Beruflich Dokumente

Kultur Dokumente

Build A Bear Report

Hochgeladen von

zephyryuCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Build A Bear Report

Hochgeladen von

zephyryuCopyright:

Verfügbare Formate

Stock Report Build-A-Bear Workshop

by A. F. Lane (SS2008)

UNIVERSITY OF MISSOURIST. LOUIS

MAKING SENSE OF INVESTING

Symbol: NYSE: BBW Rating: HOLD Suitability: Small-Cap Growth Date: July 21th, 2008 Price: $6.69 Dividend: N/A Yield: N/A Company Overview

Founded in 1997 by Maxine Clark, Build-A-Bear Workshop (Build-A-Bear) has more than 375 teddy bear themed stores around the world. Build-A-Bear became a publicly traded company in October 2004. Their mission is to bring the teddy bear experience (love, friendship, and security) to life through an interactive and entertaining retail experience where Bear Builder associates guide customers of all ages through the process of creating a fluffy new friend. Revenue for 2007 was $474.4 million, up 8.5% over the prior year.

Stock Report

BUILD-A-BEAR WORKSHOP

Retail (Specialty) _________________________________

INVESTMENT SUMMARY

Rating: HOLD. Build-A-Bear is recommended as a HOLD for investors seeking small-cap growth. While the balance sheet and cash position remain strong for a retailer given the current economic conditions, there is concern around declining sales in established stores evidenced by the negative comparable store sales. Build-A-Bear revealed an innovative initiative in the online interactive world through Build-A-Bearville.com, but additional transparency is needed on Build-A-Bears long-term growth and online strategy.

Favorable view of Build-A-Bear

Build-A-Bear introduced an interactive virtual world called Build-ABearville.com at the end of December 2007. This innovative initiative broadens the companys foundation for other entertainment oriented areas. Build-A-Bearville.com is free to signup, but when customers purchase new stuffed animals, they are able to access exciting new online places and games. Another goal of the online world is to utilize the virtual site to bring customers into the real stores for additional purchases. At the end of April 2008, there were over 3 million online characters created. Build-A-Bear has also become a collaborative partner of Ridemakerz, a private company with another retail entertainment idea. Ridemakerz is an interactive retail experience of building customized toy and remote control cars which targets boys and families. Build-A-Bear invested over $2 million in Ridemakerz at the end of April 2007 giving Build-A-Bear approximately a 33% equity stake in the privately held company. Ridemakerz was named the hot new retailer of the year by International Council of Shopping Centers.

_______________________ Market Data

52-Week Range Market Cap. Div. Pmt. Mths Est. Engs Date $5.61-$25.97 $125.0M ___ N/A ____ th Jul 24 , 2008

Valuation 07A

Earnings 1.10 P/E 6.1x PEG 0.6x

08E

0.71 9.4x 0.9x

09E

0.80 8.4x 0.8x

10% __23% N/A

Growth Outlook

Est. 5-Yr. EPS Growth Est. 5-Yr. Rev Growth Est. 5-Yr. Div Growth

Financial Data

% Rev Intl Debt Rating 12% NA

Companies with international exposure have special risks including those related to currency fluctuations and political and economic events. _______________

Expected Continued Concern: Product Cycle

The main concept and product for Build-A-Bear is the personal experience of building a stuffed animal with clothing and accessories. New animal skins and accessories are being developed as well as movie characters (Happy Feet) and TV characters

1

Stock Report Build-A-Bear Workshop

by A. F. Lane (SS2008)

(Hannah Montana), however, there is concern over the interest remaining strong with the build a bear experience. Revenue has increased 8.5% over the prior year, but profit has decreased 23.5%.

Valuation

Since the IPO in October 2004 when the offer price was $20.00, the stock price has declined into the single digits. Build-A-Bear currently trades at 6 times the fiscal year 2007 actual EPS of $1.10. Compared to Russ Berrie and Company (RUS), a specialty competitor, at $0.93 EPS, Build-A-Bear Workshops EPS is favorable. Furthermore, the PE ratio is low compared to other growth companies meaning the stock may be undervalued, but most likely since it is extraordinarily low; investors have concerns about the ability of their business model to maintain strength and grow profits. This concern is justified by the decrease in net income over the past three years and projections of EPS decreasing over the next two years. Build-A-Bear has a very low PEG ratio. A PEG ratio below 1 also indicates that the stock may be undervalued or that investors have concerns about the long term growth. Regardless, market interest in Build-A-Bears has stayed fairly constant over the period reviewed with trading volume of approximately 300,000 shares per day. There were over 3.6 millions shares shorted according to Yahoo Finance, which is down approximately 200,000 from the previous month. This suggests a more favorable sentiment could be on the horizon. Cash is high and they are debt free, but this has failed to excite investors. The market has been bearish to the Build-A-Bear stock overall and is pricing in substantial risk to future earnings.

