Beruflich Dokumente

Kultur Dokumente

Consumer Theory Example 10: Income Tax and The Budget Constraint

Hochgeladen von

jackie.chanOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Consumer Theory Example 10: Income Tax and The Budget Constraint

Hochgeladen von

jackie.chanCopyright:

Verfügbare Formate

tax bracket

Consumer Theory Example 10: Income Tax and the Budget Constraint If the marginal income tax rate is 0% on annual incomes of 0 - 5,000, so the tax threshold is 5,000 , 20% on annual incomes of 5,000 - 20,000 and 40% on annual incomes above 20,000, how much income tax do tax payers with incomes of 15,000 and 30,000 pay? The calculations are set out in tables 1 and 2. The key step is calculating how much income the tax payer has in each tax bracket.

Thus a tax payer with an income of 15,000 pays 2,000 income tax under this tax system. The tax payers average tax rate is 2,000/15,000 = 13%. The tax payers marginal tax rate is the fraction of any extra pound earned which goes on income tax, in this case 20% because income, 15,000, falls in the 20% tax bracket.

file:///J|/EC201/Designer2003/consthex10.htm (1 of 4)22/03/2006 15:38:17

tax bracket

Thus a tax payer with an income of 30,000 pays 7,000 income tax under this tax system. The tax payers average tax rate is 7,000/30,000 = 23%. The tax payers marginal tax rate is the fraction of any extra pound earned which goes on income tax, in this case 40% because income, 30,000, falls in the 40% tax bracket.

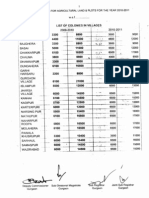

Drawing a Budget Constraint Given an Income Tax System Suppose that a worker earns 4.00 per hour and faces an income tax system with the marginal tax rates outlined above ( 0% on annual incomes of 0 - 5,000, 20% on annual incomes of 5,000 - 20,000 and 40% on annual incomes above 20,000). Show the workers budget constraint. The first step is Table 3. Note that 8760 = 365 x 24 = number of hours in a year.

file:///J|/EC201/Designer2003/consthex10.htm (2 of 4)22/03/2006 15:38:17

tax bracket

Note for Continental Europeans: This uses the British and US convention for commas and decimal points, so 1,500 is one thousand five hundred and 1.500 = 3/2.

Given this information you can now use table 3 to plot the points (time outside employment, consumption) corresponding to each of the tax bracket boundaries. In this example these are ( 8760, 0 ), ( 7510, 5000) and ( 3760, 17000 ). Join up the point ( 8760, 0 ) to ( 7510, 5000) and join the point ( 7510, 5000) to ( 3760, 17000 ) to get the budget constraint for time outside employment between 3760 and 8760 hours. These lines will have slopes 4.0 and 3.2 calculated in table 3. The slope for time outside employment of less than 3760 hours is from table 4 2.4.

file:///J|/EC201/Designer2003/consthex10.htm (3 of 4)22/03/2006 15:38:17

tax bracket

Close

file:///J|/EC201/Designer2003/consthex10.htm (4 of 4)22/03/2006 15:38:17

Das könnte Ihnen auch gefallen

- Using These Slides: 1 © Margaret Bray LSEDokument107 SeitenUsing These Slides: 1 © Margaret Bray LSERavi KumarNoch keine Bewertungen

- Unraveling The VAT Maze - Insights Into Value Added Tax For ACCA UK-TX FA2021Dokument4 SeitenUnraveling The VAT Maze - Insights Into Value Added Tax For ACCA UK-TX FA2021Gaziyah BenthamNoch keine Bewertungen

- LMT School of Management, Thapar University Masters of Business AdministrationDokument9 SeitenLMT School of Management, Thapar University Masters of Business Administrationgursimran jit singhNoch keine Bewertungen

- FDA Guide To Pension Tax Relief 2021Dokument15 SeitenFDA Guide To Pension Tax Relief 2021FDAunionNoch keine Bewertungen

