Beruflich Dokumente

Kultur Dokumente

Mmo 5 13 PDF

Hochgeladen von

aaronzhangztlOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Mmo 5 13 PDF

Hochgeladen von

aaronzhangztlCopyright:

Verfügbare Formate

&

&

&

&

&

&

&

&

&

&

Source: Standard & Poor's Global Fixed Income Research.

&

&

&

&

&

&

&

&

&

&

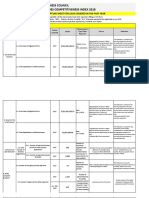

LTM Relative % Performance vs. S&P 500: Consumer Discretionary

LTM Transaction Activities: Consumer Discretionary

125%

120%

115%

110%

S&P 500

105%

LargeCap

100%

MidCap

95%

SmallCap

90%

Deal Type

All M&A

LBO

Strategic M&A

Non-LBO PE

PIPEs

Venture Capital

(M&A only)

Median Deal

Multiples

TEV/EBITDA

Equity/LTM NI

85%

Last Twelve Months Ending April 30th of:

2010

2011

2012

#

$ (mil)

#

$ (mil)

#

$ (mil)

2,092 $156,254

2,399 $ 76,140

2,581 $ 75,815

345

14,771

300

30,476

343

14,324

1,747

141,483

2,099

45,665

2,238

61,491

239 $

222

500

8,752

2,931

2,198

2010

Deal <

Deal >

$500M

$500M

10.2x

12.1x

12.1x

23.0x

382

230

671

9,115

1,694

4,529

2011

Deal < Deal >

$500M $500M

12.8x

8.5x

18.6x

17.6x

370

192

673

5,977

1,247

4,507

2013

#

$ (mil)

2,786 $161,823

369

28,653

2,417

133,171

332

114

644

$ 7,119

989

4,200

2012

2013

Deal <

Deal >

Deal <

Deal >

$500M

$500M

$500M

$500M

10.2x

8.8x

9.9x

8.6x

19.2x

21.3x

17.8x

22.8x

Distribution of Stocks by YTD % Returns and Industry: Consumer Discretionary

2013 YTD Stock Price Performance

Industry

Advertising

Apparel Retail

Apparel, Accessories and Luxury Goods

Auto Parts and Equipment

Automobile Manufacturers

Automotive Retail

Broadcasting

Cable and Satellite

Casinos and Gaming

Catalog Retail

Computer and Electronics Retail

Consumer Electronics

Department Stores

Distributors

Education Services

Footwear

General Merchandise Stores

Home Furnishing Retail

Home Furnishings

Home Improvement Retail

Homebuilding

Hotels, Resorts and Cruise Lines

Household Appliances

Housewares and Specialties

Internet Retail

Leisure Facilities

Leisure Products

Motorcycle Manufacturers

Movies and Entertainment

Publishing

Restaurants

Specialized Consumer Services

Specialty Stores

Textiles

Tires and Rubber

&

<-80%

<-60%

<-40% <-20%

<0

5

4

2

1

1

1

2

2

1

2

2

1

1

1

4

1

1

4

6

1

1

8

2

1

1

3

1

1

3

2

<20%

7

25

12

17

3

9

5

6

9

1

5

5

7

4

3

4

3

2

7

8

3

3

4

4

7

1

8

5

18

9

9

Total ($ mil)

<40%

2

4

4

2

3

3

3

1

1

1

2

3

1

3

1

1

1

5

1

1

3

3

1

4

6

2

15

2

7

<60% <80% 80%+ Count

9

3

37

2

1

23

1

1

23

1

5

1

14

4

4

18

12

2

2

1

17

2

2

2

7

3

8

5

14

1

6

7

2

8

1

5

2

5

17

15

5

7

3

3

21

7

12

1

1

16

1

11

1

1

36

1

14

1

20

1

1

2

MarCap

$35,800

$135,063

$119,464

$100,067

$108,690

$59,970

$95,755

$269,087

$103,574

$14,436

$18,152

$10,574

$55,312

$22,576

$15,175

$66,207

$83,586

$29,619

$17,986

$160,707

$52,741

$92,370

$12,982

$18,327

$201,722

$15,519

$34,830

$12,378

$306,231

$21,037

$251,112

$25,347

$75,409

$390

$4,801

Earnings

$1,425

$7,542

$5,358

$7,529

$10,399

$3,374

$3,920

$18,732

-$553

$1,671

-$644

$748

$1,518

$1,044

-$357

$2,743

$5,161

$1,704

$653

$6,493

$3,683

$3,479

$787

$800

$2,546

$809

$1,792

$676

$15,271

$1,370

$10,993

$1,093

$2,766

$17

$440

P/E

25.1x

17.9x

22.3x

13.3x

10.5x

17.8x

24.4x

14.4x

N/M

8.6x

N/M

14.1x

36.4x

21.6x

N/M

24.1x

16.2x

17.4x

27.5x

24.8x

14.3x

26.6x

16.5x

22.9x

79.2x

19.2x

19.4x

18.3x

20.1x

15.4x

22.8x

23.2x

27.3x

22.4x

10.9x

Notes

LTM relative performance chart is based

on S&P equity indices as of 4/30/13.