Same Store Sales Plunge Raising Long-Term Growth Questions

A key indicator of health for the retail sector is same store sales which measures the sales results for stores open more than thirteen months of operation. During the first quarter 2008, BuildA-Bears North American same-store sales comparisons declined 13.1% from the first quarter of the previous year. Build-A-Bear emphasized that the decrease was primarily due to macroeconomic conditions slowing discretionary spending and mall traffic, in addition to changes in entertainment trends toward online activity. There is also concern that new store openings are stealing business from established stores leading to the negative same store sales. I project the same store sales to continue to decline for 2008, but at a slower percentage given the recent efforts of Build-ABearville.com to enhance store sales and their initiatives towards customer loyalty and slowing the increase in number of stores.

Risks

The key risks facing Build-A-Bear are the macroeconomic environment which is decreasing the discretionary dollar for specialty retail spending. In addition, mall traffic across the United States is deteriorating which is a primary location for Build-A-Bear Stores. The weak United States dollar reveals the risk of fluctuating and increasing costs for inventory produced overseas in China. (84% of Build-A-Bear inventory was produced in China in 2007). Also, fuel price increases further squeeze profit margins due to increased costs of shipping inventory. The limited company vision, limited

Stock Report Build-A-Bear Workshop

by A. F. Lane (SS2008)

product concept, and instability of the product market lead to uncertainty in the longevity of sales.

0.00%

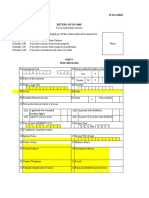

Comparable Store Sales

-0.02%

On April 24th, 2008 Build-ABear reported first quarter 2008 results with overall revenue of $123.8 million, an increase of 6% from first quarter 2007, and EPS of $0.32, decreasing 21% from first quarter 2007. Even though earnings declined, the company did beat analysts' expectations of 27 cents per share on revenue of $121 million. [1] A key financial health focus for the retail sector is comparable store sales. Comparable store sales decreased 13.1% in North America compared to negative 6.9% in first quarter 2007; but comparable stores sales increased 14.5% in Europe. Build-A-Bear reaffirmed previously announced plans of slowing new store openings in 2008. In 2008, the company plans to open a total of 25 new companyowned stores in North America and Europe compared to 50 new stores in 2007. [1]

RECENT NEWS AND ANALYSIS

-1.00% -2.00% -3.00% -4.00% -5.00% -6.00% -7.00% -8.00% -9.00% -10.00% -9.90% -6.50%

2005

2006

2007

Maxine Clark, CEO, attributes lower financial results to general declines in shopping-mall customer traffic and consumer discretionary spending; changes in the way children, especially girls, play and consume media and online entertainment; and poor sales of licensed movie products such as Shreks. [12] However, some investors are concerned that declines are due to new stores cannibalizing older stores and the concept losing originality. Others believe, such as analyst Rob Furlong, of Baltimore-based Garp Research & Securities Co., that their product is a slowing fad that was magnified only by Ms. Clarks appearance on the "The Oprah Winfrey Show." in February 2004. On the positive side, Garps Research also indicated "Fundamentally they have a great business model in retail entertainment and less inventory risk than most merchandisers." [10] Other credit analysts companies such as Credit Suisse have also downgraded the stock due to macroeconomic weakness will continue to pressure comparable (comps) store sales and margins in the foreseeable future. [9] Build-A-Bear just needs to leverage their model to gain profitability and new initiatives for future sales growth. Recent news according to Business Week indicates that Build-ABear is staying on top of new trends and hot items. Hello Kitty was introduced in May 2008. Build-A-Bear also tied the new product to www.buildabearville.com by giving Bear Bills (used in the virtual world), an extra room and Hello Kitty Wallpaper for their Cub Condo House, and a virtual Hello Kitty tee for their furry friend. Build-A-Bear is also partnering with The Game Factory to publish a game for the Nintendo Wii. This will be a family-friendly game where players can participate by personalizing their own furry friend, playing the mini games for medals, experiencing adventure

Stock Report Build-A-Bear Workshop

by A. F. Lane (SS2008)

mode, and using the medals to purchase more outfits and accessories. [5] The Wii operated remote will also be used for sack races or jumping on a trampoline.

The virtual and gaming worlds are in growth, so I see this as a benefit that Build-A-Bear has incorporated this concept into their business strategy and core concept.

Internet and TV Advertising Opportunity

The Build-A-Bear marketing plan targets moms and children and focuses heavily on prime TV spots like Hannah Montana and The Suite Life of Zack and Cody. The new 2008 marketing plan will push Bear-A-Bearville.com. I foresee the opportunity for future advertisement through popular internet sites for kids. Build-ABearville.com is also an advertisement in itself if new concepts are brought into the virtual world and customers are told that they can purchase the new items in stores.

