Beruflich Dokumente

Kultur Dokumente

Pre-Feasibility Study Prime Minister's Small Business Loan Scheme

Hochgeladen von

Mian Adi ChaudhryOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Pre-Feasibility Study Prime Minister's Small Business Loan Scheme

Hochgeladen von

Mian Adi ChaudhryCopyright:

Verfügbare Formate

Pre-Feasibility Study

Prime Ministers Small Business Loan Scheme

(12 Animal Dairy Farm)

Small and Medium Enterprises Development Authority

Ministry of Industries & Production

Government of Pakistan

www.smeda.org.pk

HEAD OFFICE

4th Floor, Building No. 3, Aiwan e Iqbal, Egerton Road,

Lahore

Tel 92 42 111 111 456, Fax 92 42 36304926-7

helpdesk@smeda.org.pk

REGIONAL OFFICE

PUNJAB

REGIONAL OFFICE

SINDH

REGIONAL OFFICE

KPK

REGIONAL OFFICE

BALOCHISTAN

3rd Floor, Building No. 3,

Aiwan e Iqbal, Egerton Road

Lahore,

Tel: (042) 111-111-456

Fax: (042)6304926-7

helpdesk.punjab@smeda.org.pk

5TH Floor, Bahria

Complex II, M.T. Khan Road,

Karachi.

Tel: (021) 111-111-456

Fax: (021) 5610572

helpdesk-khi@smeda.org.pk

Ground Floor

State Life Building

The Mall, Peshawar.

Tel: (091) 9213046-47

Fax: (091) 286908

helpdesk-pew@smeda.org.pk

Bungalow No. 15-A

Chaman Housing Scheme

Airport Road, Quetta.

Tel: (081) 831623, 831702

Fax: (081) 831922

helpdesk-qta@smeda.org.pk

September 2013

Pre-Feasibility Study

Dairy Farming

Table of Contents

1. DISCLAIMER .......................................................................................................................................... 2

2. PURPOSE OF THE DOCUMENT ......................................................................................................... 3

3. INTRODUCTION TO SMEDA .............................................................................................................. 3

4. INTRODUCTION TO SCHEME ........................................................................................................... 3

5. EXECUTIVE SUMMARY ...................................................................................................................... 4

6. BRIEF DESCRIPTION OF PROJECT & PRODUCT ........................................................................ 4

7. CRITICAL FACTORS ............................................................................................................................ 5

8. INSTALLED & OPERATIONAL CAPACITIES ................................................................................. 5

9. GEOGRAPHICAL POTENTIAL FOR INVESTMENT...................................................................... 5

10.

POTENTIAL TARGET MARKETS ............................................................................................... 5

11.

PROJECT COST SUMMARY ......................................................................................................... 5

11.1.

11.2.

11.3.

11.4.

11.5.

11.6.

11.7.

11.8.

PROJECT ECONOMICS ..................................................................................................................................6

PROJECT FINANCING ...................................................................................................................................6

PROJECT COST.............................................................................................................................................6

SPACE REQUIREMENT..................................................................................................................................7

MACHINERY AND EQUIPMENT .....................................................................................................................8

RAW MATERIAL REQUIREMENTS ................................................................................................................8

HUMAN RESOURCE REQUIREMENT .............................................................................................................9

REVENUE GENERATION ...............................................................................................................................9

12.

CONTACTS: .................................................................................................................................... 11

13.

ANNEXURE ..................................................................................................................................... 12

13.1.

13.2.

13.3.

13.4.

13.5.

14.

INCOME STATEMENT ................................................................................................................................. 12

BALANCE SHEET ....................................................................................................................................... 13

STATEMENT OF CASH FLOW ...................................................................................................................... 14

USEFUL PROJECT MANAGEMENT TIPS ...................................................................................................... 15

USEFUL LINKS ........................................................................................................................................... 15

KEY ASSUMPTIONS ..................................................................................................................... 17

1

September 2013

Pre-Feasibility Study

Dairy Farming

1. DISCLAIMER

This information memorandum is to introduce the subject matter and provide a general

idea and information on the said matter. Although, the material included in this

document is based on data/information gathered from various reliable sources;

however, it is based upon certain assumptions which may differ from case to case. The

information has been provided on as is where is basis without any warranties or

assertions as to the correctness or soundness thereof. Although, due care and diligence

has been taken to compile this document, the contained information may vary due to

any change in any of the concerned factors, and the actual results may differ

substantially from the presented information. SMEDA, its employees or agents do not

assume any liability for any financial or other loss resulting from this memorandum in

consequence of undertaking this activity. The contained information does not preclude

any further professional advice. The prospective user of this memorandum is

encouraged to carry out additional diligence and gather any information which is

necessary for making an informed decision, including taking professional advice from a

qualified consultant/technical expert before taking any decision to act upon the

information.

For more information on services offered by SMEDA, please contact our website:

www.smeda.org.pk

2

September 2013

Pre-Feasibility Study

Dairy Farming

2. PURPOSE OF THE DOCUMENT

The objective of the pre-feasibility study is primarily to facilitate potential entrepreneurs

in project identification for investment. The project pre-feasibility may form the basis of

an important investment decision and in order to serve this objective, the

document/study covers various aspects of project concept development, start-up, and

production, marketing, finance and business management.

The purpose of this document is to facilitate potential investors in Dairy Farm by

providing them with a general understanding of the business with the intention of

supporting potential investors in crucial investment decisions.

The need to come up with pre-feasibility reports for undocumented or minimally

documented sectors attains greater imminence as the research that precedes such

reports reveal certain thumb rules; best practices developed by existing enterprises by

trial and error, and certain industrial norms that become a guiding source regarding

various aspects of business set-up and its successful management.

Apart from carefully studying the whole document one must consider critical aspects

provided later on, which form basis of any Investment Decision.

3. INTRODUCTION TO SMEDA

The Small and Medium Enterprises Development Authority (SMEDA) was established in

October 1998 with an objective to provide fresh impetus to the economy through

development of Small and Medium Enterprises (SMEs).

With a mission "to assist in employment generation and value addition to the national

income, through development of the SME sector, by helping increase the number, scale

and competitiveness of SMEs" , SMEDA has carried out sectoral research to identify

policy, access to finance, business development services, strategic initiatives and

institutional collaboration and networking initiatives.

Preparation and dissemination of prefeasibility studies in key areas of investment has

been a successful hallmark of SME facilitation by SMEDA

Concurrent to the prefeasibility studies, a broad spectrum of business development

services is also offered to the SMEs by SMEDA. These services include identification of

experts and consultants and delivery of need based capacity building programs of

different types in addition to business guidance through help desk services.

4. INTRODUCTION TO SCHEME

Prime Ministers Small Business Loans Scheme, for young entrepreneurs, with an

allocated budget of Rs. 5.0 Billion for the year 2013-14, is designed to provide

subsidised financing at 8% mark-up per annum for one hundred thousand (100,000)

3

September 2013

Pre-Feasibility Study

Dairy Farming

beneficiaries, through designated financial institutions, initially through National Bank of

Pakistan (NBP) and First Women Bank Ltd. (FWBL).

