Beruflich Dokumente

Kultur Dokumente

Exemption of Supplies Against International PDF

Hochgeladen von

Ali MinhasOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Exemption of Supplies Against International PDF

Hochgeladen von

Ali MinhasCopyright:

Verfügbare Formate

INDEX

1. 2. 3. 4. 5. 6. Short title, application and commencement.-.................................................................................. 1 Definitions.- .................................................................................................................................... 1 Exemption of taxable supplies for earthquake rehabilitation.-......................................................... 2 Procedure and conditions for making zero rated supplies.- ............................................................. 2 Maintenance of records.- ................................................................................................................ 2 Penalty.- ......................................................................................................................................... 3

EXEMPTION OF SUPPLIES AGAINST INTERNATIONAL TENDER FOR EARTHQUAKE REHABILITATION RULES, 2006

S.R.O. 274(I)/2006 Islamabad, the 21st March, 2006.In exercise of the powers conferred by clause (a) of sub-section (2) of section 13 and section 50 of the Sales Tax Act, 1990, the Federal Government is pleased to make the following rules, namely:1. (1) Short title, application and commencement.These rules may be called the Exemption of Supplies against International Tender for Earthquake Rehabilitation Rules, 2006. They shall apply to supplies of taxable goods made by registered persons against international tender to UNICEF, UNDP, WHO, WFP, UNHCR and ICRC for earthquake rehabilitation. Definitions.In this Rules, unless there is anything repugnant in the subject or context,(a) (b) (c) (d) Act means the Sales Tax Act, 1990; ICRC means International Committee of the Red Cross; UNDP means United Nations Development Program; UNHCR MEANS United Nations High Commission for Refugees;

(2)

2. (1)

(e)

UNICEF means United Nations International Childrens Emergency Fund; WFP means World Food Program; and WHO means World Health Organization.

(f) (g) (2)

The words and expression used, but not defined in these rules, shall have the same meanings as are assigned to them in the Act. Exemption of taxable supplies for earthquake rehabilitation.The taxable supplies made by registered persons to UNICEF, UNDP, WHO, WFP, UNHCR and ICRC against international tender for earthquake rehabilitation shall be exempt from tax.

3.

4.

Procedure and conditions for making zero rated supplies.For making exempt supplies under these rules shall be subject to the following procedure and conditions, namely:(a) the supply shall be made against international tender issued by UNICEF, UNDP, WHO, UNHCR or ICRC. The contract signed with the concerned organization shall be retained by the supplier in his record along with a copy of the tender notice; the supplier shall issue a commercial invoice for each supply mentioning the full particulars of the buyer and the contract number; the goods shall be duly received by the organization which signed the contract and a certificate to this effect shall be issued by the organization which shall be duly attested by the Federal Relief Commissioner; and a copy of the certificate mentioned in clause (c) shall be forwarded by the organization to the Collector of Sales Tax in whose jurisdiction the supplier of goods is registered.

(b)

(c)

(d)

5.

Maintenance of records.The supplier shall maintain separate records of supplier of exempt goods, number and date of the international tender, number and date and copy of the contract, name of the organization to whom goods were supplied, value of the goods, and number and date of the certificates obtained under clause (c) of rule 4.

6.

Penalty.In case the goods are found not to be supplied to the organization specified in rule 3, the sales tax involved on such goods shall be recoverable from the supplier besides legal or penal action under appropriate provisions of the Act.

Das könnte Ihnen auch gefallen

- 1spical AmalDokument1 Seite1spical AmalAli MinhasNoch keine Bewertungen

- Spical AmalDokument15 SeitenSpical AmalAli MinhasNoch keine Bewertungen

- ChallanDokument1 SeiteChallanAli MinhasNoch keine Bewertungen

- CV Ali MinhasDokument2 SeitenCV Ali MinhasAli MinhasNoch keine Bewertungen

- Mazha Be ShiaDokument70 SeitenMazha Be ShiaAli MinhasNoch keine Bewertungen

- Mukashifat Ul Quloob by Imam Ghazali UrduDokument438 SeitenMukashifat Ul Quloob by Imam Ghazali UrduMuhammad Usman Khan100% (5)

