Beruflich Dokumente

Kultur Dokumente

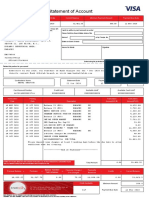

Minimum Payment Due: $62.00 New Balance: $4,144.92 Payment Due Date: 11/02/13

Hochgeladen von

nates280Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Minimum Payment Due: $62.00 New Balance: $4,144.92 Payment Due Date: 11/02/13

Hochgeladen von

nates280Copyright:

Verfügbare Formate

EVAN NATELSON Member Since 2012 Account number ending in: 5707 Billing Period: 09/07/13-10/07/13

How to reach us www.citicards.com 1-866-696-5673 BOX 6500 SIOUX FALLS, SD 57117

Minimum payment due: New balance: Payment due date:

$62.00 $4,144.92 11/02/13

Account Summary

Previous balance Payments Credits Purchases Cash advances Fees Interest New balance $5,244.92 -$1,100.00 -$0.00 +$0.00 +$0.00 +$0.00 +$0.00 $4,144.92

Make a payment now! www.payonline.citicards.com

Minimum Payment Warning: If you make only the minimum payment each period, you will pay more in interest and it will take you longer to pay off your balance. For example:

If you make no additional charges using this card and each month you pay... Only the minimum payment $137 You will pay off the balance shown on the statement in about... 18 year(s) 3 year(s) And you will end up paying an estimated total of... $7,181 $4,955 (Savings = $2,226)

Credit Limit

Credit limit

Includes $1,900 cash advance limit

$6,300 $2,155

Available credit

Includes $1,900 available for cash advances

For information about credit counseling services, call 1-877-337-8187. New York residents may contact the New York State Banking Department to obtain a comparative listing of credit card rates, fees and grace periods by calling 1-877-226-5697.

Point Balance As of 10/01/2013

1,076

See page 2 for more information about your rewards.

Pay online www.citicards.com Pay by phone 1-866-696-5673 Pay by mail Use this coupon

Enclose a valid check or money order payable

to CITI CARDS. No cash or foreign currency.

Minimum payment due New balance Payment due date Amount enclosed: $

Account number ending in 5707

$62.00 $4,144.92 11/02/13

Write the last four digits of your

account number on your check.

EVAN NATELSON 10 HILLCREST ROAD PORT WASHINGTON NY 11050-3011

CITI CARDS PO Box 183113 Columbus OH 43218-3113

EVAN NATELSON

www.citicards.com 1-866-696-5673

Page 2 of 2

Account Summary

Trans. date Post date Description Amount

Payments, Credits and Adjustments 09/14 10/01 ONLINE PAYMENT, THANK YOU ONLINE PAYMENT, THANK YOU -$600.00 -$500.00

Points transferred to your Citi Easy Deals SM Account:

Citi Easy Deals Member ID:

Fees charged

Total fees charged in this billing period $0.00

8648-20833099 0 0 0 75

Interest charged

Total interest charged in this billing period $0.00

Earned this period Adjusted this period Total Earned this period Total Earned year to date

$179.19 $0.00 Days in billing cycle: 31

2013 totals year-to-date

Total fees charged in 2013 Total interest charged in 2013

Visit citieasydeals.com to redeem pointsor for complete program details. No Citi Easy Deals Points were transferred this month to your Citi Easy Deals account. This may be because you made no eligible purchases or because a credit/adjustment/dispute exceeded the amount of eligible purchases.

Interest charge calculation

Your Annual Percentage Rate (APR) is the annual interest rate on your account.

Balance type PURCHASES Standard Purch Offer 4 ADVANCES Standard Adv

Annual percentage Balance subject rate (APR) to interest rate 0.00% 0.00% 11.99% (V) $60.88 (D) $4,606.62 (D) $0.00 (D)

Interest charge $0.00 $0.00 $0.00

Your Annual Percentage Rate (APR) is the annual interest rate on your account. APRs followed by (V) vary with the market based on the Prime Rate. Balances followed by (D) are determined by the daily balance method (including current transactions).

