Beruflich Dokumente

Kultur Dokumente

Introduction To Financial Accounting Theory

Hochgeladen von

Tosin YusufOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Introduction To Financial Accounting Theory

Hochgeladen von

Tosin YusufCopyright:

Verfügbare Formate

+ The University of Birmingham College of Social Sciences Birmingham Business School Department of Accounting and Finance Accounting Theory

(07 !7"#

An $ntroduction to Financial Accounting Theory

Introduction

Why study financial accounting theory? This question is easy to ask but difficult to answer in a straightforward and uncomplicated way. However, good theories are useful guides to behaviour in the real world in that they have the ability to e plain and predict events and, in some cases, to evaluate new practices or data.

!or e ample, consider the dividend discount model "##$% which relates a company&s current share price to the amount, timing and certainty of its future dividend stream. This is a theoretical model that links current share price to future

dividends. The theory may be used to e plain events such as the fall in a company&s share price subsequent to the announcement that sales for the recent quarter were less than e pected. !ewer sales mean less cash inflows which in turn imply lower

dividends for shareholders than previously e pected, hence the fall in the share price. The same theory and a similar argument may be used to predict that a company announcing a larger than e pected sales figure for the recent quarter will see its share price increase. 'articularly strong theories may also be used to evaluate new practices

$arek()TIntro*

* or data. !or e ample, the directors of a company wish to adopt a new depreciation method which reduces reported profit but are worried about the adverse effect this may have on the company&s share price. They may be able to take some reassurance from the ##$. #epreciation is not a cash flow and although it is true that the amount of depreciation charged affects reported profit, its amount does not affect the amount of cash the company has available to pay dividends. ) sophisticated capital market would not be fooled by the decrease in reported profits into thinking that dividends will be lower in the future hence the share price should not react to the change in depreciation policy despite the company reporting lower profits.

) good theory therefore, such as the ##$, is not divorced from the real world but rather helps us to understand it in a more meaningful and sophisticated way. The purpose of this lecture is to introduce some of the theories that have influenced financial accounting in recent years. There are a number of such theories and not all of them are compatible. ,ut this lack of agreement should not come as a surprise- the same lack of agreement is evident in other social sciences such as politics, sociology and economics. !inancial accounting is not free from controversy and disagreement and it would be a rather dull sub.ect of study if this were the case. !inancial

accounting theories differ first of all in the way they are constructed and this characteristic forms the basis of the classification of financial accounting theories presented below. !inancial accounting theories are constructed either inductively "empirically% or deductively "normatively% and the former are dealt with first.

$arek()TIntro*

Inductive approaches

Inductive approaches to financial accounting theory usually end up rationalising current accounting practice. The theories constructed using inductive approaches begin as attempts to e plain why accountants in the real world do what they do. The inductive approach observes actual accounting practice and gathers, describes and classifies it "hence the term empirical%. Then the approach attempts to rationalise actual accounting practice in a logical way which results in rules of best practice which are, in effect, applied normatively.

) simple e ample of this inductive approach is the valuation of inventory at the lower of cost and net realisable value. It may be observed that this valuation rule is prevalent not only in the annual reports of /0 companies but internationally as well. Why is this so? If practising accountants and auditors were asked this question they would probably answer that it is prudent not to anticipate profits "hence the valuation at cost% but to provide for all foreseeable losses "hence the use of net realisable value if lower than cost%. 1n this basis, a theory may be constructed which incorporates some notion of prudence as an operational rule in financial accounting practice. The theory may be strengthened by observing that some other accounting practices seem to follow the same rule, e.g., the bad debt provision reducing the balance sheet value of trade debtors may be viewed as an application of the prudence concept to another area of the balance sheet. The lower of cost and net realisable value rule for inventory becomes incorporated in an accounting standard and hence becomes a normative rule.

$arek()TIntro*

5 It is .ustified by an appeal to the prudence principle, which itself becomes an overarching normative rule.

This inductive approach to the construction of a financial accounting theory leads ultimately to a set of principles which is, in effect, a codification of current best practice. These principles are often incorporated into company law and underly the production of financial reporting standards. Historically, this approach to financial accounting theory construction was the first to be adopted and has remained at least the most influential if not always the dominant approach. This is because the

principles that arise from the rationalisation of best accounting practice fulfil three useful roles.