- 1spical AmalDokument1 Seite1spical AmalAli MinhasNoch keine Bewertungen

- Salat Ut Tasbeeh Ke Fazail Aur MasailDokument31 SeitenSalat Ut Tasbeeh Ke Fazail Aur MasailThe Holy IslamNoch keine Bewertungen

- Accountingprofit and LossDokument7 SeitenAccountingprofit and LossAli MinhasNoch keine Bewertungen

- Salat Ut Tasbeeh Ke Fazail Aur MasailDokument31 SeitenSalat Ut Tasbeeh Ke Fazail Aur MasailThe Holy IslamNoch keine Bewertungen

- Reco DiscussdeDokument27 SeitenReco DiscussdeAli MinhasNoch keine Bewertungen

- Management Report ModifiedDokument37 SeitenManagement Report ModifiedAli MinhasNoch keine Bewertungen

- How Levi Strauss approaches corporate social responsibility through sustainabilityDokument1 SeiteHow Levi Strauss approaches corporate social responsibility through sustainabilityAli MinhasNoch keine Bewertungen

- CorelDRAW Graphics Suite X6Dokument1 SeiteCorelDRAW Graphics Suite X6Ali MinhasNoch keine Bewertungen

- FullQura AnDokument7 SeitenFullQura AnAli MinhasNoch keine Bewertungen

- Asma Ul HusnaDokument8 SeitenAsma Ul HusnaUbaidUllahraaifNoch keine Bewertungen

- Sales Tax Special Procedure (Withholding) Rules, PDFDokument6 SeitenSales Tax Special Procedure (Withholding) Rules, PDFAli MinhasNoch keine Bewertungen

- Duty and Tax Remission Rules SummaryDokument8 SeitenDuty and Tax Remission Rules SummaryAli MinhasNoch keine Bewertungen

- Design Request GuidelinesDokument1 SeiteDesign Request GuidelinesAli MinhasNoch keine Bewertungen

- Sales Tax Act, 1990Dokument116 SeitenSales Tax Act, 1990msadhanani3922Noch keine Bewertungen

- Income Tax Ordinance 2001Dokument353 SeitenIncome Tax Ordinance 2001Ali Minhas100% (1)

- Agricultural Tractor Refund RulesDokument2 SeitenAgricultural Tractor Refund RulesAli MinhasNoch keine Bewertungen

- The Export Oriented Units and Small and Medium Enterprises PDFDokument19 SeitenThe Export Oriented Units and Small and Medium Enterprises PDFAli MinhasNoch keine Bewertungen

- Design Request GuidelinesDokument1 SeiteDesign Request GuidelinesAli MinhasNoch keine Bewertungen

- The Repayment of Sales Tax To Persons Registered in Azad PDFDokument6 SeitenThe Repayment of Sales Tax To Persons Registered in Azad PDFAli MinhasNoch keine Bewertungen

- The Electronic Filing of PDFDokument3 SeitenThe Electronic Filing of PDFAli MinhasNoch keine Bewertungen

- Income Tax Rules, 2002 PDFDokument244 SeitenIncome Tax Rules, 2002 PDFAli Minhas100% (1)

- The Repayment of Sales Tax To Persons Registered in Azad PDFDokument6 SeitenThe Repayment of Sales Tax To Persons Registered in Azad PDFAli MinhasNoch keine Bewertungen

- Sales Tax Refund On Taxable Input Used in Zero-Rated PDFDokument4 SeitenSales Tax Refund On Taxable Input Used in Zero-Rated PDFAli MinhasNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Statement of Account: Locked Bag 980 Milsons Point NSW 1565Dokument9 SeitenStatement of Account: Locked Bag 980 Milsons Point NSW 1565Tyler LindsayNoch keine Bewertungen

- Fundamentals of Accounting - Financial StatementsDokument8 SeitenFundamentals of Accounting - Financial StatementsAuroraNoch keine Bewertungen

- Bid BondDokument2 SeitenBid BondPatrick Long100% (5)

- Axis Bank LTD CVDokument4 SeitenAxis Bank LTD CVPrayagraj PradhanNoch keine Bewertungen

- Intermediate: AccountingDokument74 SeitenIntermediate: AccountingTiến NguyễnNoch keine Bewertungen

- Financial Analysis and ReportingDokument5 SeitenFinancial Analysis and ReportingHoneyzelOmandamPonce100% (1)