Account messages

You may pay all or part of your account balance at any time. However, you must pay, by the payment due date, at least the minimum payment due. For customers who qualify for benefits for the same transaction under Citi Price Rewind, Internet Price Protection and Price Protection coverages, or any combination of those coverages, the Company will only pay under the coverage providing the highest benefit and no benefits will be due under the other coverages. Please be sure to pay on time. If you submit your payment by mail, we suggest you mail it no later than 10/26/2013 to allow for enough time for regular mail to reach us.

About Interest Charges

How We Calculate Interest. We calculate it separately for each balance shown in the Interest Charge Calculation table. We use the daily balance method (including current transactions) if the Balance Subject to Interest Rate is followed by (D). We figure the interest charge by multiplying the daily balance by its daily periodic rate each day in the billing period. To get a daily balance, we take the balance at the end of the previous day, add the interest on the previous days balance and new charges, subtract new credits or payments, and make adjustments. The Balance Subject to Interest Rate is the average of the daily balances. We use the average daily balance method (including current transactions) if the Balance Subject to Interest Rate is followed by (A). To get an average daily balance, we take the balance at the end of the previous day, add new charges, subtract new credits or payments, and make adjustments. We add all the daily balances and divide by the number of days in the billing period. We figure the interest charge by multiplying the average daily balance by the monthly periodic rate, or by the daily periodic rate and by the number of days in the billing period, as applicable. Minimum Interest Charge. If we charge interest, it will be at least $0.50. How to Avoid Paying Interest on Purchases. Your due date is at least 23 days after the close of each billing period. We will not charge you any interest on purchases if you pay your New Balance by the due date each month. This is called a grace period on purchases. If you do not pay the New Balance in full by the due date, you will not get a grace period on purchases until you pay the New Balance in full for two billing periods in a row. We will begin charging interest on cash advances and balance transfers on the transaction date.

Your Rights if You Are Dissatisfied With Your Credit Card Purchases. If you are dissatisfied with the goods or services that you have purchased with your credit card, and you have tried in good faith to correct the problem with the merchant, you may have the right not to pay the remaining amount due on the purchase. To use this right, all of the following must be true: 1. The purchase must have been made in your home state or within 100 miles of your current mailing address, and the purchase price must have been more than $50. (Note: Neither of these is necessary if your purchase was based on an advertisement we mailed to you, or if we own the company that sold you the goods or services.) 2. You must have used your credit card for the purchase. Purchases made with cash advances from an ATM or with a check that accesses your credit card account do not qualify. 3. You must not yet have fully paid for the purchase. If all of the criteria above are met and you are still dissatisfied with the purchase, contact us online or in writing at the Customer Service address shown on front of statement. While we investigate, the same rules apply to the disputed amount as discussed above. After we finish our investigation, we will tell you our decision. At that point, if we think you owe an amount and you do not pay, we may report you as delinquent. Notification of Disputed Item You can file a billing dispute or check the status of an existing dispute online at the url above. You can also check the status of an existing billing dispute by contacting the customer service number on the top of this page.

Your Rights

What To Do If You Find A Mistake On Your Statement. If you think there is an error on your statement, visit us online at the url above or write to the Customer Service address shown on the front. In your letter, give us the following information: Account information: Your name and account number. Dollar amount: The dollar amount of the suspected error. Description of problem: If you think there is an error on your bill, describe what you believe is wrong and why you believe it is a mistake. You must contact us within 60 days after the error appeared on your statement. You must notify us of any potential errors in writing. You may call us, but if you do we are not required to investigate any potential errors and you may have to pay the amount in question. While we investigate whether or not there has been an error, the following are true: We cannot try to collect the amount in question, or report you as delinquent on that amount. The charge in question may remain on your statement, and we may continue to charge you interest on that amount. But, if we determine that we made a mistake, you will not have to pay the amount in question or any interest or other fees related to that amount. While you do not have to pay the amount in question, you are responsible for the remainder of your balance. We can apply any unpaid amount against your credit limit.

