Beruflich Dokumente

Kultur Dokumente

1 s2.0 S1061951801000416 Main PDF

Hochgeladen von

Yustina Lita SariOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

1 s2.0 S1061951801000416 Main PDF

Hochgeladen von

Yustina Lita SariCopyright:

Verfügbare Formate

Journal of International Accounting, Auditing & Taxation 10 (2001) 139 156

A study of the relationship between corporate governance structures and the extent of voluntary disclosure

Simon S.M. Ho*, Kar Shun Wong

School of Accountancy, The Chinese University of Hong Kong, Shatin, N.T., Hong Kong

Abstract The primary objective of this study is to test a theoretical framework relating four major corporate governance attributes with the extent of voluntary disclosure provided by listed rms in Hong Kong. These corporate governance attributes are the proportion of independent directors to total number of directors on the board, the existence of a voluntary audit committee, the existence of dominant personalities (CEO/Chairman duality), and the percentage of family members on the board. Using a weighted relative disclosure index for measuring voluntary disclosure, the results indicate that the existence of an audit committee is signicantly and positively related to the extent of voluntary disclosure, while the percentage of family members on the board is negatively related to the extent of voluntary disclosure. The study provides empirical evidence to policy makers and regulators in East Asia for implementing the two new board governance requirements on audit committee and family control. 2001 Elsevier Science Inc. All rights reserved.

Keywords: Corporate disclosure; Corporate governance; Voluntary disclosure; Hong Kong

1. Introduction It is commonly agreed that the recent Asian nancial crisis was not only the result of a loss in investor condence but, more importantly, of a lack of effective corporate governance and transparency in many of Asias nancial markets and individual rms1. Over the last several years, most East Asian economies have been actively reviewing and improving their regulatory frameworks, in particular, corporate governance, transparency and disclosure.

* Corresponding author. Fax: (852) 2603-6604. E-mail address: simon @baf.msmail.cuhk.edu.hk (S.S.M. Ho). The helps given by the two anonymous reviewers and the Editors are gratefully acknowledged.

1061-9518/01/$ see front matter 2001 Elsevier Science Inc. All rights reserved. PII: S 1 0 6 1 - 9 5 1 8 ( 0 1 ) 0 0 0 4 1 - 6

140

S.S.M. Ho, K.S. Wong / Journal of International Accounting, Auditing & Taxation 10 (2001) 139 156

However, the simple adoption of more International Accounting Standards (IAS) is not sufcient to resolve the transparency problem in these countries. Whether the quality of the actual corporate disclosures satises investors information needs is more central. Mandatory disclosure rules ensure equal access to basic information (Lev 1992), but this information has to be augmented by rms voluntary disclosures and information production by intermediaries. There are major market incentives to disclose information voluntarily and managers attitudes to voluntary disclosure change according to the perceived relationship of the costs and benets involved (e.g., see Gray, Radebaugh and Roberts 1990; Healy and Palepu 1995). Voluntary disclosure and its determinants have been identied as an important research area in nancial reporting since the 1970s. Previous studies on the determinants of voluntary disclosure have been done mainly in the U.S. and other developed countries (e.g., Malone, Fries and Jones 1993; Schadewitz 1994; Raffournier 1995; Lang and Lundholm 1996). Some studies have examined institutional mechanisms (i.e., corporate governance) that may inuence voluntary disclosure practice. Corporate governance attributes examined in these studies include ownership structure (e.g., Craswell and Taylor 1992; Mckinnon and Dalimunthe 1993; Hossain, Tan and Adams 1994; Raffournier 1995), the proportion or existence of independent directors (e.g., Forker, 1992; Malone, Fries and Jones 1993), the appointment of a nonexecutive director as chairman, (e.g., Forker 1992), and the existence of an audit committee (e.g., Forker 1992). However, previous research only studied the effect of one single corporate governance attribute and very few of them examine different governance attributes in a single study. The ndings of these studies also may not be applicable to Eastern economies which have different regulatory and cultural environments. Examining the relationship between corporate governance attributes and corporate disclosure behavior in Hong Kong, with its unique regulatory (relatively nonstringent disclosure requirements compared to U.K. and U.S.) and corporate ownership environment (most listed rms are family- or individual-controlled), could provide valuable input to a debate that is increasingly becoming international. The main objective of this study is therefore to test the relationship between a set of corporate governance factors (see Fig. 1) and the extent of voluntary disclosure provided by listed rms in Hong Kong. Under the implicit assumption of information theory and agency theory, the study hypothesizes that improved monitoring on the board of directors leads to more voluntary disclosures. The importance or potential contributions of this current study are several. First, the current study examines several corporate governance mechanisms in a single model assuming different mechanisms may offset or interact each other. Second, prior studies did not test the impact of family control and the current study showed that the proportion of family members on a board is signicantly related to the extent of voluntary disclosure. Third, the Hong Kong data allows a fuller and more powerful approach to analysis as there is considerable variation in the measures of the explanatory and dependent variables. Last but not the least, as the study found that the audit committee and family control are signicant governance variables, it provides empirical evidence to policy makers and regulators in East Asia for implementing such new board governance requirements. The remainder of this paper is organized as follows. Section 2 introduces the corporate

S.S.M. Ho, K.S. Wong / Journal of International Accounting, Auditing & Taxation 10 (2001) 139 156

141

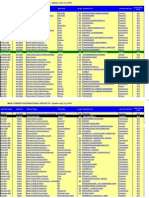

Fig. 1. The research framework & variables used.

disclosure and corporate governance environment in Hong Kong and discusses the specic hypotheses of this study. Section 3 outlines the research design and study sample. Section 4 discusses the results of the hypothesis tests. Section 5 summarizes the ndings and discusses the implications of the results.

