Beruflich Dokumente

Kultur Dokumente

Equity Weekly

Hochgeladen von

naudaslietasOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Equity Weekly

Hochgeladen von

naudaslietasCopyright:

Verfügbare Formate

Equity Weekly

Equity Research - Monday, August 10, 2009

Index value Weekly Change,% Weekly Turnover

Baltic Indices

280 Estonia 321.6 7.95% €2,5m

265 Last week the OMXT index improved by 7.95% W-o-W and ended the week at

321.6 points. The weekly turnover, which was mostly the result of retail activity,

reached €2.5m. Interest in Ekspress Grupp (+34.4% W-o-W) and Tallinna

250

Kaubamaja (+23.6% W-o-W) was stronger than usually. Somewhat higher

activity was seen in Olympic Entertainment Group (+15.1% W-o-W), Baltika

235 AS (0% W-o-W) and Norcedon International AS (+7.1% W-o-W) as well.

220

Latvia 268.5 3.80% €94,5k

205

7-May 21-May 4-Jun 18-Jun 2-Jul 16-Jul 30-Jul

Market remained quiet as total weekly turnover amounted just LVL 66k, however

Baltic Benchmark OMX Tallinn* market finished week on positive note, OMX Riga index adding 3.80% to 268.46

OMX Riga* OMX Vilnius* points. The most actively traded share and biggest gainer was Liepajas

* Relativ e to Baltic Benchmark Source: Reuters, Swedbank Metalurgs which rose by 21.43% to LVL 1.02 thanks to some buying interest

from retail and a bigger buyer. Other shares had smaller turnover.

Last Weekly Weekly P/E P/BV

Estonia (in €) Close Change Volume Trail. 4Q 09F Last Q 09F

Lithuania 209.5 8.17% €3,3m

Arco Vara 0.15 15.4% 470684 -0.2 -1.9 0.3 0.4

Baltika 0.55 0.0% 315831 -1.3 -2.0 0.8 0.7

Eesti Telekom 4.51 4.9% 84564 7.7 9.5 3.0 2.5 The OMXV performed well last week also. The index improved by 8.17% W-o-W

Ekspress Grupp 0.82 34.4% 41120 4.9 3.6 0.4 0.3 and closed at 209.5 points on Friday.

Harju Elekter 1.70 8.3% 24332 21.1 21.6 1.1 1.1 Reporting season of 2Q results on the way. Again, TEO LT was by far the most

Järvevana 0.28 7.7% 34597

liquid stock in the Baltics: the stock gained 5.6% W-o-W and closed at LTL 1.32.

Merko Ehitus 3.80 13.4% 66754 13.2 -29.6 0.5 0.5

Financial stocks were popular as well: Ukio Bankas closed 1.43% up at LTL

Nordecon International 0.91 7.1% 170923 4.1 -17.2 0.6 0.6

Norma 2.67 2.7% 2794 9.0 -26.3 0.6 0.6

0.71, while Snoras closed flat at LTL 0.59.

Olympic Entertainment Group 0.61 15.1% 128394 -3.2 -28.9 0.8 0.7

Silvano Fashion Group 0.42 20.0% 261163 -1.5 -31.0 0.5 0.4

Tallink

Tallinna Kaubamaja

0.34

3.51

9.7%

23.6%

1375729

83800

49.3

-61.3

-36.3

371.3

0.4

1.3

0.3

1.2 Estonia

Tallinna Vesi 8.35 -0.6% 41897 8.9 9.0 2.2 1.9

Viisnurk 0.46 4.5% 163794 137.2 2.9 0.5 0.4

Last Weekly Weekly P/E P/BV Olympic Entertainment Group published Q2 figures, notably the revenue

Latvia (in LVL) Close Change Volume Trail. 4Q 09F Last Q 09F fall has stabilized after sharp drop in Q1, but the Baltic gaming market still

Grindeks 3.73 0.8%

6.4%

2210 4.0 5.4 0.8 0.7

looks problematic, which limits upside potential as nearly 2/3 sales comes

Latvian Gas 4.31 2566 8.5 0.6

Latvian Shipping Company 0.49 4.3% 12484 1.9 1.4 0.2 0.2 from that region. Sales reached € 30.4m, down 31.7% Y-o-Y, and net loss in

Latvijas Balzams 1.30 0.0% 1004 4.4 0.3 Q2 amounted to €16m. Losses from liquidating of Ukraine business are

Liepajas Metalurgs 1.02 21.4% 14427 0.9 0.2

booked at around €13m after 1H09. We do not exclude possibility of smaller

Olainfarm 0.62 0.0% 11428 -7.7 24.9 0.6 0.5

SAF Tehnika 0.60 -13.0% 5310 -2.0 0.9 0.2 0.2

write downs related to equipment disposal/sale in 2H.