!irst of all, the principles that arise from this inductive approach, such as prudence, going concern, accruals, realisation and substance over form, to mention a few of the most common, provide a means of evaluating and improving current accounting standards and practice. This may ensure that financial accounting evolves in a

consistent manner. The inductive approach may also be the most pragmatic way in which to develop a conceptual framework for financial accounting. This view of financial accounting theory tends to be the one inculcated by professional accountancy training.

3econdly, these principles serve as a pedagogical device to the e tent that accounting education is dominated by professional accountancy training which in turn is dominated by the inculcation of currently used accounting techniques. 4earning and

$arek()TIntro*

8 understanding accounting techniques are aided by the e istence of theoretical principles which describe and e plain those techniques.

Thirdly, the principles are often used as a means to .ustify current accounting practice to a wider constituency of users and preparers of accounts. 'erceived deficiencies or obscurities in current accounting practice may be defended by reference to a rationalising theory.

It is important to note at this point that the principles which emerge from the inductive approach to theory construction do not purport to be merely a description of what occurs in actual accounting practice. The same principles may be used as rules for determining best accounting practice. !or e ample, the principles of realisation and matching are rationalisations of historical cost accounting. 1n the other hand, the principle of prudence is invoked to rationalise practical deviations from the pure historical cost model such as the lower of cost and net realisable value rule for inventory.

6learly, the inductive approach to financial accounting theory construction has many advantages but note also needs to be taken of its limitations. ,ecause the approach relies on e isting accounting practice, the principles derived are unable to cope with situations requiring novel accounting approaches, such as accounting for changing prices. 'rinciples based upon the application of the historical cost accounting

convention are ill7suited to deal with the problems caused by hyperinflation, for e ample. The inductive approach results in a conceptual framework for accounting that is based upon the steady evolution of consistent accounting practice. This result

$arek()TIntro*

9 may be inappropriate if a revolutionary change in accounting practice is proposed. !or e ample, advances in communication technology may prompt calls for companies to publish the raw economic data from which annual accounts are prepared so that users may construct their own financial statements using whichever accounting policies they prefer rather than having to rely on the decisions taken by the company&s directors. These raw economic data could be provided in a form which made

download into a standard accounting software package relatively quick and painless. ) conceptual framework based on current accounting practice would be of little relevance were these new parameters to obtain.

!inally, it needs to be noted that accounting practice may be inconsistent, so that it is impossible to determine best accounting practice. /nder these conditions, the

inductive approach gives no criteria to enable a choice to be made between competing accounting techniques. In the /3, the 4I!1 inventory flow assumption is frequently used but is a very rare occurrence in the /0, where the !I!1 assumption predominates. Which inventory flow assumption should be considered best practice, 4I!1 or !I!1? The inductive approach is silent on this issue, with the result that, internationally, they become equally acceptable alternatives even though they entail opposite consequences for the amount of profit reported and the balance sheet valuation of inventory.

The limitations of the inductive approach have become more marked over time because of the increasing awareness of the differences among the accounting practices of nations and because no solution was forthcoming with respect to the problem of accounting for changing prices, which remains a controversial issue to this day. )s a

$arek()TIntro*

> result, interest grew in deductive approaches to accounting theory. These deductive approaches tend to be criticised by accounting practitioners as being unrealistic but at least they result in accounting solutions unconstrained by present practice and may offer new insights into old problems unresolved by inductive approaches.

#eductive approaches

There e ists a variety of e amples of deductive approaches to financial accounting theory because such approaches are unconstrained by current practice. Instead of focussing on what accountants actually do, deductive approaches are concerned with what accountants should do "and hence are often called normative%. This approach implies the e istence of some ob.ective or norm against which current accounting practice is measured and generally found wanting. ) deductive theory sets financial accounting an ob.ective to fulfil and then deduces a set of rules or procedures that accounting practices should follow in order to ensure that the ob.ective is achieved. The rules and procedures may or may not accord with current accounting practice.

