Beruflich Dokumente

Kultur Dokumente

Net Working Capital and Cash Flows

Hochgeladen von

Refger RgwseOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Net Working Capital and Cash Flows

Hochgeladen von

Refger RgwseCopyright:

Verfügbare Formate

NET WORKING CAPITAL AND CASH FLOWS

The following example is designed to shed some light on the correct handling of net working capital cash flows in project valuation, i.e., NPV analysis. You are the proprietor of a mythical firm that has a two day life. You sell !eer on the !each. You hire la!or for "#$ per day. You want "%$$$ in inventory at the !eginning of each day and to sell your entire inventory daily. You prefer to stock out of inventory rather than providing storage overnight. Your inventory must !e paid for in cash at delivery at the start of each day. You have a %$$& mark up. 't the start of the first day, t($, you pay for your first "%$$$ in inventory. This sum represents your net working capital outlay at t($ )note* no current lia!ilities are created to fund this increase in inventory, e.g., no accounts paya!le+. The end of day % and the !eginning of day two are !oth la!eled t(%. The end of day two is t(,. Your daily income statements are as follows* -ay % .ales /0. 01 2a!or 34T Tax )#$&+ 3'T ",$$$ %$$$ "%$$$ #$ "5#$ 67# "67# "5#$ 67# "67# -ay , ",$$$ %$$$ "%$$$ #$

Your daily cash flow pattern looks as follows* t=0 t=1 t=2 88888888888888888888888888888888888888888888888888888888888888888888888888888 8 Cash Inflows ",$$$ )/ash .ales+ ",$$$ )/ash .ales+ Cash D!s"#$s%&%nts "%$$$ )9nv+ "%$$$ )9nv+ #$ ):ages+ #$ ):ages+ 67# )Tax+ 67# )Tax+

1

8888888 N%t Cash

888888

888888 '(1000) (*+, (1*+,

Flow

Your daily net working capital cash flow pattern is as follows* N%t W-C O#t N%t W-C In

t=0 t=1 t=2 888888888888888888888888888888888888888888 N%t Wo$.!n/ Ca0!tal Cash Flow 'NWC) 't time t($ we invested in Net :orking /apital in the amount of "%,$$$. 't t(, we recapture this investment in Net :orking /apital as our inventory is changed from "%,$$$ at time t(% to "$ at time t(,. Note that if we now com!ine the income statements and the negative of the changes in Net :orking /apital we can recreate the actual cash flow pattern for times t($, t(%, and t(,. The a!ove example extrapolates to the general procedure that we will follow of <flowing out= the net working capital for a project at t($ and <flowing in= the investment in net working capital at the conclusion of the projects life, in this case t(,. This will make more sense later in the class. 9t is important to introduce it now when we first start to talk a!out finding >/> so we don?t create early confusions. Note, however, that if we could charge the inventory for one day, i.e., create an accounts paya!le for one day, the cash flow picture would drastically change. The effective net working capital would !e @ero, i.e., current assets, or inventory, would eAual current lia!ilities, or accounts paya!le. Therefore, the net cash flows would !e "67# at !oth t(% and t(, with no cash flow at t($. :hat would !e the net cash flow !y period if we could charge one half of the inventory for each time periodB )'s a check, your answer should !e as follows* t($ ( "#$$C t(%( "67#, t(,( "57#.+ 1y experience indicates that the correct handling of net working capital cash flows for project or firm valuation is a significant mystery for students. Please see me if this example does not clear up the pu@@le for youD ;"%$$$ $ "%$$$

Das könnte Ihnen auch gefallen

- The Garden Spot 1Dokument25 SeitenThe Garden Spot 1Saad Arain0% (1)

- Assignment 3Dokument5 SeitenAssignment 3aklank_218105Noch keine Bewertungen

- Financial Plan TemplateDokument23 SeitenFinancial Plan TemplateKosong ZerozirizarazoroNoch keine Bewertungen

- Acc 501 Midterm Solved Papers Long Questions SolvedDokument34 SeitenAcc 501 Midterm Solved Papers Long Questions SolvedAbbas Jafri33% (3)

- Case 01a Growing Pains SolutionDokument7 SeitenCase 01a Growing Pains Solution01dynamic33% (3)

- 184733Dokument2 Seiten184733Rosemarie AgcaoiliNoch keine Bewertungen

- 4 Step Trading Protocol Discretionary FrameworkDokument42 Seiten4 Step Trading Protocol Discretionary Frameworkfake.mNoch keine Bewertungen

