Beruflich Dokumente

Kultur Dokumente

Deduction Under Section 80G

Hochgeladen von

sadathnooriOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Deduction Under Section 80G

Hochgeladen von

sadathnooriCopyright:

Verfügbare Formate

Deduction under Section 80G Section 80G offers a tax deduction for donations to certain prescribed funds and

charitable institutions. Here are the details of the section. Eligible Assesses This section is applicable to all assessees, who make an eligible donation, whether an individual, HUF, NRI or a company. Deduction Limit The extent of deduction is either 50% or 100% of the contribution, depending on the charitable institution donated to. For certain funds, the aggregate deduction is limited to 10% of the Adjusted Gross Total Income. So, in such cases, even if you do make a donation larger than 10% of your Adjusted Gross Total Income, the donation amount eligible for claiming a deduction would be capped at 10% of the Adjusted Gross Total Income. The Adjusted Gross Total in this case, is the gross total income minus long-term capital gain, short term capital gain and all deductions u/s 80CCC to 80U except any deduction under this section. Scope of Deduction The donation may be paid either out of taxable or exempted income. Only donations made in cash or cheque are eligible for deductions. Donations made in kind, in the form of food, clothing, medicines etc are not eligible. Donations to foreign charitable trusts are not eligible for any deduction. Political parties (BJP,CPI,Congress,CPM,BSP,SP) are eligible for 100% deduction. For donations made to Indian Olympic Association, any association notified u/s 10(23) for development of infrastructure for sports or games, or for sponsorship of sports or games, only a company is eligible for deduction. Donations made to not all charitable institutions qualify for a deduction. Here is a list of approved charitable institutions and funds that qualify for a deduction.

Donations with 100% deduction without any qualifying limit: 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. Prime Ministers National Relief Fund National Defence Fund Prime Ministers Armenia Earthquake Relief Fund The Africa (Public Contribution - India) Fund The National Foundation for Communal Harmony Approved university or educational institution of national eminence The Chief Ministers Earthquake Relief Fund, Maharashtra Donations made to Zila Saksharta Samitis. The National Blood Transfusion Council or a State Blood Transfusion Council. The Army Central Welfare Fund or the Indian Naval Benevolent Fund or The Air Force Central Welfare Fund. Army Central Welfare Fund, Indian Naval Ben. Fund, Air Force Central Welfare Fund. National Illness Assistance Fund Chief Minister's or Lt. Governor's Relief Fund National Sports Fund National Cultural Fund

16. Govt./ local authority/ institution/ association towards promoting family planning 17. Central Govt.'s Fund for Technology Development & Application 18. National Trust for Welfare of Persons with Autism, Cerebral Palsy, Mental Retardation & Multiple Disabilities 19. Indian Olympic Association/ other such notified association 20. Andhra Pradesh Chief Minister's Cyclone Relied Fund Donations with 50% deduction without any qualifying limit. 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Jawaharlal Nehru Memorial Fund Prime Ministers Drought Relief Fund National Childrens Fund Indira Gandhi Memorial Trust The Rajiv Gandhi Foundation Donations to govt./ local authority for charitable purposes (excluding family planning) Authority/ corporation having income exempt under erstwhile section or u/s 10(26BB) Donations for repair/ renovation of notified places of worship World Vision India Udavum Karangal

Donations to the following are eligible for 100% deduction subject to 10% of adjusted gross total income 1. 2. Donations to the Government or a local authority for the purpose of promoting family planning. Sums paid by a company to Indian Olympic Association

Donations to the following are eligible for 50% deduction subject to 10% of adjusted gross total income 1. Donation to the Government or any local authority to be utilized by them for any charitable purposes other than the purpose of promoting family planning.

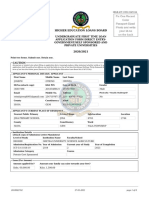

The Donation Receipt In order to claim deduction, it is mandatory for the donor to furnish a proof of payment towards the eligible fund or institution. A stamped receipt is issued by the recipient trust in this regard, which must be attached by the assessee along with the income tax returns. The receipt must include the following details. Name and address of the trust The name of the donor The amount donated, mentioned in words and figures The registration number of the trust, as given by the income tax department under section 80G, along with its validity period.

