0.72

0.65

0.36

Management Efficiency Ratios

Inventory Turnover Ratio

Debtors Turnover Ratio

Investments Turnover Ratio

Fixed Assets Turnover Ratio

Total Assets Turnover Ratio

Asset Turnover Ratio

7.45

11.72

7.45

2.49

2.22

2.04

5.81

13.57

5.81

2.28

1.85

1.87

5.74

12.67

5.74

2.89

1.83

2.06

6.68

9.3

6.68

3.01

2.13

2.05

6.57

7.86

6.57

2.63

2.05

2.17

Dividend Payout Ratio Net Profit

43.7

49.04

35.86

27.04

36.41

Dividend Payout Ratio Cash Profit

Earnings Per Share

Book Value

Dividend Per Share

35.21

6.14

31.96

2.3

38.69

5.21

28.47

2.2

31.57

64.9

258.84

20

22.81

76.21

326.11

18

26.87

53.98

217.51

16

Cash Flow Indicator Ratios

Das könnte Ihnen auch gefallen

- Questionnaire: CGPA On My Most Recent Educational Certificate Is: 0 - 3 3 - 5 5 - 7 Above 7Dokument2 SeitenQuestionnaire: CGPA On My Most Recent Educational Certificate Is: 0 - 3 3 - 5 5 - 7 Above 7Prabhjot SeehraNoch keine Bewertungen

- KodakDokument21 SeitenKodakPrabhjot Seehra83% (6)

- GlobalLeadership 11206Dokument13 SeitenGlobalLeadership 11206Prabhjot SeehraNoch keine Bewertungen

- Relationships 7. Amitabh - 2 PDFDokument17 SeitenRelationships 7. Amitabh - 2 PDFPrabhjot SeehraNoch keine Bewertungen

- MOR Ang - Van Dyne Etc. 2007Dokument37 SeitenMOR Ang - Van Dyne Etc. 2007Prabhjot SeehraNoch keine Bewertungen

- 538 546Dokument9 Seiten538 546Prabhjot SeehraNoch keine Bewertungen

- Relation Between Cultural Intelligence and Customer SatisfactionDokument25 SeitenRelation Between Cultural Intelligence and Customer SatisfactionPrabhjot SeehraNoch keine Bewertungen

- Handbook of Cultural IntelligenceAng - Van Dyne - Tan 2010 Chapter in SternbergDokument21 SeitenHandbook of Cultural IntelligenceAng - Van Dyne - Tan 2010 Chapter in SternbergPrabhjot SeehraNoch keine Bewertungen

- Children 2013Dokument81 SeitenChildren 2013Chandra RaviNoch keine Bewertungen

- Private Sector Opinion Issue 17: A Corporate Governance Model: Building Responsible Boards and Sustainable BusinessesDokument16 SeitenPrivate Sector Opinion Issue 17: A Corporate Governance Model: Building Responsible Boards and Sustainable BusinesseshinahameedNoch keine Bewertungen

- GlobalLeadership 11206Dokument13 SeitenGlobalLeadership 11206Prabhjot SeehraNoch keine Bewertungen

- Article1380711059 - Ghorbani Et AlDokument9 SeitenArticle1380711059 - Ghorbani Et AlPrabhjot SeehraNoch keine Bewertungen

- Fina Draft Questionnaire of Capstone ProjectDokument6 SeitenFina Draft Questionnaire of Capstone ProjectPrabhjot SeehraNoch keine Bewertungen

- Relation Between Cultural Intelligence and Customer SatisfactionDokument25 SeitenRelation Between Cultural Intelligence and Customer SatisfactionPrabhjot SeehraNoch keine Bewertungen

- Group WorkDokument17 SeitenGroup WorkPrabhjot SeehraNoch keine Bewertungen

- Student Satisfaction ScaleDokument10 SeitenStudent Satisfaction ScalePrabhjot SeehraNoch keine Bewertungen

- Fee Notification Schedule.Dokument2 SeitenFee Notification Schedule.Prabhjot SeehraNoch keine Bewertungen

- Chapter 1Dokument67 SeitenChapter 1satseehraNoch keine Bewertungen

- Presentation by MR Yogesh DeveshwarDokument21 SeitenPresentation by MR Yogesh DeveshwarPrabhjot SeehraNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- ABC SCURP - Course OverviewDokument22 SeitenABC SCURP - Course OverviewMaru PabloNoch keine Bewertungen

