Beruflich Dokumente

Kultur Dokumente

Disability Attorney Represents Client After Metlife Denies Extension of Long Term Disability Benefit

Hochgeladen von

camlapu160Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Disability Attorney Represents Client After Metlife Denies Extension of Long Term Disability Benefit

Hochgeladen von

camlapu160Copyright:

Verfügbare Formate

Some people see coincidence. Other people see SIGNS.

And still others see $394 per day on near autopilot! Click Here to Learn More. Disability Attorney Represents Client After Metlife Denies Extension Of Long Term Disability Benefit History behind need to hire a long-term disability attorney When John Lanier graduated from college, he became a manager and software engineer. This eventually led to a position with KPMG Consulting, Inc. which became Bearing Point, Inc. in 2002. The company offered an employee benefits package, which included both short-term and longterm disability benefits. The plan was administered by Metropolitan Life Insurance Company (MetLife). Its core components included an elimination period, followed by eligibility for three years of benefits if an employee was nable to perform the material and substantial duties of (his) Own Occupation.?The plan stipulated that after the three years, an employee would only be considered disabled if he/she couldn perform any job for which he/she was qualified for or could become qualified for when training, education and experience were taken into account. As a manager at KPMG/Bearing Point, Lanier was required to travel extensively. This meant he spent hours of each day walking and sitting. He regularly carried a computer with him, as well as luggage. If a destination was within driving distance, he spent long hours driving. It was a regular requirement of his position to lift 10 ?20 lbs., carry 10 lbs., and push or pull 30 ?40 lbs. every day. Lanier had been an active man throughout college. He didn drink or smoke and maintained a healthy lifestyle. Despite this, back pain began to trouble him within years of leaving college. He finally resorted to surgery to see if it would help relieve his symptoms. The first surgery in 1999 included a lumbar diskectomy and a laminectomy. This was followed by a second laminectomy in 2001. The surgeries failed to be effective, so Lanier applied in October 2002 for short-term disability benefits under the Bearing Point employee benefits package administered by MetLife. Evidence demonstrating disability As evidence of his disability, he provided the diagnosis of his treating physician. The symptoms listed included: - chronic cervical and lumbar pain - left lumbosacral radiculopathy - congenital narrowing of the spinal canal in the lumbar region - fibromyalgia-like features expressed through chronic migratory pain - objective anatomical abnormalities with multiple impairments in the cervical and lumbar spine - advanced degenerative arthritis in the lumbar spine at multiple levels, disc protrusion and spondylosis from C3 all the way through T2 - bilateral ulnar neuropathy at the elbows - dysfunctional sleep-wake cycles It should be noted that his treating physician noted that he was also struggling with an anxiety disorder and depression at the time of his application. Short-term disability approved MetLife approved Lanier application for short-term disability. Coverage under short-term disability fell from October 9, 2002 through April 6, 2003. Lanier then applied for long-term disability benefits. He pointed to his severe fibromyalgia and osteoarthritis in the lumbar spine, and his degenerative disc disease as the basis for his claim. MetLife approved his claim on June