- Circular No. Ch0/Fj#4Y! 019-20 / 0 3.: TRNRPT 3Trq% FwirDokument36 SeitenCircular No. Ch0/Fj#4Y! 019-20 / 0 3.: TRNRPT 3Trq% FwirPriyadarshini MohapatraNoch keine Bewertungen

- Model Scottish Budget 2018/19 (June 2018)Dokument10 SeitenModel Scottish Budget 2018/19 (June 2018)msp-archiveNoch keine Bewertungen

- F6 Tec ArticlesDokument140 SeitenF6 Tec ArticlesFloyd DaltonNoch keine Bewertungen

- Lecture Notes Week 1 2022Dokument26 SeitenLecture Notes Week 1 2022Anton BessonovNoch keine Bewertungen

- How Does It Work?: Train Law Vs Nirc What Is NIRC?Dokument7 SeitenHow Does It Work?: Train Law Vs Nirc What Is NIRC?Bryant R. CanasaNoch keine Bewertungen

- India Income Tax Slabs 2013Dokument1 SeiteIndia Income Tax Slabs 2013nkprasathNoch keine Bewertungen

- M7 - P1 Individual Income Taxation - Students'Dokument66 SeitenM7 - P1 Individual Income Taxation - Students'micaella pasionNoch keine Bewertungen

- 4 5B Taxation of Individuals Graduated RatesDokument9 Seiten4 5B Taxation of Individuals Graduated RatesArgie DeguzmanNoch keine Bewertungen

- 1TAX 301 SEP DiscussionDokument3 Seiten1TAX 301 SEP DiscussionChristine Merry AbionNoch keine Bewertungen

- Taxation RevisionDokument15 SeitenTaxation Revisionapi-302252730Noch keine Bewertungen

- Management and Cost Accounting Bhimani Solutions 5th EditionDokument41 SeitenManagement and Cost Accounting Bhimani Solutions 5th EditionMishbah Islam0% (1)

- Chap15 Tax PbmsDokument10 SeitenChap15 Tax PbmskkNoch keine Bewertungen

- Examinable Documents, K and ATX-UK - FA 2019 Exam Docs June 20 To March 21 - Draft 2 (Clean) PDFDokument5 SeitenExaminable Documents, K and ATX-UK - FA 2019 Exam Docs June 20 To March 21 - Draft 2 (Clean) PDFJudithNoch keine Bewertungen

- Module - Income Taxation - v.3.5Dokument10 SeitenModule - Income Taxation - v.3.5Kaye Tayag100% (1)

- 4 Capital Budgeting - Summer 2015.studentsDokument25 Seiten4 Capital Budgeting - Summer 2015.studentsJoseph PhamNoch keine Bewertungen

- Income Tax Slab FY 2014-15Dokument3 SeitenIncome Tax Slab FY 2014-15zveeraNoch keine Bewertungen

- LMT School of Management, Thapar University Masters of Business AdministrationDokument9 SeitenLMT School of Management, Thapar University Masters of Business Administrationtechnical sNoch keine Bewertungen

- Ecu - 08606 Lecture 5Dokument23 SeitenEcu - 08606 Lecture 5DanielNoch keine Bewertungen

- RR 12-2007 PDFDokument7 SeitenRR 12-2007 PDFnaldsdomingoNoch keine Bewertungen

- Tax Sample ComputationDokument10 SeitenTax Sample ComputationEryka Jo MonatoNoch keine Bewertungen

- Bureau of Internal RevenueDokument14 SeitenBureau of Internal Revenueapi-247793055Noch keine Bewertungen

- The Institute of Finance Management Department of Economics and Tax Management Public Finance (Ecu - 08606) - Bef 3 Review Questions Set 2Dokument4 SeitenThe Institute of Finance Management Department of Economics and Tax Management Public Finance (Ecu - 08606) - Bef 3 Review Questions Set 2V2c FungamezaNoch keine Bewertungen

