Beruflich Dokumente

Kultur Dokumente

HW 7

Hochgeladen von

urbuddy542Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

HW 7

Hochgeladen von

urbuddy542Copyright:

Verfügbare Formate

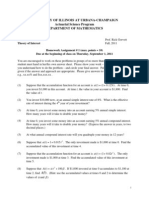

UNIVERSITY OF ILLINOIS AT URBANA-CHAMPAIGN Actuarial Science Program DEPARTMENT OF MATHEMATICS

Math 210 Theory of Interest Prof. Rick Gorvett Fall, 2011

Homework Assignment # 7 (max. points = 10) Due at the beginning of class on Thursday, November 10, 2011 You are encouraged to work on these problems in groups of no more than 3 or 4. However, each student must hand in her/his own answer sheet. Please show your work enough to show that you understand how to do the problem and circle your final answer. Full credit can only be given if the answer and approach are appropriate. Please give answers to two decimal places e.g., xx.xx% and $xx,xxx.xx . Note: Homework assignments are due at the beginning of the class. If you arrive at the class after it has started, you must hand in your assignment upon entering the classroom. Assignments will not be accepted at the end of the class period.

(1)

You make a one-time deposit of $100,000 into an account (Account A) which pays out 8% effective annual interest at the end of each year. Each year, you take the interest payout and deposit it into an account (Account B) earning an effective annual interest rate of 6%. Find the amount in Account B 15 years after your original $100,000 deposit. You make deposits of $2,000 into an account (Account A) at the end of each year, for 20 years. This account pays out 10% effective annual interest at the end of each year. Each year, you take the interest payout and deposit it into an account (Account B) earning an effective annual interest rate of 5%. Find the total amount in both accounts combined after 20 years i.e., immediately after the last deposit. You borrow $100,000 for 5 years, at an annual rate of 8% convertible quarterly. You intend to pay off the loan via level amortization payments at the end of each quarter. Determine the .total amount of payments you make over the life of the loan. You borrow $300,000 for 30 years, at an annual effective interest rate of 10%. You intend to pay off the loan via level year-end amortization payments. Find the amount of principal in your 17th payment. You borrow $200,000 for 10 years, at an annual effective interest rate of 12%. You intend to pay off the loan via level amortization payments at the end of each month. Find the total amount of interest paid during the life of the loan. You take out a 30-year $500,000 mortgage at an effective annual interest rate of 9%. Immediately after your 8th payment, you make an additional principal repayment of

1

(2)

(3)

(4)

(5)

(6)

$50,000, and then refinance the outstanding balance with a new 15-year mortgage at a 5% effective annual interest rate. Both mortgages require annual year-end level amortization payments. Find the amount of interest in the 4th payment of the new mortgage. (7) You borrow $400,000 for 30 years, at an annual effective interest rate of 7.5%. You intend to pay off the loan via the sinking fund method, with level year-end interest payments, and level year-end sinking fund deposits. The sinking fund earns an effective annual interest rate of 4%. Find the balance in the sinking fund after 22 years. A 10-year, $150,000 loan at a nominal annual interest rate of 12% convertible monthly is being paid off via the sinking fund method. The nominal annual interest rate earned on the sinking fund is 8% convertible monthly. Level sinking fund deposits and loan interest payments are each made at the end of each month. What is the net amount of interest paid during the 38th month of the loan? (Net interest during a given month is the amount of interest paid on the loan, minus the amount of interest earned on the sinking fund, during that month.) A 30-year 8% annual coupon bond has a face (and redemption) value of $1,000. Find the price of the bond, assuming an annual effective interest rate of 10%. A 25-year 6% semi-annual-coupon bond (meaning that a coupon of 6% / 2 = 3% is paid every six months, because the coupon rate is generally denoted as an annual rate, even if payments are twice per year) has a face (and redemption) value of $1,000. Find the price of the bond, assuming a nominal annual interest rate of 5% convertible semiannually.

(8)

(9)

(10)

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- HW 8Dokument2 SeitenHW 8urbuddy542Noch keine Bewertungen

- University of Illinois at Urbana-Champaign Actuarial Science Program Department of MathematicsDokument2 SeitenUniversity of Illinois at Urbana-Champaign Actuarial Science Program Department of Mathematicsurbuddy542Noch keine Bewertungen

- HW 2Dokument2 SeitenHW 2urbuddy542Noch keine Bewertungen

- HW 1Dokument2 SeitenHW 1urbuddy542Noch keine Bewertungen

- HW 6Dokument2 SeitenHW 6urbuddy542Noch keine Bewertungen

- Old 5 AnsDokument2 SeitenOld 5 Ansurbuddy542Noch keine Bewertungen

- HW 8Dokument2 SeitenHW 8urbuddy542Noch keine Bewertungen

- HW 8Dokument2 SeitenHW 8urbuddy542Noch keine Bewertungen

- HW 8Dokument2 SeitenHW 8urbuddy542Noch keine Bewertungen

- Old 1 AnsDokument2 SeitenOld 1 Ansurbuddy542Noch keine Bewertungen

- Old 2 AnsDokument4 SeitenOld 2 Ansurbuddy542Noch keine Bewertungen

- Old 6 AnsDokument2 SeitenOld 6 Ansurbuddy542Noch keine Bewertungen

- HW 1 AnsDokument2 SeitenHW 1 Ansurbuddy542Noch keine Bewertungen

- HW 2 AnsDokument2 SeitenHW 2 Ansurbuddy542Noch keine Bewertungen

- Econ303 hw1 Spring13 PDFDokument9 SeitenEcon303 hw1 Spring13 PDFurbuddy542Noch keine Bewertungen

- HW 5 AnsDokument2 SeitenHW 5 Ansurbuddy542Noch keine Bewertungen

- Modernism: Muyuan Zhang, Jamey Stolbom, Maisy PorterDokument7 SeitenModernism: Muyuan Zhang, Jamey Stolbom, Maisy Porterurbuddy542Noch keine Bewertungen