Transaction activities data is as of

4/30/13 and include both US and

Canadian targets.

Distribution of stocks by industry includes

only US-exchange traded equities above

$250MM in market cap as of 4/30/13.

Definition of 'Earnings' is aggregate LTM

net income to common excluding extra

items. 'P/E' equals total aggregate

industry market capitalization divided by

LTM net income.

&

LTM Relative % Performance vs. S&P 500: Consumer Staples

LTM Transaction Activities: Consumer Staples

All M&A

LBO

Strategic M&A

Last Twelve Months Ending April 30th of:

2010

2011

2012

#

$ (mil)

#

$ (mil)

#

$ (mil)

378 $ 34,770

456 $34,830

508 $39,087

59

237

70

13,767

62

3,651

319

34,532

386

21,063

446

35,435

2013

#

$ (mil)

520 $57,570

55

31,939

465

25,632

Non-LBO PE

PIPEs

Venture Capital

102

82

121

103

82

212

130%

Deal Type

120%

110%

MidCap

LargeCap

100%

SmallCap

S&P 500

90%

(M&A only)

Median Deal

Multiples

TEV/EBITDA

Equity/LTM NI

80%

3,240

1,226

364

2010

Deal <

Deal >

$500M

$500M

12.7x

11.2x

21.1x

15.3x

135

87

181

$ 2,827

483

526

104

101

165

$ 1,287

1,148

893

$ 1,722

176

917

2011

2012

2013

Deal <

Deal > Deal < Deal > Deal < Deal >

$500M

$500M $500M $500M $500M $500M

6.4x

8.2x

9.3x

8.7x

8.9x

12.8x

15.2x

14.2x

18.4x

17.6x

15.0x

55.7x

Distribution of Stocks by YTD % Returns and Industry: Consumer Staples

2013 YTD Stock Price Performance

Industry

Agricultural Products

Brewers

Distillers and Vintners

Drug Retail

Food Distributors

Food Retail

Household Products

Hypermarkets and Super Centers

Packaged Foods and Meats

Personal Products

Soft Drinks

Tobacco

<-80% <-60% <-40% <-20% < 0

2

2

2

1

1

2

2

1

1

<20% <40% <60% <80% 80%+

4

1

1

2

1

1

1

1

3

1

7

4

1

1

1

8

1

3

27

13

3

4

2

1

7

6

Total ($ mil)

Count

6

2

3

3

6

16

10

3

43

12

8

7

MarCap

$42,151

$11,207

$35,197

$118,612

$24,665

$54,435

$340,964

$309,619

$332,183

$50,975

$378,462

$269,577

Earnings

$2,385

$457

$1,405

$6,229

$1,144

$2,662

$16,957

$19,034

$13,575

$1,904

$17,576

$15,968

P/E

17.7x

24.5x

25.0x

19.0x

21.6x

20.5x

20.1x

16.3x

24.5x

26.8x

21.5x

16.9x

Notes

LTM relative performance chart is based

on S&P equity indices as of 4/30/13.

Transaction activities data is as of

4/30/13 and include both US and

Canadian targets.

Distribution of stocks by industry includes

only US-exchange traded equities above

$250MM in market cap as of 4/30/13.

Definition of 'Earnings' is aggregate LTM

net income to common excluding extra

items. 'P/E' equals total aggregate

industry market capitalization divided by

LTM net income.

&

&

LTM Relative % Performance vs. S&P 500: Energy

LTM Transaction Activities: Energy

125%

120%

115%

110%

105%

S&P 500

100%

LargeCap

95%

MidCap

90%

SmallCap

85%

Deal Type

All M&A

LBO

Strategic M&A

Non-LBO PE

PIPEs

Venture Capital

(M&A only)

Median Deal

Multiples

TEV/EBITDA

Equity/LTM NI

80%

Last Twelve Months Ending April 30th of:

2010

2011

2012

#

$ (mil)

#

$ (mil)

#

$ (mil)

1,031 $152,349

1,150 $142,087

1,071 $197,751

44

3,804

47

3,403

33

20915

987

148,545

1,103

138,685

1,038

176836

84 $

645

110

5,501

6,609

1,472

146 $

660

144

9,741

9,297

4,399

111

459

145

5,767

7,027

7,622

2013

#

$ (mil)

977 $175,812

40

4,655

937

171,157

109

365

140

2013 YTD Stock Price Performance

<20% <40% <60% <80% 80%+ Count

4

3

11

4

2

6

11

18

16

13

1

1

43

42

14

1

96

12

3

2

22

39

22

3

70

Total ($ mil)

MarCap

$27,551

$753,923

$104,518

$301,336

$501,690

$140,401

$473,384

Earnings

-$2,986

$78,822

$5,738

$14,280

$5,181

$16,898

$15,904

P/E

N/M

9.6x

18.2x

21.1x

96.8x

8.3x

29.8x

Notes

LTM relative performance chart is based

on S&P equity indices as of 4/30/13.