- Train I.ppt - Vers. 10.21.2018Dokument103 SeitenTrain I.ppt - Vers. 10.21.2018Ellard28 saturnoNoch keine Bewertungen

- Income Tax: Syllabus Study GuideDokument34 SeitenIncome Tax: Syllabus Study GuideSam NalliNoch keine Bewertungen

- Tax Sample ComputationDokument9 SeitenTax Sample ComputationErykaNoch keine Bewertungen

- Finance Act 2004Dokument8 SeitenFinance Act 2004openid_kMOmF8UfNoch keine Bewertungen

- Income Taxation - Chapter 2 - Individual TaxpayersDokument5 SeitenIncome Taxation - Chapter 2 - Individual TaxpayerscurlybambiNoch keine Bewertungen

- ACCA P6 SMART Compendium Notes (40 Pages) For June 2016Dokument62 SeitenACCA P6 SMART Compendium Notes (40 Pages) For June 2016Aziz Ur Rehman100% (2)

- BMA Guidance On Restricting Pensions Tax Relief - October 2010Dokument6 SeitenBMA Guidance On Restricting Pensions Tax Relief - October 2010fernandofloridoNoch keine Bewertungen

- Income TAX: Prof. Jeanefer Reyes CPA, MPADokument37 SeitenIncome TAX: Prof. Jeanefer Reyes CPA, MPAmark anthony espiritu75% (4)

- BIR ComputationsDokument10 SeitenBIR Computationsbull jackNoch keine Bewertungen

- Summary Break Even AnalysisDokument5 SeitenSummary Break Even AnalysisIveta Nguyen ThiNoch keine Bewertungen

- Direct Tax Code and Its Impact On Individuals: Submitted By: Hemant Baranda (Student of Foresight School)Dokument22 SeitenDirect Tax Code and Its Impact On Individuals: Submitted By: Hemant Baranda (Student of Foresight School)Dhru Nayan BhattNoch keine Bewertungen

- Tax Calculation Summary Notes 2022Dokument53 SeitenTax Calculation Summary Notes 2022Haroon khanNoch keine Bewertungen

- Fra Tutorial 4 Capital StructureDokument4 SeitenFra Tutorial 4 Capital Structurekarlr9Noch keine Bewertungen

- BIR ComputationsDokument10 SeitenBIR Computationsbull jack100% (1)

- Areesha Shakeel Fa18-Baf-002 Please Determined Tax Liability On Taxable Income For The Tax Year 2020 in Following CasesDokument2 SeitenAreesha Shakeel Fa18-Baf-002 Please Determined Tax Liability On Taxable Income For The Tax Year 2020 in Following CasesLaiba TufailNoch keine Bewertungen

- Income Tax Basics - July 2023Dokument6 SeitenIncome Tax Basics - July 2023maharajabby81Noch keine Bewertungen

- Tax Reform For Acceleration and Inclusion (Train Law) : Republic Act No. 10963Dokument41 SeitenTax Reform For Acceleration and Inclusion (Train Law) : Republic Act No. 10963maricrisandem100% (2)

- Taxing Situations Two Cases On Income Taxes - An Accounting Case StudyDokument5 SeitenTaxing Situations Two Cases On Income Taxes - An Accounting Case Studyfossaceca80% (5)

- Dynamic Tax Analysis Group 18Dokument10 SeitenDynamic Tax Analysis Group 18Prakhar GuptaNoch keine Bewertungen

- Chapter 8Dokument2 SeitenChapter 8caitlinroux5Noch keine Bewertungen

- Package One: Rodrigo Duterte Personal Income TaxDokument2 SeitenPackage One: Rodrigo Duterte Personal Income TaxMalvin Aragon BalletaNoch keine Bewertungen