Valmiera Fibre Glass 0.36 5.9% 10390 0.7 0.3

Ventspils Nafta 0.97 -3.0% 4502 2.8 0.3

Harju Elekter (HAE) published its Q2 2009 results which were mostly in line

Last Weekly Weekly P/E P/BV with our forecasts. Total sales declined by 27.2% Y-o-Y to €11m in Q2. In

Lithuania (in LT L) Close Change Volume Trail. 4Q 09F Last Q 09F 1H the revenue amounted to €22.6m, down by 19.6% Y-o-Y. The net profit

Apranga

City Service

2.05

5.37

8.5%

0.0%

176316

22876

15.8

9.4

-3.1

6.4

0.8

1.6

0.8

1.3

reached €0.5m in Q2 (-60% Y-o-Y) and the respective margin declined from

Grigiskes 0.57 -1.7% 363456 -7.5 0.5 7.4% in Q2 2008 to 4.1% in Q2 2009.

Invalda 1.47 0.7% 87943 -0.5 0.4

Klaipedos Nafta 0.97 2.1% 282884 12.3 0.8 Ekspress Grupp (EEG) published its Q2 2009 results which were weaker

Lietuvos Dujos 1.55 17.4% 367490 18.2 11.6 0.4 0.4 than expected. Group sales fell over 22% Y-o-Y to €17.2m in Q2 and by

Lietuvos Energija 2.10 2.4% 122913 -40.1 0.5 20.2% to €34.1m in H1 2009. EEG ended the Q2 in profit in amount of

Lietuvos Juru Laivininkyste

Lifosa

0.38 0.0%

27.30 4.2%

78513

8845

-1.9

3.6

0.4

0.7

€262k (-80.7% Y-o-Y). The half-year result ended in the red (€-862k, -142%

Panevezio Statybos Trestas 2.57 2.8% 162750 1.4 0.4 Y-o-Y) due to a higher loss recorded in Q1 2009.

Pieno Zvaigzdes 2.41 -3.6% 14990 15.5 4.3 0.9 0.8

Rokishkio Suris 2.20 -0.9% 9154 -9.7 0.5 Merko Ehitus (MRK) posted its Q2 2009 figures which were better than

RST 2.02 22.4% 193673 -11.4 0.4 expected both in terms of top and bottom line. Total sales of the company

Sanitas 7.50 -2.6% 3326 -9.2 0.9

amounted to €53.6m in Q2 2009, down by 33.1% Y-o-Y. Due to the difficult

Siauliu Bankas 0.73 4.3% 475114 3.0 0.5

Snaige 0.45 12.5% 1304141 -0.4 0.2

market situation, we saw a strong pressure on the margins. The gross

Snoras 0.59 3.5% 1690193 0.8 0.3 margin declined from 17.9% in Q2 2008 to 9.6% in Q2 2009. Sharp decline

TEO LT 1.32 4.8% 3409322 6.5 6.9 0.9 1.0 was seen both in EBITDA margin and Operating margin as well, which

Ukio Bankas 0.71 1.4% 1643643 0.8 0.3

declined to 4.9% and 4.1% in Q2 2009 (13.4% and 12.8% in Q2 2008).

Source: Reuters, Swedbank

Attention: Please note important background and customer information at the end of this report

Equity Research – Swedbank Markets Page 1 of 6

Equity Weekly – August 10, 2009

Profits for the quarter reached € 2.6m (-70.1% Y-o-Y in Q2) with the margin of 4.8%, down

from the 10.8% in Q2 2008.