INDUSTRY COMPANY OUTLOOK

Virtual Growth

AND

Entertainment

The teddy bear is a classic icon and Build-A-Bears unique interactive experience centers on the classic icon. However, the Build-A-Bear concept has been around for more than 5 years, so in order to continue business growth Build-A-Bear is going to have to explore more business and product initiatives. Build-A-Bear recently introduced Build-ABearville.com at the end of December 2007. Build-ABearville.com has exciting new online places and games are accessible for free. At the end of April 2008, there had been over 3 million online characters created. The virtual site has already shown potential growth for the companys virtual entertainment area. As stated in recent news, Build-A-Bear has also scheduled a release in the fourth quarter 2008 for a Wii game incorporating the unique entertainment experience of Build-A-Bear.

Neutral Company Outlook

Build-A-Bear has the opportunity now to re-evaluate their strategic plans for future growth and initiatives. The original core concept may be declining in interest in North America, but is still progressing in Europe. Also, the recent focus to the virtual world and partnership with The Game Factory for the development of Build-A-Bear interactive Wii games has shown the company has many routes in the unique entertainment arena.

Investing For Growth

Build-A-Bear is focusing heavily on virtual entertainment, marketing, and fresh start-up ideas such as Ridemakerz to position itself financially for the future. Build-A-Bear has no debt and significant cash, so they are able to invest in new initiatives. Capital and marketing expenditures are necessary up front to provide the long-term impact. This may be a reason for the decrease in profitability during year-end 2007 and first quarter 2008. However, these investments and expenditures are vital to stay on the cutting edge of entertainment and communicate the unique exciting experiences that kids and families can have by going to a Build-A-Bear store or to the virtual site. I believe that Build-A-Bear will see growth in sales from the virtual site as it appears they have fast growing membership and tactics that require real world purchases to advance in the virtual world. As long as the site is current and innovative, I believe there will be growth in the single digits of revenue.

Dedicated Management Team

The management team at Build-A-Bear has a dedicated work ethic and confidence in their product and company. Company founder Maxine Clark, CEO, has a strong retail background including President of Payless ShoeSource, Inc. and experience in roles merchandise development, merchandise planning, merchandise research, marketing and product development with May

4

Stock Report Build-A-Bear Workshop

by A. F. Lane (SS2008)

Department Stores. There is also a dedicated management team that appears to be competent of business functions and passionate for the job and product. The management and employees at Build-ABear embrace the Build-ABear products by keeping stuffed animals around their cubes indicating their support and joy in the product.

The Current Ratio (CR) indicates that Build-A-Bear has liquidity to cover its short-term obligations. The decrease in the CR from 20052006 and stabilization in 2007 is expected from the large investment in the United Kingdom acquisitions. Expenditures such as these generally provide higher returns than accumulated cash. The stabilization in 2007 was a good sign that the acquisition did not adversely impact liquidity as their strong cash flow enabled recovery. To ensure inventory build-up was not a problem, I have calculated the Quick Ratio (QR) which is the same as the CR without inventory, since it is the least liquid current asset. The QR follows the same trend over this time period. This suggests that the declining and stabilizing pattern was not driven by increasing inventory, but rather only from the acquisition. Build-A-Bears inventory increased by over 27% in 2006, and only decreased slightly in 2007. Inventory increases traditionally indicate slowing demand or mismanagement of assets. In this case, however, it is likely to be only because of the increase in stores. Build-A-Bear increased the number of stores from 200 to 271 (36%) in 2006, then added another 50 stores in 2007. Nevertheless, inventory management is important to controlling costs. Build-A-Bear does not manufacture their own materials so inventory is maintained at the stores themselves and leasing mall space for inventory can substantially reduce profitability. The inventory accumulation indicates that additional attention needs to be provided by evaluating the firms efficiency ratios.

EFFICIENCY RATIOS ITO TATO 2005 4.5X 1.5X 2006 4.5X 1.5X 2007 5.3X 1.4X

FINANCIAL POSITION

I have decided to perform a three year time-series analysis for Build-A-Bears ratios because it will provide insight to their unique product market. A significant fact to note over this time period is that BuildA-Bear acquired The Bear Factory Limited and Amsbra Limited in the United Kingdom for $39.4 million. Property, Plant, and Equipment realized a large increase from 2005 to 2006 as a result of this acquisition since 1) Amsbra owned several stores and 2) leasehold improvements were undertaken on the United Kingdom stores to rebrand them.

LIQUIDITY RATIOS 2005 CR QR 1.8X 1.3X 2006 1.3X 0.8X 2007 1.4X 0.9X

The table above shows that the Inventory Turnover ratio (ITO) was constant during the acquisition and increased significantly in 2007. This indicates that the amount of inventory Build-A-Bear has been holding relative to the Cost of Goods Sold has declined. This indicates the firms inventory management has become more efficient, despite adding several new locations. To compare the efficiency of the inventory use with the increased total assets I have decided to review the Total Asset Turnover ratio (TATO). The TATO has slightly decreased over the time period indicating the efficiency of the inventory management has not been consistent with the rest of Build-A-Bears asset management. Build-A-Bear added another 50 stores in 2007 explaining growth across the balance sheet, but amidst the growth they have not

5

Stock Report Build-A-Bear Workshop

by A. F. Lane (SS2008)

been able to improve on overall efficiency. Although there were increases in receivables, they were in line with the revenue growth in 2007. The asset with the most growth out of proportion to the sales increase was fortunately cash. This is a favorable increase in light of the previous discussion on a need for increased liquidity. Overall, my opinion on the efficiency of Build-A-Bear is favorable. I would like to see efficiency improvements over the long term to show that the stores are able to become more profitable over time; however, I think the consistency is not bad in light of the many new store openings and complications a major acquisition could have caused.

