Beruflich Dokumente

Kultur Dokumente

CFRxref PDF

Hochgeladen von

iamnumber8Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

CFRxref PDF

Hochgeladen von

iamnumber8Copyright:

Verfügbare Formate

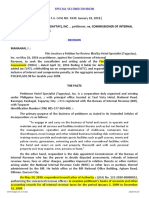

Section 6020 6201 6203 6212 6213 6214 6215 6301 6303 6321 6331 6332 6420 6601

6651 6671 6672 6701 6861 6902 7201 7203 7206 7207 7210 7212 7342 7343 7344 7401 7402 7403 7454 7601 7602 7603 7604 7605 7608

Title 26 USC Parts 61 to 80 Enforcement Regulations Description Returns prepared for or executed by Secretary Assessment authority Method of assessment Notice of deficiency Restrictions applicable to; deficiencies, petition to Tax Court Determinations by Tax Court Assessment of deficiency found by Tax Court Collection authority Notice and demand for tax Lien for taxes Levy and distraint Surrender of property subject to levy Gasoline used on farms Interest on underpayment, nonpayment, or extensions for payment, of tax Failure to file tax return or to pay tax Rules for application of assessable penalties Failure to collect and pay over tax, or attempt to evade or defeat tax Penalties for adding and abetting understatement of tax liability Jeopardy assessments of income, estate, and gift taxes Provisions of special application to transferees Attempt to evade or defeat tax Willful failure to file return, supply information, or pay tax Fraud and false statements Fraudulent returns, statements and other documents Failure to obey summons Attempts to interfere with administration of internal revenue laws Penalty for refusal to permit entry, or examination Definition of term "person" Extended application of penalties relating to officers of Treasury Department Authorization (judicial proceedings) Jurisdiction of district courts Action to enforce lien or to subject property to payment of tax Burden of proof in fraud, foundation manager, and transferee cases Canvass of districts for taxable persons and objects Examination of books and witnesses Service of summons Enforcement of summons Time and place of examination Authority of internal revenue enforcement officers

Location

27 CFR Parts 53, 70 27 CFR Part 70 27 CFR Part 70 No Regulation No Regulation No Regulation No Regulation 27 CFR Parts 24, 25, 53, 250, 270, 275 27 CFR Parts 53, 70 27 CFR Part 70 27 CFR Part 70 27 CFR Part 70 No Regulation 27 CFR Parts 70, 170, 194, 296 27 CFR Parts 24, 25, 70, 194 27 CFR Part 70 27 CFR Part 70 27 CFR Part 70 No Regulation No Regulation No Regulation No Regulation No Regulation 27 CFR Part 70 No Regulation 27 CFR Parts 170, 270, 275, 290, 295, 296 27 CFR Parts 24, 25, 170, 270, 275, 290, 295, 296 No Regulation No Regulation 27 CFR Part 70 No Regulation 27 CFR Part 70 No Regulation 27 CFR Part 70 27 CFR Parts 70, 170, 296 27 CFR Part 70 27 CFR Part 70 27 CFR Part 70 27 CFR Parts 70, 170, 296

HOME

Section 7801

Description Authority of Department of the Treasury

Location of Enforcement Regulations No Regulation 20 CFR Part 615; 26 CFR Parts 1-5, 5c, 5e, 5f, 6a, 7, 8, 9, 11-13, 14a, 15, 15a, 16, 16a, 17-20, 22, 25, 26, 27, 31, 32, 35, 35a, 36, 40, 41, 43-49, 52-55, 141, 143, 145, 148, 156, 301-303, 305, 400, 401, 403, 404, 420, 504, 505, 509-511, 514, 515, 601, 602, 701, 702; 27 Parts 3, 5, 17-22, 24, 25, 30, 70, 72, 170, 179, 194, 200, 250-252, 270, 275, 290, 295, 296 No Regulation No Regulation

