Beruflich Dokumente

Kultur Dokumente

2013 E&P Salary Report - CSI Recruiting PDF

Hochgeladen von

Bilal AmjadOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

2013 E&P Salary Report - CSI Recruiting PDF

Hochgeladen von

Bilal AmjadCopyright:

Verfügbare Formate

REPORT

2013 E&P Salary

Petroleum Engineering Petroleum Geosciences Petroleum Land Management

Salary Data and Position Descriptions U.S. E&P Technical Professionals

1-888-264-7600 www.csirecruiting.com

CSI Recruiting Domestic U.S. E&P 2013 Salary Report

Table of Contents Introduction Using the Report How the Report Was Created The Other Compensation 2013 State of the E&P Industry 2013 State of Compensation Petroleum Engineering 3 4 6 7 8 10 13

Reservoir Engineer..14 Drilling Engineer..17 Production / Operations Engineer..20 Engineering Technician.23 Petroleum Land Management 26

Landman27 Land Technician 30 Petroleum Geosciences 33

Geologist 34 Geophysicist.37 Geological / Geophysical Technician 40 Petrophysicist 43 About CSI Recruiting 46

2013 CSI Recruiting

CSI Recruiting Domestic U.S. E&P 2013 Salary Report

Introduction Welcome to our 9th annual salary report. As has been the case since we began the report in 2005, CSI Recruitings 2013 Domestic E&P Salary Report is a survey of compensation within the domestic exploration and production marketplace. This report consists of average base salary data for technical positions across the engineering, geoscience and land disciplines. In addition, the report illustrates average annual bonus payments, company stock program participation percentages and average paid time off data. The primary objective of this report is to provide up-to-date, detailed data and commentary tied to specific job titles and technical disciplines to enable readers to fully understand current market compensation conditions within the United States E&P community. Data included in this Report is restricted to technical professionals currently in full-time, salaried positions within Exploration & Production companies, working in a U.S. location. The Job Descriptions portion provides detailed and in-depth definitions for the experience and educational requirements of the position, and delves into responsibilities and expectations for those particular positions. The Annual Update portion provides an overview of present day supply and demand for the specific skill set with commentary as to the expected trends related to that specific technical role. As has been the case since we began the report in 2005, the landscape of the Domestic E&P hiring marketplace is constantly changing. Technical skill sets have been and will continue to be in high demand and short supply, resulting in an ever-changing compensation environment. Developments in the world economy and within the domestic E&P industry influence these numbers, and the evolving marketplace has implications for everyone in the E&P business.

2013 CSI Recruiting

CSI Recruiting Domestic U.S. E&P 2013 Salary Report

Using the Report This report strives to provide a comprehensive overview of compensation within the domestic E&P marketplace, backed by detailed data, to be utilized by hiring authorities, human resources personnel, company executives and technical personnel within the E&P community. CSI Recruitings 2013 Domestic E&P Salary Report includes ten Job Categories, which are organized by three Disciplines: 1. Petroleum Engineering (Includes Reservoir Engineer, Drilling Engineer, Production / Operations Engineer and Engineering Technician) 2. Petroleum Land Management (Includes Landman and Land Technician) 3. Petroleum Geoscience (Includes Geologist, Geophysicist, Geological / Geophysical Technician, and Petrophysicist) Each Job Category provides an overview of the position within a typical E&P organization, and then details the experience and educational requirements of the position. The report delves into specific responsibilities and expectations for that Job Category and addresses the current state of affairs for that particular Job Category, the overall supply and demand issues and regional nuances for the skill set. Base Salary data is presented at the end of each Job Category, presented in average and median numbers. The base salary and annual cash bonus data is further broken down into Years of Experience and Region Working. Following an addition we made to the report in 2011, we include information related to the annual cash bonus, company stock and paid time off portions of the compensation package. While the report does not address the details related to stock plans, such as vesting schedules, option versus grant programs or stock purchase plans, we feel that the details presented tell at least part of the story about non-base compensation within the industry.

2013 CSI Recruiting

CSI Recruiting Domestic U.S. E&P 2013 Salary Report

New in the 2013 E&P Salary Report is the inclusion of Average Years of Experience, provided for each of the ten Job Categories. This figure represents the average industry experience of all salary survey participants for that specific skill set. Were including this statistic to illustrate those skill sets where a senior-level population may drive the average salary data higher, or where a youthful population of a particular technical discipline may lower average base salaries. Also, it helps illustrate those job categories where industry veterans vastly outnumber young professionals, which could portend succession planning issues as the senior-level talent retires.

2013 CSI Recruiting

CSI Recruiting Domestic U.S. E&P 2013 Salary Report

How the Report Was Created

CSI Recruitings 2013 Domestic E&P Salary Report contains data from over 2,200 professionals currently employed in full-time, salaried positions within E&P Operators, based in a U.S. location, and paid in U.S. dollars. The data was gathered via voluntary survey, which asked respondents to disclose their current job title, base salary and years within the industry. bonuses and paid time off. For the sake of useable data groups, certain job titles were combined into the most suitable Job Category. For job titles with very small data groups that were not deemed to be aligned to a Job Category contained within the Report, that data was not included. Within a Job Category, in order for an Experience Data or Regional Data grouping to be presented, we required that the count of that groupings data set represented a minimum of 8% of the total count for that Job Category. As weve done since 2011, we also asked respondents for information related to participation in a company stock program, annual cash

2013 CSI Recruiting

CSI Recruiting Domestic U.S. E&P 2013 Salary Report

The Other Compensation The most-oft-asked question in response to our Salary Report is Why just Base Salary Why not include other compensation? The argument goes that since base salary is, more often than not, one piece of an overall compensation package, a report that ignores bonuses, stock options, benefits and other forms of non-salaried compensation is not comprehensive. Well, we agree. Base salary is not, on its own, representative of whether a person is well compensated or lags behind his or her colleagues. It does not illustrate wh ether a company is truly taking care of its employees, or simply keeping pace with the market. These compensation components are difficult to quantify. Given the variety of programs for the most prevalent others (stock, bonus and benefits), a side-by-side comparison is elusive as there is little consistency between organizations. Take, for example, stock options and grants: their value moves with the daily price of the publicly traded stock, making it impossible to assign a value to any stock option program. And what about privately held companies that have phantom stock programs? All this said, these other components cannot be ignored. As base salary compensation within the industry has fluctuations so does the annual bonus, the quality of benefits and the access to stock programs. Bearing that in mind, and responding to the requests of the reports participants, we are continuing with changes made in the 2011 E&P Salary Report by including data on the other compensation components that are most easily defined: Annual Cash Bonus as Percentage of Salary, Quantity of Paid Time Off and Participation in Company Stock Program (Y/N), in a new section of the report that can be found within each discipline and job category. Furthermore, following an addition to the 2012 Report we again are presenting detailed Annual Cash Bonus data. This data highlights the average percentage of salary received in Annual Bonus Segmented into Experience Level and Region for each of the ten Disciplines.

2013 CSI Recruiting

CSI Recruiting Domestic U.S. E&P 2013 Salary Report

2013 State of the E&P Industry

For domestic E&P companies, 2013 could be thought of as the year we stayed the course.

The domestic E&P industry has achieved noteworthy headlines in both crude and natural gas production as well as reorienting the US energy economy. In September 2012 the Energy Department reported that US oil production surged to the highest level since January 1997. From a global perspective, the International Energy Agency reported in November 2012 that the shale-oil boom will help the US overtake Saudi Arabia as the worlds largest oil producer by 2020. Similarly, US natural-gas production is projected to accelerate for decades. The shale-gas boom has had a profound impact on the US energy economy. The country is steadily increasing its electricity generation from natural gas (30% in 2012), instead of coal, and US carbon-dioxide emissions have fallen to their lowest level since 1994 according to a recent estimate by the US Energy Department. The natural gas growth from domestic E&P firms is also prompting

announcements of mutibillion-dollar investments to build chemical, steel, and fertilizer plants that will consume enormous quantities of gas.