Small business loans with tenure upto 7 years, and a debt: equity of 90 : 10 will be

disbursed to SME beneficiaries across Pakistan, covering; Punjab, Sindh, Khyber

Pakhtunkhwah, Balochistan, Gilgit Baltistan, Azad Jammu & Kashmir and Federally

Administered Tribal Areas (FATA).

5. EXECUTIVE SUMMARY

Dairy Farm is a project to attract small investors, in which, the 12 cows and buffalos are

raised on specific feed to gain high milk yield. Dairy farming is highly complex as it

includes breeding, management, feeding, housing, disease control and hygienic

production of milk on farm.

A dairy farm with a population of 12 cattle (6 cows and 6 buffalo) need a total

investment estimated at Rs. 2.05 million out of which the capital cost of the project is

Rs.1.95 million for animal purchase and the building construction and the rest is used to

meet the working capital requirement.

The project is expected to achieve the revenue of Rs. 2.00 million in the first year with

projected IRR and Payback of this project are 31% and 3.87 years respectively. The

farm will provide employment opportunity to 01 individual other than the owner

manager.

Legal status of the projected id proposed as a sole proprietorship.

6. BRIEF DESCRIPTION OF PROJECT & PRODUCT

Dairy farming is one of the fast growing businesses in the country which not only meet

the increasing demand of milk in the region but also contribute its part in export and

national income.

Keeping in view the significance of dairy farming, business nature and industry

competition, it is recommended to focus on management and operational aspects of the

farm, quality of herd mix, vaccination of the animals, feeding standards, and housing

system to make the business profitable.

The dairy farm is proposed to be established on purchased farm land and constructed

structure having total area of 3,485 sqft.

The proposed model is about 12 animals (6 cows and 6 buffaloes) to achieve milk

production of 33,288 liters by the end of first year. Milk production will be sold to the

domestic and bulk buyers at the rate of Rs.60 per liter with an annual price increase of

10%.

4

September 2013

Pre-Feasibility Study

Dairy Farming

7. CRITICAL FACTORS

1. Background knowledge and related experience of the entrepreneur in dairy farm

operations.

2. Selection of cows and buffalos with established minimum daily production of 10

liters or above buffalo and 12 liters or above for cows, certified with no diseases

with 2nd or 3rd lactation

3. Application of good husbandry practices as below

a. Housing and shelter

b. The housing style should be tie stall system

c. Regular vaccine of HSV and FMD is necessary

d. Feeding should be done thrice and 10% cp and 1500 kcal energy

e. Milk should be refrigerated at 4 c and transport at 11 c temperatures

8. INSTALLED & OPERATIONAL CAPACITIES

Production capacity is based on project size. The feasibility study suggests an initial

herd size of twelve (12) animals, which is economical to justify the overhead cost.

Initially, herd mix of 50% cows and 50% buffaloes is recommended to get the maximum

milk production round the year. The dairy farm will have the capacity to produce 33,288

liters of milk per annum.

9. GEOGRAPHICAL POTENTIAL FOR INVESTMENT

The development of urban and peri-urban commercial dairy farms is something new in

livestock production. Metropolitan cities like Lahore, Karachi, Multan, Rawalpindi,

Peshawar, Noshehra, Hyderabad, Sukkur Gilgit and Quetta etc are the major market of

milk. Hence, dairy farm established in peri-urban areas of these cities fulfils the daily

need of these cities.

10.

POTENTIAL TARGET MARKETS

Domestic consumers, milk processors, dairy companies, milk collection companies and

contractors are the major clients of a dairy farm.

11.

PROJECT COST SUMMARY

A detailed financial model has been developed to analyze the commercial viability of

Dairy Farm Project under the Prime Ministers Small Business Loan Scheme. Various

cost and revenue related assumptions along with results of the analysis are outlined in

this section.

The projected Income Statement, Cash Flow Statement and Balance Sheet are

attached as annexure.

5

September 2013

Pre-Feasibility Study

11.1.

Dairy Farming

Project Economics

All the figures in this financial model have been calculated for 12 Dairy animals

consisting of cows and buffalos in equal proportion.

The following table shows internal rates of return and payback period.

Table 1: Project Economics

Description

Details

Internal Rate of Return (IRR)

31%

Payback Period (Year)

3.87

Returns on the scheme and its profitability are highly dependent on the efficiency of

above mentioned critical factors. In case dairy farm project is not able to attain target

milk production and implement effective husbandry practices, it will not be able to cover

the potential market and recover payments; hence cost of operating the business will

increase. Similarly, the project using good quality and prescribed inputs will essential for

this venture.

11.2.

Project Financing

Following table provides details of the equity required and variables related to bank

financing;

Table 2: Project Financing

Description

Details (Rs.)

Total Equity (10%)

205,699

Bank Loan (90%.)

1,851,265

Markup to the Borrower (%age/annum)

8%

Tenure of the Loan (Years)

11.3.

Project Cost

6

September 2013

Pre-Feasibility Study

Dairy Farming

Following requirements have been identified for operations of the proposed business.

Table 3: Capital Investment for the Project

Capital Investment

Amount (Rs.)

Land

79,752

Building/Infrastructure

210,000

Cows and Buffalos

1,500,000

Machinery & Equipment

66,300

Pre-Operating Costs

100,909

Total Capital Costs

1,956,961

Cash in Hand

100,000

Total Project Cost

11.4.

2,056,961

Space Requirement

The area has been calculated on the basis of space requirement for production area,

management building, scrap yard and stores. However, the units operating in the

industry do not follow any set pattern. Following table shows calculations for project

space requirement.

Table 4: Space Requirement

Sr. No

Description

Area sqft

Shed for cows

600

Open Paddock for Cows

600

Shed for Buffalos

600

Open Paddock for Buffalos

600

Stores for fodder, concentrate & machine room

150

Utensils & milk storage

150

Servant Room, Wash room

90

Silage Bunker

384

Open Space

311

Total

3,485

7

September 2013

Pre-Feasibility Study

Dairy Farming

Total investment in building and infrastructure is calculated to be approximately Rs. 0.21

million.

11.5.

Machinery and Equipment

Following table provides list of machinery and equipment required for an average

foundry unit working for electrical fan sector.

Table 5: List of Machinery and Equipment

Sr. No Description

1

Calf feeder

Unit Rate (Rs.)

Qty

Cost (Rs.)

1,200

3,600

Teat Dip Cup

350

700

Maize Cutter

20,000

20,000

Water Pump

20,000

20,000

Freezer

22,000

22,000

Total

66,300

In addition to above few other equipment are required, such as fodder cutter, water

pump and some buckets etc.

11.6.

Raw Material Requirements

8

September 2013

Pre-Feasibility Study

Dairy Farming

As already mentioned that are two major end products for foundry output; Small parts of

ceiling and pedestal fan and large parts of Pedestal. Following table shows raw material

requirement to process one ton of material for large fan parts:

Table 6: Feeding Requirement for Cows

Description

Kgs/day/animal

Rs./kg

Amount (Rs.)