4, 2003, agreeing to pay benefits for 36 months under the wn occupation?clause of the plan. Coverage was to begin on April 7, 2003. MetLife notified Lanier six months before his wn occupation?benefits were to expire, that the insurance company had determined that they would not approve him for continuing benefits under the ny occupation?terms of the policy. The disability insurance company pointed to four pieces of evidence it had used to reach the conclusion that he would be able to work in another occupation: 1.Office visit notes from his attending physician, Dr. Geoffrey Seidel, dated April 25, 2005, July 26, 2005 and August 25, 2005 2.Prescription requests dated June 11, 2005 and July 1, 2005 3.Attending physician statement dated August 25, 2005 4.Physical capacity evaluation dated August 25, 2005 Need for disability attorney arises when MetLife denies continuing long-term disability benefits. MetLife leaned most on Dr. Seidel physical capacity evaluation (PCE) to reach its conclusion that Lanier could work in another position. This evaluation suggested that Lanier was now able to sit for six hours a day, stand for one hour a day, and walk for an hour a day. This was an improvement over a January 9, 2003 PCE that reported that he was only able to sit for four hours intermittently, stand for one hour intermittently, and walk for one hour intermittently. MetLife claimed that Lanier training, education and experience meant he could work in a sedentary job. They provided examples of three positions that they felt he could fill: 1) chief bank examiner, 2) controller with the Department of Transportation, or 3) a credit and collection manager. Lanier hired a disability attorney and appealed MetLife decision in March 2006. In his appeal, Lanier included a December 5, 2005 PCE in which Dr. Seidel corrected the misunderstandings created by the way he had filled out the PCE on August 25, 2005. Dr. Seidel explained that he had mistakenly carried an answer from the first page of the PCE onto the second page. The doctor informed MetLife that this had created a significant error, which he had corrected in the December 5, 2005 PCE. This PCE rather than showing an improvement in Lanier condition reflected deterioration from January 9, 2003. Now, two years later, Lanier was limited to one to two hours per day working in a seated position. Dr. Seidel reported that any longer than this and Lanier suffered from headaches, unbearable back pain and radicular symptoms. He also reported that chiropractic adjustments had failed to bring consistent relief. In addition to his doctor updated PCE, Lanier also provided proof that he had applied for Social Security disability benefits as MetLife required and been approved. Included with the benefits decision was testimony from vocational expert Elaine M. Tripi, PhD of Social Security. This expert, after reviewing Lanier symptomatology and functional limitations, concluded that he was nable to perform his past or any other work that exists in the community.?br /> He also included four objective medical tests that confirmed his disability: 1.A September 22, 2005 electrodiagnostic test that confirmed his chronic left radiculopathy and proved that no changes have occurred since a 2003 test. 2.September 28, 2005 electrodiagnostic tests performed on his left and right elbows that revealed bilateral ulnar neuropathy. Dr. Seidel pointed to this test as proof that Lanier would not be able to perform typical sedentary work. 3.A September 23, 2005 MRI of the lumbroscal spine that confirmed the congenital and chronic disc disease diagnosis and provided additional evidence of spinal nerve root compression.

4.A September 26, 2005 MRI of the cervical spine performed that confirmed the worsening condition of his multi-level degenerative disc disease and stenosis as compared to the 2003 MRI. Reversal of decision to deny long-term disability benefits makes it look like claimant no longer needs disability attorney. This information compelled MetLife to reconsider its decision to deny Lanier long-term disability benefits. The disability insurance company reversed its denial of benefits on June 14, 2006. Lanier long-term disability benefits were reinstated, retroactive to April 7, 2006. At the same time, Social Security had awarded Lanier $60,440 in retroactive benefits to April 2003. MetLife claimed that under the policy, Lanier owed MetLife $55,148 of this settlement. They announced that they would be reducing his monthly benefits by the $1990 he received from Social Security. In addition, beginning in January 2006, the disability insurance company would stop paying him benefits until he repaid the overpaid benefits. Lanier settled the matter on January 12, 2006. Disability benefits attorney steps into picture again a year later. MetLife sent Lanier medical records to two new medical experts for review. A MetLife clinical specialist reviewed the file and claimed that the evidence failed to support Lanier disability. Also, Mary L. Hale, vocational rehabilitation consultant, reviewed the August 25, 2005 PCE and a more recent May 3, 2006 functional capacity review. Ignoring the updated December 5, 2005 PCE, she informed MetLife that there was no evidence to support the claim that Lanier abilities were less than sedentary. MetLife responded to this information by notifying Lanier on February 6, 2007 that the disability insurance company was terminating his long-term disability benefits once again. Lanier disability attorney assisted him with appealing the cancelation of benefits on August 2, 2007. The letter to MetLife argued that the disability insurance benefit provider was failing to consider the information provided from his Social Security hearing in his first appeal. The disability attorney letter also pointed to the fact that MetLife erred by relying on the August 25, 2005 PCE. Included with the appeal was a February 19, 2006 note from Dr. Seidel stating that he had not seen an improvement in Lanier health since December 2005. He included a clear breakdown of Lanier physical abilities. Able to sit for 15 to 20 minutes before having to get up, reposition, lie down or walk for a few minutes. Unable to work at his computer at home for more than 20 minutes due to the spasms that occur in the back of his neck. Pain in leg increases to the point where patient has lay down if patient sits for too long. Difficulty coping from an emotional perspective. MetLife doctors claim medical evident fails to support disability. MetLife sent Lanier appeal to two medical consultants. Both physicians chose to limit their reviews to the medical records sent to them by MetLife. Neither spoke with Lanier. Dr. Reginald Gibbons, a psychiatrist, criticized Dr. Seidel diagnosis because he had not ordered cognitive tests to evaluate whether Lanier depression and anxiety created functional limitations. Dr. Sandar Pemmaraju, a physical medicine specialist, claimed that medical evidence failed to support Lanier inability to perform sedentary work and criticized the lack of a formal capacity examination in his file. Both physicians filed their reports with