It was a year marked by some firms trying to survive while their neighboring peers thrived; of foreign capital raining from Australia, China, Britain, and Canada into the key unconventional shale plays; of industry veterans seeing their retirement nest eggs recover, allowing for that delayed retirement to be realized; and of mixed movement for oil and gas pricing, neither changing substantially for any extended period of time. For those firms saddled with natural gas assets they overpaid for in years prior (Gas Companies for the purpose of this summary), these companies largely stayed afloat finding pockets of liquids in their portfolios. With the best of their gas hedges already exercised they reported losses but reduced overhead and found investment dollars from foreign and domestic sources. In summary, for the most part, theyre still in business and working to stay that way. Then there are the Contrarians, those natural gas focused startups that emerged over the last two years. These firms were founded and funded on the premise that gas was cheap and

2013 CSI Recruiting 8

CSI Recruiting Domestic U.S. E&P 2013 Salary Report

acquiring gas-heavy acreage (dry gas, at that) within the premium domestic gas plays would yield as pricing rebounded to more logical levels. Acquisitions to populate these Contrarians were a lifeline to many of the Gas Companies in need of cash, and initially the model was ideal, with an eager seller and itchy-trigger-finger buyer working out deals quickly and often. Pricing, however has been slow to make these moves lucrative, and so the Contrarians lie in wait. Diversifieds would be those E&Ps that either came into the gas pric ing collapse with a healthy oil portfolio, or were quick to adapt and build up a liquids inventory via drill bit or acquisition. The Diversifieds have enjoyed strong profits, a more attractive hiring market, and easy access to capital to develop liquid-rich plays. These firms are not in break-neck expansion mode, however. They are sitting on good sums of cash, developing the acreage they have, buying logical bolt-on properties and pursuing a strategy of measured growth.

The Diversifieds are hiring opportunistically, taking advantage of their position in the marketplace to lure good talent from the Gas Companies on a case-by-case basis.

First Quarter of 2013

The first quarter of 2013 has seen select pockets of hiring activity, primarily by the small and mid-size Diversified independents, and almost exclusively in development oriented roles with a focus on pulling liquids out of the ground Key skill sets being production engineers, drilling engineer, operations geologist and land negotiators.

While the Contrarians have held steady on their staffing levels, the Gas Companies have started backfilling roles open from the attrition or small-scale layoffs of the past 18 months.

From our perspective, supply and demand for talent is at a healthy level, with companies in need of talent being able to fill roles via various sources (internal referrals, agencies, new grads). The majority of the job seekers in the marketplace, there by circumstance or of their own volition, are having success in landing new jobs in a reasonable (~3 months) period of time.

2013 CSI Recruiting 9

CSI Recruiting Domestic U.S. E&P 2013 Salary Report

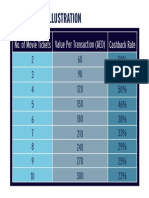

2013 State of Compensation Domestic E&P compensation continues to be a very bright area within the overall U.S. economy, with all signs pointing to continued steady growth. Even new college graduates entering the industry are extremely well positioned. The industry had the highest starting salaries of any industry for 2012 bachelors degree recipients according to the National Association of Colleges and Employers. Cash bonus compensation, at an average of 21.7% of base salary across all Job Categories, was actually down 2% from last years report. A bonus of nearly 22% is no cause for alarm, and instead we view this as a sign of two things: younger talent entering the industry and gas companies holding a little tighter on overall compensation. Participation in these cash bonuses continues to be robust with every Job Category registering a participation rate of 89% or above. These domestic cash bonus participation percentages far exceed the approximately 35% bonus participation averages we have seen in global all-company type compensation reports. Comparisons of domestic cash bonus payment amounts to global all-company type reports leads us to conclude the domestic E&P technical professionals are again earning higher average cash bonuses than the global oil & gas population. Stock / Equity Compensation, then and now Stock Compensation, for purposes of this report, is defined as present-day or deferred stock options, stock grants or phantom stock options, value creation shares, and other non-salary compensation (ORRI, for example), generally granted to professionals and managers. Stock / Equity compensation is given to employees for both individual and corporate performance, oftentimes varying in size and amount from person to person or department to department.

2013 CSI Recruiting

10

CSI Recruiting Domestic U.S. E&P 2013 Salary Report

As both our industry and the overall economy experienced a period of growth and expansion from 2001 until mid-2008, Stock /Equity compensation grew substantially, often climbing into the millions of dollars within start-up E&P companies, or for higher-level managers at mid and large-cap independents. Even staff-level technical professionals within the E&P community were able to bank six-figure sums as a result of growth in stock option values and profit sharing distributions. These perks were effectively cancelled, if not in practice, then certainly in value, in 2009. Stock options were under water with no signs of returning to the black, and profit sharing and liquidity event bonus checks were diminished if not eliminated. As we saw in 2010, the stock market, particularly within the energy sector, performed well, and incentive compensation in the form of stock showed strong value. 2011 saw the E&P industrys broad-based stock market recovery of 2010 begin to take a more personal approach, particularly in the last quarter of the year, where the oil-focused firms began to significantly outpace the natural gas operators. 2012 continued to be tough going for those public E&P firms focused on natural gas and they began to see hard-hitting declines in value as hedges expired and gas prices continued to fall. Present day Stock / Equity compensation appears to have taken on a third leg of the stool role, meaning that its one of the three primary components in an E&P professionals compensation plan, along with base salary and bonus. Engineers, Geoscientists and Landmen can expect to participate in stock options or stock unit grants, but the upside value is being vi ewed as icing on the cake versus part of a hiring decision calculation. The one segment of the industry where the Stock / Equity component does factor heavily into hiring decisions is in the world of small, privately held E&Ps backed by private equit y. As opposed to small, family-owned private E&Ps companies, these firms are more like Silicon Valley startups than multi generation oil companies. They are high energy environments, rife with entrepreneurs and lean on staff and overhead. These firms are typically led by a proven executive team of E&P veterans with major oil company and large independent pedigree, and with a thirst for ownership and more influence on outcome than they would see in a publicly traded entity. These firms, as they take flight,

2013 CSI Recruiting

11

CSI Recruiting Domestic U.S. E&P 2013 Salary Report

often need to fill in key management or technical positions in order to execute on their acquisition, development and liquidity event objectives. In order to attract top talent, and to give that talent a sense of ownership in firm, there will often be an equity component that allows the non-founding member to share in the success of the organization, i.e. an asset or whole company sale. Depending on the arrangement, this can be as simple as a small percentage share of the overall profit of the venture, or it can require a cash contribution from the new hire. Typically the level of risk involved for the individual is mirrored by the potential upside, and with the right set of circumstances between equity financing arrangement, asset quality, technical acumen and leadership, this can in a few years time translate into life-changing money. Benefits Benefits have long been an intangible component of a compensation package. Even 10 years ago, robust health insurance was considered to be a given, as was generous vacation time, and a covered, reserved parking space. Times are different, even for the oil business. Health insurance costs are onerous. The cost to insure a family in any kind of decent health insurance program can cost a company $1,500 / month or more, and that doesnt include vision, dental life or disability coverage. In tandem, gone is the company pension, replaced with 401k matching. Vacation time is now often part of a PTO Bank where time off for your honeymoon counts the same as a dentist appointment or the flu. These changes could be viewed negatively, but instead they illustrate that E&P companies, while being mindful of the runaway cost of benefits, have done well at keeping the key pieces in place: health coverage, retirement, and time off, all while maintaining strong base salaries and installing incentive compensation components. Perhaps the health coverage may have a high deductible or require more out-of-pocket monthly contribution from the employee, or you may not actually get to use all of your PTO because of workload, but overall E&P companies continue to maintain better-than-average benefits programs for their employees.