Tax benefits cannot be claimed without the above mentioned details and document. There are many trusts in India engaged in charitable activities. In order to ensure that only contributions to genuine trusts entail a tax benefit, the government has brought in registration of trusts. Thus, before you donate, check to see, if the trust you are donating to is registered and has the tax exemption certificate, which is popularly known as the 80G certificate. Note: Donation in cash is acceptable only up to Rs. 10,000 for being eligible for deduction under section 80G.

Das könnte Ihnen auch gefallen

- EDonation ReceiptDokument1 SeiteEDonation ReceiptSrinivasa GarlapatiNoch keine Bewertungen

- CMDRF Donation ReceiptDokument2 SeitenCMDRF Donation ReceiptaakashNoch keine Bewertungen

- DonationDokument7 SeitenDonationSwapnil ChodankarNoch keine Bewertungen

- Akanksha P Deshpande - 1451 PDFDokument1 SeiteAkanksha P Deshpande - 1451 PDFdpfsopfopsfhopNoch keine Bewertungen

- Tax Certificate - 008927742 - 131310Dokument2 SeitenTax Certificate - 008927742 - 131310Vignesh MahadevanNoch keine Bewertungen

- Relief Fund Certificate PDFDokument2 SeitenRelief Fund Certificate PDFSALVATAASIMNoch keine Bewertungen

- District E-Governance Society (RAJSAMAND) Duplicate ReceiptDokument1 SeiteDistrict E-Governance Society (RAJSAMAND) Duplicate Receiptvikrant paliwalNoch keine Bewertungen

- Bharatiya Janata Party Central Office 6A, Pandit Deendayal Upadhyaya Marg, New DelhiDokument1 SeiteBharatiya Janata Party Central Office 6A, Pandit Deendayal Upadhyaya Marg, New DelhiMadathukulam MuthukumarNoch keine Bewertungen

- Form10BE - ALPNA VARMA - 2021 - AABTK6329H06221000050Dokument1 SeiteForm10BE - ALPNA VARMA - 2021 - AABTK6329H06221000050hemalatha aNoch keine Bewertungen

- Received With Thanks From Mobile: The Sum of Rupees by Towards Donation For Cauvery Calling ProjectDokument1 SeiteReceived With Thanks From Mobile: The Sum of Rupees by Towards Donation For Cauvery Calling Projectsvka_3aNoch keine Bewertungen

- Donor FormDokument1 SeiteDonor FormKalpesh MangeNoch keine Bewertungen

- Tax Declaration Form 2021 22Dokument4 SeitenTax Declaration Form 2021 22Kasiviswanathan ChinnathambiNoch keine Bewertungen

- 80D SelfDokument1 Seite80D Selfnikhil nadakuditiNoch keine Bewertungen

- Tax Certificate - of Anjali Lalwani PDFDokument2 SeitenTax Certificate - of Anjali Lalwani PDFBasant GakhrejaNoch keine Bewertungen

- Shri Mata Vaishno Devi Shrine BoardDokument1 SeiteShri Mata Vaishno Devi Shrine BoardDivine NatureNoch keine Bewertungen

- LIC Sikha PDFDokument1 SeiteLIC Sikha PDFsikha singh100% (1)

- 80G CertificateTax ExemptionDokument56 Seiten80G CertificateTax ExemptionskunwerNoch keine Bewertungen

- 449QOOEf PDFDokument1 Seite449QOOEf PDFtusharsharma777Noch keine Bewertungen

- Isha Foundation: Bill of Supply / Fee Receipt TO: NoDokument1 SeiteIsha Foundation: Bill of Supply / Fee Receipt TO: NoMainak SamantaNoch keine Bewertungen

- Screenshot 2023-12-14 at 1.02.56 PMDokument1 SeiteScreenshot 2023-12-14 at 1.02.56 PMshashikumarsk0711Noch keine Bewertungen

- Donation Receipt: Details of DoneeDokument1 SeiteDonation Receipt: Details of DoneeNaveen BansalNoch keine Bewertungen

- Ved Vignan Maha Vidya Peeth Receipt For Sai Shruthi Dated (28!07!2019)Dokument1 SeiteVed Vignan Maha Vidya Peeth Receipt For Sai Shruthi Dated (28!07!2019)Sai SankalpNoch keine Bewertungen

- Interest Certificate: Shivam Garg and Ramkrishna GargDokument1 SeiteInterest Certificate: Shivam Garg and Ramkrishna GargShivamNoch keine Bewertungen