Historically, the first deductive approach to financial accounting theory was the :true income; approach- financial accounting numbers should provide a measure of a company&s :true income;, however defined. This approach was a logical e tension to the increased emphasis in the early twentieth century on the profit and loss account as a performance statement and was favoured by theorists dissatisfied with the way in which historical cost accounting behaved in conditions of changing prices "and especially the hyperinflation of the +<*=s%. #efinitions of the income number that financial accounting should be measuring were found in the economic literature

$arek()TIntro*

@ because most theorists had trained as economists and in any case the academic study of accounting was, at the time, not very well developed. income, value and cost were borrowed from economics. Hence, definitions of

The :true income; approach has generated a number of measurement systems all of which, at one time or another, purported to measure the :true income; of a companyreplacement cost accounting, current "or constant% purchasing power accounting, cash flow reporting and deprival value accounting, for e ample. ?ach particular system had its advocates and its particular advantages and disadvantages, all of which were largely theoretical because none of the systems proposed had been tested empirically for sufficiently long in a sufficient number of countries.

It was also difficult to choose among the alternatives for a different reason. The rules and procedures of each particular system flowed logically "deductively% from each system&s assumptions but, because the initial assumptions were different, each system came up with a different answer to the question of measuring a company&s true income. There was no consensus on what best represented or measured a company&s :true income; and hence no agreement on the best measurement system to achieve this purpose. The :true income; approach to theory has been criticised for leading to a sterile and unresolvable debate among incompatible measurement systems for financial accounting. However, it would be too severe to dismiss this approach altogether. 1ne way in which to resolve the dispute among the different measurement systems would be to narrow the areas of disagreement through empirical research and re.ect those theories at odds with the empirical evidence. However, such an approach is easier to suggest than to implement.

$arek()TIntro*

< )nother way to move forward on the :true income; issue is to adopt an eclectic approach to income measurement and to provide different measures of income for different purposes in recognition of the fact that no single measure of income will satisfy all purposes and this problem may be partially solved by de7emphasising the bottom line. However, the )3,&s e perience with the issue of de7emphasising the bottom line has shown that :global; measures of income may still be of use and are demanded by capital markets.

The ne t deductive approach to be considered flows naturally from the eclectic approach to the measurement of :true income;- the idea that financial accounting should satisfy the needs of users is linked to the notion of different measures of income for different purposes. The user needs approach also flows from the

appreciation that there are social and political pressures for accounting disclosure.

However, one of the problems with the user needs approach is that these needs are claimed by competing theories. 1ne of the defences of historical cost accounting is that the numbers generated are useful for stewardship purposes. 1ne of the

advantages claimed for net realisable value accounting is that it is useful for investors. Aeplacement cost accounting is claimed to be useful for the needs of a continuing business. 1ne way out of this dilemma is to do a substantial amount of empirical research in order to establish what information users actually need and this :new empiricism; is discussed later.

)n important third deductive approach to financial accounting theory is that embodied in information economics. This approach regards financial accounting

$arek()TIntro*

+= information as an economic good with supply and demand curves .ust as any other good in the market place. In this theory, user needs are formalised within the market place and the acquisition and processing of financial accounting information has a cost, which may be a function of demand. 'reparers as well as users come to the fore because the supply side of the economic equation focuses on the cost of producing the information.

Information economics approaches to financial accounting have provided some important insights into the financial reporting process. The notion of efficient

markets that value all information, regardless of whether it appears in the accounts or in the notes on the accounts, provides an insight into standard7setting debates because recognition in the accounts is usually deemed to be an important issue. The

implication of this latter argument is that markets are actually inefficient and only value information if it is recognised in the financial statements as opposed to being merely disclosed in the notes.