- Net Working Capital and Cash Flows: T 0 T 1 T 2 Cash InflowsDokument3 SeitenNet Working Capital and Cash Flows: T 0 T 1 T 2 Cash InflowsAniket KaushikNoch keine Bewertungen

- Review For Midterm (Project Mana) 102021Dokument37 SeitenReview For Midterm (Project Mana) 102021Tam MinhNoch keine Bewertungen

- SM Chapter 06Dokument42 SeitenSM Chapter 06mfawzi010Noch keine Bewertungen

- Materials Management (MM) Case StudyDokument21 SeitenMaterials Management (MM) Case StudyaniketparekhNoch keine Bewertungen

- Future Value of MoneyDokument11 SeitenFuture Value of Moneyaymanmomani2111Noch keine Bewertungen

- Discounted Cash Flow AnalysisDokument12 SeitenDiscounted Cash Flow Analysisaymanmomani2111Noch keine Bewertungen

- Solution 2011Dokument16 SeitenSolution 2011Krutika MehtaNoch keine Bewertungen

- Financial Statements, Cash Flows, and Taxes: Homework ForDokument9 SeitenFinancial Statements, Cash Flows, and Taxes: Homework Foradarshdk1Noch keine Bewertungen

- Error CDokument20 SeitenError CkleeNoch keine Bewertungen

- FM11 CH 16 Mini-Case Cap Structure DecDokument11 SeitenFM11 CH 16 Mini-Case Cap Structure DecAndreea VladNoch keine Bewertungen

- Adjusted Present Value:) Wacc 1 (CF) Wacc 1 (CF) Wacc 1 (CF Investment NPVDokument3 SeitenAdjusted Present Value:) Wacc 1 (CF) Wacc 1 (CF) Wacc 1 (CF Investment NPVAnonymous qAegy6GNoch keine Bewertungen

- A Memo To The Celsius Community. We Are Writing With A Very Important - by Celsius - Jun, 2022 - MeDokument1 SeiteA Memo To The Celsius Community. We Are Writing With A Very Important - by Celsius - Jun, 2022 - MeYevgeniy FeldmanNoch keine Bewertungen

- W 10 Midterm1 SolutionDokument13 SeitenW 10 Midterm1 SolutionSehoon OhNoch keine Bewertungen

- Principles of Finance Work BookDokument53 SeitenPrinciples of Finance Work BookNicole MartinezNoch keine Bewertungen

- Big V Telecom BrochureDokument4 SeitenBig V Telecom BrochurejericvazNoch keine Bewertungen

- How Does ??? Impact The Three Financial Statements?: What Is APV?? Adjusted Present ValueDokument3 SeitenHow Does ??? Impact The Three Financial Statements?: What Is APV?? Adjusted Present ValueSaakshi AroraNoch keine Bewertungen

- Multiple Choice Questions: Appendix II 81Dokument7 SeitenMultiple Choice Questions: Appendix II 81Smile LyNoch keine Bewertungen

- Unit VI Part 1 General Journal, General Ledger, Trial BalanceDokument20 SeitenUnit VI Part 1 General Journal, General Ledger, Trial BalancePatrick BernilNoch keine Bewertungen

- Accounting For Merchandising BusinessesDokument106 SeitenAccounting For Merchandising BusinessesKel TranNoch keine Bewertungen

- Capital Budgeting - The Basics: ACTSC 372: Corporate FinanceDokument34 SeitenCapital Budgeting - The Basics: ACTSC 372: Corporate FinanceClaire ZhangNoch keine Bewertungen

- Introduction To Finance: Chapters 9 - 11Dokument15 SeitenIntroduction To Finance: Chapters 9 - 11Xinxin KuangNoch keine Bewertungen

- Chapter 10 Quiz 1: 100% (22 Out of 22 Correct)Dokument10 SeitenChapter 10 Quiz 1: 100% (22 Out of 22 Correct)im_donnavierojoNoch keine Bewertungen

- Mcs Merged Doc 2009.Dokument137 SeitenMcs Merged Doc 2009.Nimish DeshmukhNoch keine Bewertungen

- Project ScreeningDokument19 SeitenProject ScreeningnuvanNoch keine Bewertungen

- Graphing Exponential FunctionsDokument11 SeitenGraphing Exponential FunctionsspreemouseNoch keine Bewertungen

- Capital BudgetingDokument32 SeitenCapital BudgetingKonstantinos DelaportasNoch keine Bewertungen