- SaibabaDokument1 SeiteSaibabasameer5458100% (1)

- PrmPayRcptSign PR0445228800021011Dokument1 SeitePrmPayRcptSign PR0445228800021011dipakpd100% (1)

- ICICI Health InsuranceDokument1 SeiteICICI Health Insurancecanjiatp76260% (1)

- Renewal NoticeDokument2 SeitenRenewal NoticeJerry LamaNoch keine Bewertungen

- Pawan S PDF CompletedDokument1 SeitePawan S PDF CompletedAsifshaikh7566Noch keine Bewertungen

- Premium Paid Certificate: Date: 14-DEC-2017Dokument1 SeitePremium Paid Certificate: Date: 14-DEC-2017zuhebNoch keine Bewertungen

- Elss - Fy 2021-22Dokument2 SeitenElss - Fy 2021-22Amit SinghNoch keine Bewertungen

- Renewal Premium Notice: Mr. Kishor Kumar Gupta Insured Name: MR - Kishor Kumar GuptaDokument1 SeiteRenewal Premium Notice: Mr. Kishor Kumar Gupta Insured Name: MR - Kishor Kumar GuptaYT ENTERTAINMENTNoch keine Bewertungen

- MedicalimDokument1 SeiteMedicalimsaurabhNoch keine Bewertungen

- Receipt 24 PDFDokument1 SeiteReceipt 24 PDFChinmay AtrawalkarNoch keine Bewertungen

- ReceiptPrint UIMTH-17890 PDFDokument1 SeiteReceiptPrint UIMTH-17890 PDFPubg UsaNoch keine Bewertungen

- Insurance Smart Sampoorna RakshaDokument10 SeitenInsurance Smart Sampoorna RakshaArpit ShahNoch keine Bewertungen

- Alok 4Dokument2 SeitenAlok 4Guy LoveNoch keine Bewertungen

- U200586078 New PDFDokument1 SeiteU200586078 New PDFKoushik DuttaNoch keine Bewertungen

- Edonation DNI230628122189Dokument1 SeiteEdonation DNI230628122189Mohith ReddyNoch keine Bewertungen

- 80G FormatDokument23 Seiten80G FormatPadmanabha NarayanNoch keine Bewertungen

- Donation Detail Partner Ngo Donation Giveindia Retention TotalDokument1 SeiteDonation Detail Partner Ngo Donation Giveindia Retention TotalSelvamNoch keine Bewertungen

- 1865362Dokument1 Seite1865362Bhavesh ParekhNoch keine Bewertungen

- Higher Education Loans BoardDokument8 SeitenHigher Education Loans BoardDON ONNYANGONoch keine Bewertungen

- Dengue Ns1 Antigen Test (Elisa/Elfa) - 600.00 0.00: DuplicateDokument1 SeiteDengue Ns1 Antigen Test (Elisa/Elfa) - 600.00 0.00: DuplicateAbhishek GoelNoch keine Bewertungen

- Leave and License Agreement: Particulars Amount Paid GRN/Transaction Id DateDokument6 SeitenLeave and License Agreement: Particulars Amount Paid GRN/Transaction Id DateAnonymous eCmTYonQ84Noch keine Bewertungen

- Consolidated Premium Paid STMT 2012-2013Dokument1 SeiteConsolidated Premium Paid STMT 2012-2013jahmeddNoch keine Bewertungen

- Lic Receipt PDFDokument1 SeiteLic Receipt PDFrohitjain444Noch keine Bewertungen

- Receipt Under Section 80G of The Income Tax ActDokument1 SeiteReceipt Under Section 80G of The Income Tax ActdpfsopfopsfhopNoch keine Bewertungen

- PremiumRept MDS - RameshDokument2 SeitenPremiumRept MDS - Rameshnavengg521Noch keine Bewertungen

- Consolidated Premium Paid STMT 2020-2021 PDFDokument1 SeiteConsolidated Premium Paid STMT 2020-2021 PDFSHITESH KUMARNoch keine Bewertungen

- TDS ChallanDokument1 SeiteTDS ChallanJayNoch keine Bewertungen

- Income Tax LetterDokument2 SeitenIncome Tax LetterSOUMYANoch keine Bewertungen

- Lony3004 00000037809338867 HDokument1 SeiteLony3004 00000037809338867 HlimcysebastinNoch keine Bewertungen