2. Background and hypothesis development 2.1. Corporate disclosure Since Hong Kong was a British colony before July 1997, its nancial reporting system is largely inuenced by British accounting practices. The mandatory disclosure requirements in Hong Kong are stipulated by the Hong Kong Companies Ordinance, the Securities and Futures Commission (SFC) Ordinance, Listing Rules (Appendix 7A), Listing Agreements,

142

S.S.M. Ho, K.S. Wong / Journal of International Accounting, Auditing & Taxation 10 (2001) 139 156

and the Securities Ordinances promulgated by the Stock Exchange of Hong Kong (SEHK) (recently renamed as the Hong Kong Exchange and Clearing, HKEx), and the Statements of Standard Accounting Practice (SSAPs) issued by the Hong Kong Society of Accountants (HKSA). Overall, the scope of disclosure requirements in Hong Kong is much narrower and less specic than that in the U.S. and U.K. (Eccles and Mavrinac 1995). For instance, only interim (midyear) and year-end reports are provided. Disclosure rules governing insider dealings, related party transactions, and directors interests and remuneration are much less stringent than in the U.S. Since the Listing Rules and HK SSAPs have guidance status only, they provide Hong Kong companies with more exibility in reporting and disclosure. Consequently, rms disclosure choices are also more likely to reect voluntary responses to market forces. Conformity with the Listing Rules and accounting standards by Hong Kong rms is very high in general (Tai et al. 1990; HKSA 1997). The only area that has a comparatively low standard of compliance is on the disclosure of related party transactions (HKICS 1998) due most likely to a high proportion of family-controlled listed rms. The Judges Report of the HKMA Best Annual Report Award 1994 (HKMA 1995) noted that many Hong Kong companies made only the minimum disclosures required by the accounting standards and statutory provisions. In addition, the quality and quantity of information disclosed in annual reports varied quite substantially. Listed companies have been advised to disclose more information voluntarily (SCMP 1998). However, to avoid the danger of over-regulation, the SEHK hopes to encourage a culture of voluntary disclosure among listed companies. The SEHK believes that the quality of a companys disclosures will be reected in its stock price and its future ability to raise share capital (HKICS 1998). Nevertheless, disclosure requirements in Hong Kong are reviewed regularly. For instance, the new Securities and Futures Bill, to be enacted in late 2001 by the SFC, will introduce additional disclosure requirements to further combat market misconduct and empower investors (SFC, 2000). 2.2. Corporate governance Corporate governance is viewed as effectively delineating the rights and responsibilities of each group of stakeholders in the company. Transparency is one major indicator of the standard of corporate governance in an economy. In 1993 and 1994, to improve transparency and accountability, the SEHK and the HKSA set up a Corporate Governance Working Group (CGWG) respectively prescribing a number of recommended practices (HKSA 1997). These practices included: separation of CEO and board chairman, a requirement of at least two (independent) nonexecutive directors, limitation of family members on the board to no more than 50%, and a requirement for two board committees to be composed mainly of nonexecutive directors (an audit committee and a remuneration committee). An additional requirement to appoint at least two nonexecutive directors became effective at the beginning of 1995. The establishment of an audit committee is always voluntary in Hong Kong. In 1998, the Code of Best Practice was also revised by the SEHK which requires listed rms to disclose in their interim and annual reports the reason for the establishment or nonestablishment of audit committees for accounting periods beginning January 1, 1999.

S.S.M. Ho, K.S. Wong / Journal of International Accounting, Auditing & Taxation 10 (2001) 139 156

143

While separation of ownership and control is the predominant form of corporate governance in the U.S. and U.K., family share control is prevalent in Hong Kong and most other East Asian countries (La Porta et al. 1999). The rst report of the HKSAs CGWG conrmed that over half of Hong Kong listed companies are majority-controlled by a family or an individual (HKSA 1997). The ten wealthiest families in Hong Kong owned 46.8% of the total market capitalization of the SEHK in 1996 (HKSA 1997). Many of these family members appoint themselves as board directors and senior executives of the rms and always vote collectively. 2.3. Hypotheses development An objective of this study is to determine how corporate governance mechanisms affect a rms disclosure behaviors. Four corporate governance variables are examined in the current study2. These are the percentage of independent nonexecutive directors, the existence of an audit committee, the existence of dominant personalities, and the percentage of family members on the board. Jensen and Mecklings (1976) positive agency theory provides a framework linking disclosure behavior to corporate governance. Corporate governance mechanisms are introduced to control the agency problem and ensure that managers act in the interests of shareholders. In theory, the impact of internal governance mechanisms on corporate disclosures may be complementary or substitutive. If it is complementary, agency theory predicts that a greater extent of disclosures is expected since the adoption of more governance mechanisms will strengthen the internal control of companies and provide an intensive monitoring package for a rm to reduce opportunistic behaviors and information asymmetry (Leftwich, Watts and Zimmerman 1981; Welker 1995). Managers are not likely to withhold information for their own benets under such an intensive-monitoring environment, which lead to improvement in disclosure comprehensiveness and quality of nancial statements. On the other hand, if the relationship is substitutive, companies will not provide more disclosures for more governance mechanisms since one corporate governance mechanism may substitute another one. If information asymmetry in a rm can be reduced because of the existing internal monitoring packages, the need for install additional governance devices is smaller. These apparently conicting viewpoints on the impact of corporate governance have not been totally resolved. In spite of this theoretical ambiguity, Hill (1999) argues that no one single mechanism is a governance panacea and suggests that it is desirable to have a system of overlapping checks and balances. Therefore, the hypotheses about the effect of internal governance mechanisms in the current study are mainly predictions of a positive association. 2.3.1. The proportion of independent nonexecutive directors on board One major role of boards is its control functions (Pound 1995). Outside (independent) nonexecutive directors (IND) are perceived as a tool for monitoring management behavior (Rosenstein and Wyatt 1990), resulting in more voluntary disclosure of corporate information. Both Lefwich et al. (1981) and Fama and Jensen (1983) argued that the larger the proportion of INDs on the board, the more effective it will be in monitoring managerial opportunism, and companies can be expected to have more voluntary disclosures. Forker

144

S.S.M. Ho, K.S. Wong / Journal of International Accounting, Auditing & Taxation 10 (2001) 139 156