Transaction activities data is as of

4/30/13 and include both US and

Canadian targets.

Distribution of stocks by industry includes

only US-exchange traded equities above

$250MM in market cap as of 4/30/13.

Definition of 'Earnings' is aggregate LTM

net income to common excluding extra

items. 'P/E' equals total aggregate

industry market capitalization divided by

LTM net income.

&

6,055

5,136

8,934

2010

2011

2012

2013

Deal <

Deal >

Deal <

Deal >

Deal <

Deal >

Deal <

Deal >

$500M

$500M

$500M

$500M

$500M

$500M

$500M

$500M

7.3x

8.4x

10.3x

14.6x

7.2x

8.7x

5.5x

15.4x

12.3x

26.4x

17.2x

27.0x

10.7x

25.5x

14.3x

35.6x

Distribution of Stocks by YTD % Returns and Industry: Energy

Industry

<-80% <-60% <-40% <-20% < 0

Coal and Consumable Fuels

4

Integrated Oil and Gas

Oil and Gas Drilling

7

Oil and Gas Equipment and Services

12

Oil and Gas Exploration and Production

12

27

Oil and Gas Refining and Marketing

1

4

Oil and Gas Storage and Transportation

6

&

LTM Relative % Performance vs. S&P 500: Financials

LTM Transaction Activities: Financials

125%

120%

115%

110%

S&P 500

105%

LargeCap

100%

MidCap

95%

SmallCap

90%

85%

Deal Type

All M&A

LBO

Strategic M&A

Non-LBO PE

PIPEs

Venture Capital

(M&A only)

Median Deal

Multiples

TEV/EBITDA

Equity/LTM NI

80%

Last Twelve Months Ending April 30th of:

2010

2011

2012

2013

#

$ (mil)

#

$ (mil)

#

$ (mil)

#

$ (mil)

2,833 $109,818 4,054 $188,241 4,985 $242,019 5,989 $ 263,769

202 4,015.02

167 3,879.59

128 4,761.35

167

8,722.53

2,631

105,803 3,887

184,361 4,857

237,258 5,822

255,046

395

259

289

$ 22,804

18,863

3,466

441

242

318

$ 20,907

5,785

5,390

2010

2011

Deal <

Deal > Deal < Deal >

$500M

$500M $500M

$500M

11.6x

12.9x 12.9x

14.4x

14.4x

18.9x 18.1x

18.3x

450

276

375

$ 11,992

9,264

6,809

305

220

271

2012

2013

Deal < Deal > Deal < Deal >

$500M

$500M $500M

$500M

10.9x

12.8x 13.9x

24.4x

15.9x

14.7x 17.6x

22.0x

Distribution of Stocks by YTD % Returns and Industry: Financials

2013 YTD Stock Price Performance

Industry

<-80% <-60% <-40% <-20% < 0

Asset Management and Custody Banks

2

6

Consumer Finance

1

4

Diversified Banks

1

Diversified Capital Markets

Diversified Real Estate Activities

2

Diversified REITs

Industrial REITs

Insurance Brokers

1

2

Investment Banking and Brokerage

3

Life and Health Insurance

1

1

Mortgage REITs

1

Multi-line Insurance

Multi-Sector Holdings

Office REITs

Other Diversified Financial Services

Property and Casualty Insurance

7

Real Estate Development

Real Estate Operating Companies

Real Estate Services

1

Regional Banks

1

41

Reinsurance

Residential REITs

4

Retail REITs

1

Specialized Finance

4

Specialized REITs

2

Thrifts and Mortgage Finance

1

14

&

<20% <40% <60% <80% 80%+

31

14

3

1

8

3

5

1

1

9

8

1

5

2

5

1

13

4

1

9

6

18

6

1

6

4

3

2

15

4

3

29

10

1

3

1

1

1

5

87

10

2

1

9

3

13

1

23

7

7

3

25

13

21

1

2

Total ($ mil)

Count

57

16

6

1

3

18

7

9

21

17

26

10

5

19

3

47

4

2

6

142

12

18

31

14

40

39

MarCap

$294,526

$158,061

$281,685

$758

$3,892

$50,368

$29,071

$60,280

$177,544

$149,263

$65,963

$121,049

$13,960

$73,305

$467,120

$506,590

$5,580

$4,144

$23,570

$296,304

$40,248

$88,300

$170,552

$90,762

$244,016

$52,192

Earnings

$16,143

$12,426

$26,020

$43

$28

$214

-$82

$2,302

$9,709

$10,664

$5,349

$8,643

$881

$734

$34,530

$35,921

$51

-$50

$137

$22,851

$4,838

$822

$1,695

$4,335

$4,591

$1,170

P/E

18.2x

12.7x

10.8x

17.7x

136.6x

235.6x

N/M

26.2x

18.3x

14.0x

12.3x

14.0x

15.8x

99.9x

13.5x

14.1x

108.8x

N/M

171.7x

13.0x

8.3x

107.4x

100.6x

20.9x

53.2x

44.6x

6,933

5,511

4,573

Notes

LTM relative performance chart is based

on S&P equity indices as of 4/30/13.