2013 CSI Recruiting

12

CSI Recruiting Domestic U.S. E&P 2013 Salary Report

Petroleum Engineering Reservoir Engineer Drilling Engineer

REPORT

Production / Operations Engineer Engineering Technician

2013 Salary

`

``

Petroleum Engineering

Reservoir Engineer Drilling Engineer

Salaries, Job Descriptions, and Recruiting and Hirin Production/Operations Engineer

Engineering Technician Salaries, Job Descriptions, and Recruiting and Hirin

Petroleum Engineering Summary Table AVERAGE SALARY Reservoir Engineer Drilling Engineer Production/Operations Engineer Engineering Technician $165,537 $164,012 $162,772 $89,479 AVERAGE CASH BONUS 29% 26% 25% 15% AVERAGE YEARS IN INDUSTRY 15 14 16 18

2013 CSI Recruiting

13

CSI Recruiting Domestic U.S. E&P 2013 Salary Report

Reservoir Engineer The Reservoir Engineer is responsible for estimation of hydrocarbons in place within an oil or gas reservoir, and for forecasting the probable future production performance of a gas or oil reservoir. Responsibilities and Expectations: Conduct economic evaluation of exploration and development drilling opportunities, acquisitions and divestitures Prepare budgets, forecasts, and SEC reserves reporting documents Support drilling plans and execution (e.g. well location, well testing, logging ) Develop and maintain field profitability models, and running economic models of production optimization proposals Build reservoir models and carry out simulations to evaluate the possible development scenarios and associated reserve profiles Perform detailed simulation studies to optimize well production/design or to investigate critical aspects related to fluid movements Conduct analytical studies to understand the fluid flow characteristics in the reservoir Develop and maintain standard field profitability models, and run economic models of optimization proposals Prepare reserve estimates and economic analyses for exploration and development drilling and recompletion projects Analyze electric logs, formation pressures and reservoir fluids Evaluate potential acquisitions and divestitures Identify and recommend exploitation opportunities on existing properties Supervise reserve studies performed by consulting firms Mentor junior engineers and engineering technicians, and providing guidance and training in fundamental and advanced applications of reservoir engineering Experience and Educational requirements: Bachelor of Science Degree in Petroleum Engineering Hands on experience in field studies, acquisition evaluations, and federal lease sale economics Oil and Gas Reserve Estimations, Decline Curve Analysis, Petrophysical Log Analysis, Material Balance Studies Experience in Economic Evaluations using ARIES, OGRE, PEEP software Excellent communication skills (written and oral) for internal and external project presentation

2013 CSI Recruiting

14

CSI Recruiting Domestic U.S. E&P 2013 Salary Report

2013 Update - Reservoir Engineers Reservoir engineers continue to see strong demand for their economic evaluation skills to gauge value of an E&P firms in-house assets as well as for asset purchase and sale transactions. In fact, over the last year weve seen a significant increase in employers seeking reservoir engineers to fill Business Development or New Ventures or A&D engineer positions. These roles, rather than sitting in a specific asset team, often float between geographic regions, evaluating both new play and bolt-on acquisitions, analyzing divestiture candidates in non-core areas and working hand-in-hand with senior management on overall strategy. These positions are very desirable for 10+ year experienced reservoir engineers that have seen a diversity of assets in their careers and been involved in acquisition and divestiture events previously. In addition, a team-oriented, collaborative personality is important for this role, in order to connect well across technical disciplines, corporate hierarchy and with colleagues from other E&P companies. Additionally, even small to mid-size E&P firms are carving out reserves as an engineering specialty. In years past we saw reserves as one of several duties that a senior reservoir engineer would have, along with economic evaluations, exploitation evaluation, decline curve analysis and the like. Now these growing firms are titling positions such as Reserves Engineer or Corporate Reservoir Engineer, and these positions focus exclusively on estimating reserves, preparing SEC reserve reports and coordinating that reporting and auditing with 3 rd parties and funding partners. The domestic E&P community continues to prize traditional reserv oir engineering over simulation-heavy skill sets, though the larger independents are increasingly bringing on a modeling / simulations expert or two for more complex plays. New grads that enter into rotational petroleum engineering programs within majors or large independents are seeing a reservoir engineering rotation along with drilling, production and completions. We have seen a steady uptick in 2-3 year engineers electing to specialize in reservoir engineering upon completion of the rotational program.

2013 CSI Recruiting 15

CSI Recruiting Domestic U.S. E&P 2013 Salary Report

RESERVOIR ENGINEER COMPENSATION

BASE SALARY OVERALL AVERAGE EXPERIENCE AVERAGES

0-5 Years Experience 6-10 Years Experience 11-25 Years Experience 26+ Years Experience $125,890 $145,962 $192,982 $199,279 $165,537 15 Years

ANNUAL CASH BONUS

29% of base salary

28% 27% 27% 32%

ADDITIONAL COMPENSATION

75% participate in a company stock program

STOCK

REGIONAL AVERAGES

Dallas/Fort Worth Metro Denver/Rockies Houston Metro Mid-Continent Midland $169,411 $165,173 $168,659 $162,695 $170,578 31% 28% 29% 21% 32%

93% receive an annual cash bonus

BONUS

Average 4.3 weeks

VACATION

Salary

$200,000 $150,000 $100,000 $50,000 $0

AVERAGE BASE SALARY

Years of Service

0-5 yrs

6-10 yrs

11-25 yrs

26+ yrs

2013 CSI Recruiting

16

CSI Recruiting Domestic U.S. E&P 2013 Salary Report

Drilling Engineer The Drilling Engineer is responsible for the design, development, review, and implementation of drilling and well work-over programs, and to recommend changes in such programs due to economic and production factors. Responsibilities and Expectations: Design and implement a procedure to drill the well as economically as possible Manage the complex drilling operation including both the people and technology Work closely with the drilling contractor (the operator of the rig and its crews), service contractors, and compliance personnel, as well as the other members of his internal team Direct the review and analysis of drilling, redrilling, and remedial well work-over programs; inspect the implementation of drilling and various remedial programs Review and monitor mud programs, directional drilling methods, and logging methods Review and analyze well completion methods to be used in the well for secondary recovery projects Direct and prepare graphic records relative to drilling and redrilling, such as well histories, bit performance records, directional surveys, and drilling cost records Coordinate activities with other staff as to well logging programs, interpretation of well logs and sand counting for the preparation of isopach maps Obtain cores and fluid samples for and exchanges information with other sections relative to the drilling, redrilling, and remedial well work required to obtain the maximum efficient recovery of petroleum products from waterflood programs Prepare detailed reports on the status of drilling operations Experience and Educational requirements: Bachelor of Science Degree in Petroleum Engineering Knowledge of petroleum engineering and secondary recovery methods and techniques, drilling, redrilling, and remedial work Excellent communication skills (written and oral) for interface with professional engineers, company management, field personnel and drilling contractors.

2013 CSI Recruiting 17

CSI Recruiting Domestic U.S. E&P 2013 Salary Report

2013 Update - Drilling Engineers Drilling Engineers, particularly those with advanced skill in horizontal drilling within one or more of the domestic shale plays, are in high demand and will continue to see robust salary increases and bonus payouts. The job is demanding, and the phone can ring at some very odd and inconvenient hours, however these engineers are key to driving growth within any E&P organization. Those drilling engineers with an exclusively vertical / conventional drilling background still see demand for their skills, but not nearly to the level enjoyed by the experienced horizontal drilling engineers. While rig counts for gas-focused operators have declined substantially, and drilling engineers in those companies pine for higher activity levels, drilling engineers with E&P firms that have a robust drilling budget and oil assets to exploit are busier than ever. Preparing AFEs, selecting drilling contractors, overseeing the drilling program both from the office and the field, drilling engineers shoulder a great deal of responsibility, both in manpower and dollars. Often during early stages of developing a play, these professionals will serve as both drilling superintendent and engineer in order to more closely monitor progress and ensure the program is on schedule and budget. We continue to see experienced drilling engineers crossing into completions work, and vice versa, in companies big and small, and while it still can be a hurdle, E&P firms are selectively hiring drilling and completions engineers away from the service companies. Drilling continues to be a key component of the new grad rotational programs within majors and large independents, along with completions, production operations, and reservoir engineering. Anecdotally, it seems that the more a junior engineer enjoys and connects well to the field operations, the more likely they are to continue in drilling once the rotational program is complete. As long as oil prices hold steady and gas prices maintain the incremental increases of the past couple months, drilling engineers will be in strong demand.