LEVERAGE RATIOS 2005 DR TIE EM 47% N/A 1.89X 2006 45% N/A 1.82X 2007 43% N/A 1.75X

consistently over the period indicating a decrease in use of debt to finance assets. Decreasing debt indicates lower risk since the company is not relying on a fixed cost of debt to finance its assets; however, the alternative of financing with equity foregoes favorable tax treatment of interest and will demand a greater return for shareholders. Build-A-Bear does not have interest expenses since there is no long term debt and accordingly, the Times Interest Earned ratio (TIE) is not applicable. In order to draw final conclusions about Build-A-Bears financial health the profitability will be analyzed using the Return on Equity (ROE) and Net Profit Margin (NPM).

PROFITABILITY RATIOS 2005 ROE NPM 21% 8% 2006 18% 7% 12% 5% 2007

The ROE and NPM have been declining significantly over the past three years. The ROE measures the return Build-A-Bear provides on the funds contributed by shareholders so it is crucial to the stock analysis. The DuPont System of Analysis helps to breakdown the ROE pattern to determine if the pattern is created by efficiency, leverage, or profitability. ROE = PM x TATO x EM ROE = (NI/Sales)(Sales/TA) (TA/EQ) = NPM x TATO x EM = NI/EQ The analysis provided thus far has shown that assets have been increasing, debt has been decreasing, and overall efficiency has slowly decreased. None of these anomalies alone provide justification for the drastic declines in ROE. However, when the factors are reviewed in aggregate the concerns become clear: ROE 2005: 2006: 2007: 0.21 0.18 0.12 = NPM 0.08 0.07 0.05 X TATO X 1.5 1.5 1.4 EM 1.89 1.82 1.75

Build-A-Bear does not have long term debt. Their liabilities are mostly accounts payable, gift cards, and deferred rent. Over the past three years, Build-A-Bears Debt Ratio (DR), total liabilities divided by total assets, has decreased consistently. This could be either because of decreasing debt or increasing assets. Similarly, the Equity Multiplier (EM) decreased

As evident above, the ratios combine to create a perfect storm against profitability. The assets of Build-A-Bear have been soaring, while the use of leverage has fallen, this reliance on equity to fund growth demands higher profit. Amidst the challenges of this

Stock Report Build-A-Bear Workshop

by A. F. Lane (SS2008)

capital structure decision came a decrease in the profitability of the businesses themselves. The NPM shows that margins have been falling drastically from rising input costs, a plummeting currency, and slowing comparable store sales. The Cost of Goods Sold has increased 44% over the past three years, while the sales have only increased 31%. Financing growth with current earnings is not a problem, but Build-A-Bear needs to focus the investment on keeping the stores it has profitable before continuing to open new stores. The risks in longterm profitability are only being put further at risk by continuing to open stores under the same model. On the favorable side, the research I have conducted has shown that Build-A-Bear seems to be shifting focus to other avenues of growth (online entertainment and gaming) that could make the profitability of their current assets increase in the future.

into work, but the office is still capacitated after 5:00 showing that the employees are committed to their job responsibilities.

Review of Product

Build-A-Bears product is a very distinctive entertaining experience. Recently, I went with friends in their mid to late twenties to the Build-A-Bear shop to build a bear. The staff was very friendly and the process to pick an animal skin, stuff the bear, pick clothing for the bear, and name the bear made for a unique, fun afternoon, even for twenty year-olds. The kids in the store appeared to be having a great time making bears and the Build-A-Bear website is filled with positive comments and great experiences when building bears or attending bear parties.

Managers Insights

I met with Molly Salky, Director of Investor Relations, on July 17, 2008 from 9:00 am to 10:00 am at Build-A-Bears headquarters in St. Louis, MO to gain insight into Build-A-Bears stock. I delivered a follow-up thank you note and a copy of the stock report to Ms. Salky on July 22nd 2008.

Q: What are the key challenges you see facing Build-A-Bear over

the next three years?

A:

A key challenge is the economys impact on revenues. Customer spending is under a lot of pressure and same store and store sales are declining. This results in pressure to drive profitability, but there are fixed cost components of rent and payroll. When sales come down, we have a hard time managing these costs.

ON SITE INTERVIEW

Review of Physical Site

Build-A-Bears headquarters is decorated with bright colors and shelved with stuffed animals galore. The employees working at BuildA-Bear headquarters appear to be happy in their work environment. Employees have the work environment flexibility to bring their dogs

retail entertainment experience. Long term would be to put things in place with Build-A-Bearville.com to take the brand experience of real world to the virtual world. This is a unique opportunity for guests and fun entertainment will continue in the real and virtual worlds. Also, staying relevant with guests such as offering Hannah Montana or High School Musical bears.