- Corporate Tax Planning AY 2020-21 Sem V B.ComH - Naveen MittalDokument76 SeitenCorporate Tax Planning AY 2020-21 Sem V B.ComH - Naveen MittalNidhi LathNoch keine Bewertungen

- The United KingdomDokument3 SeitenThe United KingdomMATINoch keine Bewertungen

- Income Tax Article 24Dokument18 SeitenIncome Tax Article 24JemimaPutriShintaNoch keine Bewertungen

- Excercise 1:: Year Person A (Million) Person B (Million) 1 2 3 4 5 60 60 60 60 60 80 80 60 30 50 Total 300 300Dokument4 SeitenExcercise 1:: Year Person A (Million) Person B (Million) 1 2 3 4 5 60 60 60 60 60 80 80 60 30 50 Total 300 300Quynh NguyenNoch keine Bewertungen

- 4 FinalsDokument59 Seiten4 FinalsXerez SingsonNoch keine Bewertungen

- Amendments Introduced by TRAINDokument4 SeitenAmendments Introduced by TRAINMarc Lester Hernandez-Sta AnaNoch keine Bewertungen

- INCOME AND BUSINESS TAXATION FinalsDokument21 SeitenINCOME AND BUSINESS TAXATION FinalsAbegail BlancoNoch keine Bewertungen

- Chapter 6 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Dokument71 SeitenChapter 6 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNoch keine Bewertungen

- Reales Tax Rev Computation ExerciseDokument4 SeitenReales Tax Rev Computation ExerciseJethroret RealesNoch keine Bewertungen

- ANalyse Budget ClassDokument14 SeitenANalyse Budget ClassMonkey2111Noch keine Bewertungen

- Operating a Business and Employment in the United Kingdom: Part Three of The Investors' Guide to the United Kingdom 2015/16Von EverandOperating a Business and Employment in the United Kingdom: Part Three of The Investors' Guide to the United Kingdom 2015/16Noch keine Bewertungen

- Landlord Tax Planning StrategiesVon EverandLandlord Tax Planning StrategiesNoch keine Bewertungen

- FM212 Syllabus 2011-2012Dokument5 SeitenFM212 Syllabus 2011-2012jackie.chanNoch keine Bewertungen

- FM212 Syllabus 2012-13Dokument5 SeitenFM212 Syllabus 2012-13jackie.chanNoch keine Bewertungen

- Extension ExercisesDokument10 SeitenExtension Exercisesjackie.chanNoch keine Bewertungen

- OCR Ethical GuidelinesDokument3 SeitenOCR Ethical Guidelinesjackie.chanNoch keine Bewertungen

- Exam Style PaperDokument1 SeiteExam Style Paperjackie.chanNoch keine Bewertungen

- S1 June 2004Dokument5 SeitenS1 June 2004Jonathan BlackNoch keine Bewertungen

- Atomic StructureDokument9 SeitenAtomic Structurejackie.chanNoch keine Bewertungen

- TCW Act #4 EdoraDokument5 SeitenTCW Act #4 EdoraMon RamNoch keine Bewertungen

- Oil Opportunities in SudanDokument16 SeitenOil Opportunities in SudanEssam Eldin Metwally AhmedNoch keine Bewertungen

- Why The Strengths Are Interesting?: FormulationDokument5 SeitenWhy The Strengths Are Interesting?: FormulationTang Zhen HaoNoch keine Bewertungen

- Zubair Agriculture TaxDokument3 SeitenZubair Agriculture Taxmunag786Noch keine Bewertungen

- ENG Merchant 4275Dokument7 SeitenENG Merchant 4275thirdNoch keine Bewertungen

- Circle Rates 2009-2010 in Gurgaon For Flats, Plots, and Agricultural Land - Gurgaon PropertyDokument15 SeitenCircle Rates 2009-2010 in Gurgaon For Flats, Plots, and Agricultural Land - Gurgaon Propertyqubrex1100% (2)

- Percentage and Its ApplicationsDokument6 SeitenPercentage and Its ApplicationsSahil KalaNoch keine Bewertungen