Last week Nordecon International AS (NCN) made several announcements of new

construction contracts signed. The first one was agreed by NCN subsidiaries Nordecon

Infra AS with Nordecon Infra SIA as a joint bidders and AS Pärnu Vesi. The contract is for

the reconstruction and expansion of Pärnu town water and sewage network. The price of

the contract is approx. €4.2m (excl. VAT) and the construction works will start in September

2009 and end in November 2011.

Second contract was signed also between Nordecon Infra AS with AS Napal as a joint

bidders and OÜ Paikre to design and build Rääma waste disposal site in Pärnu town. The

price of the contract is approx. €3.5m (excl. VAT) and the construction works start in

August 2009 and will end by September 2011.

The last construction contract announced made was agreed in Latvia between Nordecon

Infra SIA’s subsidiary P/S BRT and SIA Talsu Namu Parvalde for the construction and

building of water-supply, waste water system networks and waste water treatment plant. In

total 31 kilometers of water networks and 21 kilometers of waste water networks are being

reconstructed or expanded. The price of the contract is approx. €4.1m. The construction

works are estimated to last from August 2009 to July 2011.

Tallink posted July traffic volumes. Total number of passengers shipped increased by

16.3% YoY and exceeded million passengers for the first time in company’s history

(1.054m). Cargo volumes dropped by 21.5% YoY and drop was evidenced on all routes. As

current results were broadly in line with our expectations, it didn’t have an impact on the

valuation.

Latvia

Grindeks posted 6m 2009results, which were better than we expected. 2Q sales were 5%

up at LVL15.6m, EBITDA was LVL3.3m (+32% YoY), quarterly net profit was LVL2.2m

(+46.5% YoY).

Lithuania

In July 2009, the retail turnover (including VAT) of Apranga decreased 20.5% YoY to LTL

31.7m (€9.2m): 22% down in Lithuania and 28% in Latvia, and an increase of 8% in

Estonia. During January-July the retail turnover (including VAT) made LTL 219.4m

(€63.5m), a drop of 20% YoY. Currently Apranga operates 118 stores in Baltic States: 78 in

Lithuania, 31 in Latvia, and 9 in Estonia.

In July Rokiskio Suris’ consolidated sales made LTL 51.6m (€14.9m), i.e. 19% less than a

year ago. In January-July, sales totaled LTL 325.2m (€94.2m), i.e. 14.5% down YoY.

Siauliu Bankas was granted a convertible loan of up to €30 m from the European Bank for

Reconstruction and Development (EBRD).

Ukio Bankas’ consolidated pre-audited net profit in 1H2009 made LTL 6.2m (€1.8m). The

unconsolidated net profit of Ukio Bankas totaled LTL 4.6m (€1.3m).

In 1H2009, the operating income of Rytu Skirstomieji Tinklai remained flat YoY at LTL

612.2m (€177.3m). Preliminary pre-audited operating result is a net loss of LTL 6.5m

(€1.9m), compared to net profit of LTL 8.4m (€2.4m). The loss occurred due to the

unplanned temporary stop of Ignalina nuclear power plant which led to increase of

purchased electricity cost.

In 1H2009, sales of Klaipedos Nafta dropped 15% YoY to LTL 55.7m (€16.1m). Pre-

audited profit was down 21% to LTL 16.5m (€4.8m). The transshipment result for July was

634.6k tons of oil products, which adds to 4378.6k tons of oil products in January-July.

Preliminary earnings make LTL 11.4m (€3.3m) in July and LTL 67.1m (€19.4m) during 7

months of 2009.

Panevezio Statybos Trestas convenes the extraordinary general meeting on September

11, 2009.

Attention: Please note important background and customer information at the end of this report

Equity Research – Swedbank Markets Page 2 of 6

Equity Weekly – August 10, 2009

Investor Calendar:

Date Description

Estonia

10.-14.08.2009 NCN - Interim report Q2 2009

Latvia

10.08.2009 RRR1R - Extraordinary General Meeting

14.08.2009 DPK1R - Extraordinary General Meeting

17.08.2009 OLK1R - 6M non audited financial report

Lithuania

13.08.2009 GUB1L - Repeated Annual General Meeting

14.08.2009 VBL1L - 6M sales figures. Consolidated interim report 6M 2009

17.08.2009 LFO1L - Sales revenue in July 2009

Source: NASDAQ OMX

Attention: Please note important background and customer information at the end of this report