Other Account and Payment Information

When Your Payment Will Be Credited. If we receive your payment in proper form at our processing facility by 5 p.m. local time there, it will be credited as of that day. A payment received there in proper form after that time will be credited as of the next day. Allow 5 to 7 days for payments by regular mail to reach us. There may be a delay of up to 5 days in crediting a payment we receive that is not in proper form or not sent to the correct address. The correct address for regular mail is the address on the front of the payment coupon. The correct address for courier or express mail is the Express Payments Address shown below. Proper Form. For a payment sent by mail or courier to be in proper form, you must: Enclose a valid check or money order. No cash or foreign currency please. Include your name and the last four digits of your account number. How to Report a Lost or Stolen Card. Call the Customer Service number at the top of the page. Balance Transfers. Balance Transfer amounts are included in the Purchases line in the Account Summary. Membership Fee. Some accounts are charged a membership fee. To avoid paying this fee, notify us that you are closing your account within 30 days of the mailing or delivery date of the statement on which the fee is billed. Credit Reporting Disputes. We may report information about your account to credit bureaus. If you think weve reported inaccurate information, please write to us at the Customer Service address on your statement. Payment Amount You may pay all or part of your account balance at any time. However, you must pay, by the payment due date, at least the minimum payment due.

PDF-C0713

2013 Citibank, N.A. Citi, Citi with Arc Design are registered service marks of Citigroup Inc.

Payments other than by mail

Online. Go to the URL on the front of your statement to make a payment. When you enroll in Online Bill Pay you can schedule your payments up to ninety days in advance using the Other payment option. For security reasons, you may not be able to pay your entire new balance the first time you make a payment online. Phone. Call the phone number on the front of your statement to make a payment. There is no fee for this service. AutoPay. Visit autopay.citicards.com to enroll in AutoPay and have your payment amount automatically deducted each month on your due date from the payment account you choose. Express mail. Send payment by express mail to: Citi Cards Attention: Payments Department 1500 Boltonfield Street Columbus, OH 43228 Crediting Payments other than by Mail. The payment cutoff time for Online Bill Payments, Phone Payments, and Express mail payments is midnight Eastern time. This means that we will credit your account as of the calendar day, based on Eastern time, that we receive your payment request. If you send an eligible check with this payment coupon, you authorize us to complete your payment by electronic debit. If we do, the checking account will be debited in the amount on the check. We may do this as soon as the day we receive the check. Also, the check will be destroyed.

Das könnte Ihnen auch gefallen

- New Balance CR$800.00 Minimum Payment Due $0.00 Payment Not RequiredDokument6 SeitenNew Balance CR$800.00 Minimum Payment Due $0.00 Payment Not RequiredKevin Diaz100% (1)

- Minimum Payment Due: $25.00 New Balance: $412.44 Payment Due Date: 03/20/15Dokument4 SeitenMinimum Payment Due: $25.00 New Balance: $412.44 Payment Due Date: 03/20/15MaathiaasElopoldiel100% (1)

- 2014sep11 2014oct10Dokument3 Seiten2014sep11 2014oct10Karen JoyNoch keine Bewertungen

- 01-19-2016 PDFDokument4 Seiten01-19-2016 PDFAnonymous 1AcflUxYCNoch keine Bewertungen

- Payment Information Summary of Account ActivityDokument3 SeitenPayment Information Summary of Account ActivityTyrone J PalmerNoch keine Bewertungen

- Card Statement 2013 7Dokument2 SeitenCard Statement 2013 72005monicaNoch keine Bewertungen

- March Statement Minimum Payment Due: $25.00 New Balance As of 03/11/21: $94.56 Payment Due Date: 04/09/21Dokument3 SeitenMarch Statement Minimum Payment Due: $25.00 New Balance As of 03/11/21: $94.56 Payment Due Date: 04/09/21RajaNoch keine Bewertungen

- My Statements ControlDokument4 SeitenMy Statements Controlleinad423100% (1)

- January 09, 2018Dokument6 SeitenJanuary 09, 2018Monina JonesNoch keine Bewertungen