Transaction activities data is as of

4/30/13 and include both US and

Canadian targets.

Distribution of stocks by industry includes

only US-exchange traded equities above

$250MM in market cap as of 4/30/13.

Definition of 'Earnings' is aggregate LTM

net income to common excluding extra

items. 'P/E' equals total aggregate

industry market capitalization divided by

LTM net income.

&

LTM Relative % Performance vs. S&P 500: Healthcare

LTM Transaction Activities: Healthcare

140%

130%

120%

S&P 500

LargeCap

110%

MidCap

SmallCap

100%

Deal Type

All M&A

LBO

Strategic M&A

Non-LBO PE

PIPEs

Venture Capital

Last Twelve Months Ending April 30th of:

2010

2011

2012

#

$ (mil)

#

$ (mil)

#

$ (mil)

1,113 $ 64,903

1,456 $164,089

1,366 $148,822

73

7,879

125

15,276

93

19,655

1,040

57,024

1,331

148,813

1,273

129,168

543

384

1068

$ 10,252

1,766

7,171

769

402

1,145

7,473

2,383

7,320

760

373

1,087

2013

#

$ (mil)

1,456 $103,958

106

6,177

1,350

97,781

7,241

1,690

6,811

764

344

859

7,775

2,136

6,358

90%

(M&A only)

Median Deal

Multiples

TEV/EBITDA

Equity/LTM NI

80%

2010

2011

2012

2013

Deal <

Deal >

Deal <

Deal >

Deal <

Deal > Deal < Deal >

$500M

$500M

$500M

$500M

$500M

$500M $500M

$500M

10.2x

12.2x

12.1x

14.3x

12.2x

11.1x 10.5x

9.6x

18.1x

33.1x

22.3x

20.7x

16.6x

41.8x 18.5x

24.4x

Distribution of Stocks by YTD % Returns and Industry: Healthcare

2013 YTD Stock Price Performance

Industry

Biotechnology

Health Care Technology

Healthcare Distributors

Healthcare Equipment

Healthcare Facilities

Healthcare Services

Healthcare Supplies

Life Sciences Tools and Services

Managed Healthcare

Pharmaceuticals

<-80% <-60% <-40% <-20% < 0

6

15

1

4

1

3

17

4

8

2

6

1

4

2

2

4

<20% <40% <60% <80% 80%+

30

20

11

6

8

4

2

1

1

6

1

31

7

1

1

7

10

1

10

4

8

2

1

11

4

1

1

1

7

3

20

11

2

3

2

Total ($ mil)

Count

96

13

8

60

22

22

19

23

12

44

MarCap

$438,123

$30,829

$69,565

$376,122

$58,324

$101,618

$28,774

$111,262

$145,289

$959,794

Earnings

$6,963

$590

$4,263

$17,532

$2,874

$3,955

$698

$4,596

$12,938

$43,302

P/E

62.9x

52.2x

16.3x

21.5x

20.3x

25.7x

41.2x

24.2x

11.2x

22.2x

Notes

LTM relative performance chart is based

on S&P equity indices as of 4/30/13.

Transaction activities data is as of

4/30/13 and include both US and

Canadian targets.

Distribution of stocks by industry includes

only US-exchange traded equities above

$250MM in market cap as of 4/30/13.

Definition of 'Earnings' is aggregate LTM

net income to common excluding extra

items. 'P/E' equals total aggregate

industry market capitalization divided by

LTM net income.

&

&

LTM Relative % Performance vs. S&P 500: Industrials

LTM Transaction Activities: Industrials

130%

125%

120%

115%

110%

105%

S&P 500

100%

LargeCap

95%

MidCap

90%

SmallCap

85%

Deal Type

All M&A

LBO

Strategic M&A

Non-LBO PE

PIPEs

Venture Capital

(M&A only)

Median Deal

Multiples

TEV/EBITDA

Equity/LTM NI

80%

Last Twelve Months Ending April 30th of:

2010

2011

2012

2013

#

$ (mil)

#

$ (mil)

#

$ (mil)

#

$ (mil)