7805

Rules and Regulations

7806 7809

Construction of title Deposit of collections

HOME

Section 1397 1402 1421(i)

Description Income tax laws of United States in force; payment of proceeds; levy of surtax on all taxpayers Extension of industrial alcohol and internal revenue laws to Virgin Islands Income tax No Regulation No Regulation 43 CFR Part 17

Location

HOME

Section 2 3 4 101 201 285 286 287 371 372 494 495 641 1001 1002 1073 1114 1501 1503 1510 1621 1622 1623 1955 1956 1962 1963 2071 2231 2232 2233 3290

Title 18 USC Criminal Investigation Enforcement Regulations Description Location Principals Accessory after the Fact Misprison of Felony Assaulting, Resisting, Impeding Certain Officers and Employees Bribery of Public Officials and Witnesses Taking or Using Papers Relating to Claims Conspiracy to Defraud the Government with Respect to Claims False. Fictitious, or Fraudulent Claims Conspiracy to Commit Offense or to Defraud United States Conspiracy to Impede or Injure Officer Contractor's Bonds, Bids, and Public Records Contracts, Deeds, and Power of Attorney Public Money, Property or Records Statements or Entries Generally Possession of False Papers to Defraud United States Flight to Avoid Prosecution or Giving Testimony Protection of Officers and Employees of the United States Assault on Process Server Influencing or Injuring Officer, Juror, or Witness Generally Obstruction of Criminal Investigations Perjury Generally Subordination of Perjury False, Declarations Before Grand Jury or Court Prohibition of Illegal Gambling Businesses Laundering of Monetary Instruments Prohibited Activities of Racketeer Influenced and Corrupt Organizations Criminal Penalties for Racketeer Influenced and Corrupt Organizations Concealment, Removal, or Mutilation Generally Assault or Resistance Destruction or Removal of Property to Prevent Seizure Rescue of Seized Property Fugitive From Justice No Regulation No Regulation No Regulation No Regulation No Regulation No Regulation No Regulation No Regulation No Regulation No Regulation No Regulation No Regulation 42 CFR Part 4; 43 CFR Part 8200; 49 CFR Part 801 7 CFR Part 1443; 32 CFR Part 525 No Regulation No Regulation 28 CFR Part 64 No Regulation No Regulation No Regulation No Regulation No Regulation No Regulation No Regulation 39 CFR Part 233 No Regulation No Regulation 49 CFR Part 801 No Regulation No Regulation No Regulation No Regulation

HOME

Das könnte Ihnen auch gefallen

- The Biggest Tax Court Mistake W MotionDokument5 SeitenThe Biggest Tax Court Mistake W MotionLysander VenibleNoch keine Bewertungen

- Civil Government of Virginia: A Text-book for Schools Based Upon the Constitution of 1902 and Conforming to the Laws Enacted in Accordance TherewithVon EverandCivil Government of Virginia: A Text-book for Schools Based Upon the Constitution of 1902 and Conforming to the Laws Enacted in Accordance TherewithNoch keine Bewertungen

- 2017 Commercial & Industrial Common Interest Development ActVon Everand2017 Commercial & Industrial Common Interest Development ActNoch keine Bewertungen

- Counsel For Trimont Real Estate Advisors, Inc. As Special ServicerDokument3 SeitenCounsel For Trimont Real Estate Advisors, Inc. As Special ServicerChapter 11 DocketsNoch keine Bewertungen

- You Are My Servant and I Have Chosen You: What It Means to Be Called, Chosen, Prepared and Ordained by God for MinistryVon EverandYou Are My Servant and I Have Chosen You: What It Means to Be Called, Chosen, Prepared and Ordained by God for MinistryNoch keine Bewertungen

- The Appropriations Law Answer Book: A Q&A Guide to Fiscal LawVon EverandThe Appropriations Law Answer Book: A Q&A Guide to Fiscal LawNoch keine Bewertungen

- Sony CX42 PDFDokument40 SeitenSony CX42 PDFJoyRoy100% (1)