(1992) found that a higher percentage of IND on boards enhanced the monitoring of the nancial disclosure quality and reduced the benets of withholding information. It is hypothesized that: H1: Companies with a higher proportion of independent nonexecutive directors are more likely to have a higher extent of voluntary disclosure. Although SEHK requirements emphasize the number rather than the proportion of IND to total directors, the use of a proportion was used in the current study. Independent directors may not exert sufcient monitoring power if their numbers only account for a small proportion of board membership.3 2.3.2. The existence of an audit committee The functions of an audit committee include ensuring the quality of nancial accounting and control system (Collier 1993). Since an audit committee consists mainly of nonexecutive directors, it has inuence to reduce the amount of information withheld. Agency theory predicts the establishment of audit committees as a means of attenuating agency costs. Forker (1992) argued that the existence of audit committees may improve internal control and thus regarded it as an effective monitoring device for improving disclosure quality. He found a positive but weak relationship between the disclosure of the audit committee and the quality of share-option disclosure for U.K. companies. McMullen (1996) provides support for the association between the presence of an audit committee and more reliable nancial reporting. It is therefore hypothesized that: H2: Companies that have an audit committee are more likely to have a higher extent of voluntary disclosure. 2.3.3. The existence of dominant personalities Firms that have one individual who serves as both chairman and chief executive ofcer/ managing director (CEO duality) are considered to be more managerially dominated (Molz 1988). The person who occupies both roles would tend to withhold unfavorable information to outsiders. Fama and Jensen (1983) argued that any adverse consequences could be eliminated by market discipline. But Forker (1992) asserts that a dominant personality in both roles poses a threat to monitoring quality and is detrimental to the quality of disclosure. He found a signicant negative relationship between the existence of a dominant personality and the quality of share-option disclosure. Hence, it is hypothesized that: H3: Companies which appoint a dominant chief executive ofcer as board chairman are more likely to have a lower extent of voluntary disclosure. 2.3.4. The percentage of family members on the board Agency theory argues that in a diffused ownership environment, rms will disclose more information to reduce agency costs and information asymmetry. In a more concentrated ownership situation, the impact on voluntary disclosure is more complicated and the argument can be made in either direction. Jensen and Meckling (1976) indicate that since managers pursue their own interest, higher management shareholding would imply a larger sharing of the loss, and ultimately, a lower possibility that management would lower corporate value.

S.S.M. Ho, K.S. Wong / Journal of International Accounting, Auditing & Taxation 10 (2001) 139 156

145

In contrast to the convergence-of-interests hypothesis, the management entrenchment hypothesis suggests that under very high concentration of ownership, conicts of interest are not between managers and shareholders, but between large and small shareholders (Shleifer and Vishny 1997). When ownership control is high enough to ensure its position, management has the incentive to behave against the interests of other smaller shareholders because of its strong voting power to appoint someone it trusts to be CEO, directors and/or board chairman (Morck, Shleifer and Vishny 1988). Besides expropriating minority interests directly, these controlling shareholders can enrich themselves through connected party transactions in which prots are transferred to other companies they control. In Hong Kong, since family ownership is often high enough to secure a controlling position, it is generally believed that the management entrenchment hypothesis should apply. Corporate boards in Hong Kong are sometimes viewed by international investors simply a mean to approve the wishes of the family shareholders. Family members total shareholding was not used in the current study to measure family control since such data were not available in Hong Kong. Instead, the number of family members on the board of directors was used as a surrogate for family control. On the basis of the management entrenchment hypothesis, it is hypothesized that: H4: Companies with a higher proportion of family members sitting on the board are more likely to have a lower extent of voluntary disclosure. 2.3.5. Other control variables A review of the literature on voluntary disclosure led to the decision to include ve control variables in the multiple regression models for testing the main hypotheses. These are rm size (Chow and Wong-Boren 1987), assets-in-place (Hossain et al., 1994), nancial leverage (Bradbury 1992), protability (Meek et al. 1995) and industry type (Meek et al. 1995).

3. Data collection and research design 3.1. Survey A questionnaire survey of the 610 chief nancial ofcers (CFOs) of all listed rms in Hong Kong was conducted to determine the existence of an audit committee in their rms. Another version of the questionnaire was sent to 535 nancial analysts from all investment or brokerage rms in Hong Kong in late 1997 and early 1998. The purpose of this survey was to determine users perceptions of the usefulness of various voluntary disclosure items. After two mailings, 98 CFOs and 92 nancial analysts returned the survey resulting in response rates of 17% and 18%, respectively4. For both respondent groups, the responses to all Likert-scale questions from the last 20 questionnaires returned were compared to the results of the rst 20 questionnaires returned in order to check for any nonresponse bias. This technique, introduced by Oppenheim (1966), indicated no signicant difference (alpha 0.05) between those companies who responded earlier and those who responded later. Thus, assuming that the later respondents were similar to the nonrespondents, there was no indication of a visible nonresponse bias in the data. To further conrm any nonresponse bias,

146

S.S.M. Ho, K.S. Wong / Journal of International Accounting, Auditing & Taxation 10 (2001) 139 156

Table 1 Industrial Breakdown of Responding Firms Industry Type Manufacturing Conglomerate Banking & nance Property & construction Retail/trade Others Hotel, catering & entertainment Communication & media Transport & storage Utilities Chinese H share Number 23 12 12 11 9 9 8 5 5 3 1 98 Percentage 23.46 12.20 12.20 11.20 9.18 9.18 8.16 5.10 5.10 3.10 1.02 100.00

additional t tests showed that there was no signicant difference in all continuous-scale independent variables and the dependent variable between early and late respondents. Furthermore, the returned reply slips from 58 CFOs and 45 analysts who declined to complete the questionnaire indicated that over 97.5% of the nonrespondents did not complete the questionnaires due to company policy not to entertain research questionnaires or lack of time5. Table 1 provides demographic information concerning the CFO respondents. 3.2. The measurement of voluntary disclosure Most previous studies (conducted outside Hong Kong) on determinants of voluntary disclosure have developed disclosure indices to examine the association with rm-specic characteristics (see e.g., Meek et al. 1995). However, most of the studies did not take into account users perceptions of the importance or usefulness of the disclosure items. In the current study, the extent of voluntary disclosure was measured by using an importanceadjusted relative disclosure index (RDI). It was derived by rst compiling from previous literature and annual reports in Hong Kong a comprehensive list of voluntary disclosure items that companies have provided. The list was then checked against a mandatory disclosure checklist prepared by a Big-5 accounting rm (Ernst & Young) in Hong Kong. Items mandated to be disclosed by Hong Kong listed companies were eliminated. The remaining 35 items were included in a survey questionnaire and the sample of analyst users was asked to rate the importance of each item on a 5-point scale. After standardizing the responses to a zero mean and unit variance, a total of 20 of the 35 items with a minimum importance score of 3.5 were identied as the base for measuring the RDI. The RDI was then computed for each sample companies as a ratio of the absolute disclosure score to the maximum possible disclosure score. The absolute disclosure score for each company is the total number of items of the 20 most important items disclosed voluntarily in the annual report. This method of calculating RDI alleviates the concern that a company may be penalized for not disclosing that is considered irrelevant (e.g., cost of good sold is not relevant to banks). Since only the items which were perceived by analyst