1,895 $ 70,486 2,279 $82,900

2,438 $ 87,760

2,599 $ 120,103

180

6,890

231

8,392

237

15,088

268

16,573

1,715

63,597 2,048

74,508

2,201

72,671 2,331

103,531

248

243

376

5,747

2,042

3,824

390

246

410

$ 5,922

1,321

3,035

401

223

425

$ 7,255

2,209

3,351

325 $

172

383

2010

2011

2012

2013

Deal <

Deal >

Deal < Deal > Deal <

Deal > Deal <

Deal >

$500M

$500M

$500M $500M $500M

$500M $500M

$500M

6.1x

7.7x

7.3x

11.6x

8.3x

9.2x

7.5x

9.7x

16.8x

20.0x 15.1x

23.9x

12.0x

19.0x 15.1x

15.4x

Distribution of Stocks by YTD % Returns and Industry: Industrials

2013 YTD Stock Price Performance

Industry

<-80% <-60% <-40% <-20% < 0

Aerospace and Defense

9

Air Freight and Logistics

6

Airlines

1

Airport Services

Building Products

1

5

Commercial Printing

1

2

Construction and Engineering

3

7

Construction and Farm Machinery and Heavy Trucks

12

Diversified Support Services

1

4

Electrical Components and Equipment

1

5

Environmental and Facilities Services

1

3

Heavy Electrical Equipment

2

Human Resource and Employment Services

2

Industrial Conglomerates

Industrial Machinery

11

Marine

1

Marine Ports and Services

Office Services and Supplies

1

4

Railroads

Research and Consulting Services

1

5

Security and Alarm Services

2

Trading Companies and Distributors

6

Trucking

2

&

<20% <40% <60% <80% 80%+

24

6

1

4

1

1

3

4

3

1

1

2

10

4

1

3

1

10

1

1

12

2

1

6

3

1

15

1

1

3

9

2

2

1

7

4

1

4

1

40

4

2

4

5

1

1

7

1

2

3

9

3

1

15

4

10

4

2

1

Total ($ mil)

Count

40

12

12

3

21

7

22

27

15

26

15

5

14

5

57

11

1

13

5

18

3

25

19

MarCap

$425,166

$137,030

$57,388

$8,145

$41,699

$6,841

$54,327

$189,808

$31,508

$143,565

$60,912

$5,095

$22,721

$356,488

$213,482

$12,298

$312

$20,395

$137,740

$52,703

$26,223

$72,358

$46,097

6,269

1,430

2,069

Earnings

$24,355

$3,833

$2,308

$267

$445

-$351

$2,286

$12,189

$1,111

$6,474

$2,302

$282

$1,013

$22,317

$10,673

$417

$20

$1,273

$8,199

$1,703

$165

$3,490

$2,308

P/E

17.5x

35.8x

24.9x

30.6x

93.7x

N/M

23.8x

15.6x

28.4x

22.2x

26.5x

18.1x

22.4x

16.0x

20.0x

29.5x

15.9x

16.0x

16.8x

31.0x

158.9x

20.7x

20.0x

Notes

LTM relative performance chart is based

on S&P equity indices as of 4/30/13.

Transaction activities data is as of

4/30/13 and include both US and

Canadian targets.

Distribution of stocks by industry includes

only US-exchange traded equities above

$250MM in market cap as of 4/30/13.

Definition of 'Earnings' is aggregate LTM

net income to common excluding extra

items. 'P/E' equals total aggregate

industry market capitalization divided by

LTM net income.

&

LTM Relative % Performance vs. S&P 500: Information Technology

LTM Transaction Activities: Information Technology

120%

Deal Type

All M&A

LBO

Strategic M&A

Last Twelve Months Ending April

2010

2011

2012

#

$ (mil)

#

$ (mil)

#

1,897 $ 64,090

2,281 $128,602

2,239 $

128

5,407

155

22,901

149

1,769

58,684

2,126

105,701

2,090

Non-LBO PE

PIPEs

Venture Capital

716

345

2,064

115%

110%

105%

S&P 500

100%

LargeCap

95%

MidCap

90%

SmallCap

85%

(M&A only)

Median Deal

Multiples

TEV/EBITDA

Equity/LTM NI

80%

5,668

1,349

9,174

966

446

2,615

$ 14,338

1,690

11,976

942

366

3,038

30th of:

$ (mil)

92,335

10,617

81,718

$ 12,915

1,803

12,471

2013

#

2,272 $

146

2,126

980

297

2,813

2013 YTD Stock Price Performance

&

<20% <40% <60% <80% 80%+ Count MarCap

28

9

3

62

$202,477

16

4

1

39

$301,586

3

4

11

$511,690

6

5

1

14

$112,619

25

5

1

39

$344,591

6

2

1

14

$48,594

11

2

19

$22,309

7

1

1

1

21

$50,302

2

6

1

10

$34,148

26

12

5

3

2

78

$630,463

13

5

22

$335,865

2

2

$13,102

11

3

1

24

$55,214

25

5

3

1

2

69

$354,623

11

3

2

26

$561,758

4

2

11

$19,311

$ 10,063

1,757

10,698

2010

2011

2012

2013

Deal <

Deal >

Deal < Deal > Deal <

Deal >

Deal <

Deal >

$500M

$500M

$500M

$500M

$500M

$500M

$500M

$500M

8.1x

19.8x

12.6x

13.4x

10.7x

33.8x

10.9x

13.7x

15.2x

34.7x

19.5x

41.2x

11.4x

43.0x

20.5x

31.9x

Distribution of Stocks by YTD % Returns and Industry: Information Technology

Industry

<-80% <-60% <-40% <-20% < 0

Application Software

2

20

Communications Equipment

5

13

Computer Hardware

4

Computer Storage and Peripherals

1

1

Data Processing and Outsourced Services

1

7

Electronic Components

1

4

Electronic Equipment and Instruments

6

Electronic Manufacturing Services

1

2

8

Home Entertainment Software

1

Internet Software and Services

1

5

24

IT Consulting and Other Services

1

3

Office Electronics

Semiconductor Equipment

9

Semiconductors

6

27

Systems Software

3

7

Technology Distributors

5

$ (mil)