- ICAP MSA 1 AdditionalPracticeQuesDokument34 SeitenICAP MSA 1 AdditionalPracticeQuesAsad TariqNoch keine Bewertungen

- Vertical Analysis: Lesson 2.6Dokument21 SeitenVertical Analysis: Lesson 2.6JOSHUA GABATERO100% (1)

- Business Finance - ModuleDokument33 SeitenBusiness Finance - ModuleMark Laurence FernandoNoch keine Bewertungen

- Vol. 8 Issue 10 March 2011 - Better Safe Than SorryDokument40 SeitenVol. 8 Issue 10 March 2011 - Better Safe Than SorryHoss BedouiNoch keine Bewertungen

- United Nations / Uaag LedgerDokument46 SeitenUnited Nations / Uaag LedgerOlubayode OlowofoyekuNoch keine Bewertungen

- Applied Economics PPT 3Dokument9 SeitenApplied Economics PPT 3Angel AquinoNoch keine Bewertungen

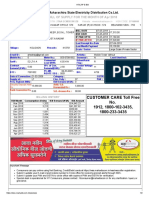

- LT bill details for mobile towerDokument2 SeitenLT bill details for mobile towerAMolNoch keine Bewertungen

- Indian Banking Sector MergersDokument10 SeitenIndian Banking Sector MergersVinayrajNoch keine Bewertungen

- SSRN Id2741701Dokument18 SeitenSSRN Id2741701Jad HajjdeebNoch keine Bewertungen

- Journalizing TransactionsDokument19 SeitenJournalizing TransactionsChristine Paola D. LorenzoNoch keine Bewertungen

- E Office UO Note FormatDokument2 SeitenE Office UO Note Formatvksgaur4_219583758Noch keine Bewertungen

- Business Differences in Developing CountriesDokument2 SeitenBusiness Differences in Developing CountriesSevinc SalmanovaNoch keine Bewertungen

- 108 Room BillDokument2 Seiten108 Room BillSamrat ChakrabortyNoch keine Bewertungen

- February 6, 2013Dokument12 SeitenFebruary 6, 2013The Delphos HeraldNoch keine Bewertungen

- Equity analysis of auto stocksDokument4 SeitenEquity analysis of auto stocksYamunaNoch keine Bewertungen

- Global Professional Accountant ACCA BrochureDokument12 SeitenGlobal Professional Accountant ACCA BrochureRishikaNoch keine Bewertungen

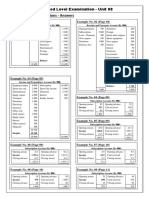

- Not-for-Profit Organizations - Answers: Advanced Level Examination - Unit 08Dokument12 SeitenNot-for-Profit Organizations - Answers: Advanced Level Examination - Unit 08Dimuthu JayasuriyaNoch keine Bewertungen

- 9 TAXREV - Michigan Holdings v. City Treasurer of MakatiDokument1 Seite9 TAXREV - Michigan Holdings v. City Treasurer of MakatiRS SuyosaNoch keine Bewertungen

- (Manufacturing and Production Engineering) Fariborz Tayyari - Cost Analysis For Engineers and Scientists-CRC Press (2021)Dokument231 Seiten(Manufacturing and Production Engineering) Fariborz Tayyari - Cost Analysis For Engineers and Scientists-CRC Press (2021)Radar NhậtNoch keine Bewertungen

- OFFICIAL ANNOUNCEMENT DEBT BURDEN LIBERATION - M1 MASTER BOND in EnglishDokument5 SeitenOFFICIAL ANNOUNCEMENT DEBT BURDEN LIBERATION - M1 MASTER BOND in EnglishWORLD MEDIA & COMMUNICATIONS88% (8)

- Chapter 22 - Retained EarningsDokument35 SeitenChapter 22 - Retained Earningswala akong pake sayoNoch keine Bewertungen

- Cost of Debt Cost of Preferred Stock Cost of Retained Earnings Cost of New Common StockDokument18 SeitenCost of Debt Cost of Preferred Stock Cost of Retained Earnings Cost of New Common StockFadhila HanifNoch keine Bewertungen

- Apsee 327Dokument2 SeitenApsee 327manikanta2235789Noch keine Bewertungen

- Report On Ocean ParkDokument6 SeitenReport On Ocean ParkSalamat Ali100% (1)