- FIN515 Week 2 Homework AssignmentDokument6 SeitenFIN515 Week 2 Homework AssignmentNatasha DeclanNoch keine Bewertungen

- Managementul Riscului de Rata de DobandaDokument8 SeitenManagementul Riscului de Rata de DobandaCristina BoboacăNoch keine Bewertungen

- Management Question 2Dokument2 SeitenManagement Question 2RakeshJoshiNoch keine Bewertungen

- Calculos ROIDokument23 SeitenCalculos ROIjfelix_aranaNoch keine Bewertungen

- Ratio Analysis On Dhaka BankDokument8 SeitenRatio Analysis On Dhaka Banktoxictouch100% (1)

- Earned Value Tutorial ForBPMDokument12 SeitenEarned Value Tutorial ForBPMNurain AliNoch keine Bewertungen

- SAP in House CashDokument3 SeitenSAP in House CashpaiashokNoch keine Bewertungen

- Module 3 QRG v1Dokument1 SeiteModule 3 QRG v1totiNoch keine Bewertungen

- Chapter08 KGWDokument24 SeitenChapter08 KGWMir Zain Ul HassanNoch keine Bewertungen

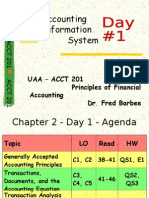

- Accounting Information System: Uaa - Acct 201 Principles of Financial Accounting Dr. Fred BarbeeDokument55 SeitenAccounting Information System: Uaa - Acct 201 Principles of Financial Accounting Dr. Fred BarbeeyenzelNoch keine Bewertungen

- Chapter - 4 - Cash Flow and InterestDokument19 SeitenChapter - 4 - Cash Flow and InterestAhmed freshekNoch keine Bewertungen

- Revision 2 - Investment Appraisal: Topics ListDokument35 SeitenRevision 2 - Investment Appraisal: Topics ListKashif MehmoodNoch keine Bewertungen

- Explanation of How The Model Was CreatedDokument2 SeitenExplanation of How The Model Was CreatedJasmine Bianca CastilloNoch keine Bewertungen

- CHAPTER 6: Some Alternative Investment Rules: 1. Internal Rate of Return (Irr)Dokument7 SeitenCHAPTER 6: Some Alternative Investment Rules: 1. Internal Rate of Return (Irr)m_hugesNoch keine Bewertungen

- Revision 2 - Investment AppraisalDokument35 SeitenRevision 2 - Investment Appraisalsamuel_dwumfourNoch keine Bewertungen

- Chap 003Dokument11 SeitenChap 003Sercan DemirNoch keine Bewertungen

- SUMMATIVE Assessment II March 2010 Design of The Question PaperDokument10 SeitenSUMMATIVE Assessment II March 2010 Design of The Question PaperSanthosh KammamNoch keine Bewertungen

- NPVDokument5 SeitenNPVsome_one372Noch keine Bewertungen

- Shapiro CHAPTER 2 SolutionsDokument14 SeitenShapiro CHAPTER 2 SolutionsPradeep HemachandranNoch keine Bewertungen

- CH 1Dokument25 SeitenCH 1abdullah18hashimNoch keine Bewertungen

- Chapter 5 Present Worth AnalysisDokument82 SeitenChapter 5 Present Worth Analysisيوسف محمدNoch keine Bewertungen

- Session 10 Cash Flow EsimationDokument52 SeitenSession 10 Cash Flow EsimationAsselek AskarovaNoch keine Bewertungen

- Place Mouse Here For Instructions: Cash Gap Days WorksheetDokument4 SeitenPlace Mouse Here For Instructions: Cash Gap Days WorksheetWalter Morales NeyreNoch keine Bewertungen

- Capital BudgetingDokument34 SeitenCapital BudgetingHija S YangeNoch keine Bewertungen

- Avery Ratio CaseDokument5 SeitenAvery Ratio Casepsu0168Noch keine Bewertungen

- An MBA in a Book: Everything You Need to Know to Master Business - In One Book!Von EverandAn MBA in a Book: Everything You Need to Know to Master Business - In One Book!Noch keine Bewertungen

- High-Q Financial Basics. Skills & Knowlwdge for Today's manVon EverandHigh-Q Financial Basics. Skills & Knowlwdge for Today's manNoch keine Bewertungen

- Economic & Budget Forecast Workbook: Economic workbook with worksheetVon EverandEconomic & Budget Forecast Workbook: Economic workbook with worksheetNoch keine Bewertungen