95,403

36,068

59,335

Total ($ mil)

Earnings

$3,832

$18,101

$29,520

$8,384

$12,958

$2,719

$658

$2,852

$1,536

$23,060

$23,006

$1,313

$1,182

$14,652

$31,147

$1,855

P/E

52.8x

16.7x

17.3x

13.4x

26.6x

17.9x

33.9x

17.6x

22.2x

27.3x

14.6x

10.0x

46.7x

24.2x

18.0x

10.4x

Notes

LTM relative performance chart is based

on S&P equity indices as of 4/30/13.

Transaction activities data is as of

4/30/13 and include both US and

Canadian targets.

Distribution of stocks by industry includes

only US-exchange traded equities above

$250MM in market cap as of 4/30/13.

Definition of 'Earnings' is aggregate LTM

net income to common excluding extra

items. 'P/E' equals total aggregate

industry market capitalization divided by

LTM net income.

&

LTM Relative % Performance vs. S&P 500: Materials

LTM Transaction Activities: Materials

Deal Type

All M&A

LBO

Strategic M&A

Last Twelve Months Ending April 30th of:

2010

2011

2012

#

$ (mil)

#

$ (mil)

#

$ (mil)

1,178 $ 33,533

1,326 $ 70,126

1,236 $ 54,889

70

4,027

97

3,435

86

2,511

1,108

29,506

1,229

66,690

1,150

52,378

2013

#

1,113 $

105

1,008

$ (mil)

58,848

13,488

45,360

Non-LBO PE

PIPEs

Venture Capital

142

2,030

152

146 $

1,426

100

2,216

3,703

544

130%

120%

S&P 500

110%

LargeCap

MidCap

100%

SmallCap

90%

(M&A only)

Median Deal

Multiples

TEV/EBITDA

Equity/LTM NI

80%

4,436

9,303

770

167 $

2,085

197

2,867

9,346

2552

158 $

1,470

156

4,320

6,313

1169

2010

2011

2012

2013

Deal <

Deal >

Deal <

Deal >

Deal <

Deal >

Deal <

Deal >

$500M

$500M

$500M

$500M

$500M

$500M

$500M

$500M

11.0x

11.7x

6.2x

13.9x

9.4x

9.4x

7.2x

13.1x

12.1x

24.9x

15.9x

16.8x

14.7x

17.3x

15.1x

21.3x

Distribution of Stocks by YTD % Returns and Industry: Materials

2013 YTD Stock Price Performance

Industry

Aluminum

Commodity Chemicals

Construction Materials

Diversified Chemicals

Diversified Metals and Mining

Fertilizers and Agricultural Chemicals

Forest Products

Gold

Industrial Gases

Metal and Glass Containers

Paper Packaging

Paper Products

Precious Metals and Minerals

Specialty Chemicals

Steel

&

<-80% <-60% <-40% <-20% < 0

1

3

5

2

2

2

6

6

2

1

1

5

1

2

1

3

1

9

8

<20% <40% <60% <80% 80%+ Count

4

4

2

11

4

1

1

8

6

8

4

1

13

4

10

1

1

4

8

3

3

5

2

9

4

2

1

8

5

3

11

4

19

5

2

2

37

5

18

Total ($ mil)

MarCap

$11,519

$57,515

$32,137

$138,415

$70,206

$119,717

$4,971

$55,501

$59,582

$29,971

$33,591

$31,669

$4,624

$137,031

$49,439

Earnings

$347

$5,510

-$1,030

$5,974

$3,461

$7,691

$243

$4,247

$3,065

$1,573

-$121

$1,362

$60

$4,608

-$1,921

P/E

33.2x

10.4x

N/M

23.2x

20.3x

15.6x

20.5x

13.1x

19.4x

19.1x

N/M

23.2x

76.9x

29.7x

N/M

Notes

LTM relative performance chart is based

on S&P equity indices as of 4/30/13.

Transaction activities data is as of 4/30/13

and include both US and Canadian

targets.

Distribution of stocks by industry includes

only US-exchange traded equities above

$250MM in market cap as of 4/30/13.

Definition of 'Earnings' is aggregate LTM

net income to common excluding extra

items. 'P/E' equals total aggregate

industry market capitalization divided by

LTM net income.