Q: What is the focus of your long term growth strategy? A: Continuing to offer a unique, highly interactive

Q:

What is the strategic purpose of BuildaBearville.com and have you seen increases in sales and profits related to this virtual world?

A: Staying relevant with core guests and be relevant with the

virtual world. We are still in the early adoption phase for the site and gaining critical mass. It is difficult to point to gains and sales.

Stock Report Build-A-Bear Workshop

by A. F. Lane (SS2008)

Who would you consider your main competitors to be and how do you believe you perform in comparison? No exact matches. We consider our competitors to be wherever families go to have fun such as movie theaters, amusement parks, miniature golf, and eating out. How have the acquisitions of BearFactory and Amsbra impacted BuildA-Bear? And what are their remaining potential benefits in the future from this acquisition?

Q:

A: Difficult to know with precision. This program allows

communication directly with the guests. If customers take the time to sign up with the program, this means they want to come back. A best guest comes to the store 3 or 4 times a year. Research shows communication within 3 months, yields higher return rates.

A:

RECOMMENDATION AND CERTIFICATION

Recommendation

The following recommendations are possible:

Buy (B)

Fundamentals and /or Valuations are compelling.

Hold (H)

Fundamentals and/or valuations are stable. Or a special situation exists, such as a merger that warrants no action.

Q:

Sell (S)

Fundamentals are deteriorating considerable and/or a recovery is highly unlikely. The stock is significantly overvalued.

Short (SS)

Fundamentals have deteriorated and are expected to continue to do so for the foreseeable future resulting in negative growth in EPS.

A: Positive acquisitions. In

quarter one 2008, the UK stores began to show year over year profitability. UK shows positive comparative store sales. This year we plan opening five new stores in the UK. The theory of acquisition came in our ability to consolidate and unify our brand across the world. In the UK, there was a direct competitor. Since the UK has lease terms of 20 to 25 years, we decided to buy the locations and convert the stores.

I have recommended a HOLD for the reasons outlined in this report.

Certification

I certify that the information contained in this report is the result of my primary research and has not been copied in whole or in part. All sources of information have been properly and completely documented in the Bibliography. Statements that are not my own have been put in quotations and are properly referenced in the Reference section. I have read and understand the University of Missouri guidelines governing plagiarism and further certify that no statements contained in this report are other than my own. Should the professor find otherwise, I understand that I am subject to the Universitys rule of suspension or expulsion from the UM system. ________________________ Ashley F. Lane ________________________ Date signed ________________________ Name Printed

Q: Do you believe the new

Stuff for Stuff" program has increased sales in your stores?

Stock Report Build-A-Bear Workshop

by A. F. Lane (SS2008)

References and Bibliography

1. Allen, Matt., Build-A-Bear revenue up 6% in Q1; profits, same-store sales down, St. Louis Business

Journal, April 24, 2008, http://www.bizjournals.com 2. About Us, Internet, July 16, 2008. http://www.buildabear.com/aboutUs/ 3. Build-a-Bear Earnings Call: Virtual World a "Conerstone of Our Long-Term Growth Strategy, Virtual Worlds News, April 24, 2008, http://www.virtualworldsnews.com 4. Build-A-Bear Workshop(R) Introduces Tropical Hello Kitty(R) by Sanrio(R), Business Wire, May 30, 2008, http://www.businesswire.com 5. First Build-A-Bear Workshop Game for the Nintendo Wii System Scheduled for Global Release in October 2008, Business Wire, April 16, 2008, http://www.businesswire.com 6. Build-A-Bear Workshop, Inc (BBW) Reuters Company Research, July 10, 2008, http://www.reuters.com/ 7. How Build-A-Bear and Others Build Buzz with Online Synergy, Retail Customer Experience. April 2008. http://www.retailcustomerexperience.com 8. Salky, Molly. Build-A-Bear, St. Louis, MO, July 17, 2008, Interview. 9. Standard & Poor Equity Research, Analyst Actions: ImClone Systems, Blockbuster, Build-A-Bear, Business Week, May 12, 2008. 10. Tritto, Christopher., Wall Street turns bearish on Build-A-Bear Workshop, St. Louis Business Journal, February 22, 2008, http://www.bizjournals.com 11. Q4 2007 Earnings Conference Call Transcript, Internet, April 8, 2008 http://phx.corporateir.net/phoenix.zhtml?c=182478&p=irol-irhome 12. 2007 Annual Report, Internet, April 8, 2008 http://phx.corporateir.net/phoenix.zhtml?c=182478&p=irol-irhome 13. 2007 Form 10-K, Internet, April 8, 2008, http://phx.corporateir.net/phoenix.zhtml?c=182478&p=irol-irhome

Das könnte Ihnen auch gefallen

- Einhorn q2 2019Dokument7 SeitenEinhorn q2 2019Zerohedge100% (2)