Equity Research – Swedbank Markets Page 3 of 6

Equity Weekly – August 10, 2009

Swedbank Markets Baltic Equity research & Institutional sales:

Energy, Materials & Utilities Industrials Equity Sales

Pavel Lupandin Estonia Risto Hunt Estonia Kristiina Vassilkova Baltic Institutional Sales

pavel.lupandin@swedbank.ee +372 6 131 535 risto.hunt@swedbank.ee +372 6 136 796 kristiina.vassilkova@swedbank.ee +372 6 131 663

Donatas Užkurėlis Lithuania Marko Daljajev Estonia Andres Suimets Head of Sales (Estonia)

donatas.uzkurelis@swedbank.lt +370 5 268 4395 marko.daljajev@swedbank.ee +372 6 131 246 andres.suimets@swedbank.ee +372 6 131 657

Svetlana Skutelska Head of Sales (Latvia)

Telecom Services Financials Svetlana.skutelska@swedbank.lv +371 6744 4154

Marko Daljajev Estonia Risto Hunt Estonia Simona Sileviciute Head of Sales (Lithuania)

marko.daljajev@swedbank.ee +372 6 131 246 risto.hunt@swedbank.ee +372 6 136 796 simona.sileviciute@swedbank.lt +370 5268 4513

Neringa Džiugelytė Lithuania Marko Daljajev Estonia

neringa.dziugelyte@swedbank.lt +370 5 268 4733 marko.daljajev@swedbank.ee +372 6 131 246 Equity Trading

Simmo Sommer Head of Baltic Trading

Consumers Healthcare simmo.sommer@swedbank.ee +372 6131 605

Pavel Lupandin Estonia Marko Daljajev Latvia

pavel.lupandin@swedbank.ee +372 6 131 535 marko.daljajev@swedbank.ee +372 6 131 246 Equity Capital Markets

Neringa Džiugelytė Lithuania Lauri Lind Head of Baltic Equity Capital Markets

neringa.dziugelyte@swedbank.lt +370 5 268 4733 lauri.lind@swedbank.ee +372 6 131 355

Donatas Užkurėlis Lithuania Mihkel Torim Baltic Equity Capital Markets

donatas.uzkurelis@swedbank.lt +370 5 268 4395 mihkel.torim@swedbank.ee +372 6 131 564

Swedbank Group Homepage: www.swedbank.com. For Research products on Bloomberg please type: HBMR <GO>.

Background Information:

Recommendation structure

Swedbank Markets’ recommendation structure consists of six recommendations: Buy, Accumulate, Hold, Reduce, Sell and Avoid. The

recommendations are based on an absolute return for the security 12 months forward. The absolute return includes share price appreciation

and dividend yield combined.

The recommendations for the securities mentioned in this report are based on risk and return considerations. The higher the risk category of

the investment, the higher the required return. For equity investments, returns are defined as capital appreciation and dividends received over

the investment horizon of 12 months forward. The expected capital appreciation is the ratio of a stock’s target price over the current price. A

company risk rating depends on its stock price volatility, liquidity and business outlook. The target price depends on a company’s

fundamentals as well as the market valuation of peer stocks, and can be changed at any time if the relevant changes occur within a

company/market perception of the peer group. “Buy”, “accumulate”, “hold”, “reduce”, “sell” and “avoid” recommendations may be used in this

report. The table below presents the relationship between recommendations and target prices compared to risk level of the stock. These are

indicative ranges and actual recommendations may deviate from the indications if other relevant issues are considered. For more detailed

information about the recommendation system please visit http://www.swedbank.ee/disclaimers/recommendation2007.pdf

Recommendation structure

Buy > +20% to target price

Accumulate +10% < target price < +20%

Hold 0% < target price < +10%

Reduce -10% < target price < 0%

Sell < -10% to target price

Avoid used when security does not match the standards presented in SWB’s investment guidelines

The recommendation by Swedbank Markets Equity Research department is based on a variety of standard valuation models. However, the

base for the calculation of the target price is our DCF model (DCF = discounted cash flow) with the exception of financial and investment

companies. The DCF model discounts future cash flow at present value.

In preparation of this report different valuation methods have been used, including, but not limited to, discounted free cash-flow and

comparative analysis. The selection of methods depends on the industry, the company, the nature of the stock and other circumstances.