- Freemason's MonitorDokument143 SeitenFreemason's Monitorpopecahbet100% (1)

- Abarientos PR1Dokument33 SeitenAbarientos PR1Angelika AbarientosNoch keine Bewertungen

- Canovan - Populism For Political Theorists¿Dokument13 SeitenCanovan - Populism For Political Theorists¿sebatorres7Noch keine Bewertungen

- Testimonies and PioneersDokument4 SeitenTestimonies and Pioneerswally ziembickiNoch keine Bewertungen

- Invoice 141Dokument1 SeiteInvoice 141United KingdomNoch keine Bewertungen

- Response Key 24.5.23Dokument112 SeitenResponse Key 24.5.23Ritu AgarwalNoch keine Bewertungen

- O.P. Jindal Global University Jindal Global Law School End-Term Examination - Semester BDokument3 SeitenO.P. Jindal Global University Jindal Global Law School End-Term Examination - Semester BRavvoNoch keine Bewertungen

- English 6: Making A On An InformedDokument30 SeitenEnglish 6: Making A On An InformedEDNALYN TANNoch keine Bewertungen

- Stross ComplaintDokument7 SeitenStross ComplaintKenan FarrellNoch keine Bewertungen

- Sita Devi KoiralaDokument18 SeitenSita Devi KoiralaIndramaya RayaNoch keine Bewertungen

- B.ed SyllabusDokument9 SeitenB.ed SyllabusbirukumarbscitNoch keine Bewertungen

- Congressional Record - House H104: January 6, 2011Dokument1 SeiteCongressional Record - House H104: January 6, 2011olboy92Noch keine Bewertungen

- FloridaDokument2 SeitenFloridaAbhay KhannaNoch keine Bewertungen

- SynopsisDokument15 SeitenSynopsisGodhuli BhattacharyyaNoch keine Bewertungen

- TOURISM AND HOSPITALITY ORGANIZATIONS Di Pa Tapooos 1 1Dokument101 SeitenTOURISM AND HOSPITALITY ORGANIZATIONS Di Pa Tapooos 1 1Dianne EvangelistaNoch keine Bewertungen

- Read MeDokument21 SeitenRead MeSyafaruddin BachrisyahNoch keine Bewertungen

- Chapter 1 To 23 Ques-AnswersDokument13 SeitenChapter 1 To 23 Ques-AnswersRasha83% (12)

- Great Books JournalDokument2 SeitenGreat Books JournalAnisa GomezNoch keine Bewertungen

- C - WEST SIDE STORY (Mambo) - Guitare 2Dokument1 SeiteC - WEST SIDE STORY (Mambo) - Guitare 2Giuseppe CrimiNoch keine Bewertungen

- Pointers To Review For Long QuizDokument1 SeitePointers To Review For Long QuizJoice Ann PolinarNoch keine Bewertungen

- Ocus Complaint RERADokument113 SeitenOcus Complaint RERAMilind Modi100% (1)

- BVP651 Installation ManualDokument12 SeitenBVP651 Installation ManualAnonymous qDCftTW5MNoch keine Bewertungen

- ECON 121 Seatwork-Assignment No. 2 Answer KeyDokument1 SeiteECON 121 Seatwork-Assignment No. 2 Answer KeyPhilip Edwin De ElloNoch keine Bewertungen

- EPLC Annual Operational Analysis TemplateDokument8 SeitenEPLC Annual Operational Analysis TemplateHussain ElarabiNoch keine Bewertungen

- TKAM ch1-5 Discussion QuestionsDokument14 SeitenTKAM ch1-5 Discussion QuestionsJacqueline KennedyNoch keine Bewertungen

- The IS - LM CurveDokument28 SeitenThe IS - LM CurveVikku AgarwalNoch keine Bewertungen

- Consejos y Recomendaciones para Viajar A Perú INGLESDokument3 SeitenConsejos y Recomendaciones para Viajar A Perú INGLESvannia23Noch keine Bewertungen

- Employee Engagement and Patient Centered Care PDFDokument8 SeitenEmployee Engagement and Patient Centered Care PDFSrinivas GoudNoch keine Bewertungen

- Madhu Limaye Vs The State of Maharashtra On 31 October, 1977Dokument13 SeitenMadhu Limaye Vs The State of Maharashtra On 31 October, 1977Nishant RanjanNoch keine Bewertungen