Dry (silage)

25.00

6.00

150.00

Concentrate

4.62

35.00

161.70

Total

311.70

Table 7: Feeding Requirement for Buffalo

Description

Kgs/day/animal

Green Fodder

Rs./kg

Amount (Rs.)

50

Dry (silage)

25.00

6.00

150.00

Concentrate

5.00

35.00

175.00

Total

325.00

Table 8: Feeding Requirement for Calfs

Description

Kgs/day/animal

Rs./kg

Amount (Rs.)

Calfs younger than one year

Dry

6.6

6.00

39.4

Concentrate

2.2

35.00

120.0

Total Fodder

159.4

Calfs younger than one year

Dry

2.6

6.00

15.8

Concentrate

0.9

35.00

120.0

Total Fodder

11.7.

135.8

Human Resource Requirement

One milk man will be required for milking and care of animals, whereas owner manager

will look after the overall business operations.

11.8.

Revenue Generation

9

September 2013

Pre-Feasibility Study

Dairy Farming

Table 9: Revenue Generation

Description

Units

Annual

Production

Milk Sales

Liters

33,288

10

September 2013

Rate (Rs./Unit)

Annual Revenue

(Rs.)

60

1,997,280

Pre-Feasibility Study

12.

Dairy Farming

CONTACTS:

Table 10: Suppliers List

Feed Suppliers

Scmen Suppliers

Hi tech feeds

Shadman cross ,Lahore

Dr Athar 03458444511

Alhaiwan Semen Production

Dr Farooq

03218695054

Punjnand Feeds

Dr Musadiq

0322 2668844

Hamza Dairy Mart

Maj.Dr. Muhammad Ramzan

40,first floor,sadiq plaza,the mall

Lahore, 0320-4011220

Doctors Dairy Feeds

203/7, UC-3, Cattle colony, Bin Qasim,

Karachi.

Phone: +92-21-5081923-27

Ghazi Brothers

B-35 KDA Scheme no 1, Mian Muhammad

Shah Road, Karachi.

Phone: 021-4543579, Fax: 021-4543763

Machinery Suppliers

Animal Suppliers

Dairy Solution (pvt) ltd.

177b ,Johar town ,Lahore

04235169450-1, 0300840 1680

info@dairysolution.com

Local Mandi s

Arifwala

Okara

Sargodha

WestFalia

Suite 623, Al Hafeez Shopping Mall,

Gulberg III, Lahore.

Phone:042-35884627-8

Consultants

Mr Major Ramzan

Dr. Rehan (Agrimasters)

210 Rewaaz Garden, Lower Mall,

Lahore.

Phone:042-37225666

11

September 2013

Pre-Feasibility Study

13.

Dairy Farming

ANNEXURE

13.1.

Income Statement

Income Statement

Year 1

Year 2

Year 3

Year 4

Year 5

Year 6

Year 7

Year 8

Year 9

Year 10

1,997,280

2,197,008

2,416,709

2,658,380

2,436,848

2,680,533

2,358,869

1,946,067

2,140,674

2,354,741

72,600

159,720

73,205

161,051

248,019

58,462

128,615

212,215

1,997,280

2,197,008

2,489,309

2,818,100

2,510,053

2,841,584

2,606,887

2,004,528

2,269,289

2,566,956

Year 1

Year 2

Year 3

Year 4

Year 5

Year 6

Year 7

Year 8

Year 9

Year 10

Revenue from sale of milk

Other Income

Total

Cost of sales

Cost of goods sold 1

Medicine, Vaccination & Insemination Charges

Operating costs 3 (direct electricity & fuel charges)

Total cost of sales

Gross Profit

1,394,373

30,600

120,000

1,544,973

452,307

1,394,373

33,660

132,000

1,560,033

636,975

1,394,373

37,026

145,200

1,576,599

912,710

1,394,373

40,729

159,720

1,594,822

1,223,278

1,161,978

37,335

175,692

1,375,004

1,135,049

1,161,978

41,068

193,261

1,396,307

1,445,277

929,582

36,140

212,587

1,178,309

1,428,578

697,187

29,815

233,846

960,848

1,043,680

697,187

32,797

257,231

987,214

1,282,075

697,187

36,077

282,954

1,016,217

1,550,739

General administration & selling expenses

Administration expense

Depreciation expense

Amortization of pre-operating costs

Subtotal

Operating Income

240,000

6,630

10,091

256,721

195,586

263,367

6,630

10,091

280,088

356,887

289,008

6,630

10,091

305,729

606,980

317,147

6,630

10,091

333,868

889,410

348,025

6,118

10,091

364,233

770,816

381,909

6,630

10,091

398,630

1,046,647

209,546

6,630

10,091

226,267

1,202,311

229,948

6,630

10,091

246,669

797,012

252,336

6,630

10,091

269,057

1,013,018

276,903

6,630

10,091

293,624

1,257,115

Earnings Before Interest & Taxes

195,586

356,887

606,980

889,410

770,816

1,046,647

1,202,311

797,012

1,013,018

1,257,115

Interest on short term debt

Interest expense on long term debt (Debt facility : Bank 1)

Interest expense on long term debt (Debt facility : Bank 2)

Subtotal

Earnings Before Tax

1,533

142,025

143,558

52,028

2,095

125,049

127,144

229,743

562

106,674

107,236

499,744

86,784

86,784

802,626

65,255

65,255

705,561

41,951

41,951

1,004,697

16,726

16,726

1,185,586

797,012

1,013,018

1,257,115

Taxable earnings for the year

Tax

NET PROFIT/(LOSS) AFTER TAX

52,028

52,028

229,743

11,487

218,256

499,744

49,974

449,770

802,626

140,460

662,167

705,561

105,834

599,727

1,004,697

210,986

793,710

1,185,586

248,973

936,613

797,012

119,552

677,460

1,013,018

212,734

800,284

1,257,115

263,994

993,121

52,028

52,028

52,028

270,285

270,285

270,285

720,055

720,055

720,055

1,382,221

691,111

691,111

691,111

1,290,837

1,290,837

1,290,837

2,084,548

1,042,274

1,042,274

1,042,274

1,978,887

989,443

989,443

989,443

1,666,903

833,452

833,452

833,452

1,633,736

816,868

816,868

816,868

1,809,989

904,994

904,994

Balance brought forward

Total profit available for appropriation

Dividend

Balance carried forward

50%

12

September 2013

Pre-Feasibility Study

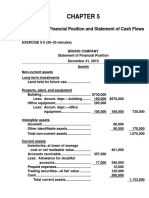

13.2.