Information economics views standard7setting as a form of regulation in contrast to the free market provision of such information. The implication is that financial accounting information has similar characteristics to that of a public good including the free rider problem. $ore particularly, financial accounting information may also suffer from the adverse selection problem in that, given an unregulated market, the most unscrupulous management, as opposed to the best, will be shown in the most favourable light. However, other theories, such as agency theory, have been used to argue that management, as agents, will enter into contracts which bind them to provide information useful to suppliers of capital, the principals in the agency

$arek()TIntro*

++ relationship. These sorts of arguments may be marshalled to favour free market approaches to financial reporting.

)ll agree on a general insight provided by information economics which is that standard7setting involves issues of social choice. !inancial accounting information has value to users but its provision imposes costs on suppliers "preparers% and therefore standard7setting decisions benefit some members of society at the e pense of others. This becomes especially true if financial accounting information is used in the determination of wages, ta ation and competition policies. )ccounting standards have economic consequences and standard7setting becomes a political process.

The new empiricism

The new empiricism, a return to focus on what actually happens in the real world, has arisen more recently in financial accounting research in response to disillusionment with deductive reasoning. )lso, clearly, a focus on user needs in deductive theory leads logically to empirical research in order to ascertain what those needs are. This research direction has been stimulated by approaches that focus on market reactions to accounting numbers "e.g., ,all and ,rown, +<9@% and the positivist influence of the 6hicago 3chool "e.g., Watts and Bimmerman, +<><% who claim that deductive accounting theories are merely normative e cuses for the political process and that empirical approaches to accounting are preferable. These approaches have been e tremely influential and are a specific focus of the final year accounting theory module and hence are not dealt with here.

$arek()TIntro*

+* However, it should be noted that the dichotomy between inductive and deductive approaches may be less than useful and in fact the approaches may be complementary. !or e ample, any empirical data used in empirical research imply selectivity and categorisation- how are these to be done in the absence of deductive reasoning? It should also be noted that a theory that is untestable may nevertheless be useful "e.g., Thomas, +<>>%. 1n the other hand, the results of empirical research may have deductive implications for rules and procedures.

6onclusions

The inductive approach remains important in current accounting practice and dominates standards and education, especially professional accounting education. The deductive :true income; approach has highlighted the deficiencies of historical cost accounting and has had practical utility with the use of current purchasing power accounting in hyperinflationary economies. The notion of an asset&s deprival value is still useful. The deductive user needs approach underlies most conceptual

frameworks and much empirical research work is undertaken on this basis. Insights from information economies have provided a rationale for standard7setting and the regulation of accounting as well as emphasising the political nature of standard7 setting. paradigm. The new empiricism provides today&s dominant accounting research

$arek()TIntro*

+2 ,ibliography

,all, A. and ,rown, '. "+<9@% C)n empirical evaluation of accounting income numbers&, Dournal of )ccounting Aesearch, )utumn- +8<7+>@. Thomas, ).4. "+<>>% C)llocation- the !allacy and the Theorists& in ,a ter, W.T. and #avidson, 3. "eds% 3tudies in )ccounting, 2rd edition. 4ondon- I6)?W, p.+@*7+<5. Watts, A.4. and Bimmerman, D.4. "+<><% CThe #emand for and 3upply of )ccounting Theories- The $arket for ? cuses&, The )ccounting Aeview, )pril- *>272=5. Whittington, E. "+<@9% C!inancial )ccounting Theory)ccounting Aeview, )utumn. )n 1ver7view&, ,ritish

$arek()TIntro*

Das könnte Ihnen auch gefallen

- Contract Lecture 4 - Terms of A Contract PDFDokument6 SeitenContract Lecture 4 - Terms of A Contract PDFTosin YusufNoch keine Bewertungen

- Year 7 Transition Challenges and JobsDokument2 SeitenYear 7 Transition Challenges and JobsTosin YusufNoch keine Bewertungen

- Fee Assessment Questionaire - NEWDokument6 SeitenFee Assessment Questionaire - NEWTosin YusufNoch keine Bewertungen

- E Tray Flyer ENGDokument2 SeitenE Tray Flyer ENGTosin YusufNoch keine Bewertungen

- Assessment CentreDokument2 SeitenAssessment CentreTosin YusufNoch keine Bewertungen

- E Tray Flyer ENGDokument2 SeitenE Tray Flyer ENGTosin YusufNoch keine Bewertungen