2013 CSI Recruiting

18

CSI Recruiting Domestic U.S. E&P 2013 Salary Report

DRILLING ENGINEER COMPENSATION

BASE SALARY OVERALL AVERAGE EXPERIENCE DATA

0-5 Years Experience 6-10 Years Experience 11-20 Years Experience 21+ Years Experience $123,786 $148,230 $173,383 $185,800 $164,012 14 Years

ANNUAL CASH BONUS

26% of base salary

ADDITIONAL COMPENSATION

79% participate in a company stock program

26% 28% 30% 21%

STOCK

95% receive an annual cash bonus

BONUS

REGIONAL DATA

Dallas/Fort Worth Metro Denver/Rockies Houston Metro Mid-Continent $166,354 $162,512 $165,830 $161,125 24% 30% 22% 31%

VACATION

Average 4.0 weeks

Salary

$200,000 $150,000 $100,000 $50,000 $0

AVERAGE BASE SALARY

Years of Service

0-5 yrs

6-10 yrs

11-20 yrs

21+ yrs

2013 CSI Recruiting

19

CSI Recruiting Domestic U.S. E&P 2013 Salary Report

Production / Operations Engineer The Production / Operations Engineer is charged with overseeing the daily operation of wells, including constant monitoring of well performance, planning, and supervising workover operations to maximize recovery and optimizing artificial-lift and pipe flow systems. Additionally, as the well produces, these engineers are responsible for the design and implementation of well completions and subsurface and surface production facilities which are needed to produce the field and treat the produced fluids to produce oil and gas with the specifications needed for transportation and refining operations. Responsibilities and Expectations: Analyze, interpret, and optimize the performance of individual wells Determine the most efficient means to develop the field considering the viscosity of the crude oil, the gas-to-oil ratio, the depth and type of formation, and the project economics Identify wells for production enhancements Maximize the daily production and ultimate recovery of producing properties through optimum operational procedures Perform open hole and cased hole log evaluation Recommend wells for completion or abandonment Design facilities and coordinate installation Responsible for cost containment and regulatory compliance Develop a system of surface equipment that will separate the oil, gas, and water. Explore additional technologies to enhance production from wells that are declining Work closely with reservoir engineers and those in other disciplines to determine the optimal approach for a particular field Coordinate all phases of drilling, completion and workover operations Oversee State, Federal and environmental compliance and deliver professional testimony Experience and Educational Requirements: Bachelor of Science Degree in Petroleum Engineering Knowledge of petroleum engineering operations and production methods for oil and natural gas recovery Excellent communication skills (written and oral) for interface with professional engineers, company management, and field personnel

2013 CSI Recruiting

20

CSI Recruiting Domestic U.S. E&P 2013 Salary Report

2013 Update Production / Operations Engineer

Production and Operations Engineers yet again came out in quantity to participate in our annual Salary Report, and at all ends of the experience spectrum.

The Average Years of Experience of respondents dipped from a 2012 average of 18 years experience to 16 years in industry, signaling that were hiring young operations and production professionals at a steady clip. The Petroleum Engineering programs at our nations colleges and universities are producing high-quality graduates, and the E&P industry is aggressively hiring them for both internships and fulltime positions.

Rotational training programs typically revolve around providing new grads with extensive production and operations engineering experience, which oftentimes leads to specializing in this discipline at the programs end. While weve seen some industry veterans retire and exit the industry, there are still a large quantity of production and operations engineers with 30+ years of experience. Given the industrys current drive towards rapid, high volume oil production, particularly in the shale plays, these engineers have plenty of work and there continues to be strong demand within the marketplace for senior-level talent.

Enhancing production performance through well optimization continues to be a hallmark of a good production / operations engineer, and that can mean anything from artificial lift techniques to workovers, even coloring into optimizing surface facilities. Young and veteran engineers alike who can demonstrate measurable success in optimizing existing wells are highly valued and, when inclined to change jobs, find an active and interested marketplace.

While the days of eye-popping sign-on bonuses have not returned, bonus targets and stock programs continue to be robust, along with a strong industry-level base salary. Production and operations is the heartbeat of any E&P organization, and it continues to be a high demand area for hiring.

2013 CSI Recruiting 21

CSI Recruiting Domestic U.S. E&P 2013 Salary Report

PRODUCTION/OPERATIONS ENGINEER

BASE SALARY OVERALL AVERAGE EXPERIENCE DATA

0-5 Years Experience 6-10 Years Experience 11-20 Years Experience 21-29 Years Experience 30+ Years Experience $109,221 $140,500 $170,149 $180,326 $196,754 $162,772 16 Years

ANNUAL CASH BONUS

25% of base salary

22% 28% 26% 27% 22%

ADDITIONAL COMPENSATION

64% participate in a company stock program

STOCK

96% receive an annual cash bonus

BONUS

REGIONAL DATA

Appalachia Dallas/Fort Worth Metro Denver/Rockies Houston Metro Mid-Continent Midland $130,264 $168,930 $160,049 $161,579 $159,937 $169,020 21% 26% 26% 25% 26% 23%

Average 4.1 weeks

VACATION

Salary

$200,000 $150,000 $100,000 $50,000 $0

AVERAGE BASE SALARY

Years of Service

0-5 yrs

6-10 yrs

11-20 yrs

21-29 yrs

30+ yrs

2013 CSI Recruiting

22

CSI Recruiting Domestic U.S. E&P 2013 Salary Report

Engineering Technician The Engineering Technician is responsible for economic evaluation of oil & gas properties for acquisition and divestment, waterflood monitoring, workover and well maintenance records, with daily utilization of ARIES and related valuation programs. Responsibilities and Expectations: Maintain reserve and production databases; provide annual, mid-year and quarterly reserve reports to banks, verifying financial position Digitize well logs and create reservoir cross-sections Maintain files and schematics for surface equipment on oil & gas leases Organize and update well log library Perform economic forecasting to evaluate marginally economic oil & gas properties for divestment Provide oil production forecasting and reserve analyses using production decline curves Generate computations to determine the economic life of oil & gas fields Maintain well equipment inventory databases for producing oil & gas leases Monitor operating, workover, and repair expenses Estimate drilling & completion costs for drilling projects and provided management with requests for approval of project capitalization Provide support to acquisition, exploration and development by accessing outside information sources Provide reports and production history graphs, and data imports for engineering software Use computer software to create wellbore schematics of downhole equipment for well completions and workovers Prepare AFEs for well drilling, completions, and workovers Prepare and maintain scheduling time lines of ongoing projects Organize and maintain well files Experience and Educational Requirements: Knowledge of petroleum evaluation software (ARIES) Experience supporting petroleum engineers within an exploration and production environment.

2013 CSI Recruiting

23

CSI Recruiting Domestic U.S. E&P 2013 Salary Report

2013 Update - Engineering Technicians While the industry isnt to the point where engineering technicians have a corner office with a window, they are certainly seen as essential members of the engineering team, and demand for those with a developed skill set in engineering support continues to be robust. Engineering Technicians typically specialize in one engineering discipline, and then become adept at the software specific to that discipline. Their data management and analysis skills are at the core of their market value. Drilling Technicians, Production Technicians, Reservoir Technicians and even Completions Technicians are invaluable to a busy engineering team, and the software applications they use are specialized and complex. In smaller operators, youll often see these lines blurred as the few (or lone) engineering technicians need to support several components of the operation. In addition, some rare hybrids are adept in supporting both the engineering and the geoscience staff. As for hiring experienced technicians, the market can be challenging, particularly in the reservoir technician skill set. As financial institutions that specialize in E&P transactions work to become more technically astute in their investment and borrowing decisions, they have been hiring away some of the top ARIES and PhD Win experienced talent, often to the tune of higherthan-industry salaries. Weve seen this more in Houston than the secondary markets, but its having an impact nationwide. At long last, training programs are beginning to take hold. Private service firms run by former E&P technicians offer to train those with a strong math and computer science aptitude in the industrys software and data sets, and then place these trainees in junior technician positions within E&P firms. The Technician ranks include a substantial number of senior-level 25+ year professionals, however that figure, Average years of experience, is creeping downward as more industry newbies gain hands-on experience.