S.S.M. Ho, K.S. Wong / Journal of International Accounting, Auditing & Taxation 10 (2001) 139 156

147

users as most important were used in computing the RDI, no further subjective weighting was applied6. The use of disclosure indices is not novel, although the incorporation of users perceptions of importance is an extension. 3.3. Measurement of independent variables Data on all but one of the independent variables were collected from the annual reports of the responding preparer rms. Data on the existence of an audit committee was collected directly from the companies through a postal survey. The proportion of independent nonexecutive directors to total number of directors (INDs) is the number of INDs on the board divided by the total number of directors on the board. The percentage of family members on board (PFM) is measured as a ratio of family board members to the total number of directors. The SEHK requires that companies must disclose the relationship or related board members in the annual report. Further, a binary scheme was used to denote the existence of an audit committee and dominant personality. These dummy variables were coded 1 to indicate existence and 0 to indicate nonexistence. Since the current study uses data from 1997 it should better reect rms voluntary adoption of audit committees in response to market forces. 3.4. Measurement of the control variables Firm size (LSIZE) is measured by the log (base 10) of total assets, leverage (LEV) is measured by the ratio of total debt to the equity value of the rm, assets-in-place (AIP) is measured by the ratio of net book value of xed assets to total assets, and protability (PROFIT) is measured by the return on capital employed. The average of three years (1994 97) of data were used to calculate all these measures. Lastly, industry type is based on the SEHK codes of classication of listed companies with some modications. Listed companies are classied as conglomerate (IT1), manufacturing (IT2), banking and nance (IT3), or others (IT4).

4. Analysis and discussion of results 4.1. Descriptive statistics and bivariate analysis Table 2 shows the distribution of the dependent variable (i.e., extent of voluntary disclosure measured by RDI). The average relative disclosure index of the sample companies was 0.29, with a range of 0.05 to 0.85. Thus, there were large variations in voluntary disclosure practices among the sample companies in Hong Kong. This result is also consistent with the literature that companies in Hong Kong have great exibility in their voluntary disclosure choices. In addition, the relative low voluntary disclosure ratio implies that analysts in Hong Kong may search for information outside of annual reports (e.g., via investor relations department). Table 2 shows that the average ratio of IND to total directors on board was 0.34 and the

148

S.S.M. Ho, K.S. Wong / Journal of International Accounting, Auditing & Taxation 10 (2001) 139 156

Table 2 Summary Statistics of Continuous Variables (N 98) Mean Dependent Variables RDI Extent of voluntary disclosures (measured by RDI) Independent Variables IND The ratio of INDs to total directors on board PFM The percentage of family members on board LSIZE Firm size (total assets in HK$m) LEV Leverage ratio (total liabilities to total equity) AIP Assets-in-place (xed assets to total assets) PROFIT Protability (return on equity as a percentage) 0.29 0.34 32.10 49928 1.86 0.35 0.08 Min 0.05 0.08 0.00 169 0.01 0.00 1.11 Max 0.85 0.80 77.00 3087850 2.90 0.87 0.95 Std. Dev. 0.15 0.14 5.71 329050 2.95 0.38 0.25

average number of IND is 2.45. On the other hand, the average percentage of family members sitting on the board was 32.1%. Table 3 shows that in 29% of the sample companies the chairman was also the managing director/chief executive ofcer, and 23.5% of the companies reported having an independent audit committee. Table 4 shows that the items most likely to be voluntarily disclosed were the future prospects of the company (75%), the description of company products and services (60%), China business review (59%), and sales and marketing network (56%). However, none of the responding companies disclosed a cash ow forecast and only one percentage of the companies disclosed information relating to cost of goods sold. The results again indicate that there was a wide variation in the disclosure of these important items in Hong Kong. The bivariate analysis in Table 5 shows the highest correlation was between LSIZE (rms in the banking and nance industry) and leverage (LEV) (R20.576). This should not be a concern until they exceed 0.8. These results also appear to suggest that no serious multicollinearity among the independent variables exist. From Table 5 it can be observed that leverage, the percentage of family members on the board and rm size were signicantly correlated with the extent of voluntary disclosure at the 0.05 level with the predicted sign. The presence of the expected bivariate relationship is encouraging as the bivariate ndings provide a basis for interpreting the results of the multivariate analysis of the extent of voluntary disclosure.

Table 3 Summary Statistics of Nominal Independent Variables (N 98) Percentage of rms in the sample AC DP IT The existence of an audit committee The existence of dominant personality Industry type: Conglomerate Banking and nance Manufacturing Others 23.5 29.0 27.6 12.0 24.5 36.0

S.S.M. Ho, K.S. Wong / Journal of International Accounting, Auditing & Taxation 10 (2001) 139 156 Table 4 The Distribution of the 20 Most Important Voluntary Disclosure Items Perceived by Financial Analysts Voluntary disclosures item Future prospects of the company Description of company products and services China business review Sales and marketing network Acquisition and disposal activities Details of investments in China & overseas Corporate stretegy and impact Discussion of factors affecting future nancial results A large variety of nancial ratios Bank loans, mortgages and their uses Capital expenditure commitments for future years Financial position & contribution of subsidiaries & associated companies Financial summary for more than 5 years Main product market share Stock price information and analysis Details of operating expenses Product contribution margin Aging of debtors balance Cost of goods sold Cash ow forecast Analysts Importance Score 4.04 3.70 3.93 3.64 3.97 3.66 3.74 4.08 3.59 3.92 3.88 3.92 3.56 4.01 3.63 3.65 3.80 3.67 3.65 3.82