- Social Security For Social JusticeDokument181 SeitenSocial Security For Social JusticenarayanaraoNoch keine Bewertungen

- The Handbook for Integrity in the Department of EnergyVon EverandThe Handbook for Integrity in the Department of EnergyNoch keine Bewertungen

- IRS Field Offices 2018 Criminal Investigation Annual ReportDokument127 SeitenIRS Field Offices 2018 Criminal Investigation Annual ReportSeniorNoch keine Bewertungen

- SS4 Fax 12 10 02Dokument2 SeitenSS4 Fax 12 10 02wealth2520Noch keine Bewertungen

- Complaint Form Ohio Supreme CourtDokument4 SeitenComplaint Form Ohio Supreme CourtVanessa EnochNoch keine Bewertungen

- US ConstitutionDokument21 SeitenUS ConstitutionAaron MonkNoch keine Bewertungen

- Vibes Media v. Digigraph - MeDokument8 SeitenVibes Media v. Digigraph - MePriorSmartNoch keine Bewertungen

- Recreational Flyer WashingtonDokument3 SeitenRecreational Flyer Washingtonsolution4theinnocentNoch keine Bewertungen

- The Terms Lien of SharesDokument6 SeitenThe Terms Lien of SharesAmit MakwanaNoch keine Bewertungen

- P ' L R 7-13 N C N - 3:10-cv-00257 (CRB) sf-2865557Dokument18 SeitenP ' L R 7-13 N C N - 3:10-cv-00257 (CRB) sf-2865557Equality Case FilesNoch keine Bewertungen

- Vehicle/Traffic: Doolan v. Carr, 125 US 618 City V Pearson, 181 Cal. 640Dokument1 SeiteVehicle/Traffic: Doolan v. Carr, 125 US 618 City V Pearson, 181 Cal. 640BeyNoch keine Bewertungen

- Tax Rates Description Tax Form Documentary Requirements Procedures Deadlines Related Revenue Issuances Codal Reference Frequently Asked QuestionsDokument10 SeitenTax Rates Description Tax Form Documentary Requirements Procedures Deadlines Related Revenue Issuances Codal Reference Frequently Asked Questionsshawn7800Noch keine Bewertungen

- International Association of Machinists ConstitutionDokument198 SeitenInternational Association of Machinists ConstitutionLaborUnionNews.comNoch keine Bewertungen

- Oregon Revised Statutes Division 479Dokument28 SeitenOregon Revised Statutes Division 479sparkyvagabondNoch keine Bewertungen

- 2012 Bar ExamsDokument22 Seiten2012 Bar ExamsVal Pierre O. Conde Jr.Noch keine Bewertungen

- Ohio SB 58Dokument7 SeitenOhio SB 58Nevin SmithNoch keine Bewertungen

- BRAUNING ESTATE 5262 County Road 3565 Ada, Oklahoma, Freewill Act and Deed ALL OTHERS ARE IN ADVERSE POSSDokument1 SeiteBRAUNING ESTATE 5262 County Road 3565 Ada, Oklahoma, Freewill Act and Deed ALL OTHERS ARE IN ADVERSE POSSMike BrownNoch keine Bewertungen

- Filed & Entered: United States Bankruptcy Court Central District of California Santa Ana DivisionDokument6 SeitenFiled & Entered: United States Bankruptcy Court Central District of California Santa Ana DivisionChapter 11 DocketsNoch keine Bewertungen

- Gresh v. MPayMe Partners - Complaint PDFDokument32 SeitenGresh v. MPayMe Partners - Complaint PDFMark JaffeNoch keine Bewertungen

- Letter: Hennepin County Attorney's Office in The Matter of The Death of Ivan Romero-OlivaresDokument5 SeitenLetter: Hennepin County Attorney's Office in The Matter of The Death of Ivan Romero-OlivaresMinnesota Public RadioNoch keine Bewertungen