2013 CSI Recruiting

24

CSI Recruiting Domestic U.S. E&P 2013 Salary Report

ENGINEERING TECHNICIAN

BASE ANNUAL SALARY CASH BONUS OVERALL AVERAGE EXPERIENCE DATA

0-5 Years Experience 6-10 Years Experience 11-20 Years Experience 21+ Years Experience $75,002 $84,162 $90,497 $98,033 14% 16% 15% 16% $89,479 18 Years 15% of base salary

ADDITIONAL COMPENSATION

STOCK

75% participate in a company stock program

REGIONAL DATA

Dallas/Fort Worth Metro Denver/Rockies Houston Metro Mid-Continent Midland $88,367 $88,165 $95,791 $84,445 $88,993 16% 16% 17% 14% 11%

96% receive an annual cash bonus

BONUS

VACATION

Average 4.4 weeks

Salary

$100,000 $80,000 $60,000 $40,000 $20,000 $0 0-5 yrs

AVERAGE BASE SALARY

Years of Service

6-10 yrs

11-20 yrs

21-29 yrs

2013 CSI Recruiting

25

CSI Recruiting Domestic U.S. E&P 2013 Salary Report

Petroleum Land Landman

REPORT

2013 Salary

Petroleum Land Summary Table AVERAGE SALARY Landman Land Technician $135,391 $66,269

Petroleum Land

Petroleum Engi

Landman

Land Technician Salaries, Job Descriptions, and Recruiting and Hir

Salaries, Job Descr

Salaries, Job Descriptions, and Recruiting and Hir

Salaries, Job Descr

AVERAGE CASH BONUS 22% 10%

AVERAGE YEARS IN INDUSTRY 16 8

2013 CSI Recruiting

26

CSI Recruiting Domestic U.S. E&P 2013 Salary Report

Landman The Petroleum Landman is a job unique to North America. landowner who owns the subsurface oil and gas. Responsibilities and Expectations: Responsible for acquisition or disposition of oil, natural gas or surface interests Conduct negotiation, drafting or management of agreements respecting property interests Interface directly with surface owners, research ownership records in county, state, or provincial offices. Research titles and negotiate and draft a wide variety of leases and agreements with landowners, mineral owners, state and federal agencies, Native American tribes and industry partners. Represent their employer before regulatory bodies, participate in and provide expertise for multidisciplinary teams, and apply state-of-the-art software to create maps, reports and other documents to aid management in the decision-making process Obtain the proper documents and data so that the company may obtain leases on acreage it is interested in Assemble data and maps in connection with acreage rental expiration deadlines to determine whether the company should renew or continue lease agreements. Review and evaluate lease recommendations and other data for presentation to management Work closely with attorneys in preparation of title opinions, filing force integration proceedings, interpleading to Court suspended royalties, and quiet title suits Maintain project area land/well forms on computer systems and spreadsheets Experience and Educational Requirements: Bachelor of Science Degree in Petroleum Land Management or related discipline Knowledge of petroleum land management principles Excellent communication skills (written and oral) for interface with professional engineers, company management, field personnel, and business contacts / partners The petroleum landman is

responsible for obtaining permission to drill a well, meaning the land must be leased from the

2013 CSI Recruiting

27

CSI Recruiting Domestic U.S. E&P 2013 Salary Report

2013 Update Landmen Landmen thrive when the industry is in an expansion cycle at the dawn of new basins and plays, when innovation and new technology allows for extraction of hydrocarbons from areas long considered uneconomical, when new infrastructure allows for cheap and easy transportation of resources to market, when commodity prices allow for even the most challenging economics to look attractive. Safe to say that over the past 10-12 years weve had a of number of these expansion events, which call into action legions of field landmen to gather leases, brokers to manage those crews, departments of in-house landmen to negotiate agreements, interface with the field and communicate with company management. As the Utica works its way into becoming an established play, were taking a pause in the land grab of the past decade. The industry is in development mode, making the most out of the strong oil prices in unconventional and conventional oil plays, producing those assets while still looking for the next marquis play or technological innovation. Domestic E&P companies are, to speak generally, in harvest mode. There is demand for experienced landmen, to be sure, however the demand is very specific. E&P firms are exacting in their hiring parameters: specific basin experience; insistence on specific type of play experience; strong preference for PLM degrees and CPL certification. Hands-on negotiations experience is key, as harvest mode can often translate into a gro wth plan via acquisition of producing assets, not a land-driven strategy. As such, landmen that can work hand-in-hand with the A&D or Business Development department look more appealing than one that has had a singular asset focus.

The transition from Field Landman to an in-house role continues to be a difficult move to navigate, largely due to overall demand for experienced landmen being soft, and an overriding desire for a deal making and A&D negotiations skill set.

We will see another land-focused expansion cycle over the next 18-24 months, and it will be interesting to see if thats driven by a new play or technological innovation, or both.

2013 CSI Recruiting 28

CSI Recruiting Domestic U.S. E&P 2013 Salary Report

LANDMAN COMPENSATION

BASE SALARY OVERALL AVERAGE EXPERIENCE DATA

0-5 Years Experience 6-10 Years Experience 11-25 Years Experience 26+ Years Experience $95,605 $121,060 $154,977 $167,540 $135,391 16 Years

ANNUAL CASH BONUS

22% of base salary

15% 24% 23% 24%

ADDITIONAL COMPENSATION

66% participate in a company stock program

STOCK

REGIONAL DATA

Dallas/Fort Worth Metro Denver/Rockies Houston Metro Mid-Continent $130,083 $129,060 $143,994 $126,193 21% 21% 23% 21%

93% receive an annual cash bonus

BONUS

VACATION

Average 4.0 weeks

Salary

$180,000 $160,000 $140,000 $120,000 $100,000 $80,000 $60,000 $40,000 $20,000 $0

AVERAGE BASE SALARY

Years of Service

0-5 yrs

6-10 yrs

11-25 yrs

26+ yrs

2013 CSI Recruiting

29

CSI Recruiting Domestic U.S. E&P 2013 Salary Report

Land Technician The Land Technician supports the petroleum landmen in their petroleum land management functions within the land department of an exploration & production firm. Responsibilities and Expectations: Orders and reviews drilling title opinions and prepares necessary curative as required for drilling activity. Prepares and reviews exhibits for Federal Unit Agreements and Unit Operating Agreements. Assists with forming federal participating areas, securing paying well determinations, preparing annual plan of development and unit contractions for government approval. Prepares communication agreements and pooling agreements. Communicates with various federal and state agency personnel. Assists Landman with spacing applications and exhibits. Prepares JOAs and state, federal, and fee assignments. Reviews and monitors contract briefs set up by Land Administration. Working with tax maps, farmline and topo maps and property deeds Working with deed plotting programs and chain of title programs

Experience and Educational Requirements: Demonstrated proficiency in Microsoft Word, Excel and Access Excellent written and oral communication skills High degree of initiative, attention to detail and accuracy, timeliness Strong working knowledge of Leases and Division Orders to interface with Land Administration personnel and handle difficult land owner questions regarding pooling, unitization, and spacing.

2013 CSI Recruiting

30

CSI Recruiting Domestic U.S. E&P 2013 Salary Report

2013 Update Land Technicians

While the overall population of land technicians within the domestic E&P industry pales to that of the geoscience or engineering technician ranks, it is a role we see more and more, and in operators of all sizes. While the title may vary from one firm to another (Land Associate / Land Analyst / Land Coordinator), the function is essentially the same, assisting the companys land professionals and utilizing oil & gas land-focused software applications where applicable.

Much like the other technician skill sets, Land Technicians have an experience profile that sits at the ends of the spectrum, meaning a large number of land techs with 25+ years experience and a growing number with less than 5 years. In fact the Average Years of Experience of Land Tech respondents declined significantly, from 11 years in 2012 to an average of 8 years in 2013. However, theres another interesting phenomenon at play with Land Technicians that we dont see nearly as much with engineering or geosciences techs the technician role seems to serve as a stepping stone to other roles within the land department.

Typically Geotechs move up in the organization to be senior geotechs and, if the company is large enough, supervisor of a team of technicians. The same is largely true of Engineering Technicians. For Land Techs, however, we often see progression not into a Senior Land

Technician job, but into Junior Landman positions after 2-5 years functioning as a Land Tech.

So why would this transition occur in an E&P land department and not an engineering or exploration department? The quick answer is the degree. In order to be a geologist, you need to have (at a minimum) a BS in Geology. In order to be a Drilling Engineer need to have a BS in (preferably) Petroleum Engineering, or in Chemical or Mechanical Engineering. While PLM degrees are a huge plus for landmen to have, particularly when shopping their skills, it is by no means a must-have degree in order to be a Petroleum Landman at an E&P company.

Land Technicians provide much-needed support to landmen, and in the process, build themselves a versatile skill set that can be applied to senior-level tech work or a junior landman role.