149

Percentage of companies disclosing 75.0 60.2 59.3 55.9 45.6 42.0 41.0 34.4 32.0 18.2 16.1 15.1 14.0 9.6 5.3 5.3 5.3 2.2 1.0 0.0

4.2. Multiple regression models and assumption testings Multiple regressions were estimated using the set of four corporate governance factors and ve other rm-specic attributes as independent variables. The possible existence of multicollinearity was tested in this study using several methods. As mentioned earlier, low coefcients in the correlation matrix suggest that the problem of multicollinearity was

Table 5 Correlation Analysis RDI RDI IND PFM LSIZE LEV AIP PROFIIT 1.000 0.152 0.230* 0.423** 0.242* 0.007 0.113 IND 1.000 0.046 0.199* 0.228 0.029 0.081 PFM LSIZE LEV AIP PROFIT

1.000 0.060 0.142 0.101 0.085

1.000 0.576** 0.018 0.082

1.000 0.029 0.101

1.000 0.082

1.000

*signicant at 5% level **signicant at 1% level

150

S.S.M. Ho, K.S. Wong / Journal of International Accounting, Auditing & Taxation 10 (2001) 139 156

Table 6 Multiple Regression Results of the Relationship between Corporate Governance and Other Specic Characteristics with the Extent of Voluntary Disclosures R2 0.42 Adjusted R2 0.314 F Signicance 0.000 Durbin-Watson Test 1.9698 Number of signicant coefcients 5 N 98 Explanatory Variable Constant IND AC DP PFM LSIZE LEV AIP PROFIT IT1 IT2 IT3 Coefcient 0.0497 0.112 0.08057 0.003984 0.190 0.08771 0.00416 0.01885 0.03582 0.07427 0.120 0.0123 0.111 0.040 0.031 0.080 0.026 0.006 0.040 0.055 0.039 0.040 0.057 Std Error Beta t-values 0.484 1.012 2.001 0.127 2.373 3.387 0.688 0.462 0.648 1.912 2.986 0.216 Signicance 0.629 0.315 0.049* 0.899 0.020* 0.001* 0.493 0.638 0.519 0.060 0.004* 0.829

*signicant at 5% level IND independent non-executive directors AC audit committee DP dominant personality PFM percentage of family members on board LSIZE rm size LEV nancial leverage AIP asset-in-place PROFIT protability IT1 industry type 1 IT2 industry type 2 IT3 industry type 3

minimal. However, a certain degree of multicollinearity can still exist even when none of the bivariate correlation coefcients is very large, since one independent variable may be an approximate linear function of a set of several independent variables. Another effective means of testing multicollinearity is to compute the Variance Ination Factor (VIF). The largest VIF factor observed for the full model was 2.5 (LSIZE) and the VIFs of all other independent variables were below 2.0. Thus, these results further support the lack of presence of multicollinearity in the research model. The results of the regression analysis can, therefore, be interpreted with a greater degree of condence. 4.3. Results of hypotheses testing Table 6 presents the R2 (coefcient of determination), F-ratio, beta coefcients and

S.S.M. Ho, K.S. Wong / Journal of International Accounting, Auditing & Taxation 10 (2001) 139 156

151

t-statistics for the model and summarizes the multiple regression results of Y (the extent of voluntary disclosure) on the explanatory variables. The table indicates R2 of 0.42 (F3.45, p 0.000), which shows that a moderate percentage (42%) of the variation in Y can be explained by variations in the whole set of independent variables (adjusted R2 0.31). At the 0.05 level of signicance, the hypothesis that all explanatory variable coefcients are simultaneously equal to zero is rejected. Only ve independent variables entered the equation with a regression coefcient that was signicant at the 0.05 level in the regression model. These variables include: audit committee, rm size, percentage of family members on the board and two industry dummy variables. In addition, the directions of the signs of all signicant coefcients in the regression model are in agreement with the hypotheses. On the other hand, the ratio of independent directors to total directors on board, family ownership control, protability, asset-in-place, and leverage are insignicant. The most signicant corporate governance variable is the percentage of family members on board (PFM) with a p-value of 0.02. This provides support for the Hypothesis 4 that the more family members on the board, the less likely that a rm has a higher extent of voluntary disclosure. The next most signicant variable is the existence of an audit committee, which has a p-value of 0.049. Thus, Hypothesis 2 that companies that have an audit committee are likely to have a higher extent of voluntary disclosure is also supported. In addition, large rms tend to have more voluntary disclosure (p 0.01). This result supports numerous previous empirical studies which show that large rms disclose more information. This could occur because large rms need more nancing capital than smaller rms. 4.4. Discussion of ndings A comparison of the ndings of the current study with previous related studies can be found in Table 7. Hypothesis 1 which states that companies with a higher ratio of independent nonexecutive directors to total directors on board would more likely have a higher extent of voluntary disclosure was not supported. This nding is not consistent with the ndings of Forker (1992) and Chen and Jaggis (1998) which found that the proportion of independent nonexecutive directors on board was positively related to the quality/extent of nancial disclosure. Chen and Jaggis disclosure index score includes both mandatory and voluntary disclosure items but the index score adopted in this study includes only the voluntary disclosure items perceived as most important by analysts. Thus, a possible explanation of this result is that while IND in Hong Kong are likely to ensure that the company has complied with mandatory disclosure requirements, they are still not actively pressing the company to disclose more nonmandatory information. Also, there are questions about the independence of so-called independent nonexecutive directors in Hong Kong and their effectiveness as a monitoring device as many of them are appointed by the CEO or the board chairman. Hypothesis 2 which states that companies which have an audit committee are more likely to have a higher extent of voluntary disclosure was supported. This result is encouraging since a previous study by Forker (1992) only found a weak relationship between the existence of an audit committee and the quality (extent) of disclosure. An important

152

Table 7 Summary of Literature Relating Corporate Governance Attributes to Corporate Disclosure Previous Studies Corporate Governance Attributes Author(s) Findings (signicant unless otherwise stated) Current Study Corporate Governance Attributes Hypothesized Directions Findings (Signicant unless otherwise stated) Not signicant

S.S.M. Ho, K.S. Wong / Journal of International Accounting, Auditing & Taxation 10 (2001) 139 156