&

LTM Relative % Performance vs. S&P 500: Telecommunication Services

LTM Transaction Activities: Telecommunication Services

130%

125%

120%

115%

S&P 500

110%

LargeCap

105%

MidCap

100%

SmallCap

95%

90%

85%

Deal Type

All M&A

LBO

Strategic M&A

Non-LBO PE

PIPEs

Venture Capital

(M&A only)

Median Deal

Multiples

TEV/EBITDA

Equity/LTM NI

80%

Last Twelve Months Ending April 30th of:

2010

2011

2012

#

$ (mil)

#

$ (mil)

#

$ (mil)

118 $42,690

132 $ 13,555

102 $13,546

6

1,534

10

3,359

3

1,000

112

41,156

122

10,196

99

12,546

28 $

398

30

1,811

33

285

29

41

24

612

132

1,807

38 $

22

24

659

452

599

2013

#

$ (mil)

115 $ 124,337

7

1,535

108

122,802

19

14

27

2013 YTD Stock Price Performance

<20% <40% <60% <80%

3

2

2

3

2

2

9

3

Total ($ mil)

80%+

Count

10

12

14

MarCap

$13,609

$385,927

$105,088

Earnings

-$22

$10,027

-$2,502

P/E

N/M

38.5x

N/M

Notes

LTM relative performance chart is based

on S&P equity indices as of 4/30/13.

Transaction activities data is as of

4/30/13 and include both US and

Canadian targets.

Distribution of stocks by industry includes

only US-exchange traded equities above

$250MM in market cap as of 4/30/13.

Definition of 'Earnings' is aggregate LTM

net income to common excluding extra

items. 'P/E' equals total aggregate

industry market capitalization divided by

LTM net income.

&

382

8,085

167

2010

2011

2012

2013

Deal <

Deal > Deal <

Deal >

Deal < Deal > Deal <

Deal >

$500M

$500M $500M

$500M

$500M $500M $500M

$500M

4.6x

5.6x

5.9x

10.2x

9.0x

8.7x

10.9x

28.5x

44.9x

16.1x

35.8x

6.5x

29.7x

21.4x

Distribution of Stocks by YTD % Returns and Industry: Telecommunication Services

Industry

<-80% <-60% <-40% <-20% < 0

Alternative Carriers

3

Integrated Telecommunication Services

1

4

Wireless Telecommunication Services

2

&

LTM Relative % Performance vs. S&P 500: Utilities

LTM Transaction Activities: Utilities

130%

125%

120%

115%

S&P 500

110%

LargeCap

105%

MidCap

100%

SmallCap

95%

90%

Deal Type

All M&A

LBO

Strategic M&A

Non-LBO PE

PIPEs

Venture Capital

(M&A only)

Median Deal

Multiples

TEV/EBITDA

Equity/LTM NI

85%

Last Twelve Months Ending April 30th of:

2010

2011

2012

#

$ (mil)

#

$ (mil)

#

$ (mil)

211 $35,552

253 $76,673

237 $ 31,759

10

1,024

17

1550

13

878

201

34,528

236

75,123

224

30,881

46

47

72

$ 5,256

2,028

643

58

60

72

$ 4,988

507

1224

65 $

45

72

8,681

297

2,160

2013

#

$ (mil)

230 $ 18,407

14

1,551

216

16,856

60 $

28

46

2010

2011

2012

2013

Deal <

Deal > Deal < Deal > Deal <

Deal >

Deal <

Deal >

$500M

$500M $500M $500M $500M

$500M

$500M

$500M

18.0x

10.8x

9.8x

8.7x

6.8x

10.4x

28.0x

8.5x

124.2x

10.5x

12.5x

17.5x

16.1x

24.1x

22.5x

Distribution of Stocks by YTD % Returns and Industry: Utilities

2013 YTD Stock Price Performance

Industry

<-80% <-60% <-40% <-20% < 0

Electric Utilities

Gas Utilities

1

Independent Power Producers and Energy Traders

Multi-Utilities

1

Water Utilities

3

Total ($ mil)

<20% <40% <60% <80% 80%+ Count MarCap Earnings

27

5

32

$342,945 $17,161

11

6

18

$55,813

$2,539

2

3

5

$32,253

-$33

14

6

21

$205,651 $7,649

3

1

7

$14,973

$725

P/E

20.0x

22.0x

N/M

26.9x

20.7x

Notes

LTM relative performance chart is based

on S&P equity indices as of 4/30/13.

Transaction activities data is as of

4/30/13 and include both US and

Canadian targets.

Distribution of stocks by industry includes

only US-exchange traded equities above

$250MM in market cap as of 4/30/13.

Definition of 'Earnings' is aggregate LTM

net income to common excluding extra

items. 'P/E' equals total aggregate

industry market capitalization divided by

LTM net income.