The target price (previous fair value) takes into account the DCF value, the relative valuation of the share versus others peers (national or

international) and news that can have a positive or negative effect on the share price. Relative and absolute multiples that we consider are:

EV/EBITDA, EV/EBIT, PE, PEG and Net Asset models for companies with liquid markets for their assets and other industry specific ratios

when available. Break-up valuation models are also sometimes considered.

Buy

Under 41%

Recommendations by the 10 aug 2009 Rev iew

No of shares Part of Total 49%

Accum

Buy 9 41% ulate

Accumulate 1 5% 5%

Hold 1 5%

Under Review 11 50% Hold

5%

Equity Research – Swedbank Markets Page 4 of 5

Equity Weekly – August 10, 2009

Information to the customer: assessments are compounded with uncertainty. The recipients

and clients of Swedbank are responsible for such risks and they

are recommended to supplement their decision-making

General information with that material which is assessed to be necessary,

including but not limited to knowledge on the financial instruments

Equity weekly is a compilation of news, corporate events, in question and on the prevailing requirements as regards trading

companies’ results and other similar information published in stock in financial instruments. Opinions contained in the weekly

exchange notifications last week, an overview of Baltic stock represent the analyst's present opinion only and may be subject to

exchanges of the same period and a weekly timeline of upcoming change.

corporate events of listed companies. No research is made here, To the extent permitted by applicable law, no liability whatsoever is

any resemblances to research are purely coincidental and should accepted by Swedbank for any direct, indirect or consequential

be considered unintentional. Weekly may contain references to loss arising from the use of this weekly.

effective price targets and investment recommendations of

companies mentioned in previously published research reports Conflicts of interest

and may update such price targets and recommendations on the All equity weeklies are produced by Swedbank Markets’ Research

basis of important new information. Previous research reports are department, which is separated from the rest of its activities by a

available at Chinese wall; as such, equity weeklies are independent and based

https://www.swedbank.ee/private/investor/portfolio/analysis/equity solely on publicly available information. The analysts at Swedbank

Information on how the price targets and investment Markets may not own securities covered by the weekly, that

recommendations are constructed in research reports is available represent more than 5% of the total share capital or voting rights of

at http://www.swedbank.ee/disclaimers/recommendation2007.pdf. any company mentioned in this weekly.

Issuer and recipients Internal guidelines are implemented in order to ensure the integrity

and independence of research analysts. The guidelines include

This report by Swedbank Markets Equity Research is issued by

rules regarding, but not limited to, the identification, management

Swedbank Markets business area within Swedbank AB (publ)

and avoidance of conflicts of interest.

(“Swedbank”). Swedbank Markets is a registered secondary name

The remuneration of staff within the Research department may

to Swedbank and is under the supervision of the Swedish

include discretionary awards based on Swedbank’s total earnings,

Financial Inspection Authority (Finansinspektionen) and other

including investment banking income; staff, however, shall not

financial supervisory bodies where Swedbank or Swedbank

receive remuneration based upon specific investment banking

Markets have offices. Swedbank is a public limited liability

transactions.

company and a member of the stock exchanges in Stockholm,

Swedbank shall not receive compensation from any company

Helsinki, Oslo and Reykjavik as well as being a member of

mentioned in the weekly for making an investment

EUREX. Swedbank AS disseminates this report in Estonia.

recommendation or enter into an agreement with the said

Swedbank AS is under the supervision of the Estonian Financial

company to make an investment recommendation.

Supervisory Authority (Finantsinspektsioon). “Swedbank” AB

disseminates the report in Lithuania. “Swedbank” AB is under the

Company specific disclosures and potential conflicts of

supervision of the Lithuanian Financial Supervisory Authority

interest

(Lietuvos Respublikos vertybinių popierių komisija) in Lithuania.