- HBS Case2 ToyRUs LBODokument22 SeitenHBS Case2 ToyRUs LBOTam NguyenNoch keine Bewertungen

- Trading PlanDokument1 SeiteTrading PlanDanish Cooper100% (1)

- Ebay's Secret IngredientDokument5 SeitenEbay's Secret Ingredientapi-3708437Noch keine Bewertungen

- Forex Fund ManagementDokument11 SeitenForex Fund ManagementTelepathy Girithara Mahadevan BabaNoch keine Bewertungen

- YummyDokument100 SeitenYummyzephyryu100% (2)

- Value Line PublishingDokument11 SeitenValue Line PublishingIrka Dewi Tanemaru100% (3)

- Differences Between Trading and NonDokument2 SeitenDifferences Between Trading and NonEdcel Joy Fernandez Zolina100% (1)

- Statistic Exam (MCQ)Dokument5 SeitenStatistic Exam (MCQ)zephyryu88% (8)

- The Cost of Doing Business Study, 2019 EditionVon EverandThe Cost of Doing Business Study, 2019 EditionNoch keine Bewertungen

- Marketing Plan For Snack Books: Masters Degree in Management Faculdade de Economia Da Universidade Nova de LisboaDokument30 SeitenMarketing Plan For Snack Books: Masters Degree in Management Faculdade de Economia Da Universidade Nova de LisboazephyryuNoch keine Bewertungen

- PadiniDokument22 SeitenPadinizephyryu100% (1)

- MGMT590 Best Buy Strategy Report - FinalDokument26 SeitenMGMT590 Best Buy Strategy Report - FinalJasmine Abd El Karim100% (1)

- Value Line PublishingDokument5 SeitenValue Line PublishingPatricksparks50% (2)

- BBBY Case ExerciseDokument7 SeitenBBBY Case ExerciseSue McGinnisNoch keine Bewertungen

- HomeDepot Case StudyDokument21 SeitenHomeDepot Case StudyLamaRitscher80% (5)

- Option Trading WorkbookDokument26 SeitenOption Trading WorkbookMuhammad Ahsan MukhtarNoch keine Bewertungen

- BestBuyCaseStudy 1 2 FinalDokument16 SeitenBestBuyCaseStudy 1 2 FinalRahila SaeedNoch keine Bewertungen

- Masan GroupDokument17 SeitenMasan GroupDoan Tu100% (1)

- Alpha New Trader GuideDokument9 SeitenAlpha New Trader GuideChaitanya ShethNoch keine Bewertungen

- Sbi Afi 2012Dokument48 SeitenSbi Afi 2012Moneylife FoundationNoch keine Bewertungen

- Exclusive Warren Buffett - A Few Lessons For Investors and Managers - The Blog of Author Tim FerrissDokument19 SeitenExclusive Warren Buffett - A Few Lessons For Investors and Managers - The Blog of Author Tim Ferrisskaya nathNoch keine Bewertungen

- Account-Based Marketing: How to Target and Engage the Companies That Will Grow Your RevenueVon EverandAccount-Based Marketing: How to Target and Engage the Companies That Will Grow Your RevenueBewertung: 1 von 5 Sternen1/5 (1)

- Best BuyDokument36 SeitenBest BuySuperman2182100% (1)

- Case Studies Fev AnswersDokument5 SeitenCase Studies Fev AnswersAisha KhanNoch keine Bewertungen

- ALCUCOA StandardsDokument21 SeitenALCUCOA StandardsDennis Esik Maligaya100% (5)

- Thesis Summary Week 10Dokument4 SeitenThesis Summary Week 10api-278033882Noch keine Bewertungen

- Best Buy Co Inc in Retailing (World) PDFDokument36 SeitenBest Buy Co Inc in Retailing (World) PDFLivonne PatrickNoch keine Bewertungen

- Stocks To Buy: NewslettersDokument17 SeitenStocks To Buy: Newslettersfrank valenzuelaNoch keine Bewertungen

- HomeDepot Case StudyDokument20 SeitenHomeDepot Case StudyKhushbooNoch keine Bewertungen

- Case 1Dokument3 SeitenCase 1alegpontonNoch keine Bewertungen

- GOCH Update On 8-06-08Dokument22 SeitenGOCH Update On 8-06-08MattNoch keine Bewertungen

- A Case Analysis of Ebay4143Dokument21 SeitenA Case Analysis of Ebay4143Zakiah Abu KasimNoch keine Bewertungen

- Ebay CorporationDokument9 SeitenEbay Corporationmary_cook9250Noch keine Bewertungen

- Bbby Vincemartin 071222Dokument3 SeitenBbby Vincemartin 071222Vince MartinNoch keine Bewertungen

- Sakshi Assign DmsDokument29 SeitenSakshi Assign Dmsvaibhav rajoreNoch keine Bewertungen

- Questions: 1.main Factors Supporting The LBODokument6 SeitenQuestions: 1.main Factors Supporting The LBOAmmer Yaser MehetanNoch keine Bewertungen