- Savings Summary: We'Re Updating Our AtmsDokument2 SeitenSavings Summary: We'Re Updating Our AtmsJP Ramos DatinguinooNoch keine Bewertungen

- December 2012 Statement PDFDokument4 SeitenDecember 2012 Statement PDFDeborahDaniels1Noch keine Bewertungen

- Griffin p2Dokument4 SeitenGriffin p2bootybethathangNoch keine Bewertungen

- 09-28-2018 PDFDokument12 Seiten09-28-2018 PDFAnonymous haqBJBY100% (2)

- Account Summary Payment Information: New Balance $135.86Dokument6 SeitenAccount Summary Payment Information: New Balance $135.86chloeNoch keine Bewertungen

- Statement Jan 2010Dokument8 SeitenStatement Jan 2010Bryan HowardNoch keine Bewertungen

- Account Summary Payment Information: New Balance - $78.87Dokument6 SeitenAccount Summary Payment Information: New Balance - $78.87AriadnaUrsachi100% (1)

- American Express - BS 2019Dokument1 SeiteAmerican Express - BS 2019Max PatelNoch keine Bewertungen

- Account Summary Payment InformationDokument3 SeitenAccount Summary Payment InformationJohn Bean100% (1)

- StatementDokument4 SeitenStatementjoan manuel100% (1)

- Statements 0201Dokument4 SeitenStatements 0201Lena VvarNoch keine Bewertungen

- 01-13-2017 PDFDokument3 Seiten01-13-2017 PDFAnonymous xxpU7OaNoch keine Bewertungen

- CreditCard Statement 04-02-2020T22 02 46Dokument1 SeiteCreditCard Statement 04-02-2020T22 02 46Sheikh Shoaib67% (3)

- Statement May 2018Dokument5 SeitenStatement May 2018tpsroxNoch keine Bewertungen

- November 21Dokument5 SeitenNovember 21Robert DupuisNoch keine Bewertungen

- Best Buy Citibank StatementDokument8 SeitenBest Buy Citibank Statementadrian mayoNoch keine Bewertungen

- Statements 4743Dokument4 SeitenStatements 4743Marcus GreenNoch keine Bewertungen

- AchDokument2 SeitenAchValdi PokerNoch keine Bewertungen

- 22 January Statement HuntingtonDokument1 Seite22 January Statement HuntingtonbonitaNoch keine Bewertungen

- Bmo 8.1.13 PDFDokument7 SeitenBmo 8.1.13 PDFChad Thayer VNoch keine Bewertungen

- Checking Summary: 000000968891432 Customer Service InformationDokument2 SeitenChecking Summary: 000000968891432 Customer Service Informationahmed4_chatNoch keine Bewertungen

- Chase Bank Statement BankStatements - Net SepDokument4 SeitenChase Bank Statement BankStatements - Net SepJoe SFNoch keine Bewertungen

- YearEndSummary PDFDokument10 SeitenYearEndSummary PDFAnonymous Pq2iqJk2bNoch keine Bewertungen

- New Balance $925.16 Minimum Payment Due $40.00 Payment Due Date 05/03/21Dokument5 SeitenNew Balance $925.16 Minimum Payment Due $40.00 Payment Due Date 05/03/21DONALD INGENoch keine Bewertungen

- Jul 15 - Aug 14 PDFDokument5 SeitenJul 15 - Aug 14 PDFpat orantezNoch keine Bewertungen

- Sen. John Kerry's Statement To The U.S. Senate Foreign Relations Committee On His Nomination As Secretary of State.Dokument9 SeitenSen. John Kerry's Statement To The U.S. Senate Foreign Relations Committee On His Nomination As Secretary of State.Southern California Public RadioNoch keine Bewertungen

- Statement Feb 2018Dokument6 SeitenStatement Feb 2018MicahNoch keine Bewertungen

- Credit Card BOA DuyDokument4 SeitenCredit Card BOA Duynghia leNoch keine Bewertungen