- Cons-0420925660 08082020170150Dokument1 SeiteCons-0420925660 08082020170150Ananya SharmaNoch keine Bewertungen

- Premium Receipt 008102909 - 14 02 2023 14 02 2023Dokument1 SeitePremium Receipt 008102909 - 14 02 2023 14 02 2023UTSAV DUBEYNoch keine Bewertungen

- AC Bajaj Finance - 2Dokument2 SeitenAC Bajaj Finance - 2prsnjt11Noch keine Bewertungen

- For HDFC ERGO General Insurance Company LTDDokument2 SeitenFor HDFC ERGO General Insurance Company LTDNAVEEN H ENoch keine Bewertungen

- DonationS UNDE INCOME TAX ACTDokument2 SeitenDonationS UNDE INCOME TAX ACTManjeet KaurNoch keine Bewertungen

- WebsiteDokument17 SeitenWebsiteAkansha GuptaNoch keine Bewertungen

- Unit 5Dokument9 SeitenUnit 5piyush.birru25Noch keine Bewertungen

- Section 80P - Deduction For Co-Operative SocietiesDokument15 SeitenSection 80P - Deduction For Co-Operative SocietiesSURESHNoch keine Bewertungen

- Prov List 11Dokument23 SeitenProv List 11sadathnooriNoch keine Bewertungen

- BNP Paribas Bank DetailsDokument1 SeiteBNP Paribas Bank DetailssadathnooriNoch keine Bewertungen

- Pá Éãdä Pàët E ÁséDokument4 SeitenPá Éãdä Pàët E ÁsésadathnooriNoch keine Bewertungen

- Section B Questions and Answers. Each Question Carries 5 Marks 1. Distinguish Between Accounting and Auditing. (2012, 2013)Dokument8 SeitenSection B Questions and Answers. Each Question Carries 5 Marks 1. Distinguish Between Accounting and Auditing. (2012, 2013)sadathnooriNoch keine Bewertungen

- Business Environment Question Bank With AnswersDokument11 SeitenBusiness Environment Question Bank With Answerssadathnoori75% (4)

- To TB JayachandraDokument1 SeiteTo TB JayachandrasadathnooriNoch keine Bewertungen

- ªàiá£Àågé, «Μàaiàä:-°Auàgádä Ja§ «Záåyðaiàä «ΜàaiàäDokument3 Seitenªàiá£Àågé, «Μàaiàä:-°Auàgádä Ja§ «Záåyðaiàä «ΜàaiàäsadathnooriNoch keine Bewertungen

- Sub:Statement of Diesel Bill: Date Indent HSD in Ltrs Bill No Rate, Rs AmountDokument16 SeitenSub:Statement of Diesel Bill: Date Indent HSD in Ltrs Bill No Rate, Rs AmountsadathnooriNoch keine Bewertungen

- Explain The Various NonDokument1 SeiteExplain The Various NonsadathnooriNoch keine Bewertungen

- Fms TestDokument1 SeiteFms TestsadathnooriNoch keine Bewertungen

- A Stock ExchangeDokument1 SeiteA Stock ExchangesadathnooriNoch keine Bewertungen

- 7.blessed SalivaDokument2 Seiten7.blessed SalivasadathnooriNoch keine Bewertungen

- CoinsDokument2 SeitenCoinssadathnooriNoch keine Bewertungen

- Unit 4 Nbfcs MeaningDokument7 SeitenUnit 4 Nbfcs MeaningsadathnooriNoch keine Bewertungen

- 7.blessed SalivaDokument2 Seiten7.blessed SalivasadathnooriNoch keine Bewertungen

- MbaDokument54 SeitenMbasadathnooriNoch keine Bewertungen

- Noor Part 1Dokument3 SeitenNoor Part 1sadathnooriNoch keine Bewertungen

- 2020 Specimen Paper 1Dokument10 Seiten2020 Specimen Paper 1mohdportmanNoch keine Bewertungen

- 425 1594 1 PBDokument23 Seiten425 1594 1 PBWOYOPWA SHEMNoch keine Bewertungen

- Compensation N BenfitsDokument52 SeitenCompensation N BenfitsShalaka MohiteNoch keine Bewertungen