- United States Post Offices Volume 6 The Mid AtlanticVon EverandUnited States Post Offices Volume 6 The Mid AtlanticNoch keine Bewertungen

- United States Bankruptcy Court Southern District of New YorkDokument4 SeitenUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsNoch keine Bewertungen

- Full Private Record/Commercial Agreement Regarding The DIMITRIS DAVID CLAYBORNE ESTATEDokument72 SeitenFull Private Record/Commercial Agreement Regarding The DIMITRIS DAVID CLAYBORNE ESTATE:meechamaka-seelife :allah100% (1)

- Wisconsin ConstitutionDokument65 SeitenWisconsin ConstitutionMaria ShankNoch keine Bewertungen

- Ohio Age of Consent LawsDokument2 SeitenOhio Age of Consent LawsErin LaviolaNoch keine Bewertungen

- Name Change Correction Form PDFDokument1 SeiteName Change Correction Form PDFSrimanthula SrikanthNoch keine Bewertungen

- Deed of SurrenderDokument10 SeitenDeed of SurrenderGhanshyam mishraNoch keine Bewertungen

- Judgment AssignmentDokument2 SeitenJudgment Assignmentolboy92Noch keine Bewertungen

- O'Donoghue v. United States, 289 U.S. 516 (1933)Dokument21 SeitenO'Donoghue v. United States, 289 U.S. 516 (1933)Scribd Government DocsNoch keine Bewertungen

- Fishing Rights CORDokument5 SeitenFishing Rights CORSamuel J. Tassia100% (1)

- First American Savings, Fa v. M & I Bank of Menomonee Falls Appeal of First American Savings, F.A, 865 F.2d 561, 1st Cir. (1989)Dokument8 SeitenFirst American Savings, Fa v. M & I Bank of Menomonee Falls Appeal of First American Savings, F.A, 865 F.2d 561, 1st Cir. (1989)Scribd Government DocsNoch keine Bewertungen

- Lighting the Way: Federal Courts, Civil Rights, and Public PolicyVon EverandLighting the Way: Federal Courts, Civil Rights, and Public PolicyNoch keine Bewertungen

- LCC Lawsuit Sameer ShahDokument50 SeitenLCC Lawsuit Sameer ShahMike EllisNoch keine Bewertungen

- Form 8-K: Current Report Pursuant To Section 13 OR 15 (D) of The Securities Exchange Act of 1934Dokument22 SeitenForm 8-K: Current Report Pursuant To Section 13 OR 15 (D) of The Securities Exchange Act of 1934Sakan PoolsawatkitikoolNoch keine Bewertungen

- Deed of ExchangeDokument3 SeitenDeed of ExchangeVetritheivu KavanurNoch keine Bewertungen

- 37-2013-00078268-Cu-Bt-Ctl Roa-1 12-04-13 Complaint 1386637937306Dokument118 Seiten37-2013-00078268-Cu-Bt-Ctl Roa-1 12-04-13 Complaint 1386637937306api-218643948Noch keine Bewertungen

- Winslow Township - Commerical Lien - Affidavit of ObligationDokument1 SeiteWinslow Township - Commerical Lien - Affidavit of ObligationJ. F. El - All Rights ReservedNoch keine Bewertungen

- LOCAL NON-FILERS-7-26-2012: Filer - Id First Middle - Last Name - Suffix Title Organization Suborg - NameDokument60 SeitenLOCAL NON-FILERS-7-26-2012: Filer - Id First Middle - Last Name - Suffix Title Organization Suborg - NameIntegrity FloridaNoch keine Bewertungen

- Ohio Civil ProcedureDokument247 SeitenOhio Civil Procedurebconawa1Noch keine Bewertungen

- SEC v. Babikian Doc 40 Filed 23 May 14Dokument3 SeitenSEC v. Babikian Doc 40 Filed 23 May 14scion.scionNoch keine Bewertungen