In view of Swedbank’s position in its markets, recipients of this

Swedbank AS disseminates this report in Latvia. Swedbank AS is

weekly should assume that it may currently (or may in the coming

under the supervision of the Latvian Financial Supervisory

three months and beyond) be providing or seeking to provide

Authority (Finanšu un kapitāla tirgus komisija). In no instances is

confidential investment banking services to the companies referred

the report altered before dissemination.

to in this weekly and that an agreement regarding such services

may have been in effect over the previous 12 months, under which

This research report is produced for the private information of

Swedbank may have received payments.

recipients and Swedbank is not advisory nor soliciting any action

Recipients of this weekly should also note that it may happen that

based upon it. If you are not a client of ours, you are not entitled to

Swedbank, its directors, its employees or its subsidiary companies

this research report. The Equity Research report is not, and should

at various times have had, or have sought, positions, advisory

not be construed as, an offer to sell or solicitation of an offer to buy

assignments in connection with corporate finance transactions,

any securities.

investment or merchant banking assignments and/or lending as

Analyst’s certification

regards companies and/or financial instruments covered by this

The analyst(s) responsible for the content of this weekly hereby

weekly. It may also occur that Swedbank may act as a liquidity

confirm that notwithstanding the existence of any potential conflicts

provider in trading with financial instruments covered by this

of interest referred to herein, the views expressed in this weekly

weekly.

accurately reflect our personal views about the companies and

Swedbank has not been lead manager or co-lead manager over

securities covered. The analyst(s) further confirm not to have

the previous 12 months of any publicly disclosed offer of financial

been, nor are or will be, receiving direct or indirect compensation

instruments of any company mentioned in this weekly.

in exchange for expressing any of the views or the specific

recommendation contained in the weekly.

Reproduction and dissemination

This material may not be reproduced without permission from

Limitation of liability

Swedbank Markets. The weekly may not be disseminated to

All information, including statements of fact, contained in this

physical or legal person who are citizens of, or have domicile in a

equity weekly have been obtained and compiled in good faith from

country in which dissemination is not permitted according to

sources believed to be reliable. However, no representation or

applicable legislation or other decisions.

warranty, express or implied, is made by Swedbank with respect to

Information contained in this weekly is confidential and is intended

the completeness or accuracy of its contents, and it is not to be

to be used solely by the clients of Swedbank to whom this weekly

relied upon as authoritative and should not be taken in substitution

was addressed. By accepting this weekly you have accepted the

for the exercise of reasoned, independent judgment by you.

declared restrictions.

Swedbank would like to point out that recipients of the weekly

should note that investments in capital markets e.g. such as in this

document carry economic risks and statements regarding future

Swedbank Group, 2009, All rights reserved.

The Swedbank does not have shareholdings exceeding 5 % in companies referred to in this report, but it may hold securities mentioned in this

report on behalf of its clients, acting in custodial capacity. Companies mentioned in this report do not have shareholdings exceeding 5% in

Swedbank. For information regarding the Bank and its internal organizational and administrative arrangements for the prevention and avoidance

of conflicts of interest, refer to the following websites:

Swedbank AS in Estonia: http://www.swedbank.ee

Swedbank AS in Latvia: http://www.swedbank.lv

“Swedbank” AB in Lithuania: http://www.swedbank.lt

Das könnte Ihnen auch gefallen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- CBC Organic. NewDokument74 SeitenCBC Organic. NewDiana Daina100% (1)

- 2 HirarcDokument10 Seiten2 HirarcHaji Mohd DimyatiNoch keine Bewertungen

- SALVO Paper IET Conference Nov 2011Dokument10 SeitenSALVO Paper IET Conference Nov 2011foca88Noch keine Bewertungen

- Essential Knowledge For Potential Offshore Installation ManagersDokument101 SeitenEssential Knowledge For Potential Offshore Installation Managersseahorse88Noch keine Bewertungen

- Orange Book Management of RiskDokument48 SeitenOrange Book Management of RiskNelson LimaNoch keine Bewertungen

- Contoh HirarcDokument12 SeitenContoh HirarcAkbar100% (1)

- Appurtenant Structures For Dams Spillways and Outlet WorksDokument126 SeitenAppurtenant Structures For Dams Spillways and Outlet WorksEndless LoveNoch keine Bewertungen

- Credit Policy GuidelinesDokument4 SeitenCredit Policy Guidelinesnazmul099Noch keine Bewertungen

- SWOT Analysis - Potential Future of The Three Lines ModelDokument21 SeitenSWOT Analysis - Potential Future of The Three Lines Modelapanisile14142Noch keine Bewertungen