2013 CSI Recruiting 31

CSI Recruiting Domestic U.S. E&P 2013 Salary Report

LAND TECHNICIANS

BASE SALARY OVERALL AVERAGE EXPERIENCE DATA

0-3 Years Experience 4-8 Years Experience 9+ Years Experience $52,804 $66,273 $81,413 $66,269 8 Years

ANNUAL CASH BONUS

10% of base salary

ADDITIONAL COMPENSATION

64% participate in a company stock program

11% 8% 11%

STOCK

REGIONAL DATA

Dallas/Fort Worth Metro Denver/Rockies Houston Metro Mid-Continent $64,500 $67,277 $64,700 $71,430 15% 9% 12% 9%

89% receive an annual cash bonus

BONUS

Average 3 weeks

VACATION

Salary

$90,000 $80,000 $70,000 $60,000 $50,000 $40,000 $30,000 $20,000 $10,000 $0

AVERAGE BASE SALARY

Years of Service

0-5 yrs

4-8 yrs

9+ yrs

2013 CSI Recruiting

32

CSI Recruiting Domestic U.S. E&P 2013 Salary Report

Petroleum Geosciences Geologist Geophysicist

REPORT

2013 Salary

Petroleum Geosciences Summary Table AVERAGE SALARY Geologist Geophysicist Geological/Geophysical Technician Petrophysicist $160,214 $192,135 $90,210 $172,006

Geological / Geophysical Technician

Petroleum Geosciences

Geologist

Geophysicist Salaries, Job Descriptions, and Recruiting and Hir Geological/Geophysical Technician

Salaries, Job Descriptions, and Recruiting and Hir Petrophysicist

AVERAGE CASH BONUS 26% 25% 15% 24%

AVERAGE YEARS IN INDUSTRY 18 27 24 18

2013 CSI Recruiting

33

CSI Recruiting Domestic U.S. E&P 2013 Salary Report

Geologist The Petroleum Geologist is typically focused on development (also referred to as operations) geology or exploration geology. Exploration Geologists are more involved in the activity of prospect generation, which includes locating a prospect, making geological surveys, and documenting the viability and location of the prospect. Development Geologists work alongside drilling staff to best get the resources out of the ground. Responsibilities and Expectations: Perform log analysis, and well site work that results in the discovery of new reservoirs and field extensions Prepare detailed studies regarding producing properties with respect to future drilling, secondary recovery operations, and rework potential Prepare a variety of detailed structural and stratigraphic maps used to define exploration models for generating prospects Work closely with Geophysics, Land and Engineering to develop a prospect portfolio Achieve increases in oil and natural gas production by revising previous formation structural and stratigraphic interpretations Evaluate prospects and develop lead areas by conducting well data analysis, log interpretation and lithologic correlation, generation of maps and cross sections, and modeling gas/oil in-place volumetric estimates Develop existing assets by daily interaction with engineering (reservoir management), selection of well completion intervals, and providing geological interpretation to field operations Select core sites and intervals, and coordinate geologic specific drilling requirements Interpret geologic data and calculate pay zones from log analysis Compile and evaluate historical production and trends in completion techniques. Conduct subsurface evaluations to link logs, stratigraphy, and petrophysical properties to production Experience and Educational Requirements: Master and Bachelor of Science Degrees in Geology or related Geosciences discipline Successful track record of prospect generation and finding hydrocarbons Excellent communication skills (written and oral) for interface with geoscientists, company management, seismic service companies and technicians Experience as well-site geologist or in well-logging or data acquisition or interpretation is desirable

2013 CSI Recruiting

34

CSI Recruiting Domestic U.S. E&P 2013 Salary Report

2013 Update Geologists

Geologists experienced another good year in 2012, with a steady flow of open positions in both exploration and operations / development functions. The unconventional plays most certainly focused more on hiring for development and operations geologists, while the offshore and onshore new ventures roles sought explorationists.

Overall, geologist salaries from year to year did not change appreciably within our report except for notable growth in the 6-10 year experience group. We largely attribute the lack of overall increase in average salary to a lower average years of experience in our data sets, the result of more young geologists entering the business combined with the retirement of industry veterans. With an average salary of $107k for geologists with 0-5 years experience versus an average of $194k for those with 30+ years, its easy to see how a small increase in the number of young geologists and the removal of a quantity of senior talent can impact the statistics.

E&P firms, particularly the majors and large independents have continued to hire the top academic performers coming out of the Masters-level programs throughout the U.S. We see new hires that are graduating from programs in California, Kansas, Wisconsin, Ohio and New York, in addition to many from the usual suspects of UT, A&M, Oklahoma, OSU and Mines. With some exceptions, an MS is still the gold standard. Those with a BS in Geology can certainly land a job in industry, but the lack of a Masters certainly limits their opportunities. Geologists continue to be key players within New Ventures or Business Development team. These teams are charged with locating, evaluating and proposing acquisition opportunities, both in the form of bolt-ons to existing acreage and in new play opportunities, be it existing production or exploration acreage. These positions, highly desired by exploration-minded

geoscientists, can have a huge influence on the future of an organization, and therefore are typically reserved for senior-level professionals.

Geologists should see consistent demand for their skills in the coming year in most of the major markets in the U.S.

2013 CSI Recruiting 35

CSI Recruiting Domestic U.S. E&P 2013 Salary Report

GEOLOGISTS

BASE SALARY OVERALL AVERAGE EXPERIENCE DATA

0-5 Years Experience 6-10 Years Experience 11-20 Years Experience 21-29 Years Experience 30+ Years Experience $107,074 $140,402 $166,165 $180,683 $194,223 $160,214 18 Years

ANNUAL CASH BONUS

26% of base salary

22% 23% 25% 28% 30%

ADDITIONAL COMPENSATION

STOCK

70% participate in a company stock program

REGIONAL DATA

Appalachia Dallas/Fort Worth Metro Denver/Rockies Houston Metro Mid-Continent Midland $143,045 $160,236 $155,637 $167,828 $162,390 $167,088 28% 25% 23% 31% 23% 29%

90% receive an annual cash bonus

BONUS

VACATION

Average 4.2 weeks

AVERAGE BASE SALARY

Salary

$200,000 $150,000 $100,000 $50,000 $0

Years of Service

0-5 yrs

6-10 yrs

11-20 yrs

21-29 yrs

30+ yrs

2013 CSI Recruiting

36

CSI Recruiting Domestic U.S. E&P 2013 Salary Report

Geophysicist Petroleum Geophysicists use the principles of physics to measure and assess the properties of the earth and its environment in order to manage exploration and development projects on land and at sea. They plan, oversee and analyze complex land and marine surveys. Responsibilities and Expectations: Take seismic projects from concept to drill ready which can include 2-D / 3-D design, acquisition, processing, interpretation, and modeling Perform evaluations utilizing workstation environments including Landmark, Kingdom/3D-Pak, Geoquest, ZMAP, Geographix, and GMAplus software platforms Compile regional maps and coordinate seismic processing efforts for exploration efforts Participate in the evaluation and acquisition of production and exploration assets Conduct structural and stratigraphic interpretation of 3D seismic reflection volumes Perform quantitative amplitude interpretation, including AVO, for pre-drill prediction of lithology and fluid types away from well control Assess 3D seismic data fidelity by, for example, ray-tracing effects of acquisition on seismic image and modeling effects of velocity on migrated position of reflectors Perform volumetric calculations, risk assessment and preliminary economic analysis for exploration opportunities Work with Managers of Engineering, Land, and Exploration to fully evaluate all aspects of new exploration opportunities

Experience and Educational Requirements: Master and Bachelor of Science Degrees in Geophysics or related Geosciences discipline Successful track record of prospect generation and finding hydrocarbons Excellent communication skills (written and oral) for interface with geoscientists, company management, seismic service companies and technicians

2013 CSI Recruiting

37

CSI Recruiting Domestic U.S. E&P 2013 Salary Report

2013 Update Geophysicists

Another year, another substantial increase in average base salary for Geophysicists!

Up from

last years average of $183k to $192k yet again Geophysicists were our top earners in the 2013 E&P Salary Report. They also outpaced (by a wide margin) the Average Years Experience of all the other skill sets, at an average of 27 years of experience. The next highest for professionallevel skill sets was Petrophysicists at an average of 18 years of experience not even close. So whats to be made of this aging Geophysicist population? 10 years ago, this phenomenon was seen in every technical discipline in E&P. In 2001, SPE published data that their membership was aging at a rate almost identical to the calendar, meaning no young people were entering the industry. Thats changed in Engineering, its changed in Land and its even changed in Geology, so why not in geophysics?