- Historical Cost AccountingDokument9 SeitenHistorical Cost AccountingTosin YusufNoch keine Bewertungen

- Revision Pack 2009-10Dokument9 SeitenRevision Pack 2009-10Tosin YusufNoch keine Bewertungen

- Contract Law Lecture 4 - Terms of A Contract (PowerPoint)Dokument39 SeitenContract Law Lecture 4 - Terms of A Contract (PowerPoint)Tosin YusufNoch keine Bewertungen

- Reconciliation Between Economic and Accounting IncomeDokument8 SeitenReconciliation Between Economic and Accounting IncomeTosin YusufNoch keine Bewertungen

- Replacement Cost AccountingDokument8 SeitenReplacement Cost AccountingTosin YusufNoch keine Bewertungen

- Essay A Essay B: Totals $569,000 $386,000Dokument4 SeitenEssay A Essay B: Totals $569,000 $386,000Tosin YusufNoch keine Bewertungen

- Contract Law Lecture 3 - Discharge and Remedies PowerPointDokument55 SeitenContract Law Lecture 3 - Discharge and Remedies PowerPointTosin YusufNoch keine Bewertungen

- Module Outline 2009-10Dokument8 SeitenModule Outline 2009-10Tosin YusufNoch keine Bewertungen

- Basic Issues in DepreciationDokument2 SeitenBasic Issues in DepreciationTosin YusufNoch keine Bewertungen

- Economic IncomeDokument18 SeitenEconomic IncomeTosin YusufNoch keine Bewertungen

- Example LTD Question OnlyDokument5 SeitenExample LTD Question OnlyTosin YusufNoch keine Bewertungen

- CCA Lecture NotesDokument10 SeitenCCA Lecture NotesTosin YusufNoch keine Bewertungen

- Collins LTD Question OnlyDokument1 SeiteCollins LTD Question OnlyTosin YusufNoch keine Bewertungen

- Depreciation - Methods and CalculationsDokument18 SeitenDepreciation - Methods and CalculationsTosin YusufNoch keine Bewertungen

- 2009-10 Term Time Self Test Questions OnlyDokument8 Seiten2009-10 Term Time Self Test Questions OnlyTosin YusufNoch keine Bewertungen

- ABJ Study Guide 2009-10Dokument63 SeitenABJ Study Guide 2009-10Tosin YusufNoch keine Bewertungen

- Cash Flow ReportingDokument8 SeitenCash Flow ReportingTosin YusufNoch keine Bewertungen

- Deprival Value Lecture NotesDokument7 SeitenDeprival Value Lecture NotesTosin YusufNoch keine Bewertungen

- Sainsbury Report Final - MergedDokument38 SeitenSainsbury Report Final - MergedTosin Yusuf100% (1)

- IFRS Monopoly The Pied Piper of Financial ReportingDokument56 SeitenIFRS Monopoly The Pied Piper of Financial ReportingTosin YusufNoch keine Bewertungen

- Tesco (2012) Merged MergedDokument45 SeitenTesco (2012) Merged MergedTosin YusufNoch keine Bewertungen

- Winter Exam 2012 Questions Only Formatted Final1Dokument11 SeitenWinter Exam 2012 Questions Only Formatted Final1Tosin YusufNoch keine Bewertungen

- XBRL Solving Real-World ProblemsDokument18 SeitenXBRL Solving Real-World ProblemsTosin YusufNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (120)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Bouzek, Jan - Studies of Homeric Greece-Karolinum Press (2018)Dokument320 SeitenBouzek, Jan - Studies of Homeric Greece-Karolinum Press (2018)Natko NemecNoch keine Bewertungen

- Pro Yec To Machine LearningDokument35 SeitenPro Yec To Machine LearningcredifamiliadesarrolloNoch keine Bewertungen

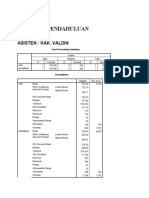

- Tugas Pendahuluan: Korelasi Asisten: Kak. ValdinDokument19 SeitenTugas Pendahuluan: Korelasi Asisten: Kak. ValdinSilvana papoiwoNoch keine Bewertungen

