Beruflich Dokumente

Kultur Dokumente

Annotated Biblography

Hochgeladen von

Majid AliOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Annotated Biblography

Hochgeladen von

Majid AliCopyright:

Verfügbare Formate

Lawrence, C. (2003). Why is gold different from other assets?An empirical in estigation. World Gold Council , !".

#he st$dy is cond$cted for the p$rpose that is gold and its ret$rns are correlated with other financial asset also %n this st$dy a$thor tried to in estigate why gold is s$pposed to &e different asset from all other commodities what are the main reasons &ehind this arg$ment when we tal' a&o$t other commodities if s$ddenly the demand for any commodity rises and that demand is not satisfied &y ade($ate s$pply s$ddenly d$e to lac' of s$pply the price of that commodity will rise &$t in case of gold the prices not change d$e to instant demand. )old has some attri&$tes that differentiate it from other commodities. A$thor applied ario$s methods for collection of data. *es$lts are &ased on ($arterly data from +an$ary ,-." to /ecem&er 200,. *eal data was $sed in the analysis 01 )/2 growth rate was held constant at ,--0 prices 01 prod$cer price inde3 was $sed as pro3y for inflation. 4$arterly res$lts ha e &een ann$ali5ed. Apart from that correlation was also $sed in the analysis to chec' the relationship of different aria&les the second approach $sed in the analysis is 6A* ( ector a$to regressi e).the second method is $sed for identification of correlation of different aria&les across different time periods. 7or e3ample can last year8s change in inflation rate affect the price of gold in the c$rrent year? #his st$dy is related to my research topic &eca$se the pro&lem statement is more or less same with the change in some aria&les &oth the st$dies are &ased on what are the 'ey characteristics of gold that differentiate it from other assets.

9a$r, /. )., : L$cey, 9. ;. (200-). %s )old a <edge or a 1afe <a en?An Analysis of 1toc's, 9onds and )old. Financial Review , 2-.

%n this st$dy the a$thor tried to in estigate that is gold a hedge or safe hea en the term hedge or safe hea en means that when mar'et is in crash the ret$rns of gold are $naffected with those mar'et crashes or in estors cannot &ear any loss d$e to high crash in mar'et of inflation in the mar'et an asset that red$ces loss in $nsta&le conditions of mar'et is 'nown as hea en or di ersifier. /ata which is $sed in the analysis consists of daily prices of ;1C% stoc' and &ond 01 closing spot gold. All stoc' and &ond prices are in local c$rrency and are con erted into 9ritish c$rrency when necessary regression and correlation is also $sed to determine the relationship among gold prices and stoc', &ond prices. Correlation coefficient also indicates that there is a positi e relation in stoc' and gold prices. #his st$dy is related with my research paper &eca$se in this analysis a$thor tried to in estigate that which aria&les change gold prices what are the factors that deri e gold prices methodology is same % also $se correlation and regression.

;cCown, +. *., : =immerman, +. *. (200>). %s )old a =ero?9eta Asset? Analysis of the %n estment 2otential of. Meinders School of Business Oklahoma City University , 23. %n this st$dy a$thor in estigated that gold has the ret$rns same as treas$ry &ills ha e with no mar'et ris' and gold ha e the a&ility to hedge inflation it means when inflation rises gold prices also go $pwards in this st$dy sil er is also st$died and cond$cted that gold and sil er &oth ha e the same characteristics of hedging inflation. %n estment in gold has no symmetric ris' to in estors. )old has 5ero &eta in capital asset pricing model. /ata consists of month end spot prices from ,-.0 for comparison p$rpose and $se in the asset pricing model these data were $tili5ed 01 inflation, interest rate, ret$rns on 01 ;1C%. All the res$lts are &ased on capital asset pricing model.

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Employee Bio Data Form Format in WordDokument1 SeiteEmployee Bio Data Form Format in WordMajid Ali50% (2)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Project Guidelines HRMDokument1 SeiteProject Guidelines HRMMajid AliNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Ending The War in Afghanistan - 2013Dokument13 SeitenEnding The War in Afghanistan - 2013Majid AliNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- Egypt Must Make Democratic ProgressDokument3 SeitenEgypt Must Make Democratic ProgressMajid AliNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Energy Crisis in PakistanDokument4 SeitenEnergy Crisis in PakistanMajid AliNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Case Analysis of Financial StatementsDokument1 SeiteCase Analysis of Financial StatementsMajid AliNoch keine Bewertungen