- November 2019Dokument4 SeitenNovember 2019Astrid MeloNoch keine Bewertungen

- Statement - Oct 2019 3 PDFDokument17 SeitenStatement - Oct 2019 3 PDFHarry Winters100% (1)

- Statement Jan, 2021Dokument4 SeitenStatement Jan, 2021Marco Antonio Martinez Estrada0% (2)

- Costco Anywhere Visa Card by CitiDokument4 SeitenCostco Anywhere Visa Card by CitiOsvaldo CalderonUACJNoch keine Bewertungen

- Bill - 2014 01 01Dokument4 SeitenBill - 2014 01 01Nor Hidayah0% (1)

- March BOA Statement 2 PDF 2Dokument6 SeitenMarch BOA Statement 2 PDF 2mdyafi8084Noch keine Bewertungen

- Dec 21Dokument2 SeitenDec 21girichote100% (1)

- Debit 2021 2 StatementDokument1 SeiteDebit 2021 2 StatementJames DunbarNoch keine Bewertungen

- Statement Chase PDFDokument4 SeitenStatement Chase PDFN N100% (1)

- 05-26-2016Dokument6 Seiten05-26-2016Mike CarraggiNoch keine Bewertungen

- 7-2019 AmexDokument5 Seiten7-2019 Amexal_crespoNoch keine Bewertungen

- Statement September 2019Dokument6 SeitenStatement September 2019Mike Schmoronoff100% (1)

- Document5 AMEX Dec 2013Dokument14 SeitenDocument5 AMEX Dec 2013Daniel TaylorNoch keine Bewertungen

- CreditCardStatement2801868 - 2085 - 27-Oct-20Dokument1 SeiteCreditCardStatement2801868 - 2085 - 27-Oct-20Abdul AleemNoch keine Bewertungen

- StatementDokument3 SeitenStatementStephen SnowdenNoch keine Bewertungen

- Rewards Summary: Online BankingDokument1 SeiteRewards Summary: Online Bankingcarol0garber-99560Noch keine Bewertungen

- Account Summary Payment Information: New Balance $2,102.08 Minimum Payment Due $86.42 Payment Due Date March 6, 2021Dokument2 SeitenAccount Summary Payment Information: New Balance $2,102.08 Minimum Payment Due $86.42 Payment Due Date March 6, 2021franklin reid rosarioNoch keine Bewertungen

- Chase Bank Account Statement 2021Dokument3 SeitenChase Bank Account Statement 2021quannbui950% (1)

- 1 This First Bank: Sample Account Statement and BalancingDokument2 Seiten1 This First Bank: Sample Account Statement and BalancingQuenie De la CruzNoch keine Bewertungen

- Account Summary Payment Information: New Balance $135.86Dokument6 SeitenAccount Summary Payment Information: New Balance $135.86thinh thanhNoch keine Bewertungen

- PDFDokument6 SeitenPDFTimothy MeadNoch keine Bewertungen

- Statement - Jun 2017 PDFDokument19 SeitenStatement - Jun 2017 PDFAnonymous Tu4oOPknNoch keine Bewertungen

- Methods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeVon EverandMethods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeNoch keine Bewertungen

- Heart Health:: Combating StressDokument62 SeitenHeart Health:: Combating Stressnates280Noch keine Bewertungen

- Hadland Davis - The Persian Mystics Jalaluddin RumiDokument87 SeitenHadland Davis - The Persian Mystics Jalaluddin Ruminates280Noch keine Bewertungen

- Report 1424983820428Dokument14 SeitenReport 1424983820428nates280Noch keine Bewertungen

- Rebates Salesforce IntegrationDokument1 SeiteRebates Salesforce Integrationnates280Noch keine Bewertungen

- Seeing God, Ten Life-Changing Lessons of The KabbalahDokument216 SeitenSeeing God, Ten Life-Changing Lessons of The Kabbalahnates280Noch keine Bewertungen

- Function For WorkflowDokument1 SeiteFunction For Workflownates280Noch keine Bewertungen

- Seeing God, Ten Life-Changing Lessons of The KabbalahDokument216 SeitenSeeing God, Ten Life-Changing Lessons of The Kabbalahnates280Noch keine Bewertungen