- Billingsley ComplaintDokument12 SeitenBillingsley ComplaintJimmy ElliottNoch keine Bewertungen

- Disclaimer, n.1. A Renunciation of One's Legal Right or Claim Esp., A Renunciation of ADokument1 SeiteDisclaimer, n.1. A Renunciation of One's Legal Right or Claim Esp., A Renunciation of Ageoraw9588Noch keine Bewertungen

- What Is A MortgageDokument6 SeitenWhat Is A MortgagekrishnaNoch keine Bewertungen

- Land of Oppression Instead of Land of OpportunityVon EverandLand of Oppression Instead of Land of OpportunityNoch keine Bewertungen

- QuestionDokument2 SeitenQuestionJannahAimiNoch keine Bewertungen

- Electronic Structure and the Periodic Table: Essential Chemistry Self-Teaching GuideVon EverandElectronic Structure and the Periodic Table: Essential Chemistry Self-Teaching GuideNoch keine Bewertungen

- Social Security Solvency and ReformDokument5 SeitenSocial Security Solvency and Reformapi-242431676Noch keine Bewertungen

- J.H U.S.A.G. Complaint - 10-3-2016Dokument43 SeitenJ.H U.S.A.G. Complaint - 10-3-2016iamnumber8100% (1)

- The Federal Reserve SystemDokument48 SeitenThe Federal Reserve Systemiamnumber8100% (1)

- JH Notice To Samson 7-11-2017Dokument60 SeitenJH Notice To Samson 7-11-2017iamnumber8100% (2)

- App For Ss Number Ss-5Dokument5 SeitenApp For Ss Number Ss-5iamnumber8100% (1)

- Hardin Family SF95 Form Submission 4-4-2017Dokument38 SeitenHardin Family SF95 Form Submission 4-4-2017EheyehAsherEheyehNoch keine Bewertungen

- Form - Ssa521Dokument1 SeiteForm - Ssa521iamnumber8Noch keine Bewertungen

- Victims of Terrorism-Standards For AssistanceDokument15 SeitenVictims of Terrorism-Standards For Assistanceiamnumber8Noch keine Bewertungen

- JH Rico-Bivens Evidence U.S. Atty - Dst. Co. Part 2-9-28-2016Dokument26 SeitenJH Rico-Bivens Evidence U.S. Atty - Dst. Co. Part 2-9-28-2016iamnumber8Noch keine Bewertungen

- J.H U.S.A.G. Complaint - 10-3-2016Dokument43 SeitenJ.H U.S.A.G. Complaint - 10-3-2016iamnumber8Noch keine Bewertungen

- B.H. Dental EvidenceDokument1 SeiteB.H. Dental Evidenceiamnumber8Noch keine Bewertungen

- The TRUMPETS of Judicium Dei 8-8-2016Dokument243 SeitenThe TRUMPETS of Judicium Dei 8-8-2016iamnumber8Noch keine Bewertungen

- Hardin's 2004 and 2008 Poisonings With Evidence and Medical RecordsDokument84 SeitenHardin's 2004 and 2008 Poisonings With Evidence and Medical Recordsiamnumber8100% (1)

- JH Rico-Bivens Evidence U.S. Atty - Dst. Co. 9-28-2016Dokument62 SeitenJH Rico-Bivens Evidence U.S. Atty - Dst. Co. 9-28-2016iamnumber8Noch keine Bewertungen

- Julia and Puppy NecropsyDokument10 SeitenJulia and Puppy Necropsyiamnumber8Noch keine Bewertungen

- ICC - Hardin Fam. Records of Bio. Poisonings 2007-2008Dokument59 SeitenICC - Hardin Fam. Records of Bio. Poisonings 2007-2008iamnumber8Noch keine Bewertungen

- OPCWDokument128 SeitenOPCWiamnumber8100% (1)

- Director General O.P.C.W.Dokument37 SeitenDirector General O.P.C.W.iamnumber8100% (1)