- Thai LawDokument18 SeitenThai LawsohaibleghariNoch keine Bewertungen

- Packing List PDFDokument1 SeitePacking List PDFKatherine SalamancaNoch keine Bewertungen

- Intellectual Property RightsDokument2 SeitenIntellectual Property RightsPuralika MohantyNoch keine Bewertungen

- Irda CircularDokument1 SeiteIrda CircularKushal AgarwalNoch keine Bewertungen

- 3D2N Bohol With Countryside & Island Hopping Tour Package PDFDokument10 Seiten3D2N Bohol With Countryside & Island Hopping Tour Package PDFAnonymous HgWGfjSlNoch keine Bewertungen

- P1 Ii2005Dokument3 SeitenP1 Ii2005Boris YanguezNoch keine Bewertungen

- Manual Goldfinger EA MT4Dokument6 SeitenManual Goldfinger EA MT4Mr. ZaiNoch keine Bewertungen

- Readymade Plant Nursery in Maharashtra - Goa - KarnatakaDokument12 SeitenReadymade Plant Nursery in Maharashtra - Goa - KarnatakaShailesh NurseryNoch keine Bewertungen

- Arithmetic of EquitiesDokument5 SeitenArithmetic of Equitiesrwmortell3580Noch keine Bewertungen

- Application Form For Subscriber Registration: Tier I & Tier II AccountDokument9 SeitenApplication Form For Subscriber Registration: Tier I & Tier II AccountSimranjeet SinghNoch keine Bewertungen

- Microsoft Word - CHAPTER - 05 - DEPOSITS - IN - BANKSDokument8 SeitenMicrosoft Word - CHAPTER - 05 - DEPOSITS - IN - BANKSDuy Trần TấnNoch keine Bewertungen

- Company ProfileDokument13 SeitenCompany ProfileDauda AdijatNoch keine Bewertungen

- Traffic Problem in Chittagong Metropolitan CityDokument2 SeitenTraffic Problem in Chittagong Metropolitan CityRahmanNoch keine Bewertungen

- Coconut Oil Refiners Association, Inc. vs. TorresDokument38 SeitenCoconut Oil Refiners Association, Inc. vs. TorresPia SottoNoch keine Bewertungen

- Forex Fluctuations On Imports and ExportsDokument33 SeitenForex Fluctuations On Imports and Exportskushaal subramonyNoch keine Bewertungen

- Industry Analysis: Liquidity RatioDokument10 SeitenIndustry Analysis: Liquidity RatioTayyaub khalidNoch keine Bewertungen

- Table 1. Different Modules of Training Proposed On Mushroom Cultivation Technology DetailsDokument11 SeitenTable 1. Different Modules of Training Proposed On Mushroom Cultivation Technology DetailsDeepak SharmaNoch keine Bewertungen

- Involvement of Major StakeholdersDokument4 SeitenInvolvement of Major StakeholdersDe Luna BlesNoch keine Bewertungen

- Factors Affecting SME'sDokument63 SeitenFactors Affecting SME'sMubeen Shaikh50% (2)

- Dimapanat, Nur-Hussein L. Atty. Porfirio PanganibanDokument3 SeitenDimapanat, Nur-Hussein L. Atty. Porfirio PanganibanHussein DeeNoch keine Bewertungen

- Nissan Leaf - The Bulletin, March 2011Dokument2 SeitenNissan Leaf - The Bulletin, March 2011belgianwafflingNoch keine Bewertungen

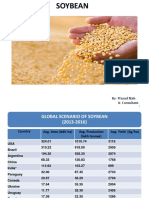

- Soybean Scenario - LaturDokument18 SeitenSoybean Scenario - LaturPrasad NaleNoch keine Bewertungen

- Patent Trolling in IndiaDokument3 SeitenPatent Trolling in IndiaM VridhiNoch keine Bewertungen