Dairy Farming

Balance Sheet

Balance Sheet

Year 0

Year 1

Year 2

Year 3

Year 4

Year 5

Year 6

Year 7

Year 8

Year 9

Year 10

Assets

Current assets

Cash & Bank

Total Current Assets

Fixed assets

Land

Building/Infrastructure

Animals

Revaluation Surplus/ (loss)

Net value of animals

Machinery & equipment

Total Fixed Assets

Intangible assets

Pre-operation costs

Total Intangible Assets

TOTAL ASSETS

Liabilities & Shareholders' Equity

Current liabilities

Short term debt

Total Current Liabilities

Other liabilities

Deferred tax

Long term debt (Debt facility : Bank 1)

Long term debt (Debt facility : Bank 2)

Total Long Term Liabilities

Shareholders' equity

Paid-up capital

Gain/ (Loss) on revaluation of animals

Retained earnings

Total Equity

TOTAL CAPITAL AND LIABILITIES

100,000

100,000

79,752

210,000

1,500,000

261,543

261,543

128,603

128,603

567,666

567,666

240,799

240,799

122,427

122,427

102,708

102,708

315,579

315,579

684,420

684,420

1,500,000

66,300

1,856,052

79,752

210,000

1,500,000

1,500,000

59,670

1,849,422

79,752

210,000

1,500,000

1,500,000

53,040

1,842,792

79,752

210,000

1,500,000

(250,000)

1,250,000

46,410

1,586,162

79,752

249,930

1,500,000

(250,000)

1,250,000

39,268

1,618,950

79,752

249,930

1,500,000

(500,000)

1,000,000

33,150

1,362,832

79,752

249,930

1,500,000

(750,000)

750,000

26,520

1,106,202

79,752

249,930

1,500,000

(750,000)

750,000

19,890

1,099,572

79,752

249,930

1,500,000

(750,000)

750,000

13,260

1,092,942

79,752

249,930

1,500,000

(750,000)

750,000

6,630

1,086,312

79,752

249,930

1,500,000

1,500,000

1,829,682

100,909

100,909

2,056,961

90,818

90,818

1,940,240

80,727

80,727

1,923,519

70,636

70,636

1,918,342

60,545

60,545

1,808,098

50,454

50,454

1,980,952

40,364

40,364

1,387,365

30,273

30,273

1,252,272

20,182

20,182

1,215,832

10,091

10,091

1,411,982

2,514,102

37,187

37,187

13,635

13,635

1,645,328

1,645,328

11,487

1,422,416

1,433,904

61,462

1,181,129

1,242,591

201,921

919,952

1,121,874

307,755

637,246

945,001

518,742

331,236

849,977

767,715

767,715

887,266

887,266

1,100,000

1,100,000

1,363,994

1,363,994

205,696

52,028

257,724

1,940,240

205,696

270,285

475,981

1,923,519

205,696

(250,000)

720,055

675,751

1,918,342

245,114

(250,000)

691,111

686,224

1,808,098

245,114

(500,000)

1,290,837

1,035,951

1,980,952

245,114

(750,000)

1,042,274

537,387

1,387,365

245,114

(750,000)

989,443

484,557

1,252,272

245,114

(750,000)

833,452

328,565

1,215,832

245,114

(750,000)

816,868

311,982

1,411,982

245,114

904,994

1,150,108

2,514,102

1,851,265

1,851,265

205,696

205,696

2,056,961

13

September 2013

Pre-Feasibility Study

13.3.

Dairy Farming

Statement of Cash Flow

Cash Flow Statement

Year 0

Operating activities

Net profit

Add: depreciation expense

amortization of pre-operating costs

Deferred income tax

Cash provided by operations

Financing activities

Debt facility : Bank 1 - principal repayment

Short term debt principal repayment

Additions to Debt facility : Bank 1

Issuance of shares

Purchase of (treasury) shares

Cash provided by / (used for) financing activities

Investing activities

Capital expenditure

Acquisitions

Cash (used for) / provided by investing activities

NET CASH

Cash balance brought forward

Cash available for appropriation

Dividend

Cash balance

Cash carried forward

Year 1

Year 2

Year 3

Year 4

Year 6

Year 7

Year 8

Year 9

218,256

6,630

10,091

11,487

246,464

449,770

6,630

10,091

49,974

516,465

662,167

6,630

10,091

140,460

819,347

599,727

6,118

10,091

105,834

721,769

793,710

6,630

10,091

210,986

1,021,417

936,613

6,630

10,091

248,973

1,202,307

1,851,265

205,696

(205,936)

-

(222,912)

(37,187)

-

(241,287)

(13,635)

-

(261,177)

39,418

(282,706)

-

(306,010)

-

(331,236)

-

2,056,961

(205,936)

(260,099)

(254,922)

(221,759)

(282,706)

(306,010)

(331,236)

677,460

6,630

10,091

119,552

813,733

Year 10

52,028

6,630

10,091

68,749

800,284

6,630

10,091

212,734

1,029,739

993,121

6,630

10,091

263,994

1,273,836

(1,956,961)

(39,418)

(1,956,961)

(39,418)

100,000

100,000

100,000

100,000

(137,187)

(13,635)

261,543

558,170

439,063

715,407

871,071

813,733

1,029,739

1,273,836

100,000

(37,187)

(37,187)

-

(13,635)

(13,635)

-

261,543

261,543

261,543

261,543

819,713

691,111

128,603

128,603

128,603

567,666

567,666

567,666

567,666

1,283,073

1,042,274

240,799

240,799

240,799

1,111,870

989,443

122,427

122,427

122,427

936,160

833,452

102,708

102,708

102,708

1,132,447

816,868

315,579

315,579

315,579

1,589,415

904,994

684,420

684,420

14

September 2013

Year 5

Pre-Feasibility Study

13.4.

Dairy Farming

Useful Project Management Tips

Management

Knowledge of Business Operation:

Background

knowledge

and

related experience of the entrepreneur is a pre-requisite for starting this

business

Animal Selection:

Selection of disease free animals with established

standards of daily production

Quality Assurance Standards:

Whatever means required

quality standards need to be defined, this improves credibility

products

Marketing

Ads & Point of Sales Promotion: Business promotion and dissemination

through banners and launch events is highly recommended. Product

broachers from good quality service providers

Price - Bulk Discounts, Cost plus Introductory Discounts: Price should

never be allowed to compromise quality. Price during introductory phase may

be lower and used as promotional tool.

13.5.

Useful Links

Prime Ministers Office, www.pmo.gov.pk

Small and Medium Enterprise Development Authority, www.smeda.org.pk

National Bank of Pakistan (NBP), www.nbp.com.pk

First Women Bank Limited (FWBL), www.fwbl.com.pk

Government of Pakistan, www.pakistan.gov.pk

Ministry of Industries & Production, www.moip.gov.pk

Ministry of Education, Training & Standards in Higher Education,

http://moptt.gov.pk

Government of Punjab, www.punjab.gov.pk

Government of Sindh, www.sindh.gov.pk

Government of Khyber Pakhtunkhwa, www.khyberpakhtunkhwa.gov.pk

Government of Balochistan, www.balochistan.gov.pk

15

September 2013

Pre-Feasibility Study

Dairy Farming

Government of Gilgit Baltistan, www.gilgitbaltistan.gov.pk

Government of Azad Jamu Kashmir, www.ajk.gov.pk

Security Commission of Pakistan (SECP), www.secp.gov.pk

Federation of Pakistan Chambers of Commerce and Industry (FPCCI)

www.fpcci.com.pk

Dairy and Live Stock Departments

State Bank of Pakistan (SBP), www.sbp.org.pk

16

September 2013

Pre-Feasibility Study

14.