&

5,693

237

808

&

&

&

&

&

&

&

&

&

&

&

&

&

&

&

&

&

&

&

&

&

&

&

&

&

&

&

&

&

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- 1Dokument6 Seiten1sufyanbutt0070% (1)

- SoftwareDokument38 SeitenSoftwareRaven R. LabiosNoch keine Bewertungen

- Stock Market ReportDokument43 SeitenStock Market ReportPatelDMNoch keine Bewertungen

- Test and Exam Qs Topic 2 - Solutions - v2 PDFDokument20 SeitenTest and Exam Qs Topic 2 - Solutions - v2 PDFCindy YinNoch keine Bewertungen

- Capsim Final-Stockholders DebriefDokument27 SeitenCapsim Final-Stockholders DebriefShama RoshanNoch keine Bewertungen

- Royal AholdDokument27 SeitenRoyal AholdSanzida Begum100% (2)

- Financials Infosys Last 5 Years Annual Revenue History and Growth RateDokument7 SeitenFinancials Infosys Last 5 Years Annual Revenue History and Growth RateDivyavadan MateNoch keine Bewertungen

- Little Champs PMS: An Investment Strategy For Indian Small Caps From Marcellus Investment ManagersDokument18 SeitenLittle Champs PMS: An Investment Strategy For Indian Small Caps From Marcellus Investment Managerssubham mohantyNoch keine Bewertungen

- FMEP Interactive Handbook GoldDokument5 SeitenFMEP Interactive Handbook GoldNavi Fis0% (1)

- Edwards Lifesciences Corp (EW) : Financial and Strategic SWOT Analysis ReviewDokument36 SeitenEdwards Lifesciences Corp (EW) : Financial and Strategic SWOT Analysis ReviewHITESH MAKHIJANoch keine Bewertungen

- 1 1+Basic+Methodology+for+KRX+Indices (2011)Dokument8 Seiten1 1+Basic+Methodology+for+KRX+Indices (2011)Edwin ChanNoch keine Bewertungen

- Annual Report Emea PLC PDFDokument550 SeitenAnnual Report Emea PLC PDFNikhil ChaudharyNoch keine Bewertungen

- The Effect of Round Number Bias in U.S. and Chinese Stock MarketsDokument38 SeitenThe Effect of Round Number Bias in U.S. and Chinese Stock MarketsEric GuoNoch keine Bewertungen

- Constitution of InvestingDokument46 SeitenConstitution of InvestingAmartya RoyNoch keine Bewertungen

- Equity ValuationDokument18 SeitenEquity ValuationNaddieNoch keine Bewertungen

- Fundamental Equity Analysis - QMS Advisors HDAX FlexIndex 110 PDFDokument227 SeitenFundamental Equity Analysis - QMS Advisors HDAX FlexIndex 110 PDFQ.M.S Advisors LLCNoch keine Bewertungen

- CS Investing NotesDokument3 SeitenCS Investing NotesGerald TomNoch keine Bewertungen

- Mid Cap and Small CapDokument131 SeitenMid Cap and Small CapJeffin George100% (3)

- Douglas KinghornDokument24 SeitenDouglas KinghornAnonymous 3DG7N5Noch keine Bewertungen

- Lecture 10: Developing A Brand Equity Measurement & Management SystemDokument16 SeitenLecture 10: Developing A Brand Equity Measurement & Management SystemAabhash ShahiNoch keine Bewertungen

- Kaushal Final Project at KARVY STOK BROKING LTD (1) .Dokument128 SeitenKaushal Final Project at KARVY STOK BROKING LTD (1) .krimybNoch keine Bewertungen

- (Aman Pathak) RESEARCH METHODOLOGYDokument4 Seiten(Aman Pathak) RESEARCH METHODOLOGYAman PathakNoch keine Bewertungen

- Impact of Liquidity On Market Capitalization EdelwiseDokument39 SeitenImpact of Liquidity On Market Capitalization Edelwisekharemix0% (2)

- Market Capitalization Versus Market ValueDokument3 SeitenMarket Capitalization Versus Market ValueIdrisNoch keine Bewertungen

- The Structure of The Egyptian Securities MarketDokument10 SeitenThe Structure of The Egyptian Securities MarketZakaria HegazyNoch keine Bewertungen

- National Competitiveness Council Cities and Municipalities Competitiveness Index 2018Dokument21 SeitenNational Competitiveness Council Cities and Municipalities Competitiveness Index 2018Chen C AbreaNoch keine Bewertungen

- Strategy Paper: Enhancing Kse-100 Index To Free Float MethodologyDokument24 SeitenStrategy Paper: Enhancing Kse-100 Index To Free Float MethodologysakiaslamNoch keine Bewertungen

- How To Invest in Stocks For Beginners (FREE CourDokument38 SeitenHow To Invest in Stocks For Beginners (FREE CourThar LayNoch keine Bewertungen

- Religare ProjectDokument109 SeitenReligare Projectjagrutisolanki01Noch keine Bewertungen

- Summer Intern ReportDokument32 SeitenSummer Intern ReportPradeep DashoraNoch keine Bewertungen