Clearly there are young geophysicists (< 5 years experience) in the E&P business, however their numbers are few. Furthermore, as the domestic operators continue to concentrate on

unconventional plays the need for exploration geophysicists to perform high-end seismic interpretation wanes. Geophysicists are called into action on development and operations efforts, but not at the rate geologists are needed. Geophysicists are key to unlocking the potential in new frontier areas and offshore, but the domestic industry seems to be in harvest mode, not looking for elephants.

The Geophysicist is still a key component to any successful exploration effort, and they are well compensated for their work. When an E&P company needs to hire a senior geophysicist, often its a long search and requires both strong financial incentives and a demonstrated commitment to exploration to get candidates hired.

That said, while these industry veterans are still coming to work every day, there needs to be more young people brought into the industry to be mentored and trained in the nuances of seismic interpretation and hydrocarbon exploration. It would be a shame to have that experience leave the industry without more knowledge transferred to younger colleagues.

2013 CSI Recruiting 38

CSI Recruiting Domestic U.S. E&P 2013 Salary Report

GEOPHYSICISTS

BASE SALARY OVERALL AVERAGE EXPERIENCE DATA

0-10 Years Experience 11-20 Years Experience 21-29 Years Experience 30+ Years Experience $131,994 $179,091 $200,708 $205,576 $192,135 27 Years

ANNUAL CASH BONUS

25% of base salary

ADDITIONAL COMPENSATION

14% 27% 20% 29% 70% participate in a company stock program

STOCK

REGIONAL DATA

Dallas/Fort Worth Metro Denver/Rockies Houston Metro Mid-Continent $191,500 $184,118 $194,776 $189,250 33% 21% 26% 33%

91% receive an annual cash bonus

BONUS

PAID TIME OFF

Average 4.7 weeks

Salary

$250,000 $200,000 $150,000 $100,000 $50,000 $0 0-10 yrs

AVERAGE BASE SALARY

Years of Service

11-20 yrs

21-29 yrs

30+ yrs

2013 CSI Recruiting

39

CSI Recruiting Domestic U.S. E&P 2013 Salary Report

Geological / Geophysical Technician The Geological / Geophysical Technician supports petroleum geoscientists in their exploration and development efforts for company assets. Additionally, these technicians assist the geoscientists with evaluation efforts for acquisitions and divestitures. The Technicians work is performed using workstation software and mapping software, including Geographix, Petra, Kingdom / SMT, and Zmap, to name a few. Responsibilities and Expectations: Scanning, digitizing and geo-referencing all types of hard copy geological maps, lease maps, etc. for use in many different software packages including GESX, AutoCAD, and Global Mapper Creating thematic seismic basemaps, Isopach maps and cross sections in GES97 and GES Explorer Retrieve, print and prepare mud logs for geologists Create and maintain team well files which includes e-logs, mud logs, maps and election papers for wells Researched and produced acreage ArcView/GIS gas maps to determine new ventures acreage for new acquisitions Generate contour maps of monthly production (gas & water rate). Coordinate with Drafting department to complete comprehensive Geographix mapping projects for presentations Utilize Geographix to depth calibrate and create smart-rasters for wells, creating maps and cross-sections to determine new drill locations Generate maps and cross-sections zeroing in on multiple pay zones using Petra and hand cross-sections Prepared structure and isopach maps Work closely with engineers to determine production rates, reserve adds, decline curves, gas in place, recoverable gas, spacing issues and potential payout Manage GESX Well Library, consisting of the acquisition and importation of .las data and workstation ready digits from numerous vendors Deliver clear and succinct presentations to management, geoscientists and mineral owners Undertake practical field and laboratory work to support geophysical exploration and development work Experience and Educational Requirements: Bachelors Degree in Geology, Geophysics or related Geosciences discipline is preferred but not essential Knowledge of geosciences workstation software and mapping software Experience supporting petroleum geoscientists within an exploration and production environment

2013 CSI Recruiting

40

CSI Recruiting Domestic U.S. E&P 2013 Salary Report

2013 Update Geological and Geophysical Technicians

Steady as she goes would summarize the marketplace for Geological and Geophysical Technicians over the past year. The average salary data showed a small increase in both base salary, from an average of $89k to an average of $90k, and a small bump in the percentage of salary received as cash bonuses from 14% to 15%. The Average Years of Experience continued to be one of the highest in the report at over 23 years of industry experience.

While demand for geoscience technicians was not as robust as that for their engineering technician counterparts, hiring was steady throughout the year, with the typical requests for Petra experience for Geotechs and for SMT and Geographix experience for Geophysical Techs. The most significant change in experience wish lists is the increasing requests for GIS experience, particularly the ESRI line of ArcGIS / ArcInfo products. In larger E&P shops, weve see dedicated GIS Technicians who oftentimes have not worked in the E&P industry, but bring an advanced knowledge of these ESRI products. In smaller E&P companies, Geotechs are being asked to work with both the legacy products like Petra as well as become proficient with these new tools. While theres still no industry-standard training to become a Geoscience Technician, we are seeing younger professionals with a BS in Geology take the route of becoming a Tech, either as a career path of its own or as a lead-in to becoming a Geologist by being in the right place at the right time, or in advance of returning to school to gain the Masters Degree.

We anticipate demand to stay consistent for Geological and Geophysical Technicians in the year to come, with an increasing emphasis on GIS tools and their role in E&P mapping efforts.

2013 CSI Recruiting

41

CSI Recruiting Domestic U.S. E&P 2013 Salary Report

GEOLOGICAL/GEOPHYSICAL TECHNICIAN

BASE SALARY OVERALL AVERAGE EXPERIENCE DATA

0-10 Years Experience 11-29 Years Experience 30+ Years Experience $75,842 $92,500 $97,531 $90,210 24 Years

ANNUAL CASH BONUS

15% of base salary

ADDITIONAL COMPENSATION

71% participate in a company stock program

STOCK

14% 16% 16%

94% receive an annual cash bonus

BONUS

REGIONAL DATA

Dallas/Fort Worth Metro Denver/Rockies Houston Metro Mid-Continent $91,333 $87,708 $91,262 $86,461 16% 15% 13% 17%

Average 4.7 weeks

VACATION

Salary

$100,000 $80,000 $60,000 $40,000 $20,000 $0 0-10 yrs

AVERAGE BASE SALARY

Years of Service

11-29 yrs

30+ yrs

2013 CSI Recruiting

42

CSI Recruiting Domestic U.S. E&P 2013 Salary Report

Petrophysicist Petrophysicists within the E&P industry typically are tasked with working alongside engineers and other geoscientists to help fully understand the rock properties of the reservoir. Petrophysicists evaluate the reservoir rock properties by employing well log measurements, in which a string of measurement tools are inserted in the borehole, core measurements, in which rock samples are retrieved from subsurface, and seismic measurements, and combining them with geology and geophysics. These petrophysicists compute the conventional (or reservoir) petrophysical properties, including lithology, porosity, water saturation and permeability. Reservoir models are built upon their measured and derived petrophysical properties to estimate the amount of hydrocarbon present in the reservoir, the rate at which that hydrocarbon can be produced to the Earths surface through wellbores, and the fluid flow in rocks. The petrophysicist will evaluate petrophysical problems of varying complexity and design and/or apply the correct solution to them, in addition to conducting advanced technical studies independently or integrated with exploration and development teams. Experience and Educational Requirements: Bachelors and Masters Degree in Geology, Geophysics or related Physics discipline is strongly preferred, although occasionally a petrophysicist will have a Petroleum Engineering degree. Petrophysical skills should cover the entire range of issues encountered from exploration to development, with experience in designing well logging programs, doing data quality control of acquired log data, formation evaluations of wells, creating final log curve for input in reservoir models, reservoir description, and rock properties for seismic models. Ability to integrate petrophysical work with geophysics, geology and reservoir engineering is critical. Those with strong log analysis skills but without extensive technical education credentials are starting to make progress in industry, however the technical degree still differentiates a Log Analyst from a Petrophysicist.

2013 CSI Recruiting 43

CSI Recruiting Domestic U.S. E&P 2013 Salary Report

2013 Update Petrophysicists

Petrophysicists continue to occupy the #2 slot (behind Geophysicists) of highest base salary in our annual Salary Report, this year with an average base salary of $172k. That figure actually represents a small decrease from the 2012 average salary of $175k, and while the less than 2% delta is not significant, the reason behind the minor decrease most certainly is.