Dairy Farming

KEY ASSUMPTIONS

Milk Sale Price (cow) Rs.

60

Milk Sale Price (buffalo) Rs.

60

Capacity Utilization

100

Cow Ratio in the Herd

0.50

Purchase Price of a Cow (Rs.)

130,000

Purchase Price of a Buffalo (Rs.)

120,000

Sale Price of a Low Yielder cow (Rs.)

50,000

Sale Price of a Low Yielder buffalo (Rs.)

50,000

Sale Price of one year Male Calf (Rs.)

50,000

Milk Yield per Cow/day (liters)

12

Milk Yield per Buffalo/day (liters)

17

September 2013

Das könnte Ihnen auch gefallen

- Somaliland: Private Sector-Led Growth and Transformation StrategyVon EverandSomaliland: Private Sector-Led Growth and Transformation StrategyNoch keine Bewertungen

- Prime Minister's Small Business Loan Scheme Medical Store Pre-Feasibility StudyDokument18 SeitenPrime Minister's Small Business Loan Scheme Medical Store Pre-Feasibility Studyadnansensitive5057100% (1)

- Pre-Feasibility Study for Starting a Meat Shop (Rs. 1.24 MillionDokument19 SeitenPre-Feasibility Study for Starting a Meat Shop (Rs. 1.24 Millionmustafakarim100% (1)

- Micro or Small Goat Entrepreneurship Development in IndiaVon EverandMicro or Small Goat Entrepreneurship Development in IndiaNoch keine Bewertungen

- Pre-Feasibility Study Prime Minister's Small Business Loan SchemeDokument20 SeitenPre-Feasibility Study Prime Minister's Small Business Loan SchemeMian Adi ChaudhryNoch keine Bewertungen

- Augmentation of Productivity of Micro or Small Goat Entrepreneurship through Adaptation of Sustainable Practices and Advanced Marketing Management Strategies to Double the Farmer’s IncomeVon EverandAugmentation of Productivity of Micro or Small Goat Entrepreneurship through Adaptation of Sustainable Practices and Advanced Marketing Management Strategies to Double the Farmer’s IncomeNoch keine Bewertungen

- Footwear Retail Outlet PDFDokument16 SeitenFootwear Retail Outlet PDFMian Adi ChaudhryNoch keine Bewertungen

- Pre-Feasibility Study for Distribution Agency ProjectDokument20 SeitenPre-Feasibility Study for Distribution Agency ProjectschakirzamanNoch keine Bewertungen

- Inland Fish FarmingDokument15 SeitenInland Fish FarmingNarino JamBooNoch keine Bewertungen

- Pre-Feasibility Study Prime Minister's Small Business Loan SchemeDokument26 SeitenPre-Feasibility Study Prime Minister's Small Business Loan SchemeMian Adi ChaudhryNoch keine Bewertungen

- Gaming Zone PDFDokument18 SeitenGaming Zone PDFMian Adi ChaudhryNoch keine Bewertungen

- Montessori School Standardize Feasibility ReportDokument41 SeitenMontessori School Standardize Feasibility ReportGhulam Mustafa75% (4)

- Calf Fattening PDFDokument16 SeitenCalf Fattening PDFMian Adi ChaudhryNoch keine Bewertungen

- Internet CafeDokument16 SeitenInternet CafeKamal Shah67% (3)

- Medical Transcription Business PlanDokument16 SeitenMedical Transcription Business PlanMohsinRazaNoch keine Bewertungen

- Goat Fattening FarmDokument18 SeitenGoat Fattening FarmZohaib Pervaiz100% (2)

- Poultry FarmDokument22 SeitenPoultry Farmrisingprince89Noch keine Bewertungen

- Restaurant Cum Fast FoodDokument23 SeitenRestaurant Cum Fast FoodAbdul Saboor AbbasiNoch keine Bewertungen

- Pre-Feasibility Study: (Shrimp Farming)Dokument19 SeitenPre-Feasibility Study: (Shrimp Farming)Rameez100% (1)

- Pre-Feasibility Study Prime Minister's Small Business Loan SchemeDokument20 SeitenPre-Feasibility Study Prime Minister's Small Business Loan SchemeMian Adi Chaudhry100% (1)

- Montessori SchoolDokument21 SeitenMontessori SchoolAhmad UsmanNoch keine Bewertungen

- Pre-Feasibility Study for Medical Store Business (Rs. 1.06MDokument17 SeitenPre-Feasibility Study for Medical Store Business (Rs. 1.06MDanish Ahmed AlviNoch keine Bewertungen

- Cut Flower Farm - RoseDokument17 SeitenCut Flower Farm - RoseAlmira Naz ButtNoch keine Bewertungen

- SMEDA Pre-Feasibility Study on Fruits Processing & Packaging PlantDokument20 SeitenSMEDA Pre-Feasibility Study on Fruits Processing & Packaging PlantAyaz ShaukatNoch keine Bewertungen

- Florist Shop Business PlanDokument19 SeitenFlorist Shop Business PlanBrave King100% (1)

- Footwear Retail Outlet (Rs. 1.31 Million)Dokument18 SeitenFootwear Retail Outlet (Rs. 1.31 Million)longmanlong100Noch keine Bewertungen

- Pre-Feasibility Study Honey Production, Processing & MarketingDokument22 SeitenPre-Feasibility Study Honey Production, Processing & MarketingNarino JamBoo100% (3)

- Pre-Feasibility Study Prime Minister’s Small Business Loan Scheme (12 Animal Dairy FarmDokument18 SeitenPre-Feasibility Study Prime Minister’s Small Business Loan Scheme (12 Animal Dairy FarmSohaib KhanNoch keine Bewertungen

- Boutique (Women Designer Wear)Dokument20 SeitenBoutique (Women Designer Wear)sreedhu100% (1)

- Pre-Feasibility Study Prime Minister's Small Business Loan SchemeDokument14 SeitenPre-Feasibility Study Prime Minister's Small Business Loan SchemeMian Adi ChaudhryNoch keine Bewertungen

- Fodder Production & Trading Company Business PlanDokument18 SeitenFodder Production & Trading Company Business PlanBrave King100% (2)

- Stone CrushingDokument19 SeitenStone CrushingFaheem Mirza100% (2)

- Veterinary ClinicDokument19 SeitenVeterinary Clinicpradip_kumar100% (1)

- Sheep Fattening PDFDokument18 SeitenSheep Fattening PDFMian Adi Chaudhry100% (1)

- Pre-Feasibility Study for Marble Tiles Manufacturing UnitDokument19 SeitenPre-Feasibility Study for Marble Tiles Manufacturing UnitFaheem MirzaNoch keine Bewertungen