- Individual Assignment 1 - 0332273Dokument7 SeitenIndividual Assignment 1 - 0332273Rishi TenaNoch keine Bewertungen

- Build A BearDokument10 SeitenBuild A Bearmeonly88100% (2)

- Wedgewood Partners - ULTADokument19 SeitenWedgewood Partners - ULTAConceaviso AvisoNoch keine Bewertungen

- EbayDokument32 SeitenEbayrohaiza1979Noch keine Bewertungen

- JB Hi Fi LimitedDokument5 SeitenJB Hi Fi LimitedpnrahmanNoch keine Bewertungen

- 1589620365bisola EDITED gst212Dokument11 Seiten1589620365bisola EDITED gst212SURAJ KUMARNoch keine Bewertungen

- Costco PDFDokument4 SeitenCostco PDFmessiNoch keine Bewertungen

- CostcoDokument7 SeitenCostcoAbeer arifNoch keine Bewertungen

- Thesis SummaryDokument4 SeitenThesis Summaryapi-278033882Noch keine Bewertungen

- HDPP FinalDokument23 SeitenHDPP FinalGauravNoch keine Bewertungen

- Short Story 1Dokument4 SeitenShort Story 1Avina AjitNoch keine Bewertungen

- Valuation Thesis: Target Corp.: Corporate Finance IIDokument22 SeitenValuation Thesis: Target Corp.: Corporate Finance IIagusNoch keine Bewertungen

- Semiannual Report: June 30, 2011 BRTNXDokument15 SeitenSemiannual Report: June 30, 2011 BRTNXfstreetNoch keine Bewertungen

- Case 2 Questions To Consider For Discussion: Costco: Anish Tamrakar 1Dokument3 SeitenCase 2 Questions To Consider For Discussion: Costco: Anish Tamrakar 1Anish TamrakarNoch keine Bewertungen

- Lego AS - SWOT AnalysisDokument3 SeitenLego AS - SWOT AnalysisDUJARDINNoch keine Bewertungen

- Costco FinalDokument24 SeitenCostco FinalnureenbanoNoch keine Bewertungen

- Programmazione e Controllo Esercizi Capitolo 10Dokument4 SeitenProgrammazione e Controllo Esercizi Capitolo 10Queenielyn TagraNoch keine Bewertungen

- AC3103 Seminar 3 AnswersDokument5 SeitenAC3103 Seminar 3 AnswersKrithika NaiduNoch keine Bewertungen

- Financial Reporting Financial Statement Analysis and Valuation 6th Edition Stickney Test BankDokument25 SeitenFinancial Reporting Financial Statement Analysis and Valuation 6th Edition Stickney Test Bankcleopatramabelrnnuqf100% (27)

- Assignment CFDokument6 SeitenAssignment CFISMAIL RAGE100% (1)

- Mac - 494 - 110508 - 224346 L&FDokument24 SeitenMac - 494 - 110508 - 224346 L&FcaidahuihuiNoch keine Bewertungen

- Best Buy 3Q Profit Sinks, Offers Staff Buyouts - Yahoo! NewsDokument2 SeitenBest Buy 3Q Profit Sinks, Offers Staff Buyouts - Yahoo! Newsnnicotero100% (1)

- Read Writ U6 ComercioDokument3 SeitenRead Writ U6 ComercioRosaFuentes100% (1)

- Cape Chemical-Cash ManagementDokument11 SeitenCape Chemical-Cash ManagementSeno Patih0% (2)

- Case Study 1 - ABC Learning 'Reliant' On Debt To Cover Cash ShortfallsDokument2 SeitenCase Study 1 - ABC Learning 'Reliant' On Debt To Cover Cash ShortfallsRuwan GunarathnaNoch keine Bewertungen

- Stern MBA Valuation Final ProjectDokument31 SeitenStern MBA Valuation Final Projectjimingli100% (1)

- EGTalking Points 080608Dokument18 SeitenEGTalking Points 080608russ8609100% (2)

- Practice Problems First MidDokument6 SeitenPractice Problems First MidAsif Ali LarikNoch keine Bewertungen

- Top 20 COMPANIES 2007-2012Dokument9 SeitenTop 20 COMPANIES 2007-2012Yen055Noch keine Bewertungen

- Ebay Case StudyDokument8 SeitenEbay Case StudyVishal Dixit100% (1)

- Strategic Management Term PaperDokument12 SeitenStrategic Management Term Paperapi-3715493100% (4)

- Yell Part IDokument5 SeitenYell Part IAdithi RajuNoch keine Bewertungen

- Optimizing Growth: Predictive and Profitable Strategies to Understand Demand and Outsmart Your CompetitorsVon EverandOptimizing Growth: Predictive and Profitable Strategies to Understand Demand and Outsmart Your CompetitorsNoch keine Bewertungen

- The Risk Premium Factor: A New Model for Understanding the Volatile Forces that Drive Stock PricesVon EverandThe Risk Premium Factor: A New Model for Understanding the Volatile Forces that Drive Stock PricesNoch keine Bewertungen