Petrophysicists, much like their geophysical counterparts, are largely industry veterans.

fraction of new college grads are hired into petrophysical roles as compared to engineering or geology. Combine that with a veteran roster of 30+ year experienced professionals that are at or beyond retirement age, and youve got a potential problem brewing when all of these seasoned petrophysicists decide its time to hang up the cleats.

That said, this year our data showed that the Average Years Experience for petrophysicists that participated in the report was down two whole years, from an average of 20 years to an average of 18 years of industry experience. While the decrease in average years of experience in our participant pool explains the dip in average salary, it certainly begs the question of how this came to pass.

We believe that E&P companies have responded to a clear supply and demand problem by having younger petrophysicists in their organizations and its our contention that theyve done this not by taking a new college grad and making them a petrophysicist (undoubtedly that happens, but we think its limited in number). Instead, our anecdotal experience is that young geologists (2-5 years experience) are being trained to be petrophysicists by their current employer. They are transferring their geological education and experience, which has largely been in developmental geology, and parlayed that background into overseeing the execution of logging programs in the field, and then learning log and core analysis, as well as pore pressure prediction and porosity and saturation modeling.

The net of all of this is great news for the industry, as we are making significant strides to replace a highly technical skill set before that skill set leaves the workforce.

2013 CSI Recruiting 44

CSI Recruiting Domestic U.S. E&P 2013 Salary Report

PETROPHYSICISTS

BASE SALARY OVERALL AVERAGE EXPERIENCE DATA

0-10 Years Experience 11-25 Years Experience 26+ Years Experience $142,670 $185,067 $193,505 $172,006 18 Years

ANNUAL CASH BONUS

24% of base salary

ADDITIONAL COMPENSATION

STOCK

81% participate in a company stock program

18% 28% 26%

REGIONAL DATA

Denver/Rockies Houston Metro Mid-Continent Midland $179,450 $184,625 $165,700 $164,000 19% 21% 30% 30%

97% receive an annual cash bonus

BONUS

VACATION

Average 4.3 weeks

Salary

$200,000 $150,000 $100,000 $50,000 $0

AVERAGE BASE SALARY

Years of Service

0-10 yrs

11-25 yrs

26+ yrs

2013 CSI Recruiting

45

CSI Recruiting Domestic U.S. E&P 2013 Salary Report

About CSI Recruiting CSI Recruiting is a professional recruiting and personnel search firm focused exclusively on the Domestic U.S. Exploration & Production industry since the founding of the company in 2001. Headquartered in Denver, Colorado, CSIs staff of experienced oil & gas recruiters work with candidates and client companies throughout the U.S., finding and placing E&P professionals into Engineering, Geosciences and Land positions located from Alaska to Appalachia. CSI Recruitings division office in Dallas / Fort Worth, opened in 2011, is growing rapidly, adding new clients throughout the DFW market, Houston, Midland and in Oklahoma. CSIs recruiting professionals are consistently involved with the industrys annual conferences and prospect expositions, and have been long-time members and supporters of AAPG, AAPL, SEG, and SPE. CSI is often cited by national publications such as The Wall Street Journal and Oil & Gas Investor in articles pertaining to oil & gas hiring trends and recruiting efforts. CSI Recruiting is supporting the development and execution of this report in response to market demands for a detailed and focused summary of current salaries within the U.S. E&P marketplace. The comments contained herein regarding compensation trends and marketplace demands are the opinion of staffers within CSI Recruiting, based on their years of in-depth work within the domestic E&P industry.

Offices in Denver, Dallas / Fort Worth and Houston 1-888-264-7600 www.csirecruiting.com 2013 CSI Recruiting 46

Das könnte Ihnen auch gefallen

- Innovative Exploration Methods for Minerals, Oil, Gas, and Groundwater for Sustainable DevelopmentVon EverandInnovative Exploration Methods for Minerals, Oil, Gas, and Groundwater for Sustainable DevelopmentA. K. MoitraNoch keine Bewertungen

- Business Credit Institutions Miscellaneous Revenues World Summary: Market Values & Financials by CountryVon EverandBusiness Credit Institutions Miscellaneous Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Politica Co MuterDokument29 SeitenPolitica Co MuterYlver J. Estrada CarmonaNoch keine Bewertungen

- Prysmian Group FY21 PresentationDokument50 SeitenPrysmian Group FY21 PresentationPrysmian GroupNoch keine Bewertungen

- CariminDokument22 SeitenCariminJi HaoNoch keine Bewertungen

- Google HR PoliciesDokument17 SeitenGoogle HR PoliciesPradeepNoch keine Bewertungen

- Organogram: Recomtiiie, NdedDokument23 SeitenOrganogram: Recomtiiie, NdedMd Habib100% (2)

- Shell General Business PrinciplesDokument11 SeitenShell General Business PrinciplesusrjpfptNoch keine Bewertungen

- Tax Treatment For Gross Split Production Sharing Contracts in Indonesian Oil and Gas Sector - SSEK Corporate - Commercial Indonesian Law FirmDokument6 SeitenTax Treatment For Gross Split Production Sharing Contracts in Indonesian Oil and Gas Sector - SSEK Corporate - Commercial Indonesian Law FirmDewa Gede Praharyan JayadiputraNoch keine Bewertungen

- Improving Drilling Performance Through Systematic Analysis of Historical Data Case Study of A Canadian Field - SPE-87177-MSDokument8 SeitenImproving Drilling Performance Through Systematic Analysis of Historical Data Case Study of A Canadian Field - SPE-87177-MSMohabNoch keine Bewertungen

- Hotel InventoryDokument10 SeitenHotel InventoryATA PLANNERSNoch keine Bewertungen

- Global Talent 2021 Executive SummaryDokument21 SeitenGlobal Talent 2021 Executive Summaryalberthdezhdez100% (1)

- Cross Cultural Management Culture Session 2: Yoginder KatariaDokument22 SeitenCross Cultural Management Culture Session 2: Yoginder KatariaAshish SaxenaNoch keine Bewertungen

- MCI Executive SearchDokument6 SeitenMCI Executive SearchdputrowNoch keine Bewertungen

- CHEVRON - Direct Employment Interview Call LetterDokument2 SeitenCHEVRON - Direct Employment Interview Call LetterZaimari FerminNoch keine Bewertungen

- 2016 Kelly Singapore Salary GuideDokument32 Seiten2016 Kelly Singapore Salary GuideBobNoch keine Bewertungen

- Handover FormatDokument2 SeitenHandover Formatshannbaby22Noch keine Bewertungen

- of Incentives Plans ModifiedDokument79 Seitenof Incentives Plans ModifiedSunita VermaNoch keine Bewertungen

- Business Analysis of A Fast Food Restaurant ChainDokument3 SeitenBusiness Analysis of A Fast Food Restaurant ChainrsisinternationalNoch keine Bewertungen

- The Innovation Value Chain QuestionnaireDokument1 SeiteThe Innovation Value Chain QuestionnaireromitguptaNoch keine Bewertungen

- Turnkey Contract IntroDokument3 SeitenTurnkey Contract Introsarathirv6Noch keine Bewertungen

- Empirical Validation of Operations Strategy FrameworkDokument15 SeitenEmpirical Validation of Operations Strategy FrameworkSaayantan RoyNoch keine Bewertungen

- Why Incentive Plans Cannot WorkDokument3 SeitenWhy Incentive Plans Cannot WorkFaribaTabassumNoch keine Bewertungen

- Approaches To International Compensation: There Are Two Main Options in The Area of International CompensationDokument24 SeitenApproaches To International Compensation: There Are Two Main Options in The Area of International CompensationPraveen KumarNoch keine Bewertungen

- Draft Company Profile ASKDokument10 SeitenDraft Company Profile ASKHarly Perdana PutraNoch keine Bewertungen

- Energy TransitionsDokument50 SeitenEnergy Transitionssonja_ŽarićNoch keine Bewertungen

- Chapter-3 Key Indicators: Selected Deals of Mergers & AcquisitionsDokument60 SeitenChapter-3 Key Indicators: Selected Deals of Mergers & Acquisitionsarun_gaurNoch keine Bewertungen

- A Project Report ON Wages and Salary Administration & Morale of The Employee IN ONGC LTDDokument89 SeitenA Project Report ON Wages and Salary Administration & Morale of The Employee IN ONGC LTDImraan KhanNoch keine Bewertungen

- ProposalDokument7 SeitenProposalDylanBudimanNoch keine Bewertungen