- Essence of YogaDokument108 SeitenEssence of YogaG_Krithika100% (1)

- The Concepts of Buddha & BodhisattvaDokument10 SeitenThe Concepts of Buddha & Bodhisattvanates280Noch keine Bewertungen

- LIU Tuition Fees Schedule 2012 13Dokument14 SeitenLIU Tuition Fees Schedule 2012 13nates280Noch keine Bewertungen

- Mystics of IslamDokument84 SeitenMystics of IslamMadan G Gandhi100% (2)

- Elisabeth Haich InitiationDokument368 SeitenElisabeth Haich InitiationJose RudraNoch keine Bewertungen

- FY 13 Expense Reimbursement New RateDokument3 SeitenFY 13 Expense Reimbursement New Ratenates280Noch keine Bewertungen

- Salesforce App Limits Cheatsheet PDFDokument9 SeitenSalesforce App Limits Cheatsheet PDFnates280Noch keine Bewertungen

- FY14 Catering RequestDokument2 SeitenFY14 Catering Requestnates280Noch keine Bewertungen

- Albert Pike The Book of WordsDokument177 SeitenAlbert Pike The Book of Wordswindz360100% (2)

- Albert Pike The Book of WordsDokument177 SeitenAlbert Pike The Book of Wordswindz360100% (2)

- DF Breakfast Ticket PDFDokument1 SeiteDF Breakfast Ticket PDFnates280Noch keine Bewertungen

- Personal Data Form PDFDokument2 SeitenPersonal Data Form PDFnates280Noch keine Bewertungen

- The Pragmatic Guide To Training and Onboarding Salesforce Users in Your Nonprofit V 1 PDFDokument37 SeitenThe Pragmatic Guide To Training and Onboarding Salesforce Users in Your Nonprofit V 1 PDFnates280Noch keine Bewertungen

- LIU Tuition Fees Schedule 2012 13Dokument14 SeitenLIU Tuition Fees Schedule 2012 13nates280Noch keine Bewertungen

- The Pragmatic Guide To Training and Onboarding Salesforce Users in Your Nonprofit V 1 PDFDokument37 SeitenThe Pragmatic Guide To Training and Onboarding Salesforce Users in Your Nonprofit V 1 PDFnates280Noch keine Bewertungen

- Master and MargaritaDokument205 SeitenMaster and MargaritaDan Flod100% (4)

- Org ChartDokument1 SeiteOrg Chartnates280Noch keine Bewertungen

- Carl Sagan - Definitions of LifeDokument4 SeitenCarl Sagan - Definitions of LifejacobmohNoch keine Bewertungen

- Final GemsDokument402 SeitenFinal GemsShanmugasundaram Raghuraman100% (1)

- Final GemsDokument402 SeitenFinal GemsShanmugasundaram Raghuraman100% (1)

- Awareness&SelfDokument36 SeitenAwareness&Selfnates280Noch keine Bewertungen

- Final GemsDokument402 SeitenFinal GemsShanmugasundaram Raghuraman100% (1)

- 4th Grading w2 Fabm Las 2Dokument4 Seiten4th Grading w2 Fabm Las 210 Hour 10 Minute100% (8)

- Answers Questions Given Only English: His/herDokument11 SeitenAnswers Questions Given Only English: His/herOmsai YelmalwarNoch keine Bewertungen

- Chapter 4 Completing The Accounting Cycle PDFDokument20 SeitenChapter 4 Completing The Accounting Cycle PDFJed Riel BalatanNoch keine Bewertungen

- Chapter 7 - Accounting For ReceivablesDokument53 SeitenChapter 7 - Accounting For ReceivablesJes ReelNoch keine Bewertungen

- Ultimate Sample Paper 2Dokument22 SeitenUltimate Sample Paper 2Tûshar ThakúrNoch keine Bewertungen

- Accounting Cycle: 1. Analysis of TransactionsDokument18 SeitenAccounting Cycle: 1. Analysis of TransactionsAda Janelle ManzanoNoch keine Bewertungen