- CH 06Dokument106 SeitenCH 06Ray Vega LugoNoch keine Bewertungen

- For Dummy VariablesDokument13 SeitenFor Dummy VariablesRounak KumarNoch keine Bewertungen

- Aristotle Rhetoric PDFDokument247 SeitenAristotle Rhetoric PDFDanangAjiNoch keine Bewertungen

- InductiveDokument26 SeitenInductiveRoel de la RosaNoch keine Bewertungen

- Ortho PathyDokument2 SeitenOrtho PathyJonas Sunshine Callewaert100% (1)

- Answers Review Questions EconometricsDokument59 SeitenAnswers Review Questions EconometricsZX Lee84% (25)

- 4-CLT - Hypothesis TestingDokument47 Seiten4-CLT - Hypothesis TestingRajeev SoniNoch keine Bewertungen

- 17Dokument20 Seiten17AndresAmayaNoch keine Bewertungen

- HCI Unit 2 (3rd Final)Dokument105 SeitenHCI Unit 2 (3rd Final)BereketNoch keine Bewertungen

- Hypothesis Testing.2 HoDokument10 SeitenHypothesis Testing.2 HoJayci LeiNoch keine Bewertungen

- Group 1 Eapp Written ReportDokument3 SeitenGroup 1 Eapp Written ReportJanvier PacunayenNoch keine Bewertungen

- BRM MCQs For PG - MergedDokument57 SeitenBRM MCQs For PG - MergedNarmadha DeviNoch keine Bewertungen

- GST 112 Logic and Critical Thinking PDFDokument54 SeitenGST 112 Logic and Critical Thinking PDFManniru isaNoch keine Bewertungen

- Malhotra 15Dokument99 SeitenMalhotra 15Satyajeet ChauhanNoch keine Bewertungen

- DOM105 Session 20Dokument10 SeitenDOM105 Session 20DevanshiNoch keine Bewertungen

- Chapter 4 Problem Solving and ReasoningDokument22 SeitenChapter 4 Problem Solving and ReasoningDaryll EscusaNoch keine Bewertungen

- Chapter 12 SolutionsDokument3 SeitenChapter 12 Solutions1012219Noch keine Bewertungen

- Co VarianceDokument7 SeitenCo VarianceRikka TakanashiNoch keine Bewertungen

- MATH 121 Chapter 8 Hypothesis TestingDokument31 SeitenMATH 121 Chapter 8 Hypothesis TestingJanine LerumNoch keine Bewertungen

- Statistical Analysis Using SPSS and R - Chapter 5 PDFDokument93 SeitenStatistical Analysis Using SPSS and R - Chapter 5 PDFKarl LewisNoch keine Bewertungen

- ExP Psych 14Dokument29 SeitenExP Psych 14Jhaven MañasNoch keine Bewertungen

- Dummy VariablesDokument60 SeitenDummy Variablesdiani oktafianiNoch keine Bewertungen

- Teller-Formal Logic PrimerDokument323 SeitenTeller-Formal Logic PrimerIVeverm0reNoch keine Bewertungen

- Statistical Estimation: Prof GRC NairDokument15 SeitenStatistical Estimation: Prof GRC Nairanindya_kunduNoch keine Bewertungen

- Philosophy TextDokument198 SeitenPhilosophy TextFellOnEarthNoch keine Bewertungen

- Test of Difference Between Profile and Factors Affecting The Academic Performance Variables Test Stat Computed Value P-Value Remarks DecisionDokument2 SeitenTest of Difference Between Profile and Factors Affecting The Academic Performance Variables Test Stat Computed Value P-Value Remarks DecisionSarmiento, Jovenal B.Noch keine Bewertungen

- What Does Galileo's Discovery of Jupiter's Moons Tell Us About The Process of Scientific Discovery?Dokument24 SeitenWhat Does Galileo's Discovery of Jupiter's Moons Tell Us About The Process of Scientific Discovery?marcio_biologiaNoch keine Bewertungen