- SWB53EquityWeekly04 01Dokument5 SeitenSWB53EquityWeekly04 01naudaslietasNoch keine Bewertungen

- Equity Weekly: Equity Research - Monday, January 18, 2009Dokument5 SeitenEquity Weekly: Equity Research - Monday, January 18, 2009naudaslietasNoch keine Bewertungen

- SWB01EquityWeekly11 01Dokument5 SeitenSWB01EquityWeekly11 01naudaslietasNoch keine Bewertungen

- Equity Weekly: Equity Research - Monday, December 14, 2009Dokument5 SeitenEquity Weekly: Equity Research - Monday, December 14, 2009naudaslietasNoch keine Bewertungen

- Equity Weekly: Equity Research - Monday, November 16, 2009Dokument4 SeitenEquity Weekly: Equity Research - Monday, November 16, 2009naudaslietasNoch keine Bewertungen

- Equity Weekly: Equity Research - Monday, November 23, 2009Dokument5 SeitenEquity Weekly: Equity Research - Monday, November 23, 2009naudaslietasNoch keine Bewertungen

- Equity Weekly: Equity Research - Monday, November 09, 2009Dokument5 SeitenEquity Weekly: Equity Research - Monday, November 09, 2009naudaslietasNoch keine Bewertungen

- SWB43EquityWeekly26 10Dokument5 SeitenSWB43EquityWeekly26 10naudaslietasNoch keine Bewertungen

- Equity Weekly: Equity Research - Monday, August 24, 2009Dokument5 SeitenEquity Weekly: Equity Research - Monday, August 24, 2009naudaslietasNoch keine Bewertungen

- Olympic Entertainment GroupDokument35 SeitenOlympic Entertainment GroupnaudaslietasNoch keine Bewertungen

- Winners and LosersDokument3 SeitenWinners and LosersnaudaslietasNoch keine Bewertungen

- City Service AB PresentationDokument17 SeitenCity Service AB PresentationnaudaslietasNoch keine Bewertungen

- Company Presentation: October 2009Dokument16 SeitenCompany Presentation: October 2009naudaslietasNoch keine Bewertungen

- SEB Eastern European Outlook October 2009 (English)Dokument22 SeitenSEB Eastern European Outlook October 2009 (English)SEB GroupNoch keine Bewertungen

- Equity Weekly: Equity Research - Monday, November 2, 2009Dokument5 SeitenEquity Weekly: Equity Research - Monday, November 2, 2009naudaslietasNoch keine Bewertungen

- Equity Weekly: Equity Research - Monday, September 21, 2009Dokument5 SeitenEquity Weekly: Equity Research - Monday, September 21, 2009naudaslietasNoch keine Bewertungen

- Equity WeeklyDokument5 SeitenEquity WeeklynaudaslietasNoch keine Bewertungen

- SWB36EquityWeekly07 09 2009Dokument5 SeitenSWB36EquityWeekly07 09 2009naudaslietasNoch keine Bewertungen

- Equity Weekly: Equity Research - Monday, September 14, 2009Dokument5 SeitenEquity Weekly: Equity Research - Monday, September 14, 2009naudaslietasNoch keine Bewertungen

- Swedbank EquityWeekly - 03.08.2009Dokument5 SeitenSwedbank EquityWeekly - 03.08.2009naudaslietas100% (2)

- Equity Weekly: Equity Research - Monday, August 17, 2009Dokument5 SeitenEquity Weekly: Equity Research - Monday, August 17, 2009naudaslietasNoch keine Bewertungen

- Equity Weekly: Equity Research - Monday, August 31, 2009Dokument5 SeitenEquity Weekly: Equity Research - Monday, August 31, 2009naudaslietasNoch keine Bewertungen

- SEB Baltijas Akciju Rīta Apskats - 10.08.2009Dokument2 SeitenSEB Baltijas Akciju Rīta Apskats - 10.08.2009naudaslietasNoch keine Bewertungen

- Redefining Ways To Deliver AdviceDokument56 SeitenRedefining Ways To Deliver AdvicenaudaslietasNoch keine Bewertungen

- Equity Weekly: Equity Research - Monday, May 11, 2009Dokument6 SeitenEquity Weekly: Equity Research - Monday, May 11, 2009naudaslietasNoch keine Bewertungen