- Boutique Women Designer WearDokument21 SeitenBoutique Women Designer WearSohaib KhanNoch keine Bewertungen

- Dairy FarmDokument18 SeitenDairy FarmSardar Jan100% (1)

- Prime Minister's Small Business Loan Scheme for Florist ShopDokument20 SeitenPrime Minister's Small Business Loan Scheme for Florist ShopMian Adi ChaudhryNoch keine Bewertungen

- Pre-Feasibility Study Prime Minister's Small Business Loan SchemeDokument22 SeitenPre-Feasibility Study Prime Minister's Small Business Loan SchemeFaseeh MinhasNoch keine Bewertungen

- Light Weight Roof Tiles Pre-Feasibility StudyDokument22 SeitenLight Weight Roof Tiles Pre-Feasibility StudyRai FahadNoch keine Bewertungen

- Goat Fattening FarmDokument17 SeitenGoat Fattening FarmZee KhanNoch keine Bewertungen

- High School Franchise Rs. 5.8 Million Aug 2015Dokument18 SeitenHigh School Franchise Rs. 5.8 Million Aug 2015RajaNoch keine Bewertungen

- Day Care Center (Rs. 1.12 Million)Dokument18 SeitenDay Care Center (Rs. 1.12 Million)Farooq BhattiNoch keine Bewertungen

- Cut Flower Farm Gladiolus Marigold Statice and Chrysanthemum PDFDokument20 SeitenCut Flower Farm Gladiolus Marigold Statice and Chrysanthemum PDFMian Adi ChaudhryNoch keine Bewertungen

- Catering & Decor Pre-FeasibilityDokument18 SeitenCatering & Decor Pre-FeasibilityMian Adi ChaudhryNoch keine Bewertungen

- Bakery & ConfectionaryDokument26 SeitenBakery & ConfectionaryTarique AbbassNoch keine Bewertungen

- Pre-Feasibility Study for Starting a Small Bakery and Confectionery BusinessDokument25 SeitenPre-Feasibility Study for Starting a Small Bakery and Confectionery BusinessGulfraz AzeemiNoch keine Bewertungen

- Pre-Feasibility Study Catering & Decorating ServicesDokument17 SeitenPre-Feasibility Study Catering & Decorating Servicespaktts50% (2)

- Pre-Feasibility Study Reveals Profitable Gaming Zone BusinessDokument16 SeitenPre-Feasibility Study Reveals Profitable Gaming Zone BusinessskprofessionalNoch keine Bewertungen

- Poultry Farm PDFDokument20 SeitenPoultry Farm PDFMian Adi Chaudhry50% (8)

- Driving SchoolDokument14 SeitenDriving SchoolKhalid MemonNoch keine Bewertungen

- Pre-Feasibility Study for Starting a Camel Farming BusinessDokument18 SeitenPre-Feasibility Study for Starting a Camel Farming Businessfarooqansari45100% (1)

- PM's Small Business Loan Scheme - Veterinary Clinic Pre-FeasibilityDokument20 SeitenPM's Small Business Loan Scheme - Veterinary Clinic Pre-FeasibilityMian Adi Chaudhry50% (4)

- Catering and Decorating ServicesDokument17 SeitenCatering and Decorating ServicesSajjad HussainNoch keine Bewertungen

- Engineering Workshop - SubcontractingDokument16 SeitenEngineering Workshop - Subcontractingnav2ed100% (1)

- Security Agency PDFDokument22 SeitenSecurity Agency PDFMian Adi Chaudhry100% (1)

- Medical Store Business PlanDokument17 SeitenMedical Store Business PlanBrave King100% (3)

- Fortress Stadium Lahore: Valid: Monday, 10 JulyDokument2 SeitenFortress Stadium Lahore: Valid: Monday, 10 JulyMian Adi ChaudhryNoch keine Bewertungen

- Lahore Packages Market Flyer PDFDokument2 SeitenLahore Packages Market Flyer PDFMian Adi ChaudhryNoch keine Bewertungen

- C by MAR PDFDokument199 SeitenC by MAR PDFMian Adi ChaudhryNoch keine Bewertungen

- Salt Products PDFDokument18 SeitenSalt Products PDFMian Adi ChaudhryNoch keine Bewertungen

- Alaaa PDFDokument3 SeitenAlaaa PDFMian Adi ChaudhryNoch keine Bewertungen

- Seed Oil Extraction UnitDokument19 SeitenSeed Oil Extraction UnitzeeshanshahbazNoch keine Bewertungen

- Grad 37Dokument4 SeitenGrad 37Farwa MalikNoch keine Bewertungen

- Lahore Packages Market Flyer PDFDokument2 SeitenLahore Packages Market Flyer PDFMian Adi ChaudhryNoch keine Bewertungen

- Shopping Fiesta Leaflet 2017Dokument16 SeitenShopping Fiesta Leaflet 2017Mian Adi ChaudhryNoch keine Bewertungen

- Import Export DocumentationDokument14 SeitenImport Export DocumentationWarisJamalNoch keine Bewertungen

- Poultry Farm PDFDokument20 SeitenPoultry Farm PDFMian Adi Chaudhry50% (8)

- Prime Minister's Small Business Loan Scheme Pickle Production StudyDokument22 SeitenPrime Minister's Small Business Loan Scheme Pickle Production StudyMian Adi Chaudhry0% (1)

- Sheep Fattening PDFDokument18 SeitenSheep Fattening PDFMian Adi Chaudhry100% (1)

- Security Agency PDFDokument22 SeitenSecurity Agency PDFMian Adi Chaudhry100% (1)

- Spices Processing Packing MarketingDokument26 SeitenSpices Processing Packing MarketingRana990100% (1)

- Small To Medium Scale Distribuation Agency PDFDokument19 SeitenSmall To Medium Scale Distribuation Agency PDFMian Adi ChaudhryNoch keine Bewertungen

- PM's Loan Scheme: Stone Crushing Plant FeasibilityDokument20 SeitenPM's Loan Scheme: Stone Crushing Plant FeasibilityMian Adi Chaudhry50% (2)

- Shrimp Farming PDFDokument26 SeitenShrimp Farming PDFMian Adi ChaudhryNoch keine Bewertungen

- Subcontractor PDFDokument17 SeitenSubcontractor PDFMian Adi ChaudhryNoch keine Bewertungen

- PM's Small Business Loan Scheme - Veterinary Clinic Pre-FeasibilityDokument20 SeitenPM's Small Business Loan Scheme - Veterinary Clinic Pre-FeasibilityMian Adi Chaudhry50% (4)

- Small To Medium Scale Distribuation Agency PDFDokument19 SeitenSmall To Medium Scale Distribuation Agency PDFMian Adi ChaudhryNoch keine Bewertungen

- Fast Food Restaurant PDFDokument24 SeitenFast Food Restaurant PDFMian Adi ChaudhryNoch keine Bewertungen

- PM's Small Business Loan Scheme for Gemstone Lapidary ProjectDokument22 SeitenPM's Small Business Loan Scheme for Gemstone Lapidary ProjectMian Adi Chaudhry100% (2)