- ICC - Hardin Fam. Cypress Bio. Claim Evidence 07-08 - Part 2Dokument115 SeitenICC - Hardin Fam. Cypress Bio. Claim Evidence 07-08 - Part 2iamnumber8100% (1)

- ICC - Hardin's Poisoning and Berrettini Case Ties To Bushes and US-UK Tax Treaty - Part 2Dokument84 SeitenICC - Hardin's Poisoning and Berrettini Case Ties To Bushes and US-UK Tax Treaty - Part 2iamnumber8Noch keine Bewertungen

- ICC - Hardin DOJ Complaint - Poison and Banking Fraud - TomballDokument88 SeitenICC - Hardin DOJ Complaint - Poison and Banking Fraud - Tomballiamnumber8Noch keine Bewertungen

- JH Request For Criminal Grand Jury InvestigationDokument89 SeitenJH Request For Criminal Grand Jury Investigationiamnumber8Noch keine Bewertungen

- Is This Oil Spilling On Bolivar PenninsulaDokument2 SeitenIs This Oil Spilling On Bolivar Penninsulaiamnumber8100% (1)

- A - Kemper Mail Recpt. Claim Dockuments 9-26-2012Dokument11 SeitenA - Kemper Mail Recpt. Claim Dockuments 9-26-2012iamnumber8Noch keine Bewertungen

- ICC - Hardin Fam. Cypress Bio. Claim Evidence 07-08 - Part 1 of 2Dokument122 SeitenICC - Hardin Fam. Cypress Bio. Claim Evidence 07-08 - Part 1 of 2iamnumber8Noch keine Bewertungen

- ICC - Hardin Fam. Cypress Bio. Claim Evidence 07-08 - Part 3Dokument49 SeitenICC - Hardin Fam. Cypress Bio. Claim Evidence 07-08 - Part 3iamnumber8Noch keine Bewertungen

- Cope Terror InjuredDokument8 SeitenCope Terror Injurediamnumber8Noch keine Bewertungen

- FBI - Victims Coping With TerrorDokument8 SeitenFBI - Victims Coping With Terroriamnumber8Noch keine Bewertungen

- Rules of Procedure and Evidence English (ICC)Dokument94 SeitenRules of Procedure and Evidence English (ICC)John Vincent Alayon BedrioNoch keine Bewertungen

- Permit - Texas General Land OfficeDokument20 SeitenPermit - Texas General Land Officeiamnumber8Noch keine Bewertungen

- ICC Elements of Crimes PDFDokument50 SeitenICC Elements of Crimes PDFKaye de LeonNoch keine Bewertungen

- 3 - Commissioner of Internal Revenue Vs - Liquigaz PhilippinesDokument30 Seiten3 - Commissioner of Internal Revenue Vs - Liquigaz PhilippinesAnne sherly OdevilasNoch keine Bewertungen

- 27 - Hotel Specialist Tagaytay Inc. v..20210505-11-1fg6pgfDokument23 Seiten27 - Hotel Specialist Tagaytay Inc. v..20210505-11-1fg6pgfPio Vincent BuencaminoNoch keine Bewertungen

- C.T.A. CASE NO. 8935. January 10, 2018 PDFDokument2 SeitenC.T.A. CASE NO. 8935. January 10, 2018 PDFnathalie velasquezNoch keine Bewertungen

- CIR V Marubeni CorporationDokument5 SeitenCIR V Marubeni CorporationJosef MacanasNoch keine Bewertungen

- US Internal Revenue Service: p1582Dokument27 SeitenUS Internal Revenue Service: p1582IRS100% (9)

- 2017 Case Digests - TaxationDokument58 Seiten2017 Case Digests - TaxationedreaNoch keine Bewertungen

- Aznar vs. Court of Tax Appeals GR No. 20569, 23 August 1974Dokument6 SeitenAznar vs. Court of Tax Appeals GR No. 20569, 23 August 1974Mai ReamicoNoch keine Bewertungen