- MAJU Faculty Application FormDokument1 SeiteMAJU Faculty Application Formblazing_gale7304Noch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Government BorrowingDokument19 SeitenGovernment BorrowingMajid AliNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- PSO BetaDokument1 SeitePSO BetaMajid AliNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Workplace Humor and Its Many BenefitsDokument13 SeitenWorkplace Humor and Its Many BenefitsMajid AliNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- BSG PowerPoint Presentation - V1.5Dokument41 SeitenBSG PowerPoint Presentation - V1.5Henry PamaNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Time Value of Money (New)Dokument22 SeitenTime Value of Money (New)NefarioDMNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- "Understanding Incoterms 2020" SeminarDokument1 Seite"Understanding Incoterms 2020" SeminarPortCallsNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- World Transfer Pricing 2016Dokument285 SeitenWorld Transfer Pricing 2016Hutapea_apynNoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- FIRST TERM EXAM 2021-22 Accountancy XII Marking SchemeDokument2 SeitenFIRST TERM EXAM 2021-22 Accountancy XII Marking SchemeANUJ SHARMANoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Residentail LeaseDokument17 SeitenResidentail LeaseMuzammil ZargarNoch keine Bewertungen

- Chapter 3 - Investment Appraisal - DCFDokument37 SeitenChapter 3 - Investment Appraisal - DCFInga ȚîgaiNoch keine Bewertungen

- Group 2 Ancom BerhadDokument21 SeitenGroup 2 Ancom Berhad杰小Noch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- International Fisher Effect and Exchange Rate ForecastingDokument12 SeitenInternational Fisher Effect and Exchange Rate ForecastingRunail harisNoch keine Bewertungen

- Instructions for Excel templatesDokument4 SeitenInstructions for Excel templatespcsriNoch keine Bewertungen

- Digital Banking W.R.T. Janakalyan Sahakari Bank Ltd.Dokument43 SeitenDigital Banking W.R.T. Janakalyan Sahakari Bank Ltd.Kareena WasanNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Exchange Rates EssayDokument5 SeitenExchange Rates EssayNikolas CiniNoch keine Bewertungen

- Fund Flow StatementDokument11 SeitenFund Flow StatementpriyankalawateNoch keine Bewertungen

- Board Resolution Authorizing Loan (Sample)Dokument6 SeitenBoard Resolution Authorizing Loan (Sample)JohnAlexanderBelderol100% (4)

- Agri S.B.A Business PlanDokument21 SeitenAgri S.B.A Business Planlashaunlewis.stu2019Noch keine Bewertungen

- INVOICE-SummaryDokument1 SeiteINVOICE-SummaryManis KmrNoch keine Bewertungen

- Name: HELEN Christiana NWAFOR Wallet Number: 8036414919Dokument6 SeitenName: HELEN Christiana NWAFOR Wallet Number: 8036414919Praise PiusNoch keine Bewertungen

- Financial Planning and Analysis: The Master BudgetDokument37 SeitenFinancial Planning and Analysis: The Master BudgetWailNoch keine Bewertungen

- Chapter 8 Regular Income Tax - Exclusion From Gross IncomeDokument2 SeitenChapter 8 Regular Income Tax - Exclusion From Gross IncomeJason MablesNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Bank Recon ShortcutDokument2 SeitenBank Recon ShortcutMethlyNoch keine Bewertungen

- PMC Bank Scam: Banking OperationsDokument10 SeitenPMC Bank Scam: Banking Operationssakshi kaul0% (1)

- A Brief Introduction To Business IncubationDokument9 SeitenA Brief Introduction To Business IncubationThiagarajan VenugopalNoch keine Bewertungen

- Valuation of Inventories.a Cost Basis ApproachDokument36 SeitenValuation of Inventories.a Cost Basis ApproachMarvin Agustin De CastroNoch keine Bewertungen

- Analyze Financial Ratios of a CompanyDokument9 SeitenAnalyze Financial Ratios of a Companyshameeee67% (3)

- 1 182Dokument182 Seiten1 182Allison SnipesNoch keine Bewertungen

- FX Market ReflectionDokument1 SeiteFX Market ReflectionHella Mae RambunayNoch keine Bewertungen

- BISI - Equity Research - FikryDokument12 SeitenBISI - Equity Research - Fikryaly_rowiNoch keine Bewertungen

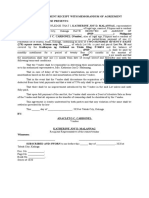

- Acknowledgement Receipt With Memorandum of Agreement (Anacleto C. Carbonel)Dokument1 SeiteAcknowledgement Receipt With Memorandum of Agreement (Anacleto C. Carbonel)Christina Pic-it BaguiwanNoch keine Bewertungen

- Takehome Assessment No. 4Dokument9 SeitenTakehome Assessment No. 4Raezel Carla Santos Fontanilla0% (4)

- Comparison of Selected Equity Capital and Mutual Fund Schemes in Respect Their RiskDokument7 SeitenComparison of Selected Equity Capital and Mutual Fund Schemes in Respect Their RiskSuman V RaichurNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)