- Lecture 5 - Merchandising OperationDokument43 SeitenLecture 5 - Merchandising OperationNayeem Ahamed AdorNoch keine Bewertungen

- Kotak Mahindra Bank 121121123739 Phpapp02Dokument112 SeitenKotak Mahindra Bank 121121123739 Phpapp02RahulSinghNoch keine Bewertungen

- 0452 s14 Ms 22Dokument9 Seiten0452 s14 Ms 22simplesaiedNoch keine Bewertungen

- Cost Accounting Level 3/series 4-2009Dokument15 SeitenCost Accounting Level 3/series 4-2009Hein Linn Kyaw100% (1)

- Chapter 2: AUDIT OF CASH (Receipts and Disbursements) Audit of Cash and Cash Chapter 2 Equivalents Chapter OverviewDokument20 SeitenChapter 2: AUDIT OF CASH (Receipts and Disbursements) Audit of Cash and Cash Chapter 2 Equivalents Chapter OverviewAngel RosalesNoch keine Bewertungen

- Cost and Management Accounting MCQDokument14 SeitenCost and Management Accounting MCQsasikumarthanus100% (2)

- PayGate PayHost v1.6.2Dokument56 SeitenPayGate PayHost v1.6.2Sanjeev Kumar Malla100% (1)

- Accounting Notes For StudentsDokument14 SeitenAccounting Notes For StudentsArjun SainiNoch keine Bewertungen

- Analyzing Transactions To Start A BusinessDokument22 SeitenAnalyzing Transactions To Start A BusinessPaula MabulukNoch keine Bewertungen

- Depreciation: Depreciation Is A Term Used inDokument10 SeitenDepreciation: Depreciation Is A Term Used inalbertNoch keine Bewertungen

- Chap 8Dokument63 SeitenChap 8Jose Martin Castillo PatiñoNoch keine Bewertungen

- ACCT 215 Quiz 1, Hodge Fall 2009Dokument5 SeitenACCT 215 Quiz 1, Hodge Fall 2009Jenny HuynhNoch keine Bewertungen

- Accounting For Pensions and Postretirement Benefits: Assignment Classification Table (By Topic)Dokument71 SeitenAccounting For Pensions and Postretirement Benefits: Assignment Classification Table (By Topic)Andreas AndreanoNoch keine Bewertungen

- Section 20 - NIL Case DigestDokument12 SeitenSection 20 - NIL Case DigestCML100% (1)

- Kinds of ErrorsDokument5 SeitenKinds of ErrorsTaranpreetkaur SekhonNoch keine Bewertungen

- BBA AccountingDokument2 SeitenBBA AccountingAnonymous UKybnj9Otd50% (2)

- Prooblem 4-5 No. 2 Journal EntriesDokument12 SeitenProoblem 4-5 No. 2 Journal EntriesJoseph LimbongNoch keine Bewertungen

- Acctg TP 1B 1Dokument347 SeitenAcctg TP 1B 1Rochelle Ann Diane100% (2)

- ACCOUNTINGDokument12 SeitenACCOUNTINGharoonadnan196Noch keine Bewertungen

- Department of Veterinary &: A.H. Extension EducationDokument21 SeitenDepartment of Veterinary &: A.H. Extension Educationdahiphale1Noch keine Bewertungen

- Accounts Form 2 - 2021Dokument40 SeitenAccounts Form 2 - 2021Tafaranashe100% (13)

- A Study On Working Capital of Nagarjuna Fertilizers and Chemicals LTDDokument31 SeitenA Study On Working Capital of Nagarjuna Fertilizers and Chemicals LTDorangeponyNoch keine Bewertungen

- Chapter 01 QS 1-14-16 Accounting in BusinessDokument10 SeitenChapter 01 QS 1-14-16 Accounting in BusinessSharmi laNoch keine Bewertungen

- Lembar Jawaban (PRINT) - UD WIRASTRIDokument34 SeitenLembar Jawaban (PRINT) - UD WIRASTRInafitNoch keine Bewertungen