MetLife on August 21, 2007. These two reports were sent to Dr. Seidel for his response on August 24. He did so on August 28. He noted that he had only received Dr. Pemmaraju review, so could only comment on it. He noted that Dr. Pemmaraju review ignored many of the clinical findings, suggesting that he had not looked at a complete medical record. He also noted that a full functional capacity evaluation had not been ordered, because there was no one who was willing to pay for it. Once again Dr. Seidel confirmed the impairments that a recent examination had confirmed: 1.chronic cervical pain; 2.chronic lumbar pain; 3.left lumbrosacral radiculopathy; 4.right cervical radiculopathy; 5.fibromyalgia; 6.dysfunctional sleep-wake cycle; 7.objective reduced range of motion of the cervical spine, mild reduction in range of motion of the right shoulder, objective reduction in range of motion of the lumbar spine, and objective atrophy noted in the right upper extremity and left lower extremity; 8.Radiographic evidence of advanced severe degenerative joint disease of the cervical spine and lumbar spine in excess of what would be expected for his age. If MetLife considered this response, there was no evidence in the administrative record that it did so. On September 6, 2007, the disability insurance company sent Lanier a denial letter. The disability insurance company gave the following reasons for upholding the decision to reverse the decision to pay disability benefits: W]ith the medical records available for review, we concluded that the file did not contain any severity of impairment that resulted in functional limitations and restrictions preventing you from performing sedentary level of employment beyond February 6, 2007. In completing our review, we have determined that although you have medical conditions that support you having restrictions and limitations, you would be able to perform sedentary level work. Your symptoms and diagnoses would not prevent you from performing the alternate occupations identified with alternate employers. Therefore, our original decision to terminate your long-term disability benefits beyond February 6, 2007 was appropriate.?br /> Further medical evidence proving disability is ignored. Lanier heard from MetLife again on September 20. This letter revealed that MetLife had ignored Dr. Seidel letter of August 28 because it didn include any additional objective clinical proof supporting Lanier disability. Dr. Seidel order two more MRIs and electrodiagnostic testing of Lanier upper and lower extremities to rectify this. The nerve conduction tests confirmed the presence of cubital tunnel neuropathy in both elbows and abnormalities in nerve function in his legs. The MRIs showed abnormalities. A small central protrusion at the C4-C5 level slightly flattened the vental cord, slightly effacing the exiting right and abutting the exiting left C5 nerves. The MRI also found mixed biforaminal protrusions, with the right protrusions being greater than the left. The MRI observed a flattening of the right side of the ventral cord at the C5-C6 level. Mild retrolisthesis and mixed broad-based displacement with a slight flattening of the ventral cord at C6-C7 level that abutted the bilateral exiting C7 nerves was also noted. All of these abnormalities were reasonable explanations for the level of pain Lanier reported. Disability attorney takes client long-term disability termination to the Courts. MetLife claimed that none of this new information had any bearing on their decision to terminate

Lanier disability benefits as of February 7, 2007. The disability insurance company claimed that new test results dated September 2007, despite the fact that they demonstrated Lanier inability to perform sedentary work in September, failed to prove the results failed to demonstrate his inability to work in a sedentary job in February of the same year. Lanier and his disability attorney took action. They filed a suit against MetLife. In a separate article, we will consider how Lanier disability insurance attorney presented the case before the U.S. District Court. The primary purpose here has been to show you how disability insurance companies work. Hiring an experienced disability insurance attorney with a strong track record is one of the wisest investments you can make if you ever face making a disability claim. Get Cash For Surveys - Secrets Of A Single Dad Who Made Over $3K/Month Taking Surveys!