- Rental-Property Profits: A Financial Tool Kit for LandlordsVon EverandRental-Property Profits: A Financial Tool Kit for LandlordsNoch keine Bewertungen

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsVon EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNoch keine Bewertungen

- Classification of AccountsDokument12 SeitenClassification of AccountsNaurah Atika DinaNoch keine Bewertungen

- Predicting Bankruptcy Through Financial Statement AnalysisDokument21 SeitenPredicting Bankruptcy Through Financial Statement AnalysisRashed TariqueNoch keine Bewertungen

- Chapter 7 Chap SevenDokument11 SeitenChapter 7 Chap SevenRanShibasaki50% (2)

- Rathna Bitotch - ProjectDokument14 SeitenRathna Bitotch - ProjectM SeshadriNoch keine Bewertungen

- Vdocuments - MX - Obligations Contracts Memory AidDokument24 SeitenVdocuments - MX - Obligations Contracts Memory AidMarie Lourence AngelesNoch keine Bewertungen

- Contract of Guarantee: Sanjay BangDokument39 SeitenContract of Guarantee: Sanjay BangShivangi SaxenaNoch keine Bewertungen

- Ethics - Summary of Selected Examples - Standards of Practice Handbook - 11th EdDokument22 SeitenEthics - Summary of Selected Examples - Standards of Practice Handbook - 11th EdKailash Kaju100% (1)

- MMS III Finance SyllabusDokument30 SeitenMMS III Finance SyllabusHardik ThakkarNoch keine Bewertungen

- NBFC NotesDokument2 SeitenNBFC NotesHemavathy Gunaseelan100% (1)

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDokument30 SeitenDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDevisNoch keine Bewertungen

- Bookkeeping NC 3 Review GuideDokument6 SeitenBookkeeping NC 3 Review GuideCatherine Hidalgo100% (1)

- 2017documentary Requirements Lending Company Head OfficeDokument1 Seite2017documentary Requirements Lending Company Head OfficeLawrence PiNoch keine Bewertungen

- Unit-1Financial Credit Risk AnalyticsDokument40 SeitenUnit-1Financial Credit Risk AnalyticsAkshitNoch keine Bewertungen

- Moody - S Credit Opinion FleuryDokument12 SeitenMoody - S Credit Opinion FleuryMr BrownstoneNoch keine Bewertungen

- Audit Practice Manual - IndexDokument4 SeitenAudit Practice Manual - IndexIftekhar IfteNoch keine Bewertungen

- Top 100 CompaniesDokument148 SeitenTop 100 CompaniesNavin ChandarNoch keine Bewertungen

- Report Financial ManagementDokument30 SeitenReport Financial ManagementRishelle Mae C. AcademíaNoch keine Bewertungen

- Accounting Quetion Paper 2022Dokument12 SeitenAccounting Quetion Paper 2022Almeida Carlos MassingueNoch keine Bewertungen

- Journal EntriesDokument12 SeitenJournal Entriesg81596262Noch keine Bewertungen

- RWJ Chapter 1 - EUDokument17 SeitenRWJ Chapter 1 - EULokkhi BowNoch keine Bewertungen

- Alternative Sources of Finance, Private and Social Cost Benefit - RBI Grade B 2018Dokument22 SeitenAlternative Sources of Finance, Private and Social Cost Benefit - RBI Grade B 2018prashant soniNoch keine Bewertungen

- Change in Estimate and Error Correction Holtzman Company Is in PDFDokument1 SeiteChange in Estimate and Error Correction Holtzman Company Is in PDFAnbu jaromiaNoch keine Bewertungen

- Chapter 22Dokument8 SeitenChapter 22GONZALES, MICA ANGEL A.Noch keine Bewertungen

- Tata AIG Motor Policy Schedule 3189 6301019675-00Dokument5 SeitenTata AIG Motor Policy Schedule 3189 6301019675-00BOC ClaimsNoch keine Bewertungen

- AXIS BANK Statement For February 2021-1Dokument5 SeitenAXIS BANK Statement For February 2021-1Vijay ShanigarapuNoch keine Bewertungen

- Obligasi - PembahasanDokument18 SeitenObligasi - Pembahasangaffar aimNoch keine Bewertungen

- Module 3 - Different Kinds of ObligationsDokument62 SeitenModule 3 - Different Kinds of ObligationsZee GuillebeauxNoch keine Bewertungen