Proportion on Existence of Independent Directors

Leftwich, Watt & Zimmerman (1981) Forker (1992) Malone, Fries & Jones (1993) Chen & Jaggi (1998) Forker (1992) Forker (1992) Millstein (1992) Ruland, Tung & George (1990) McKinnon & Dalimunthe (1993) Malone, Fries & Jones (1993) Craswell & Taylor (1992) Raffocunier (1995) Hossain, Tan & Adams (1994)

Interim Reporting Disclosure () Share Options Disclosure () Disclosure Quality () Not signicant Extent of Financial Disclosure (including Mandatory) () Share Option Disclosure () Weak Signicant Share Option Disclosure () Disclosure of Managers Prot Forecasts () Segmental Information () Extent of Disclosure () Disclosure Reserve Information () n.s. Extent of Voluntary Disclosure () n.s. Extent of Voluntary Disclosure ()

Proportion of Independent Directors

Existence of Audit Committee Existence of Dominant Personalities Outside Ownership Ownership Diffusion

Existence of Audit Committee Existence of Dominant Personalities Proportion of Family Members on Board

Not signicant

No. of Shareholders Separation of Ownership & Control Ownership Diffusion Ownership Concentration

*Ecxept Chen & Jaggi (1998), which examines comprehensiveness of disclosure (mandatory voluntary), all other studies focus on the extent or existence of voluntary disclosures.

S.S.M. Ho, K.S. Wong / Journal of International Accounting, Auditing & Taxation 10 (2001) 139 156

153

implication of this nding is that it may be appropriate for regulatory authorities to require listed companies in Hong Kong to establish an audit committee in order to secure more corporate transparency. Hypothesis 3 states that rms with the existence of a dominant personality are more likely to have a lower extent of disclosure. Although the hypothesized direction was correct, the hypothesis was not supported at the 5% signicance level. This result is not consistent with that of Forker (1992) who found a signicant negative relationship between a dominant personality and quality (extent) of disclosure. A possible reason is a person who serves as both board chairman and CEO of a company in Hong Kong is likely to be a substantial shareholder, so it does not matter whether or not the two jobs are separated. Hypothesis 4, which states that companies with a higher proportion of family members on the board are more likely to have a lower extent of voluntary disclosure, was supported. Chen and Jaggi (1998) also found that the relationship between independent nonexecutive directors and total nancial disclosure (mandatory and voluntary) was weaker for family-controlled rms. Although the situation where family members dominate the board is not as common in Hong Kong as one might expect, these ndings might have implications for other Asian countries where it is common for family members to dominate the board. The recommendation by the HKSA Second Report of Corporate Governance that family members should not make up more than half of the board membership seems valid and should be maintained. Boards composed of a wider membership would help strengthen the transparency of the company.

5. Summary and conclusion In recent years, regulatory bodies have promulgated new corporate governance requirements in order to enhance corporate transparency. In Asia the recent nancial crisis has underlined the need for more evidence on the corporate governance and transparency issues. There has been little research relating voluntary disclosure to specic corporate governance attributes. This study uses Hong Kong data to analyze whether rms disclose more voluntary information when they are family-controlled, have an audit committee, have independent board directors, and have a duality of board chairman/CEO. There are several important implications of this study. The results provide empirical evidence to support Hong Kong regulatory bodies certain new requirements on board composition, that is, the formation of an audit committee and the family members should not make up more than half of the board membership. These results may also help other East Asia reformers, policy makers and regulators to improve market transparency in their countries by introducing similar new requirements. In particular, the vast majority of listed companies in East Asia economies are owned and controlled by families. It is essential to have a higher degree of minority investors protection via more such corporate governance devices. There are two major limitations of this study. First, the main focus of this study is on the extent of voluntary disclosures. However, such disclosures do not mean that they are credible or reecting the true state of affairs of the company. Also, more disclosures do not

154

S.S.M. Ho, K.S. Wong / Journal of International Accounting, Auditing & Taxation 10 (2001) 139 156

necessarily imply more quality disclosures. Second, although the study found the expected relationship between corporate governance variables and disclosures, it is not certain whether the results were due to the hypothesized causality. Therefore, the ndings should be interpreted with care because of these limitations. Future studies in this area should address these specic issues directly.

Notes 1. Transparency refers to a process by which information about existing conditions, decisions and actions is made accessible, visible and understandable (Working Group on International Financial Crisis, 1998). Operationally, it is referred to voluntary disclosure in addition to the already mandated disclosure. 2. Some corporate governance and rm-specic variables which had been considered initially during the research planning process were nally excluded. For example, using the services of a Big-5/non-Big-5 audit rm was excluded because nearly all listed companies are audited by Big-5 rms in Hong Kong. Familys share ownership, directors share ownership and independent nonexecutives share ownership were not used due to the lack of exact and direct share ownership data publicly available in Hong Kong. 3. On the other hand, one may argue that even one or two IND can also exert inuence if they are vocal on a particular issue. Therefore, besides proportion of IND to total directors, the current study also used the number of IND in a supplementary test. However, since the result of the supplementary test did not differ from the model using the proportion of IND, only the ndings on the proportion of IND are presented. 4. Fifty-ve completed preparer questionnaires and 42 completed user questionnaires were returned within two weeks of the rst mailing. The researcher sent follow-up letters to all targeted rms to remind those who had not responded in the rst mailing, along with an additional copy of the questionnaire and a reply envelope. The follow-up reminder emphasized the importance of the research, its practical focus and in addition, requested them to give the reason (s) by returning the bottom slip of the letter if they decided not to return the questionnaire. A further 43 completed preparer questionnaires and 50 completed user questionnaires were received within two weeks of the second mailing. Data collection was completed about ten weeks after the initial distribution of the questionnaires. 5. It is well known that Hong Kong rms are very conservative and generally unwilling to allow studies by outsiders (Redding and Pugh, 1986). Thus, although the response rate of this study is not high compared with similar studies in other countries, this rate can be considered satisfactory for a company survey conducted in Hong Kong. 6. Assuming the maximum possible disclosure score for a rm is 18 (i.e., two others are irrelevant to its business) and the rm did disclose 12 out of the 18 items in is annual report, then the RDI 12/18 0.67.