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

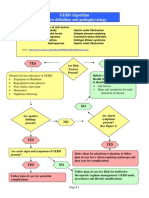

- GERD Algorithm Review Definition and Pathophysiology: NO YESDokument3 SeitenGERD Algorithm Review Definition and Pathophysiology: NO YESdianyNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Discuss What Resources Are Often Necessary For Nonacute Care For Cardiorespiratory IssuesDokument2 SeitenDiscuss What Resources Are Often Necessary For Nonacute Care For Cardiorespiratory IssuesBettNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Social Anxiety Disorder 1.editedDokument4 SeitenSocial Anxiety Disorder 1.editedmoureenNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- FSH and LH LevelsDokument4 SeitenFSH and LH Levelsujjwal guptaNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Journal Reading Ilmu Penyakit DalamDokument15 SeitenJournal Reading Ilmu Penyakit DalamSeffia riandiniNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- History of Psychosomatic Medicine BlumenfeldDokument20 SeitenHistory of Psychosomatic Medicine Blumenfeldtatih meilaniNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- NaturopathyDokument47 SeitenNaturopathyDeenky ShahNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Bipolar SOAP NoteDokument8 SeitenBipolar SOAP NoteRich AmbroseNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Star Wars Force User's Quick Reference ManualDokument8 SeitenStar Wars Force User's Quick Reference ManualBoris MikoNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- Emerging Re-Emerging Infectious Disease 2022Dokument57 SeitenEmerging Re-Emerging Infectious Disease 2022marioNoch keine Bewertungen

- Short Term Disability Overview 2020Dokument1 SeiteShort Term Disability Overview 2020tim cleavelandNoch keine Bewertungen

- Wa0012.Dokument19 SeitenWa0012.sg carNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- CVJ anatomy classification and clinical signsDokument53 SeitenCVJ anatomy classification and clinical signssa2tigNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- EnvMonitoringHygieneGuideforEHOs PDFDokument16 SeitenEnvMonitoringHygieneGuideforEHOs PDFPramod SivanandanNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- 21 Masterclass NLE Gapuz 2 - HANDOUTSDokument16 Seiten21 Masterclass NLE Gapuz 2 - HANDOUTSLimuel dale CaldezNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Community Living Guide for Mental Health RecoveryDokument36 SeitenCommunity Living Guide for Mental Health RecoveryMelissa HickeyNoch keine Bewertungen

- лекц10Dokument41 Seitenлекц10A A D H INoch keine Bewertungen

- AllDokument54 SeitenAlladham bani younesNoch keine Bewertungen

- BASIC NUTRITION GUIDELINESDokument7 SeitenBASIC NUTRITION GUIDELINESMicko QuintoNoch keine Bewertungen

- MRCP 2 Oct 2021 Recall QsDokument13 SeitenMRCP 2 Oct 2021 Recall QsKiran Shah100% (1)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Herbal PlantsDokument14 SeitenHerbal Plantsapi-3739910100% (2)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- PHILOSOPHY and DISABILITYDokument21 SeitenPHILOSOPHY and DISABILITYLuhan Albert YnarezNoch keine Bewertungen

- East Meets West From The Bottom Up - Chapter 11 "Phantom & Opera"Dokument5 SeitenEast Meets West From The Bottom Up - Chapter 11 "Phantom & Opera"nyhartp2457Noch keine Bewertungen

- Chapter 21 DigestionDokument96 SeitenChapter 21 DigestionJwnsbdhdNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- "Usmle Cs2Dokument27 Seiten"Usmle Cs2Drbee10Noch keine Bewertungen

- Simple Indigestion in RuminantsDokument11 SeitenSimple Indigestion in RuminantsAli H. Sadiek أ.د. علي حسن صديق75% (4)

- 1 Florendo Vs Philam PlansDokument6 Seiten1 Florendo Vs Philam PlansRon GamboaNoch keine Bewertungen

- Anxiety ButeykoDokument83 SeitenAnxiety ButeykoMartyn Brannan100% (2)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Obesity: Sharmila A/P Rajendran E20141008930 Diploma Sains Dan MatematikDokument18 SeitenObesity: Sharmila A/P Rajendran E20141008930 Diploma Sains Dan MatematikSharmila RajNoch keine Bewertungen

- Payment Policies and Agreement To PayDokument5 SeitenPayment Policies and Agreement To PayChristopher HartmanNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)