- Equity Weekly: Equity Research - Monday, July 27, 2009Dokument5 SeitenEquity Weekly: Equity Research - Monday, July 27, 2009naudaslietasNoch keine Bewertungen

- SWB29 Equity Weekly 20072009Dokument5 SeitenSWB29 Equity Weekly 20072009naudaslietasNoch keine Bewertungen

- Research Assignment,,ProposalDokument22 SeitenResearch Assignment,,ProposalAbreham GetachewNoch keine Bewertungen

- FulltextDokument174 SeitenFulltextLeo CerenoNoch keine Bewertungen

- Tachew - Tadesse Dhaka AssignmentDokument10 SeitenTachew - Tadesse Dhaka AssignmentMichael G. TadesseNoch keine Bewertungen

- This Study Resource Was: MAN-435 Project Management Written Assignment 3 Mentor: Dr. John Byrne Charles D. StutzmanDokument5 SeitenThis Study Resource Was: MAN-435 Project Management Written Assignment 3 Mentor: Dr. John Byrne Charles D. StutzmanProcurement LNSP LabNoch keine Bewertungen

- Stihl FS 91R ManualDokument48 SeitenStihl FS 91R ManualGEORGE MIHAINoch keine Bewertungen

- Itn521 2019 2 PDFDokument63 SeitenItn521 2019 2 PDF_Vezir_Noch keine Bewertungen

- Palko IR Nov17 2010Dokument35 SeitenPalko IR Nov17 2010administrator5767Noch keine Bewertungen

- Annual Report BCGCDokument34 SeitenAnnual Report BCGCBernewsAdminNoch keine Bewertungen

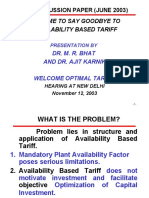

- It Is Time To Say Goodbye To Availability Based Tariff: Cerc Discussion Paper (June 2003)Dokument41 SeitenIt Is Time To Say Goodbye To Availability Based Tariff: Cerc Discussion Paper (June 2003)Kiran Kumar AllaNoch keine Bewertungen

- Auditor's Death Sparks Debate: Auditing Job Kills - Whose Mistake Is It?Dokument4 SeitenAuditor's Death Sparks Debate: Auditing Job Kills - Whose Mistake Is It?naruto0501Noch keine Bewertungen

- Key Differences Between Entrepreneurs and Small Business OwnersDokument15 SeitenKey Differences Between Entrepreneurs and Small Business OwnersnidasblogNoch keine Bewertungen

- Attributes and Myths OF Technology Entreperneurs: Galing, Giray, & SagayapDokument33 SeitenAttributes and Myths OF Technology Entreperneurs: Galing, Giray, & SagayapGeraldine GalingNoch keine Bewertungen

- IENG 461 20160920 Risk AssessmentDokument23 SeitenIENG 461 20160920 Risk AssessmentAbdu AbdoulayeNoch keine Bewertungen

- Comparative Study On Investment in Stocks, Mutual Funds and ULIPsDokument66 SeitenComparative Study On Investment in Stocks, Mutual Funds and ULIPsbistamasterNoch keine Bewertungen

- Ram Mohan MishraDokument10 SeitenRam Mohan Mishraram10008Noch keine Bewertungen

- Studi Kasus: Surfer Dude Duds, Inc.: Considering The Going-Concern AssumptionDokument7 SeitenStudi Kasus: Surfer Dude Duds, Inc.: Considering The Going-Concern AssumptionfirmanNoch keine Bewertungen

- Management of Change (MOC) Procedure Template Checklist - SafetyCultureDokument8 SeitenManagement of Change (MOC) Procedure Template Checklist - SafetyCultureardi yansaNoch keine Bewertungen

- Bam 2012 q2 LTR To ShareholdersDokument7 SeitenBam 2012 q2 LTR To ShareholdersDan-S. ErmicioiNoch keine Bewertungen

- RRL April13Dokument11 SeitenRRL April13Noralden AminolahNoch keine Bewertungen

- Hirarc Intro Practical 1Dokument2 SeitenHirarc Intro Practical 1izzat ezmanNoch keine Bewertungen

- 4th Week Trainig SessionDokument155 Seiten4th Week Trainig SessionBharathk KldNoch keine Bewertungen