S.S.M. Ho, K.S. Wong / Journal of International Accounting, Auditing & Taxation 10 (2001) 139 156

155

References

Bradury, M. (1992). Voluntary disclosure of nancial segment data. Accounting and Finance, 32, 1526. Chen, J.P., Charles, & Jaggi, B. L. (1998). The Association between independent nonexecutive directors, family control and nancial disclosures. Journal of Accounting and Public Policy (forthcoming). Chow, C., & Wong-Boren, A. (1987). Voluntary nancial disclosure by Mexican corporations. The Accounting Review, 62 (3), 533541. Collier, P. (1993). Factors affecting the formation of audit committees in major UK listed companies. Accounting and Business Research, 23 (91), 421 430. Craswell, A., & Taylor, S. (1992). Discretionary disclosure of reserves by oil and gas companies: an economic analysis. Journal of Business Finance and Accounting, 19, 295308. Eccles, R. G., & Mavrinac, S. C. (1995). Improving the corporate disclosure process. Sloan Management Review, Summer, 1124. Fama, E., & Jensen, M. (1983). Separation of ownership and control. Journal of Law and Economics, 26, 301326. Forker, J. J. (1992). Corporate governance and disclosure quality. Accounting and Business Research, 22 (86), 111124. Gray, S. J., Radebaugh, L. H., & Robert, C. B. (1990). International perceptions of cost constraints on voluntary information disclosures: a comparative study of UK & US multinationals. Journal of International Business Studies, Fourth Quarter, 597 622. Healy, P. M. & Palepu, K. G. (1995). The challenges of investor communication: the case of CUC International, Inc. Journal of Financial Economics, Vol. 38, No.2, 111140. Hill, J. G. (1999). Deconstructing SunbeamContemporary issues in corporate governance. University of Cincinnati Law Review, Vol.67, 1099 1127. Hong Kong Institute of Company Secretaries (HKICS). (1998). The limits of governance. Company Secretaries, January, 1518. Hong Kong Management Association (HKMA). (1995). Judges Report of the HKMA Best Annual Report Award 1994. Hong Kong Society of Accountants (HKSA). (1997). Second Report of the Corporate Governance Working Group. Hossain, M., Tan, L. M., & Adams, M. (1994). Voluntary disclosure in an emerging capital market: some empirical evidence from companies listed on the K.L. Stock Exchange. International Journal of Accounting, 29, 334 351. Jensen, M.C., & Meckling, W. H. (1976). Theory of the rm: managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3, 305360. Lang, M. H., & Lundholm, R. J. (1996). Corporate disclosure policy and analyst behavior. The Accounting Review, 71 (4), 467 492. La Porta, R., Lopez-De-Silances, & Shieifer, A. (1999). Corporate ownership around the world. The Journal of Finance, April, 471517. Leftwich, R., Watts, R., & Zimmerman, J. (1981). Voluntary corporate disclosure: the case of interim reporting. Journal of Accounting Research, Supplement to Vol.19, 50 77. Lev, B. (1992). Information disclosure strategy. Calfornia Management Review, Summer, 9 32. Malone, D., Fries, C., & Jones, T. (1993). An empirical investigation of the extent of corporate nancial disclosure in the oil and gas Industry. Journal of Accounting, Auditing and Finance, 249 273. Mckinnon, J. L., & Dalimunthe, L. (1993). Voluntary disclosure of segment information by Australian diversied companies. Accounting and Finance, May, 3350. McMullen, D. A. (1996). Audit committee performance: an investigation of the consequences associated with audit committee. Auditing: A Journal of Theory and Practice, 15 (1), 87103. Meek, G. K., Robert, C. B., & Gray, S. J. (1995). Factors inuencing voluntary annual report disclosures by U.S., U.K. and Continental Europe multinational corporations. Journal of International Business Studies, 26 (3), 555572.

156

S.S.M. Ho, K.S. Wong / Journal of International Accounting, Auditing & Taxation 10 (2001) 139 156

Millstein, I. (1992). The Limits of Corporate Power: Existing Constraints on the Exercise of Corporate Discretion. New York: Macmillan. Molz, R. (1988). Managerial domination of boards of directors and nancial performance. Journal of Business Research, 16, 235249. Morck, R., Shleifer, A., & Vishny, R. W. (1988). Management ownership and market valuation: an empirical analysis. Journal of Financial Economics, 20, 293315. Oppenheim, A. N. 1966. Questionnaire Design and Attitude Measurement. New York: Basic Books. Pound, J. 1995. The promise of the governed corporation. Harvard Business Review, 73 (2), 89 98. Raffournier, B. (1995). The determinants of voluntary nancial disclosure by Swiss listed companies. European Accounting Review, 4 (2), 261280. Redding, S. G., & Pugh, D. S. (1986). The formal and the informal: Japanese and Chinese organization structures. The Enterprise and Management in East Asia, Hong Kong, Center of Asian Studies, the University of Hong Kong, 153168. Rosenstein, S., & Wyatt, J. G. (1990). Outside directors, board independence and shareholder wealth. Journal of Financial Economics, 26, 175192. Ruland, W., Tung, S., & George, N. 1990. Factors associated with the disclosure of managers forecasts. The Accounting Review, 65, 710 21. South China Morning Post (SCMP). (1998). Accountants want better disclosure, Business Section, July 30:2 Securities and Futures Commission (SFC). (2000). The Securities and Futures Bill. Shleifer, A., & Vishey, R. (1997). A survey of corporate governance. Journal of Finance, 52, 737783. Tai, B. Y. K, Au-Yeung, O. K., Kwok, M. C. M., & Lau, L. W. C. (1990). Noncompliance with disclosure requirements in nancial statements: the case of Hong Kong companies. International Journal of Accounting, 25 (2), 99 112. The Stock Exchange of Hong Kong (SEHK). (1997). The Rules Governing the Listing of Securities. The Stock Exchange of Hong Kong (SEHK). (1998). Fact Book 1998. Welker, M. (1995). Disclosure policy, information asymmetry, and liquid in equity market, Contemporary Accounting Research, 11 (Spring), 800 827.