- Act 599 - Consumer Protection Act 1999 (Cetakan Semula 2013)Dokument107 SeitenAct 599 - Consumer Protection Act 1999 (Cetakan Semula 2013)zephyryuNoch keine Bewertungen

- VampiresDokument6 SeitenVampireszephyryuNoch keine Bewertungen

- CIMB ASB Loan Repayment TableDokument1 SeiteCIMB ASB Loan Repayment Tablezephyryu0% (1)

- Gender Quotas and Female Leadership A Review - April 2011Dokument42 SeitenGender Quotas and Female Leadership A Review - April 2011Jafar KizhakkethilNoch keine Bewertungen

- Bonia Corporation BerhadDokument4 SeitenBonia Corporation BerhadzephyryuNoch keine Bewertungen

- What Is The Relationship Between Justice and Law?Dokument3 SeitenWhat Is The Relationship Between Justice and Law?zephyryuNoch keine Bewertungen

- Do You Have A Competitive StrategyDokument12 SeitenDo You Have A Competitive StrategysvdangyeuNoch keine Bewertungen

- Advertorial Kowamas UtusanDokument1 SeiteAdvertorial Kowamas UtusanzephyryuNoch keine Bewertungen

- International POSTGRADUATE BUSINESS Journal Vol 4Dokument1 SeiteInternational POSTGRADUATE BUSINESS Journal Vol 4zephyryuNoch keine Bewertungen

- Academic Sessions 2010-2011Dokument1 SeiteAcademic Sessions 2010-2011Aizad AzmiNoch keine Bewertungen

- 1 D 1 DF 41 D 6 F 8 C 8 G 5Dokument5 Seiten1 D 1 DF 41 D 6 F 8 C 8 G 5Kia PottsNoch keine Bewertungen

- Current Status of Derivative Products in India: An OverviewDokument17 SeitenCurrent Status of Derivative Products in India: An OverviewSarojKumarSinghNoch keine Bewertungen

- Capital Market Questions BankDokument11 SeitenCapital Market Questions Bankdev12_lokesh100% (1)

- Financial Economics Assignment OneDokument10 SeitenFinancial Economics Assignment OneAaron KuudzeremaNoch keine Bewertungen

- Lecture 3 - Intensity Based ModelsDokument17 SeitenLecture 3 - Intensity Based ModelsPARTHNoch keine Bewertungen

- SIP ReportDokument111 SeitenSIP ReportDesarollo OrganizacionalNoch keine Bewertungen

- Chapter 9-STOCK VALUATION-FIXDokument33 SeitenChapter 9-STOCK VALUATION-FIXRacing FirmanNoch keine Bewertungen

- FRM 6 EsatDokument0 SeitenFRM 6 EsatChuck YintNoch keine Bewertungen

- Distance Learning Finance Management Course (PGDFM) - MIT PuneDokument2 SeitenDistance Learning Finance Management Course (PGDFM) - MIT PuneDistance MbaNoch keine Bewertungen

- HDFC Bank Equity Research ReportDokument9 SeitenHDFC Bank Equity Research ReportShreyo ChakrabortyNoch keine Bewertungen

- It 11ga2016Dokument17 SeitenIt 11ga2016shiblu39100% (1)

- Figs Research Thesis 9-7-2022Dokument113 SeitenFigs Research Thesis 9-7-2022Ti LoNoch keine Bewertungen

- Carrying On Business in SingaporeDokument5 SeitenCarrying On Business in SingaporeAnonymous 7CxwuBUJz3Noch keine Bewertungen

- Teknik Forex: Timeframe 30 MinitDokument10 SeitenTeknik Forex: Timeframe 30 MinitHasbi NozNoch keine Bewertungen

- A Study On Financial Statement Analysis of Tata Steel Odisha Project, Kalinga NagarDokument12 SeitenA Study On Financial Statement Analysis of Tata Steel Odisha Project, Kalinga Nagargmb117Noch keine Bewertungen

- Ghana Banks FailureDokument5 SeitenGhana Banks Failurems mbaNoch keine Bewertungen

- Rampver Financials Mutual Fund Investing Basics PDFDokument29 SeitenRampver Financials Mutual Fund Investing Basics PDFEmmanuel AuguisNoch keine Bewertungen

- Diploma in Investment AnalysisDokument4 SeitenDiploma in Investment AnalysisyanauitmNoch keine Bewertungen

- Sources of FinanceDokument26 SeitenSources of Finance409005091Noch keine Bewertungen

- Practice Problems 263Dokument5 SeitenPractice Problems 263GNoch keine Bewertungen

- Mid CORFINDokument16 SeitenMid CORFINRichard LazaroNoch keine Bewertungen

- Gujarat Pipavav Port LTD (GPPL) Gujarat Pipavav Port LTD (GPPL)Dokument11 SeitenGujarat Pipavav Port LTD (GPPL) Gujarat Pipavav Port LTD (GPPL)Rajiv BharatiNoch keine Bewertungen