- Fodder Production Trading Company PDFDokument18 SeitenFodder Production Trading Company PDFMian Adi ChaudhryNoch keine Bewertungen

- Direct Marketing Services PDFDokument24 SeitenDirect Marketing Services PDFMian Adi ChaudhryNoch keine Bewertungen

- Gaming Zone PDFDokument18 SeitenGaming Zone PDFMian Adi ChaudhryNoch keine Bewertungen

- Prime Minister's Small Business Loan Scheme for Florist ShopDokument20 SeitenPrime Minister's Small Business Loan Scheme for Florist ShopMian Adi ChaudhryNoch keine Bewertungen

- Pre-Feasibility Study Prime Minister's Small Business Loan SchemeDokument14 SeitenPre-Feasibility Study Prime Minister's Small Business Loan SchemeMian Adi ChaudhryNoch keine Bewertungen

- Pre-Feasibility Study Prime Minister's Small Business Loan SchemeDokument14 SeitenPre-Feasibility Study Prime Minister's Small Business Loan SchemeMian Adi ChaudhryNoch keine Bewertungen

- Chapter 3 Financial Statements and Ratio Analysis: Principles of Managerial Finance, 14e (Gitman/Zutter)Dokument31 SeitenChapter 3 Financial Statements and Ratio Analysis: Principles of Managerial Finance, 14e (Gitman/Zutter)chinyNoch keine Bewertungen

- Current Liabilities - ProvisionsDokument9 SeitenCurrent Liabilities - ProvisionsJerome_JadeNoch keine Bewertungen

- Balance Sheet ProblemsDokument2 SeitenBalance Sheet ProblemsLouiseNoch keine Bewertungen

- AmalgamationDokument3 SeitenAmalgamationSowmya Upadhya G SNoch keine Bewertungen

- Consolidation Theories, Push-Down Accounting, and Corporate Joint VenturesDokument27 SeitenConsolidation Theories, Push-Down Accounting, and Corporate Joint VenturesvionaNoch keine Bewertungen

- Important Tables in SAP FICODokument5 SeitenImportant Tables in SAP FICOkeyspNoch keine Bewertungen

- Understanding Financial Accounting ReportsDokument23 SeitenUnderstanding Financial Accounting Reportschangyong leeNoch keine Bewertungen

- Care Home - Management AccountsDokument9 SeitenCare Home - Management AccountscoolmanzNoch keine Bewertungen

- Business Plan Electrical ShopDokument34 SeitenBusiness Plan Electrical ShopMirela Gashi85% (189)

- How Much Cash Does Your Company NeedDokument8 SeitenHow Much Cash Does Your Company NeedSairam PrakashNoch keine Bewertungen

- Buying an Existing Business GuideDokument24 SeitenBuying an Existing Business GuideberkNoch keine Bewertungen

- Merrill Lynch - How To Read Financial ReportDokument52 SeitenMerrill Lynch - How To Read Financial ReportDrei TorresNoch keine Bewertungen

- Accounting for Derivative InstrumentsDokument42 SeitenAccounting for Derivative InstrumentskristjuNoch keine Bewertungen

- ULANGANDokument5 SeitenULANGANRama Nur Anggrit PratamaNoch keine Bewertungen

- Fundamentals of Accounting Lesson 1 2 Acctng Equation DONEDokument13 SeitenFundamentals of Accounting Lesson 1 2 Acctng Equation DONEkim fernandoNoch keine Bewertungen

- Business Plan For Cleaning Company. ExampleDokument21 SeitenBusiness Plan For Cleaning Company. ExampleShantae CarterNoch keine Bewertungen

- Financial Reporting Financial Statement Analysis and Valuation 8th Edition Wahlen Solutions ManualDokument32 SeitenFinancial Reporting Financial Statement Analysis and Valuation 8th Edition Wahlen Solutions Manualmrsbrianajonesmdkgzxyiatoq100% (27)

- Beams11 ppt04Dokument49 SeitenBeams11 ppt04Rika RieksNoch keine Bewertungen

- Prosper Chapter6v2 PDFDokument28 SeitenProsper Chapter6v2 PDFAdam Taggart100% (2)

- Problem Quizzes 3 4 5Dokument9 SeitenProblem Quizzes 3 4 5Marjorie Palma0% (1)

- Solutions To Chapter 5Dokument13 SeitenSolutions To Chapter 5Saskia SpencerNoch keine Bewertungen

- Impact of Managerial Finance in BusinessDokument19 SeitenImpact of Managerial Finance in BusinessEzaz Chowdhury100% (2)

- Module: Activity 2: Michael Angelo G. Aleman February 22, 2022 AU-1BSA-A ACC 103Dokument3 SeitenModule: Activity 2: Michael Angelo G. Aleman February 22, 2022 AU-1BSA-A ACC 103Michael Angelo Guillermo AlemanNoch keine Bewertungen

- MCQs Far-1 (Final)Dokument64 SeitenMCQs Far-1 (Final)farwaakmal7Noch keine Bewertungen

- CAF7-Financial Accounting and Reporting II - QuestionbankDokument250 SeitenCAF7-Financial Accounting and Reporting II - QuestionbankEvan Jones100% (7)

- DLL Abm 1 Week 3Dokument4 SeitenDLL Abm 1 Week 3Christopher SelebioNoch keine Bewertungen

- Dwnload Full Introduction To Financial Accounting 11th Edition Horngren Test Bank PDFDokument35 SeitenDwnload Full Introduction To Financial Accounting 11th Edition Horngren Test Bank PDFgilmadelaurentis100% (13)

- Declaration 4220188016649Dokument3 SeitenDeclaration 4220188016649Shehla FarooqNoch keine Bewertungen

- IAS 16 Problem SolutionsDokument2 SeitenIAS 16 Problem SolutionsRimsha ArifNoch keine Bewertungen

- Divisionalized Performance and TPDokument22 SeitenDivisionalized Performance and TPNicole TaylorNoch keine Bewertungen

- Summary: Atomic Habits by James Clear: An Easy & Proven Way to Build Good Habits & Break Bad OnesVon EverandSummary: Atomic Habits by James Clear: An Easy & Proven Way to Build Good Habits & Break Bad OnesBewertung: 5 von 5 Sternen5/5 (1631)

- Mindset by Carol S. Dweck - Book Summary: The New Psychology of SuccessVon EverandMindset by Carol S. Dweck - Book Summary: The New Psychology of SuccessBewertung: 4.5 von 5 Sternen4.5/5 (327)

- The War of Art by Steven Pressfield - Book Summary: Break Through The Blocks And Win Your Inner Creative BattlesVon EverandThe War of Art by Steven Pressfield - Book Summary: Break Through The Blocks And Win Your Inner Creative BattlesBewertung: 4.5 von 5 Sternen4.5/5 (273)

- The Compound Effect by Darren Hardy - Book Summary: Jumpstart Your Income, Your Life, Your SuccessVon EverandThe Compound Effect by Darren Hardy - Book Summary: Jumpstart Your Income, Your Life, Your SuccessBewertung: 5 von 5 Sternen5/5 (456)