- US Internal Revenue Service: I1028Dokument2 SeitenUS Internal Revenue Service: I1028IRSNoch keine Bewertungen

- Republic Act No. 1125Dokument8 SeitenRepublic Act No. 1125Jazlynn WongNoch keine Bewertungen

- Republic of The Philippines Manila: Supreme CourtDokument9 SeitenRepublic of The Philippines Manila: Supreme CourtElisa Dela FuenteNoch keine Bewertungen

- CIR V Philippine Global CommunicationDokument3 SeitenCIR V Philippine Global CommunicationdorianNoch keine Bewertungen

- Letter To An IRS DirectorDokument74 SeitenLetter To An IRS DirectorLars Nielsen85% (33)

- Cir v. LancasterDokument2 SeitenCir v. LancasterGlyza Kaye Zorilla PatiagNoch keine Bewertungen

- Kollel Pay Article - HamodiaDokument2 SeitenKollel Pay Article - HamodiaJudah KupferNoch keine Bewertungen

- HealthySFMRA - 03001 - San Francisco MRA Claim FormDokument3 SeitenHealthySFMRA - 03001 - San Francisco MRA Claim FormlepeepNoch keine Bewertungen

- Revenue Memorandum Circular No. 19-95Dokument8 SeitenRevenue Memorandum Circular No. 19-95Carla GrepoNoch keine Bewertungen

- Steag State Power Inc. v. CIRDokument10 SeitenSteag State Power Inc. v. CIRClarence ProtacioNoch keine Bewertungen

- Estrada vs. Sandiganbayan (Jurisdiction) Facts: Office of The Ombudsman's RulingDokument11 SeitenEstrada vs. Sandiganbayan (Jurisdiction) Facts: Office of The Ombudsman's RulingJMXNoch keine Bewertungen

- Tax RemediesDokument5 SeitenTax RemediesCherrelyne AlmazanNoch keine Bewertungen

- M. Construction and Interpretation I. Cir vs. Puregold Duty Free, Inc. G.R. NO. 202789, JUNE 22, 2015Dokument3 SeitenM. Construction and Interpretation I. Cir vs. Puregold Duty Free, Inc. G.R. NO. 202789, JUNE 22, 2015Marry LasherasNoch keine Bewertungen

- BIR RR 17-2010 (Criteria For LTS)Dokument11 SeitenBIR RR 17-2010 (Criteria For LTS)raphael alexis reyesNoch keine Bewertungen

- Pree-Offset Notice - ABH-122009-PON101 PDFDokument1 SeitePree-Offset Notice - ABH-122009-PON101 PDFAllen-nelson of the Boisjoli family100% (8)

- PM Reyes Tax Audit Assessment Primer PDFDokument6 SeitenPM Reyes Tax Audit Assessment Primer PDFAnge Buenaventura SalazarNoch keine Bewertungen

- American Atheist Magazine March 1979Dokument44 SeitenAmerican Atheist Magazine March 1979American Atheists, Inc.Noch keine Bewertungen

- G.R. No. 187485Dokument61 SeitenG.R. No. 187485Adora EspadaNoch keine Bewertungen

- Information Referral: Section A - Information About The Person or Business You Are ReportingDokument3 SeitenInformation Referral: Section A - Information About The Person or Business You Are ReportingAndrea BradleyNoch keine Bewertungen

- Business Expenses PDFDokument53 SeitenBusiness Expenses PDFSniNoch keine Bewertungen

- 2010 BAR QuestionsDokument74 Seiten2010 BAR QuestionsJoshua Elli BajadaNoch keine Bewertungen

- 1 Cebu Portland Vs CTADokument5 Seiten1 Cebu Portland Vs CTAvendetta scrubNoch keine Bewertungen

- Donor's Tax CasesDokument28 SeitenDonor's Tax CasesStevensonYuNoch keine Bewertungen