- Apbl Annual Report 2010Dokument153 SeitenApbl Annual Report 2010Suet Mei ChunNoch keine Bewertungen

- Module 2. Rate, Tax, and Expenses (Legal Aspects)Dokument13 SeitenModule 2. Rate, Tax, and Expenses (Legal Aspects)MARITONI MEDALLANoch keine Bewertungen

- Muhammad Rizwan Khan OrderDokument5 SeitenMuhammad Rizwan Khan OrderNaeem SolangiNoch keine Bewertungen

- JBL T160 Wired Headset: Grand Total 549.00Dokument1 SeiteJBL T160 Wired Headset: Grand Total 549.00Arpit AwasthiNoch keine Bewertungen

- 4 - Terminus Hotel - ADokument5 Seiten4 - Terminus Hotel - AAnonymous 2EdAmT96Hh0% (5)

- Sui Southern Gas Company Limited: Contract For The Supply of Gas For Industrial UseDokument20 SeitenSui Southern Gas Company Limited: Contract For The Supply of Gas For Industrial UseNoor Ul IslamNoch keine Bewertungen

- Administrative Law - Smart NotesDokument65 SeitenAdministrative Law - Smart NotesAchyut TewariNoch keine Bewertungen

- Economics Unit 1 Revision NotesDokument32 SeitenEconomics Unit 1 Revision NotesJohn EdwardNoch keine Bewertungen

- Batangas State University: College of Engineering, Architecture, Fine Arts and Computing SciencesDokument5 SeitenBatangas State University: College of Engineering, Architecture, Fine Arts and Computing SciencesMeynard MagsinoNoch keine Bewertungen

- Federal and State Income Taxation of Individuals, Form #12.003Dokument143 SeitenFederal and State Income Taxation of Individuals, Form #12.003Sovereignty Education and Defense Ministry (SEDM)Noch keine Bewertungen

- Wa0018.Dokument3 SeitenWa0018.ramlingjrodgeNoch keine Bewertungen

- Taxation II ReviewerDokument9 SeitenTaxation II ReviewerLiezl CatorceNoch keine Bewertungen

- Macroeconomics Canadian 5th Edition Mankiw Solutions Manual 1Dokument22 SeitenMacroeconomics Canadian 5th Edition Mankiw Solutions Manual 1jason100% (56)

- A Project Report: "Equity Analysis"Dokument103 SeitenA Project Report: "Equity Analysis"Sampath SanguNoch keine Bewertungen

- Public CHAPTER 4Dokument15 SeitenPublic CHAPTER 4embiale ayaluNoch keine Bewertungen

- 2004 Birmingham Business License CodeDokument325 Seiten2004 Birmingham Business License CodeJeffrey RobbinsNoch keine Bewertungen

- Hindustan Petroleum Corporation Limited Direct Sales Office 130/1, Sarojini Devi Street, Secunderabad - 500 003Dokument1 SeiteHindustan Petroleum Corporation Limited Direct Sales Office 130/1, Sarojini Devi Street, Secunderabad - 500 003Srinivas NayakuniNoch keine Bewertungen

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Dokument1 SeiteTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)kishanprasadNoch keine Bewertungen

- Bustax Chapters 1 4Dokument6 SeitenBustax Chapters 1 4Naruto UzumakiNoch keine Bewertungen

- Group Activity Mina HanDokument4 SeitenGroup Activity Mina HanLevi's DishwasherNoch keine Bewertungen

- 2016 Index of Ecnomic Freedom - ChinaDokument2 Seiten2016 Index of Ecnomic Freedom - ChinaNelson Vargas ColomaNoch keine Bewertungen

- Macroeconomics - Staicu&PopescuDokument155 SeitenMacroeconomics - Staicu&PopescuŞtefania Alice100% (1)

- Batas Pambansa BLG 232Dokument11 SeitenBatas Pambansa BLG 232Chrisel Joy Casuga SorianoNoch keine Bewertungen

- TCT Title Transfer and Annotation StepsDokument8 SeitenTCT Title Transfer and Annotation StepsNegros HomesNoch keine Bewertungen

- DocxDokument10 SeitenDocxAiziel OrenseNoch keine Bewertungen

- Small Business Income and Expenses TemplateDokument3 SeitenSmall Business Income and Expenses TemplateMETANOIANoch keine Bewertungen