- SUMMARY: So Good They Can't Ignore You (UNOFFICIAL SUMMARY: Lesson from Cal Newport)Von EverandSUMMARY: So Good They Can't Ignore You (UNOFFICIAL SUMMARY: Lesson from Cal Newport)Bewertung: 4.5 von 5 Sternen4.5/5 (14)

- The One Thing: The Surprisingly Simple Truth Behind Extraordinary ResultsVon EverandThe One Thing: The Surprisingly Simple Truth Behind Extraordinary ResultsBewertung: 4.5 von 5 Sternen4.5/5 (708)

- Can't Hurt Me by David Goggins - Book Summary: Master Your Mind and Defy the OddsVon EverandCan't Hurt Me by David Goggins - Book Summary: Master Your Mind and Defy the OddsBewertung: 4.5 von 5 Sternen4.5/5 (382)

- Summary of The Anxious Generation by Jonathan Haidt: How the Great Rewiring of Childhood Is Causing an Epidemic of Mental IllnessVon EverandSummary of The Anxious Generation by Jonathan Haidt: How the Great Rewiring of Childhood Is Causing an Epidemic of Mental IllnessNoch keine Bewertungen

- Make It Stick by Peter C. Brown, Henry L. Roediger III, Mark A. McDaniel - Book Summary: The Science of Successful LearningVon EverandMake It Stick by Peter C. Brown, Henry L. Roediger III, Mark A. McDaniel - Book Summary: The Science of Successful LearningBewertung: 4.5 von 5 Sternen4.5/5 (55)

- Summary of 12 Rules for Life: An Antidote to ChaosVon EverandSummary of 12 Rules for Life: An Antidote to ChaosBewertung: 4.5 von 5 Sternen4.5/5 (294)

- How To Win Friends and Influence People by Dale Carnegie - Book SummaryVon EverandHow To Win Friends and Influence People by Dale Carnegie - Book SummaryBewertung: 5 von 5 Sternen5/5 (555)

- The Body Keeps the Score by Bessel Van der Kolk, M.D. - Book Summary: Brain, Mind, and Body in the Healing of TraumaVon EverandThe Body Keeps the Score by Bessel Van der Kolk, M.D. - Book Summary: Brain, Mind, and Body in the Healing of TraumaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Summary of Slow Productivity by Cal Newport: The Lost Art of Accomplishment Without BurnoutVon EverandSummary of Slow Productivity by Cal Newport: The Lost Art of Accomplishment Without BurnoutBewertung: 1 von 5 Sternen1/5 (1)

- Summary of Supercommunicators by Charles Duhigg: How to Unlock the Secret Language of ConnectionVon EverandSummary of Supercommunicators by Charles Duhigg: How to Unlock the Secret Language of ConnectionNoch keine Bewertungen

- Summary of The Galveston Diet by Mary Claire Haver MD: The Doctor-Developed, Patient-Proven Plan to Burn Fat and Tame Your Hormonal SymptomsVon EverandSummary of The Galveston Diet by Mary Claire Haver MD: The Doctor-Developed, Patient-Proven Plan to Burn Fat and Tame Your Hormonal SymptomsNoch keine Bewertungen

- Essentialism by Greg McKeown - Book Summary: The Disciplined Pursuit of LessVon EverandEssentialism by Greg McKeown - Book Summary: The Disciplined Pursuit of LessBewertung: 4.5 von 5 Sternen4.5/5 (187)

- We Were the Lucky Ones: by Georgia Hunter | Conversation StartersVon EverandWe Were the Lucky Ones: by Georgia Hunter | Conversation StartersNoch keine Bewertungen

- Designing Your Life by Bill Burnett, Dave Evans - Book Summary: How to Build a Well-Lived, Joyful LifeVon EverandDesigning Your Life by Bill Burnett, Dave Evans - Book Summary: How to Build a Well-Lived, Joyful LifeBewertung: 4.5 von 5 Sternen4.5/5 (61)

- Summary of Bad Therapy by Abigail Shrier: Why the Kids Aren't Growing UpVon EverandSummary of Bad Therapy by Abigail Shrier: Why the Kids Aren't Growing UpBewertung: 5 von 5 Sternen5/5 (1)

- Book Summary of The Subtle Art of Not Giving a F*ck by Mark MansonVon EverandBook Summary of The Subtle Art of Not Giving a F*ck by Mark MansonBewertung: 4.5 von 5 Sternen4.5/5 (577)

- The 5 Second Rule by Mel Robbins - Book Summary: Transform Your Life, Work, and Confidence with Everyday CourageVon EverandThe 5 Second Rule by Mel Robbins - Book Summary: Transform Your Life, Work, and Confidence with Everyday CourageBewertung: 4.5 von 5 Sternen4.5/5 (329)

- Steal Like an Artist by Austin Kleon - Book Summary: 10 Things Nobody Told You About Being CreativeVon EverandSteal Like an Artist by Austin Kleon - Book Summary: 10 Things Nobody Told You About Being CreativeBewertung: 4.5 von 5 Sternen4.5/5 (128)

- Summary of Atomic Habits by James ClearVon EverandSummary of Atomic Habits by James ClearBewertung: 5 von 5 Sternen5/5 (168)

- Crucial Conversations by Kerry Patterson, Joseph Grenny, Ron McMillan, and Al Switzler - Book Summary: Tools for Talking When Stakes Are HighVon EverandCrucial Conversations by Kerry Patterson, Joseph Grenny, Ron McMillan, and Al Switzler - Book Summary: Tools for Talking When Stakes Are HighBewertung: 4.5 von 5 Sternen4.5/5 (97)

- The Whole-Brain Child by Daniel J. Siegel, M.D., and Tina Payne Bryson, PhD. - Book Summary: 12 Revolutionary Strategies to Nurture Your Child’s Developing MindVon EverandThe Whole-Brain Child by Daniel J. Siegel, M.D., and Tina Payne Bryson, PhD. - Book Summary: 12 Revolutionary Strategies to Nurture Your Child’s Developing MindBewertung: 4.5 von 5 Sternen4.5/5 (57)

- Blink by Malcolm Gladwell - Book Summary: The Power of Thinking Without ThinkingVon EverandBlink by Malcolm Gladwell - Book Summary: The Power of Thinking Without ThinkingBewertung: 4.5 von 5 Sternen4.5/5 (114)

- Summary of Million Dollar Weekend by Noah Kagan and Tahl Raz: The Surprisingly Simple Way to Launch a 7-Figure Business in 48 HoursVon EverandSummary of Million Dollar Weekend by Noah Kagan and Tahl Raz: The Surprisingly Simple Way to Launch a 7-Figure Business in 48 HoursNoch keine Bewertungen

- Psycho-Cybernetics by Maxwell Maltz - Book SummaryVon EverandPsycho-Cybernetics by Maxwell Maltz - Book SummaryBewertung: 4.5 von 5 Sternen4.5/5 (91)