Das könnte Ihnen auch gefallen

- Jeff Butler's Presentation PDFDokument27 SeitenJeff Butler's Presentation PDFYustina Lita SariNoch keine Bewertungen

- Spesifikasi Allura XPER FD 20 (Clarity IQ)Dokument3 SeitenSpesifikasi Allura XPER FD 20 (Clarity IQ)Yustina Lita SariNoch keine Bewertungen

- Akuntansi Biaya Dan Manajemen - PPT Horngren (Soal Latihan) PDFDokument385 SeitenAkuntansi Biaya Dan Manajemen - PPT Horngren (Soal Latihan) PDFYustina Lita Sari100% (1)

- Mankeu Ross PDFDokument733 SeitenMankeu Ross PDFYustina Lita SariNoch keine Bewertungen

- AUDITS' ROLE IN IMPROVING FINANCIAL PerformanceDokument33 SeitenAUDITS' ROLE IN IMPROVING FINANCIAL PerformanceYustina Lita SariNoch keine Bewertungen

- Anti-Corruption in Public Procurement inDokument32 SeitenAnti-Corruption in Public Procurement inYustina Lita Sari100% (1)

- HIPAA Workforce Training1 PDFDokument48 SeitenHIPAA Workforce Training1 PDFYustina Lita SariNoch keine Bewertungen

- CH 01 Solution Manual Information Technology Auditing 2nd Ed James Hall - EDP Auditing Class - Jakarta State UniversityDokument21 SeitenCH 01 Solution Manual Information Technology Auditing 2nd Ed James Hall - EDP Auditing Class - Jakarta State UniversitySjifa Aulia80% (10)

- Lavena Manuscript 1307 - 607Dokument45 SeitenLavena Manuscript 1307 - 607Yustina Lita SariNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Proposed Enka Village Project in Asheville, North CarolinaDokument12 SeitenProposed Enka Village Project in Asheville, North CarolinaDillon DavisNoch keine Bewertungen

- Current Projects 2010-N°172Dokument73 SeitenCurrent Projects 2010-N°172Subramaniam RamasamyNoch keine Bewertungen

- Advertising and Sales Promotion For MicromaxDokument6 SeitenAdvertising and Sales Promotion For Micromaxatishsahani0% (1)

- Case Analysis of Dendrite International: Industrial Marketing StrategyDokument3 SeitenCase Analysis of Dendrite International: Industrial Marketing StrategyyodamNoch keine Bewertungen

- NBM Shares Signed Away Under Duress - Malta Today 28MAY2012Dokument5 SeitenNBM Shares Signed Away Under Duress - Malta Today 28MAY2012sevee2081Noch keine Bewertungen

- Top Law FirmsDokument6 SeitenTop Law FirmsRB BalanayNoch keine Bewertungen

- Nisms05a PDFDokument235 SeitenNisms05a PDFAtul SharmaNoch keine Bewertungen

- Magallanes Watercraft Association, Inc. v. AuguisDokument8 SeitenMagallanes Watercraft Association, Inc. v. AuguisCyruz TuppalNoch keine Bewertungen

- Tender RRDokument1 SeiteTender RRAsron NizaNoch keine Bewertungen

- The Marketing Mix-ColgateDokument2 SeitenThe Marketing Mix-Colgaterobinkapoor100% (11)

- Regal Raptor Spyder FrameDokument19 SeitenRegal Raptor Spyder FrameNikola Milosev100% (2)

- Insomniac Holdings LLC V Conscious Entertainment Group Wawdce-20-00137 0001.0Dokument28 SeitenInsomniac Holdings LLC V Conscious Entertainment Group Wawdce-20-00137 0001.0MattMeadowNoch keine Bewertungen

- A Study On Market Potential of Reliance InfraDokument57 SeitenA Study On Market Potential of Reliance InfraAtul MumbarkarNoch keine Bewertungen

- Jefferies-High Yield Best Picks 2004-Greg ImbruceDokument3 SeitenJefferies-High Yield Best Picks 2004-Greg ImbrucerpupolaNoch keine Bewertungen

- Research Methodology: The Buying Behaviour of Consumer Regarding Cars in LudhianaDokument34 SeitenResearch Methodology: The Buying Behaviour of Consumer Regarding Cars in LudhianaGurinder DeolNoch keine Bewertungen

- Leveraged FinanceDokument1 SeiteLeveraged Financeoogle12345Noch keine Bewertungen

- LindtDokument12 SeitenLindtMilan StancicNoch keine Bewertungen

- Olaguer vs. PurunggananDokument20 SeitenOlaguer vs. PurunggananavrilleNoch keine Bewertungen

- TAMP BriefingDokument17 SeitenTAMP Briefingdragon 999999100% (1)

- 12 2 11Dokument2 Seiten12 2 11AshleyNoch keine Bewertungen

- BCG Matrix: Boston Consulting GroupDokument10 SeitenBCG Matrix: Boston Consulting GroupKatha GandhiNoch keine Bewertungen

- 2010 Black List PDFDokument19 Seiten2010 Black List PDFbigeazyeNoch keine Bewertungen

- 0324 11p-Bateel001Dokument4 Seiten0324 11p-Bateel001Tayyeb ShahNoch keine Bewertungen

- TV One V Universal McCann WorldwideDokument20 SeitenTV One V Universal McCann WorldwideTHROnline100% (1)

- Chairman and Ceo of Infosys: Nandan M. NilekaniDokument9 SeitenChairman and Ceo of Infosys: Nandan M. NilekaniPrabu PrasathNoch keine Bewertungen

- Excavators 17 1Dokument4 SeitenExcavators 17 1eunice199703150% (1)

- Business LawsDokument22 SeitenBusiness LawsShiyal drashti100% (1)

- Cms-300-05-Pl-00013 Anti-Corruption Laws and Foreign Corrupt Practices Act (Fcpa)Dokument4 SeitenCms-300-05-Pl-00013 Anti-Corruption Laws and Foreign Corrupt Practices Act (Fcpa)andruta1978Noch keine Bewertungen

- Chapter 2 - Accounting PrinciplesDokument36 SeitenChapter 2 - Accounting PrinciplesIbni Amin100% (2)

- Corporate GovernanceDokument64 SeitenCorporate GovernanceRamapriyaiyengarNoch keine Bewertungen